422bab176a617d32e154c5d41b1f39e2.ppt

- Количество слайдов: 16

MAKING IT PERSONAL – EVERY STEP OF THE WAY INDEX INVESTING with the companies of One. America® For company and recruiting use only. Not for public distribution. ® Products and financial services provided by the companies of One. America 1

MAKING IT PERSONAL – EVERY STEP OF THE WAY INDEX INVESTING with the companies of One. America® For company and recruiting use only. Not for public distribution. ® Products and financial services provided by the companies of One. America 1

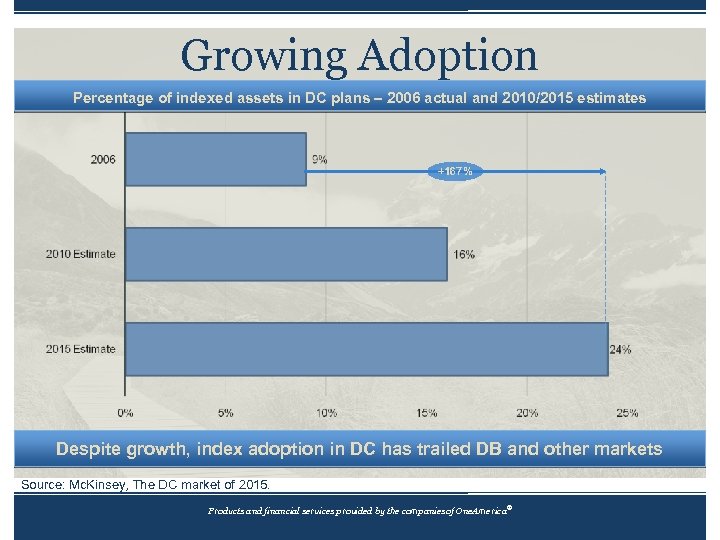

Growing Adoption Percentage of indexed assets in DC plans – 2006 actual and 2010/2015 estimates +167% Despite growth, index adoption in DC has trailed DB and other markets Source: Mc. Kinsey, The DC market of 2015. ® Products and financial services provided by the companies of One. America

Growing Adoption Percentage of indexed assets in DC plans – 2006 actual and 2010/2015 estimates +167% Despite growth, index adoption in DC has trailed DB and other markets Source: Mc. Kinsey, The DC market of 2015. ® Products and financial services provided by the companies of One. America

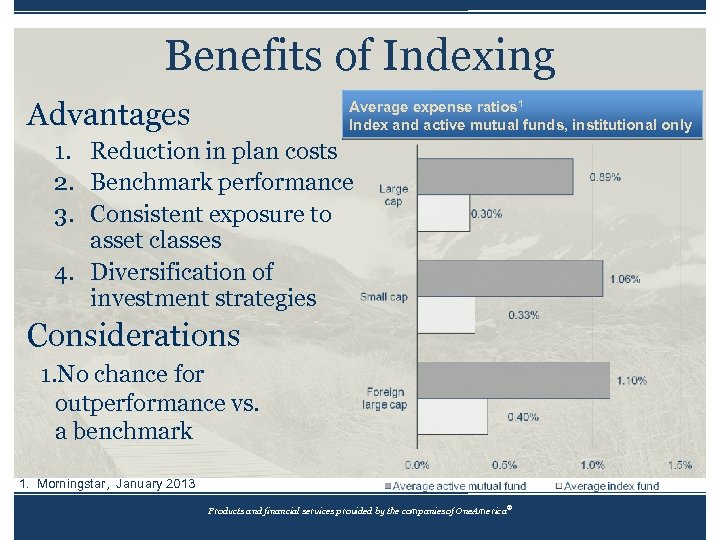

Benefits of Indexing Advantages Average expense ratios 1 Index and active mutual funds, institutional only 1. Reduction in plan costs 2. Benchmark performance 3. Consistent exposure to asset classes 4. Diversification of investment strategies Considerations 1. No chance for outperformance vs. a benchmark 1. Morningstar, January 2013 ® Products and financial services provided by the companies of One. America

Benefits of Indexing Advantages Average expense ratios 1 Index and active mutual funds, institutional only 1. Reduction in plan costs 2. Benchmark performance 3. Consistent exposure to asset classes 4. Diversification of investment strategies Considerations 1. No chance for outperformance vs. a benchmark 1. Morningstar, January 2013 ® Products and financial services provided by the companies of One. America

Why Choose Index(k)® and Index(b)TM Index(k) and Index(b) are unique retirement plan offerings focused exclusively on indexed investing for plan sponsors and financial professionals who: • Need an alternative to underperforming active managers • Are looking for lower cost investment options • Seek total transparency and disclosure • Need beta solutions in order to spend their time focusing on other aspects of their retirement plan ® Products and financial services provided by the companies of One. America

Why Choose Index(k)® and Index(b)TM Index(k) and Index(b) are unique retirement plan offerings focused exclusively on indexed investing for plan sponsors and financial professionals who: • Need an alternative to underperforming active managers • Are looking for lower cost investment options • Seek total transparency and disclosure • Need beta solutions in order to spend their time focusing on other aspects of their retirement plan ® Products and financial services provided by the companies of One. America

Why Index(k)® and Index(b)TM Appropriate for retirement plan specialists and generalists: • Change conversations with clients from investment selection and replacement to plan design improvements and participant outcomes • Lowest cost investments makes plans less approachable from competitors ® Products and financial services provided by the companies of One. America

Why Index(k)® and Index(b)TM Appropriate for retirement plan specialists and generalists: • Change conversations with clients from investment selection and replacement to plan design improvements and participant outcomes • Lowest cost investments makes plans less approachable from competitors ® Products and financial services provided by the companies of One. America

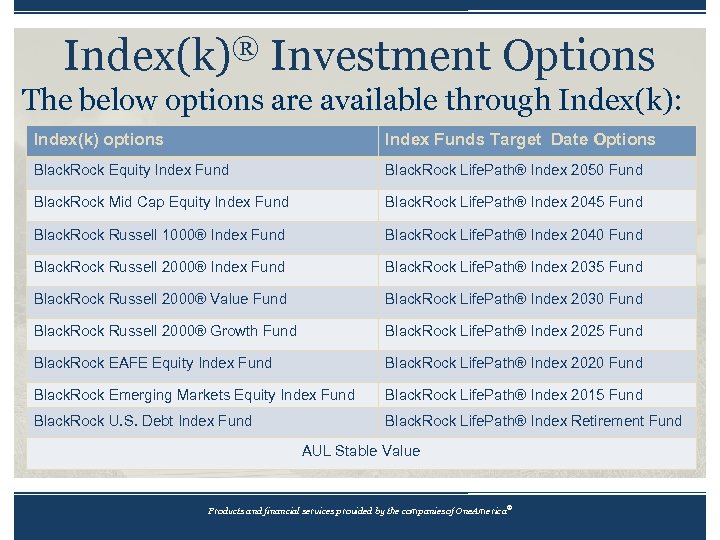

Index(k)® Investment Options The below options are available through Index(k): Index(k) options Index Funds Target Date Options Black. Rock Equity Index Fund Black. Rock Life. Path® Index 2050 Fund Black. Rock Mid Cap Equity Index Fund Black. Rock Life. Path® Index 2045 Fund Black. Rock Russell 1000® Index Fund Black. Rock Life. Path® Index 2040 Fund Black. Rock Russell 2000® Index Fund Black. Rock Life. Path® Index 2035 Fund Black. Rock Russell 2000® Value Fund Black. Rock Life. Path® Index 2030 Fund Black. Rock Russell 2000® Growth Fund Black. Rock Life. Path® Index 2025 Fund Black. Rock EAFE Equity Index Fund Black. Rock Life. Path® Index 2020 Fund Black. Rock Emerging Markets Equity Index Fund Black. Rock Life. Path® Index 2015 Fund Black. Rock U. S. Debt Index Fund Black. Rock Life. Path® Index Retirement Fund AUL Stable Value ® Products and financial services provided by the companies of One. America

Index(k)® Investment Options The below options are available through Index(k): Index(k) options Index Funds Target Date Options Black. Rock Equity Index Fund Black. Rock Life. Path® Index 2050 Fund Black. Rock Mid Cap Equity Index Fund Black. Rock Life. Path® Index 2045 Fund Black. Rock Russell 1000® Index Fund Black. Rock Life. Path® Index 2040 Fund Black. Rock Russell 2000® Index Fund Black. Rock Life. Path® Index 2035 Fund Black. Rock Russell 2000® Value Fund Black. Rock Life. Path® Index 2030 Fund Black. Rock Russell 2000® Growth Fund Black. Rock Life. Path® Index 2025 Fund Black. Rock EAFE Equity Index Fund Black. Rock Life. Path® Index 2020 Fund Black. Rock Emerging Markets Equity Index Fund Black. Rock Life. Path® Index 2015 Fund Black. Rock U. S. Debt Index Fund Black. Rock Life. Path® Index Retirement Fund AUL Stable Value ® Products and financial services provided by the companies of One. America

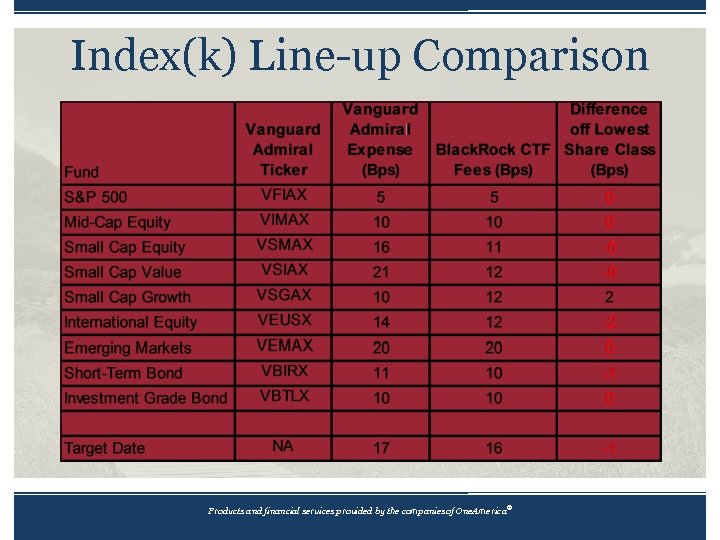

Index(k) Line-up Comparison ® Products and financial services provided by the companies of One. America

Index(k) Line-up Comparison ® Products and financial services provided by the companies of One. America

Index(k) Investment Options • 9 core index investments • 9 target date investments Ø GVA – Retail & Institutional Ø Premier Trust Multiple Fee options • Average cost of investments - 14 bps ® Products and financial services provided by the companies of One. America

Index(k) Investment Options • 9 core index investments • 9 target date investments Ø GVA – Retail & Institutional Ø Premier Trust Multiple Fee options • Average cost of investments - 14 bps ® Products and financial services provided by the companies of One. America

Index(b) Investment Options The below options are available through Index(b): Index(b) options Index TARGET DATE options TIAA-CREF Large Cap Value Index TIAA-CREF Lifecycle Index 2010 TIAA-CREF Large Cap Growth Index TIAA-CREF Lifecycle Index 2015 TIAA-CREF Bond Index TIAA-CREF Lifecycle Index 2020 TIAA-CREF Emerging Markets Equity Index TIAA-CREF Lifecycle Index 2025 TIAA-CREF International Equity Index TIAA-CREF Lifecycle Index 2030 State Street Equity 500 TIAA-CREF Lifecycle Index 2035 Columbia Mid Cap Index TIAA-CREF Lifecycle Index 2040 Columbia Small Cap Index TIAA-CREF Lifecycle Index 2045 TIAA-CREF Lifecycle Index 2050 TIAA-CREF Lifecycle Index 2055 TIAA-CREF Lifecycle Index Retirement Income AUL Stable Value ® Products and financial services provided by the companies of One. America

Index(b) Investment Options The below options are available through Index(b): Index(b) options Index TARGET DATE options TIAA-CREF Large Cap Value Index TIAA-CREF Lifecycle Index 2010 TIAA-CREF Large Cap Growth Index TIAA-CREF Lifecycle Index 2015 TIAA-CREF Bond Index TIAA-CREF Lifecycle Index 2020 TIAA-CREF Emerging Markets Equity Index TIAA-CREF Lifecycle Index 2025 TIAA-CREF International Equity Index TIAA-CREF Lifecycle Index 2030 State Street Equity 500 TIAA-CREF Lifecycle Index 2035 Columbia Mid Cap Index TIAA-CREF Lifecycle Index 2040 Columbia Small Cap Index TIAA-CREF Lifecycle Index 2045 TIAA-CREF Lifecycle Index 2050 TIAA-CREF Lifecycle Index 2055 TIAA-CREF Lifecycle Index Retirement Income AUL Stable Value ® Products and financial services provided by the companies of One. America

Index(b) Investment Options • 8 core index investment options • 10 target date options with an Retirement Income option Ø GVA Institutional platform • Average cost of investments for GVA Institutional is 38 bps which includes 25 bps of revenue sharing ® Products and financial services provided by the companies of One. America

Index(b) Investment Options • 8 core index investment options • 10 target date options with an Retirement Income option Ø GVA Institutional platform • Average cost of investments for GVA Institutional is 38 bps which includes 25 bps of revenue sharing ® Products and financial services provided by the companies of One. America

The companies of One. America • Custom communications • Local client service • Tax-exempt experience and flexibility ® Products and financial services provided by the companies of One. America

The companies of One. America • Custom communications • Local client service • Tax-exempt experience and flexibility ® Products and financial services provided by the companies of One. America

Disclosures • • The strategies referred to in this publication are among various investment strategies that are managed by Black. Rock as part of its investment management and fiduciary services. Strategies may include collective investment funds maintained by Black. Rock Institutional Trust Company, N. A. , which are available only to certain qualified employee benefit plans and governmental plans and not offered to the general public. Accordingly, prospectuses are not required and prices are not available in local publications. To obtain pricing information, please contact your local service representative. Black. Rock Institutional Trust Company, N. A. , a national banking association operating as a limited purpose trust company, manages the investment strategies and other fiduciary services referred to in this publication and provides fiduciary and trust services to various institutional investors. Strategies maintained by Black. Rock are not insured by the Federal Deposit Insurance Corporation and are not guaranteed by Black. Rock or its affiliates. BLACKROCK, LIFEPATH, and i. SHARES® are registered trademarks of Black. Rock. All other trademarks, service marks or registered trademarks are the property of their respective owners. DC-0063 All statements herein are qualified by, and any offer is made solely pursuant to, a final offering document and investment management agreement. No offer to purchase units in any fund will be accepted prior to receipt by the offeree of these documents and the completion of all appropriate documentation. ® Products and financial services provided by the companies of One. America

Disclosures • • The strategies referred to in this publication are among various investment strategies that are managed by Black. Rock as part of its investment management and fiduciary services. Strategies may include collective investment funds maintained by Black. Rock Institutional Trust Company, N. A. , which are available only to certain qualified employee benefit plans and governmental plans and not offered to the general public. Accordingly, prospectuses are not required and prices are not available in local publications. To obtain pricing information, please contact your local service representative. Black. Rock Institutional Trust Company, N. A. , a national banking association operating as a limited purpose trust company, manages the investment strategies and other fiduciary services referred to in this publication and provides fiduciary and trust services to various institutional investors. Strategies maintained by Black. Rock are not insured by the Federal Deposit Insurance Corporation and are not guaranteed by Black. Rock or its affiliates. BLACKROCK, LIFEPATH, and i. SHARES® are registered trademarks of Black. Rock. All other trademarks, service marks or registered trademarks are the property of their respective owners. DC-0063 All statements herein are qualified by, and any offer is made solely pursuant to, a final offering document and investment management agreement. No offer to purchase units in any fund will be accepted prior to receipt by the offeree of these documents and the completion of all appropriate documentation. ® Products and financial services provided by the companies of One. America

Disclosures • • • Investing involves risk, including possible loss of principal. The principal value of the funds is not guaranteed at any time including at and after the target-date. Asset allocation models and diversification do not promise any level of performance or guarantee against loss of principal. Investment in the funds is subject to the risks of the underlying funds. The strategies discussed are strictly for illustrative and educational purposes and should not be construed as a recommendation to purchase or sell, or an offer to sell or a solicitation of an offer to buy any security. There is no guarantee that any strategies discussed will be effective. The information provided is not intended to be a complete analysis of every material fact respecting any strategy. All group variable annuity contracts are issued by American United Life Insurance Company® (AUL), One American Square, Indianapolis, IN 46206 -0368, 1 -800 -249 -6269. Registered group variable annuity contracts are distributed by One. America Securities, Inc. , Member FINRA, SIPC, a Registered Investment Advisor, 433 N. Capitol Ave. , Indianapolis, IN 46204, 1 -877 -285 -3863 Mc. Cready and Keene provides administrative and record keeping services and is not a broker/dealer or an investment advisor. Neither AUL, One. America Securities, Mc. Cready and Keene nor their representatives provide tax, legal or investment advice. ® Products and financial services provided by the companies of One. America

Disclosures • • • Investing involves risk, including possible loss of principal. The principal value of the funds is not guaranteed at any time including at and after the target-date. Asset allocation models and diversification do not promise any level of performance or guarantee against loss of principal. Investment in the funds is subject to the risks of the underlying funds. The strategies discussed are strictly for illustrative and educational purposes and should not be construed as a recommendation to purchase or sell, or an offer to sell or a solicitation of an offer to buy any security. There is no guarantee that any strategies discussed will be effective. The information provided is not intended to be a complete analysis of every material fact respecting any strategy. All group variable annuity contracts are issued by American United Life Insurance Company® (AUL), One American Square, Indianapolis, IN 46206 -0368, 1 -800 -249 -6269. Registered group variable annuity contracts are distributed by One. America Securities, Inc. , Member FINRA, SIPC, a Registered Investment Advisor, 433 N. Capitol Ave. , Indianapolis, IN 46204, 1 -877 -285 -3863 Mc. Cready and Keene provides administrative and record keeping services and is not a broker/dealer or an investment advisor. Neither AUL, One. America Securities, Mc. Cready and Keene nor their representatives provide tax, legal or investment advice. ® Products and financial services provided by the companies of One. America

Disclosures • • The underlying mutual fund investments selected by your plan’s investment advisor are held in trust by Wilmington Trust Retirement and Institutional Services Company, a nondepository trust company that acts as a custodian and/or directed trustee. These investments are not deposits or obligations of or guaranteed by Wilmington Trust, and are not insured by the FDIC, the Federal Reserve, or any other governmental agency. Mutual Funds are sold by prospectus. The prospectus contains important information about the fund. Before investing any money, plan participants should read the prospectus and carefully consider the fund's investment objectives, risks, charges and expenses. Investing involves risk, including the potential loss of principal. To obtain a copy of the prospectus, the participant should contact the plan's investment advisor or the mutual fund company directly. Variable products are sold by prospectus. Both the product prospectus and underlying fund prospectuses can be obtained from your investment professional or by writing to 433 N. Capitol Ave. , Indianapolis, IN 46204, 1 -800 -249 -6269. Before investing, carefully consider the fund's investment objectives, risks, charges and expenses. The product prospectus and underlying fund prospectus contain this and other important information. Read the prospectuses carefully before investing. The Index is comprised of an unmanaged portfolio of stocks with no fees or expenses reflected in the performance. Individuals cannot invest directly in an index. ® Products and financial services provided by the companies of One. America

Disclosures • • The underlying mutual fund investments selected by your plan’s investment advisor are held in trust by Wilmington Trust Retirement and Institutional Services Company, a nondepository trust company that acts as a custodian and/or directed trustee. These investments are not deposits or obligations of or guaranteed by Wilmington Trust, and are not insured by the FDIC, the Federal Reserve, or any other governmental agency. Mutual Funds are sold by prospectus. The prospectus contains important information about the fund. Before investing any money, plan participants should read the prospectus and carefully consider the fund's investment objectives, risks, charges and expenses. Investing involves risk, including the potential loss of principal. To obtain a copy of the prospectus, the participant should contact the plan's investment advisor or the mutual fund company directly. Variable products are sold by prospectus. Both the product prospectus and underlying fund prospectuses can be obtained from your investment professional or by writing to 433 N. Capitol Ave. , Indianapolis, IN 46204, 1 -800 -249 -6269. Before investing, carefully consider the fund's investment objectives, risks, charges and expenses. The product prospectus and underlying fund prospectus contain this and other important information. Read the prospectuses carefully before investing. The Index is comprised of an unmanaged portfolio of stocks with no fees or expenses reflected in the performance. Individuals cannot invest directly in an index. ® Products and financial services provided by the companies of One. America

Disclosures • • • Target Date Funds are designed for people who plan to retire and begin taking withdrawals during or near a specific year. These funds use a strategy that reallocates equity exposure to a higher percentage of fixed investments; the funds will shift assets from equities to fixed -income investments over time. As a result, the funds become more conservative over time as you approach retirement. It’s important to remember that no strategy can assure a profit or prevent a loss in a declining market and the principal value of the Target Date Funds is not guaranteed at any time, including the target date. Target Date Funds are designed to provide diversification and asset allocation across several types of investments and asset classes, primarily by investing in underlying funds. Therefore, in addition to the expenses of the Target Date Funds, an investor is indirectly paying a proportionate share of the applicable fees and expenses of the underlying funds. The principal amounts invested into these funds are not guaranteed at any point and may lose value. The AUL Stable Value Account is provided through an AUL Group Annuity Contract and is supported by the general account of AUL. It is not a separate account, and plan participants do not own units, any portion of, or any entitlement to the AUL general account. Please refer to the applicable AUL Group Annuity Contract for more information on the Stable Value Account. Black. Rock, Inc. , TIAA-CREF, Vanguard, and Wilmington Trust Retirement and Institutional Services Company are not affiliates of Mc. Cready and Keene, Inc. or AUL and are not One. America companies. ® Products and financial services provided by the companies of One. America

Disclosures • • • Target Date Funds are designed for people who plan to retire and begin taking withdrawals during or near a specific year. These funds use a strategy that reallocates equity exposure to a higher percentage of fixed investments; the funds will shift assets from equities to fixed -income investments over time. As a result, the funds become more conservative over time as you approach retirement. It’s important to remember that no strategy can assure a profit or prevent a loss in a declining market and the principal value of the Target Date Funds is not guaranteed at any time, including the target date. Target Date Funds are designed to provide diversification and asset allocation across several types of investments and asset classes, primarily by investing in underlying funds. Therefore, in addition to the expenses of the Target Date Funds, an investor is indirectly paying a proportionate share of the applicable fees and expenses of the underlying funds. The principal amounts invested into these funds are not guaranteed at any point and may lose value. The AUL Stable Value Account is provided through an AUL Group Annuity Contract and is supported by the general account of AUL. It is not a separate account, and plan participants do not own units, any portion of, or any entitlement to the AUL general account. Please refer to the applicable AUL Group Annuity Contract for more information on the Stable Value Account. Black. Rock, Inc. , TIAA-CREF, Vanguard, and Wilmington Trust Retirement and Institutional Services Company are not affiliates of Mc. Cready and Keene, Inc. or AUL and are not One. America companies. ® Products and financial services provided by the companies of One. America

LIFE INSURANCE | RETIREMENT | EMPLOYEE BENEFITS ONEAMERICA® companies: AMERICAN UNITED LIFE INSURANCE COMPANY® AUL REINSURANCE MANAGEMENT SERVICES, LLC MCCREADY and KEENE, INC. ONEAMERICA SECURITIES, INC. PIONEER MUTUAL LIFE INSURANCE COMPANY A stock subsidiary of American United Mutual Insurance Holding Company THE STATE LIFE INSURANCE COMPANY ® Products and financial services provided by the companies of One. America

LIFE INSURANCE | RETIREMENT | EMPLOYEE BENEFITS ONEAMERICA® companies: AMERICAN UNITED LIFE INSURANCE COMPANY® AUL REINSURANCE MANAGEMENT SERVICES, LLC MCCREADY and KEENE, INC. ONEAMERICA SECURITIES, INC. PIONEER MUTUAL LIFE INSURANCE COMPANY A stock subsidiary of American United Mutual Insurance Holding Company THE STATE LIFE INSURANCE COMPANY ® Products and financial services provided by the companies of One. America