b7810237feb1e10b906b9319b00e0e72.ppt

- Количество слайдов: 15

Making life easier

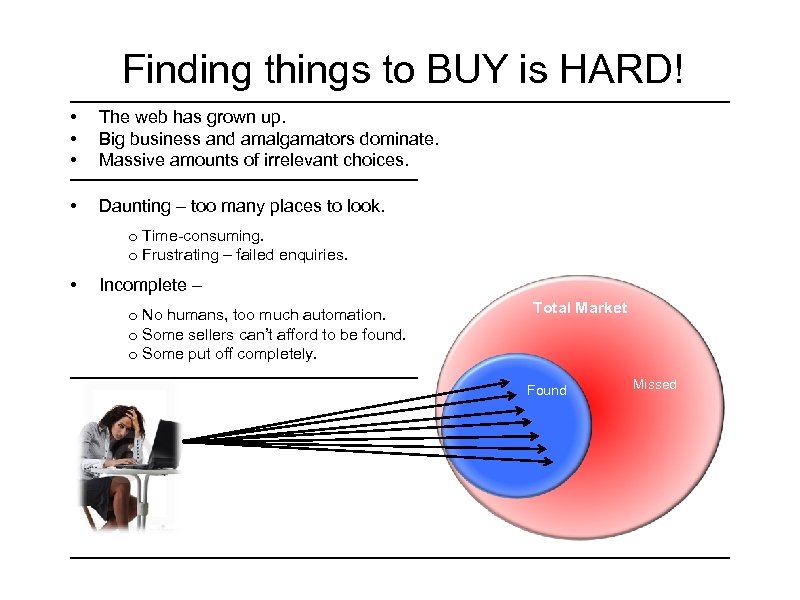

Finding things to BUY is HARD! • • • The web has grown up. Big business and amalgamators dominate. Massive amounts of irrelevant choices. • Daunting – too many places to look. o Time-consuming. o Frustrating – failed enquiries. • Incomplete – o No humans, too much automation. o Some sellers can’t afford to be found. o Some put off completely. Total Market Found Missed

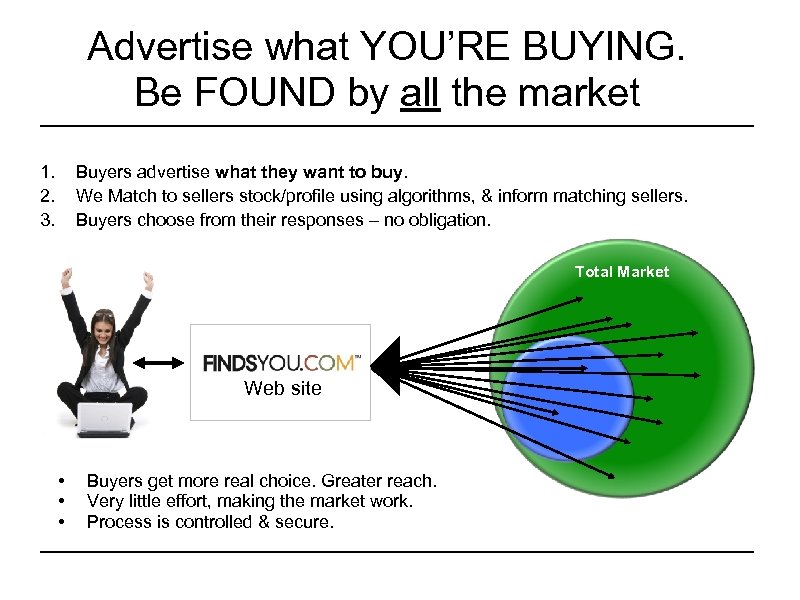

Advertise what YOU’RE BUYING. Be FOUND by all the market 1. 2. 3. Buyers advertise what they want to buy. We Match to sellers stock/profile using algorithms, & inform matching sellers. Buyers choose from their responses – no obligation. Total Market Web site • • • Buyers get more real choice. Greater reach. Very little effort, making the market work. Process is controlled & secure.

Approach 1. Phase 1 a. Prove model in one category - UK Cars. b. Prove model can transfer - UK Holiday Accommodation. 2. Phase 2 Profits in UK Car sector. Exploit the model in sectors other than cars. • • 1. 5 years of R&D – £ 200 k invested by founder. This model did not exist. A lot of trial and error. Successful 10 month trial in UK Car market.

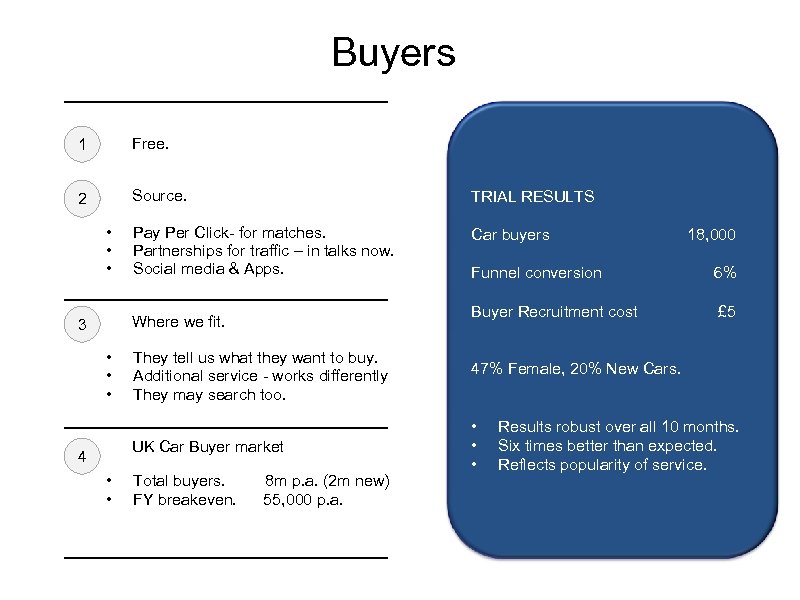

Buyers 1 Free. 2 Source. TRIAL RESULTS Pay Per Click- for matches. Partnerships for traffic – in talks now. Social media & Apps. Car buyers • • • Funnel conversion 6% Buyer Recruitment cost Where we fit. 3 £ 5 • • They tell us what they want to buy. Additional service - works differently They may search too. 47% Female, 20% New Cars. UK Car Buyer market 4 18, 000 • • • Total buyers. FY breakeven. 8 m p. a. (2 m new) 55, 000 p. a. Results robust over all 10 months. Six times better than expected. Reflects popularity of service.

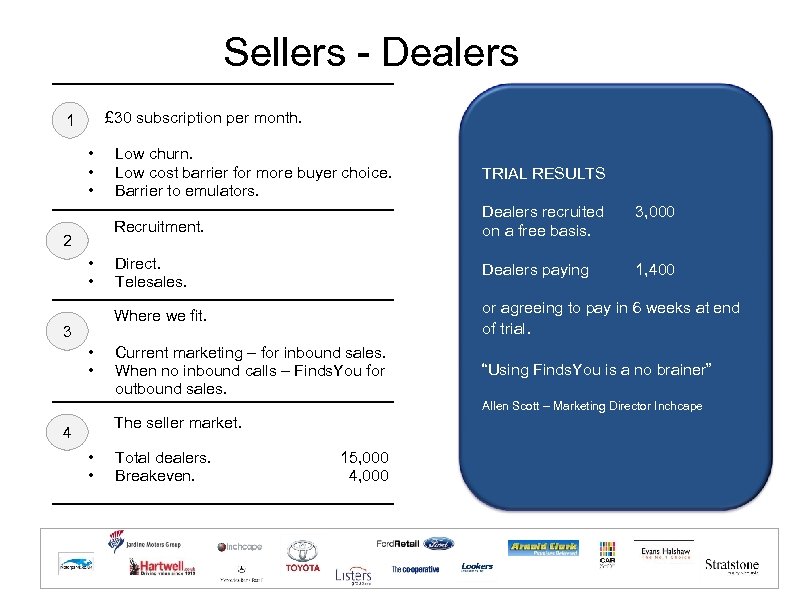

Sellers - Dealers £ 30 subscription per month. 1 • • • 3 • • Dealers recruited on a free basis. 3, 000 Direct. Telesales. Dealers paying 1, 400 Where we fit. • • TRIAL RESULTS Recruitment. 2 Low churn. Low cost barrier for more buyer choice. Barrier to emulators. or agreeing to pay in 6 weeks at end of trial. Current marketing – for inbound sales. When no inbound calls – Finds. You for outbound sales. “Using Finds. You is a no brainer” Allen Scott – Marketing Director Inchcape The seller market. 4 • • Total dealers. Breakeven. 15, 000 4, 000

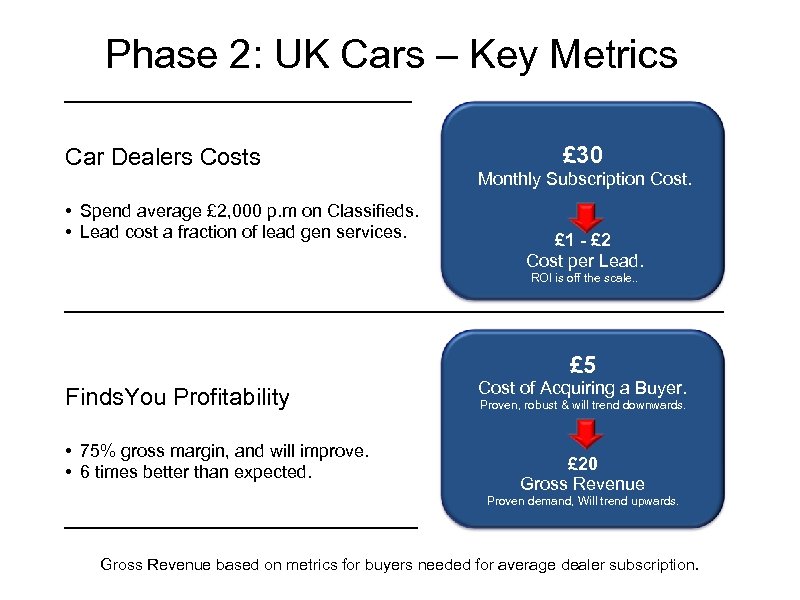

Phase 2: UK Cars – Key Metrics Car Dealers Costs • Spend average £ 2, 000 p. m on Classifieds. • Lead cost a fraction of lead gen services. £ 30 Monthly Subscription Cost. £ 1 - £ 2 Cost per Lead. ROI is off the scale. . £ 5 Finds. You Profitability • 75% gross margin, and will improve. • 6 times better than expected. Cost of Acquiring a Buyer. Proven, robust & will trend downwards. £ 20 Gross Revenue Proven demand, Will trend upwards. Gross Revenue based on metrics for buyers needed for average dealer subscription.

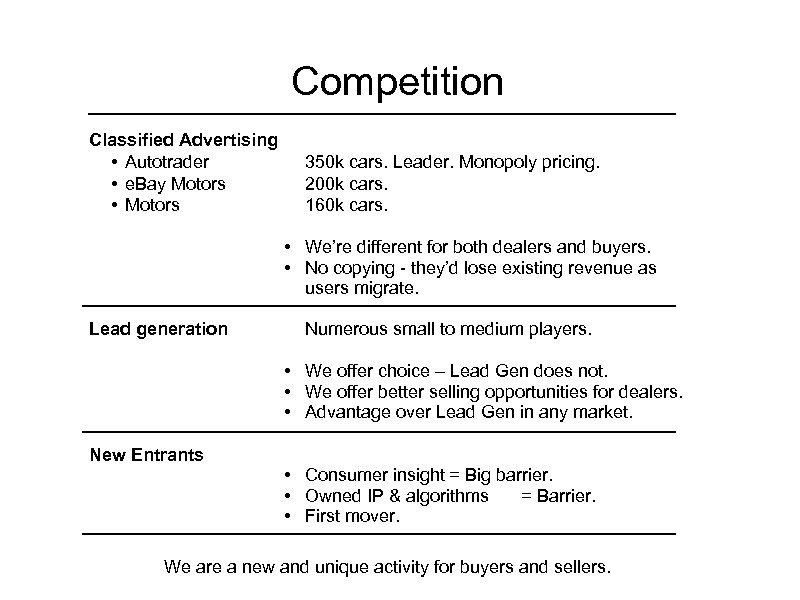

Competition Classified Advertising • Autotrader • e. Bay Motors • Motors 350 k cars. Leader. Monopoly pricing. 200 k cars. 160 k cars. • We’re different for both dealers and buyers. • No copying - they’d lose existing revenue as users migrate. Lead generation Numerous small to medium players. • We offer choice – Lead Gen does not. • We offer better selling opportunities for dealers. • Advantage over Lead Gen in any market. New Entrants • Consumer insight = Big barrier. • Owned IP & algorithms = Barrier. • First mover. We are a new and unique activity for buyers and sellers.

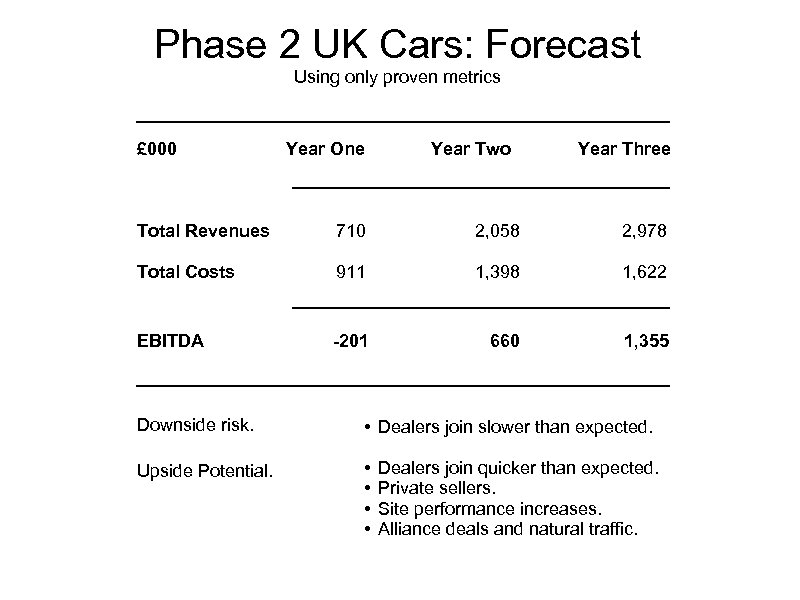

Phase 2 UK Cars: Forecast Using only proven metrics £ 000 Year One Year Two Year Three Total Revenues 710 2, 058 2, 978 Total Costs 911 1, 398 1, 622 EBITDA -201 660 1, 355 Downside risk. • Dealers join slower than expected. Upside Potential. • • Dealers join quicker than expected. Private sellers. Site performance increases. Alliance deals and natural traffic.

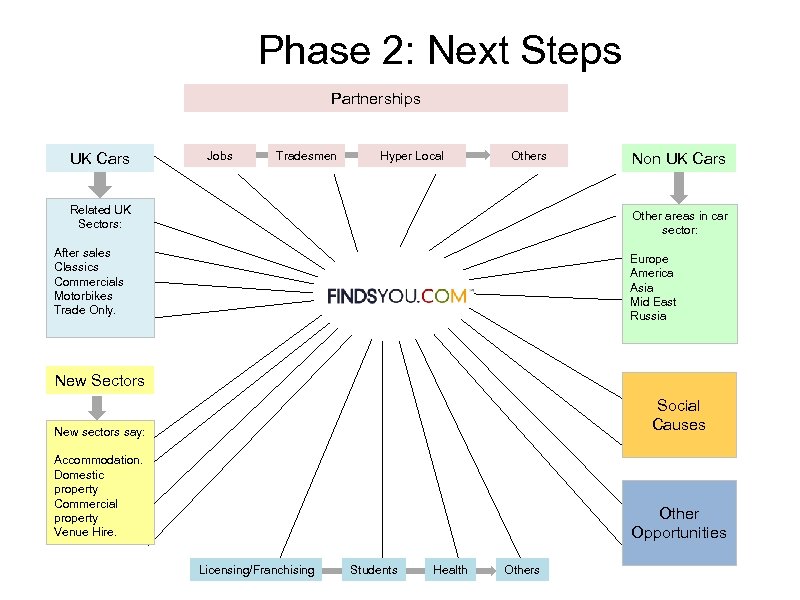

Phase 2: Next Steps Partnerships UK Cars Jobs Tradesmen Hyper Local Others Related UK Sectors: Non UK Cars Other areas in car sector: After sales Classics Commercials Motorbikes Trade Only. Europe America Asia Mid East Russia New Sectors New sectors say: Social Causes Accommodation. Domestic property Commercial property Venue Hire. Other Opportunities Licensing/Franchising Students Health Others

Flex – Private Sellers and Dealers Year 3 EBITDA Private sellers per month Dealers 15, 000 per month is 6% of private sellers p. a. 12, 200 dealers is 80% of total dealers. Ignores all other variables.

Current Web Sites UK cars UK Accommodation

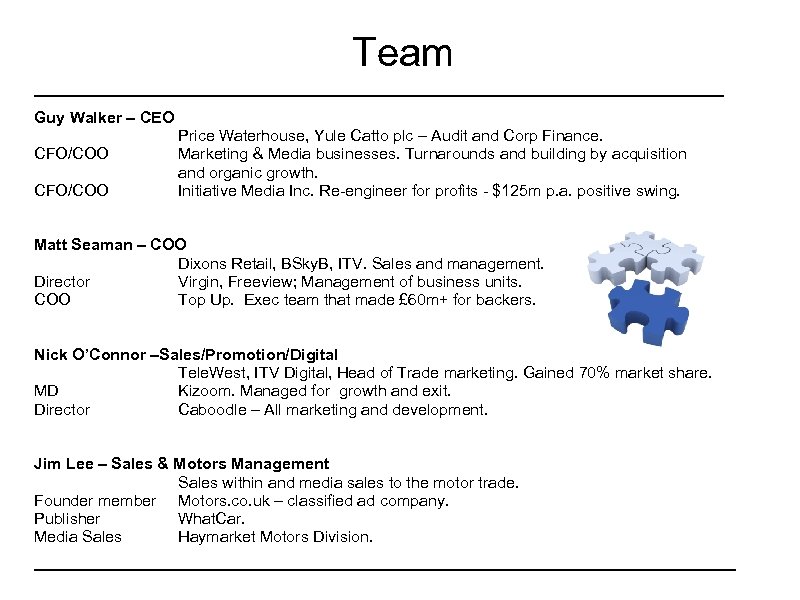

Team Guy Walker – CEO CFO/COO Price Waterhouse, Yule Catto plc – Audit and Corp Finance. Marketing & Media businesses. Turnarounds and building by acquisition and organic growth. Initiative Media Inc. Re-engineer for profits - $125 m p. a. positive swing. Matt Seaman – COO Dixons Retail, BSky. B, ITV. Sales and management. Director Virgin, Freeview; Management of business units. COO Top Up. Exec team that made £ 60 m+ for backers. Nick O’Connor –Sales/Promotion/Digital Tele. West, ITV Digital, Head of Trade marketing. Gained 70% market share. MD Kizoom. Managed for growth and exit. Director Caboodle – All marketing and development. Jim Lee – Sales & Motors Management Sales within and media sales to the motor trade. Founder member Motors. co. uk – classified ad company. Publisher What. Car. Media Sales Haymarket Motors Division.

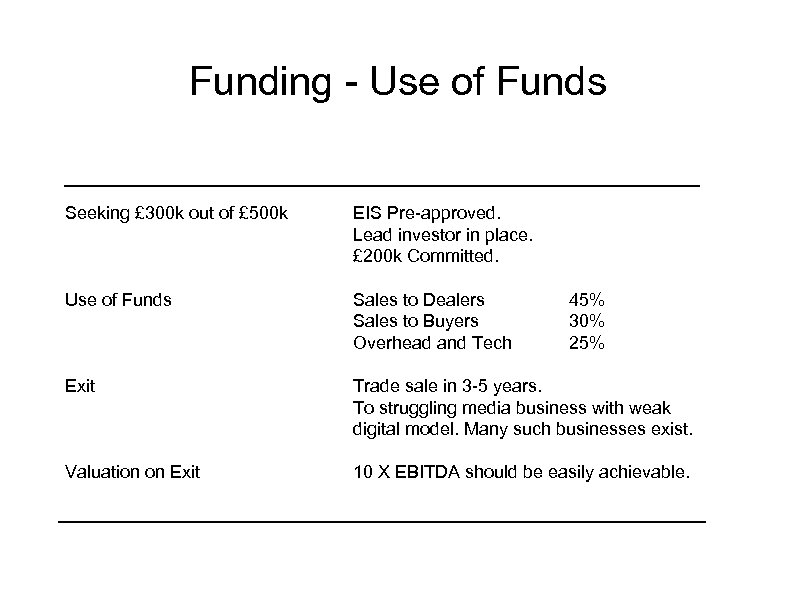

Funding - Use of Funds Seeking £ 300 k out of £ 500 k EIS Pre-approved. Lead investor in place. £ 200 k Committed. Use of Funds Sales to Dealers Sales to Buyers Overhead and Tech Exit Trade sale in 3 -5 years. To struggling media business with weak digital model. Many such businesses exist. Valuation on Exit 10 X EBITDA should be easily achievable. 45% 30% 25%

Where what you’re looking for 1. Very popular & proven model for buyers and sellers. – – Makes life easier – people use things like this. How the web should work 2. First mover, ready to move. – – Unique position in all markets. Immune from giants – barriers against emulators. 3. High potential returns. – – – Scalable and Applies to many markets and geographies. Network effect. Ideal for mobile applications. Profitable model.

b7810237feb1e10b906b9319b00e0e72.ppt