a1766417b3ce912c3c345a8395b28453.ppt

- Количество слайдов: 53

Management Reports - What the Team Should be Monitoring CVC West 2010 Tom A. Mc. Ferson, CPA, ABV www. gattomcferson. com

Managing the Practice – Where to start? – What to look at? – Limited time – Limited resources www. gattomcferson. com

Managing the Practice Technicians, managers and owners can be bombarded with financial information. Given the limited amount of time they can devote to management, determining which information to focus on can be an important task. www. gattomcferson. com

Financial Information Goals – Have good handle on practice finances and issues – Be efficient with time • Work-life balance – Find management information “sweet spot” • Not too little • Not too much www. gattomcferson. com

Financial Information Goals – System of financial reports in place • Timely • Reliable • Automated as possible – Paints the “picture” – Use to make decisions – Be sure to follow up www. gattomcferson. com

Important to Remember… • Frequency of information – – – Daily Weekly Monthly Quarterly Annually • Set up reports to be as automated/easy to prepare as possible. www. gattomcferson. com

Important to Remember… • Determine who prepares these reports. – – Technician Manager Bookkeeper Accountant • Determine what are you looking for when you review these reports. • What action should you take based on the information you’ve reviewed? www. gattomcferson. com

Management reports are only as good as the information they are created from. Always ensure that your source documents are accurate and timely. www. gattomcferson. com

Source Documents/Data – Daily Totals – Accurate bank balance – Payroll registers – Doctor production reports – Monthly Production Reports by Service Area – Bills/Vendor Invoices/Disbursements/Checks Written www. gattomcferson. com

Source Documents/Data – Quickbooks – Financial Statements – Tax Returns – Overtime/Vacation Information – Budget – Competition www. gattomcferson. com

Daily – Daily Deposit a. From practice management software 1. 2. 3. Breakdown of deposit: cash/check/CC Breakdown of service Breakdown by doctor – Practice Schedule for following day – Practice Schedule for day just ended • • Cancellations Walk ins www. gattomcferson. com

Daily – Flash Report a. Summarize activity by day: a. b. c. d. e. f. Daily Revenue Daily Deposit Daily A/R Balance Daily Checking Account Balance Client Visits New Clients www. gattomcferson. com

Daily – – Helps you monitor day to day activity Keep an eye on spikes Monitor checking account Issues with schedule www. gattomcferson. com

Weekly – Flash Reports a. Summarizes activity by week a. b. c. d. e. f. g. h. Weekly Revenue Weekly Deposit Weekly A/R Balance Weekly Checking Account Balance Client Visits New Clients Cash Flow Compared to prior year www. gattomcferson. com

Weekly – Helps you monitor weekly activity – Keep an eye on spikes – trends begin to develop www. gattomcferson. com

Monthly – Financial Statements • • Profit and loss Balance Sheet Statement of Cash Flows All important…all give you results www. gattomcferson. com

Importance of Understanding Clinic Financial Matters • • Financial statements are the only reports a practice has that summarize the results of all the decisions made when operating the practice Financial acumen is key to increased personal earnings

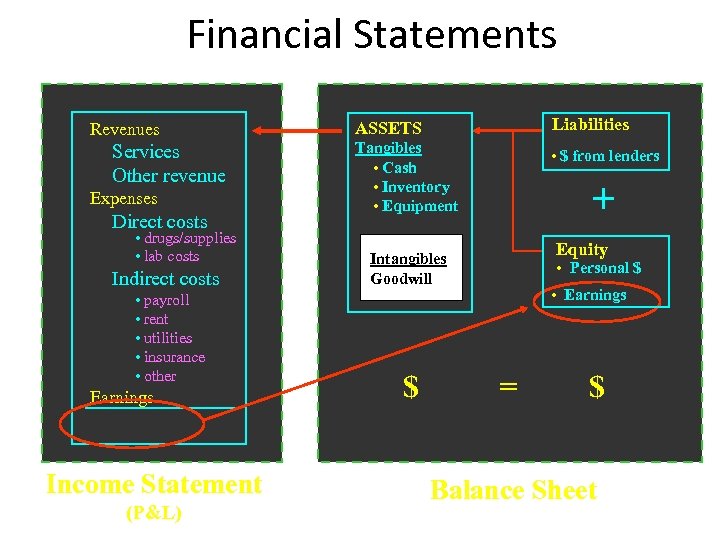

Financial Statements Revenues Services Other revenue Expenses Direct costs • drugs/supplies • lab costs Indirect costs • payroll • rent • utilities • insurance • other Earnings Income Statement (P&L) ASSETS Liabilities Tangibles • Cash • Inventory • Equipment • $ from lenders + Equity Intangibles Goodwill $ • Personal $ • Earnings = $ Balance Sheet

Basic Financial Statements • Balance sheet • Income statement • Statement of cash flows

Balance Sheet • Accounting statement summarizing the financial position of an entity at a point in time Assets = Liabilities + Equity

Income Statement • Accounting statement reflecting the financial performance of an entity between two points in time • The statement of many names – Profit and loss statement (P&L) – Statement of operations – Statement of revenues and expenses • Represents the equation Revenue – Expenses = Net Income

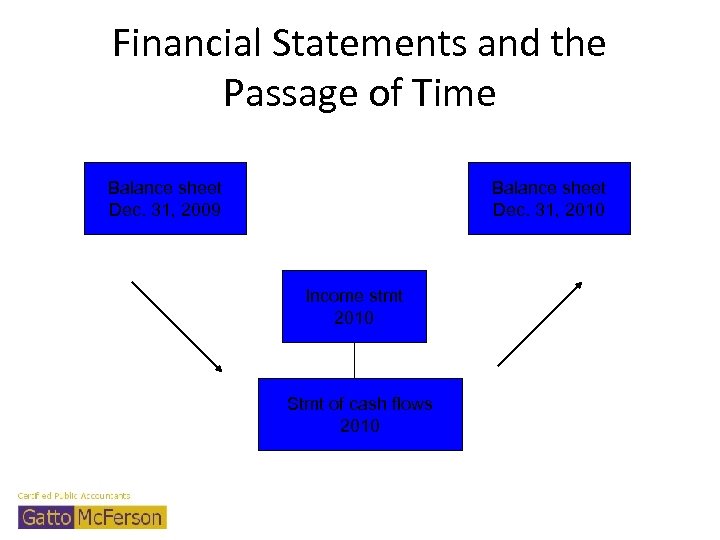

Financial Statements and the Passage of Time Balance sheet Dec. 31, 2009 Balance sheet Dec. 31, 2010 Income stmt 2010 Stmt of cash flows 2010

Uses of Financial Statements • Basis for tax returns • Provide information – Results of operations – Assets (resources) – Liabilities (claims against resources)

Uses of Financial Statements • Identify weaknesses – Business – Internal control • Plan for the future

Monthly – Profit and loss for month and year-to-date • Organized according to AAHA Chart of Accounts • With percentages (occupancy costs were 9% of gross revenues) • Comparable to industry • Gives you financial results for the month, and also year to date www. gattomcferson. com

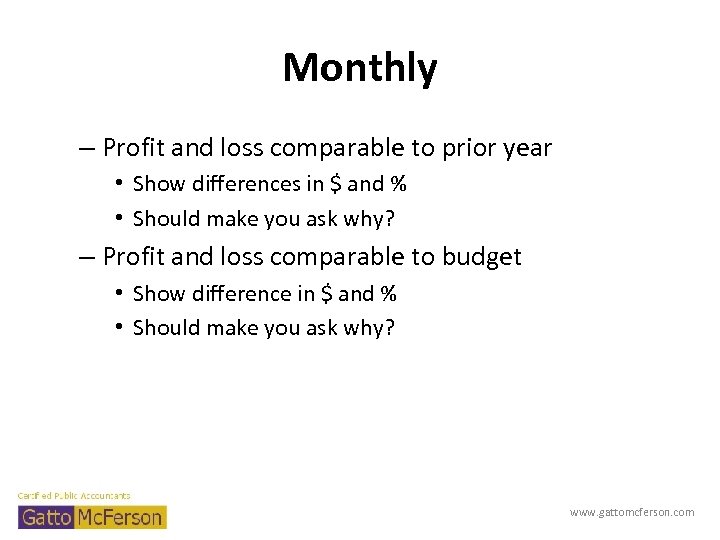

Monthly – Profit and loss comparable to prior year • Show differences in $ and % • Should make you ask why? – Profit and loss comparable to budget • Show difference in $ and % • Should make you ask why? www. gattomcferson. com

Monthly – Balance Sheet • Comparable to prior year • Show differences in $ and % • Accurate Current assets – Cash – Inventory – A/R • Accurate Current liabilities – Accounts payable – Accrued Expenses www. gattomcferson. com

Cash vs. Accrual Accounting

Cash Accounting • Process of reporting revenues and expenses in the financial statements of the period when the cash is received or paid • Do not have a “matching” between when revenue generating activity occurs and when revenue recognized • Comparative financial statements less reliable

Accrual Accounting • Process of recording revenues and expenses in the financial statements of the period in which the transaction occurs vs. when cash is received or paid • Revenue recognized when earned • Expenses recognized when incurred • Comparative financial statements more reliable

Modified Cash Accounting • Primarily cash based • Some transactions handled on an accrual basis—inventory capitalization, fixed asset capitalization and depreciation • Accrual items usually determined by IRS requirements

Monthly – Statement of Cash Flows • P&L says I made money. Where is it? • Tracks where your cash went for the month – Bought fixed assets – Paid down debt – Owner distributions www. gattomcferson. com

Monthly – Accounts Receivable Aging • Depends on whether your practice has much in way of A/R • Should show – – – Current (under 30 days) 31 -60 days 61 -90 days 91 -120 days Over 120 days…(deadbeats) • Ask yourself, what to do about certain clients? www. gattomcferson. com

Accounts Receivable • Extra profit you generate from offering this service must exceed costs to administrate and bad debt write-offs • Chance of collection if receivable is one month old— 93. 8%, chance of collection if 12 months old— 26. 6%--don’t wait too long! : Commercial Collection Agency Section of the Commercial Law League of America

Monthly – Accounts Payable Aging • Are you current with bills? • What bills are coming due (property taxes, delayed drug bills) • Should show – Current (under 30 days) – 31 -60 days – 61 -90 days – 91 -120 days – Over 120 days…(you’re the deadbeat) • What to do about lagging payables/cash flow problems www. gattomcferson. com

Monthly – Doctor Production Summary Total production for each doctor for the month Should also include benefit versus cost analysis If on straight production pay, easy…. If not, need to calculate what they would have made if on production versus what they were paid • Average per client • Number of clients seen • Number of days worked • • www. gattomcferson. com

Total Doctor Revenue • Includes revenue for all medical and surgical services • Does not include revenue for ancillary services— boarding, grooming, OTC product sales • Usually 85 -90% of total practice revenue

What Can Cause Changes? • Fee increases • Change in transactions (# clients or # of visits per client) • Change in ATC • Change in support staff (#, competency) • Equipment additions

What Can Cause Changes? Demographics Range and mix of services Changes in economy Not recommending all appropriate diagnostics and treatments • Not charging for everything done • Discounts • Efficiency • •

Quarterly – Income Tax Analysis • • Estimated taxes for year are usually based on prior year income Compare expected quarterly profit to actual Determine whether estimated taxes or withholding need to be adjusted Important if income is up or down significantly www. gattomcferson. com

Quarterly – Inventory Count • • • Update your quarterly inventory counts Look for fluctuations/surprises Reason? Big drug order? Something not accounted for? Adjust ordering for next quarter accordingly www. gattomcferson. com

Quarterly – Staff Overtime Analysis • Summarizes number of overtime hours paid to each employee • If excessive, why? – Short-staffed? – Someone out sick? – Busy month? • • Who approved these hours? Is it becoming a pattern? Cost? Need another employee? www. gattomcferson. com

Quarterly – Vacation/Sick Pay • Summarizes by employee what each is currently owed in vacation/sick/personal days • Helps you plan ahead • Depending on policy, plan for upcoming vacations or extra compensation • Someone not taking vacation? Why? • Someone “overdrawn”? Why? www. gattomcferson. com

Quarterly – Analysis of Competition • • • Hours they’re open Doctor schedules Exam fees Prices on other shopped items Specials or discounts running www. gattomcferson. com

Quarterly – Analysis of Vendors • When possible, compare prices of certain drugs/medications • Quantity ordered per month • Possible savings www. gattomcferson. com

Annual – Annual Financial Statements • • • Profit and loss – comparable to prior year Profit and loss - comparable to budget Profit and loss – comparable to industry Balance Sheet Statement of Cash Flows www. gattomcferson. com

Annual – Annual Financial Statements • • How did you do? Improvement? Changes implemented? Important to have good historical data for next year’s budget. www. gattomcferson. com

Annual – Next Year’s Budget • • • Where do you want practice to go? Month by month Helps plan for cash flow Use historical data Goal setting Motivating www. gattomcferson. com

Annual – Tax Return • Ultimate management report • Everything according to plan? • What about next year? www. gattomcferson. com

Annual – True Profitability Analysis • Income statement often includes: – – Extra compensation Excess rent Owner perks Other unusual or one-time only expenses • What was your true profit, after you adjust for all of these? • Tax versus value often butt heads • Target: 15 -20% • Used for valuation www. gattomcferson. com

Annual – Valuation Analysis • What is the practice worth? • Important to know: – – Future sale Future buy-in Estate planning Curiosity • What have outside forces done to the value of your practice? • Often largest asset in net worth – important to know its value www. gattomcferson. com

Copy of slides and budget template by email?

Questions? Answers

a1766417b3ce912c3c345a8395b28453.ppt