d3ec5ad6ac7327cd26f1f0e37c3cd766.ppt

- Количество слайдов: 10

Managerial Economics & Business Strategy Chapter 9 Basic Oligopoly Models

Stackelberg Summary • Stackelberg model illustrates how commitment can enhance profits in strategic environments. • Leader produces more than the Cournot equilibrium output. n n Larger market share, higher profits. First-mover advantage. • Follower produces less than the Cournot equilibrium output. n Smaller market share, lower profits.

Let’s work through demonstration problem 9 -6 (put your books away) • Suppose the inverse demand function for two firms in a homogeneous-product Stackelberg oligopoly is given by P=50 -(Q 1+Q 2) and the cost functions for the two firms are C 1(Q 1)=2 Q 1 and C 2(Q 2)=2 Q 2 • Firm 1 is the leader, and firm 2 is the follower n n What is firm 2’s reaction function? What is firm 1’s output? What is firm 2’s output? What is the market price?

Bertrand Model • Few firms that sell to many consumers. • Firms produce identical products at constant marginal cost. • Each firm independently sets its price in order to maximize profits. • Barriers to entry. • Consumers enjoy n n Perfect information. Zero transaction costs.

Bertrand Equilibrium • Firms set P 1 = P 2 = MC! Why? • Suppose MC < P 1 < P 2. • Firm 1 earns (P 1 - MC) on each unit sold, while firm 2 earns nothing. • Firm 2 has an incentive to slightly undercut firm 1’s price to capture the entire market. • Firm 1 then has an incentive to undercut firm 2’s price. This undercutting continues. . . • PRICE WAR • Equilibrium: Each firm charges P 1 = P 2 = MC.

Firms don’t like this. . . • Bertrand oligopoly leads to zero economic profits • Consumers like this… n n Products are identical Buy from the firm with the lowest price • Ending outcome is like Perfect Competition • Called the Bertrand Trap n n This is why firms spend millions on advertising “We” charge a different price BECAUSE “We” are different

What if firms WORK together? • Collusion n Dealt with in greater detail in Chapter 10 • Maximize TOTAL industry profit n Q = Q 1 + Q 2 • P=1000 -Q and C(Q) = 4 Q • Set MR=MC n n 1000 -2 Q=4 Q=498 P=$502 Profits = (498*502)-(4*498)=248004

Summary • Cournot (oil production) n n Set MR=MC for each firm and cross substitute to find Q 1 and Q 2 Plug back into the inverse demand function to find P • Stackelberg (Diamonds) n n n Set MR=MC for the FOLLOWER to find reaction function Maximize the Profit of the Leader plugging in the followers reaction function in for Q 2 • Plug in the reaction function BEFORE you maximize Profits Plug back into the inverse demand function to find P • Bertrand (contractors bidding for the job) n n Use the inverse demand cost functions to set P=MC Profits always equal ZERO • Collusion n n Work together and maximize total industry Q Monopoly outcome (MR=MC)

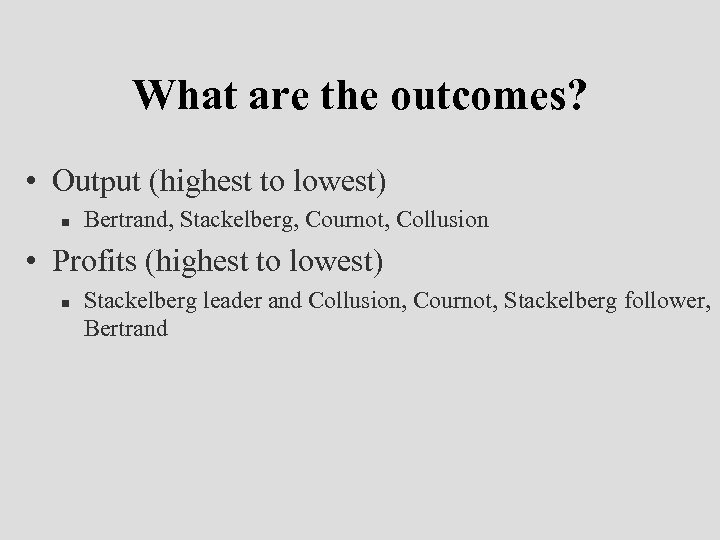

What are the outcomes? • Output (highest to lowest) n Bertrand, Stackelberg, Cournot, Collusion • Profits (highest to lowest) n Stackelberg leader and Collusion, Cournot, Stackelberg follower, Bertrand

Let’s work on Chapter 9 homework Numbers 2, 4, and 5

d3ec5ad6ac7327cd26f1f0e37c3cd766.ppt