4d3fbb85b265785bc7992565f0a84709.ppt

- Количество слайдов: 66

Making Lunch Out of Lien Law Duncan W. Glaholt LLP

Making Lunch Out of Lien Law Duncan W. Glaholt LLP

1. Encounters with E-Reg. 2. David Goldman’s Interesting Problem 3. What’s New and Different with Liens?

1. Encounters with E-Reg. 2. David Goldman’s Interesting Problem 3. What’s New and Different with Liens?

1. Encounters With E-Reg.

1. Encounters With E-Reg.

Concerns and Suggested Solutions Prepared with the assistance of Roger J. Gillott, Osler Hoskin & Harcourt LLP

Concerns and Suggested Solutions Prepared with the assistance of Roger J. Gillott, Osler Hoskin & Harcourt LLP

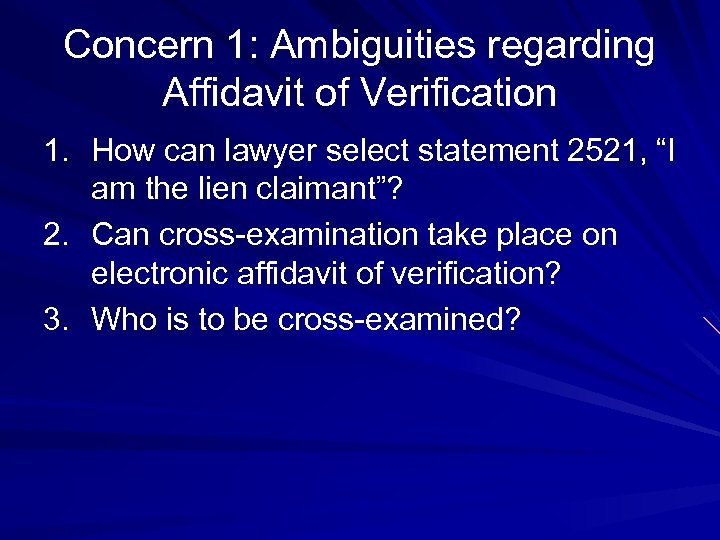

Concern 1: Ambiguities regarding Affidavit of Verification 1. How can lawyer select statement 2521, “I am the lien claimant”? 2. Can cross-examination take place on electronic affidavit of verification? 3. Who is to be cross-examined?

Concern 1: Ambiguities regarding Affidavit of Verification 1. How can lawyer select statement 2521, “I am the lien claimant”? 2. Can cross-examination take place on electronic affidavit of verification? 3. Who is to be cross-examined?

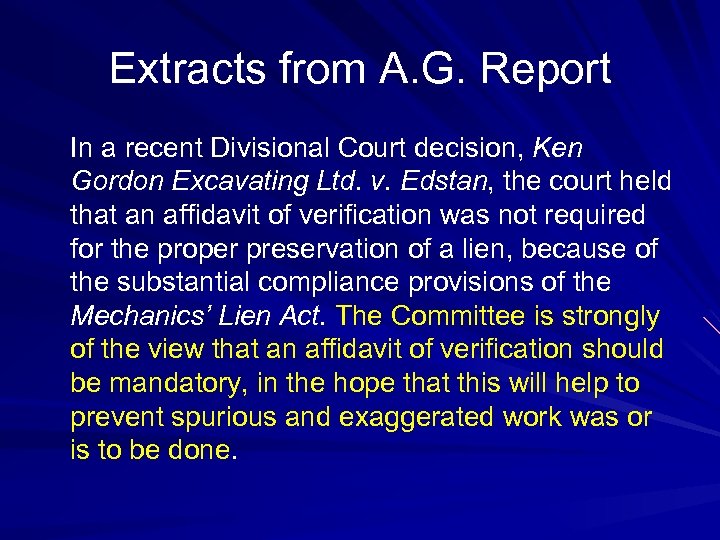

Extracts from A. G. Report In a recent Divisional Court decision, Ken Gordon Excavating Ltd. v. Edstan, the court held that an affidavit of verification was not required for the proper preservation of a lien, because of the substantial compliance provisions of the Mechanics’ Lien Act. The Committee is strongly of the view that an affidavit of verification should be mandatory, in the hope that this will help to prevent spurious and exaggerated work was or is to be done.

Extracts from A. G. Report In a recent Divisional Court decision, Ken Gordon Excavating Ltd. v. Edstan, the court held that an affidavit of verification was not required for the proper preservation of a lien, because of the substantial compliance provisions of the Mechanics’ Lien Act. The Committee is strongly of the view that an affidavit of verification should be mandatory, in the hope that this will help to prevent spurious and exaggerated work was or is to be done.

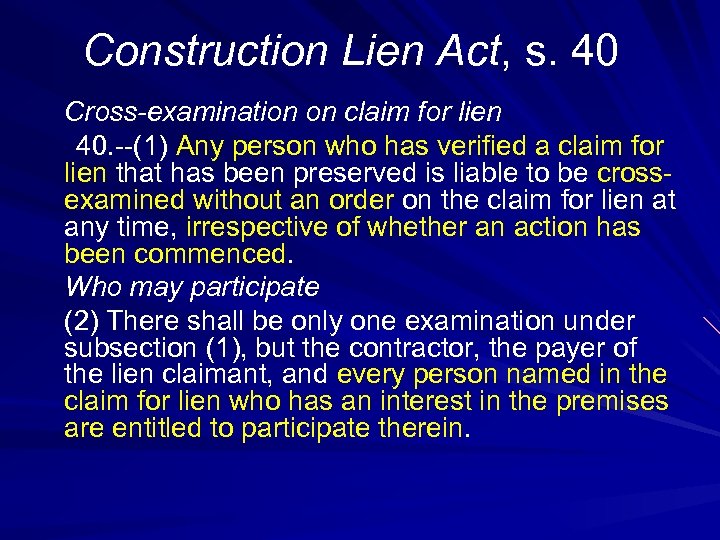

Construction Lien Act, s. 40 Cross-examination on claim for lien 40. --(1) Any person who has verified a claim for lien that has been preserved is liable to be crossexamined without an order on the claim for lien at any time, irrespective of whether an action has been commenced. Who may participate (2) There shall be only one examination under subsection (1), but the contractor, the payer of the lien claimant, and every person named in the claim for lien who has an interest in the premises are entitled to participate therein.

Construction Lien Act, s. 40 Cross-examination on claim for lien 40. --(1) Any person who has verified a claim for lien that has been preserved is liable to be crossexamined without an order on the claim for lien at any time, irrespective of whether an action has been commenced. Who may participate (2) There shall be only one examination under subsection (1), but the contractor, the payer of the lien claimant, and every person named in the claim for lien who has an interest in the premises are entitled to participate therein.

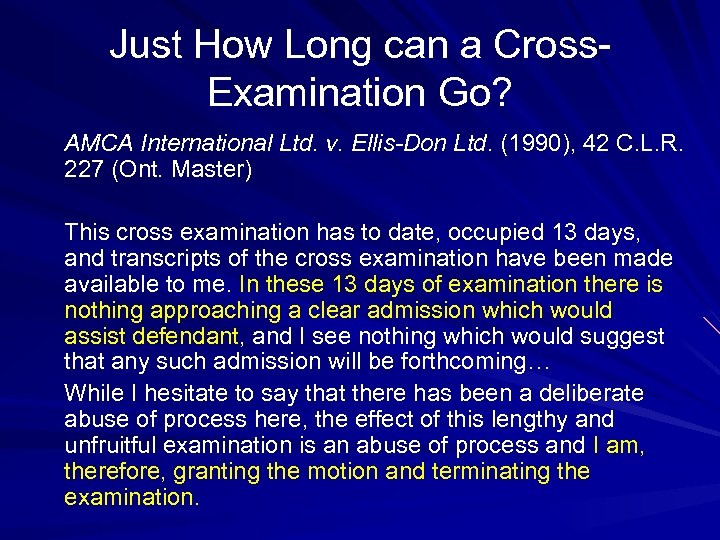

Just How Long can a Cross. Examination Go? AMCA International Ltd. v. Ellis-Don Ltd. (1990), 42 C. L. R. 227 (Ont. Master) This cross examination has to date, occupied 13 days, and transcripts of the cross examination have been made available to me. In these 13 days of examination there is nothing approaching a clear admission which would assist defendant, and I see nothing which would suggest that any such admission will be forthcoming… While I hesitate to say that there has been a deliberate abuse of process here, the effect of this lengthy and unfruitful examination is an abuse of process and I am, therefore, granting the motion and terminating the examination.

Just How Long can a Cross. Examination Go? AMCA International Ltd. v. Ellis-Don Ltd. (1990), 42 C. L. R. 227 (Ont. Master) This cross examination has to date, occupied 13 days, and transcripts of the cross examination have been made available to me. In these 13 days of examination there is nothing approaching a clear admission which would assist defendant, and I see nothing which would suggest that any such admission will be forthcoming… While I hesitate to say that there has been a deliberate abuse of process here, the effect of this lengthy and unfruitful examination is an abuse of process and I am, therefore, granting the motion and terminating the examination.

Suggested Solutions Ministry to issue practice direction clarifying that: (a) cross-examination on affidavits will proceed as before under s. 40 of the Act; (b) Where statement 2521 is selected (“I am the lien claimant”, the lawyer is understood to be the recording the fact that his client is swearing the affidavit; (c) where statement 2522 is selected (“I ___ am the agent of the lien claimant”), the individual named will be cross-examined, even if that person is a lawyer for the lien claimant.

Suggested Solutions Ministry to issue practice direction clarifying that: (a) cross-examination on affidavits will proceed as before under s. 40 of the Act; (b) Where statement 2521 is selected (“I am the lien claimant”, the lawyer is understood to be the recording the fact that his client is swearing the affidavit; (c) where statement 2522 is selected (“I ___ am the agent of the lien claimant”), the individual named will be cross-examined, even if that person is a lawyer for the lien claimant.

Until Ministry Makes Suggested Changes: Ministry has issued direction to Land Titles Offices to allow paper claim for lien, including the affidavit of verification, to be scanned into Statement 61.

Until Ministry Makes Suggested Changes: Ministry has issued direction to Land Titles Offices to allow paper claim for lien, including the affidavit of verification, to be scanned into Statement 61.

Concern 2: Limit on the Number of PINs that can be Affected by Single Lien 1. Current limit is 250 PINs. 2. When liening common elements, more may be required.

Concern 2: Limit on the Number of PINs that can be Affected by Single Lien 1. Current limit is 250 PINs. 2. When liening common elements, more may be required.

Suggested Solution Until number of PINs is increased, Ministry recommends that documents be registered in paper.

Suggested Solution Until number of PINs is increased, Ministry recommends that documents be registered in paper.

Concern 3: Field for “Owner” not long enough to include multiple parties Solution: Until size of field is increased, a list of owners should be scanned into Statement 61 as a schedule.

Concern 3: Field for “Owner” not long enough to include multiple parties Solution: Until size of field is increased, a list of owners should be scanned into Statement 61 as a schedule.

Concern 4: Vacating Lien Instruments Using Court Orders Problem: Statement 702 does not account for the fact that a court order which discharges a lien, and which is to be registered on title, will always involve vacating the registration of a claim for lien, but may or may not involve vacating the registration of a certificate of action (if the lien has not been perfected, no such instrument will exist).

Concern 4: Vacating Lien Instruments Using Court Orders Problem: Statement 702 does not account for the fact that a court order which discharges a lien, and which is to be registered on title, will always involve vacating the registration of a claim for lien, but may or may not involve vacating the registration of a certificate of action (if the lien has not been perfected, no such instrument will exist).

Suggested Solution The Ministry recommends, where the Statements do not match the situation, that the generic “Application to Amend Based Upon a Court Order” be used, and the Court Order is to be scanned into Statement 61. This is viewed as a temporary measure.

Suggested Solution The Ministry recommends, where the Statements do not match the situation, that the generic “Application to Amend Based Upon a Court Order” be used, and the Court Order is to be scanned into Statement 61. This is viewed as a temporary measure.

Concern 5: Statement 708 Problem: A court order providing that the registration of a claim for lien and/or a certificate of action is to be vacated could result from posting security with the court, or from an order of the court upon some other basis. If the order is not scanned into Statement 61, and Statement 708 is left in its current form, an individual reviewing title will have no way of knowing whethere is money in court to the credit of the lien that has been vacated. It will be necessary for that individual to do a court file search to obtain a copy of the order, based upon the court file number and date currently provided in Statement 708. This process involves going outside the land registration system to get the information.

Concern 5: Statement 708 Problem: A court order providing that the registration of a claim for lien and/or a certificate of action is to be vacated could result from posting security with the court, or from an order of the court upon some other basis. If the order is not scanned into Statement 61, and Statement 708 is left in its current form, an individual reviewing title will have no way of knowing whethere is money in court to the credit of the lien that has been vacated. It will be necessary for that individual to do a court file search to obtain a copy of the order, based upon the court file number and date currently provided in Statement 708. This process involves going outside the land registration system to get the information.

Suggested Solution The system should be changed, and two possibilities present themselves: 1. Make it a requirement of registering an order which vacates the registration of a claim for lien and/or a certificate of action that the order be scanned in to Statement 61. 2. Provide the following optional field, to be inserted into Statement 708: “Security in the form of in the amount of $XXXX was posted with the court. ”

Suggested Solution The system should be changed, and two possibilities present themselves: 1. Make it a requirement of registering an order which vacates the registration of a claim for lien and/or a certificate of action that the order be scanned in to Statement 61. 2. Provide the following optional field, to be inserted into Statement 708: “Security in the form of in the amount of $XXXX was posted with the court. ”

Concern 6: Statement 705 Problem: It seems inappropriate to have a lawyer who is arranging to vacate the registration of a certificate of action make a definitive statement that a lien or liens are sheltering under his client’s certificate of action, since this is not something the lawyer could possibly know for certain. It would seem more appropriate to make the statement that another lien may be sheltering behind the certificate of action. Accordingly, Statement 705 should be amended to read, “Another lien or liens may be sheltering under the Certificate of Action registered as number ……. . ”

Concern 6: Statement 705 Problem: It seems inappropriate to have a lawyer who is arranging to vacate the registration of a certificate of action make a definitive statement that a lien or liens are sheltering under his client’s certificate of action, since this is not something the lawyer could possibly know for certain. It would seem more appropriate to make the statement that another lien may be sheltering behind the certificate of action. Accordingly, Statement 705 should be amended to read, “Another lien or liens may be sheltering under the Certificate of Action registered as number ……. . ”

Concern No. 7: Never (NEVER!) use the document “Registration of Court Order” when you are dealing with liens. It will not amend the register to delete the instrument that the order deals with. Instead, use the form “Application to Amend Based on Court Order”.

Concern No. 7: Never (NEVER!) use the document “Registration of Court Order” when you are dealing with liens. It will not amend the register to delete the instrument that the order deals with. Instead, use the form “Application to Amend Based on Court Order”.

Concern No. 8: Certain Land Registry Offices are encouraging (insisting!) that solicitors who want to vacate liens select the document “Discharge of Lien”. Unless you mean to wipe out the lien for all purposes, forever, DO NOT DISCHARGE THE LIEN.

Concern No. 8: Certain Land Registry Offices are encouraging (insisting!) that solicitors who want to vacate liens select the document “Discharge of Lien”. Unless you mean to wipe out the lien for all purposes, forever, DO NOT DISCHARGE THE LIEN.

Construction Lien Act, s. 48 A discharge of a lien under this part is irrevocable and the discharged lien cannot be revived, but no discharge affects the right of the person whose lien was discharged to claim a lien in respect of services or materials supplied by the person subsequent to the preservation of the discharged lien. See Southridge Construction Group Inc. v. 667293 Ontario Ltd. (1993), 2 C. L. R. (2 d) 177 (Ont. Div. Ct. )

Construction Lien Act, s. 48 A discharge of a lien under this part is irrevocable and the discharged lien cannot be revived, but no discharge affects the right of the person whose lien was discharged to claim a lien in respect of services or materials supplied by the person subsequent to the preservation of the discharged lien. See Southridge Construction Group Inc. v. 667293 Ontario Ltd. (1993), 2 C. L. R. (2 d) 177 (Ont. Div. Ct. )

Best Practice No. 1 An informal polling of lien practitioners indicates that the practice is to scan and paste into statement 61 (a text file schedule), the entire claim for lien form, as executed by the client, including affidavit of verification.

Best Practice No. 1 An informal polling of lien practitioners indicates that the practice is to scan and paste into statement 61 (a text file schedule), the entire claim for lien form, as executed by the client, including affidavit of verification.

Best Practice No. 2 At the time the client attends to execute the paper copy of the lien, have them execute an acknowledgement and direction to your firm and your E-Reg. clerk: 1. that you were authorized and directed to register the lien electronically; 2. that they have provided you with all of the information to be contained in the electronic version of the lien, which they represent to be accurate and reliable; 3. that they understand that electronic registration of the lien has the same consequences as ordinary registration.

Best Practice No. 2 At the time the client attends to execute the paper copy of the lien, have them execute an acknowledgement and direction to your firm and your E-Reg. clerk: 1. that you were authorized and directed to register the lien electronically; 2. that they have provided you with all of the information to be contained in the electronic version of the lien, which they represent to be accurate and reliable; 3. that they understand that electronic registration of the lien has the same consequences as ordinary registration.

Best Practice No. 3 Always use the document “Application to Amend Based on Court Order”.

Best Practice No. 3 Always use the document “Application to Amend Based on Court Order”.

Special Bonus Track !

Special Bonus Track !

Electronic Tendering

Electronic Tendering

What is Electronic Tendering? Two versions exist today: (a) Internet based system that displays a description of the commodity being procured. (b) Same as (a), plus option to download and pay for tender documents.

What is Electronic Tendering? Two versions exist today: (a) Internet based system that displays a description of the commodity being procured. (b) Same as (a), plus option to download and pay for tender documents.

Future of E-tendering (a) Internet based system that displays a description of the commodity being procured, plus option to download and pay for tender documents PLUS (b) Submission of tender in purely electronic format, without any paper being produced.

Future of E-tendering (a) Internet based system that displays a description of the commodity being procured, plus option to download and pay for tender documents PLUS (b) Submission of tender in purely electronic format, without any paper being produced.

Two Potential Problems With Pure Electronic Tendering and an Unanswered Question First Problem: Security ! (a) threat of others accessing information sent through the internet (b) threat of others altering information sent through the internet

Two Potential Problems With Pure Electronic Tendering and an Unanswered Question First Problem: Security ! (a) threat of others accessing information sent through the internet (b) threat of others altering information sent through the internet

Two Potential Problems With Pure Electronic Tendering and an Unanswered Question Second Problem: Technology (a) software compatibility, updates, antivirus, encryption issues (b) internet and server size, reliability and speed

Two Potential Problems With Pure Electronic Tendering and an Unanswered Question Second Problem: Technology (a) software compatibility, updates, antivirus, encryption issues (b) internet and server size, reliability and speed

Unanswered Questions When has a purely electronic tender been sent and received? How will courts apply the existing rules in a construction setting? Will this change the carefully erected superstructure created by the S. C. C. in a series of cases beginning with Ron Engineering?

Unanswered Questions When has a purely electronic tender been sent and received? How will courts apply the existing rules in a construction setting? Will this change the carefully erected superstructure created by the S. C. C. in a series of cases beginning with Ron Engineering?

Electronic Commerce Act 2000, S. O. 2000, c. 17. Time of sending of electronic information or document 22. (1) Electronic information or an electronic document is sent when it enters an information system outside the sender's control or, if the sender and the addressee use the same information system, when it becomes capable of being retrieved and processed by the addressee. Contracting out (2) Subsection (1) applies unless the parties agree otherwise. Presumption, time of receipt (3) Electronic information or an electronic document is presumed to be received by the addressee, (a) if the addressee has designated or uses an information system for the purpose of receiving information or documents of the type sent, when it enters that information system and becomes capable of being retrieved and processed by the addressee; or (b) if the addressee has not designated or does not use an information system for the purpose of receiving information or documents of the type sent, when the addressee becomes aware of the information or document in the addressee's information system and it becomes capable of being retrieved and processed by the addressee.

Electronic Commerce Act 2000, S. O. 2000, c. 17. Time of sending of electronic information or document 22. (1) Electronic information or an electronic document is sent when it enters an information system outside the sender's control or, if the sender and the addressee use the same information system, when it becomes capable of being retrieved and processed by the addressee. Contracting out (2) Subsection (1) applies unless the parties agree otherwise. Presumption, time of receipt (3) Electronic information or an electronic document is presumed to be received by the addressee, (a) if the addressee has designated or uses an information system for the purpose of receiving information or documents of the type sent, when it enters that information system and becomes capable of being retrieved and processed by the addressee; or (b) if the addressee has not designated or does not use an information system for the purpose of receiving information or documents of the type sent, when the addressee becomes aware of the information or document in the addressee's information system and it becomes capable of being retrieved and processed by the addressee.

More Unanswered Questions How does one make sure that it has been received in the same form it was sent? How does a purely electronic tender remain “sealed”? (see S. N. Bunston, “Electronic Tendering: Potential Risks and How to Avoid Them”, Toronto, Canadian Institute, 2002)

More Unanswered Questions How does one make sure that it has been received in the same form it was sent? How does a purely electronic tender remain “sealed”? (see S. N. Bunston, “Electronic Tendering: Potential Risks and How to Avoid Them”, Toronto, Canadian Institute, 2002)

2. David Goldman’s Interesting Problem

2. David Goldman’s Interesting Problem

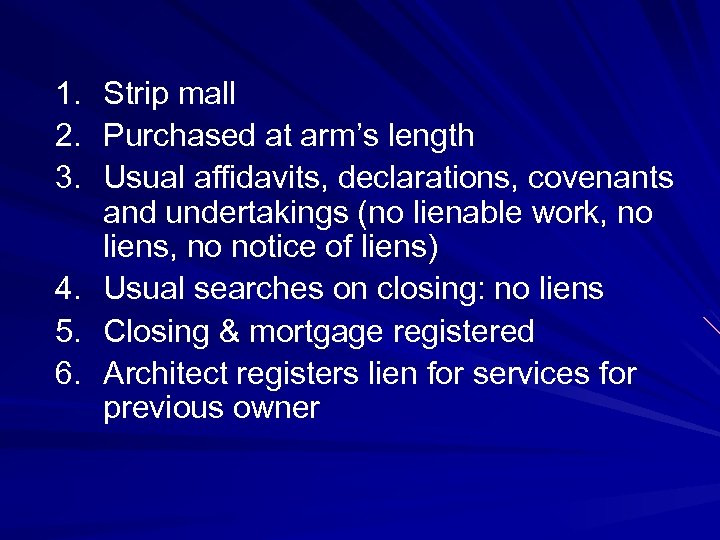

1. 2. 3. 4. 5. 6. Strip mall Purchased at arm’s length Usual affidavits, declarations, covenants and undertakings (no lienable work, no liens, no notice of liens) Usual searches on closing: no liens Closing & mortgage registered Architect registers lien for services for previous owner

1. 2. 3. 4. 5. 6. Strip mall Purchased at arm’s length Usual affidavits, declarations, covenants and undertakings (no lienable work, no liens, no notice of liens) Usual searches on closing: no liens Closing & mortgage registered Architect registers lien for services for previous owner

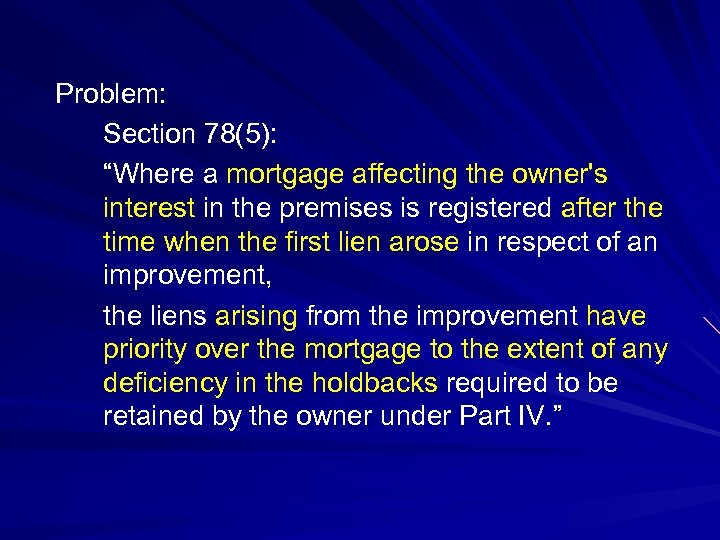

Problem: Section 78(5): “Where a mortgage affecting the owner's interest in the premises is registered after the time when the first lien arose in respect of an improvement, the liens arising from the improvement have priority over the mortgage to the extent of any deficiency in the holdbacks required to be retained by the owner under Part IV. ”

Problem: Section 78(5): “Where a mortgage affecting the owner's interest in the premises is registered after the time when the first lien arose in respect of an improvement, the liens arising from the improvement have priority over the mortgage to the extent of any deficiency in the holdbacks required to be retained by the owner under Part IV. ”

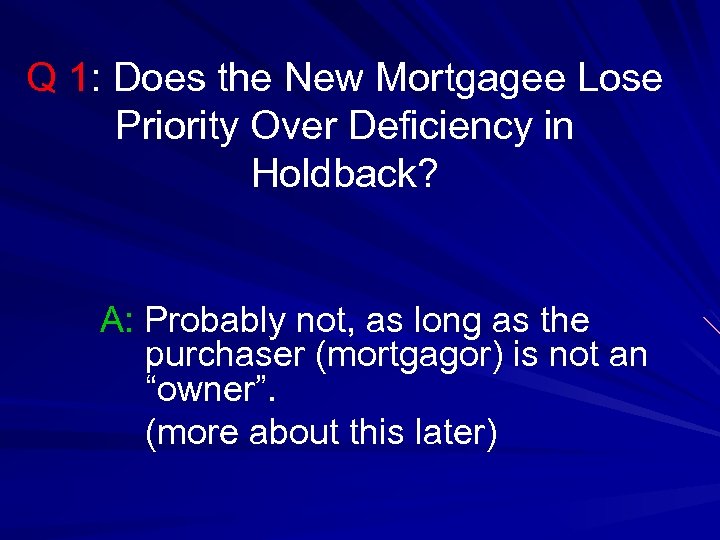

Q 1: Does the New Mortgagee Lose Priority Over Deficiency in Holdback? A: Probably not, as long as the purchaser (mortgagor) is not an “owner”. (more about this later)

Q 1: Does the New Mortgagee Lose Priority Over Deficiency in Holdback? A: Probably not, as long as the purchaser (mortgagor) is not an “owner”. (more about this later)

Q 2: Do architects have lien rights? A: Yes!

Q 2: Do architects have lien rights? A: Yes!

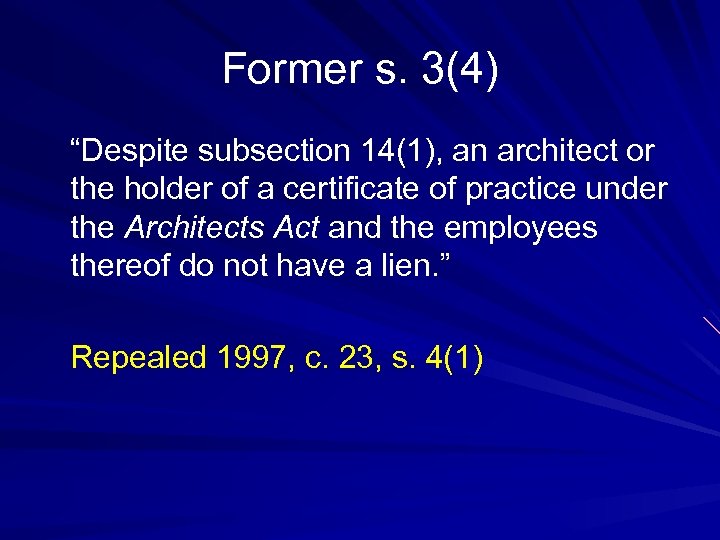

Former s. 3(4) “Despite subsection 14(1), an architect or the holder of a certificate of practice under the Architects Act and the employees thereof do not have a lien. ” Repealed 1997, c. 23, s. 4(1)

Former s. 3(4) “Despite subsection 14(1), an architect or the holder of a certificate of practice under the Architects Act and the employees thereof do not have a lien. ” Repealed 1997, c. 23, s. 4(1)

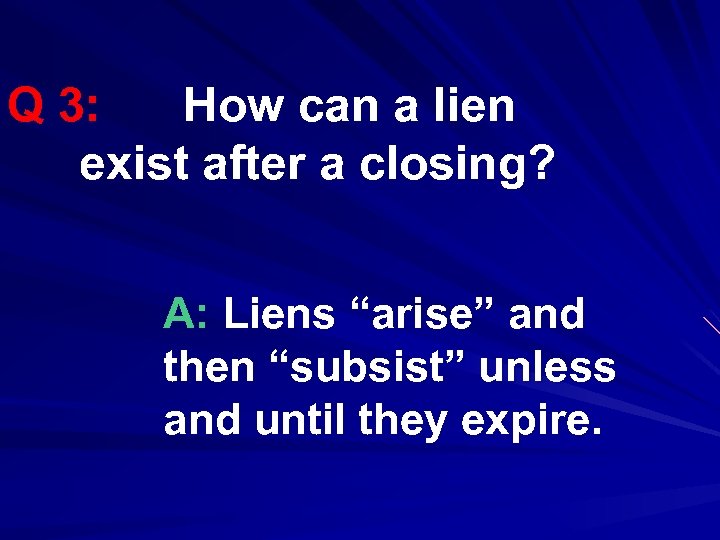

Q 3: How can a lien exist after a closing? A: Liens “arise” and then “subsist” unless and until they expire.

Q 3: How can a lien exist after a closing? A: Liens “arise” and then “subsist” unless and until they expire.

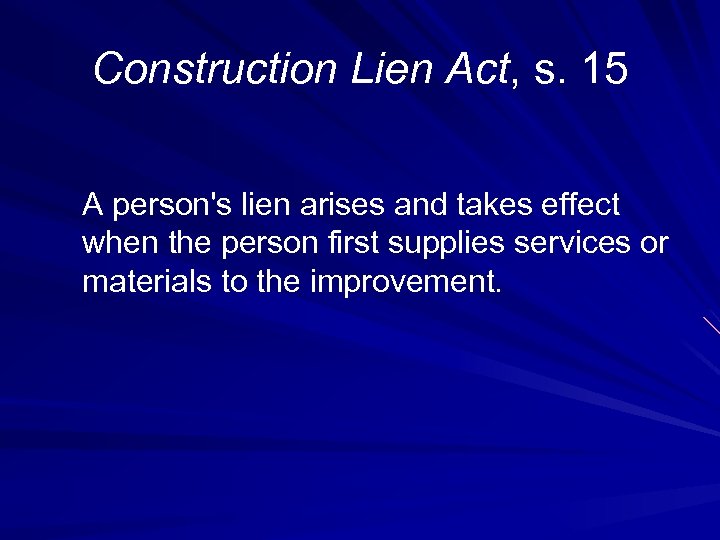

Construction Lien Act, s. 15 A person's lien arises and takes effect when the person first supplies services or materials to the improvement.

Construction Lien Act, s. 15 A person's lien arises and takes effect when the person first supplies services or materials to the improvement.

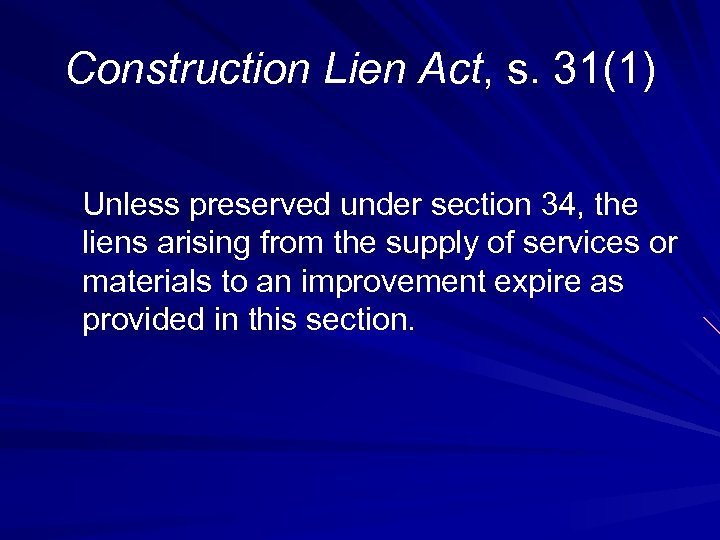

Construction Lien Act, s. 31(1) Unless preserved under section 34, the liens arising from the supply of services or materials to an improvement expire as provided in this section.

Construction Lien Act, s. 31(1) Unless preserved under section 34, the liens arising from the supply of services or materials to an improvement expire as provided in this section.

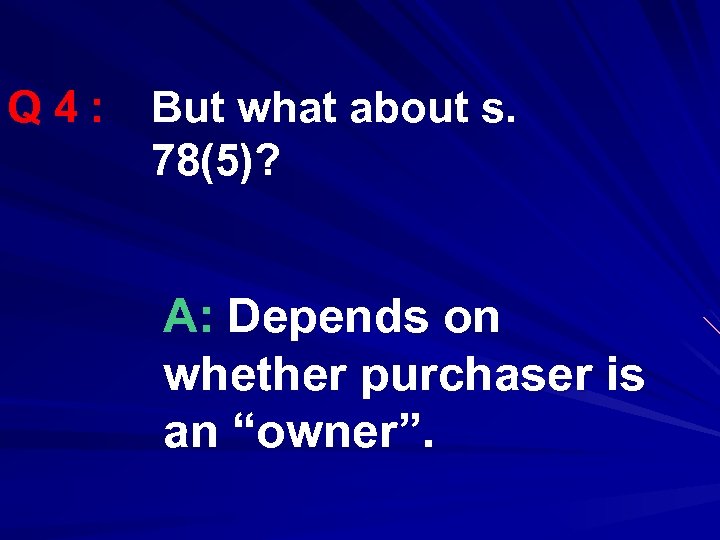

Q 4: But what about s. 78(5)? A: Depends on whether purchaser is an “owner”.

Q 4: But what about s. 78(5)? A: Depends on whether purchaser is an “owner”.

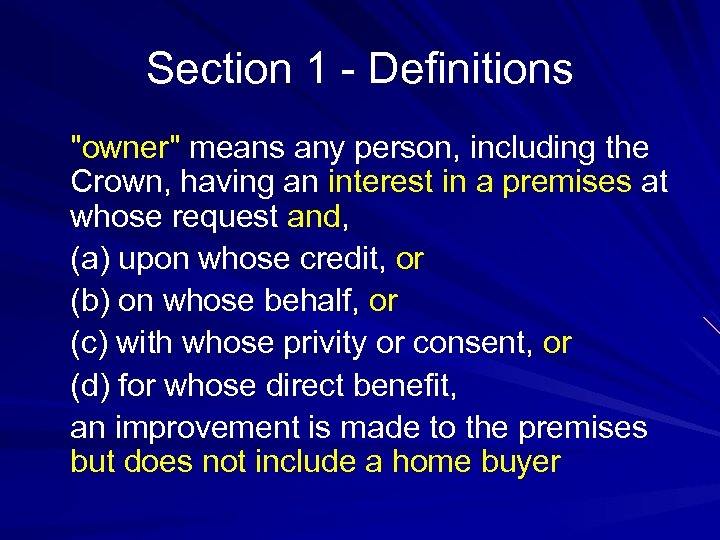

Section 1 - Definitions "owner" means any person, including the Crown, having an interest in a premises at whose request and, (a) upon whose credit, or (b) on whose behalf, or (c) with whose privity or consent, or (d) for whose direct benefit, an improvement is made to the premises but does not include a home buyer

Section 1 - Definitions "owner" means any person, including the Crown, having an interest in a premises at whose request and, (a) upon whose credit, or (b) on whose behalf, or (c) with whose privity or consent, or (d) for whose direct benefit, an improvement is made to the premises but does not include a home buyer

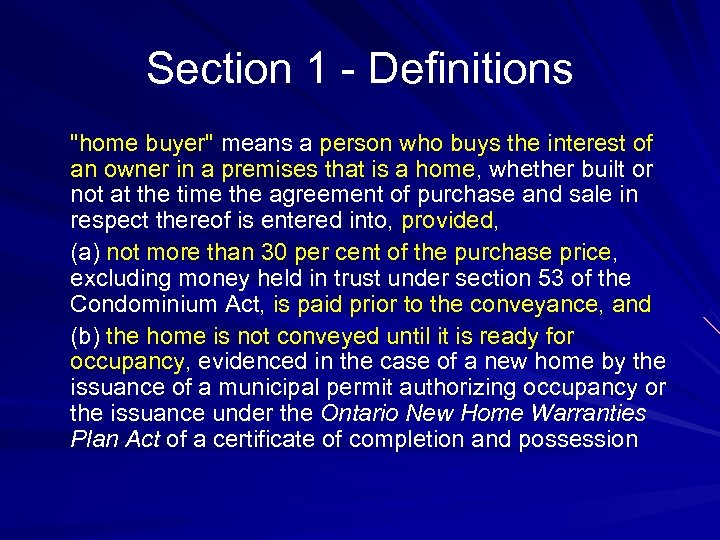

Section 1 - Definitions "home buyer" means a person who buys the interest of an owner in a premises that is a home, whether built or not at the time the agreement of purchase and sale in respect thereof is entered into, provided, (a) not more than 30 per cent of the purchase price, excluding money held in trust under section 53 of the Condominium Act, is paid prior to the conveyance, and (b) the home is not conveyed until it is ready for occupancy, evidenced in the case of a new home by the issuance of a municipal permit authorizing occupancy or the issuance under the Ontario New Home Warranties Plan Act of a certificate of completion and possession

Section 1 - Definitions "home buyer" means a person who buys the interest of an owner in a premises that is a home, whether built or not at the time the agreement of purchase and sale in respect thereof is entered into, provided, (a) not more than 30 per cent of the purchase price, excluding money held in trust under section 53 of the Condominium Act, is paid prior to the conveyance, and (b) the home is not conveyed until it is ready for occupancy, evidenced in the case of a new home by the issuance of a municipal permit authorizing occupancy or the issuance under the Ontario New Home Warranties Plan Act of a certificate of completion and possession

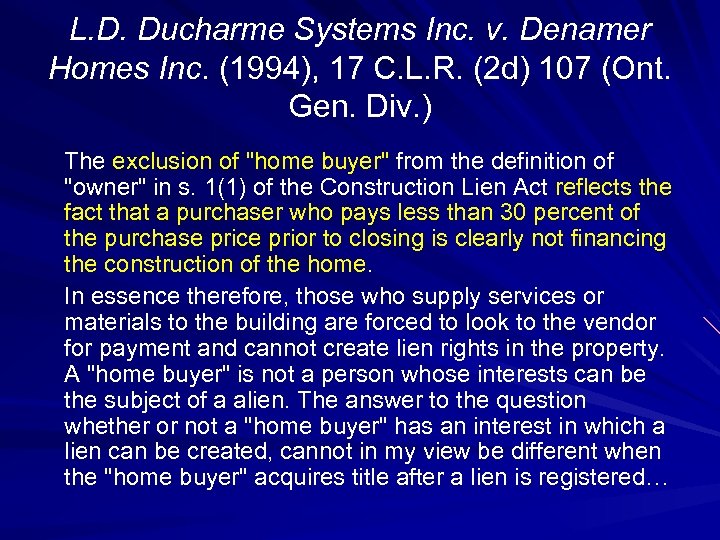

L. D. Ducharme Systems Inc. v. Denamer Homes Inc. (1994), 17 C. L. R. (2 d) 107 (Ont. Gen. Div. ) The exclusion of "home buyer" from the definition of "owner" in s. 1(1) of the Construction Lien Act reflects the fact that a purchaser who pays less than 30 percent of the purchase price prior to closing is clearly not financing the construction of the home. In essence therefore, those who supply services or materials to the building are forced to look to the vendor for payment and cannot create lien rights in the property. A "home buyer" is not a person whose interests can be the subject of a alien. The answer to the question whether or not a "home buyer" has an interest in which a lien can be created, cannot in my view be different when the "home buyer" acquires title after a lien is registered…

L. D. Ducharme Systems Inc. v. Denamer Homes Inc. (1994), 17 C. L. R. (2 d) 107 (Ont. Gen. Div. ) The exclusion of "home buyer" from the definition of "owner" in s. 1(1) of the Construction Lien Act reflects the fact that a purchaser who pays less than 30 percent of the purchase price prior to closing is clearly not financing the construction of the home. In essence therefore, those who supply services or materials to the building are forced to look to the vendor for payment and cannot create lien rights in the property. A "home buyer" is not a person whose interests can be the subject of a alien. The answer to the question whether or not a "home buyer" has an interest in which a lien can be created, cannot in my view be different when the "home buyer" acquires title after a lien is registered…

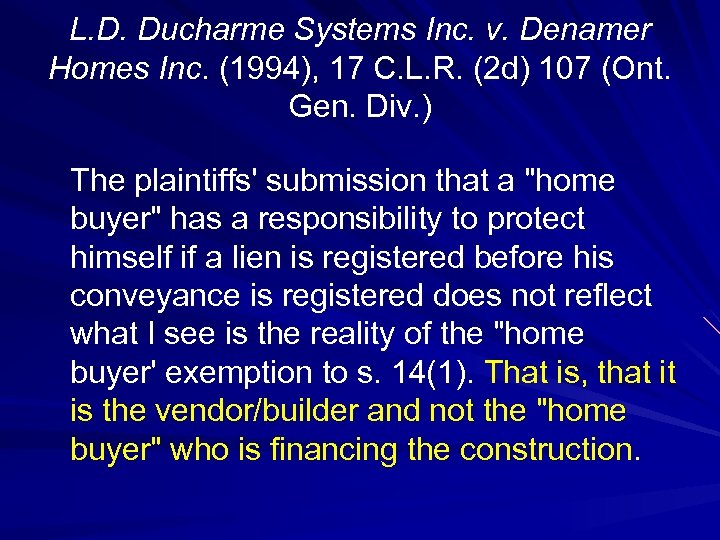

L. D. Ducharme Systems Inc. v. Denamer Homes Inc. (1994), 17 C. L. R. (2 d) 107 (Ont. Gen. Div. ) The plaintiffs' submission that a "home buyer" has a responsibility to protect himself if a lien is registered before his conveyance is registered does not reflect what I see is the reality of the "home buyer' exemption to s. 14(1). That is, that it is the vendor/builder and not the "home buyer" who is financing the construction.

L. D. Ducharme Systems Inc. v. Denamer Homes Inc. (1994), 17 C. L. R. (2 d) 107 (Ont. Gen. Div. ) The plaintiffs' submission that a "home buyer" has a responsibility to protect himself if a lien is registered before his conveyance is registered does not reflect what I see is the reality of the "home buyer' exemption to s. 14(1). That is, that it is the vendor/builder and not the "home buyer" who is financing the construction.

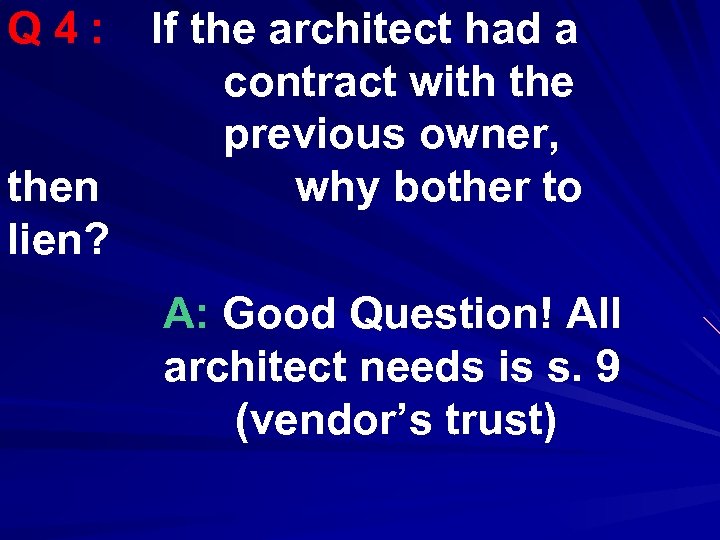

Q 4: then lien? If the architect had a contract with the previous owner, why bother to A: Good Question! All architect needs is s. 9 (vendor’s trust)

Q 4: then lien? If the architect had a contract with the previous owner, why bother to A: Good Question! All architect needs is s. 9 (vendor’s trust)

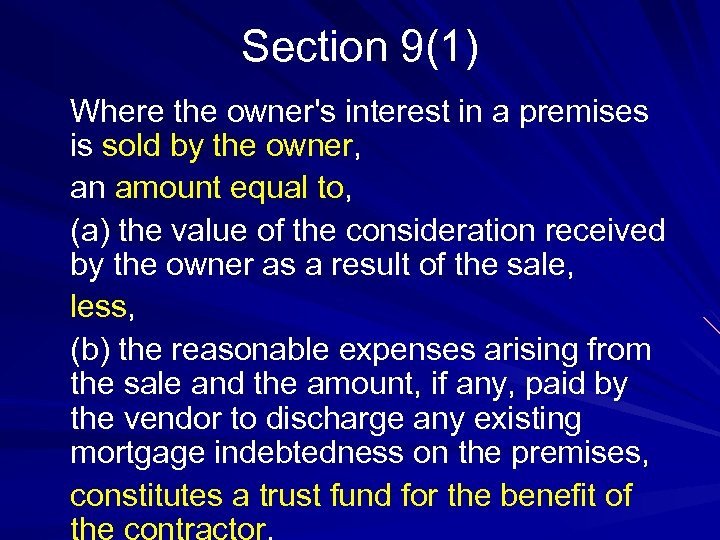

Section 9(1) Where the owner's interest in a premises is sold by the owner, an amount equal to, (a) the value of the consideration received by the owner as a result of the sale, less, (b) the reasonable expenses arising from the sale and the amount, if any, paid by the vendor to discharge any existing mortgage indebtedness on the premises, constitutes a trust fund for the benefit of

Section 9(1) Where the owner's interest in a premises is sold by the owner, an amount equal to, (a) the value of the consideration received by the owner as a result of the sale, less, (b) the reasonable expenses arising from the sale and the amount, if any, paid by the vendor to discharge any existing mortgage indebtedness on the premises, constitutes a trust fund for the benefit of

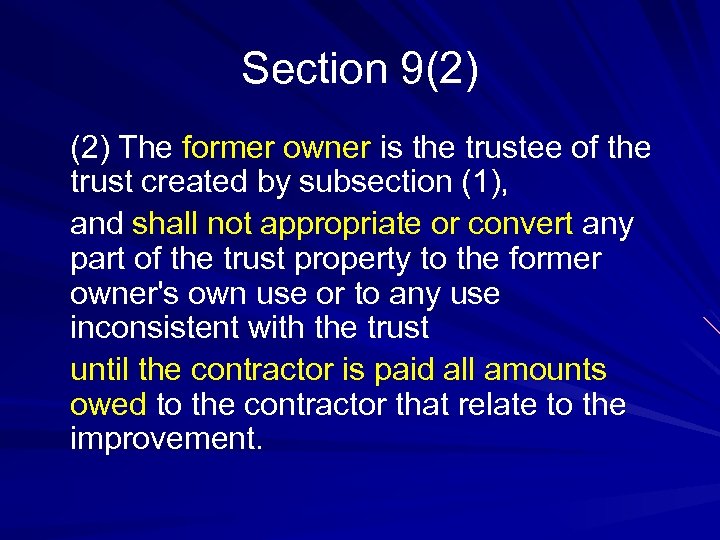

Section 9(2) The former owner is the trustee of the trust created by subsection (1), and shall not appropriate or convert any part of the trust property to the former owner's own use or to any use inconsistent with the trust until the contractor is paid all amounts owed to the contractor that relate to the improvement.

Section 9(2) The former owner is the trustee of the trust created by subsection (1), and shall not appropriate or convert any part of the trust property to the former owner's own use or to any use inconsistent with the trust until the contractor is paid all amounts owed to the contractor that relate to the improvement.

New & Interesting Developments

New & Interesting Developments

What Constitutes a Lienable Interest in Land?

What Constitutes a Lienable Interest in Land?

Construction Lien Act, s. 1 "interest in the premises" means an estate or interest of any nature, and includes a statutory right given or reserved to the Crown to enter any lands or premises belonging to any person or public authority for the purpose of doing any work, construction, repair or maintenance in, upon, through, over or under any lands or premises

Construction Lien Act, s. 1 "interest in the premises" means an estate or interest of any nature, and includes a statutory right given or reserved to the Crown to enter any lands or premises belonging to any person or public authority for the purpose of doing any work, construction, repair or maintenance in, upon, through, over or under any lands or premises

![Pankka v. Butchart [1956] O. R. 837 (C. A. ) Pankka v. Butchart [1956] O. R. 837 (C. A. )](https://present5.com/presentation/4d3fbb85b265785bc7992565f0a84709/image-54.jpg) Pankka v. Butchart [1956] O. R. 837 (C. A. )

Pankka v. Butchart [1956] O. R. 837 (C. A. )

Facts I Veteran entered into agreement with the Director, The Veterans’ Land Act, to purchase a parcel of land registered in the name of the Director. Under Veterans’ Land Act, purchaser had right to: (a) balance of surplus remaining in hands of Director after sale; (b) refund of down-payment in certain circumstances; (c) notice in case of default; (d) in the event of rescission, the surplus over and above the amount owing under the contract

Facts I Veteran entered into agreement with the Director, The Veterans’ Land Act, to purchase a parcel of land registered in the name of the Director. Under Veterans’ Land Act, purchaser had right to: (a) balance of surplus remaining in hands of Director after sale; (b) refund of down-payment in certain circumstances; (c) notice in case of default; (d) in the event of rescission, the surplus over and above the amount owing under the contract

Did any of these interests constitute an interest in land for the purposes of the Construction Lien Act?

Did any of these interests constitute an interest in land for the purposes of the Construction Lien Act?

Court of Appeal: The provisions to which I have made reference make it plain, beyond all doubt, that the subject of a mechanics' lien created by the Act is intended to be an estate or interest in land which can be sold and vested by order of the Court in a purchaser. The lien attaches "to the land" and to the estate or interest of an owner "in the land. " A sale made under the Act is a sale of real property, and the estate and interest which may be vested in a purchaser is an estate or interest in rem. It is realty, and not personalty. There is nothing in the Act to suggest that a person can have a lien attaching to a right of a personal nature.

Court of Appeal: The provisions to which I have made reference make it plain, beyond all doubt, that the subject of a mechanics' lien created by the Act is intended to be an estate or interest in land which can be sold and vested by order of the Court in a purchaser. The lien attaches "to the land" and to the estate or interest of an owner "in the land. " A sale made under the Act is a sale of real property, and the estate and interest which may be vested in a purchaser is an estate or interest in rem. It is realty, and not personalty. There is nothing in the Act to suggest that a person can have a lien attaching to a right of a personal nature.

Bravo Cement v. University of Toronto (1991), 46 C. L. R. 207 (Ont. Div. Ct. )

Bravo Cement v. University of Toronto (1991), 46 C. L. R. 207 (Ont. Div. Ct. )

Facts I University of Toronto leases land to Sunnybrook Hospital, save as to lands conveyed to third parties. Conveyances contained provision reserving the Grantor the right at any time to enter upon said lands and to there lay down, repair, maintain or remove storm or sanitary drainage installations for the benefit of all abutting lands now owned and retained by the Grantor. Description of lands in Schedule A also reserved a right of way.

Facts I University of Toronto leases land to Sunnybrook Hospital, save as to lands conveyed to third parties. Conveyances contained provision reserving the Grantor the right at any time to enter upon said lands and to there lay down, repair, maintain or remove storm or sanitary drainage installations for the benefit of all abutting lands now owned and retained by the Grantor. Description of lands in Schedule A also reserved a right of way.

Did reservations in conveyances amount to an interest in land as required by the Construction Lien Act?

Did reservations in conveyances amount to an interest in land as required by the Construction Lien Act?

Divisional Court Decision: Reversionary provisions described as “a fee simple upon condition precedent” or as “a determinable fee simple” do not amount to an interest in the land. They are mere rights which can be exercised should the circumstances permit.

Divisional Court Decision: Reversionary provisions described as “a fee simple upon condition precedent” or as “a determinable fee simple” do not amount to an interest in the land. They are mere rights which can be exercised should the circumstances permit.

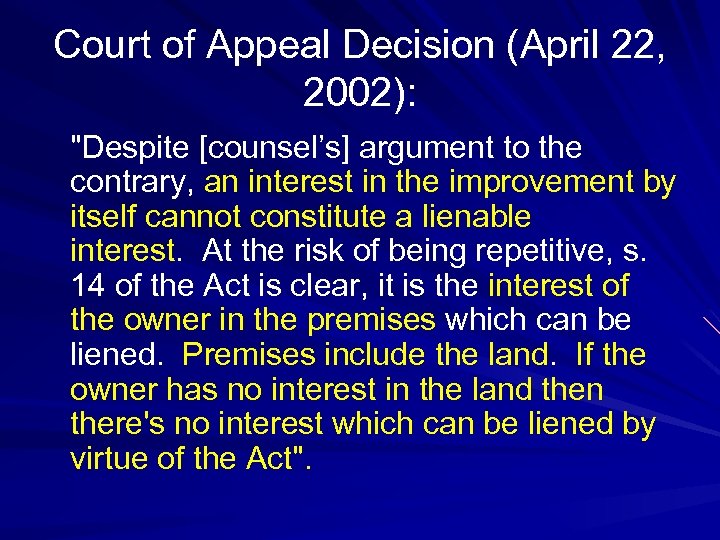

Graham Mining Ltd. v. Rapid-Eau Technologies Inc. (2000), 7 C. L. R. (3 d) 279 (Ont. S. C. J. ); aff’d [2001] O. J. No. 4183 (Div. Ct. ); aff’d April 22, 2002, File No. M 28063 (C. A. )

Graham Mining Ltd. v. Rapid-Eau Technologies Inc. (2000), 7 C. L. R. (3 d) 279 (Ont. S. C. J. ); aff’d [2001] O. J. No. 4183 (Div. Ct. ); aff’d April 22, 2002, File No. M 28063 (C. A. )

Facts I Lien claimants had done a significant amount of surface and underground work on a small hydroelectric project in Northern Ontario, including blasting and tunneling pursuant to a revocable series of work permits and land use permits, to create a generating station on federal Crown land. The developers’ ultimate goal was to apply for and obtain a provincial Water Power Lease which would give them some security of tenure.

Facts I Lien claimants had done a significant amount of surface and underground work on a small hydroelectric project in Northern Ontario, including blasting and tunneling pursuant to a revocable series of work permits and land use permits, to create a generating station on federal Crown land. The developers’ ultimate goal was to apply for and obtain a provincial Water Power Lease which would give them some security of tenure.

Facts II In the meanwhile, the land remained unpatented and all that the developers had was a realistic expectation that they would be treated fairly by the provincial government when they finished the project. Could this equitable interest support a lien?

Facts II In the meanwhile, the land remained unpatented and all that the developers had was a realistic expectation that they would be treated fairly by the provincial government when they finished the project. Could this equitable interest support a lien?

Court of Appeal Decision (April 22, 2002): "Despite [counsel’s] argument to the contrary, an interest in the improvement by itself cannot constitute a lienable interest. At the risk of being repetitive, s. 14 of the Act is clear, it is the interest of the owner in the premises which can be liened. Premises include the land. If the owner has no interest in the land then there's no interest which can be liened by virtue of the Act".

Court of Appeal Decision (April 22, 2002): "Despite [counsel’s] argument to the contrary, an interest in the improvement by itself cannot constitute a lienable interest. At the risk of being repetitive, s. 14 of the Act is clear, it is the interest of the owner in the premises which can be liened. Premises include the land. If the owner has no interest in the land then there's no interest which can be liened by virtue of the Act".

The End

The End