f121341481441eb59c4a5db879302bea.ppt

- Количество слайдов: 18

Make or Break Time September 2012 Daryl Montgomery September 12, 2012 Copyright 2012, All Rights Reserved The contents of this presentation are not intended as a recommendation to buy or sell any security.

The Current State of Affairs

Greece Selling Government Assets

The real Draghi Plan for the ECB

Summary • EU has not solved its problems. New Draghi plan will fall apart soon enough. Did he go too far? • Fed wants to do more QE, although no proof QE helps the economy, nor can it. • U. S. bleeding jobs at incredible rate. • U. S. debt broke above $16 trillion. Heading toward fiscal cliff at end of year. • It’s only a matter of time before HFT implodes the market.

The latest EU Plan That Won’t Work • ECB head Draghi promises unlimited, sterilized buying of bonds of peripheral country debt of 3 yrs or less duration. • Unlimited and sterilized are contradictory, may be only € 500 billion of excess liquidity. • Replaces unsuccessful SMP program. . • To get aid, countries must let ECB take over their finances – end of career for a politician that does. • There is not supposed to be any money printing. • Germans opposed plan. Merkel on both sides.

Impact of the New Plan • German 10 -year bond auction fails only for 2 nd time the day plan is announced. • Liquidity will be drained out of northern countries to buy southern country bonds. This will damage their economies and employment rates. • German court decision on legality of ESM limits German liability to € 190 billion (very little). • Troika report on Greece “delayed”. • Cash bailouts: Greece € 240 billion, Ireland € 85 billion, Portugal € 78 billion, Spain € 100 billion.

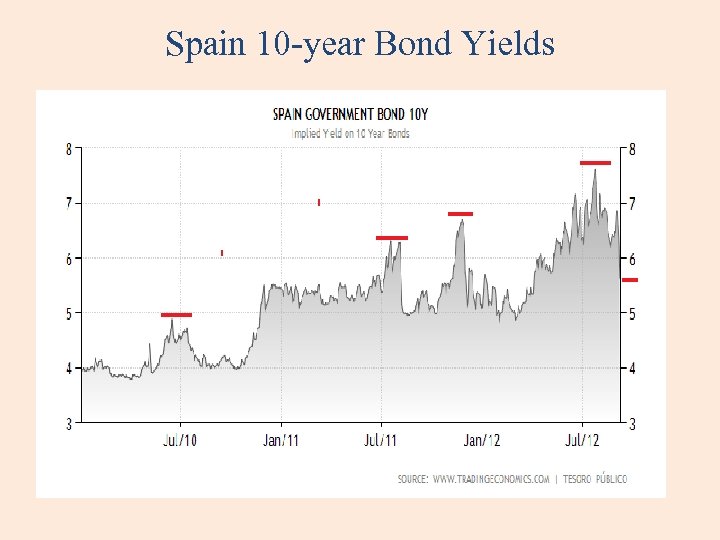

Spain 10 -year Bond Yields

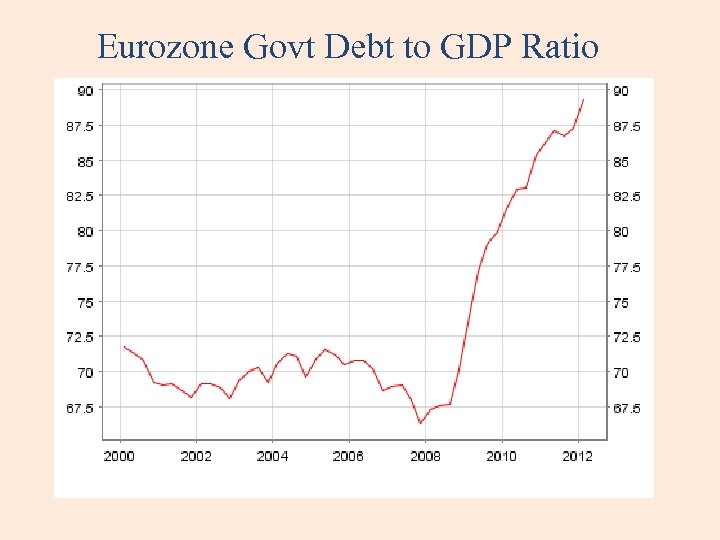

Eurozone Govt Debt to GDP Ratio

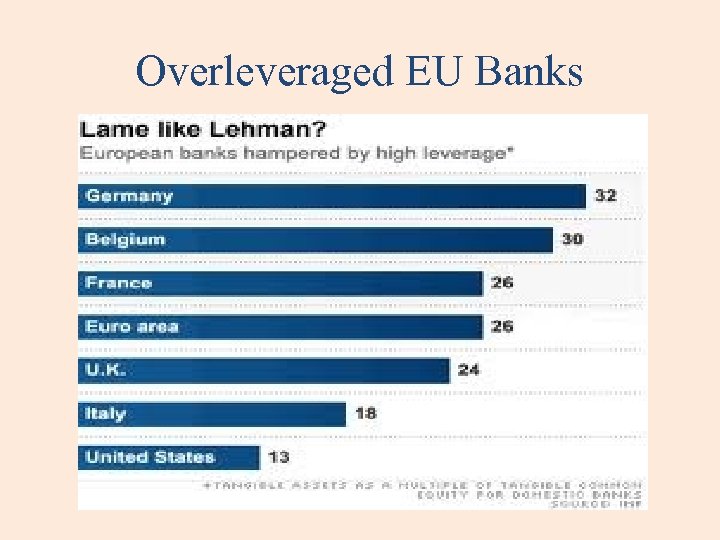

Overleveraged EU Banks

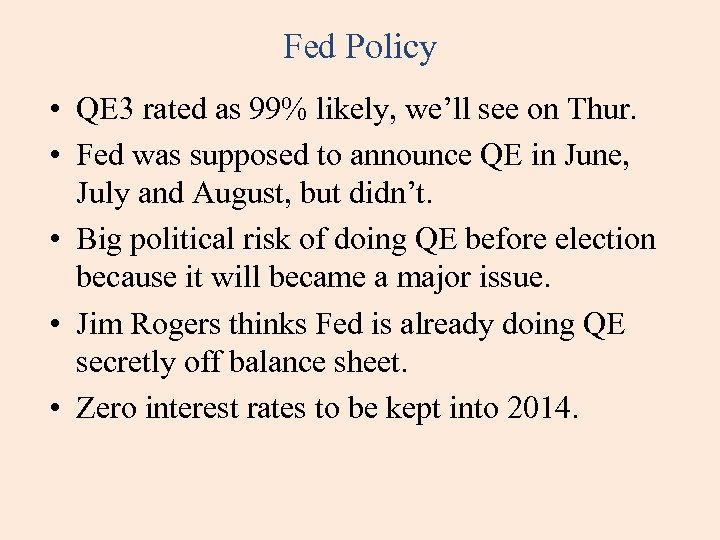

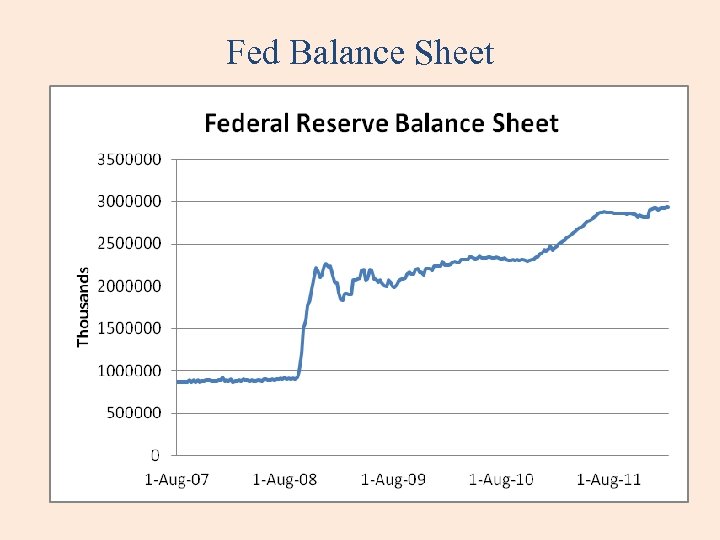

Fed Policy • QE 3 rated as 99% likely, we’ll see on Thur. • Fed was supposed to announce QE in June, July and August, but didn’t. • Big political risk of doing QE before election because it will became a major issue. • Jim Rogers thinks Fed is already doing QE secretly off balance sheet. • Zero interest rates to be kept into 2014.

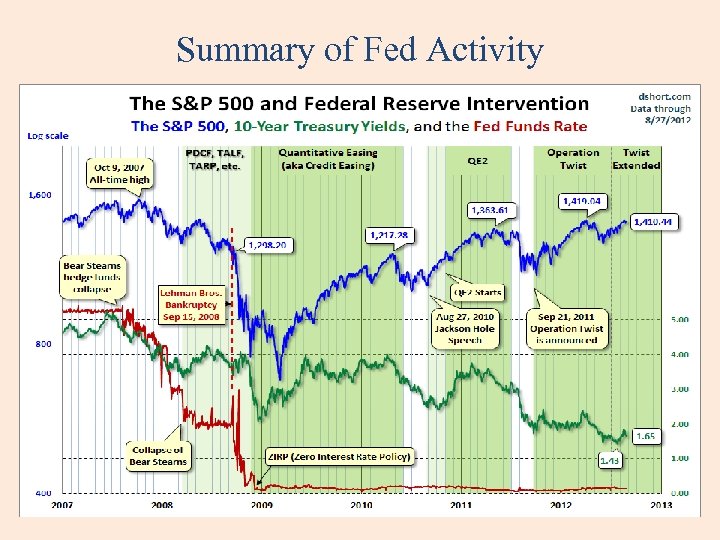

Summary of Fed Activity

Fed Balance Sheet

Employment Situation • Aug employment was up 96, 000 or down 195, 000. Two surveys disagree. BLS reported only the good news (and so did the mainstream media). • Rate fell to 8. 3% to 8. 1% in July. LF down 368, 000. • 3. 7 million less total jobs in US than in Aug 2007. NOT employed up from 79. 3 to 88. 9 million. • Labor Force should have increased by 5. 7 million to maintain employment rate. • Obama record: # of jobs Jan 2009: 142. 1 million # of jobs Aug 2012: 142. 1 million A net 2, 000 jobs have been created under Obama.

The High Frequency Trading Threat • HFT is the cause of falling market volume for last 3 ½ years. Bad trades force out good. • HFT caused the Flash Crash in May 2010. • HFT caused Knight Trading $440 million loss because of out of control trading. • HFT algos written to make market go up. This creates a classic bubble scenario. The anti-bubble will be very ugly.

U. S. Fiscal State • National Debt: $16. 02 trillion (early Sept) State and Local Debt $2. 8 trillion Unfunded liabilities $120. 5 trillion. • Debt to GDP ratio >104. 4% (actually greater). • Debt doesn’t include Federal Reserve or Fannie Mae, Freddie Mac and FHA obligations. • Debt Ceiling at $16. 4 trillion. Will be hit around election (gov’t will be funded until January). • Federal budget deficit for 2012 now $1. 2 trillion. • 2012 Trade Deficit estimate $500 to $600.

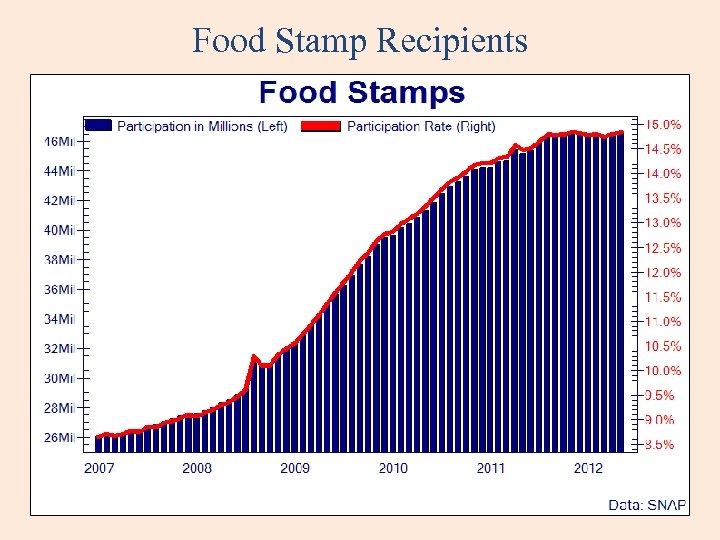

Food Stamp Recipients

f121341481441eb59c4a5db879302bea.ppt