be2f951323b0cdd66956ad888e1176e0.ppt

- Количество слайдов: 14

Management of the Company Investment Activity in the Terms of Risk (based on results of IC "Insurance House") Student: Andreenko N. I. Scientific supervisor: Senior lecturer Pestovska Z. S. Language supervision: Senior lecturer 1 Glinska O. M.

Management of the Company Investment Activity in the Terms of Risk (based on results of IC "Insurance House") Student: Andreenko N. I. Scientific supervisor: Senior lecturer Pestovska Z. S. Language supervision: Senior lecturer 1 Glinska O. M.

Content CHAPTER 1. THEORETICAL FOUNDATIONS OF INVESTING INSURANCE COMPANIES AT RISK 1. 1. The concept investment insurance company 1. 2. The essence of investment activity of insurance companies in terms of risk 1. 3. Status of investment of insurance companies in Ukraine CHAPTER 2 CURRENT STATUS OF INVESTMENT ACTIVITY IC "INSURANCE HOUSE" 2. 1. Organizational and economic characteristics of JSC IC "Insurance House” 2. 2. Assessing the impact of investment on the financial results of JSC IC “Insurance House” 2. 3. Status of investment activity at risk IC "Home Insurance“ CHAPTER 3. DIRECTIONS OF IMPROVEMENT OF INVESTMENT ACTIVITY IC “INSURANCE HOUSE” 3. 1. Modeling of investment risk in JSC IC " Insurance House" 3. 2. Investment Opportunities JSC IC “Insurance House" in the Ukrainian stock market 3. 3. The new investment model for JSC IC “Insurance House" in the foreign exchange market CHAPTER 4. HEALTH AND SAFETY IN EMERGENCIES IN IC “INSURANCE HOUSE” 4. 1. Occupational safety and health at IC “Insurance House” 2 4. 2. Security Emergency in IC “Insurance House”

Content CHAPTER 1. THEORETICAL FOUNDATIONS OF INVESTING INSURANCE COMPANIES AT RISK 1. 1. The concept investment insurance company 1. 2. The essence of investment activity of insurance companies in terms of risk 1. 3. Status of investment of insurance companies in Ukraine CHAPTER 2 CURRENT STATUS OF INVESTMENT ACTIVITY IC "INSURANCE HOUSE" 2. 1. Organizational and economic characteristics of JSC IC "Insurance House” 2. 2. Assessing the impact of investment on the financial results of JSC IC “Insurance House” 2. 3. Status of investment activity at risk IC "Home Insurance“ CHAPTER 3. DIRECTIONS OF IMPROVEMENT OF INVESTMENT ACTIVITY IC “INSURANCE HOUSE” 3. 1. Modeling of investment risk in JSC IC " Insurance House" 3. 2. Investment Opportunities JSC IC “Insurance House" in the Ukrainian stock market 3. 3. The new investment model for JSC IC “Insurance House" in the foreign exchange market CHAPTER 4. HEALTH AND SAFETY IN EMERGENCIES IN IC “INSURANCE HOUSE” 4. 1. Occupational safety and health at IC “Insurance House” 2 4. 2. Security Emergency in IC “Insurance House”

The Topicality of the problem. Investment activity is a very important and interesting research topic. Nowadays, a lot of businesses depend on some extent of investment. State economic performance is very dependent on the performance of investment and development of the country. The object of investigation - the investment activities of the company. The subject of the investigation - management of the investment activities of the company at risk. 3

The Topicality of the problem. Investment activity is a very important and interesting research topic. Nowadays, a lot of businesses depend on some extent of investment. State economic performance is very dependent on the performance of investment and development of the country. The object of investigation - the investment activities of the company. The subject of the investigation - management of the investment activities of the company at risk. 3

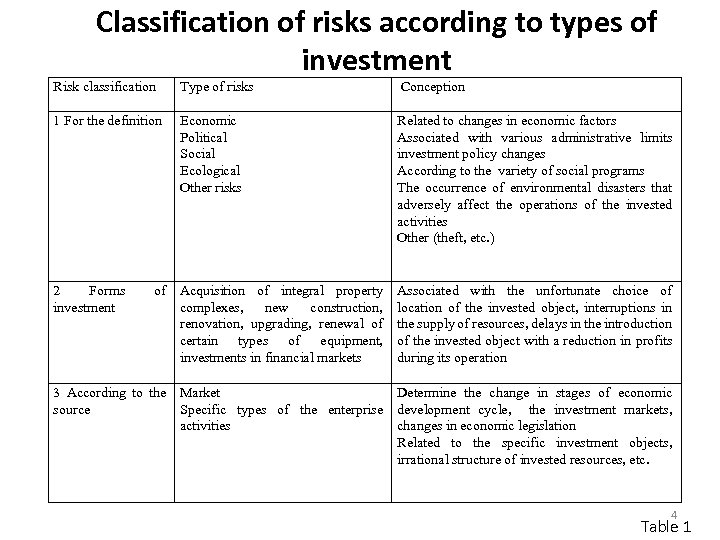

Classification of risks according to types of investment Risk classification Type of risks Conception 1 For the definition Economic Political Social Ecological Other risks Related to changes in economic factors Associated with various administrative limits investment policy changes According to the variety of social programs The occurrence of environmental disasters that adversely affect the operations of the invested activities Other (theft, etc. ) 2 Forms investment of Acquisition of integral property complexes, new construction, renovation, upgrading, renewal of certain types of equipment, investments in financial markets Associated with the unfortunate choice of location of the invested object, interruptions in the supply of resources, delays in the introduction of the invested object with a reduction in profits during its operation 3 According to the source Market Specific types of the enterprise activities Determine the change in stages of economic development cycle, the investment markets, changes in economic legislation Related to the specific investment objects, irrational structure of invested resources, etc. 4 Table 1

Classification of risks according to types of investment Risk classification Type of risks Conception 1 For the definition Economic Political Social Ecological Other risks Related to changes in economic factors Associated with various administrative limits investment policy changes According to the variety of social programs The occurrence of environmental disasters that adversely affect the operations of the invested activities Other (theft, etc. ) 2 Forms investment of Acquisition of integral property complexes, new construction, renovation, upgrading, renewal of certain types of equipment, investments in financial markets Associated with the unfortunate choice of location of the invested object, interruptions in the supply of resources, delays in the introduction of the invested object with a reduction in profits during its operation 3 According to the source Market Specific types of the enterprise activities Determine the change in stages of economic development cycle, the investment markets, changes in economic legislation Related to the specific investment objects, irrational structure of invested resources, etc. 4 Table 1

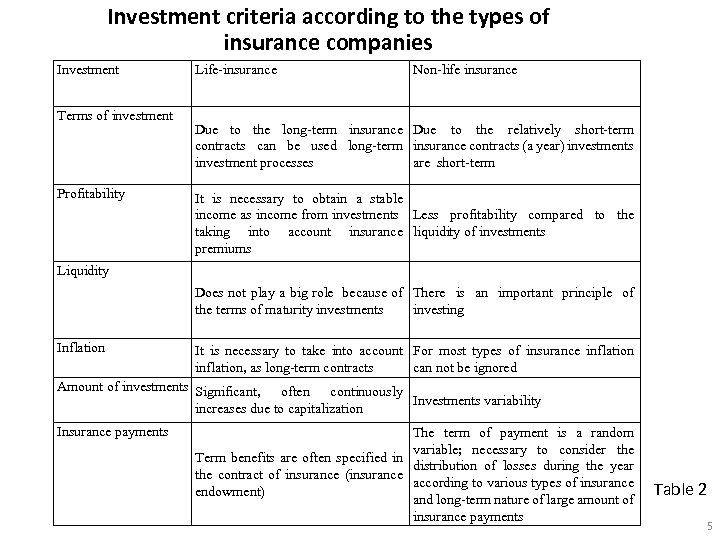

Investment criteria according to the types of insurance companies Investment Terms of investment Profitability Life-insurance Non-life insurance Due to the long-term insurance Due to the relatively short-term contracts can be used long-term insurance contracts (a year) investments investment processes are short-term It is necessary to obtain a stable income as income from investments Less profitability compared to the taking into account insurance liquidity of investments premiums Liquidity Does not play a big role because of There is an important principle of the terms of maturity investments investing Inflation It is necessary to take into account For most types of insurance inflation, as long-term contracts can not be ignored Amount of investments Significant, often continuously Investments variability increases due to capitalization Insurance payments The term of payment is a random variable; necessary to consider the Term benefits are often specified in distribution of losses during the year the contract of insurance (insurance according to various types of insurance endowment) and long-term nature of large amount of insurance payments Table 2 5

Investment criteria according to the types of insurance companies Investment Terms of investment Profitability Life-insurance Non-life insurance Due to the long-term insurance Due to the relatively short-term contracts can be used long-term insurance contracts (a year) investments investment processes are short-term It is necessary to obtain a stable income as income from investments Less profitability compared to the taking into account insurance liquidity of investments premiums Liquidity Does not play a big role because of There is an important principle of the terms of maturity investments investing Inflation It is necessary to take into account For most types of insurance inflation, as long-term contracts can not be ignored Amount of investments Significant, often continuously Investments variability increases due to capitalization Insurance payments The term of payment is a random variable; necessary to consider the Term benefits are often specified in distribution of losses during the year the contract of insurance (insurance according to various types of insurance endowment) and long-term nature of large amount of insurance payments Table 2 5

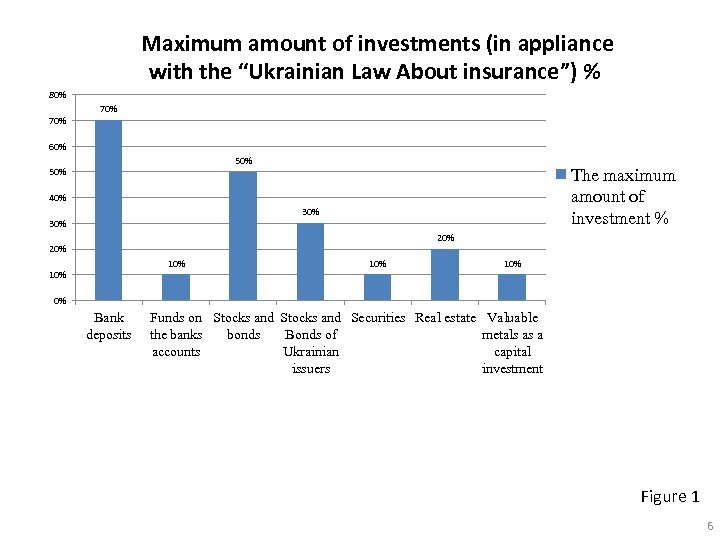

Maximum amount of investments (in appliance with the “Ukrainian Law About insurance”) % 80% 70% 60% 50% The maximum amount of investment % 40% 30% 20% 10% 10% 0% Bank deposits Funds on Stocks and Securities Real estate Valuable the banks bonds Bonds of metals as a accounts Ukrainian capital issuers investment Figure 1 6

Maximum amount of investments (in appliance with the “Ukrainian Law About insurance”) % 80% 70% 60% 50% The maximum amount of investment % 40% 30% 20% 10% 10% 0% Bank deposits Funds on Stocks and Securities Real estate Valuable the banks bonds Bonds of metals as a accounts Ukrainian capital issuers investment Figure 1 6

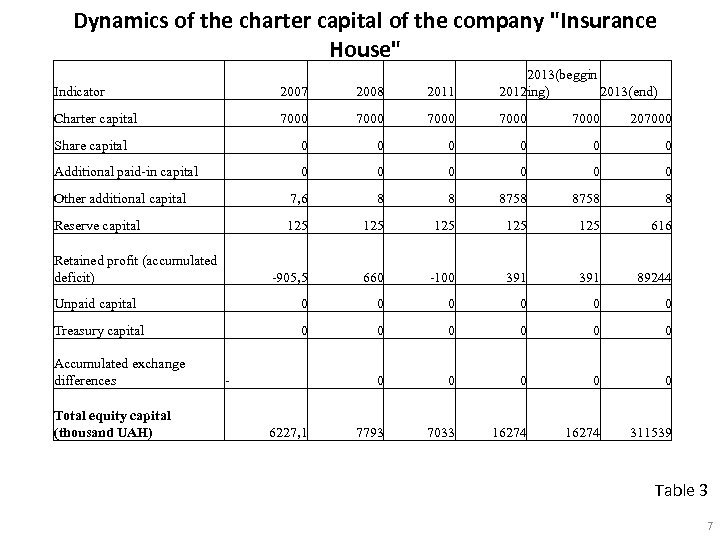

Dynamics of the charter capital of the company "Insurance House" Indicator 2007 2008 2011 2013(beggin 2012 ing) 2013(end) Charter capital 7000 7000 207000 Share capital 0 0 0 Additional paid-in capital 0 0 0 Other additional capital 7, 6 8 8 8758 8 Reserve capital 125 125 125 616 -905, 5 660 -100 391 89244 Unpaid capital 0 0 0 Treasury capital 0 0 0 7793 7033 16274 311539 Retained profit (accumulated deficit) Accumulated exchange differences Total equity capital (thousand UAH) - 6227, 1 Table 3 7

Dynamics of the charter capital of the company "Insurance House" Indicator 2007 2008 2011 2013(beggin 2012 ing) 2013(end) Charter capital 7000 7000 207000 Share capital 0 0 0 Additional paid-in capital 0 0 0 Other additional capital 7, 6 8 8 8758 8 Reserve capital 125 125 125 616 -905, 5 660 -100 391 89244 Unpaid capital 0 0 0 Treasury capital 0 0 0 7793 7033 16274 311539 Retained profit (accumulated deficit) Accumulated exchange differences Total equity capital (thousand UAH) - 6227, 1 Table 3 7

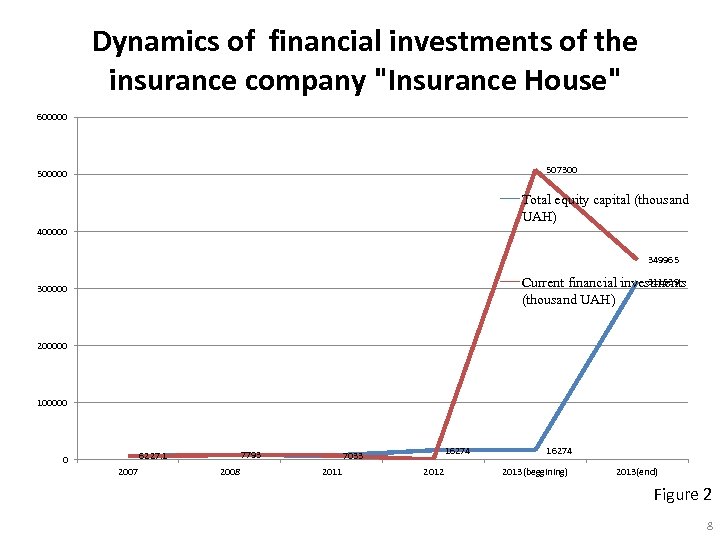

Dynamics of financial investments of the insurance company "Insurance House" 600000 507300 500000 Total equity capital (thousand UAH) 400000 349965 311539 Current financial investments (thousand UAH) 300000 200000 100000 7793 6227. 1 0 2007 2008 16274 7033 2011 2012 16274 2013(beggining) 2013(end) Figure 2 8

Dynamics of financial investments of the insurance company "Insurance House" 600000 507300 500000 Total equity capital (thousand UAH) 400000 349965 311539 Current financial investments (thousand UAH) 300000 200000 100000 7793 6227. 1 0 2007 2008 16274 7033 2011 2012 16274 2013(beggining) 2013(end) Figure 2 8

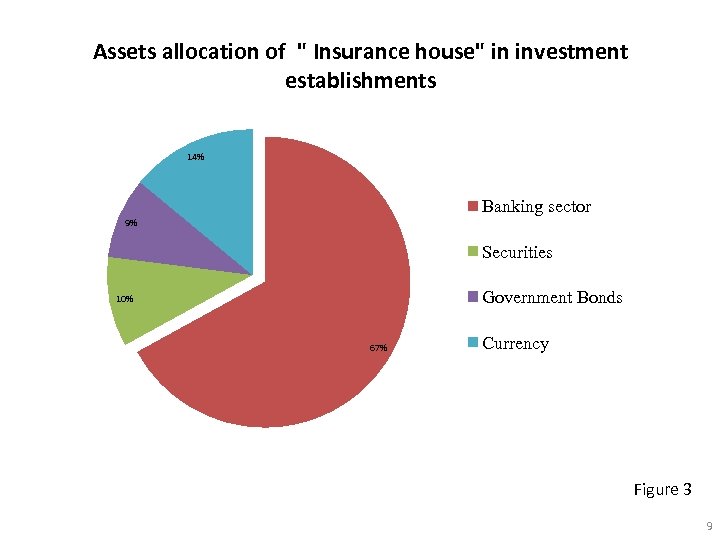

Assets allocation of " Insurance house" in investment establishments 14% Banking sector 9% Securities Government Bonds 10% 67% Currency Figure 3 9

Assets allocation of " Insurance house" in investment establishments 14% Banking sector 9% Securities Government Bonds 10% 67% Currency Figure 3 9

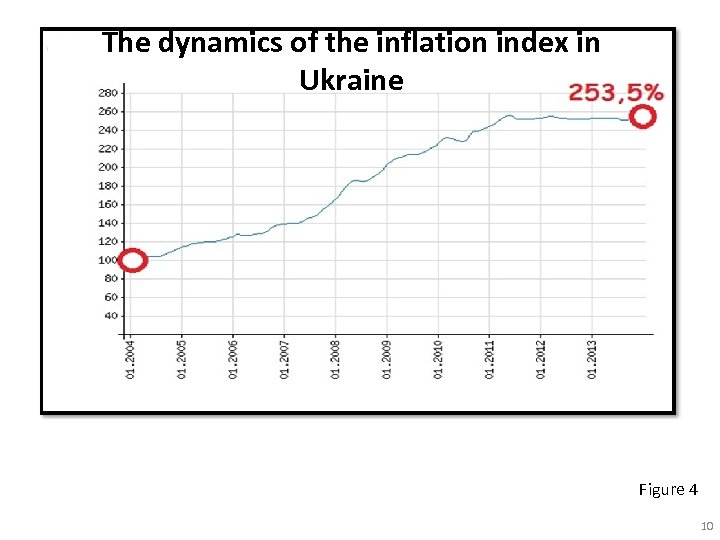

The dynamics of the inflation index in Ukraine Figure 4 10

The dynamics of the inflation index in Ukraine Figure 4 10

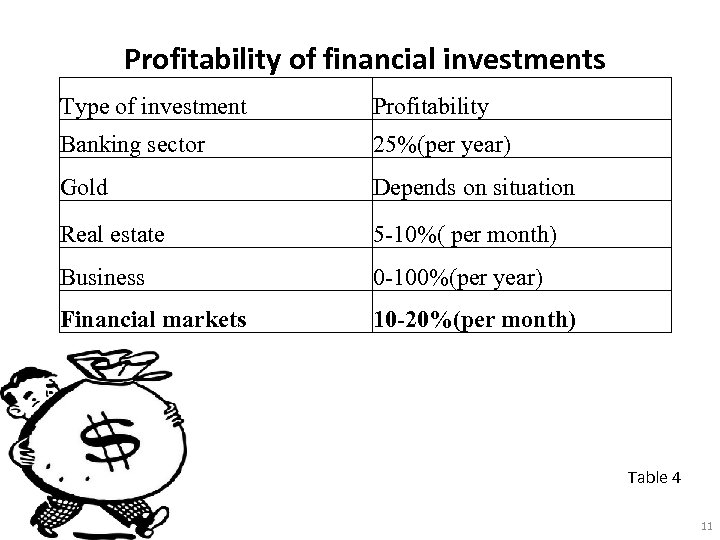

Profitability of financial investments Type of investment Profitability Banking sector 25%(per year) Gold Depends on situation Real estate 5 -10%( per month) Business 0 -100%(per year) Financial markets 10 -20%(per month) Table 4 11

Profitability of financial investments Type of investment Profitability Banking sector 25%(per year) Gold Depends on situation Real estate 5 -10%( per month) Business 0 -100%(per year) Financial markets 10 -20%(per month) Table 4 11

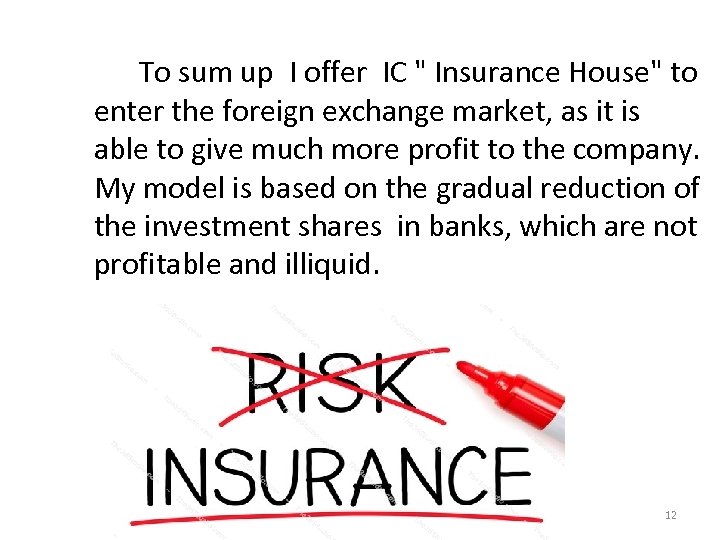

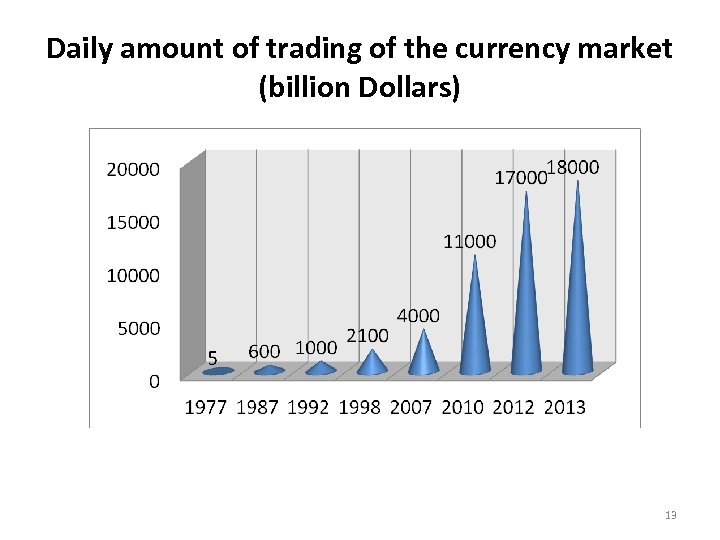

To sum up I offer IC " Insurance House" to enter the foreign exchange market, as it is able to give much more profit to the company. My model is based on the gradual reduction of the investment shares in banks, which are not profitable and illiquid. 12

To sum up I offer IC " Insurance House" to enter the foreign exchange market, as it is able to give much more profit to the company. My model is based on the gradual reduction of the investment shares in banks, which are not profitable and illiquid. 12

Daily amount of trading of the currency market (billion Dollars) 13

Daily amount of trading of the currency market (billion Dollars) 13

THANK YOU FOR ATTENTION ! 14

THANK YOU FOR ATTENTION ! 14