96fb4aceb9413e1bd00a59582248167a.ppt

- Количество слайдов: 91

Management Presentation 27 th September 2002

Corporate Strategy Andrew Lindberg Managing Director 27 th September 2002

Our financial objectives are clear Target: • 15% ROE • Consistent trend EPS growth • Stable dividend • Improve quality of earnings • Efficient capital management

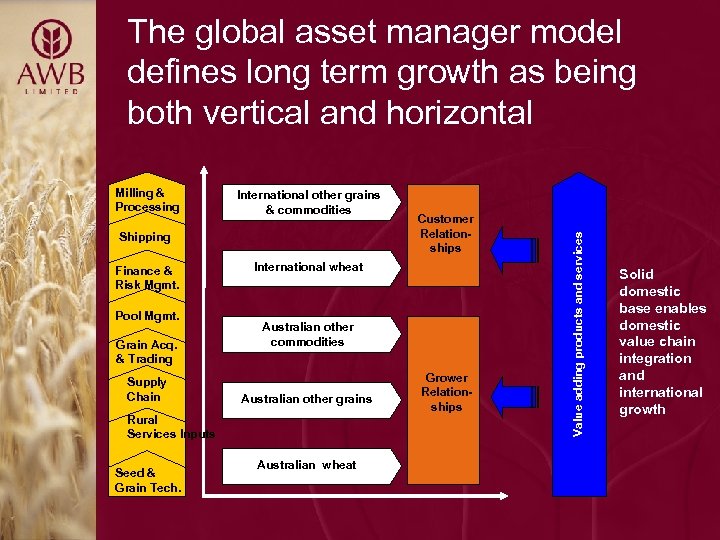

Milling & Processing International other grains & commodities Shipping Finance & Risk Mgmt. Pool Mgmt. Grain Acq. & Trading Supply Chain International wheat Australian other commodities Australian other grains Rural Services Inputs Seed & Grain Tech. Customer Relationships Australian wheat Grower Relationships Value adding products and services The global asset manager model defines long term growth as being both vertical and horizontal Solid domestic base enables domestic value chain integration and international growth

In order to achieve our objectives, AWB has clearly defined strategies Maximise value for growers, customers & shareholders • Win grower mandates • Create value through supply chain efficiencies • Sustain trading out performance • Lead in grain technology • Maintain growth and diversify revenue streams • Strengthen stakeholder support • Secure end user demand • Strengthen organisational capability and performance

Specific near term initiatives will support our strategies • Diversify domestically and offshore – Expand finance & risk management offerings – Strengthen position in Asia and Middle East and develop global trading business (Geneva) – Step up investigation of M&A opportunities • Increase grains under management • Strengthen our rural services base • Supply chain investments that provide commercial returns • Active capital management • Ensure effective cost control

In 2001/02 AWB strengthened its core business … Strengthen core business to sustain performance • Further improvement to a key under-performing business area Chartering • Strengthening of the performance of the Single Desk and implementation of new performance based remuneration model • Broaden financial and risk services to growers and customers • Strengthen grower/rural services and financial advisory networks • Development of AWB supply chain network with capacity of around 3 mt • Development of superior grain varieties through a JV with Syngenta • Establishment of new business processes, systems and product development capability

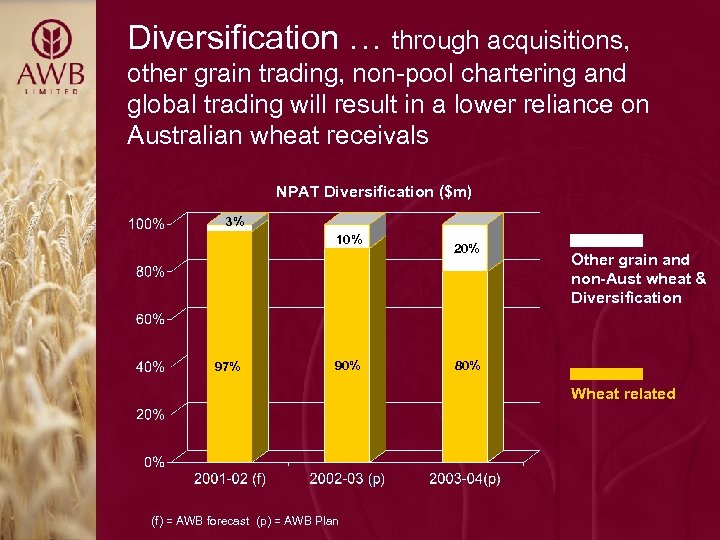

Diversification … through acquisitions, other grain trading, non-pool chartering and global trading will result in a lower reliance on Australian wheat receivals NPAT Diversification ($m) 3% 10% 97% 90% 20% Other grain and non-Aust wheat & Diversification 80% Wheat related (f) = AWB forecast (p) = AWB Plan

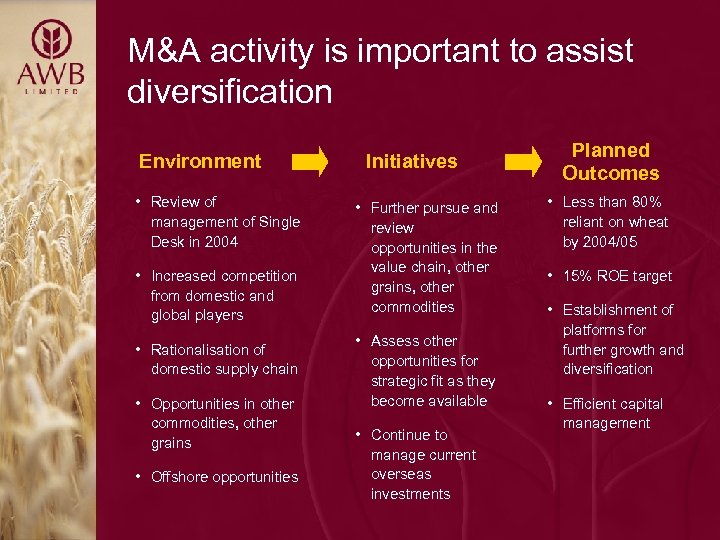

M&A activity is important to assist diversification Environment • Review of management of Single Desk in 2004 • Increased competition from domestic and global players • Rationalisation of domestic supply chain • Opportunities in other commodities, other grains • Offshore opportunities Initiatives • Further pursue and review opportunities in the value chain, other grains, other commodities • Assess other opportunities for strategic fit as they become available • Continue to manage current overseas investments Planned Outcomes • Less than 80% reliant on wheat by 2004/05 • 15% ROE target • Establishment of platforms for further growth and diversification • Efficient capital management

Investment highlights • Significant expertise and scale in global wheat marketing • One of the largest integrated global wheat managers • Large existing customer base • Manager of the Single Desk • Potential to broaden range of products, services and customers in Australia and overseas • Strong balance sheet and dividend paying capacity

QUESTIONS Corporate Strategy

Capital Management, Risk Management & Financial Services Paul Ingleby Chief Financial Officer 27 th September 2002

Efficient capital management 01/02 Shareholders’ funds (average) $772 m PAT (midpoint of range) $105 m ROE 13. 6% EPS 38 cps DPS 25 -28 cps

Capital allocation Capital is allocated (notionally to businesses) • Main businesses that use capital are: - Finance & Risk Management Products - Grain Acquisition & Trading - Supply Chain & Other Investments • Other business streams include: - Grain Technology - Pool Management Services

Capital management • We allocate capital using a top-down and bottom-up approach • We consider a range of factors such as targeted credit rating, value at risk and the universe of agricultural operations and product companies • As an indication, for 2001/02 we allocated: - Finance & Risk Management Products $150 m - Grain Acquisition & Trading $200 m - Supply Chain & Other Investments $100 m • Other main capital uses include corporate assets • As we diversify we will allocate capital accordingly

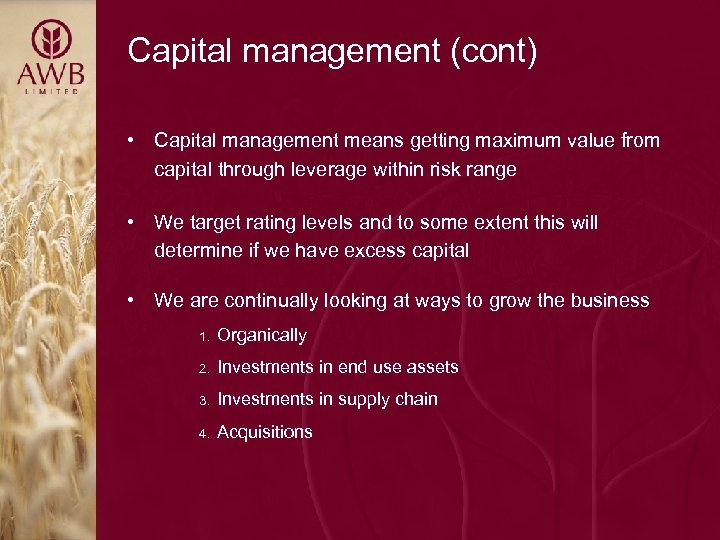

Capital management (cont) • Capital management means getting maximum value from capital through leverage within risk range • We target rating levels and to some extent this will determine if we have excess capital • We are continually looking at ways to grow the business 1. Organically 2. Investments in end use assets 3. Investments in supply chain 4. Acquisitions

Capital management (cont) Commercial Paper • We fund the company and therefore businesses through 3 commercial paper (CP) programs – AUD, US & EURO • We have a relationship bank panel of 16 throughout the world. These banks provide liquidity support i. e. ability to fund company at all times even when markets are tight • Last year AWB issued over $US 5 b in CP • We are an active participant in the FX, Options and Swaps markets

Capital management (cont) • We are constantly looking at the mix of capital and debt in relation to the opportunities available to us • Depending on the range and size of these opportunities we will consider the structure of the balance sheet for maximum value to shareholders • This will include raising some long term debt (none currently) which could take the form of medium term notes, private placement, or hybrid securities. • We will consider a share buy back if this makes sense for shareholder value

Risk management AWB comprises of a range of businesses with a range of risk profiles. AWB has a focus on risk management: - Corporate Risk Board Committee (CRBC) - Corporate Risk Review Committee (CRRC) - Corporate Risk Unit (CRU) Key factors are: - Physical sales - Foreign exchange management - Wheat price management - Administration - Governance

Financial services product range has been expanded to provide more flexibility to growers Environment Initiatives Planned Outcomes • Reliant on value of national wheat export crop • New Group GM of Financial Services, Marcus Kennedy • Pool payment options take-up above 65% • Increase in cash purchases decreases market available for loans • Expand loan products: - Harvest Loan - Flexible Drawdown Loan - Pre Delivery Loan • Enhanced relationship with growers from more flexible product suite • Increased competition from banks, particularly NAB, ANZ and CBA • Expand financial services to offer more cashflow choices for grain marketing decisions • Opportunity to introduce wealth creation products and strategies to growers • New payment products: - Advanced Payment - Deferred Payment • Strengthening of grower services network • 6 new Regional Financial Services Managers as onground product experts • Improved skill set and product knowledge of staff in marketing financial services • Improve ‘time to market’ • Wealth creation pilot program

QUESTIONS Capital Management, Risk Management & Financial Services

Grower Interface Tim Goodacre Group General Manager Corporate 27 th September 2002

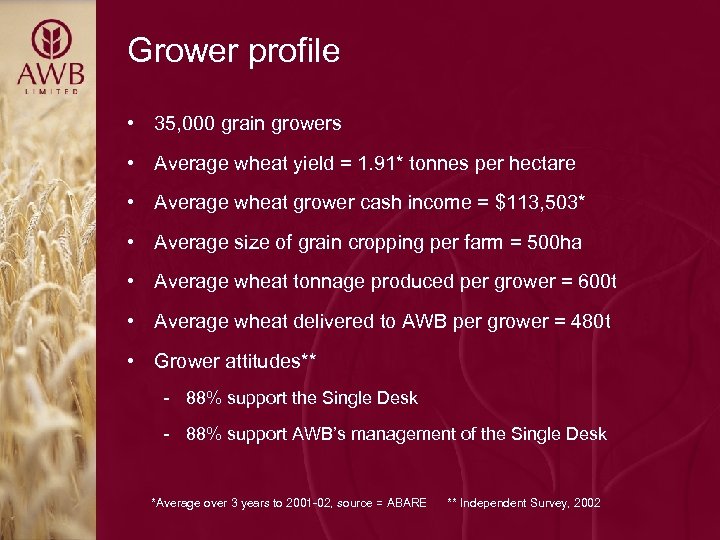

Grower profile • 35, 000 grain growers • Average wheat yield = 1. 91* tonnes per hectare • Average wheat grower cash income = $113, 503* • Average size of grain cropping per farm = 500 ha • Average wheat tonnage produced per grower = 600 t • Average wheat delivered to AWB per grower = 480 t • Grower attitudes** - 88% support the Single Desk - 88% support AWB’s management of the Single Desk *Average over 3 years to 2001 -02, source = ABARE ** Independent Survey, 2002

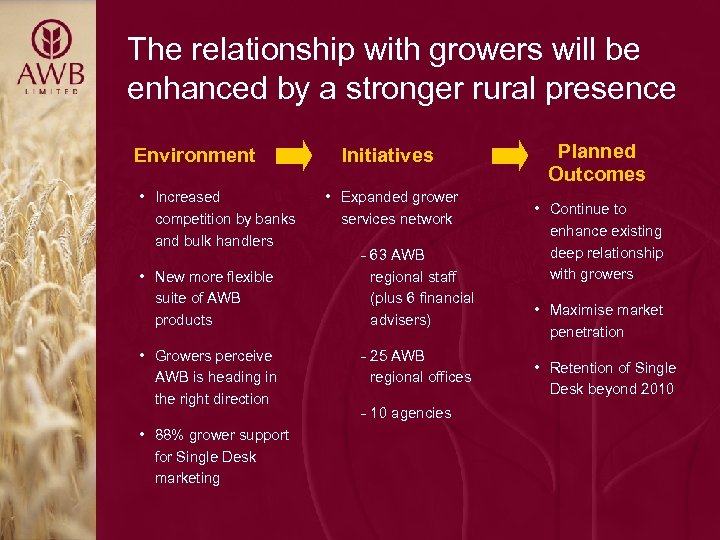

The relationship with growers will be enhanced by a stronger rural presence Environment • Increased competition by banks and bulk handlers • New more flexible suite of AWB products • Growers perceive AWB is heading in the right direction • 88% grower support for Single Desk marketing Initiatives • Expanded grower services network - 63 AWB regional staff (plus 6 financial advisers) - 25 AWB regional offices - 10 agencies Planned Outcomes • Continue to enhance existing deep relationship with growers • Maximise market penetration • Retention of Single Desk beyond 2010

Strategy to further enhance grower relations Formation of Grower Relations Division with mission to: • Maintain and build grower support for AWB and AWB managed Single Desk • Further align AWB with the commercial needs of growers

QUESTIONS Grower Interface

National Pool and the Pool Services Management Model Sarah Scales General Manager National Pool 27 th September 2002

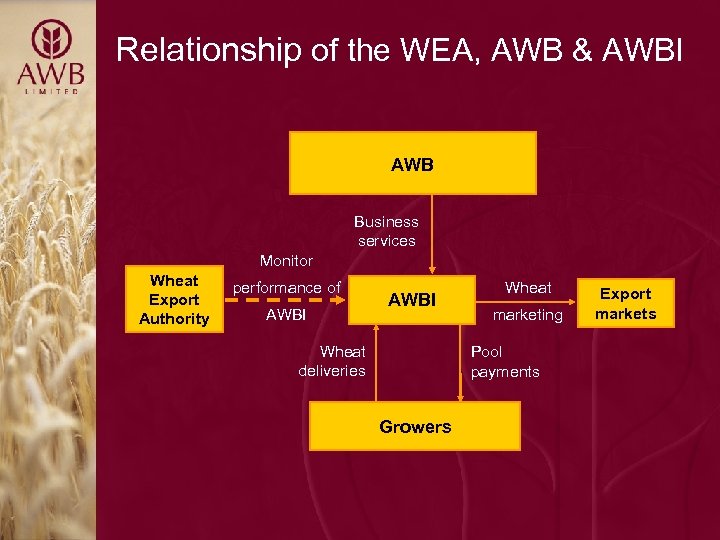

Relationship of the WEA, AWB & AWBI AWB Business services Monitor Wheat Export Authority performance of AWBI Wheat deliveries Wheat marketing Pool payments Growers Export markets

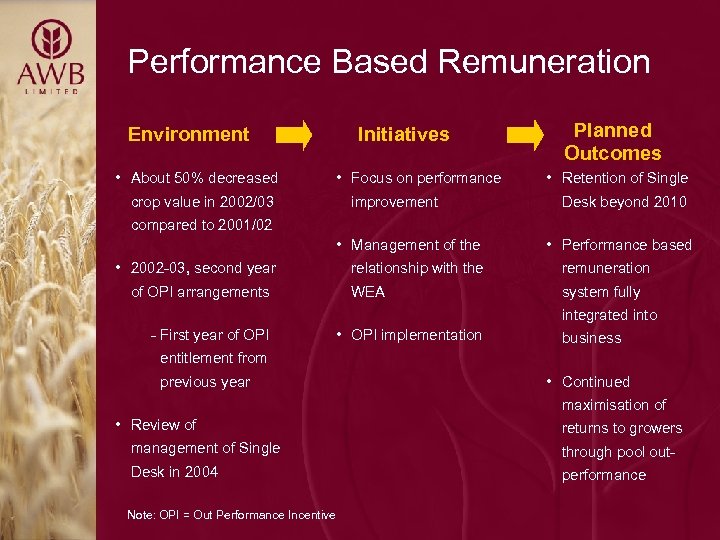

Performance Based Remuneration Environment • About 50% decreased Initiatives • Focus on performance crop value in 2002/03 improvement Planned Outcomes • Retention of Single Desk beyond 2010 compared to 2001/02 • Management of the • 2002 -03, second year • Performance based relationship with the WEA of OPI arrangements remuneration system fully integrated into - First year of OPI • OPI implementation business entitlement from previous year • Continued maximisation of • Review of returns to growers management of Single through pool out- Desk in 2004 performance Note: OPI = Out Performance Incentive

AWB(I)’s Mandate Maximise net returns to National Pool Growers • Maximise USD FOB price obtained • Minimise USD/AUD rate • Minimise domestic supply chain costs deducted from growers Actively manage the main harvest risk exposures • Management of wheat price, currency and domestic supply chain cost exposures Total harvest coverage • Accept delivery of all grades of Australian wheat (subject to minimum quality standards) • Sell all Australian wheat delivered to the National Pool in the pool period

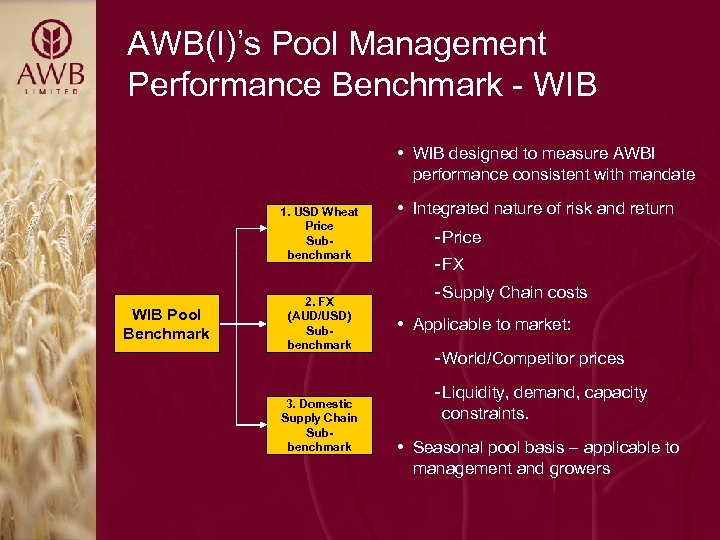

AWB(I)’s Pool Management Performance Benchmark - WIB • WIB designed to measure AWBI performance consistent with mandate 1. USD Wheat Price Subbenchmark WIB Pool Benchmark 2. FX (AUD/USD) Subbenchmark 3. Domestic Supply Chain Subbenchmark • Integrated nature of risk and return - Price - FX - Supply Chain costs • Applicable to market: - World/Competitor prices - Liquidity, demand, capacity constraints. • Seasonal pool basis – applicable to management and growers

A performance hurdle is necessary to reconcile AWB(L) decision making ability with the full AWB(I) mandate Hurdle Components Freight advantage: • Reflect price advantages/ disadvantages available to any Australian wheat exporter Single Desk Advantage: • Reflect the market power available to any manager of the Single Desk System

Performance Based Remuneration Model The performance based remuneration model has a twotiered payment system consisting of: 1. Base Fee • 1. 5% of Gross Pool Value(GPV) • Subject to a cap of AUD$60 m and a floor of AUD$45 m (CPI indexed) • Effectively covers operating costs to provide services to AWB(I) • Reduces risk to both AWB(I) and AWB(L) 2. Out-Performance Incentive (OPI) • Calculated as 20% of revenue generated above the WIB plus hurdle: = [GPV – {WIB + HURDLE}] x 20% Total cap of 3% of GPV, limiting risk to AWB(I)

Conclusion • Consistent with the Pool mandate: - Strives for out-performance within defined risk parameters balancing grower risk and grower rewards (Pool Returns) - Does not strive for maximum returns regardless of risk • Transparent, objective, auditable • Provides incentive to the manager to maximise grower returns • Grower preference: reflects main revenue and cost drivers for the National Pool & links AWB(L) remuneration to Pool Performance • Practically applicable to the business & consistent with industry standards • Quantifies and limits remuneration risk to AWB(I) and AWB(L) • Encourages AWB(L) to invest in achieving out-performance

QUESTIONS National Pool and the Pool Services Management Model

Grain Acquisition & Trading Peter Geary Group General Manager Trading 27 th September 2002

Domestic and global trading Grain Acquisition & Trading Domestic 1. Contract Acquisition Products 1. 70 Regional based representatives 2. 2 million tonnes committed prior to harvest 2001/02 2. Domestic Trading 1. Wheat and other grains 2. 50 domestic customers 3. Grain traders 4. Pool transfers 5. Normally trade 4. 5 to 5 million tonnes 3. Non Wheat exports 1. Canola, sorghum, barley Global • Establish global trading business in Geneva • Establishing new trade flows with new customers • 02/03 opportunity to supply existing customers other origin wheat • Global trading to trade 1. 5 million tonnes in 2002/03

Our domestic trading strategy • Grain is predominately accumulated incrementally from growers • Grain is physically priced with customers or priced in the derivatives market leaving a basis position to trade • AWB also trades with other grain companies which increases the volume of grain trade and liquidity to close physical positions • Positions will be built and transferred to the Pool in the appropriate circumstances Major factors impacting trading strategy for growers in 02/03 • Domestic regional shortages in high domestic demand areas

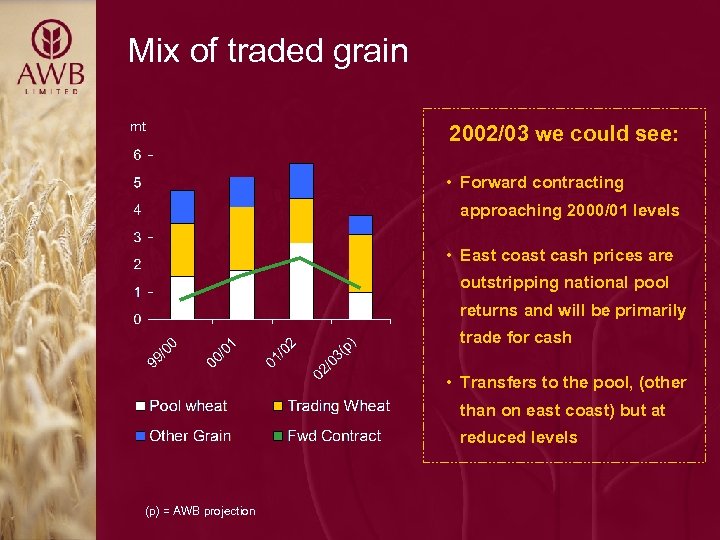

Mix of traded grain mt 2002/03 we could see: • Forward contracting approaching 2000/01 levels • East coast cash prices are outstripping national pool returns and will be primarily trade for cash • Transfers to the pool, (other than on east coast) but at reduced levels (p) = AWB projection

Trading risks and how we manage them • Local production – volume traded • Price volatility – production in exporters & importer • Foreign exchange exposure – active management • Hedging is used to price physical exposures (not to speculate) • Basis trading – requires correctly positioning physical product in line with movements in basis Drought conditions result in contract washouts • replacement cost to protect position • credit risk of collecting washout settlement

Grower demand for risk products increasing Environment • Grower demand for risk products increasing • Opportunity to expand the range of contract alternatives to growers • Opportunity, as part of Initiatives • Expanded range of risk management products: - Basis Pool - Riskassist – Basis Pool Products - Riskassist – Fixed Basis Contracts - Riskassist – Planned Outcomes • Increased take-up of Riskassist • Stronger relationship with growers • Contribution to securing end user trading group, to Consumer Risk demand through provide solution Services solution selling to end users

QUESTIONS Grain Acquisition & Trading

Supply Chain Investments & Chartering Jill Gillingham Chief Operating Officer 27 th September 2002

Agenda • Objectives for supply chain • Outline of supply chain strategy • Examples of returns • Chartering

Objectives for supply chain • Reduce costs • Improve efficiency • Secure grain for the long-term • Commercial return on capital invested Strategy East Coast: Compete West Coast: Collaborate

Domestic supply chain strategy Environment • Supply chain costs of $1. 4 b • Domestic supply chain inefficient • Old infrastructure BHCs have geographic monopolies and employ traditional uniform pricing structures • Freight companies with traditional monopolies have also employed uniform pricing structures • Susceptible to Initiatives • New grain centres built • On farm storage pilot being conducted during the 2002/03 harvest in Southern NSW • Investment in NSW rail and grain handling infrastructure via joint rail freight agreement with Freight. Corp • Purchase of rail wagons – leased to Freight Australia • Port options being investigated • JV / Merger options Planned Outcomes • Supply chain optimisation • Deliver a return on investment above weighted average cost of capital • OPI for supply chain subbenchmark • Increase AWB’s ability to access the wheat flow • Strategic hedge against deregulation

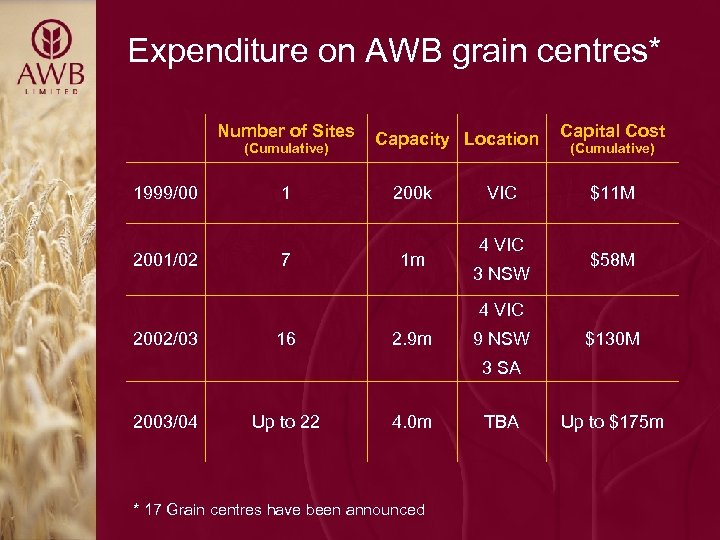

Expenditure on AWB grain centres* Number of Sites (Cumulative) 1999/00 2001/02 1 7 Capacity Location 200 k 1 m VIC 4 VIC 3 NSW Capital Cost (Cumulative) $11 M $58 M 4 VIC 2002/03 16 2. 9 m 9 NSW $130 M 3 SA 2003/04 Up to 22 4. 0 m * 17 Grain centres have been announced TBA Up to $175 m

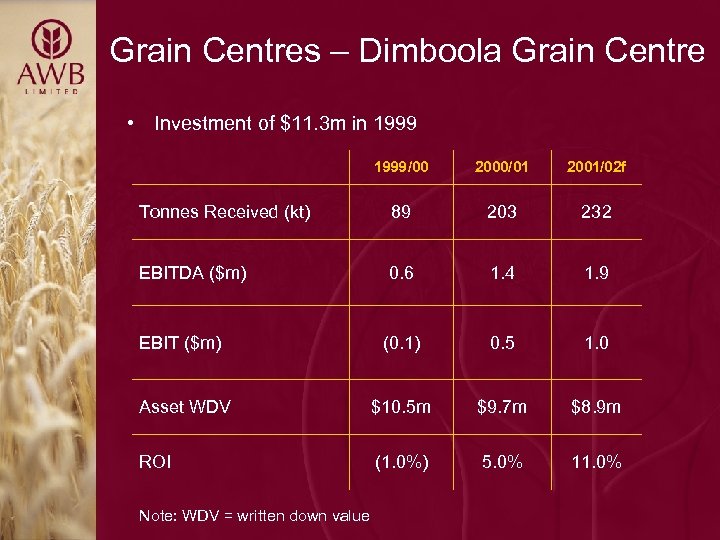

Grain Centres – Dimboola Grain Centre • Investment of $11. 3 m in 1999/00 2000/01 2001/02 f Tonnes Received (kt) 89 203 232 EBITDA ($m) 0. 6 1. 4 1. 9 EBIT ($m) (0. 1) 0. 5 1. 0 Asset WDV $10. 5 m $9. 7 m $8. 9 m ROI (1. 0%) 5. 0% 11. 0% Note: WDV = written down value

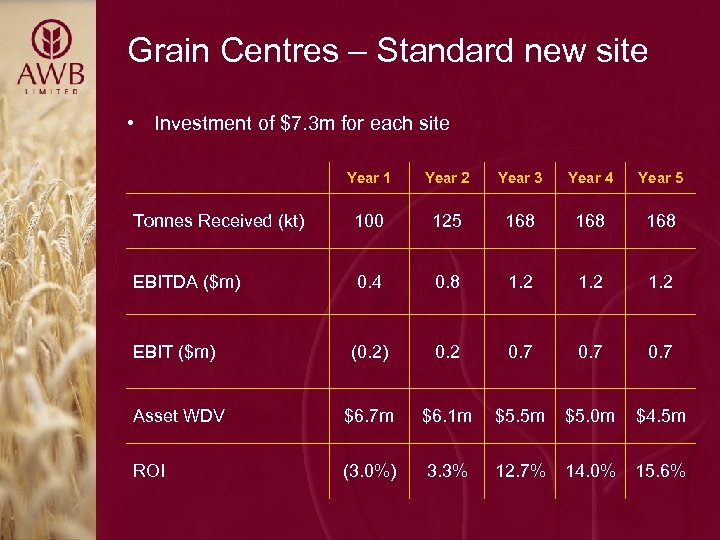

Grain Centres – Standard new site • Investment of $7. 3 m for each site Year 1 Year 2 Year 3 Year 4 Year 5 Tonnes Received (kt) 100 125 168 168 EBITDA ($m) 0. 4 0. 8 1. 2 EBIT ($m) (0. 2) 0. 2 0. 7 Asset WDV $6. 7 m $6. 1 m $5. 5 m $5. 0 m $4. 5 m ROI (3. 0%) 3. 3% 12. 7% 14. 0% 15. 6%

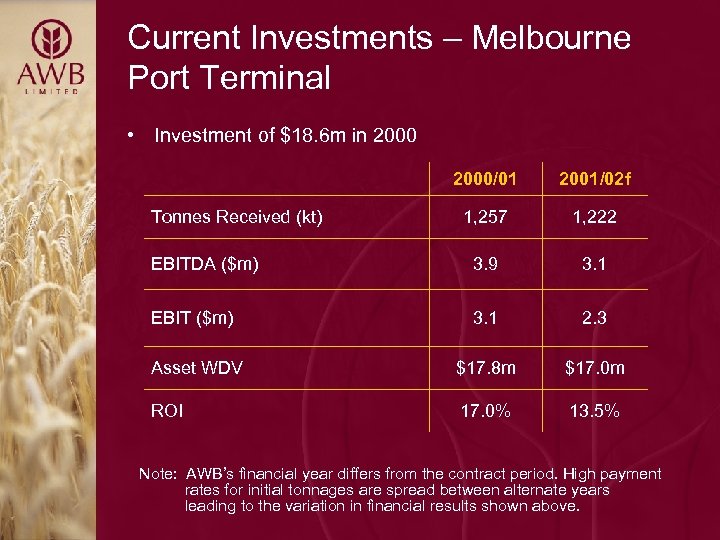

Current Investments – Melbourne Port Terminal • Investment of $18. 6 m in 2000/01 2001/02 f 1, 257 1, 222 EBITDA ($m) 3. 9 3. 1 EBIT ($m) 3. 1 2. 3 Asset WDV $17. 8 m $17. 0 m ROI 17. 0% 13. 5% Tonnes Received (kt) Note: AWB’s financial year differs from the contract period. High payment rates for initial tonnages are spread between alternate years leading to the variation in financial results shown above.

Current Investments – Rail Wagons • Investment of $5. 4 m in 2001 Year 2 Year 3 EBITDA ($m) 1. 15 EBIT ($m) 0. 8 Asset WDV $4. 8 m $4. 4 m $4. 0 m ROI 16. 8% 18. 2% 19. 8%

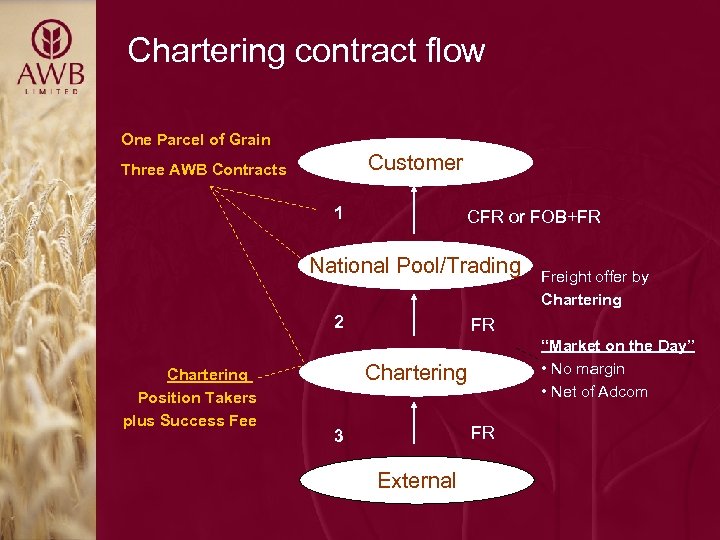

Chartering contract flow One Parcel of Grain Customer Three AWB Contracts 1 CFR or FOB+FR National Pool/Trading 2 Chartering Position Takers plus Success Fee Freight offer by Chartering FR “Market on the Day” • No margin • Net of Adcom Chartering FR 3 External

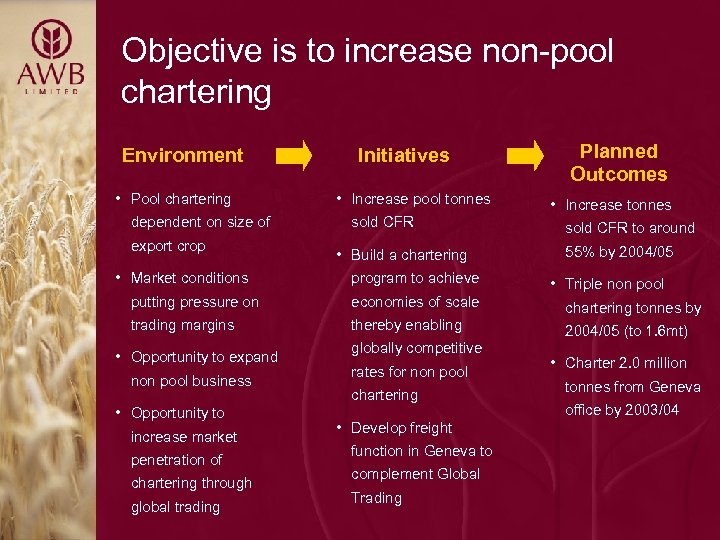

Objective is to increase non-pool chartering Environment • Pool chartering dependent on size of export crop • Market conditions Initiatives • Increase pool tonnes sold CFR • Build a chartering program to achieve Planned Outcomes • Increase tonnes sold CFR to around 55% by 2004/05 • Triple non pool putting pressure on economies of scale chartering tonnes by trading margins thereby enabling 2004/05 (to 1. 6 mt) • Opportunity to expand non pool business • Opportunity to increase market penetration of chartering through global trading globally competitive rates for non pool chartering • Develop freight function in Geneva to complement Global Trading • Charter 2. 0 million tonnes from Geneva office by 2003/04

Summary • Reduce costs • Improve efficiency • Secure grain for the long-term • Commercial return on capital invested

QUESTIONS Supply Chain Investments & Chartering

Presentation Supplement

Finance & Risk Management Products

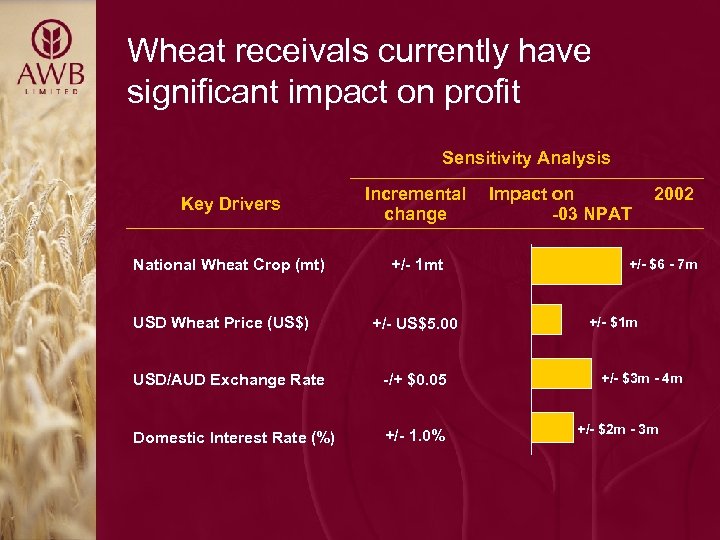

Wheat receivals currently have significant impact on profit Sensitivity Analysis Key Drivers Incremental change National Wheat Crop (mt) +/- 1 mt USD Wheat Price (US$) +/- US$5. 00 USD/AUD Exchange Rate -/+ $0. 05 Domestic Interest Rate (%) +/- 1. 0% Impact on -03 NPAT 2002 +/- $6 - 7 m +/- $1 m +/- $3 m - 4 m +/- $2 m - 3 m

Opportunity to introduce wealth creation products and strategies to growers • $3. 5 -$5 B in gross pool value per annum • Each crop farm has $70, 000 in liquid assets ($31 k shares, $17 k deposits) • Average balance of Farm Management Deposit account is $40, 000 (medium/long term investment product) • Succession planning issues for growers • AWB has strong brand name with growers • Pilot program in 2003 Source: ABARE, Australian Farm Surveys Report 2001. Dept of Fisheries, Agriculture and Forestry Australia

Strengthening our financial services manufacturing and distribution capability 1. Marcus Kennedy, new Group General Manager Financial Services 1. Strong financial services background 2. Grower Services Division 1. 63 regional staff, 25 regional offices and 10 agencies 3. 6 new Regional Financial Services Managers 1. On-ground product experts 4. Product Development Division 1. Improving ‘time to market’ capability 5. New SAP system which enables products to be built in-house rapidly

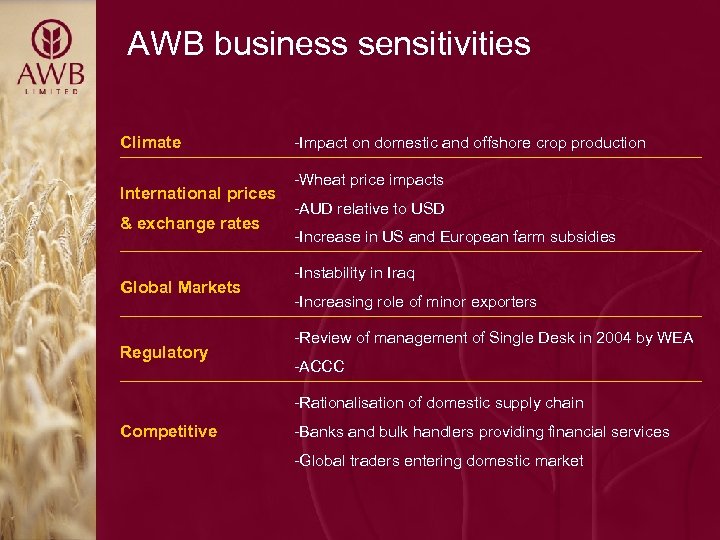

AWB business sensitivities Climate International prices & exchange rates Global Markets Regulatory -Impact on domestic and offshore crop production -Wheat price impacts -AUD relative to USD -Increase in US and European farm subsidies -Instability in Iraq -Increasing role of minor exporters -Review of management of Single Desk in 2004 by WEA -ACCC -Rationalisation of domestic supply chain Competitive -Banks and bulk handlers providing financial services -Global traders entering domestic market

Pool management services risk profile Operation Risk • OPI Fee Return • Price Risk (Flat & Basis)* • FX Risk* Control / Risk Mitigator • Hedge Policies & Benchmarks • Board Committees Oversight • Position Reporting • Mgt Risk Committee Monitoring • Sales risk* • Credit Limits on Counter-Parties • Crop size* National Pool • Interest rate risk* • Internal/External Audit Reviews • Logistics risk* • Credit risk* * Grower risks • Credit Risk Transfer • Insurance

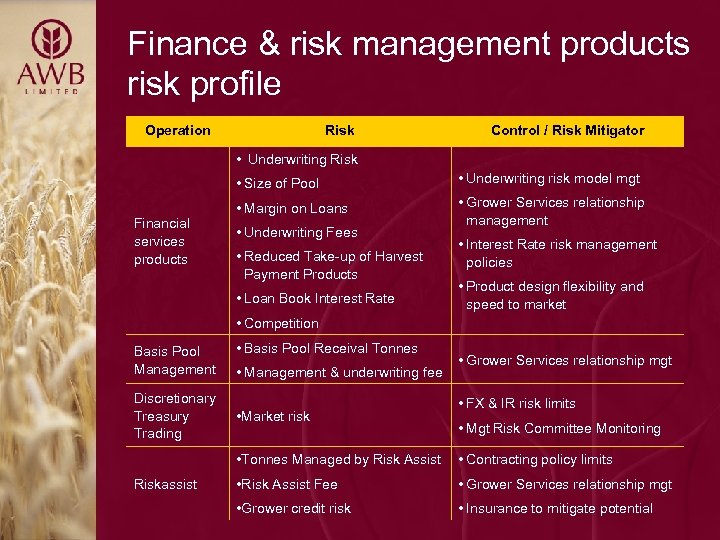

Finance & risk management products risk profile Operation Risk Control / Risk Mitigator • Underwriting Risk • Size of Pool Financial services products • Underwriting risk model mgt • Margin on Loans • Grower Services relationship management • Underwriting Fees • Reduced Take-up of Harvest Payment Products • Loan Book Interest Rate • Interest Rate risk management policies • Product design flexibility and speed to market • Competition Basis Pool Management Discretionary Treasury Trading • Basis Pool Receival Tonnes • Management & underwriting fee • Market risk • Grower Services relationship mgt • FX & IR risk limits • Mgt Risk Committee Monitoring • Tonnes Managed by Risk Assist Riskassist • Contracting policy limits • Risk Assist Fee • Grower Services relationship mgt • Grower credit risk • Insurance to mitigate potential

Grain acquisition & trading risk profile Operation Risk • Trade Execution Management Domestic Trading • Credit Risk • Market Risk Grain Contract Acquisition Products • Credit Risk Control / Risk Mitigator • VAR & Trading Limits • Board Committee oversight • Position reporting • Mgt Risk Committee Monitoring • Grower Services relationship management • Grower Services "Almanac" Policies

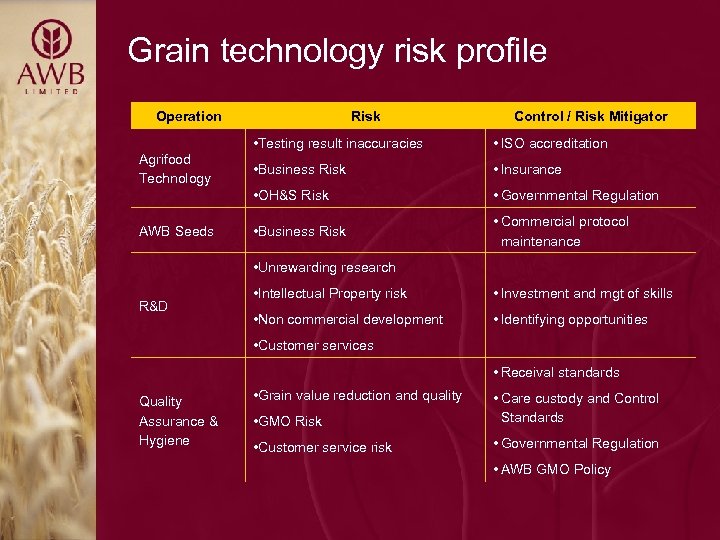

Grain technology risk profile Operation Risk Control / Risk Mitigator • Testing result inaccuracies AWB Seeds • Business Risk • Insurance • OH&S Risk Agrifood Technology • ISO accreditation • Governmental Regulation • Business Risk • Commercial protocol maintenance • Unrewarding research R&D • Intellectual Property risk • Investment and mgt of skills • Non commercial development • Identifying opportunities • Customer services • Receival standards Quality Assurance & Hygiene • Grain value reduction and quality • GMO Risk • Care custody and Control Standards • Customer service risk • Governmental Regulation • AWB GMO Policy

Supply chain & other investments risk profile Operation Chartering Domestic Investments (Grain Centres) Risk • Pool Receival Tonnes • Chartering Price risk • Tonnes Handled/Received • OH&S Risk • Operational Risk • Country/Political Risk Offshore Investments Control / Risk Mitigator • National Pool service • FX and Chartering Price Risk Limits • Insurance • Business/Grower relationship management • O, H&S Risk management strategy • Insurance • Market Risk • Active Board Management and Oversight • Business Risk • Risk limits and policies

Pool Management Services

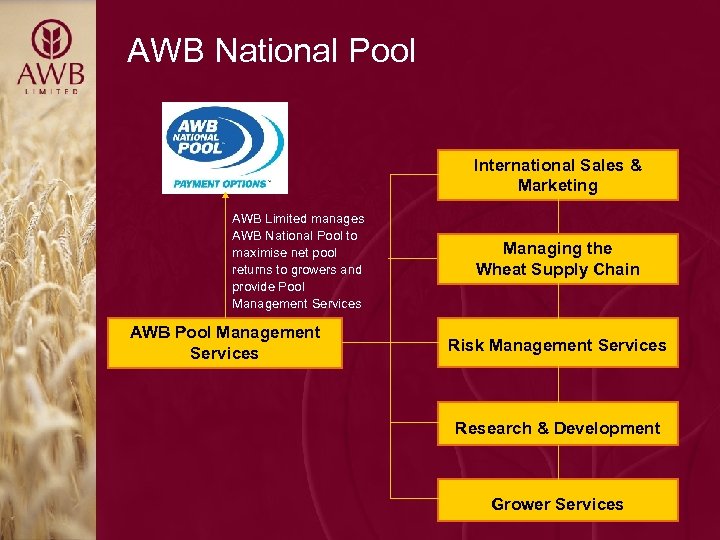

AWB National Pool International Sales & Marketing AWB Limited manages AWB National Pool to maximise net pool returns to growers and provide Pool Management Services AWB Pool Management Services Managing the Wheat Supply Chain Risk Management Services Research & Development Grower Services

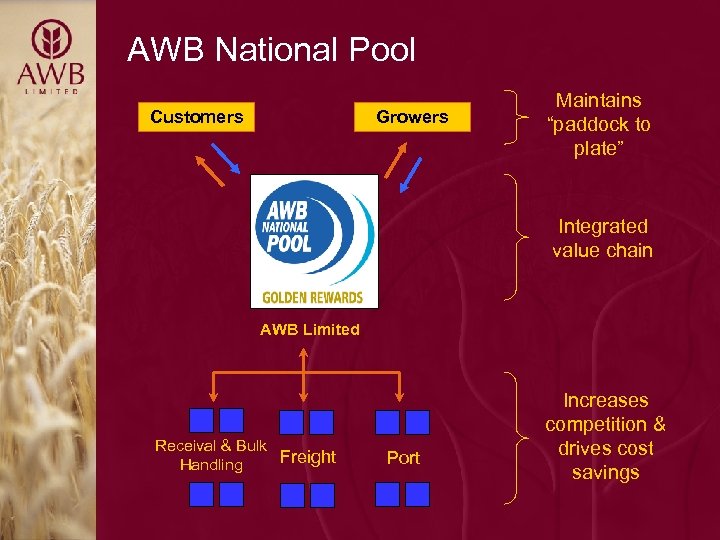

AWB National Pool Customers Growers National Pool Maintains “paddock to plate” Integrated value chain AWB Limited Receival & Bulk Freight Handling Port Increases competition & drives cost savings

Managing to achieve AWB(I)’s Mandate Management behaviour consistent with mandate: • Maximise Pool Returns within defined risk parameters • Performance Monitoring Models drives behaviour • Performance Monitoring Models consistent with mandate • Remuneration also drives behaviour • Remuneration therefore consistent with mandate and performance assessment of achieving mandate

Management of “paddock to plate” marketing • National Pool generates value for growers through managing the value chain from farm-gate to end user • “Line of sight” is maintained between customer and grower to ensure customers get the product they want and growers are rewarded for providing the product • National Pool shapes the quality profile of the crop by: • Setting receival standards • Developing binning and segregation strategies • Operating payment programs like Golden Rewards • National Pool meets customers’ growing requirements through sophisticated site selection of cargoes based on specific quality attributes of the grain from a region or even receival point. • Uses its customer relationships, its marketing ability and its confidence to back up the quality of the product to extract premiums and maintain and enhance market share

Integrated management of the value chain • In an effort to achieve cost reductions, the National Pool is becoming involved in tactical management of the supply chain • Strategic management of grain flows • Direct negotiation with service providers • Coordinating interface between storage and handling, freight and port services • Tactical management is increasingly allowing the National Pool to manage logistics and select most efficient distribution channels for specific parcels of grain • National Pool returns all value generated back to growers in full – efficiency gains, blending and swap revenues

Driving competition in the supply chain • National Pool involvement at the tactical level critical to it carrying out its marketing program today and into the future. • New players prepared to invest in new assets eg. AWB, ABA, movement across borders • Incumbents investing in up grades and new sites to maintain their market position • Similar reductions have been seen where competition has been introduced in rail freight services • In NSW, have witnessed savings of between 8. 3% and 17. 5% depending on the level of competition on freight routes • These are real savings being passed on to growers in the form of lower costs • A more efficient industry will benefit all participants

USD Wheat Price Sub-benchmark • The benchmark aims to represent average USD price achieved for a passively managed portfolio of Australian Wheat (of known grade mix and volume) sold into global markets (of known global demand) • It has three core elements: - an expected price for Australian wheat based on the market prices of world traded wheat grades that can be related to Australian wheat prices - a sell-down (allocation to market) profile which takes account of capacity and demand constraints - a return from wheat price hedging in accordance with the Hedging Policy

FX (AUD/USD) and Supply Chain Sub-benchmarks FX Sub-Benchmark: • The FX benchmark aims to represent the currency outcome a passive manager could expect to achieve given the AWB(I) FX mandate and a passively managed $US wheat price exposure Supply Chain Sub-Benchmark: • The Supply Chain benchmark, unlike export wheat and FX, there is no ‘market’ in supply chain services. AWB is the price maker. • The benchmark index aims to reflect the expected/passive outcome for supply chain costs, • It adjusts for cost changes outside the control of the pool manager, such as those caused by different harvest sizes. • It has three main components, Freight Costs, Bulk Handling costs & Port Costs

Grain Acquisition & Trading

AWB Geneva office established Business activities • Australian wheat sales • Non Australian wheat and feed-grain sales • Freight • Structured finance products/services • Risk management products/services Investment structure • 100% AWBL ownership • US$20 m capital investment via AWBL Tonnes traded • 1. 5 mt in 2003 Management • Skill and capability of core team is strong • Office of 12

Supply Chain & Other Investments

Supply chain history in Australia • Established more than 60 years ago yet remains remarkably unchanged • Minor cost savings, competition and efficiency gains achieved in this time • Competition in the supply chain has historically been limited – only small number of new entrants • Incumbents still enjoy monopoly or near monopoly positions in their markets • Incumbents enjoy high profit margins on storage and handling business – up to 50% • BHC’s charge uniform prices across storage facilities leads to inefficient use of infrastructure

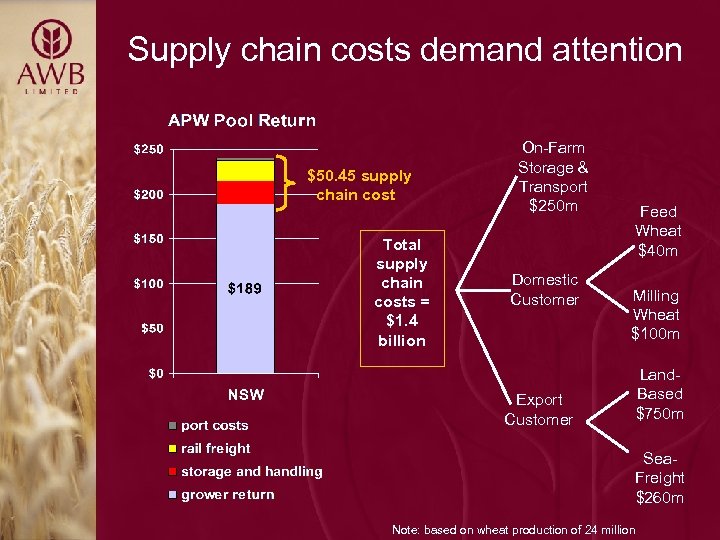

Supply chain costs demand attention $50. 45 supply chain cost Total supply chain costs = $1. 4 billion On-Farm Storage & Transport $250 m Domestic Customer Feed Wheat $40 m Milling Wheat $100 m Land. Based $750 m Export Customer Sea. Freight $260 m Note: based on wheat production of 24 million

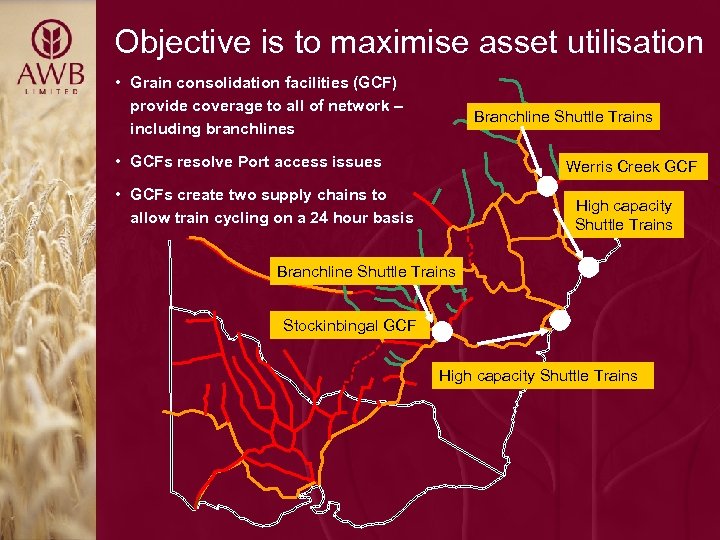

Objective is to maximise asset utilisation • Grain consolidation facilities (GCF) provide coverage to all of network – including branchlines Branchline Shuttle Trains • GCFs resolve Port access issues Werris Creek GCF • GCFs create two supply chains to allow train cycling on a 24 hour basis High capacity Shuttle Trains Branchline Shuttle Trains Stockinbingal GCF High capacity Shuttle Trains

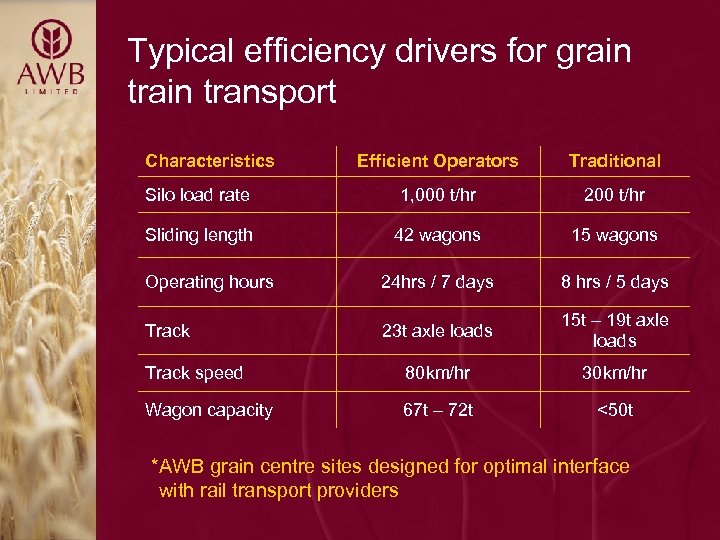

Typical efficiency drivers for grain transport Characteristics Efficient Operators Traditional Silo load rate 1, 000 t/hr 200 t/hr Sliding length 42 wagons 15 wagons Operating hours 24 hrs / 7 days 8 hrs / 5 days Track 23 t axle loads 15 t – 19 t axle loads Track speed 80 km/hr 30 km/hr Wagon capacity 67 t – 72 t <50 t *AWB grain centre sites designed for optimal interface with rail transport providers

Grain Technology

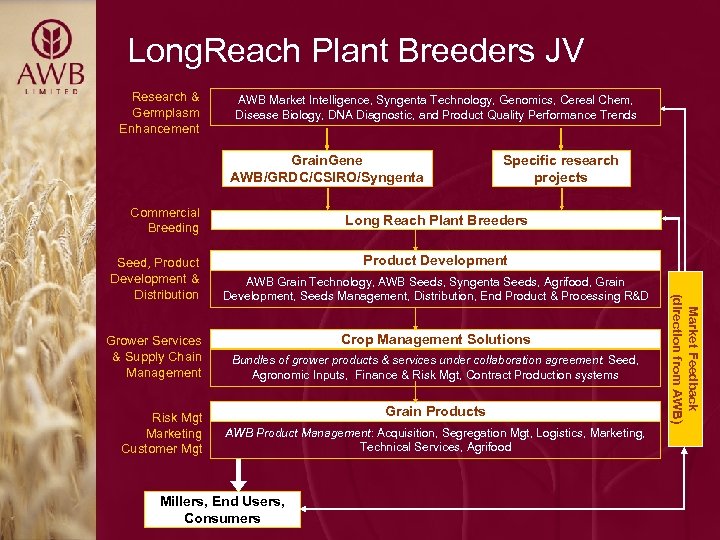

Long. Reach Plant Breeders JV Research & Germplasm Enhancement AWB Market Intelligence, Syngenta Technology, Genomics, Cereal Chem, Disease Biology, DNA Diagnostic, and Product Quality Performance Trends Grain. Gene AWB/GRDC/CSIRO/Syngenta Commercial Breeding Grower Services & Supply Chain Management Risk Mgt Marketing Customer Mgt Long Reach Plant Breeders Product Development AWB Grain Technology, AWB Seeds, Syngenta Seeds, Agrifood, Grain Development, Seeds Management, Distribution, End Product & Processing R&D Crop Management Solutions Bundles of grower products & services under collaboration agreement: Seed, Agronomic Inputs, Finance & Risk Mgt, Contract Production systems Grain Products AWB Product Management: Acquisition, Segregation Mgt, Logistics, Marketing, Technical Services, Agrifood Millers, End Users, Consumers Market Feedback (direction from AWB) Seed, Product Development & Distribution Specific research projects

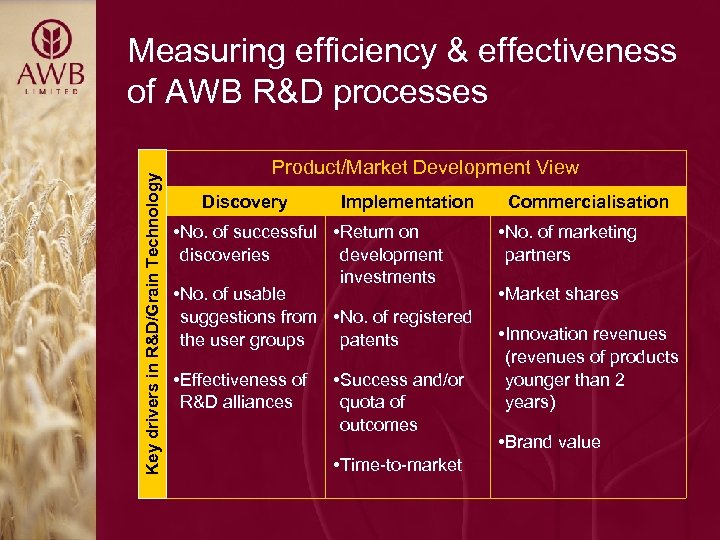

Key drivers in R&D/Grain Technology Measuring efficiency & effectiveness of AWB R&D processes Product/Market Development View Discovery Implementation • No. of successful • Return on discoveries development investments • No. of usable suggestions from • No. of registered the user groups patents • Effectiveness of R&D alliances • Success and/or quota of outcomes • Time-to-market Commercialisation • No. of marketing partners • Market shares • Innovation revenues (revenues of products younger than 2 years) • Brand value

Wheat Statistics

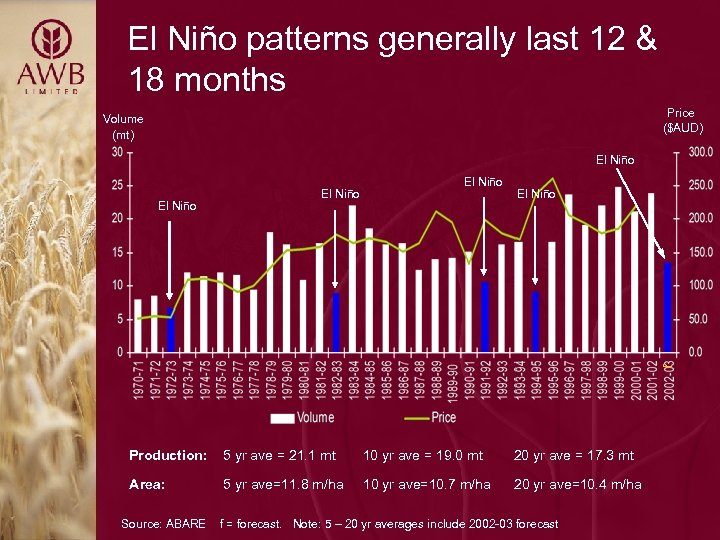

El Niño patterns generally last 12 & 18 months Price ($AUD) Volume (mt) El Niño f El Niño Production: 5 yr ave = 21. 1 mt 10 yr ave = 19. 0 mt 20 yr ave = 17. 3 mt Area: 5 yr ave=11. 8 m/ha 10 yr ave=10. 7 m/ha 20 yr ave=10. 4 m/ha Source: ABARE f = forecast. Note: 5 – 20 yr averages include 2002 -03 forecast

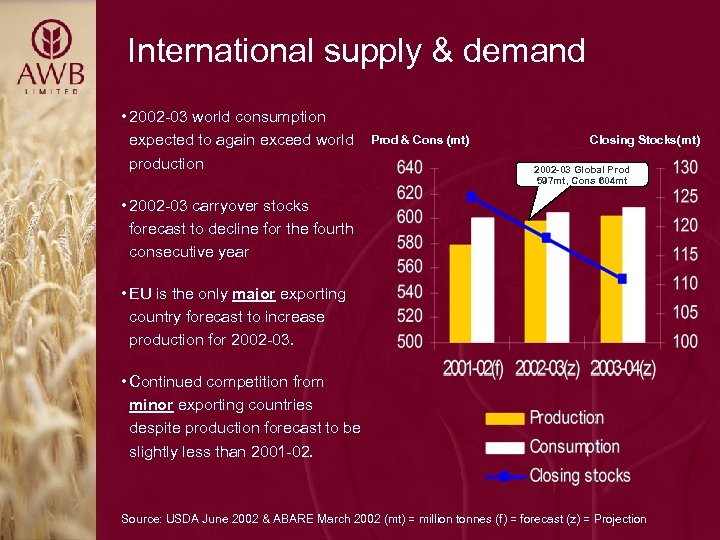

International supply & demand • 2002 -03 world consumption expected to again exceed world production Prod & Cons (mt) Closing Stocks(mt) 2002 -03 Global Prod 597 mt, Cons 604 mt • 2002 -03 carryover stocks forecast to decline for the fourth consecutive year • EU is the only major exporting country forecast to increase production for 2002 -03. • Continued competition from minor exporting countries despite production forecast to be slightly less than 2001 -02. Source: USDA June 2002 & ABARE March 2002 (mt) = million tonnes (f) = forecast (z) = Projection

Senior Management

Senior management Office of the MD Andrew Lindberg MD, 49 Joined AWB 2000 Richard Fuller Jean-Luc Boulanger Michael Thomas Company Secretary GM, Strategy & Head of Investor Relations Performance Mgt. Paul Ingleby Tim Goodacre Sarah Scales Peter Geary Jill Gillingham Charles Stott Marcus Kennedy CFO, 50 Group GM, Corporate, 48 Group GM National Pool, 36 Group GM, Trading, 41 Chief Operating Officer, 52 Group GM, Bus. Development, 43 Joined AWB 1985 Joined AWB 2000 Group GM, Financial Services, 43 Responsible for Domestic & Global Trading and International Sales & Marketing. Responsible for Information Systems, Supply Chain Mgt, Chartering and Grain Technology. Responsible for Investments, Mergers and Acquisitions. Joined AWB 1998 Responsible for Finance & Admin, Treasury, Trade Finance, Risk Mgt & Compliance, Legal, and Commercial Managers. Joined AWB 1990 Responsible for Grower Services, Public Affairs and HR. Joined AWB 1992 Responsible for managing National Wheat Pools and the Single Desk. Joined AWB 2002 Responsible for Financial Services & Product Development.

For more information contact: Michael Thomas Head of Investor Relations Ph: +61 3 9209 2064 Email: mthomas@awb. com. au

96fb4aceb9413e1bd00a59582248167a.ppt