38af5b3e2bd7b39b9592e62ad0262464.ppt

- Количество слайдов: 23

"Making Texas Competitive" State Senator Eliot Shapleigh January 11, 2006 Texas Tax Reform Commission ©Texas State Senator Eliot Shapleigh,

"Making Texas Competitive" State Senator Eliot Shapleigh January 11, 2006 Texas Tax Reform Commission ©Texas State Senator Eliot Shapleigh,

What Will Make Texas Competitive? n "Don't tax us, or we can't compete with the lawyers in New York. " – Ron Kirk, January 9, 2006 n "Cut our taxes and we create jobs. " – Ronald Reagan, 1984 n "Don't tax me, don't tax thee, tax the fella behind the tree. " – Russell Long, 1944

What Will Make Texas Competitive? n "Don't tax us, or we can't compete with the lawyers in New York. " – Ron Kirk, January 9, 2006 n "Cut our taxes and we create jobs. " – Ronald Reagan, 1984 n "Don't tax me, don't tax thee, tax the fella behind the tree. " – Russell Long, 1944

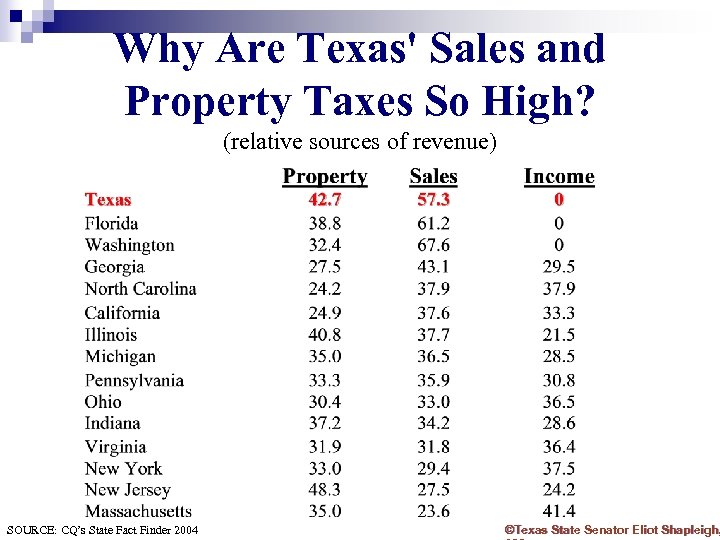

Why Are Texas' Sales and Property Taxes So High? (relative sources of revenue) SOURCE: CQ’s State Fact Finder 2004 ©Texas State Senator Eliot Shapleigh,

Why Are Texas' Sales and Property Taxes So High? (relative sources of revenue) SOURCE: CQ’s State Fact Finder 2004 ©Texas State Senator Eliot Shapleigh,

Principles for a Good Revenue System n Raises enough money n Everyone pays fair share n Enhances state and local economic development n Avoids over-reliance on any one tax or set of taxes n Minimal compliance and enforcement costs for simplicity n Withstands shifts in the economy and promotes certainty for taxpayers and government n Broad based, even-handed treatment of all tax payers so as to keep tax rates low Billy Hamilton, “What is a ‘Good’ Tax System, “ Select Committee on Tax Equity, Rethinking Texas Taxes, Volume 2 Analysis of the Tax System (Austin, January 1989) ©Texas State Senator Eliot Shapleigh,

Principles for a Good Revenue System n Raises enough money n Everyone pays fair share n Enhances state and local economic development n Avoids over-reliance on any one tax or set of taxes n Minimal compliance and enforcement costs for simplicity n Withstands shifts in the economy and promotes certainty for taxpayers and government n Broad based, even-handed treatment of all tax payers so as to keep tax rates low Billy Hamilton, “What is a ‘Good’ Tax System, “ Select Committee on Tax Equity, Rethinking Texas Taxes, Volume 2 Analysis of the Tax System (Austin, January 1989) ©Texas State Senator Eliot Shapleigh,

The Property Tax: The First Leg of a Three Legged Stool ©Texas State Senator Eliot Shapleigh,

The Property Tax: The First Leg of a Three Legged Stool ©Texas State Senator Eliot Shapleigh,

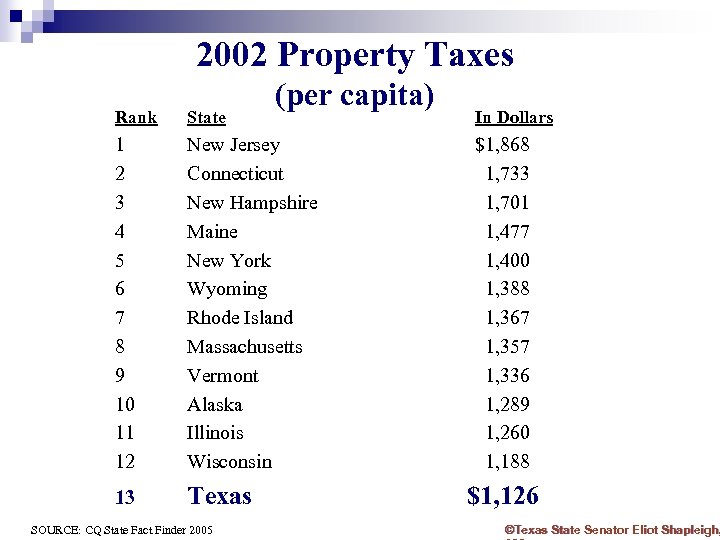

2002 Property Taxes (per capita) Rank State 1 2 3 4 5 6 7 8 9 10 11 12 New Jersey Connecticut New Hampshire Maine New York Wyoming Rhode Island Massachusetts Vermont Alaska Illinois Wisconsin 13 Texas SOURCE: CQ State Fact Finder 2005 In Dollars $1, 868 1, 733 1, 701 1, 477 1, 400 1, 388 1, 367 1, 357 1, 336 1, 289 1, 260 1, 188 $1, 126 ©Texas State Senator Eliot Shapleigh,

2002 Property Taxes (per capita) Rank State 1 2 3 4 5 6 7 8 9 10 11 12 New Jersey Connecticut New Hampshire Maine New York Wyoming Rhode Island Massachusetts Vermont Alaska Illinois Wisconsin 13 Texas SOURCE: CQ State Fact Finder 2005 In Dollars $1, 868 1, 733 1, 701 1, 477 1, 400 1, 388 1, 367 1, 357 1, 336 1, 289 1, 260 1, 188 $1, 126 ©Texas State Senator Eliot Shapleigh,

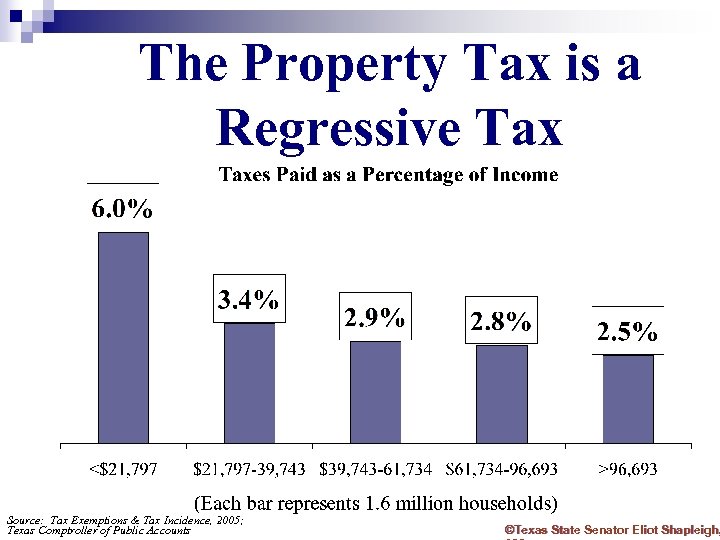

The Property Tax is a Regressive Tax Source: Tax Exemptions & Tax Incidence, 2005; Texas Comptroller of Public Accounts ©Texas State Senator Eliot Shapleigh,

The Property Tax is a Regressive Tax Source: Tax Exemptions & Tax Incidence, 2005; Texas Comptroller of Public Accounts ©Texas State Senator Eliot Shapleigh,

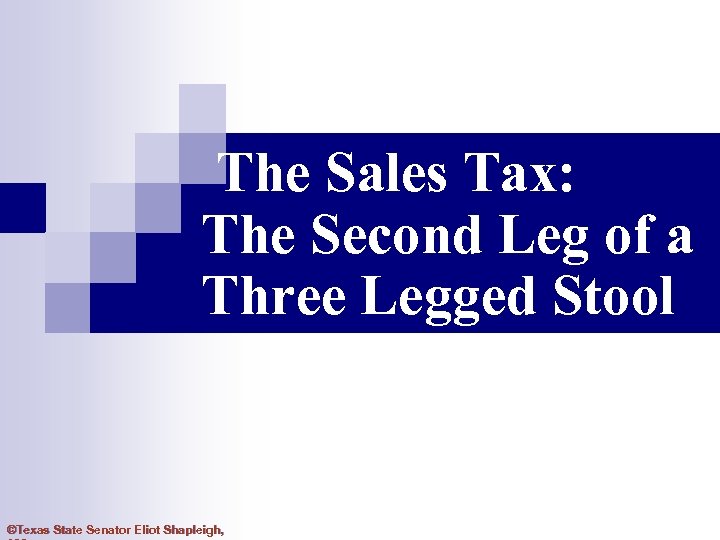

The Sales Tax: The Second Leg of a Three Legged Stool ©Texas State Senator Eliot Shapleigh,

The Sales Tax: The Second Leg of a Three Legged Stool ©Texas State Senator Eliot Shapleigh,

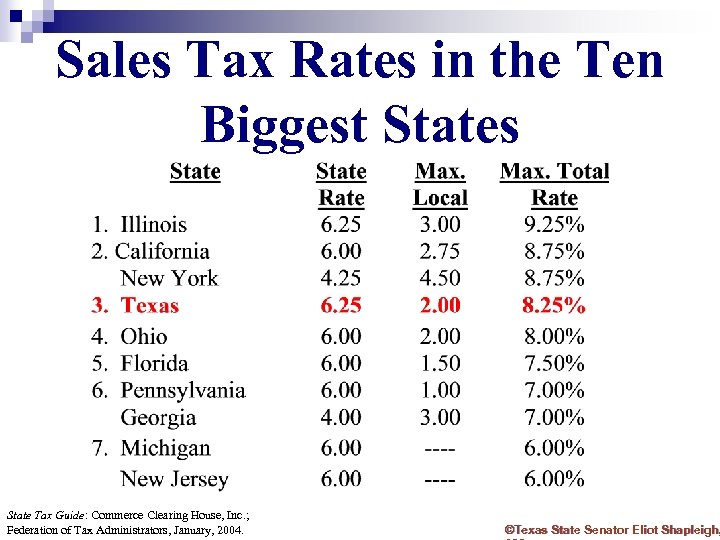

Sales Tax Rates in the Ten Biggest States State Tax Guide: Commerce Clearing House, Inc. ; Federation of Tax Administrators, January, 2004. ©Texas State Senator Eliot Shapleigh,

Sales Tax Rates in the Ten Biggest States State Tax Guide: Commerce Clearing House, Inc. ; Federation of Tax Administrators, January, 2004. ©Texas State Senator Eliot Shapleigh,

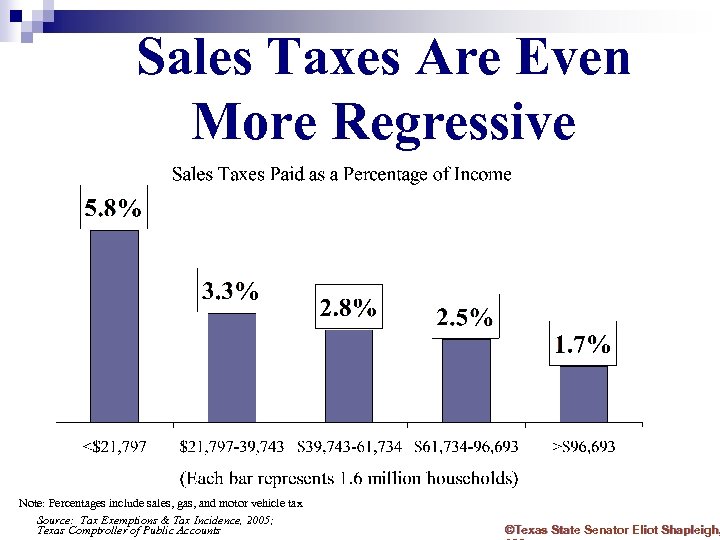

Sales Taxes Are Even More Regressive Note: Percentages include sales, gas, and motor vehicle tax Source: Tax Exemptions & Tax Incidence, 2005; Texas Comptroller of Public Accounts ©Texas State Senator Eliot Shapleigh,

Sales Taxes Are Even More Regressive Note: Percentages include sales, gas, and motor vehicle tax Source: Tax Exemptions & Tax Incidence, 2005; Texas Comptroller of Public Accounts ©Texas State Senator Eliot Shapleigh,

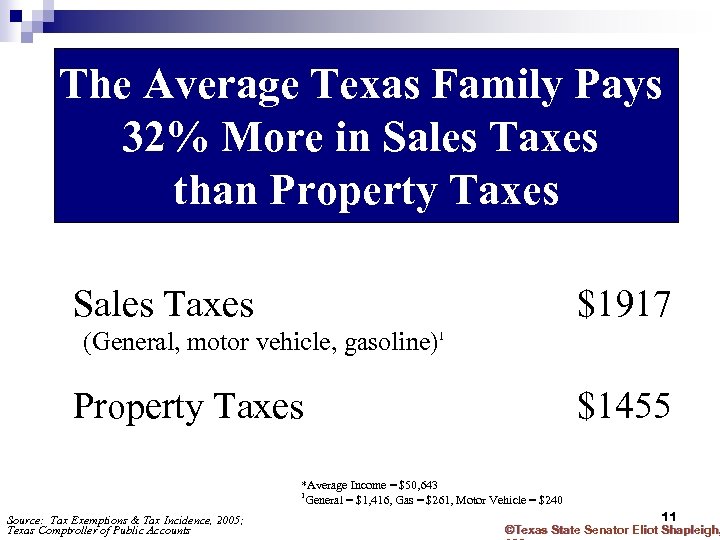

What Does the Average Texas The Average Texas Family Pay in Taxes? * 32% More in Sales Taxes than Property Taxes Sales Taxes $1917 (General, motor vehicle, gasoline)1 Property Taxes $1455 *Average Income = $50, 643 1 General = $1, 416, Gas = $261, Motor Vehicle = $240 Source: Tax Exemptions & Tax Incidence, 2005; Texas Comptroller of Public Accounts 11 ©Texas State Senator Eliot Shapleigh,

What Does the Average Texas The Average Texas Family Pay in Taxes? * 32% More in Sales Taxes than Property Taxes Sales Taxes $1917 (General, motor vehicle, gasoline)1 Property Taxes $1455 *Average Income = $50, 643 1 General = $1, 416, Gas = $261, Motor Vehicle = $240 Source: Tax Exemptions & Tax Incidence, 2005; Texas Comptroller of Public Accounts 11 ©Texas State Senator Eliot Shapleigh,

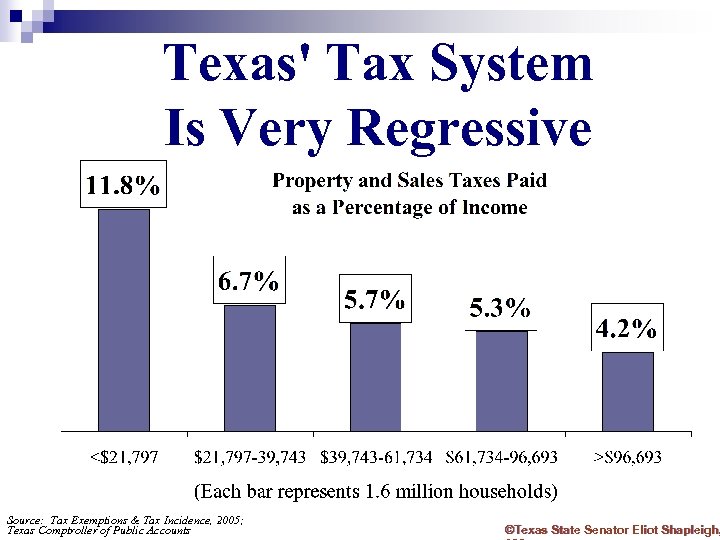

Texas' Tax System Is Very Regressive Source: Tax Exemptions & Tax Incidence, 2005; Texas Comptroller of Public Accounts ©Texas State Senator Eliot Shapleigh,

Texas' Tax System Is Very Regressive Source: Tax Exemptions & Tax Incidence, 2005; Texas Comptroller of Public Accounts ©Texas State Senator Eliot Shapleigh,

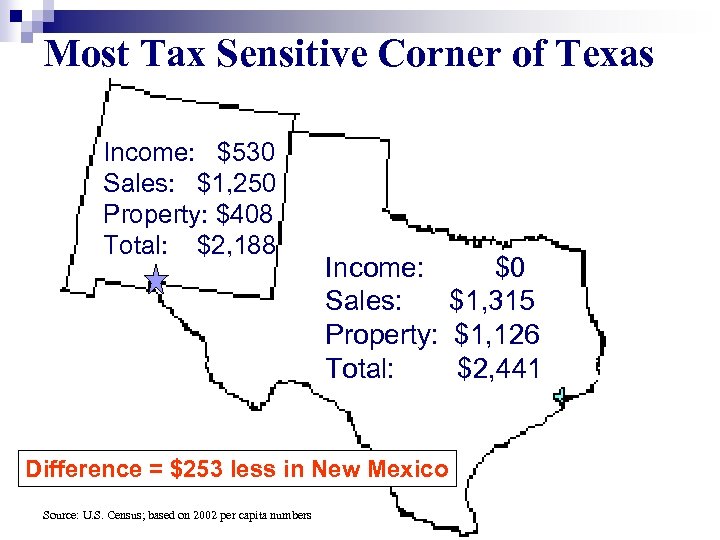

Most Tax Sensitive Corner of Texas Income: $530 Sales: $1, 250 Property: $408 Total: $2, 188 Income: $0 Sales: $1, 315 Property: $1, 126 Total: $2, 441 Difference = $253 less in New Mexico Source: U. S. Census; based on 2002 per capita numbers

Most Tax Sensitive Corner of Texas Income: $530 Sales: $1, 250 Property: $408 Total: $2, 188 Income: $0 Sales: $1, 315 Property: $1, 126 Total: $2, 441 Difference = $253 less in New Mexico Source: U. S. Census; based on 2002 per capita numbers

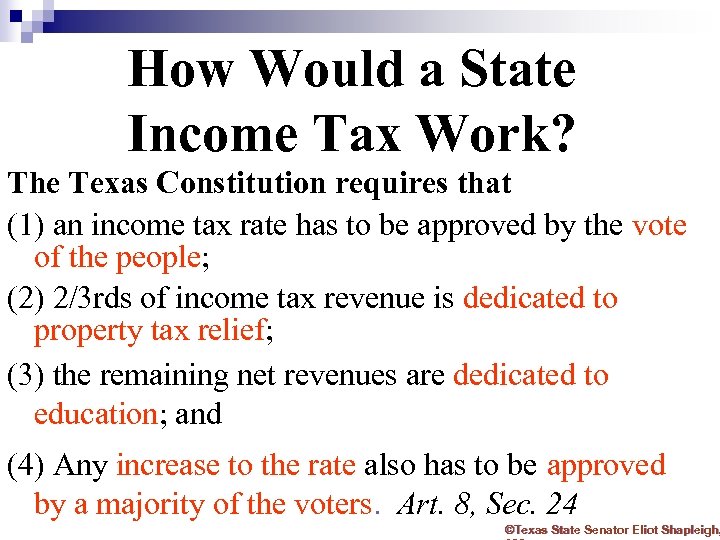

How Would a State Income Tax Work? The Texas Constitution requires that (1) an income tax rate has to be approved by the vote of the people; (2) 2/3 rds of income tax revenue is dedicated to property tax relief; (3) the remaining net revenues are dedicated to education; and (4) Any increase to the rate also has to be approved by a majority of the voters. Art. 8, Sec. 24 ©Texas State Senator Eliot Shapleigh,

How Would a State Income Tax Work? The Texas Constitution requires that (1) an income tax rate has to be approved by the vote of the people; (2) 2/3 rds of income tax revenue is dedicated to property tax relief; (3) the remaining net revenues are dedicated to education; and (4) Any increase to the rate also has to be approved by a majority of the voters. Art. 8, Sec. 24 ©Texas State Senator Eliot Shapleigh,

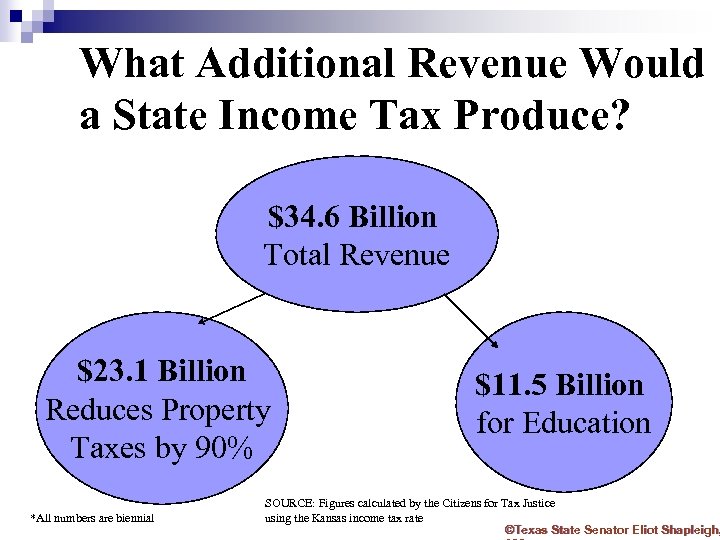

What Additional Revenue Would a State Income Tax Produce? $34. 6 Billion Total Revenue $23. 1 Billion Reduces Property Taxes by 90% *All numbers are biennial $11. 5 Billion for Education SOURCE: Figures calculated by the Citizens for Tax Justice using the Kansas income tax rate ©Texas State Senator Eliot Shapleigh,

What Additional Revenue Would a State Income Tax Produce? $34. 6 Billion Total Revenue $23. 1 Billion Reduces Property Taxes by 90% *All numbers are biennial $11. 5 Billion for Education SOURCE: Figures calculated by the Citizens for Tax Justice using the Kansas income tax rate ©Texas State Senator Eliot Shapleigh,

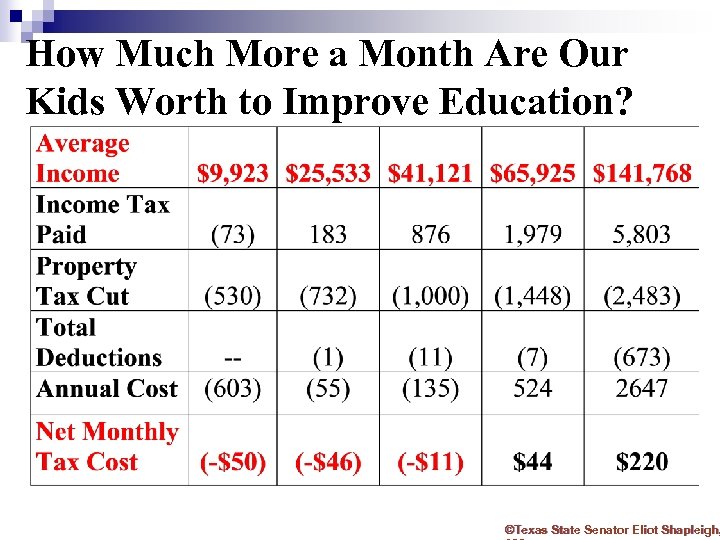

How Much More a Month Are Our Kids Worth to Improve Education? ©Texas State Senator Eliot Shapleigh,

How Much More a Month Are Our Kids Worth to Improve Education? ©Texas State Senator Eliot Shapleigh,

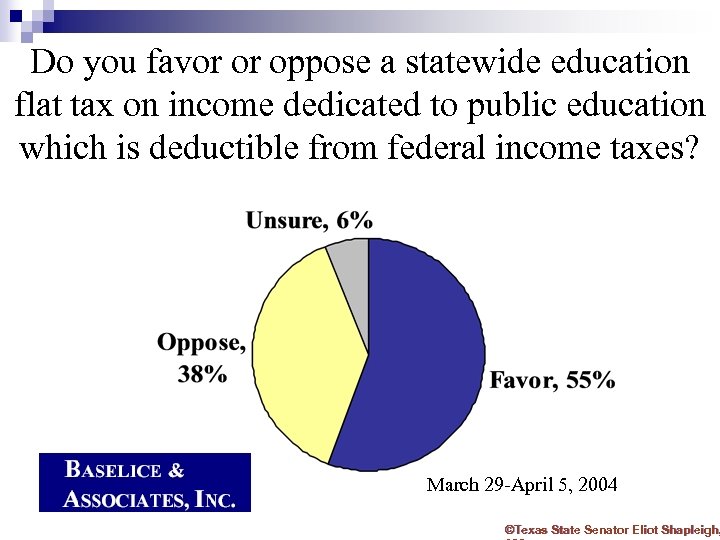

Do you favor or oppose a statewide education flat tax on income dedicated to public education which is deductible from federal income taxes? March 29 -April 5, 2004 ©Texas State Senator Eliot Shapleigh,

Do you favor or oppose a statewide education flat tax on income dedicated to public education which is deductible from federal income taxes? March 29 -April 5, 2004 ©Texas State Senator Eliot Shapleigh,

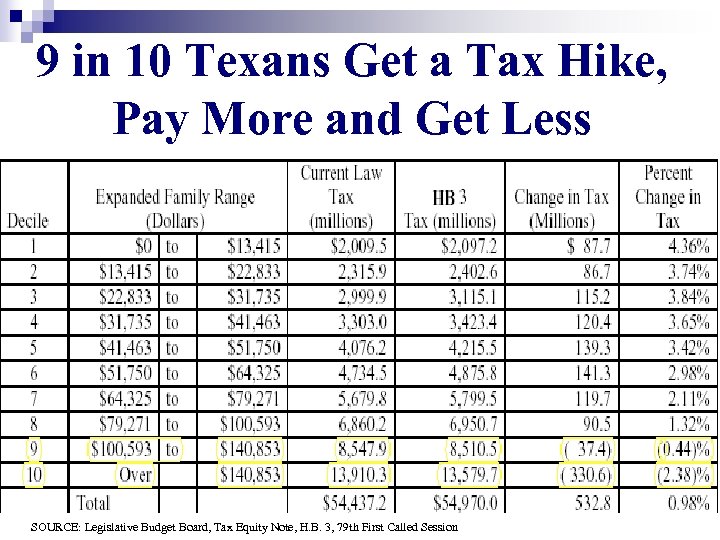

9 in 10 Texans Get a Tax Hike, Pay More and Get Less SOURCE: Legislative Budget Board, Tax Equity Note, H. B. 3, 79 th First Called Session

9 in 10 Texans Get a Tax Hike, Pay More and Get Less SOURCE: Legislative Budget Board, Tax Equity Note, H. B. 3, 79 th First Called Session

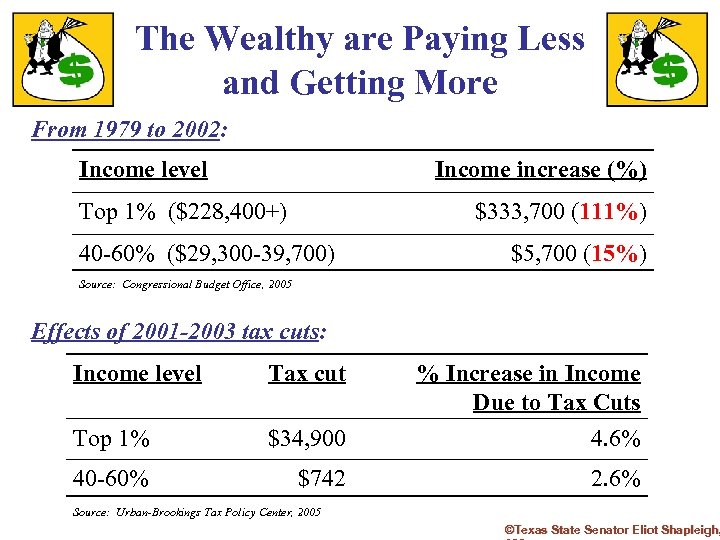

The Wealthy are Paying Less and Getting More From 1979 to 2002: Income level Income increase (%) Top 1% ($228, 400+) $333, 700 (111%) 40 -60% ($29, 300 -39, 700) $5, 700 (15%) Source: Congressional Budget Office, 2005 Effects of 2001 -2003 tax cuts: Income level Tax cut % Increase in Income Due to Tax Cuts Top 1% $34, 900 4. 6% 40 -60% $742 2. 6% Source: Urban-Brookings Tax Policy Center, 2005 ©Texas State Senator Eliot Shapleigh,

The Wealthy are Paying Less and Getting More From 1979 to 2002: Income level Income increase (%) Top 1% ($228, 400+) $333, 700 (111%) 40 -60% ($29, 300 -39, 700) $5, 700 (15%) Source: Congressional Budget Office, 2005 Effects of 2001 -2003 tax cuts: Income level Tax cut % Increase in Income Due to Tax Cuts Top 1% $34, 900 4. 6% 40 -60% $742 2. 6% Source: Urban-Brookings Tax Policy Center, 2005 ©Texas State Senator Eliot Shapleigh,

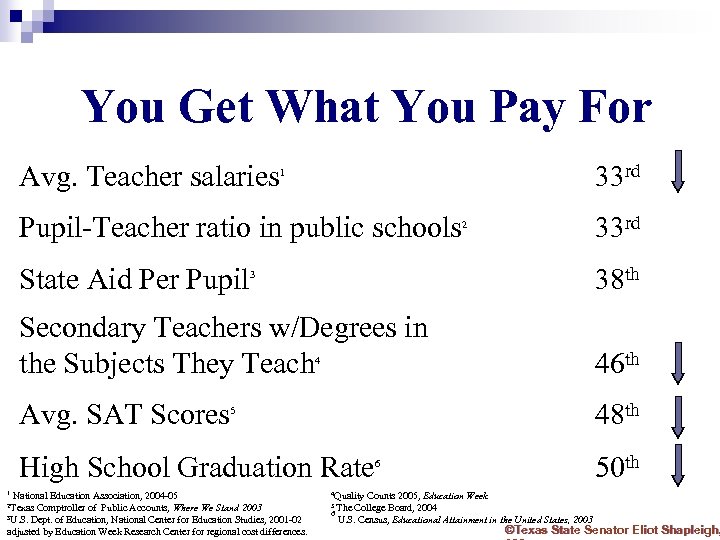

You Get What You Pay For Avg. Teacher salaries 33 rd 1 Pupil-Teacher ratio in public schools State Aid Per Pupil 33 rd 2 38 th 3 Secondary Teachers w/Degrees in the Subjects They Teach 46 th Avg. SAT Scores 48 th 4 5 High School Graduation Rate 1 4 Quality 2 Texas 50 th 6 5 The National Education Association, 2004 -05 Comptroller of Public Accounts, Where We Stand 2003 3 U. S. Dept. of Education, National Center for Education Studies, 2001 -02 adjusted by Education Week Research Center for regional cost differences. Counts 2005, Education Week College Board, 2004 6 U. S. Census, Educational Attainment in the United States, 2003 ©Texas State Senator Eliot Shapleigh,

You Get What You Pay For Avg. Teacher salaries 33 rd 1 Pupil-Teacher ratio in public schools State Aid Per Pupil 33 rd 2 38 th 3 Secondary Teachers w/Degrees in the Subjects They Teach 46 th Avg. SAT Scores 48 th 4 5 High School Graduation Rate 1 4 Quality 2 Texas 50 th 6 5 The National Education Association, 2004 -05 Comptroller of Public Accounts, Where We Stand 2003 3 U. S. Dept. of Education, National Center for Education Studies, 2001 -02 adjusted by Education Week Research Center for regional cost differences. Counts 2005, Education Week College Board, 2004 6 U. S. Census, Educational Attainment in the United States, 2003 ©Texas State Senator Eliot Shapleigh,

Education is the Key to Texas Competitiveness n The industries that I think about most…are far more sensitive to the quality of talent in the area than they are to tax policies. n It is worrisome for the U. S. economy that the number of Americans studying science and engineering is declining while those academic disciplines were increasingly popular in China and other nations. ---Bill Gates, National Conference of State Legislatures, August, 2005

Education is the Key to Texas Competitiveness n The industries that I think about most…are far more sensitive to the quality of talent in the area than they are to tax policies. n It is worrisome for the U. S. economy that the number of Americans studying science and engineering is declining while those academic disciplines were increasingly popular in China and other nations. ---Bill Gates, National Conference of State Legislatures, August, 2005

Making the System Better n n n Deliver the property tax reduction through a homestead exemption Exempt small businesses with less than $500, 000 in gross revenues Deliver a health care tax credit to reward businesses that provide quality health care Expand the sales tax holiday to December Exempt Lone Star Card participants from increases to the sales tax rate or expansion to the sales tax base

Making the System Better n n n Deliver the property tax reduction through a homestead exemption Exempt small businesses with less than $500, 000 in gross revenues Deliver a health care tax credit to reward businesses that provide quality health care Expand the sales tax holiday to December Exempt Lone Star Card participants from increases to the sales tax rate or expansion to the sales tax base

"Making Texas Competitive" State Senator Eliot Shapleigh January 11, 2005 Texas Tax Reform Commission Revised 9/20/2005 ©Texas State Senator Eliot Shapleigh,

"Making Texas Competitive" State Senator Eliot Shapleigh January 11, 2005 Texas Tax Reform Commission Revised 9/20/2005 ©Texas State Senator Eliot Shapleigh,