f62b9428bdaa356f4319638888d1fc10.ppt

- Количество слайдов: 96

MANAGERIAL ECONOMICS IN A GLOBAL DOMINICK SALVATORE

THE BASIC OF DEMAND, SUPPLY AND EQUILIBRIUM Lecture for MM CORDEV -11 (PJJ) Bandung, 2 -9 - 13 By : Teguh Widodo tewidodo@gmail. com Twitter : bro. Teguh 02135126126

Scope • Demand side of market – Demand theory and curve – Effect of non-price to demand • Supply side of market – Supply teory and curve – Effect of non-price to supply • Equilibrium & Change of equilibrium • Elasticity

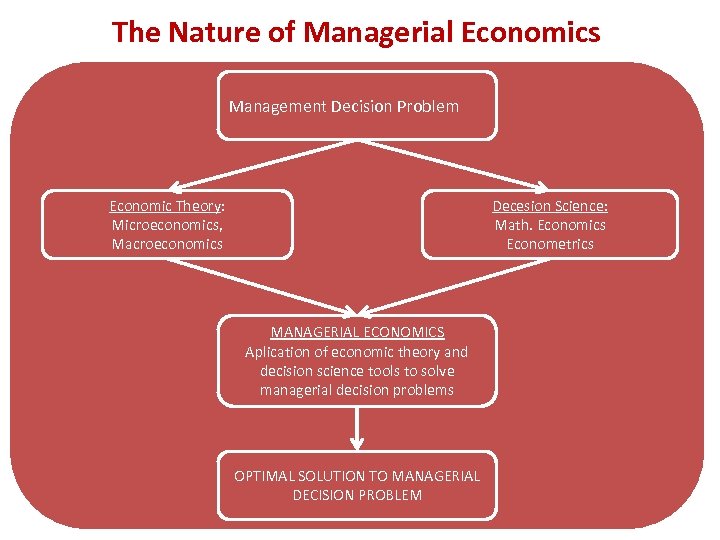

The Nature of Managerial Economics Management Decision Problem Economic Theory: Microeconomics, Macroeconomics Decesion Science: Math. Economics Econometrics MANAGERIAL ECONOMICS Aplication of economic theory and decision science tools to solve managerial decision problems OPTIMAL SOLUTION TO MANAGERIAL DECISION PROBLEM

DEMAND SUPPLY § § § Economics begins and ends with the “Law” of supply and demand. The laws of supply and demand are an important beginning in the attempt to answer vital questions about the working of a market system. Demand for a good or service is defined as quantities of a good or service that people are ready (willing and able) to buy at various prices within some given time period, other factors besides price held constant. The supply of a good or service is defined as quantities of a good or service that people are ready to sell at various prices within some given time period, other factors besides price held constant.

Demand Side • Every market has a demand side and a supply side. • The demand side can be represented by a market demand curve which shows the amount of commodity buyers would like to purchase at different prices. • Demand curves are drawn on the assumption that buyers’ tastes, income, the number of consumers in the market and the price of related commodities are unchanged.

LAW OF DEMAND The inverse relationship between the price of the commodity and the quantity demanded period is referred to as the law of demand. A decrease in the price of a good, all other things held constant (ceteris paribus), will cause an increase in the quantity demanded of the good. An increase in the price of a good, all other things held constant, will cause a decrease in the quantity demanded of the good.

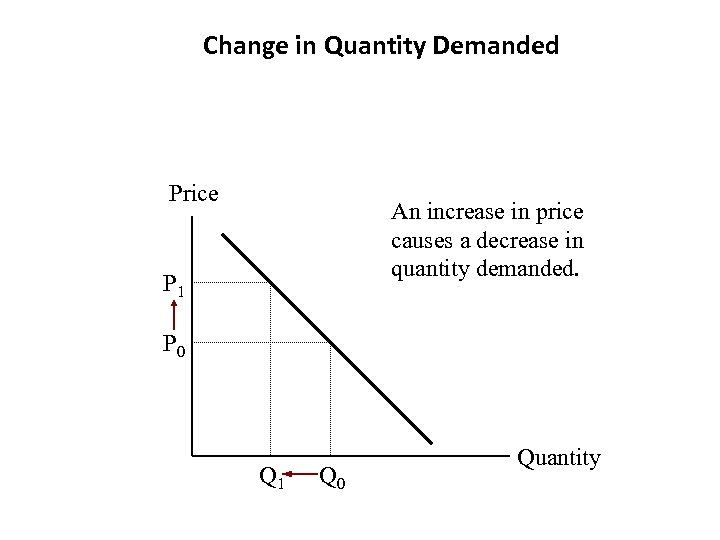

Change in Quantity Demanded Price An increase in price causes a decrease in quantity demanded. P 1 P 0 Q 1 Q 0 Quantity

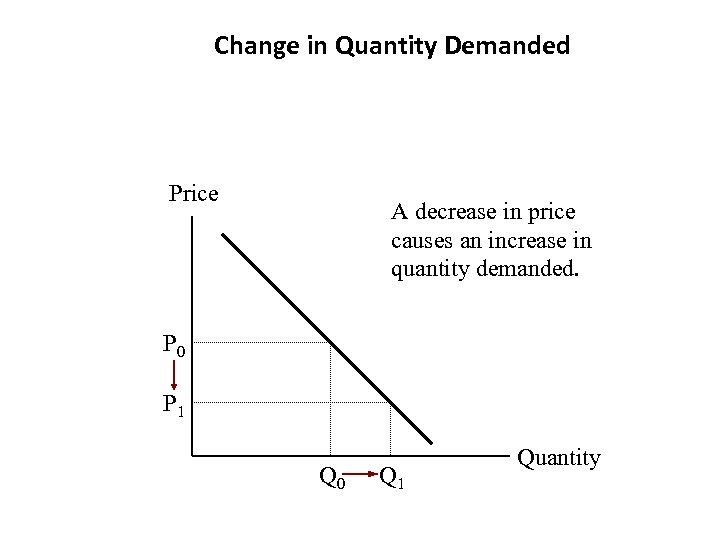

Change in Quantity Demanded Price A decrease in price causes an increase in quantity demanded. P 0 P 1 Q 0 Q 1 Quantity

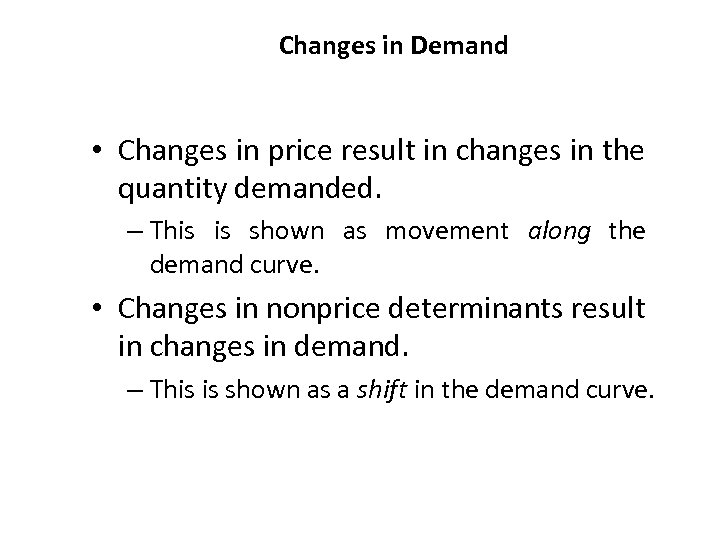

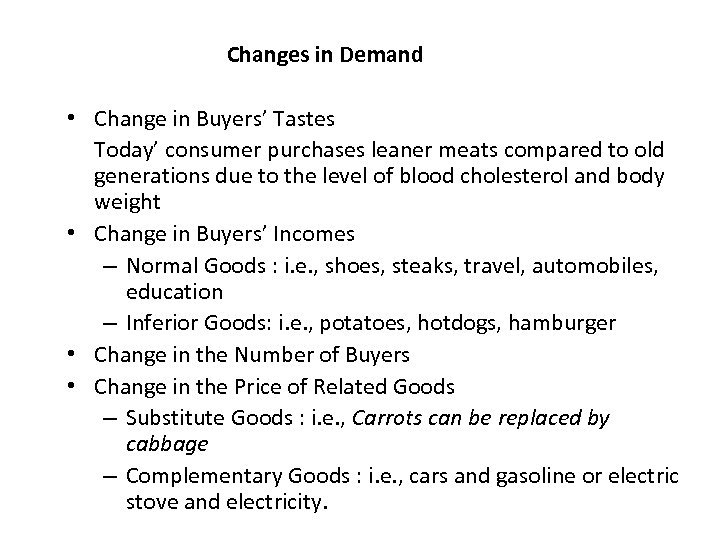

Changes in Demand • Changes in price result in changes in the quantity demanded. – This is shown as movement along the demand curve. • Changes in nonprice determinants result in changes in demand. – This is shown as a shift in the demand curve.

Changes in Demand • Change in Buyers’ Tastes Today’ consumer purchases leaner meats compared to old generations due to the level of blood cholesterol and body weight • Change in Buyers’ Incomes – Normal Goods : i. e. , shoes, steaks, travel, automobiles, education – Inferior Goods: i. e. , potatoes, hotdogs, hamburger • Change in the Number of Buyers • Change in the Price of Related Goods – Substitute Goods : i. e. , Carrots can be replaced by cabbage – Complementary Goods : i. e. , cars and gasoline or electric stove and electricity.

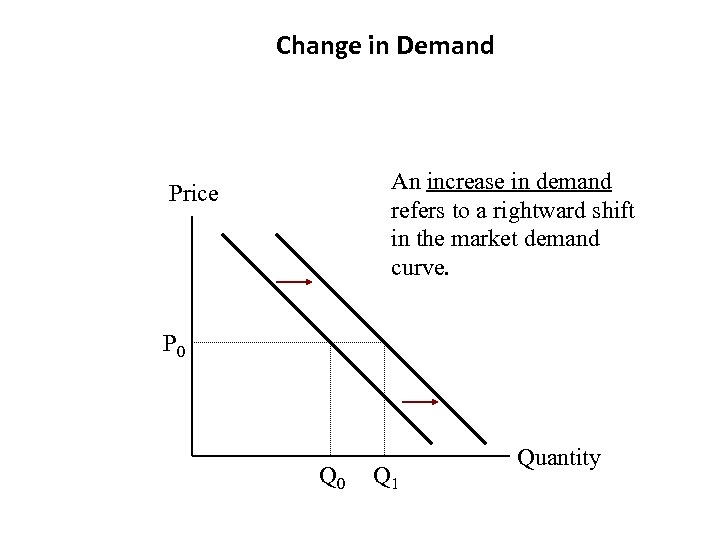

Change in Demand An increase in demand refers to a rightward shift in the market demand curve. Price P 0 Q 1 Quantity

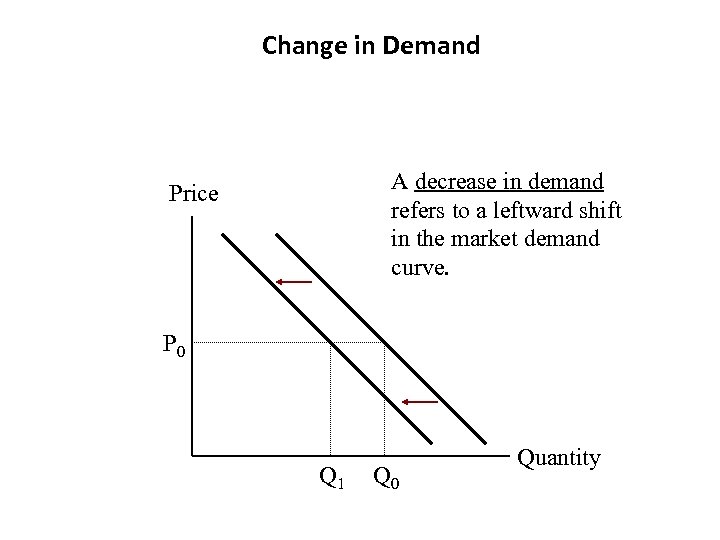

Change in Demand A decrease in demand refers to a leftward shift in the market demand curve. Price P 0 Q 1 Q 0 Quantity

Demand, Supply and Equilibrium • Every market has a demand side and a supply side. The Supply side can be represented by a market supply curve which shows the amount of commodity sellers would offer a sale at various prices. • Supply curves are drawn on the assumption of technology and input or resources (as such labor, capital and land) and prices.

Law of Supply • The direct relationship between the price of the commodity and the quantity supplied period is referred to as the law of supply. • A decrease in the price of a good, all other things held constant (ceteris paribus), will cause a decrease in the quantity supplied of the good. • An increase in the price of a good, all other things held constant, will cause an increase in the quantity supplied of the good.

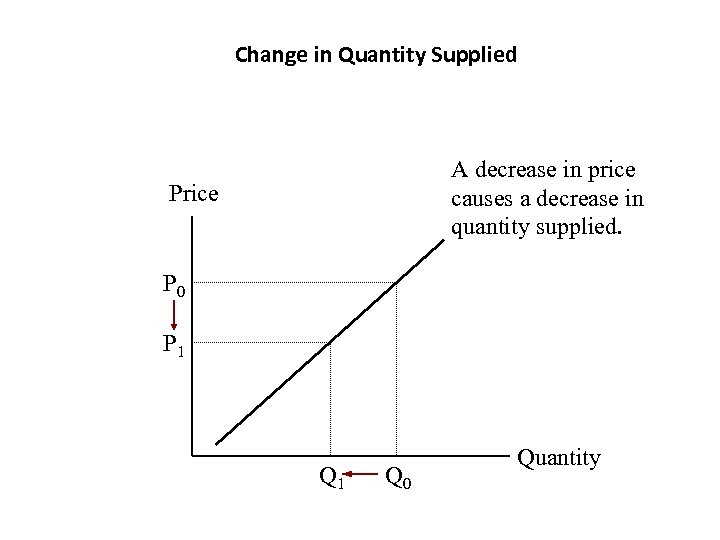

Change in Quantity Supplied A decrease in price causes a decrease in quantity supplied. Price P 0 P 1 Q 0 Quantity

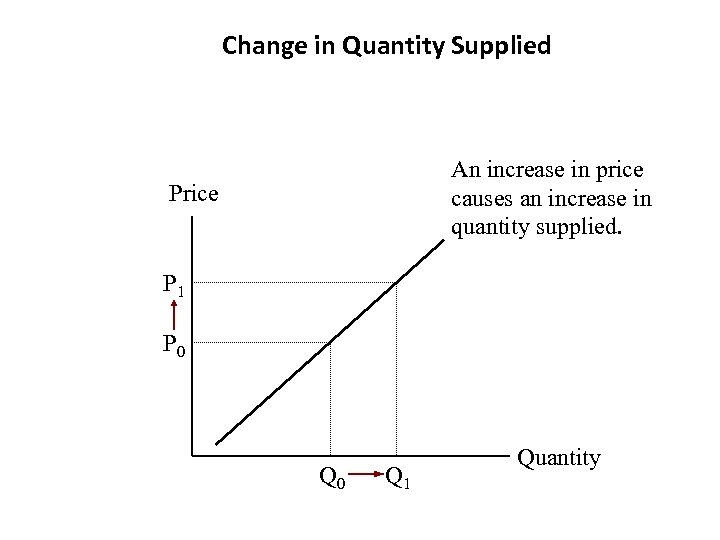

Change in Quantity Supplied An increase in price causes an increase in quantity supplied. Price P 1 P 0 Q 1 Quantity

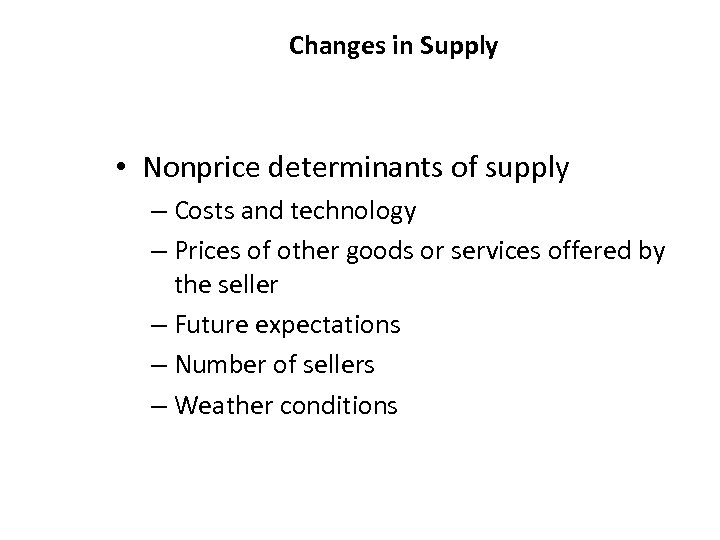

Changes in Supply • Nonprice determinants of supply – Costs and technology – Prices of other goods or services offered by the seller – Future expectations – Number of sellers – Weather conditions

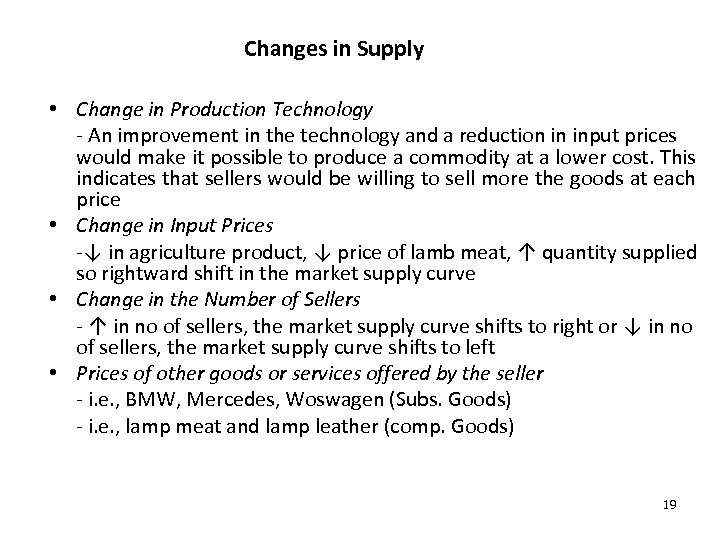

Changes in Supply • Change in Production Technology - An improvement in the technology and a reduction in input prices would make it possible to produce a commodity at a lower cost. This indicates that sellers would be willing to sell more the goods at each price • Change in Input Prices -↓ in agriculture product, ↓ price of lamb meat, ↑ quantity supplied so rightward shift in the market supply curve • Change in the Number of Sellers - ↑ in no of sellers, the market supply curve shifts to right or ↓ in no of sellers, the market supply curve shifts to left • Prices of other goods or services offered by the seller - i. e. , BMW, Mercedes, Woswagen (Subs. Goods) - i. e. , lamp meat and lamp leather (comp. Goods) 19

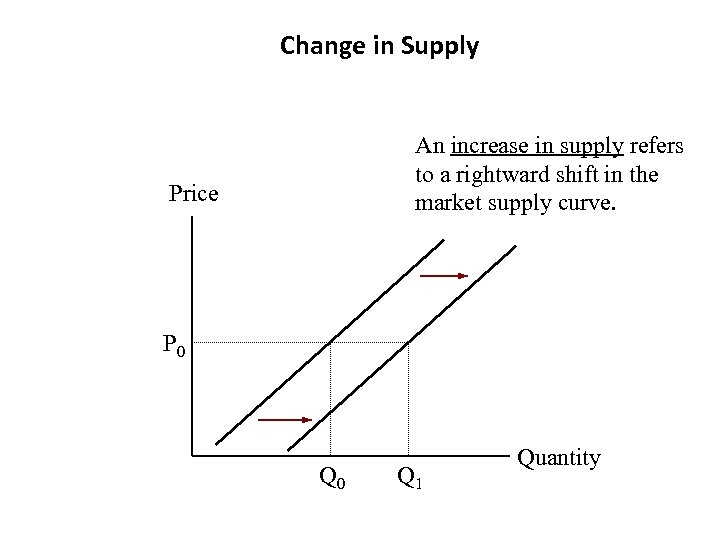

Change in Supply An increase in supply refers to a rightward shift in the market supply curve. Price P 0 Q 1 Quantity

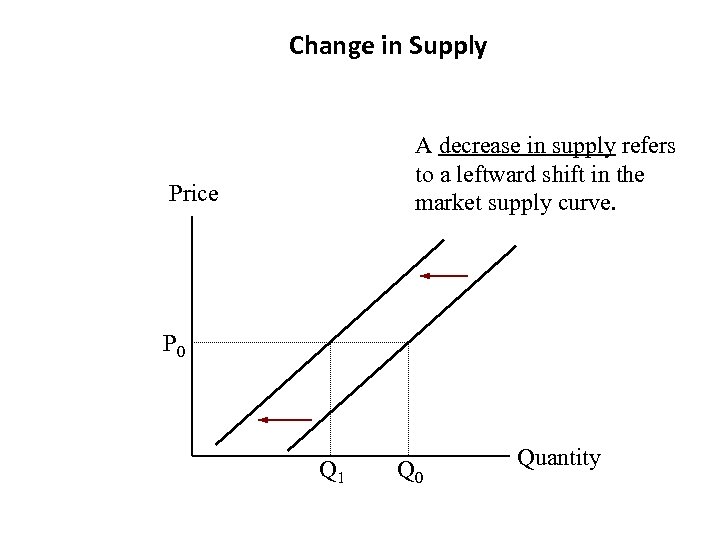

Change in Supply A decrease in supply refers to a leftward shift in the market supply curve. Price P 0 Q 1 Q 0 Quantity

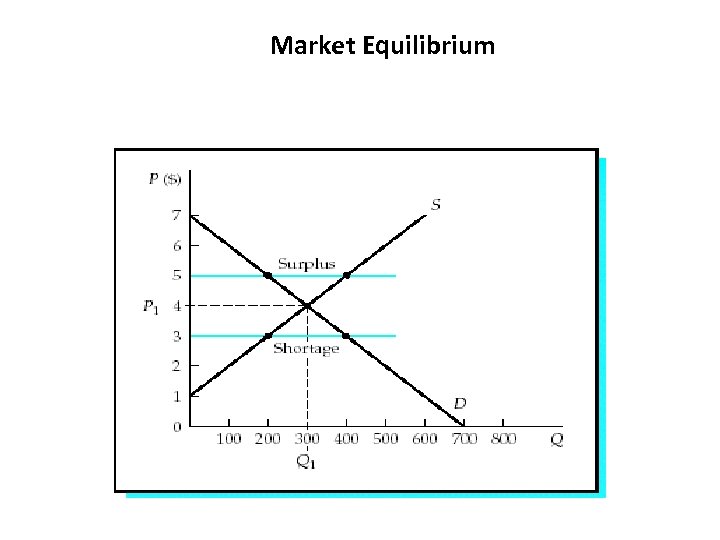

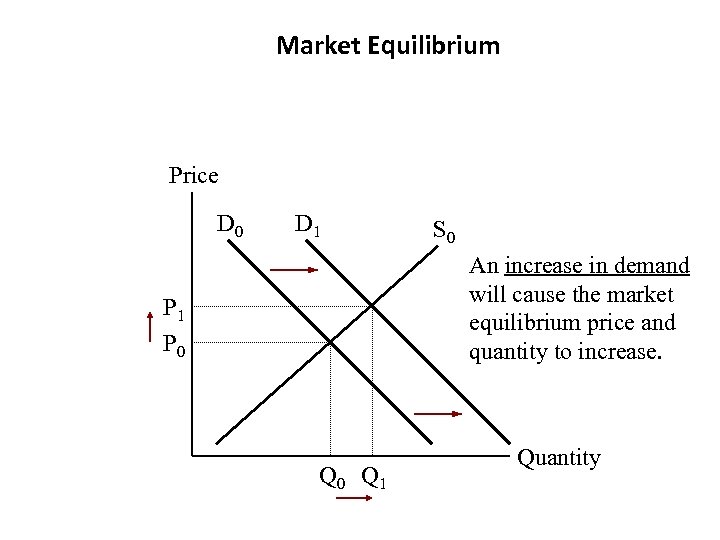

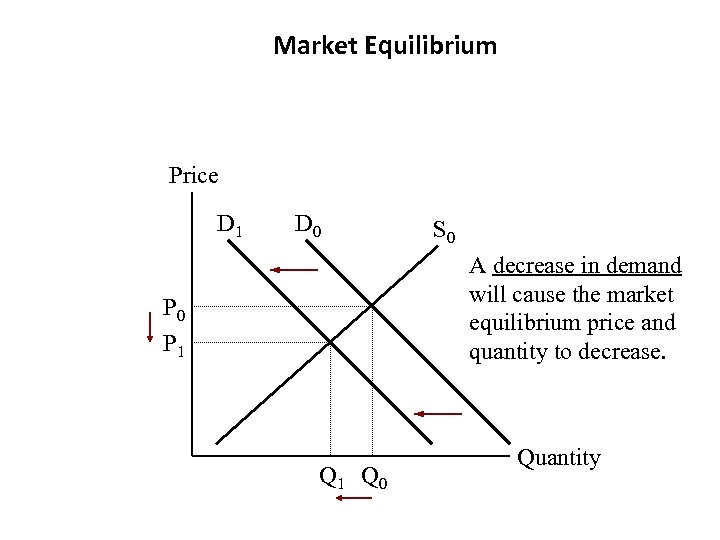

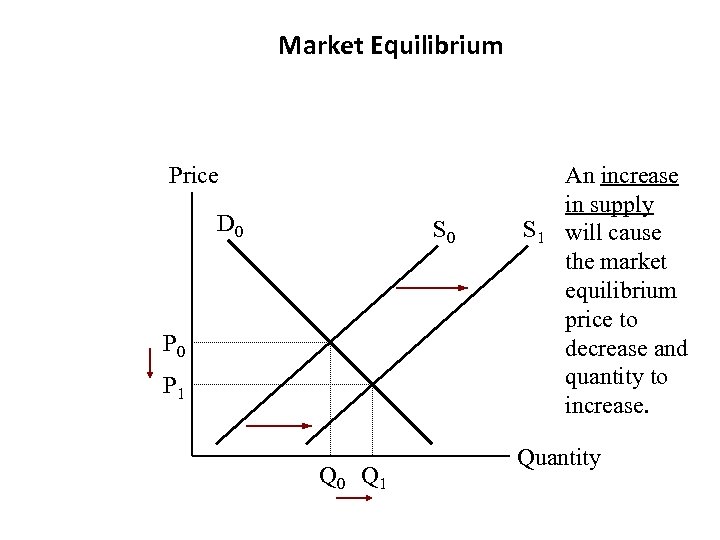

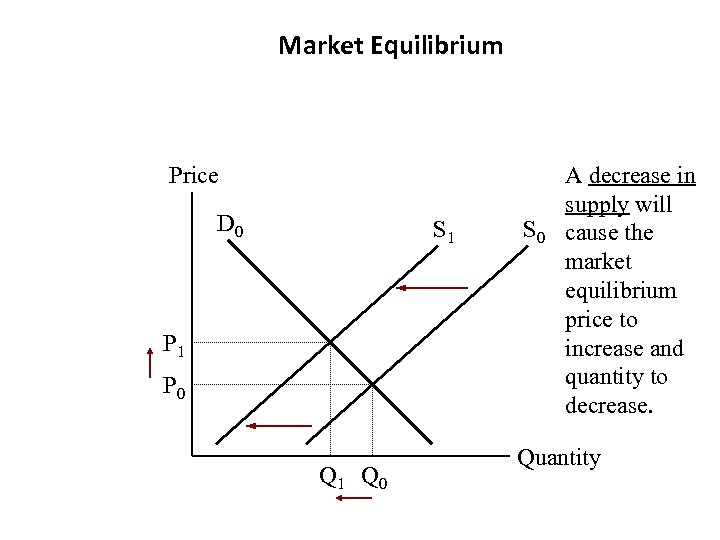

Market Equilibrium • Market equilibrium is determined at the intersection of the market demand curve and the market supply curve. • Equilibrium price: The price that equates the quantity demanded with the quantity supplied. • Equilibrium quantity: The amount that people are willing to buy and sellers are willing to offer at the equilibrium price level. • The equilibrium price causes quantity demanded to be equal to quantity supplied. • An increase or decrease in the demand or supply curve, it defines a new equilibrium point.

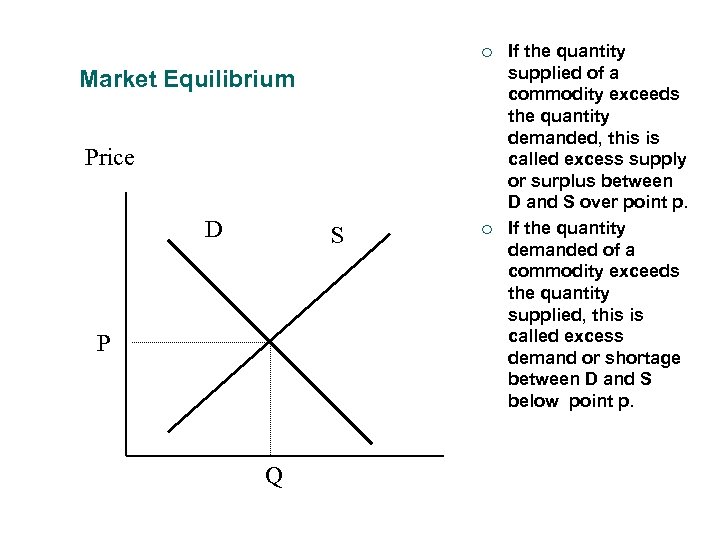

¡ Market Equilibrium Price D S P Q ¡ If the quantity supplied of a commodity exceeds the quantity demanded, this is called excess supply or surplus between D and S over point p. If the quantity demanded of a commodity exceeds the quantity supplied, this is called excess demand or shortage between D and S below point p.

Market Equilibrium • Shortage: A market situation in which the quantity demanded exceeds the quantity supplied. – A shortage occurs at a price below the equilibrium level. • Surplus: A market situation in which the quantity supplied exceeds the quantity demanded. – A surplus occurs at a price above the equilibrium level.

Market Equilibrium

Market Equilibrium Price D 0 D 1 S 0 An increase in demand will cause the market equilibrium price and quantity to increase. P 1 P 0 Q 1 Quantity

Market Equilibrium Price D 1 D 0 S 0 A decrease in demand will cause the market equilibrium price and quantity to decrease. P 0 P 1 Q 0 Quantity

Market Equilibrium Price D 0 S 0 P 1 Q 0 Q 1 S 1 An increase in supply will cause the market equilibrium price to decrease and quantity to increase. Quantity

Market Equilibrium Price D 0 S 1 P 0 Q 1 Q 0 S 0 A decrease in supply will cause the market equilibrium price to increase and quantity to decrease. Quantity

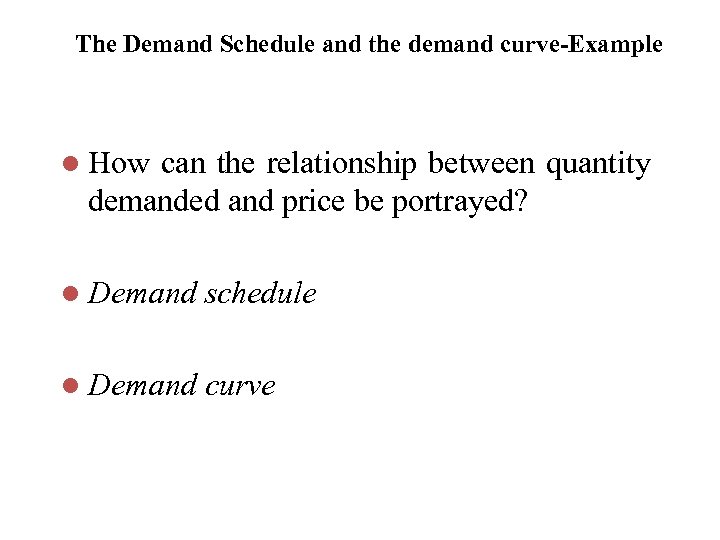

The Demand Schedule and the demand curve-Example l How can the relationship between quantity demanded and price be portrayed? l Demand schedule l Demand curve

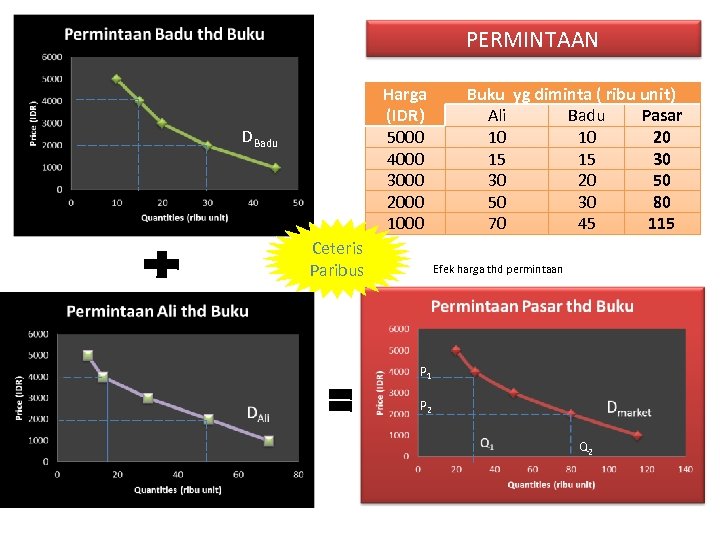

PERMINTAAN Harga (IDR) 5000 4000 3000 2000 1000 DBadu Ceteris Paribus Buku yg diminta ( ribu unit) Ali Badu Pasar 10 10 20 15 15 30 30 20 50 50 30 80 70 45 115 Efek harga thd permintaan P 1 D P 2 Q 2

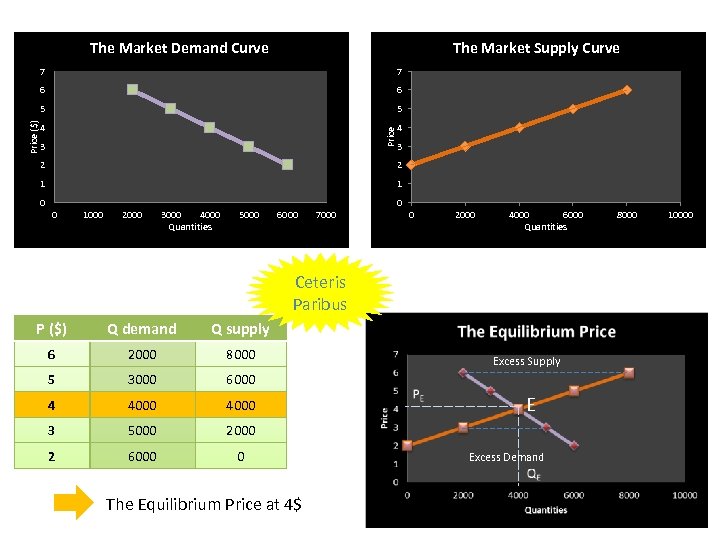

The Market Demand Curve The Market Supply Curve 6 5 5 4 4 Price 7 6 Price ($) 7 3 3 2 2 1 1 0 0 0 1000 2000 3000 4000 Quantities 5000 6000 7000 0 2000 4000 6000 Quantities Ceteris Paribus P ($) Q demand Q supply 6 2000 8000 5 3000 6000 4 4000 3 5000 2 6000 0 The Equilibrium Price at 4$ Excess Supply E Excess Demand 8000 10000

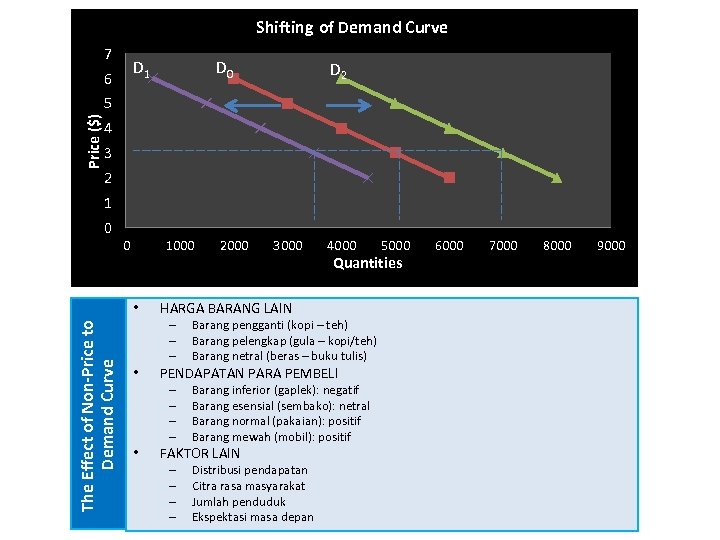

Shifting of Demand Curve 7 D 1 6 D 0 D 2 Price ($) 5 4 3 2 1 0 0 1000 The Effect of Non-Price to Demand Curve • 4000 Barang pengganti (kopi – teh) Barang pelengkap (gula – kopi/teh) Barang netral (beras – buku tulis) Barang inferior (gaplek): negatif Barang esensial (sembako): netral Barang normal (pakaian): positif Barang mewah (mobil): positif FAKTOR LAIN – – Distribusi pendapatan Citra rasa masyarakat Jumlah penduduk Ekspektasi masa depan 5000 Quantities PENDAPATAN PARA PEMBELI – – • 3000 HARGA BARANG LAIN – – – • 2000 6000 7000 8000 9000

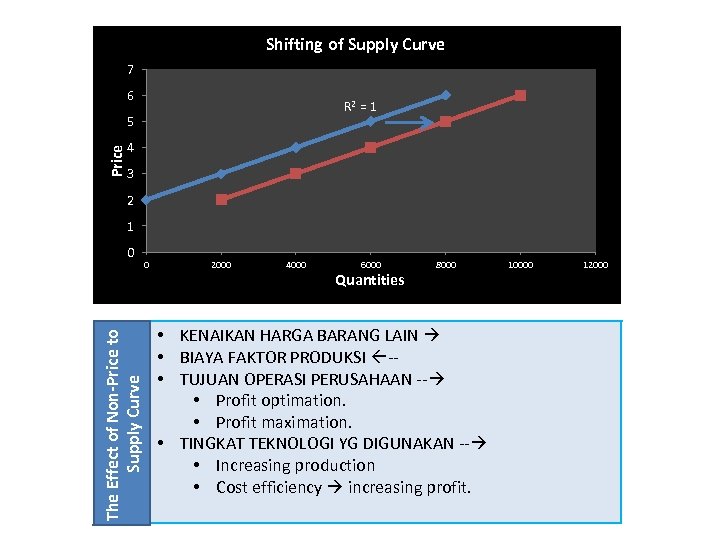

Shifting of Supply Curve 7 6 R 2 = 1 Price 5 4 3 2 1 The Effect of Non-Price to Supply Curve 0 0 2000 4000 6000 Quantities 8000 • KENAIKAN HARGA BARANG LAIN • BIAYA FAKTOR PRODUKSI - • TUJUAN OPERASI PERUSAHAAN -- • Profit optimation. • Profit maximation. • TINGKAT TEKNOLOGI YG DIGUNAKAN -- • Increasing production • Cost efficiency increasing profit. 10000 12000

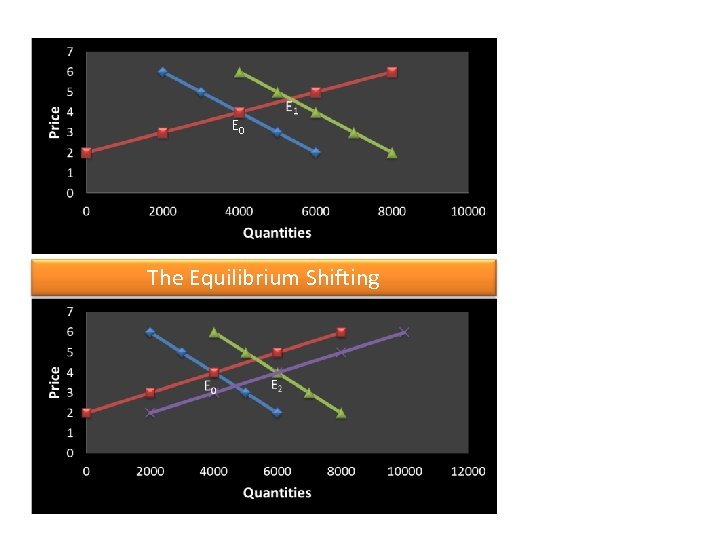

E 0 The Equilibrium Shifting

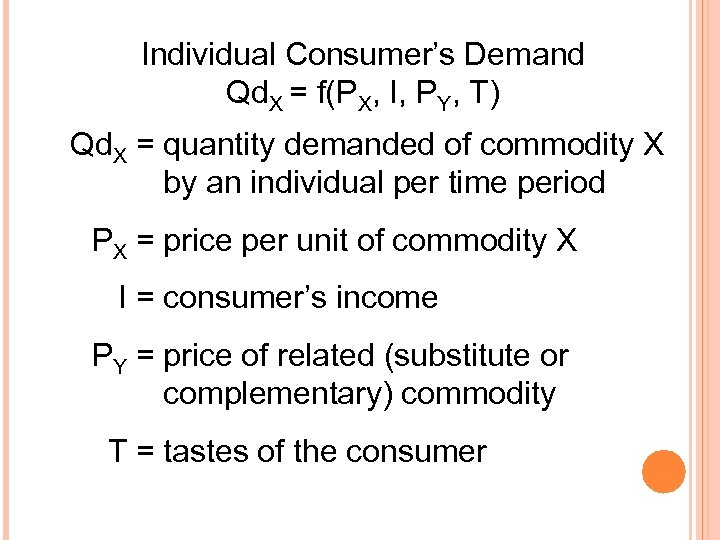

Individual Demand function l The demand for a commodity arises from the consumers’ willingness and ability to purchase the commodity. Consumer demand theory postulates that the quantity demanded of a commodity is a function of / or depends on the price of the commodity, the consumers’ income, the price of related commodities, and the tastes of the consumer.

Individual Consumer’s Demand Qd. X = f(PX, I, PY, T) Qd. X = quantity demanded of commodity X by an individual per time period PX = price per unit of commodity X I = consumer’s income PY = price of related (substitute or complementary) commodity T = tastes of the consumer

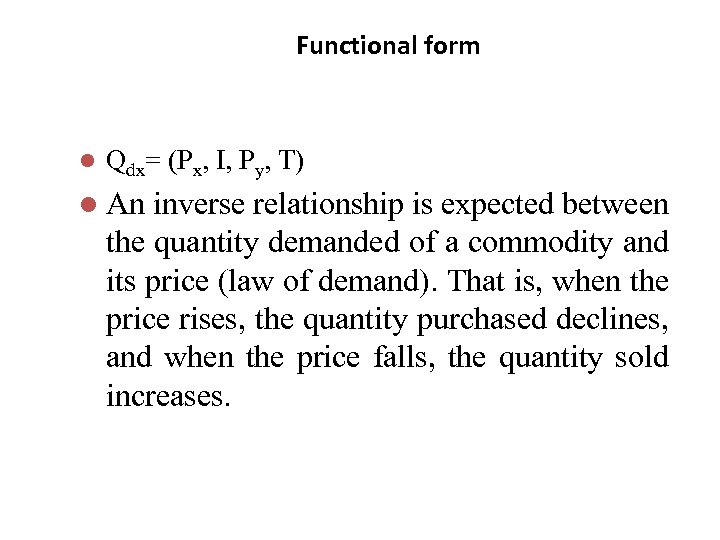

Functional form l Qdx= (Px, I, Py, T) l An inverse relationship is expected between the quantity demanded of a commodity and its price (law of demand). That is, when the price rises, the quantity purchased declines, and when the price falls, the quantity sold increases.

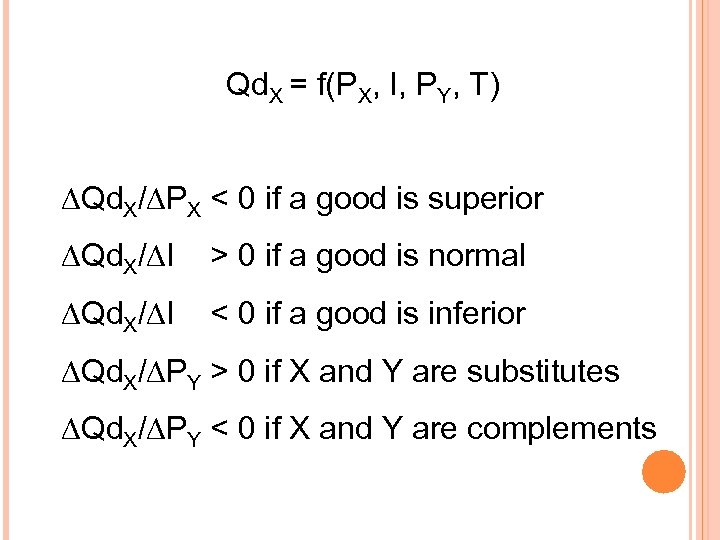

Qd. X = f(PX, I, PY, T) Qd. X/ PX < 0 if a good is superior Qd. X/ I > 0 if a good is normal Qd. X/ I < 0 if a good is inferior Qd. X/ PY > 0 if X and Y are substitutes Qd. X/ PY < 0 if X and Y are complements

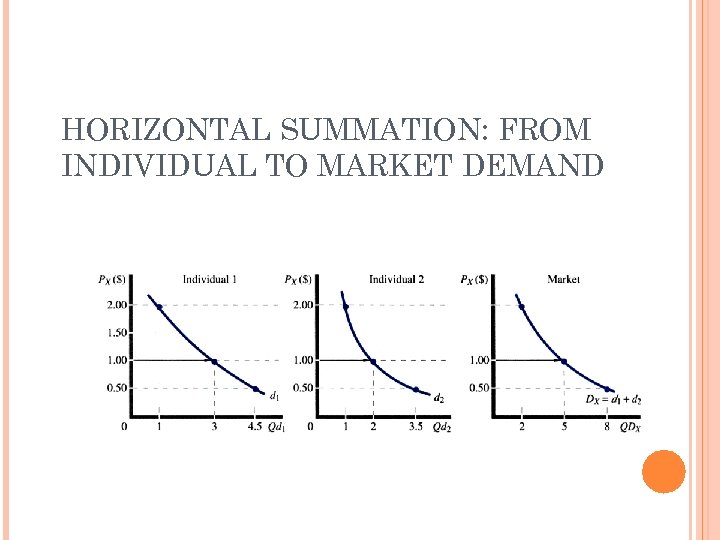

HORIZONTAL SUMMATION: FROM INDIVIDUAL TO MARKET DEMAND

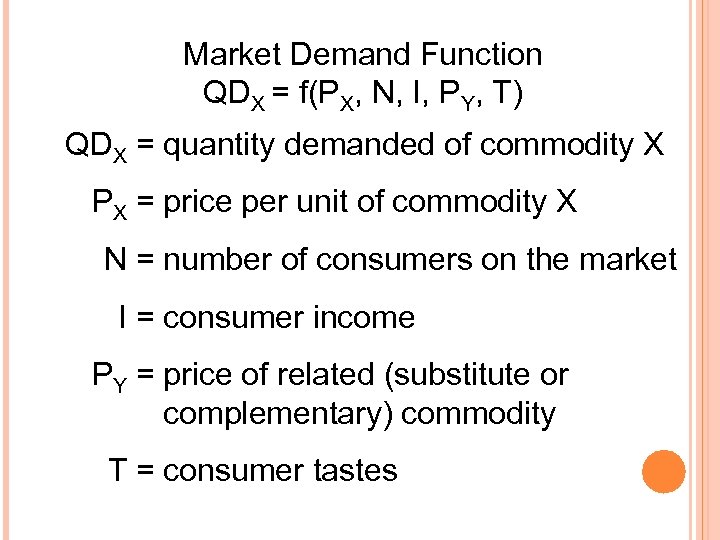

Market Demand Function QDX = f(PX, N, I, PY, T) QDX = quantity demanded of commodity X PX = price per unit of commodity X N = number of consumers on the market I = consumer income PY = price of related (substitute or complementary) commodity T = consumer tastes

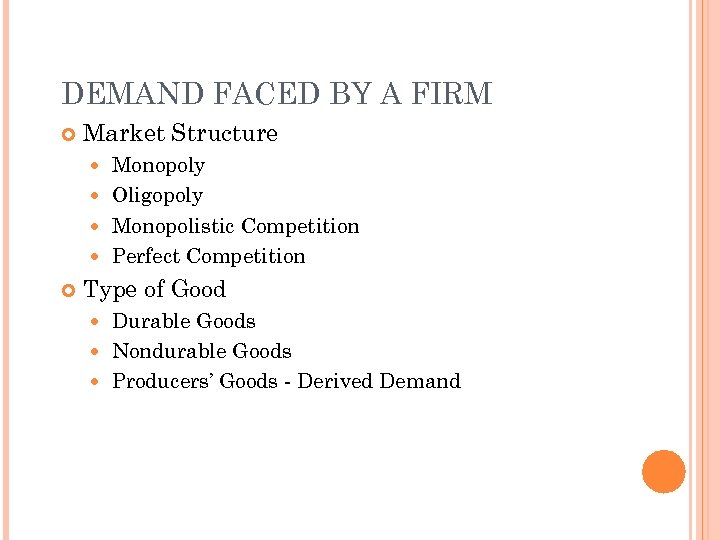

DEMAND FACED BY A FIRM Market Structure Monopoly Oligopoly Monopolistic Competition Perfect Competition Type of Good Durable Goods Nondurable Goods Producers’ Goods - Derived Demand

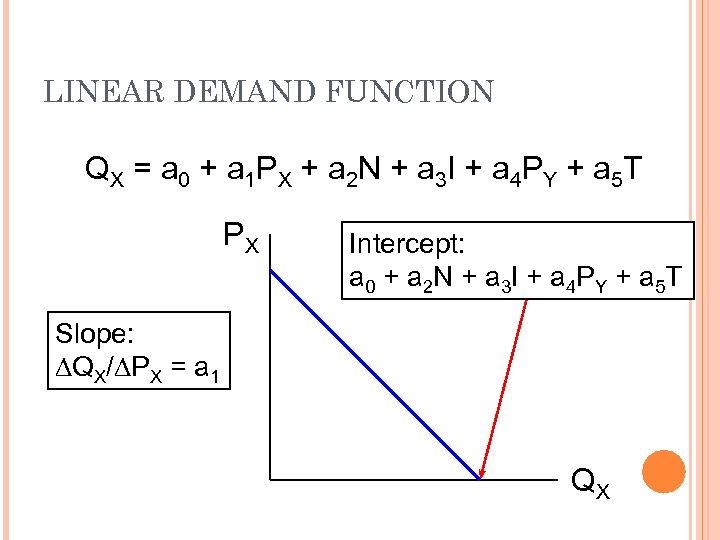

LINEAR DEMAND FUNCTION QX = a 0 + a 1 PX + a 2 N + a 3 I + a 4 PY + a 5 T PX Intercept: a 0 + a 2 N + a 3 I + a 4 PY + a 5 T Slope: QX/ PX = a 1 QX

ELASTICITY OF DEMAND

PRICE ELASTICITY OF DEMAND ¡ The price elasticity of demand (Ep) is mainly depends on the following factors: v Existence of substitutes effect e. g. Oil product cannot easily be substituted-demand of oil product is inelastic. e. g. The demand for taxi services is expected to be elastic. Instead, You may use bus, train etc. .

¡ The price elasticity of demand (Ep) is mainly depends on the following factors: v The portion of money allocated in the budget o A change in the price of a product do not influence consumers’ budget in a negative way. e. g. An increase in black pepper will not decrease the demand of consumers on black pepper due to their small portion of money allocated in their budget.

¡ The price elasticity of demand (Ep) is mainly depends on the following factors: v The time period after changes in price o As long as time period gets longer, the demand becomes more elastic. e. g. When oil prices increase, consumers cannot find a solution to change the current system to another alternative system in a short run period. This shows us demand for oil will remain same to a certain extent and an increase or a decrease in demand will be depend on time.

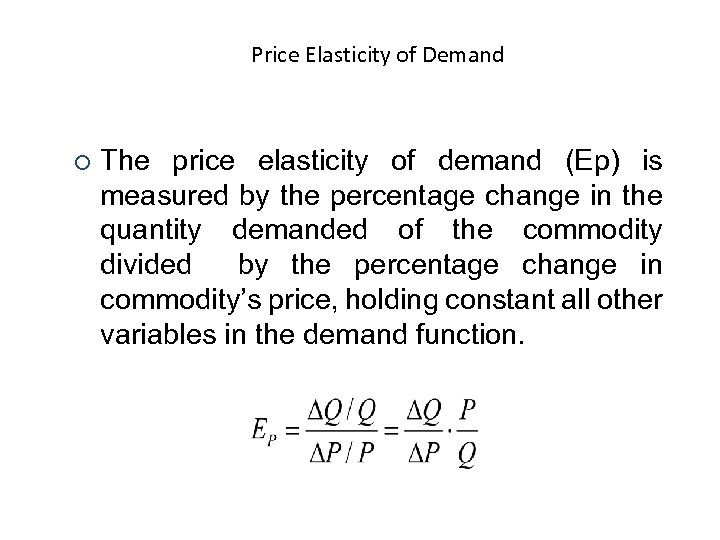

Price Elasticity of Demand ¡ The price elasticity of demand (Ep) is measured by the percentage change in the quantity demanded of the commodity divided by the percentage change in commodity’s price, holding constant all other variables in the demand function.

PRICE ELASTICITY OF DEMAND Point Definition Arc Definition Calculus approach

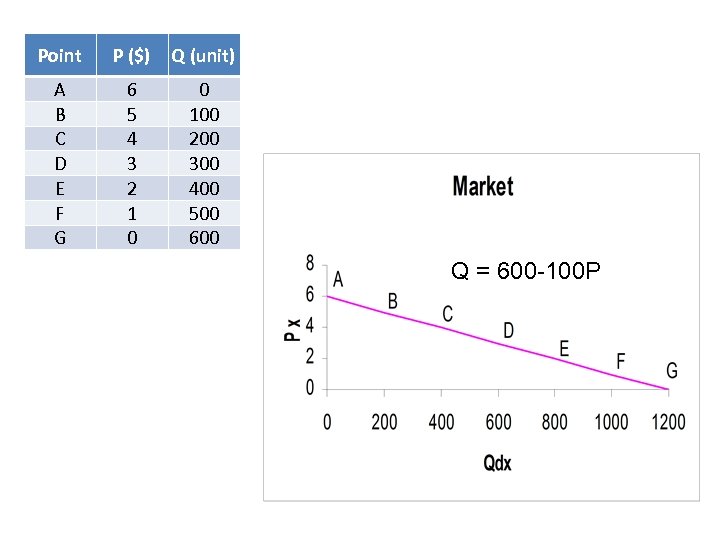

Point P ($) Q (unit) A B C D E F G 6 5 4 3 2 1 0 0 100 200 300 400 500 600 Q = 600 -100 P

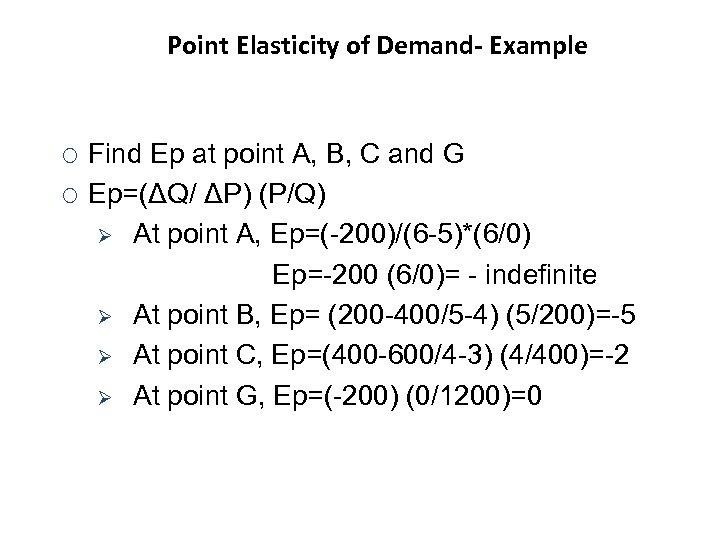

Point Elasticity of Demand- Example ¡ ¡ Find Ep at point A, B, C and G Ep=(ΔQ/ ΔP) (P/Q) Ø At point A, Ep=(-200)/(6 -5)*(6/0) Ep=-200 (6/0)= - indefinite Ø At point B, Ep= (200 -400/5 -4) (5/200)=-5 Ø At point C, Ep=(400 -600/4 -3) (4/400)=-2 Ø At point G, Ep=(-200) (0/1200)=0

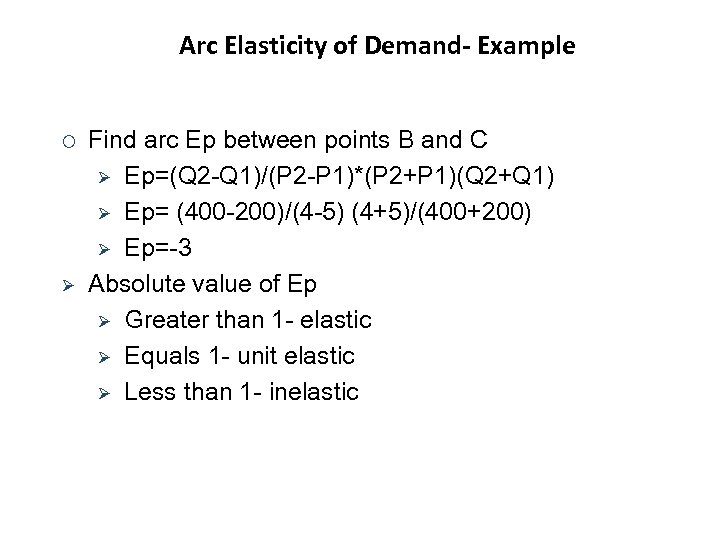

Arc Elasticity of Demand- Example ¡ Ø Find arc Ep between points B and C Ø Ep=(Q 2 -Q 1)/(P 2 -P 1)*(P 2+P 1)(Q 2+Q 1) Ø Ep= (400 -200)/(4 -5) (4+5)/(400+200) Ø Ep=-3 Absolute value of Ep Ø Greater than 1 - elastic Ø Equals 1 - unit elastic Ø Less than 1 - inelastic

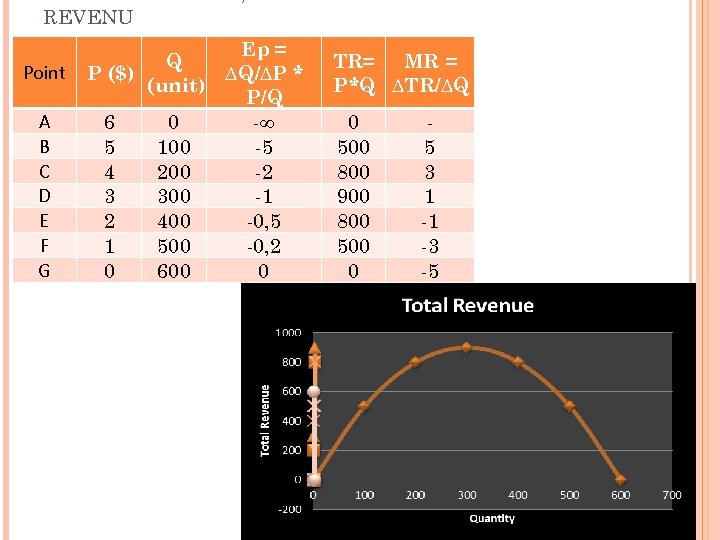

PRICE ELASTICITY, TOTAL REVENUE AND MARGINAL REVENU Point A B C D E F G Ep = Q P ($) ∆Q/∆P * (unit) P/Q 6 0 -∞ 5 100 -5 4 200 -2 3 300 -1 2 400 -0, 5 1 500 -0, 2 0 600 0 TR= MR = P*Q ∆TR/∆Q 0 500 800 900 800 500 0 5 3 1 -1 -3 -5

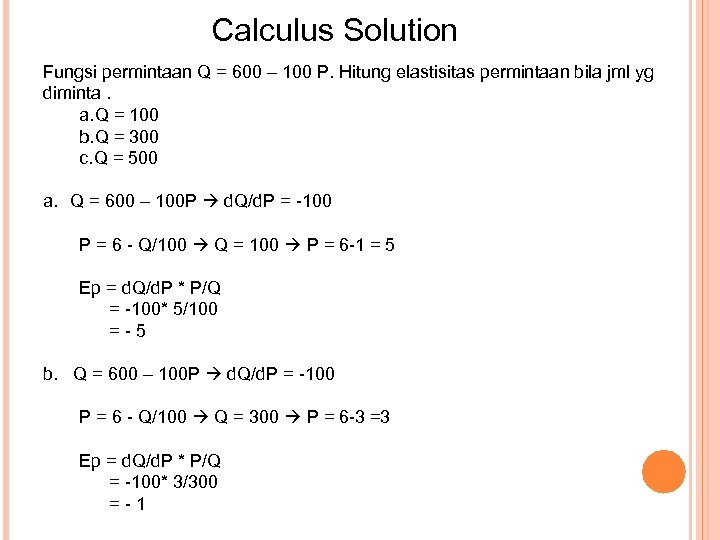

Calculus Solution Fungsi permintaan Q = 600 – 100 P. Hitung elastisitas permintaan bila jml yg diminta. a. Q = 100 b. Q = 300 c. Q = 500 a. Q = 600 – 100 P d. Q/d. P = -100 P = 6 - Q/100 Q = 100 P = 6 -1 = 5 Ep = d. Q/d. P * P/Q = -100* 5/100 = - 5 b. Q = 600 – 100 P d. Q/d. P = -100 P = 6 - Q/100 Q = 300 P = 6 -3 =3 Ep = d. Q/d. P * P/Q = -100* 3/300 = - 1

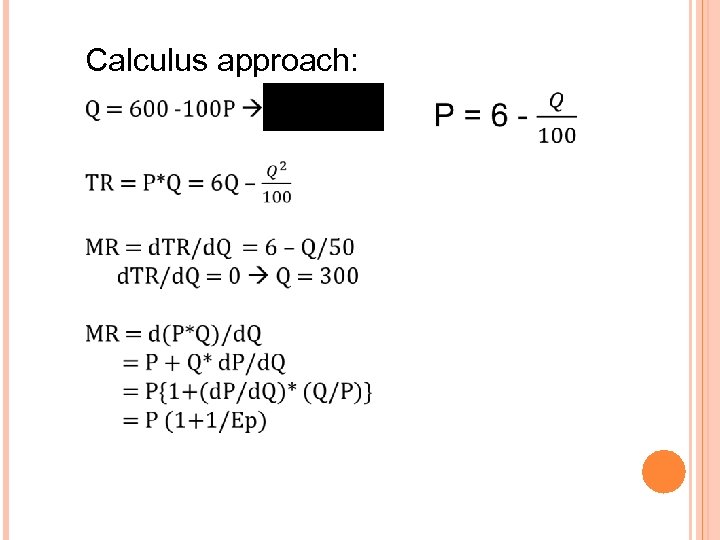

Calculus approach:

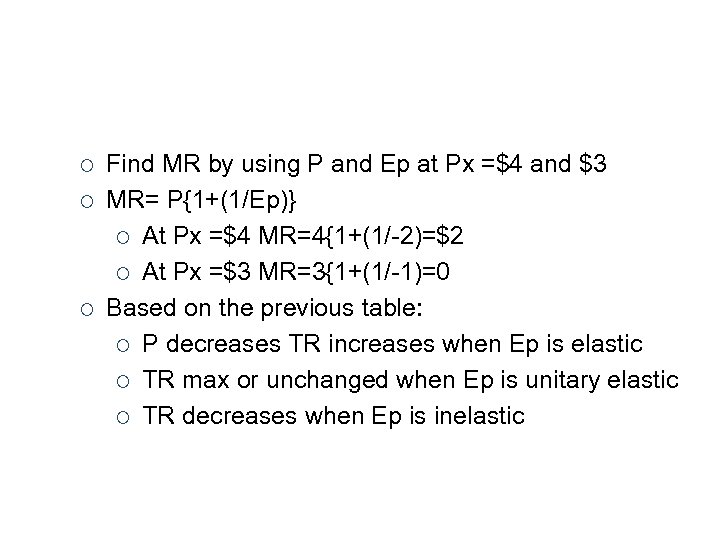

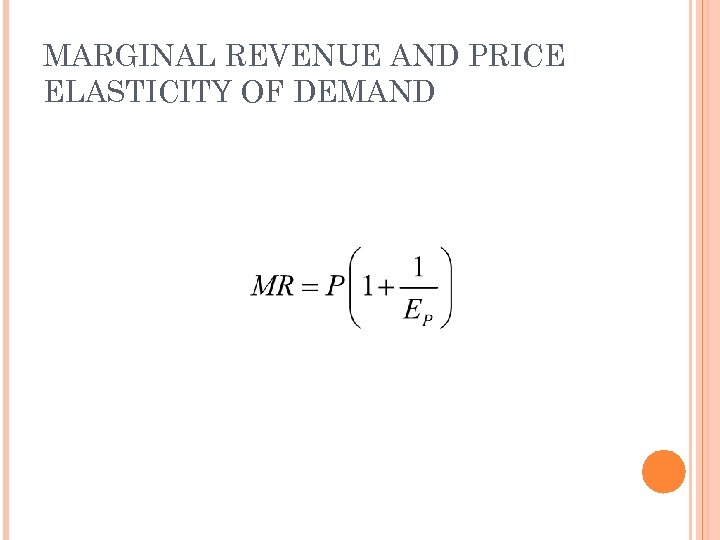

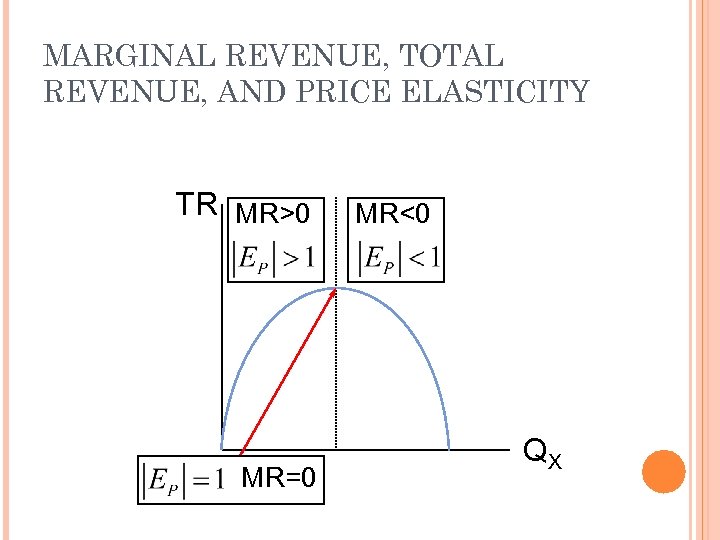

¡ ¡ ¡ Find MR by using P and Ep at Px =$4 and $3 MR= P{1+(1/Ep)} ¡ At Px =$4 MR=4{1+(1/-2)=$2 ¡ At Px =$3 MR=3{1+(1/-1)=0 Based on the previous table: ¡ P decreases TR increases when Ep is elastic ¡ TR max or unchanged when Ep is unitary elastic ¡ TR decreases when Ep is inelastic

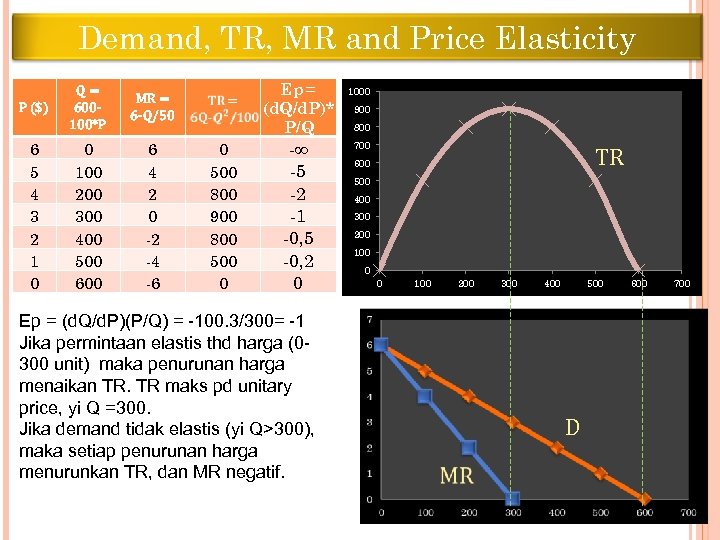

Demand, TR, MR and Price Elasticity P ($) 6 5 4 3 2 1 0 Q= 600100*P 0 100 200 300 400 500 6 4 2 0 -2 -4 -6 Ep = (d. Q/d. P)* P/Q MR = 6 -Q/50 0 500 800 900 800 500 0 -∞ -5 -2 -1 -0, 5 -0, 2 0 Ep = (d. Q/d. P)(P/Q) = -100. 3/300= -1 Jika permintaan elastis thd harga (0300 unit) maka penurunan harga menaikan TR. TR maks pd unitary price, yi Q =300. Jika demand tidak elastis (yi Q>300), maka setiap penurunan harga menurunkan TR, dan MR negatif. 1000 900 800 700 TR 600 500 400 300 200 100 0 0 100 200 300 400 500 D 600 700

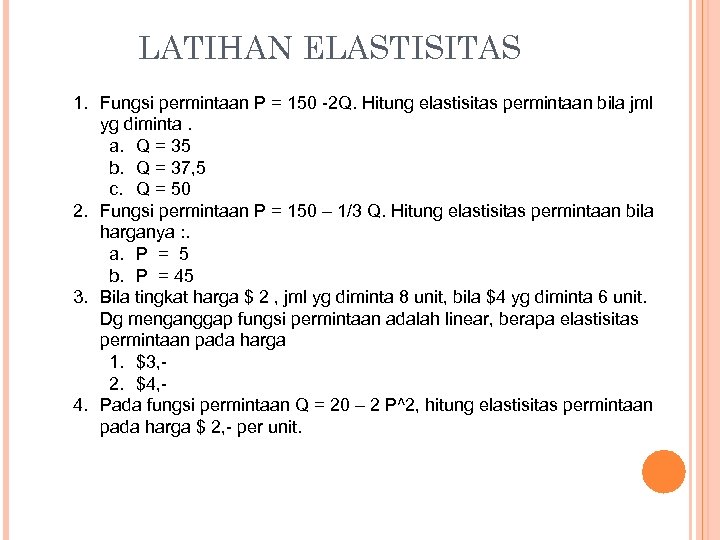

LATIHAN ELASTISITAS 1. Fungsi permintaan P = 150 -2 Q. Hitung elastisitas permintaan bila jml yg diminta. a. Q = 35 b. Q = 37, 5 c. Q = 50 2. Fungsi permintaan P = 150 – 1/3 Q. Hitung elastisitas permintaan bila harganya : . a. P = 5 b. P = 45 3. Bila tingkat harga $ 2 , jml yg diminta 8 unit, bila $4 yg diminta 6 unit. Dg menganggap fungsi permintaan adalah linear, berapa elastisitas permintaan pada harga 1. $3, 2. $4, 4. Pada fungsi permintaan Q = 20 – 2 P^2, hitung elastisitas permintaan pada harga $ 2, - per unit.

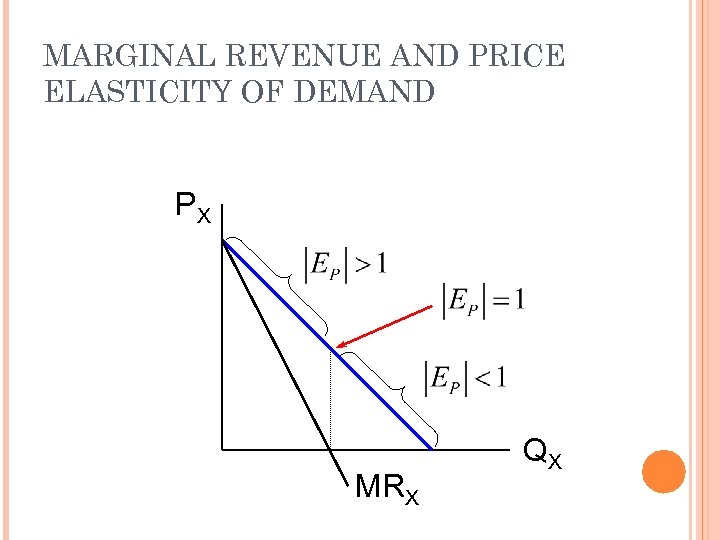

MARGINAL REVENUE AND PRICE ELASTICITY OF DEMAND

MARGINAL REVENUE AND PRICE ELASTICITY OF DEMAND PX MRX QX

MARGINAL REVENUE, TOTAL REVENUE, AND PRICE ELASTICITY TR MR>0 MR=0 MR<0 QX

DETERMINANTS OF PRICE ELASTICITY OF DEMAND Demand for a commodity will be more elastic if: It has many close substitutes It is narrowly defined More time is available to adjust to a price change

DETERMINANTS OF PRICE ELASTICITY OF DEMAND Demand for a commodity will be less elastic if: It has few substitutes It is broadly defined Less time is available to adjust to a price change

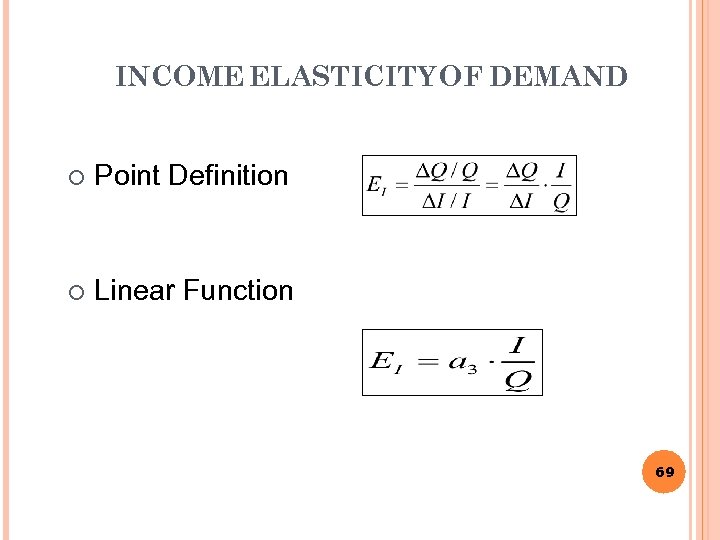

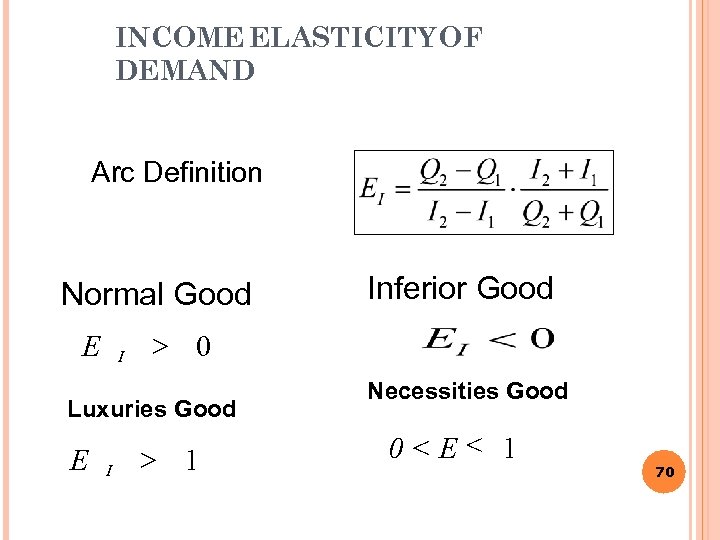

INCOME ELASTICITY OF DEMAND Point Definition: Arc Definition: Calculus approach: Normal Good Inferior Good

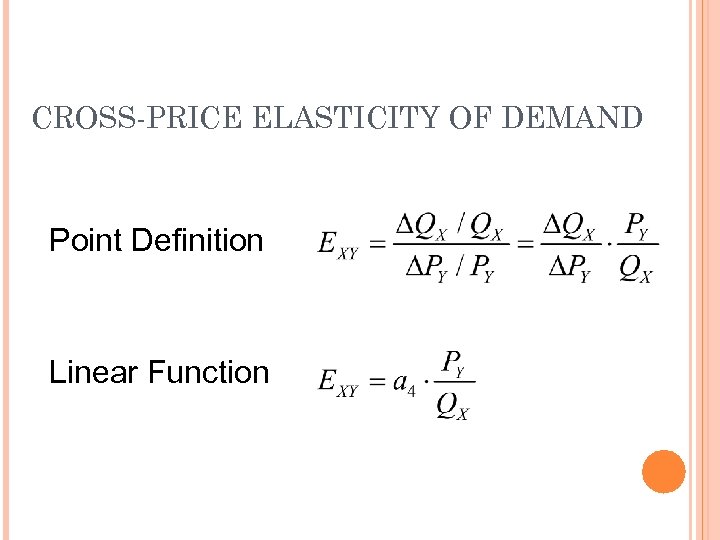

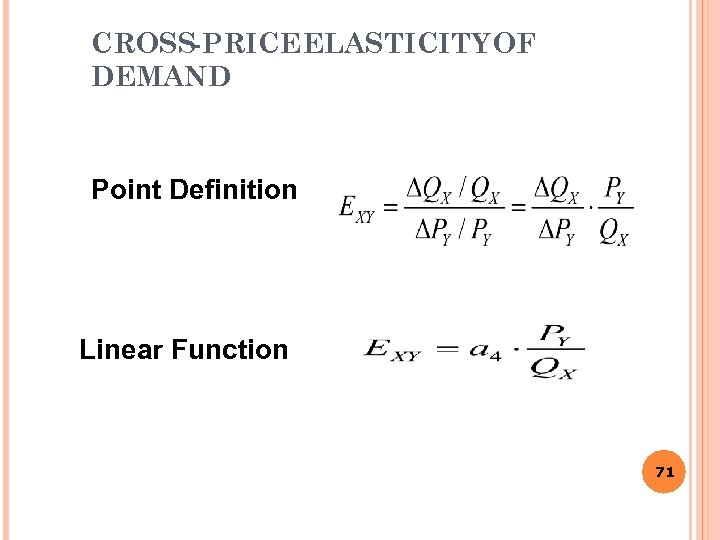

CROSS-PRICE ELASTICITY OF DEMAND Point Definition Linear Function

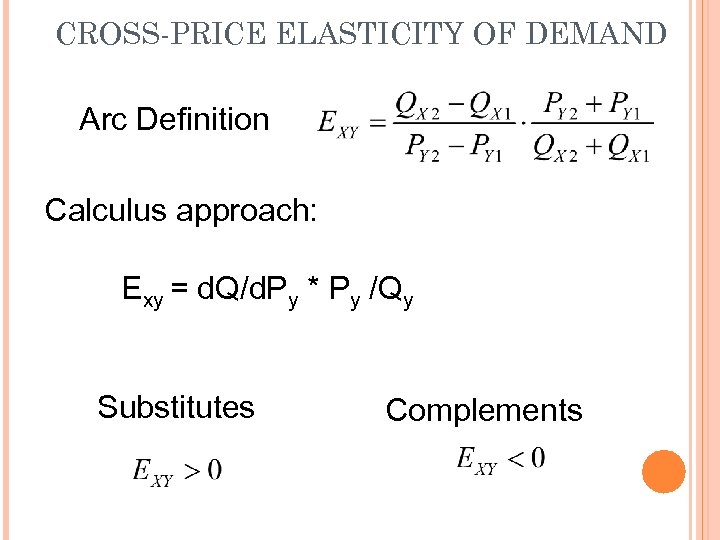

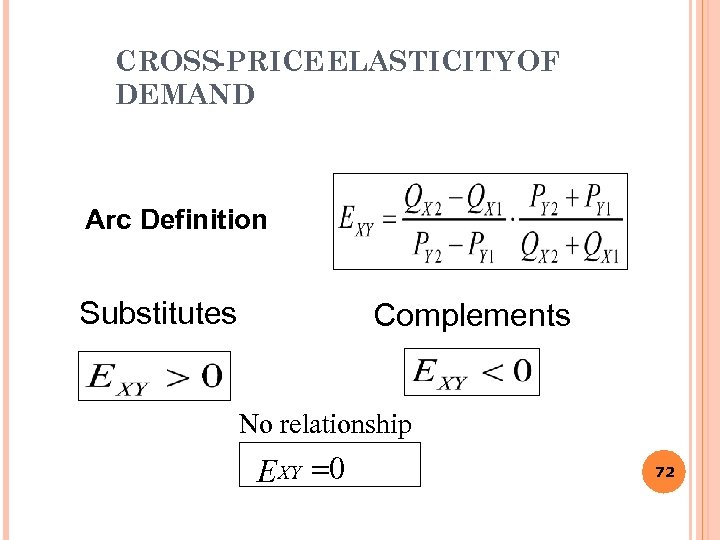

CROSS-PRICE ELASTICITY OF DEMAND Arc Definition Calculus approach: Exy = d. Q/d. Py * Py /Qy Substitutes Complements

OTHER FACTORS RELATED TO DEMAND THEORY International Convergence of Tastes Globalization of Markets Influence of International Preferences on Market Demand Growth of Electronic Commerce Cost of Sales Supply Chains and Logistics Customer Relationship Management

INCOME ELASTICITY OF DEMAND ¡ Point Definition ¡ Linear Function 69

INCOME ELASTICITY OF DEMAND Arc Definition Normal Good E I > 0 Luxuries Good E I Inferior Good > 1 Necessities Good 0<E< 1 I 70

CROSS-PRICE ELASTICITY OF DEMAND Point Definition Linear Function 71

CROSS-PRICE ELASTICITY OF DEMAND Arc Definition Substitutes Complements No relationship EXY =0 72

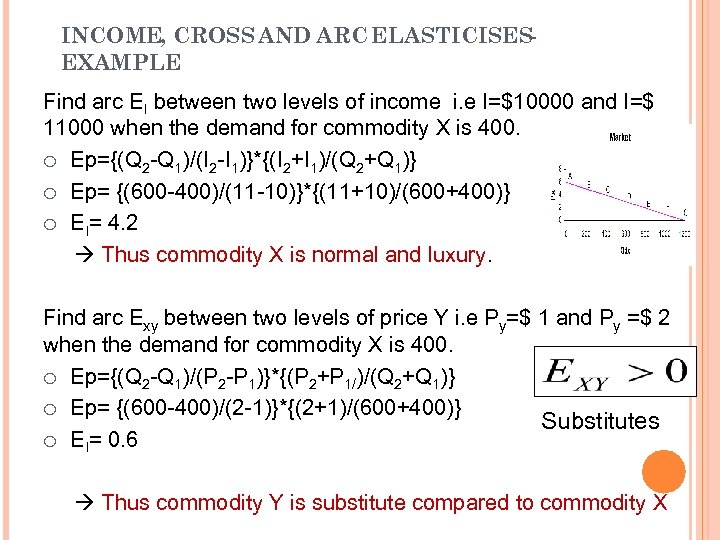

INCOME, CROSS AND ARC ELASTICISES EXAMPLE 73 Find arc EI between two levels of income i. e I=$10000 and I=$ 11000 when the demand for commodity X is 400. ¡ Ep={(Q 2 -Q 1)/(I 2 -I 1)}*{(I 2+I 1)/(Q 2+Q 1)} ¡ Ep= {(600 -400)/(11 -10)}*{(11+10)/(600+400)} ¡ EI= 4. 2 Thus commodity X is normal and luxury. Find arc Exy between two levels of price Y i. e Py=$ 1 and Py =$ 2 when the demand for commodity X is 400. ¡ Ep={(Q 2 -Q 1)/(P 2 -P 1)}*{(P 2+P 1/)/(Q 2+Q 1)} ¡ Ep= {(600 -400)/(2 -1)}*{(2+1)/(600+400)} Substitutes ¡ EI= 0. 6 Thus commodity Y is substitute compared to commodity X

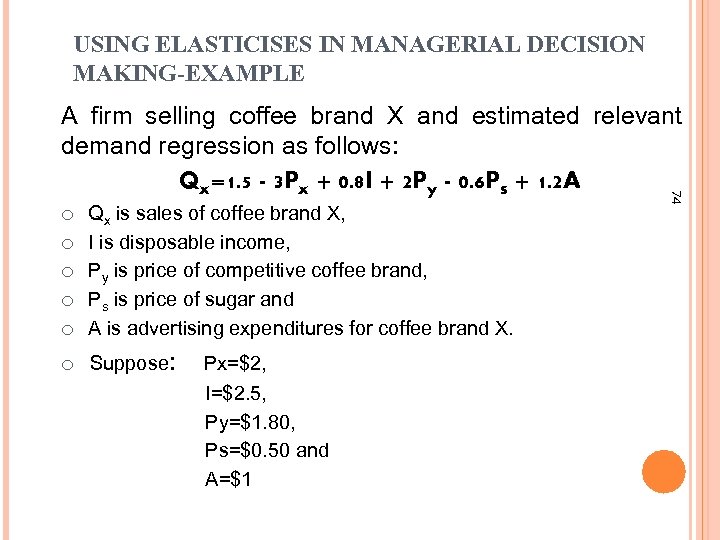

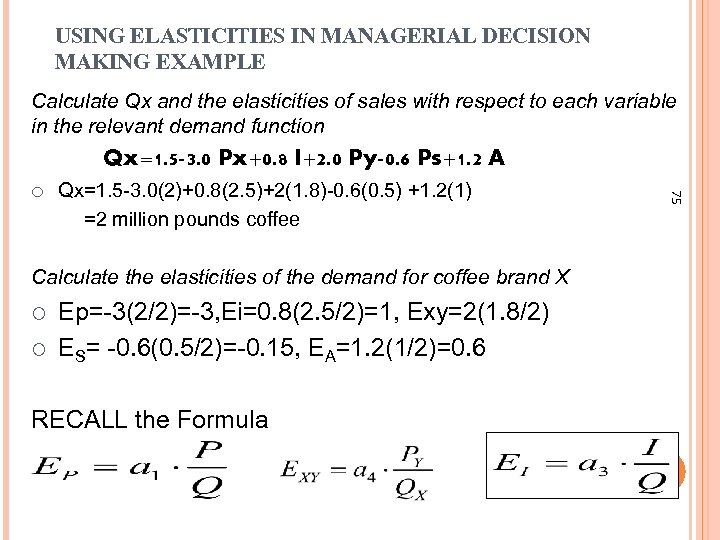

USING ELASTICISES IN MANAGERIAL DECISION MAKING-EXAMPLE ¡ ¡ ¡ Qx is sales of coffee brand X, I is disposable income, Py is price of competitive coffee brand, Ps is price of sugar and A is advertising expenditures for coffee brand X. Suppose: Px=$2, I=$2. 5, Py=$1. 80, Ps=$0. 50 and A=$1 74 A firm selling coffee brand X and estimated relevant demand regression as follows: Qx=1. 5 - 3 Px + 0. 8 I + 2 Py - 0. 6 Ps + 1. 2 A

USING ELASTICITIES IN MANAGERIAL DECISION MAKING EXAMPLE Calculate Qx and the elasticities of sales with respect to each variable in the relevant demand function Qx=1. 5 -3. 0 Px+0. 8 I+2. 0 Py-0. 6 Ps+1. 2 A Qx=1. 5 -3. 0(2)+0. 8(2. 5)+2(1. 8)-0. 6(0. 5) +1. 2(1) =2 million pounds coffee Calculate the elasticities of the demand for coffee brand X ¡ ¡ Ep=-3(2/2)=-3, Ei=0. 8(2. 5/2)=1, Exy=2(1. 8/2) ES= -0. 6(0. 5/2)=-0. 15, EA=1. 2(1/2)=0. 6 RECALL the Formula 75 ¡

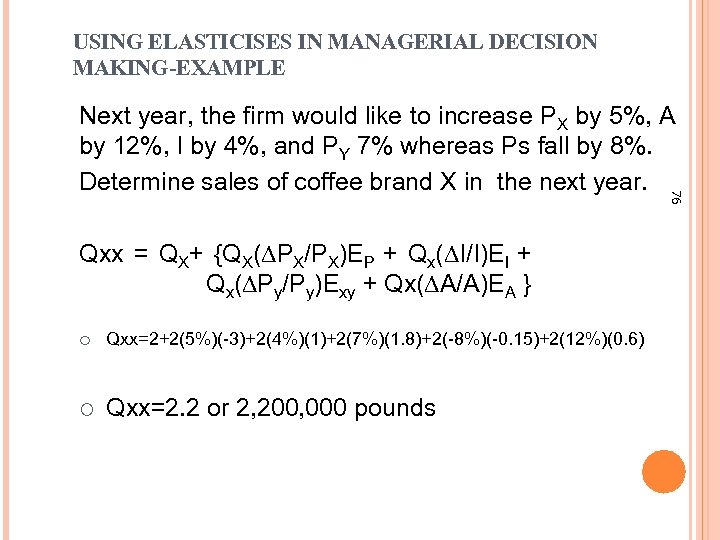

USING ELASTICISES IN MANAGERIAL DECISION MAKING-EXAMPLE 76 Next year, the firm would like to increase PX by 5%, A by 12%, I by 4%, and PY 7% whereas Ps fall by 8%. Determine sales of coffee brand X in the next year. Qxx = QX+ {QX(∆PX/PX)EP + Qx(∆I/I)EI + Qx(∆Py/Py)Exy + Qx(∆A/A)EA } ¡ Qxx=2+2(5%)(-3)+2(4%)(1)+2(7%)(1. 8)+2(-8%)(-0. 15)+2(12%)(0. 6) ¡ Qxx=2. 2 or 2, 200, 000 pounds

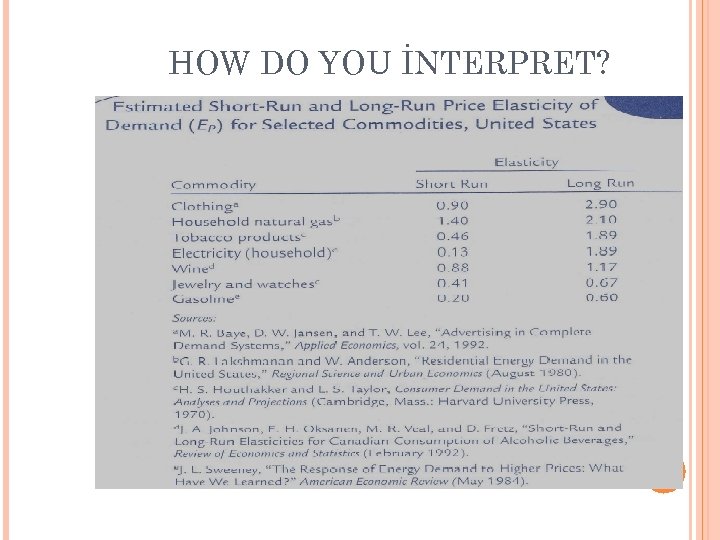

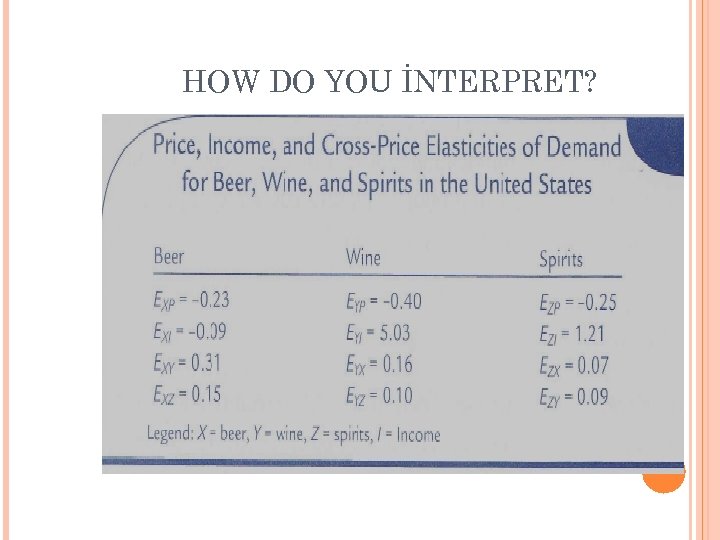

HOW DO YOU İNTERPRET? 77

HOW DO YOU İNTERPRET? ¡ 78 1 percent increase in price leads to a reduction in the quantity demanded of clothing of 0 f 0. 90 percent in the short-run and 2. 90 percent in the long-run. Price elasticity of demand for gasoline is three times higher in the long-run. Both elasticities are very small. It seems that people cannot find suitable substitutes for gasoline. ¡ ¡ ¡

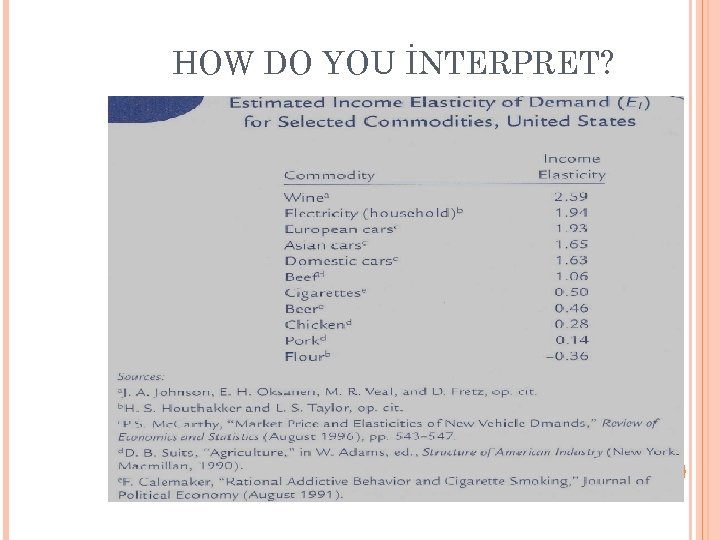

HOW DO YOU İNTERPRET? 79

HOW DO YOU İNTERPRET? ¡ 80 Income elesticity of demand is 2. 59 for wine and 0. 36 for flour. This means that a 1 percent increase in consumers’ income leads to a 2. 59 percent increase in expenditure on wine but to a 0. 36 percent reduction in expenditures on flour. Thus wine is a luxury while flour is a inferior good. Electricity is also a luxury and so European cars, Asian cars, and domestic cars in the U. S. While cigarettes, beer, chicken and pork are necessities. Beef is a borderline commodity ¡ ¡

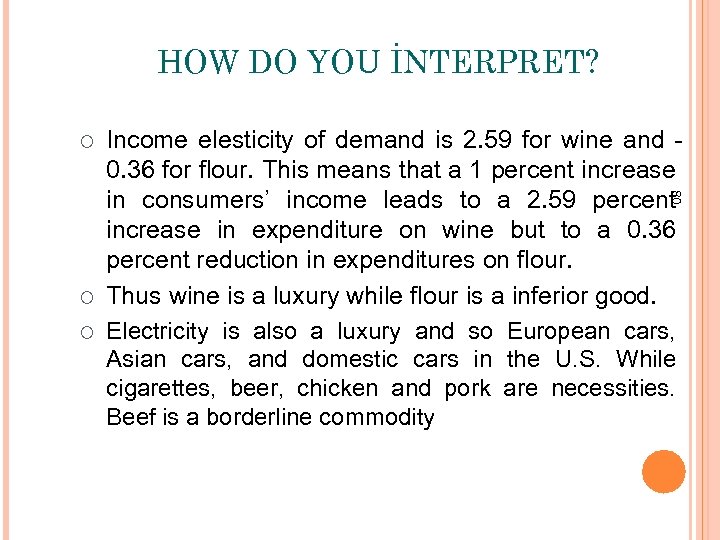

HOW DO YOU İNTERPRET? 81

HOW DO YOU İNTERPRET? ¡ 82 The cross price elesticity of demand of margarine with respect to the price of butter is 1. 53 percent. This means that a 1 percent increase in the price of butter leads to a 1. 53 percent increase in the demand for margarine. Thus margarine and butter are substitutes in the U. S. The cross price elesticity of demand of cereals (e. g. Bread) with respect to the price of fresh fish is -0. 87 percent. This means that a 1 percent increase in the price of cereals leads to a 0. 87 percent reduction in the demand for fresh fish. ¡ ¡ ¡ Thus cereal and fresh fish are complements.

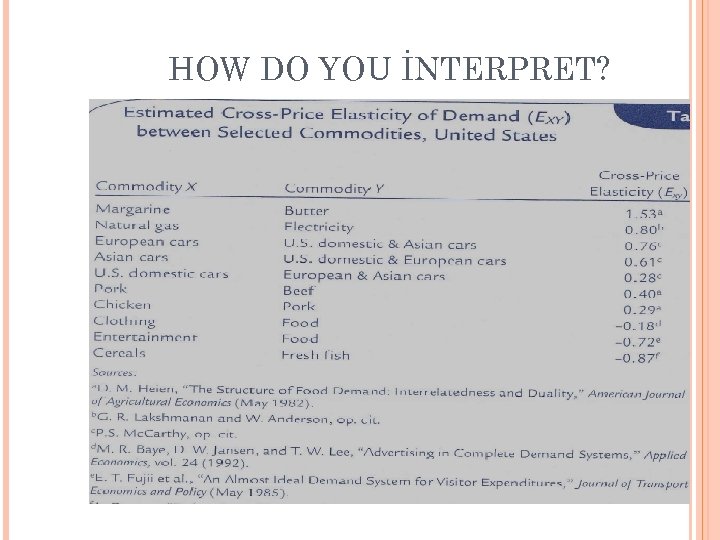

HOW DO YOU İNTERPRET? 83

HOW DO YOU İNTERPRET? ¡ 84 The price elesticity of demand of beer is -0. 23 percent. This means that a 10 percent increase in the price of beer leads to a 2. 3 percent reduction in the quantity of beer demanded and thus an increase in consumer expenditures on beer. The price elesticity of wine is -0. 40 and spirits is -0. 25 so that an increase in their price also leads consumers to demand a smaller quantity of wine and spirits, but also to spend more on the alcoholic beverages. The cross price elesticity of demand for beer with respect to the price of wine is 0. 31 and with respect to spirits is 0. 15. This means that wine and spirits are substitutes for beer, with wine being better substitute. ¡ ¡

HOW DO YOU İNTERPRET? ¡ ¡ ¡ 85 ¡ Thus a 10 percent increase in the price of wine will lead to a 3. 1 percent increase in demand for beer, while a 10 percent increase in the price of spirits leads to a 1. 5 percent increase in demand for beer. a 10 percent increase in consumer income will lead to a 0. 9 percent reduction in the demand for beer, but 50. 3 percent increase in demand for wine, while a 12. 1 percent increase in demand for spirits. Thus beer can be considered an inferior good, while wine and spirits can be regarded as a luxury goods. Wine seems much stronger luxury than spirits.

THE İMPORTANTSTEPS BY USİNG ELASTİCİTİES ü 86 The analysis of the forces or variables that affect on demand reliable estimates of their quantitative effect on sales (elasticities) are essential in order for firm to make best operating decisions in shor-run and to plan for its growth in the long-run. The firms can use the elasticities of demand of the variables under their controls to find out best policies as well as to maximize their profits. If the demand for the firm’s product is price inelastic, the firm will want to increase the product price since that would increase its total revenue and reduce its total cost. If the elasticity of the firm’s sales wrt the variable beyod its control or If the cross-price elasticity of demand for the firm’s product is very high, the firm will need to respond quickly to a competitor’s price reduction otherwise losing a great deal of its sales. ü ü ü

THE İMPORTANTSTEPS BY USİNG ELASTİCİTİES 87 The size of the price elasticity of demand is larger, the closer and the greater is the number of available substitutes for the commodity. For example, sugar is more price elastic than table salt (e. g. honey) In general, the greater is its price elasticity of demand, the greater will be the number of substitutes For a given price change, the quantity response is likely to be much larger in the long run than short run so the price elasticity of demand is likely to be much greater in the long run than short run.

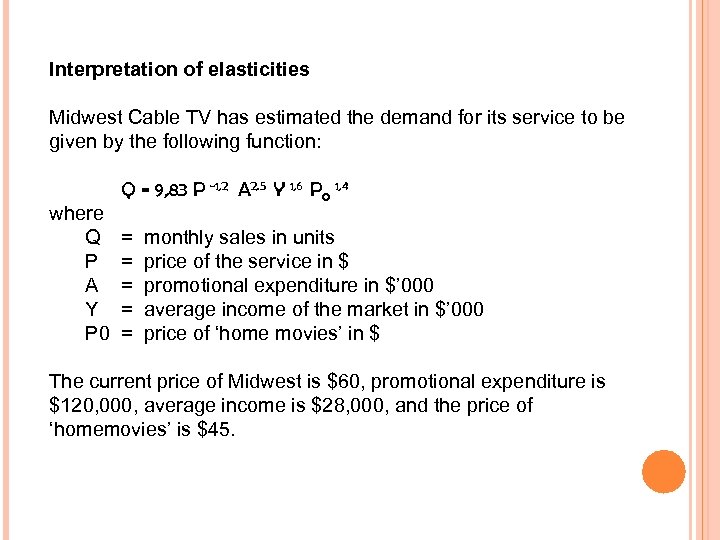

Interpretation of elasticities Midwest Cable TV has estimated the demand for its service to be given by the following function: where Q P A Y P 0 Q = 9, 83 P -1, 2 A 2. 5 Y 1, 6 P 0 1, 4 = monthly sales in units = price of the service in $ = promotional expenditure in $’ 000 = average income of the market in $’ 000 = price of ‘home movies’ in $ The current price of Midwest is $60, promotional expenditure is $120, 000, average income is $28, 000, and the price of ‘homemovies’ is $45.

Indicate whether the following statements are true or false, giving your reasons and making the necessary corrections. a. If Midwest increases its price this will reduce the number of its customers. b. If Midwest increases its price this will reduce its revenues. c. People’s expenditure on the cable TV service as a proportion of their income will increase when their income increases. d. If Midwest increases its price this will increase the sales of ‘home movies’. e. ‘Home movies’ are a substitute for cable TV. f. A 5 per cent increase in income will increase demand by 16 per cent. g. A 10 per cent increase in price will reduce demand by 12 per cent. h. Current sales are over a million units a month. i. The demand curve for Midwest is given by: Q=9, 83 P 1, 2 j. Midwest’s sales are more affected by the price of ‘home movies’ than by the price of its own service. k. If Midwest increases its price this will reduce its profit.

1. True; customers and quantity demanded are synonymous in this case, and there is an inverse relationship between Q and P, as seen by the negative price elasticity. 2. True; demand is elastic, since the PED is greater than 1 in absolute magnitude. Therefore an increase in price causes a greater than proportional decrease in quantity demanded and a fall in revenue. 3. True; this is because the YED is greater than 1, indicating that cable TV is a luxury product. Note that the statement would be false if the good were a staple. For staples, although expenditure on the roduct increases as income increases, expenditure as a proportion of income falls, since expenditure rises more slowly than income. 4. False; the two products are complementary, shown by the CED being negative; therefore an increase in the price of one product will reduce the sales of the other. It appears therefore that ‘home movies’ is a cable channel. 5. False; the two products are complementary, shown by the CED being negative.

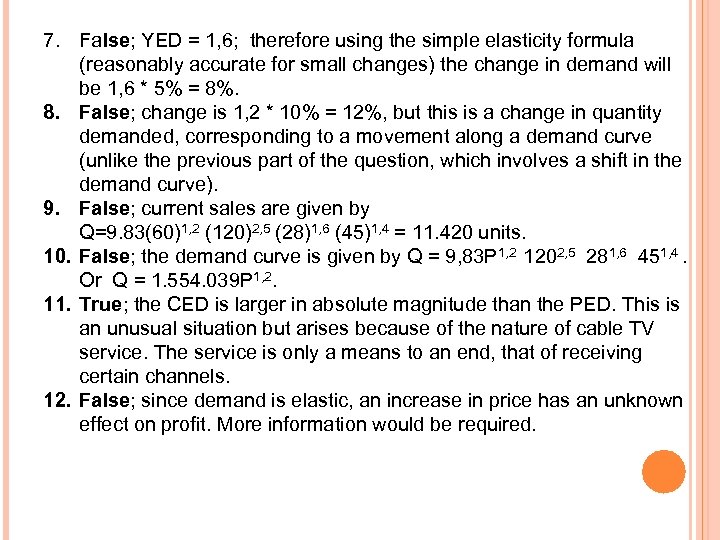

7. False; YED = 1, 6; therefore using the simple elasticity formula (reasonably accurate for small changes) the change in demand will be 1, 6 * 5% = 8%. 8. False; change is 1, 2 * 10% = 12%, but this is a change in quantity demanded, corresponding to a movement along a demand curve (unlike the previous part of the question, which involves a shift in the demand curve). 9. False; current sales are given by Q=9. 83(60)1, 2 (120)2, 5 (28)1, 6 (45)1, 4 = 11. 420 units. 10. False; the demand curve is given by Q = 9, 83 P 1, 2 1202, 5 281, 6 451, 4. Or Q = 1. 554. 039 P 1, 2. 11. True; the CED is larger in absolute magnitude than the PED. This is an unusual situation but arises because of the nature of cable TV service. The service is only a means to an end, that of receiving certain channels. 12. False; since demand is elastic, an increase in price has an unknown effect on profit. More information would be required.

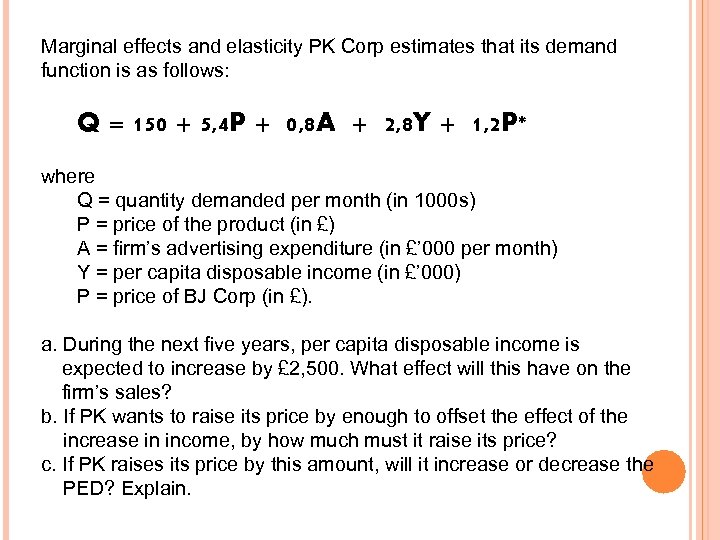

Marginal effects and elasticity PK Corp estimates that its demand function is as follows: Q = 150 + 5, 4 P + 0, 8 A + 2, 8 Y + 1, 2 P* where Q = quantity demanded per month (in 1000 s) P = price of the product (in £) A = firm’s advertising expenditure (in £’ 000 per month) Y = per capita disposable income (in £’ 000) P = price of BJ Corp (in £). a. During the next five years, per capita disposable income is expected to increase by £ 2, 500. What effect will this have on the firm’s sales? b. If PK wants to raise its price by enough to offset the effect of the increase in income, by how much must it raise its price? c. If PK raises its price by this amount, will it increase or decrease the PED? Explain.

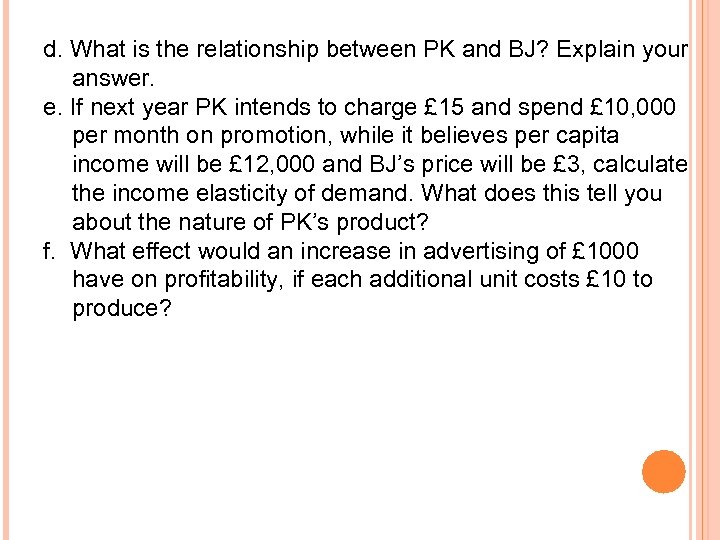

d. What is the relationship between PK and BJ? Explain your answer. e. If next year PK intends to charge £ 15 and spend £ 10, 000 per month on promotion, while it believes per capita income will be £ 12, 000 and BJ’s price will be £ 3, calculate the income elasticity of demand. What does this tell you about the nature of PK’s product? f. What effect would an increase in advertising of £ 1000 have on profitability, if each additional unit costs £ 10 to produce?

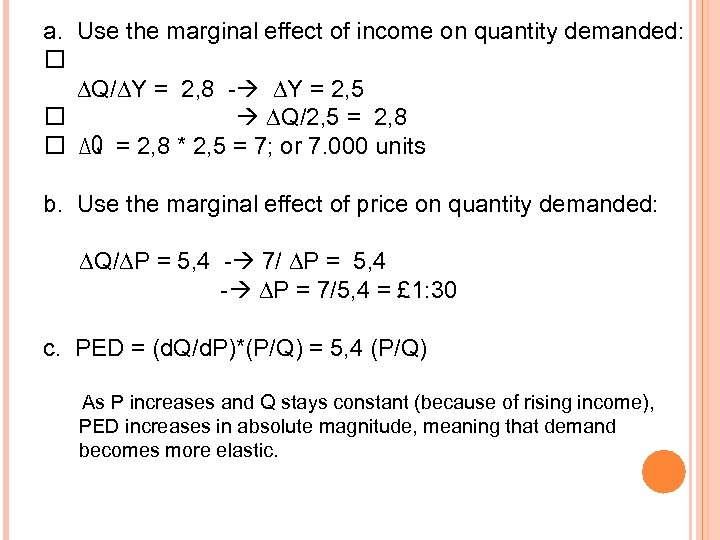

a. Use the marginal effect of income on quantity demanded: ∆Q/∆Y = 2, 8 - ∆Y = 2, 5 ∆Q/2, 5 = 2, 8 ∆Q = 2, 8 * 2, 5 = 7; or 7. 000 units b. Use the marginal effect of price on quantity demanded: ∆Q/∆P = 5, 4 - 7/ ∆P = 5, 4 - ∆P = 7/5, 4 = £ 1: 30 c. PED = (d. Q/d. P)*(P/Q) = 5, 4 (P/Q) As P increases and Q stays constant (because of rising income), PED increases in absolute magnitude, meaning that demand becomes more elastic.

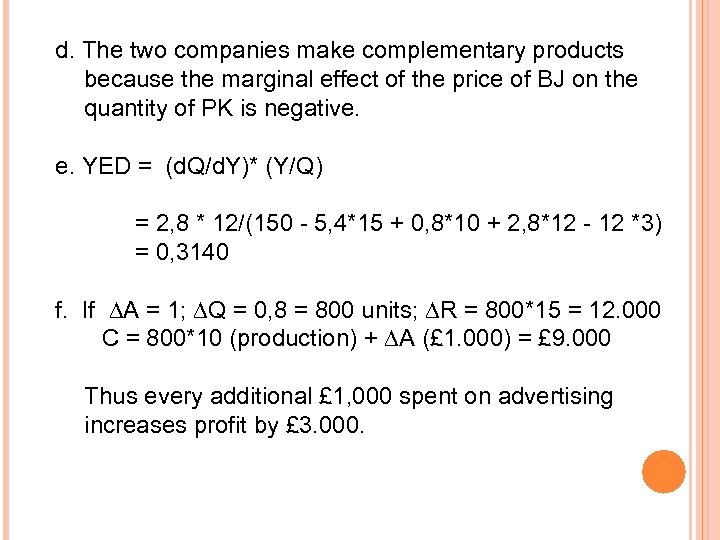

d. The two companies make complementary products because the marginal effect of the price of BJ on the quantity of PK is negative. e. YED = (d. Q/d. Y)* (Y/Q) = 2, 8 * 12/(150 - 5, 4*15 + 0, 8*10 + 2, 8*12 - 12 *3) = 0, 3140 f. If ∆A = 1; ∆Q = 0, 8 = 800 units; ∆R = 800*15 = 12. 000 C = 800*10 (production) + ∆A (£ 1. 000) = £ 9. 000 Thus every additional £ 1, 000 spent on advertising increases profit by £ 3. 000.

f62b9428bdaa356f4319638888d1fc10.ppt