50da42952ec450da4b54b1a2e7b65f6d.ppt

- Количество слайдов: 22

“Making the Carbon Market work for Development Finance” Finance ADB Carbon Market Program Bruce Dunn Environment Specialist GEF Carbon Finance Meeting 15 November 2010, Washington, D. C.

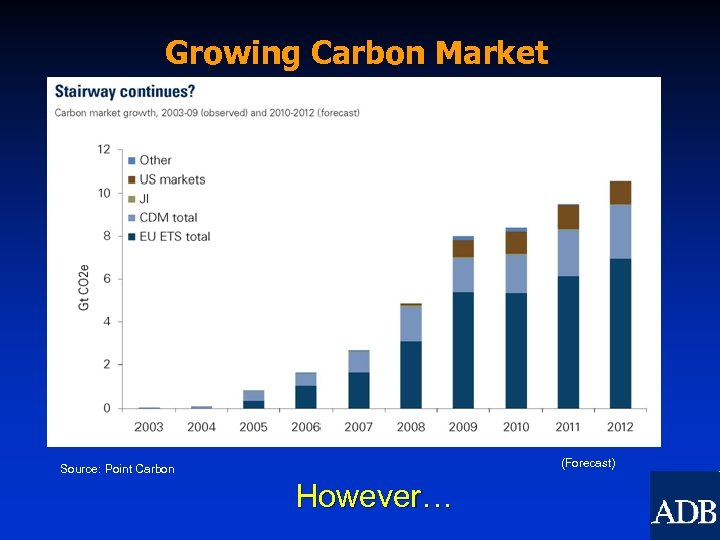

Growing Carbon Market (Forecast) Source: Point Carbon However…

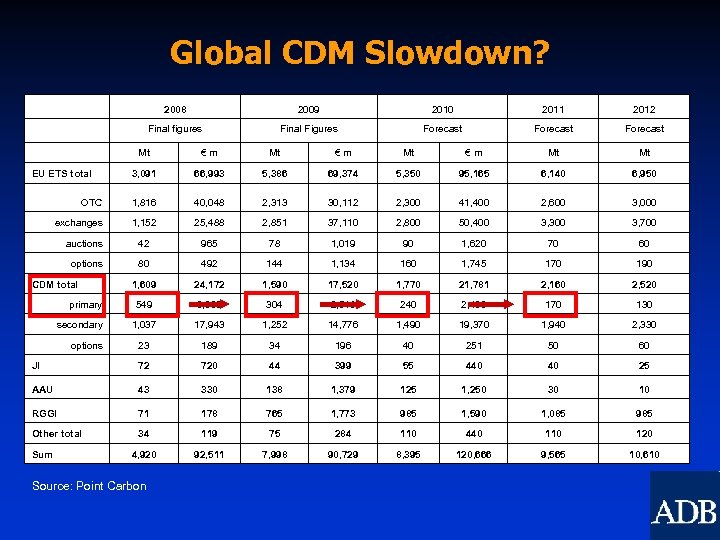

Global CDM Slowdown? 2008 2010 2011 2012 Final figures 2009 Final Figures Forecast Mt € m Mt Mt 3, 091 66, 993 5, 386 69, 374 5, 350 95, 165 6, 140 6, 950 OTC 1, 816 40, 048 2, 313 30, 112 2, 300 41, 400 2, 600 3, 000 exchanges 1, 152 25, 488 2, 851 37, 110 2, 800 50, 400 3, 300 3, 700 auctions 42 965 78 1, 019 90 1, 620 70 60 options 80 492 144 1, 134 160 1, 745 170 190 1, 609 24, 172 1, 590 17, 520 1, 770 21, 781 2, 160 2, 520 549 6, 039 304 2, 548 240 2, 160 170 130 1, 037 17, 943 1, 252 14, 776 1, 490 19, 370 1, 940 2, 330 23 189 34 196 40 251 50 60 JI 72 720 44 399 55 440 40 25 AAU 43 330 138 1, 379 125 1, 250 30 10 RGGI 71 178 765 1, 773 985 1, 590 1, 085 985 Other total 34 119 75 284 110 440 110 120 4, 920 92, 511 7, 998 90, 729 8, 395 120, 666 9, 565 10, 610 EU ETS total CDM total primary secondary options Sum Source: Point Carbon

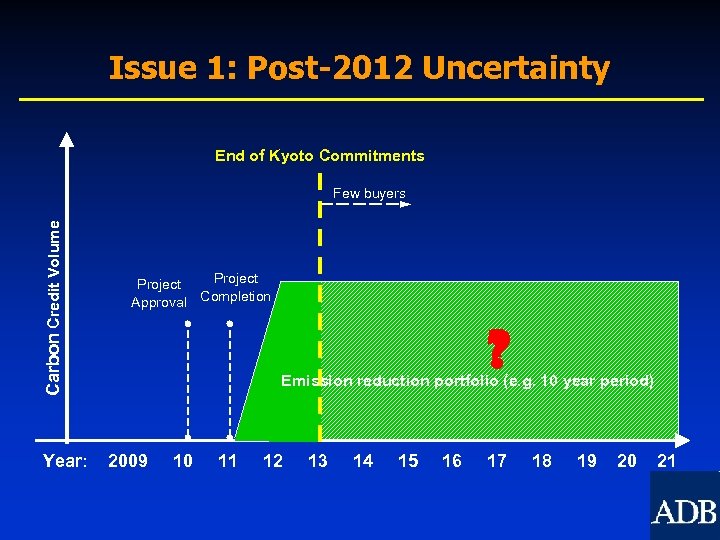

Issues q Kyoto Protocol commitments ending in 2012; no agreed international framework yet on post-2012 n Lack of long-term price signal to give incentive for economies to invest in low-carbon alternatives q Lack of investment/equity – carbon market contributing to cash flow of approved projects, but rarely contribute to project financing

Issue 1: Post-2012 Uncertainty End of Kyoto Commitments Carbon Credit Volume Few buyers Year: Project Approval Completion ? Emission reduction portfolio (e. g. 10 year period) 2009 10 11 12 13 14 15 16 17 18 19 20 21

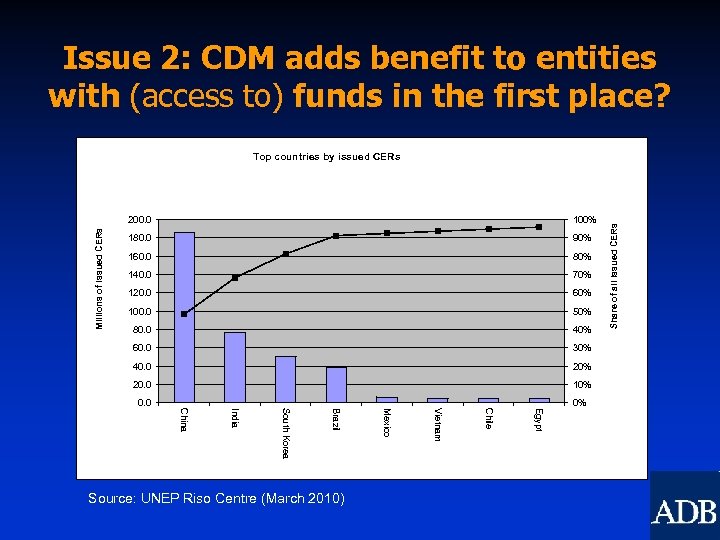

Issue 2: CDM adds benefit to entities with (access to) funds in the first place? 100% 180. 0 90% 160. 0 80% 140. 0 70% 120. 0 60% 100. 0 50% 80. 0 40% 60. 0 30% 40. 0 20% 20. 0 10% 0. 0 Millions of issued CERs 200. 0 0% Egypt Chile Vietnam Mexico Brazil South Korea India China Source: UNEP Riso Centre (March 2010) Share of all issued CERs Top countries by issued CERs

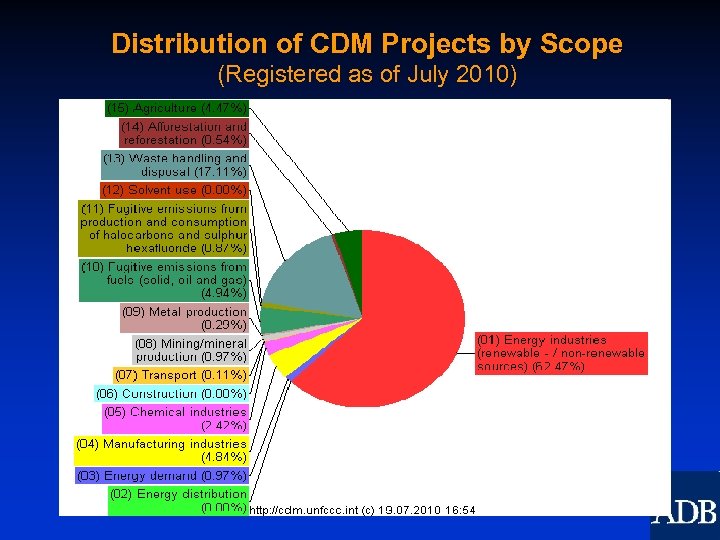

Distribution of CDM Projects by Scope (Registered as of July 2010)

ADB Carbon Market Program Overview

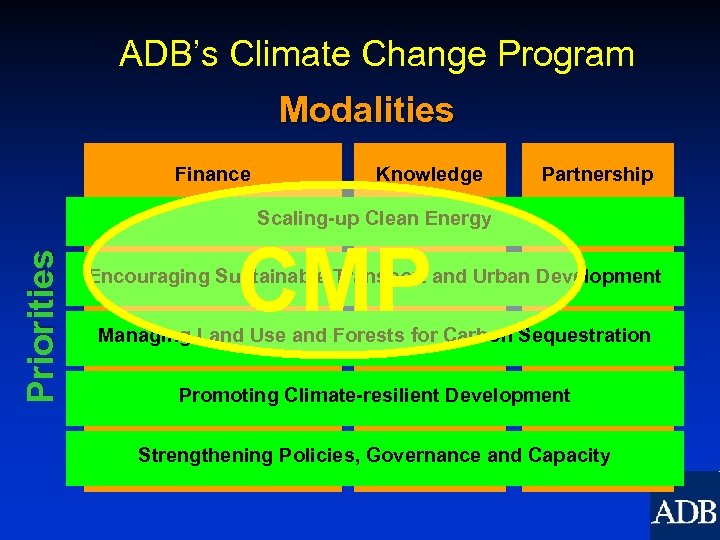

ADB’s Climate Change Program Modalities Finance Knowledge Partnership Priorities Scaling-up Clean Energy CMP Encouraging Sustainable Transport and Urban Development Managing Land Use and Forests for Carbon Sequestration Promoting Climate-resilient Development Strengthening Policies, Governance and Capacity

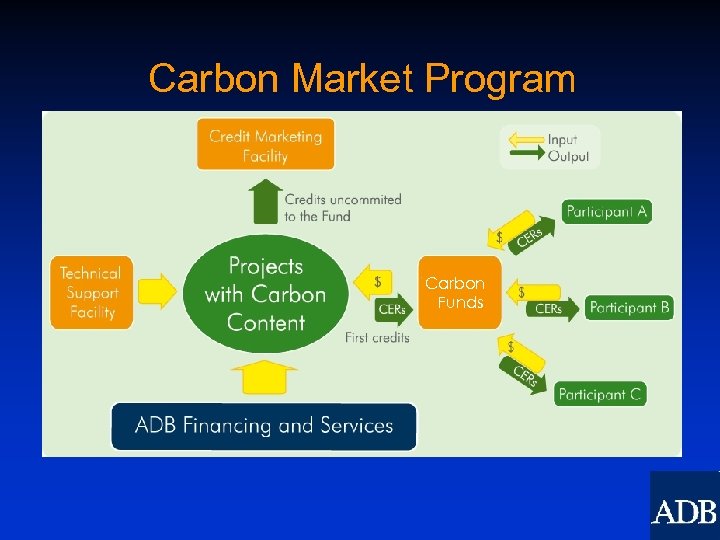

Carbon Market Program Carbon Funds

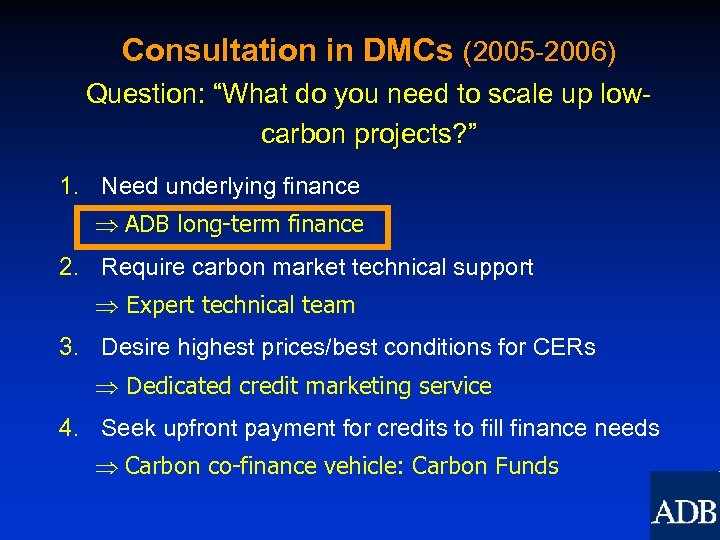

Consultation in DMCs (2005 -2006) Question: “What do you need to scale up lowcarbon projects? ” 1. Need underlying finance ADB long-term finance 2. Require carbon market technical support Expert technical team 3. Desire highest prices/best conditions for CERs Dedicated credit marketing service 4. Seek upfront payment for credits to fill finance needs Carbon co-finance vehicle: Carbon Funds

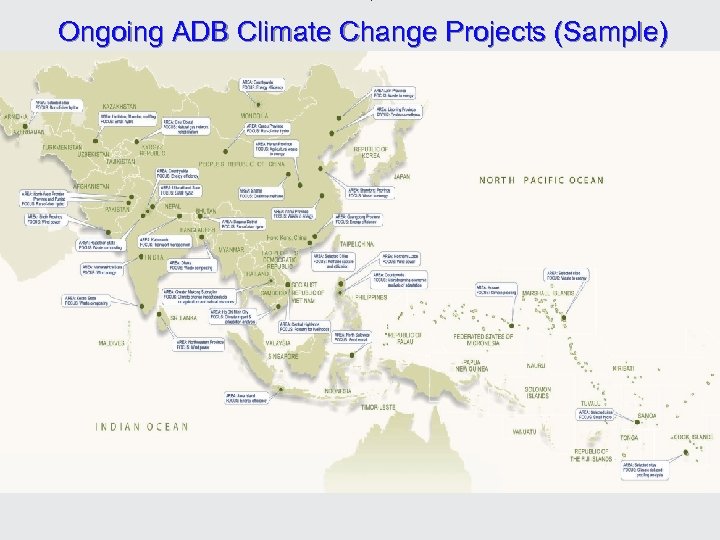

Ongoing ADB Climate Change Projects (Sample)

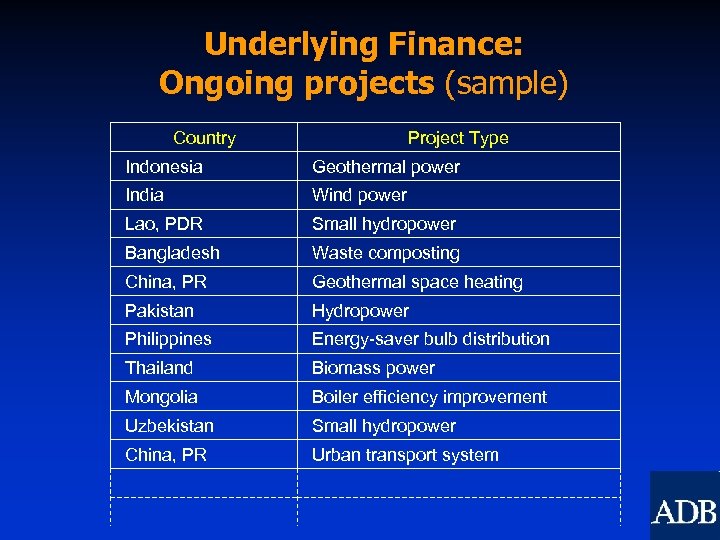

Underlying Finance: Ongoing projects (sample) Country Project Type Indonesia Geothermal power India Wind power Lao, PDR Small hydropower Bangladesh Waste composting China, PR Geothermal space heating Pakistan Hydropower Philippines Energy-saver bulb distribution Thailand Biomass power Mongolia Boiler efficiency improvement Uzbekistan Small hydropower China, PR Urban transport system

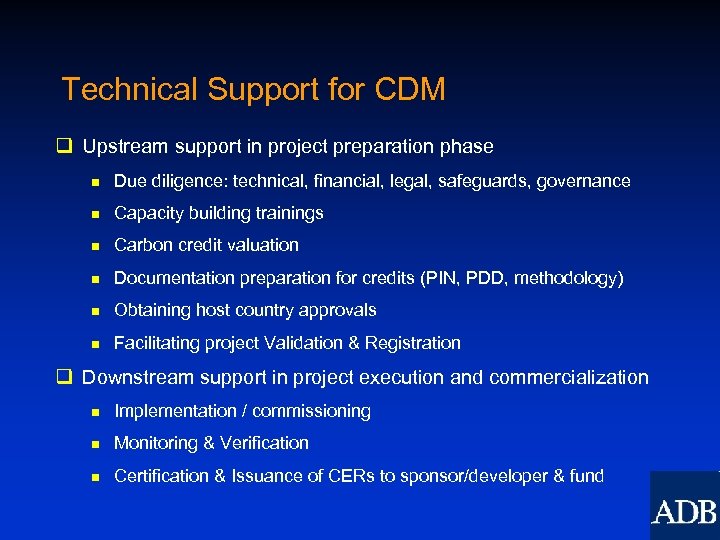

Technical Support for CDM q Upstream support in project preparation phase n Due diligence: technical, financial, legal, safeguards, governance n Capacity building trainings n Carbon credit valuation n Documentation preparation for credits (PIN, PDD, methodology) n Obtaining host country approvals n Facilitating project Validation & Registration q Downstream support in project execution and commercialization n Implementation / commissioning n Monitoring & Verification n Certification & Issuance of CERs to sponsor/developer & fund

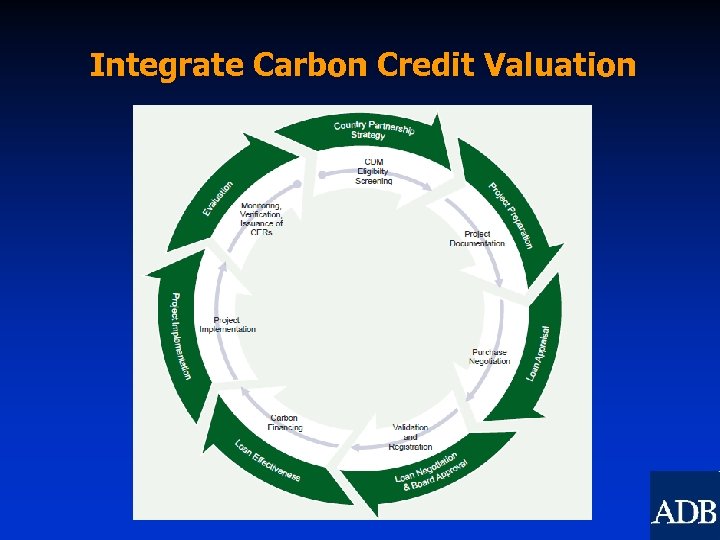

Integrate Carbon Credit Valuation

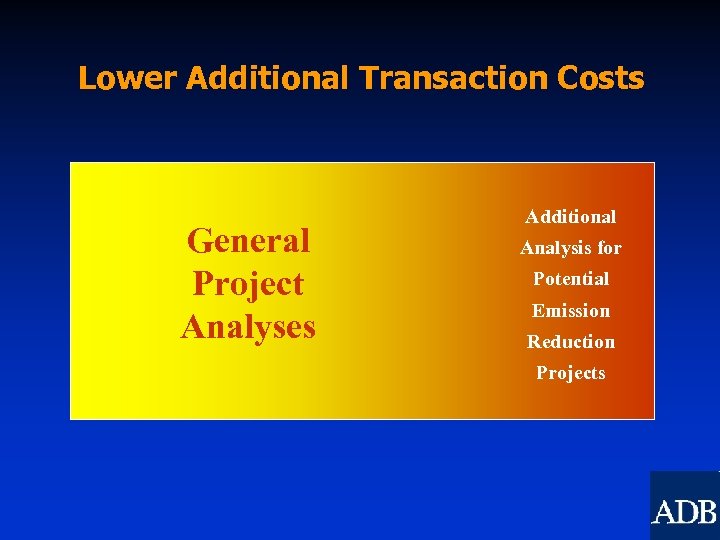

Lower Additional Transaction Costs General Project Analyses Additional Analysis for Potential Emission Reduction Projects

Credit Marketing Facility

CMF Agents q Terms of reference and fee structure pre-negotiated with ADB; contracts directly with project entity as “seller’s agent” to find best offer from buyers q Agents are only allowed to collect fee from the seller in percentage terms of actual funds transferred from the buyer to the seller q Currently retained agents q TFS Green: 2 -3. 5% charge depending on project size (in CER volume) q CM Capital Markets: 1% charge regardless of project size

Carbon Co-Finance: Carbon Funds § Asia Pacific Carbon Fund (APCF) for credits up to end of 2012, and Future Carbon Fund (FCF) for post-2012 § Co-finances projects alongside ADB to help fill project financing gap § Purchase of credits generated from now up to 2020 § Can purchase 25 -75% of expected carbon credits on upfront payment basis and the remaining credits via payment on delivery § Lower transaction cost if debt/equity financier is ADB

CMP Summary: Main Advantages for Project Developers/Sponsors § Certain funds today, for commodity with uncertain value in the future § Reduced budget commitments to close the financing plan of projects § Comprehensive technical and implementation support § Extra credits from successful project implementation can be marketed with ADB support for further financial upside

Other Ongoing Initiatives § Tech-transfer CDM to accelerate the transfer and diffusion of energy-efficient equipment/appliances and other clean energy technologies using CDM § Broadening the Regional Distribution of CDM through capacity building and project identification/development seminars in collaboration with IGES and UNFCCC Secretariat § Asia-Pacific REDD financing as part of the global REDD partnership (led by the World Bank FCPF and UN-REDD); possible future public-private regional REDD carbon fund

THANK YOU! Bruce Dunn / Toru Kubo bdunn@adb. org / tkubo@adb. org Regional and Sustainable Development Department General inquiries: adbcdm@adb. org

50da42952ec450da4b54b1a2e7b65f6d.ppt