1 Introduction to Managerial Finance.pptx

- Количество слайдов: 15

Managerial Finance Instructor : Son Dmitriy

Managerial Finance Instructor : Son Dmitriy

Introduction to Managerial Finance The role of Managerial finance The Financial Market Environment

Introduction to Managerial Finance The role of Managerial finance The Financial Market Environment

Learning Goals • Define finance and the managerial finance function. • Describe the legal forms of business organization. • Describe the goal of the firm, and explain why maximizing the value of the firm is an appropriate goal for a business. • Describe how the managerial finance function is related to economics and accounting. • Identify the primary activities of the financial manager. • Describe the nature of the principal–agent relationship between the owners and managers of a corporation, and explain how various corporate governance mechanisms attempt to manage agency problems.

Learning Goals • Define finance and the managerial finance function. • Describe the legal forms of business organization. • Describe the goal of the firm, and explain why maximizing the value of the firm is an appropriate goal for a business. • Describe how the managerial finance function is related to economics and accounting. • Identify the primary activities of the financial manager. • Describe the nature of the principal–agent relationship between the owners and managers of a corporation, and explain how various corporate governance mechanisms attempt to manage agency problems.

Why This Chapter Matters to You In your professional life • ACCOUNTING You need to understand the relationships between the accounting and finance functions within the firm; how decision makers rely on the financial statements you prepare; why maximizing a firm’s value is not the same as maximizing its profits; and the ethical duty that you have when reporting financial results to investors and other stakeholders.

Why This Chapter Matters to You In your professional life • ACCOUNTING You need to understand the relationships between the accounting and finance functions within the firm; how decision makers rely on the financial statements you prepare; why maximizing a firm’s value is not the same as maximizing its profits; and the ethical duty that you have when reporting financial results to investors and other stakeholders.

• INFORMATION SYSTEMS You need to understand why financial information is important to managers in all functional areas; the documentation that firms must produce to comply with various regulations; and how manipulating information for personal gain can get managers into serious trouble. • MANAGEMENT You need to understand the various legal forms of a business organization; how to communicate the goal of the firm to employees and other stakeholders; the advantages and disadvantages of the agency relationship between a firm’s managers and its owners; and how compensation systems can align or misalign the interests of managers and investors.

• INFORMATION SYSTEMS You need to understand why financial information is important to managers in all functional areas; the documentation that firms must produce to comply with various regulations; and how manipulating information for personal gain can get managers into serious trouble. • MANAGEMENT You need to understand the various legal forms of a business organization; how to communicate the goal of the firm to employees and other stakeholders; the advantages and disadvantages of the agency relationship between a firm’s managers and its owners; and how compensation systems can align or misalign the interests of managers and investors.

• MARKETING You need to understand why increasing a firm’s revenues or market share is not always a good thing; how financial managers evaluate aspects of customer relations such as cash and credit management policies; and why a firm’s brands are an important part of its value to investors. • OPERATIONS You need to understand the financial benefits of increasing a firm’s production efficiency; why maximizing profit by cutting costs may not increase the firm’s value; and how managers act on behalf of investors when operating a corporation.

• MARKETING You need to understand why increasing a firm’s revenues or market share is not always a good thing; how financial managers evaluate aspects of customer relations such as cash and credit management policies; and why a firm’s brands are an important part of its value to investors. • OPERATIONS You need to understand the financial benefits of increasing a firm’s production efficiency; why maximizing profit by cutting costs may not increase the firm’s value; and how managers act on behalf of investors when operating a corporation.

WHAT IS FINANCE? The science and art of managing money. CAREER OPPORTUNITIES IN FINANCE Financial managers Actively manages the financial affairs of all types of businesses, whether private or public, large or small, profit seeking or not for profit.

WHAT IS FINANCE? The science and art of managing money. CAREER OPPORTUNITIES IN FINANCE Financial managers Actively manages the financial affairs of all types of businesses, whether private or public, large or small, profit seeking or not for profit.

LEGAL FORMS OF BUSINESS ORGANIZATION Sole proprietorship A business owned by one person and operated for his or her own profit. unlimited liability The condition of a sole proprietorship (or general partnership), giving creditors the right to make claims against the owner’s personal assets to recover debts owed by the business. partnership A business owned by two or more people and operated for profit. Corporations Company or group of people authorized to act as a single entityand recognized as such in law

LEGAL FORMS OF BUSINESS ORGANIZATION Sole proprietorship A business owned by one person and operated for his or her own profit. unlimited liability The condition of a sole proprietorship (or general partnership), giving creditors the right to make claims against the owner’s personal assets to recover debts owed by the business. partnership A business owned by two or more people and operated for profit. Corporations Company or group of people authorized to act as a single entityand recognized as such in law

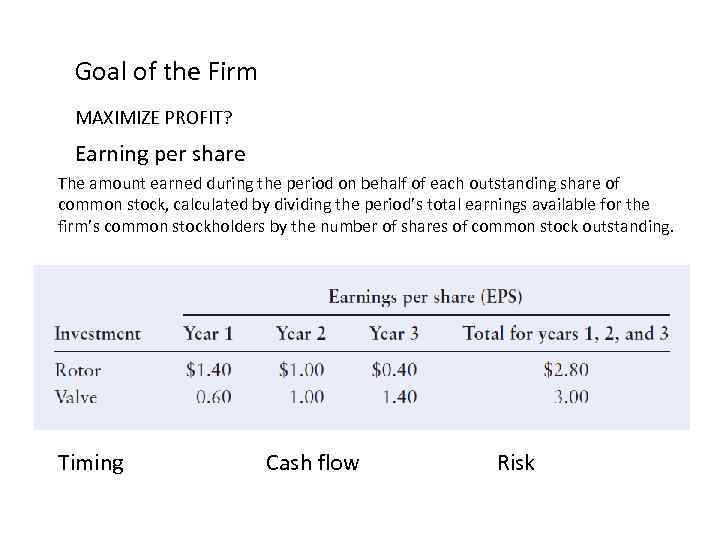

Goal of the Firm MAXIMIZE PROFIT? Earning per share The amount earned during the period on behalf of each outstanding share of common stock, calculated by dividing the period’s total earnings available for the firm’s common stockholders by the number of shares of common stock outstanding. Timing Cash flow Risk

Goal of the Firm MAXIMIZE PROFIT? Earning per share The amount earned during the period on behalf of each outstanding share of common stock, calculated by dividing the period’s total earnings available for the firm’s common stockholders by the number of shares of common stock outstanding. Timing Cash flow Risk

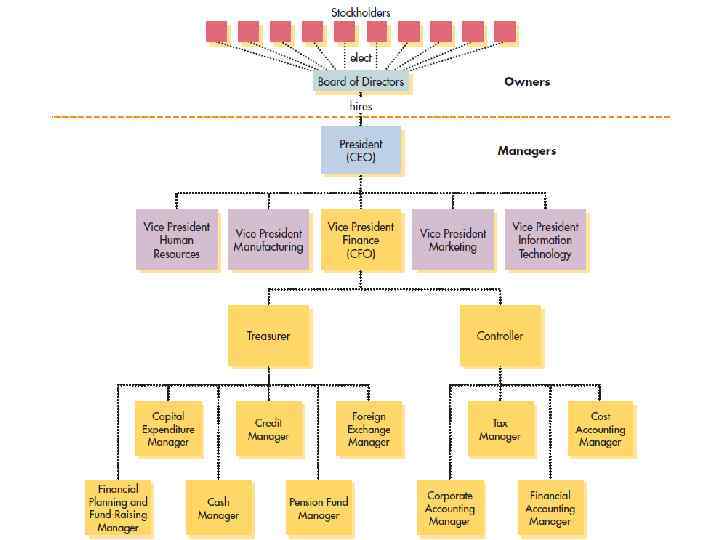

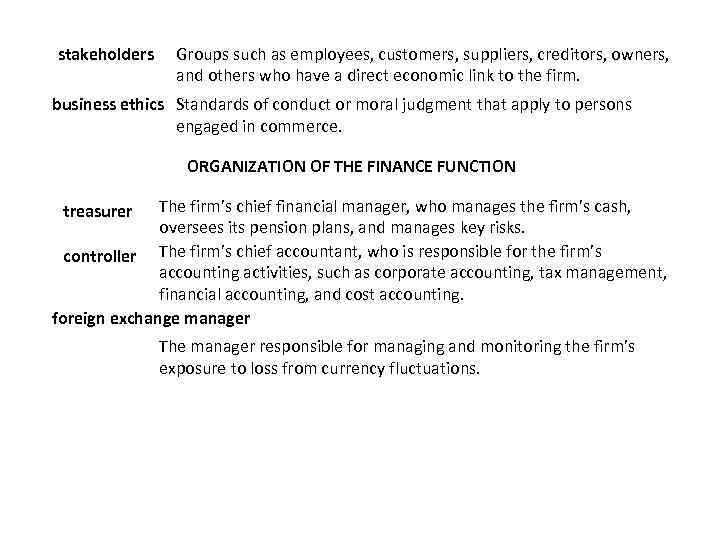

stakeholders Groups such as employees, customers, suppliers, creditors, owners, and others who have a direct economic link to the firm. business ethics Standards of conduct or moral judgment that apply to persons engaged in commerce. ORGANIZATION OF THE FINANCE FUNCTION The firm’s chief financial manager, who manages the firm’s cash, oversees its pension plans, and manages key risks. controller The firm’s chief accountant, who is responsible for the firm’s accounting activities, such as corporate accounting, tax management, financial accounting, and cost accounting. foreign exchange manager treasurer The manager responsible for managing and monitoring the firm’s exposure to loss from currency fluctuations.

stakeholders Groups such as employees, customers, suppliers, creditors, owners, and others who have a direct economic link to the firm. business ethics Standards of conduct or moral judgment that apply to persons engaged in commerce. ORGANIZATION OF THE FINANCE FUNCTION The firm’s chief financial manager, who manages the firm’s cash, oversees its pension plans, and manages key risks. controller The firm’s chief accountant, who is responsible for the firm’s accounting activities, such as corporate accounting, tax management, financial accounting, and cost accounting. foreign exchange manager treasurer The manager responsible for managing and monitoring the firm’s exposure to loss from currency fluctuations.

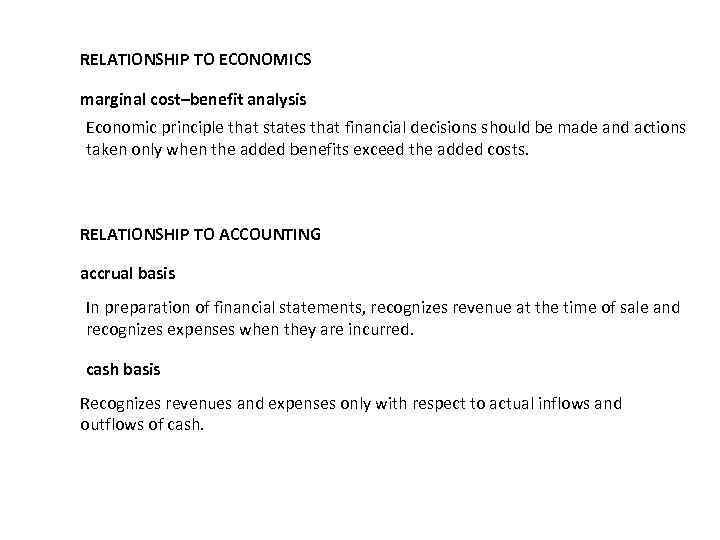

RELATIONSHIP TO ECONOMICS marginal cost–benefit analysis Economic principle that states that financial decisions should be made and actions taken only when the added benefits exceed the added costs. RELATIONSHIP TO ACCOUNTING accrual basis In preparation of financial statements, recognizes revenue at the time of sale and recognizes expenses when they are incurred. cash basis Recognizes revenues and expenses only with respect to actual inflows and outflows of cash.

RELATIONSHIP TO ECONOMICS marginal cost–benefit analysis Economic principle that states that financial decisions should be made and actions taken only when the added benefits exceed the added costs. RELATIONSHIP TO ACCOUNTING accrual basis In preparation of financial statements, recognizes revenue at the time of sale and recognizes expenses when they are incurred. cash basis Recognizes revenues and expenses only with respect to actual inflows and outflows of cash.

Governance and Agency corporate governance The rules, processes, and laws by which companies are operated, controlled, and regulated. Individual versus Institutional Investors who own relatively small quantities of shares so as to meet personal investment goals. Investment professionals, such as banks, insurance companies, mutual funds, and pension funds, that are paid to manage and hold large quantities of securities on behalf of others. Government Regulation Sarbanes-Oxley Act of 2002 (SOX) An act aimed at eliminating corporate disclosure and conflict of interest problems. Contains provisions about corporate financial disclosures and the relationships among corporations, analysts, auditors, attorneys, directors, officers, and shareholders.

Governance and Agency corporate governance The rules, processes, and laws by which companies are operated, controlled, and regulated. Individual versus Institutional Investors who own relatively small quantities of shares so as to meet personal investment goals. Investment professionals, such as banks, insurance companies, mutual funds, and pension funds, that are paid to manage and hold large quantities of securities on behalf of others. Government Regulation Sarbanes-Oxley Act of 2002 (SOX) An act aimed at eliminating corporate disclosure and conflict of interest problems. Contains provisions about corporate financial disclosures and the relationships among corporations, analysts, auditors, attorneys, directors, officers, and shareholders.

THE AGENCY ISSUE principal–agent relationship An arrangement in which an agent acts on the behalf of a principal. For example, shareholders of a company (principals) elect management (agents) to act on their behalf. agency problems Problems that arise when managers place personal goals ahead of the goals of shareholders. agency costs Costs arising from agency problems that are borne by shareholders and represent a loss of shareholder wealth. incentive plans Management compensation plans that tie management compensation to share price; one example involves the granting of stock options Options extended by the firm that allow management to benefit from increases in stock prices over time. performance plans Plans that tie management compensation to measures such as EPS or growth in EPS. Performance shares and/or cash bonuses are used as compensation under these plans. performance shares Shares of stock given to management for meeting stated performance goals. cash bonuses Cash paid to management for achieving certain performance goals. The Threat of Takeover

THE AGENCY ISSUE principal–agent relationship An arrangement in which an agent acts on the behalf of a principal. For example, shareholders of a company (principals) elect management (agents) to act on their behalf. agency problems Problems that arise when managers place personal goals ahead of the goals of shareholders. agency costs Costs arising from agency problems that are borne by shareholders and represent a loss of shareholder wealth. incentive plans Management compensation plans that tie management compensation to share price; one example involves the granting of stock options Options extended by the firm that allow management to benefit from increases in stock prices over time. performance plans Plans that tie management compensation to measures such as EPS or growth in EPS. Performance shares and/or cash bonuses are used as compensation under these plans. performance shares Shares of stock given to management for meeting stated performance goals. cash bonuses Cash paid to management for achieving certain performance goals. The Threat of Takeover

The end

The end