3861cf791794f4a7c0ceff70f4630fab.ppt

- Количество слайдов: 56

Macroeconomics The National Income and Output

Macroeconomics The National Income and Output

ECONOMIC AGENTS in a TWO-SECTOR economy Households FIRMS 1

ECONOMIC AGENTS in a TWO-SECTOR economy Households FIRMS 1

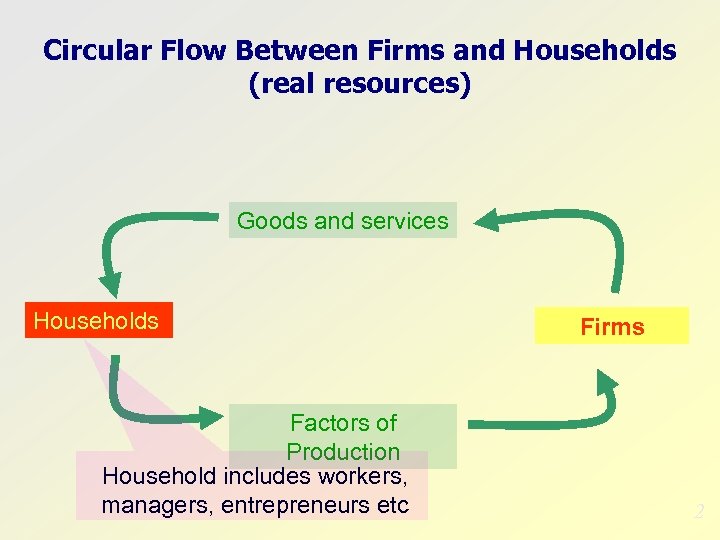

Circular Flow Between Firms and Households (real resources) Goods and services Households Factors of Production Household includes workers, managers, entrepreneurs etc Firms 2

Circular Flow Between Firms and Households (real resources) Goods and services Households Factors of Production Household includes workers, managers, entrepreneurs etc Firms 2

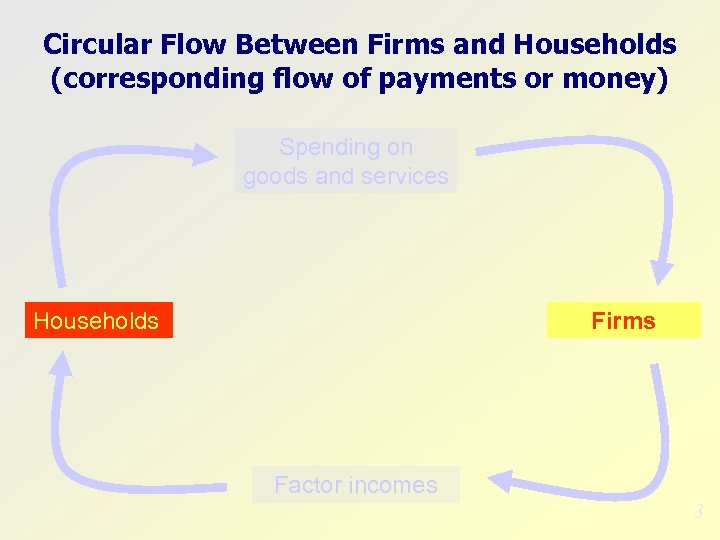

Circular Flow Between Firms and Households (corresponding flow of payments or money) Spending on goods and services Households Firms Factor incomes 3

Circular Flow Between Firms and Households (corresponding flow of payments or money) Spending on goods and services Households Firms Factor incomes 3

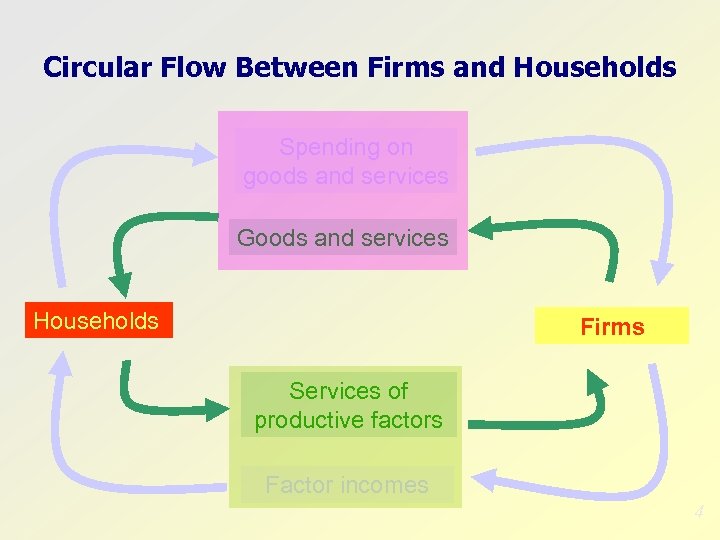

Circular Flow Between Firms and Households Spending on goods and services Goods and services Households Firms Services of productive factors Factor incomes 4

Circular Flow Between Firms and Households Spending on goods and services Goods and services Households Firms Services of productive factors Factor incomes 4

Three measures of national output • Expenditure – the sum of expenditures in the economy • Income – the sum of all factor incomes • Output – the sum of output (final or value added) produced in the economy • All three approaches should give you the same final figure for national output 5

Three measures of national output • Expenditure – the sum of expenditures in the economy • Income – the sum of all factor incomes • Output – the sum of output (final or value added) produced in the economy • All three approaches should give you the same final figure for national output 5

Circular Flow Between Firms and Households he y t Spending on ng om Expenditure i n goods and services r su co ea e e Goods. Output and services f m th o in ay ity Households Firms t w ctiv en a r c ffe mi Services of i d oproductive factors 3 on ec Income Factor incomes 6

Circular Flow Between Firms and Households he y t Spending on ng om Expenditure i n goods and services r su co ea e e Goods. Output and services f m th o in ay ity Households Firms t w ctiv en a r c ffe mi Services of i d oproductive factors 3 on ec Income Factor incomes 6

Measuring Output • Total value added – is the economy’s net output after deducting goods used during production – to avoid double counting – E. g. egg, milk, flour used for making muffins. MUFFINS. Final Good. • Gross domestic product (GDP) – measures the final output produced (by factors of production located in the domestic economy) over a period of time, usually a year. 7

Measuring Output • Total value added – is the economy’s net output after deducting goods used during production – to avoid double counting – E. g. egg, milk, flour used for making muffins. MUFFINS. Final Good. • Gross domestic product (GDP) – measures the final output produced (by factors of production located in the domestic economy) over a period of time, usually a year. 7

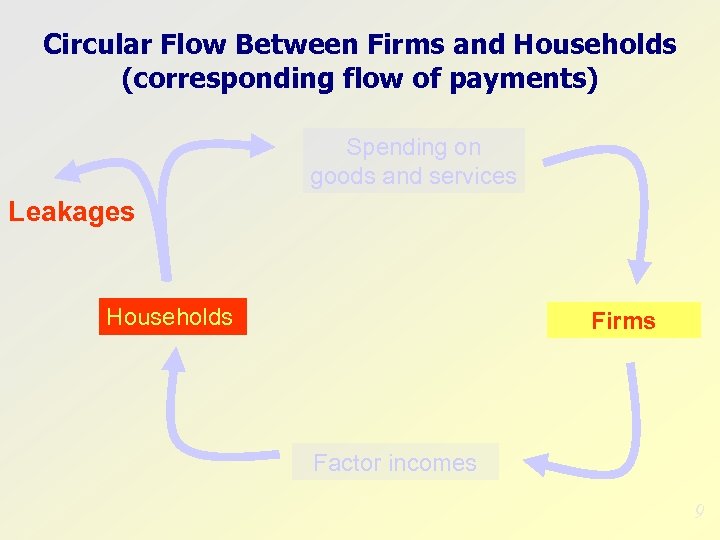

Leakages from the Circular Flow • Leakages (in terms of flow of payment) – money paid to the households but not returned to firm – Or flow of payments that started from firms but did not return back to firms – e. g. household savings, net taxes and imports 8

Leakages from the Circular Flow • Leakages (in terms of flow of payment) – money paid to the households but not returned to firm – Or flow of payments that started from firms but did not return back to firms – e. g. household savings, net taxes and imports 8

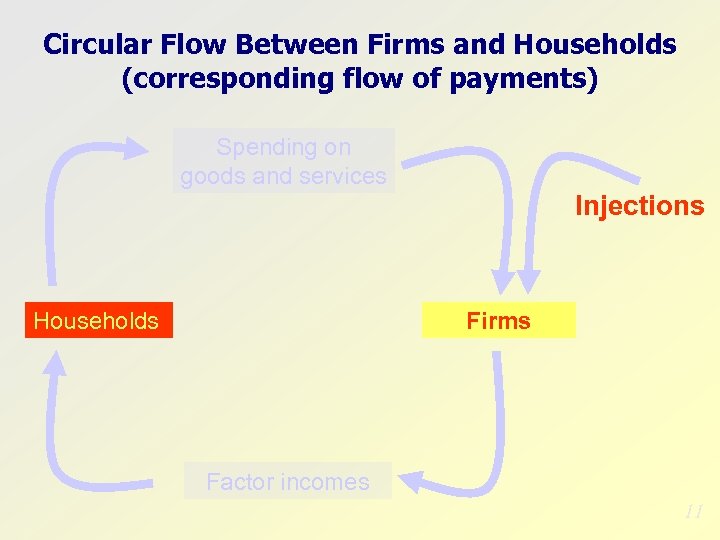

Circular Flow Between Firms and Households (corresponding flow of payments) Spending on goods and services Leakages Households Firms Factor incomes 9

Circular Flow Between Firms and Households (corresponding flow of payments) Spending on goods and services Leakages Households Firms Factor incomes 9

Injections into the Circular Flow • Injections (in terms of flow of payment) – are revenue for firms not from sales to household – e. g. investment by firms, government purchases and exports 10

Injections into the Circular Flow • Injections (in terms of flow of payment) – are revenue for firms not from sales to household – e. g. investment by firms, government purchases and exports 10

Circular Flow Between Firms and Households (corresponding flow of payments) Spending on goods and services Injections Households Firms Factor incomes 11

Circular Flow Between Firms and Households (corresponding flow of payments) Spending on goods and services Injections Households Firms Factor incomes 11

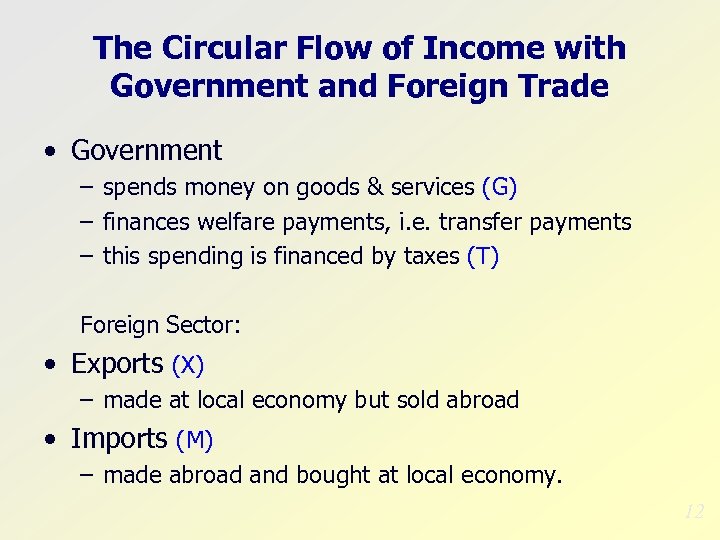

The Circular Flow of Income with Government and Foreign Trade • Government – spends money on goods & services (G) – finances welfare payments, i. e. transfer payments – this spending is financed by taxes (T) Foreign Sector: • Exports (X) – made at local economy but sold abroad • Imports (M) – made abroad and bought at local economy. 12

The Circular Flow of Income with Government and Foreign Trade • Government – spends money on goods & services (G) – finances welfare payments, i. e. transfer payments – this spending is financed by taxes (T) Foreign Sector: • Exports (X) – made at local economy but sold abroad • Imports (M) – made abroad and bought at local economy. 12

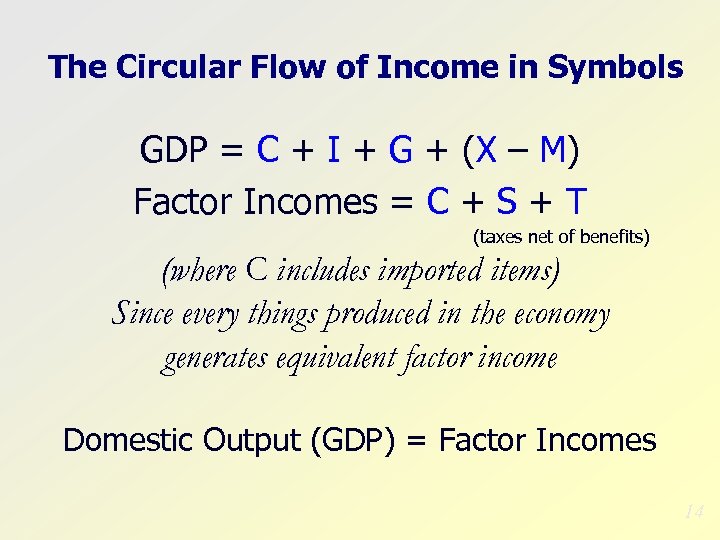

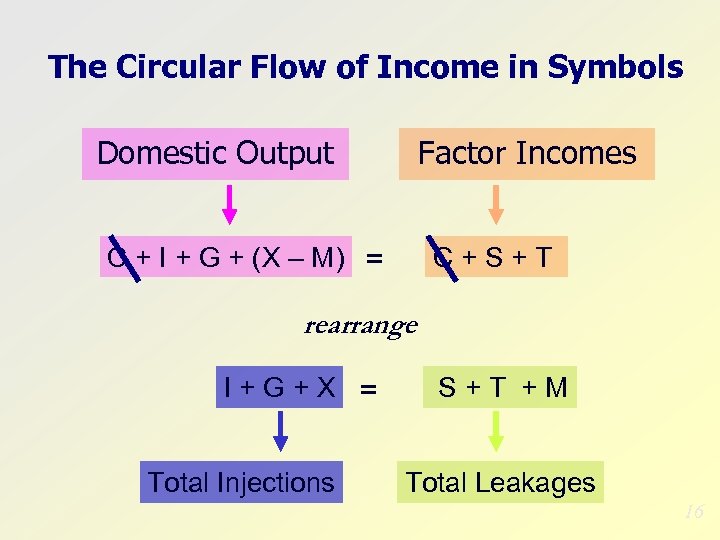

The Circular Flow of Income in Symbols • Domestic Output (GDP) is either – – Consumed (C) Invested (I) (INCREASE IN STOCK OF CAPITAL) Bought by the Government (G) Bought by the foreigners, net exports (X-M) • Factor Incomes are spent on – Consumption (C) – Saving (S) – Paying taxes net of benefits (T) 13

The Circular Flow of Income in Symbols • Domestic Output (GDP) is either – – Consumed (C) Invested (I) (INCREASE IN STOCK OF CAPITAL) Bought by the Government (G) Bought by the foreigners, net exports (X-M) • Factor Incomes are spent on – Consumption (C) – Saving (S) – Paying taxes net of benefits (T) 13

The Circular Flow of Income in Symbols GDP = C + I + G + (X – M) Factor Incomes = C + S + T (taxes net of benefits) (where C includes imported items) Since every things produced in the economy generates equivalent factor income Domestic Output (GDP) = Factor Incomes 14

The Circular Flow of Income in Symbols GDP = C + I + G + (X – M) Factor Incomes = C + S + T (taxes net of benefits) (where C includes imported items) Since every things produced in the economy generates equivalent factor income Domestic Output (GDP) = Factor Incomes 14

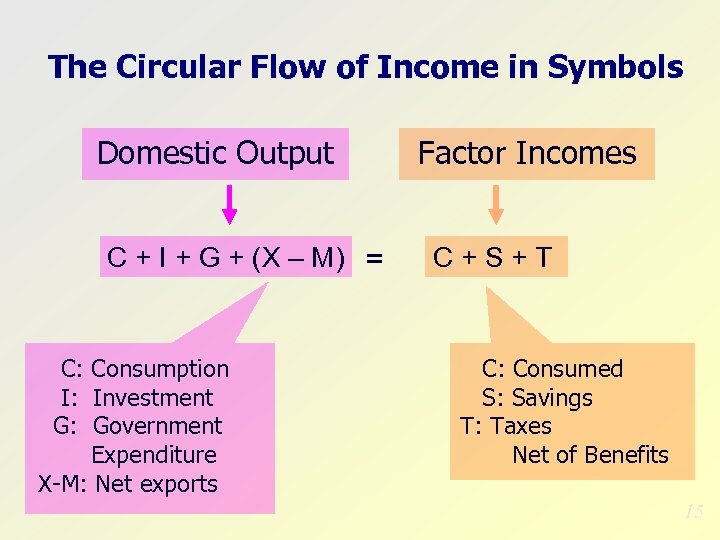

The Circular Flow of Income in Symbols Domestic Output C + I + G + (X – M) = C: Consumption I: Investment G: Government Expenditure X-M: Net exports Factor Incomes C+S+T C: Consumed S: Savings T: Taxes Net of Benefits 15

The Circular Flow of Income in Symbols Domestic Output C + I + G + (X – M) = C: Consumption I: Investment G: Government Expenditure X-M: Net exports Factor Incomes C+S+T C: Consumed S: Savings T: Taxes Net of Benefits 15

The Circular Flow of Income in Symbols Domestic Output Factor Incomes C + I + G + (X – M) = C+S+T rearrange I+G+X = Total Injections S+T +M Total Leakages 16

The Circular Flow of Income in Symbols Domestic Output Factor Incomes C + I + G + (X – M) = C+S+T rearrange I+G+X = Total Injections S+T +M Total Leakages 16

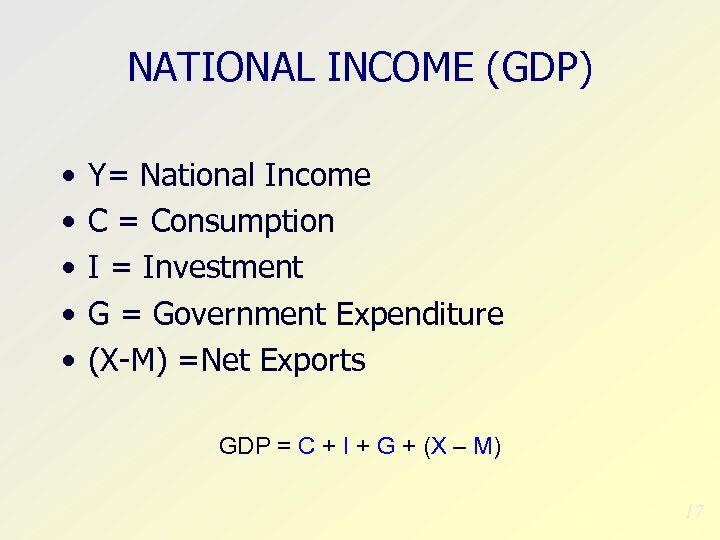

NATIONAL INCOME (GDP) • • • Y= National Income C = Consumption I = Investment G = Government Expenditure (X-M) =Net Exports GDP = C + I + G + (X – M) 17

NATIONAL INCOME (GDP) • • • Y= National Income C = Consumption I = Investment G = Government Expenditure (X-M) =Net Exports GDP = C + I + G + (X – M) 17

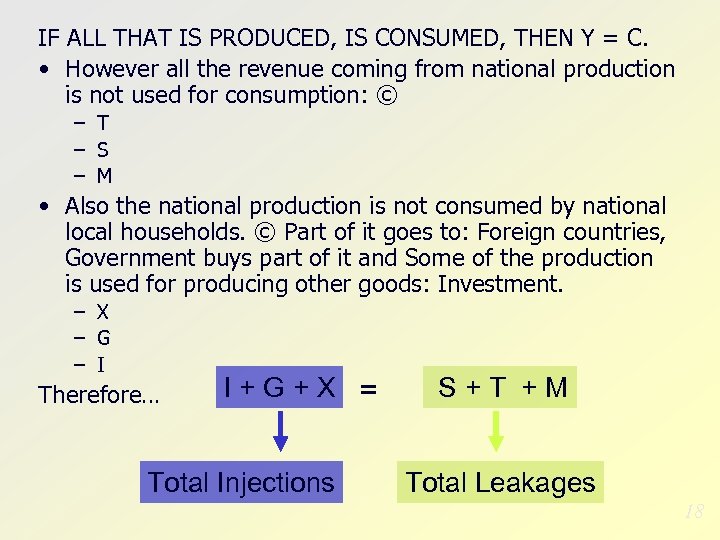

IF ALL THAT IS PRODUCED, IS CONSUMED, THEN Y = C. • However all the revenue coming from national production is not used for consumption: © – T – S – M • Also the national production is not consumed by national local households. © Part of it goes to: Foreign countries, Government buys part of it and Some of the production is used for producing other goods: Investment. – X – G – I Therefore… I+G+X = Total Injections S+T +M Total Leakages 18

IF ALL THAT IS PRODUCED, IS CONSUMED, THEN Y = C. • However all the revenue coming from national production is not used for consumption: © – T – S – M • Also the national production is not consumed by national local households. © Part of it goes to: Foreign countries, Government buys part of it and Some of the production is used for producing other goods: Investment. – X – G – I Therefore… I+G+X = Total Injections S+T +M Total Leakages 18

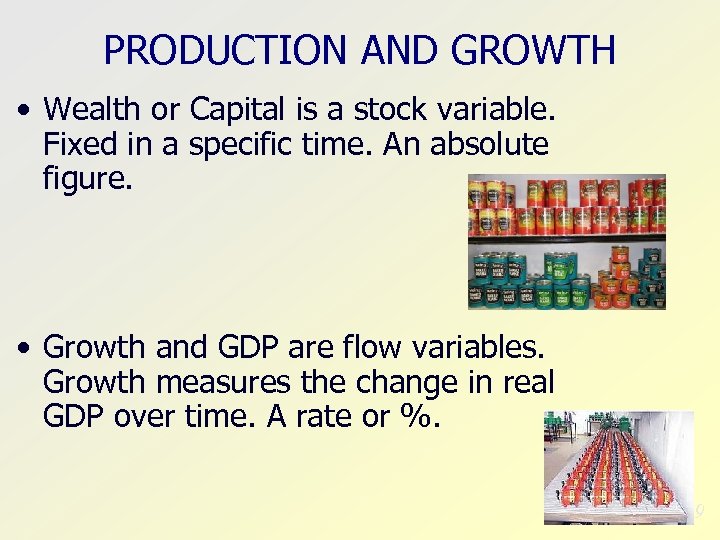

PRODUCTION AND GROWTH • Wealth or Capital is a stock variable. Fixed in a specific time. An absolute figure. • Growth and GDP are flow variables. Growth measures the change in real GDP over time. A rate or %. 19

PRODUCTION AND GROWTH • Wealth or Capital is a stock variable. Fixed in a specific time. An absolute figure. • Growth and GDP are flow variables. Growth measures the change in real GDP over time. A rate or %. 19

Flow or stock? 20

Flow or stock? 20

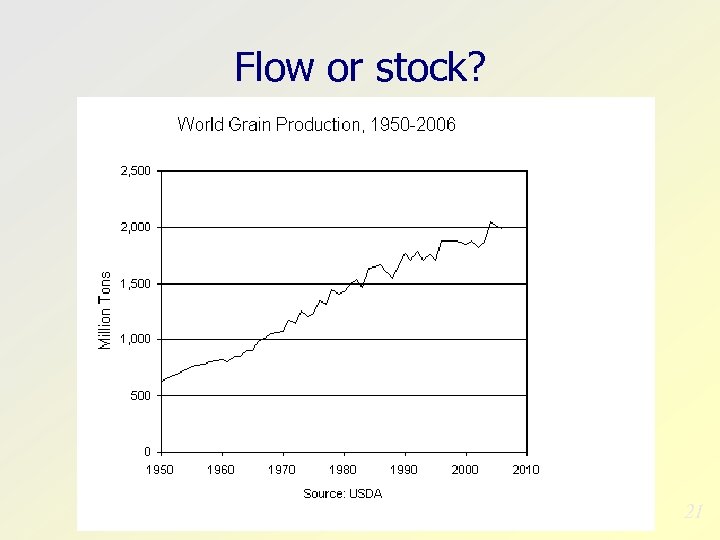

Flow or stock? 21

Flow or stock? 21

GDP, GNP or GNI, • Gross domestic product (GDP) – measures the output produced by factors of production located in the domestic economy over a period of time, usually a year. • Gross National Product or INCOME (GNP or GNI) – total income of citizens wherever it is earned = GDP + Net Income from abroad IF GDP > GNP then Net Income from abroad is negative It means that citizens from abroad in the local economy plus locals make the local economy GDP bigger than its Citizens abroad and in the local economy together. Depreciation: wear and tear of capital stock Gross: DOES NOT TAKE IN ACCOUNT DEPRECIATION. Only the total increase in K stock. • (Optional) Net National Income = GNP – Depreciation 22

GDP, GNP or GNI, • Gross domestic product (GDP) – measures the output produced by factors of production located in the domestic economy over a period of time, usually a year. • Gross National Product or INCOME (GNP or GNI) – total income of citizens wherever it is earned = GDP + Net Income from abroad IF GDP > GNP then Net Income from abroad is negative It means that citizens from abroad in the local economy plus locals make the local economy GDP bigger than its Citizens abroad and in the local economy together. Depreciation: wear and tear of capital stock Gross: DOES NOT TAKE IN ACCOUNT DEPRECIATION. Only the total increase in K stock. • (Optional) Net National Income = GNP – Depreciation 22

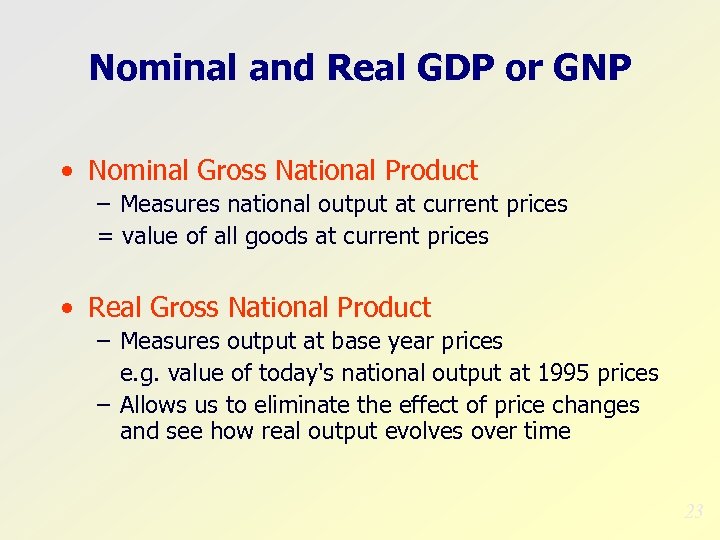

Nominal and Real GDP or GNP • Nominal Gross National Product – Measures national output at current prices = value of all goods at current prices • Real Gross National Product – Measures output at base year prices e. g. value of today's national output at 1995 prices – Allows us to eliminate the effect of price changes and see how real output evolves over time 23

Nominal and Real GDP or GNP • Nominal Gross National Product – Measures national output at current prices = value of all goods at current prices • Real Gross National Product – Measures output at base year prices e. g. value of today's national output at 1995 prices – Allows us to eliminate the effect of price changes and see how real output evolves over time 23

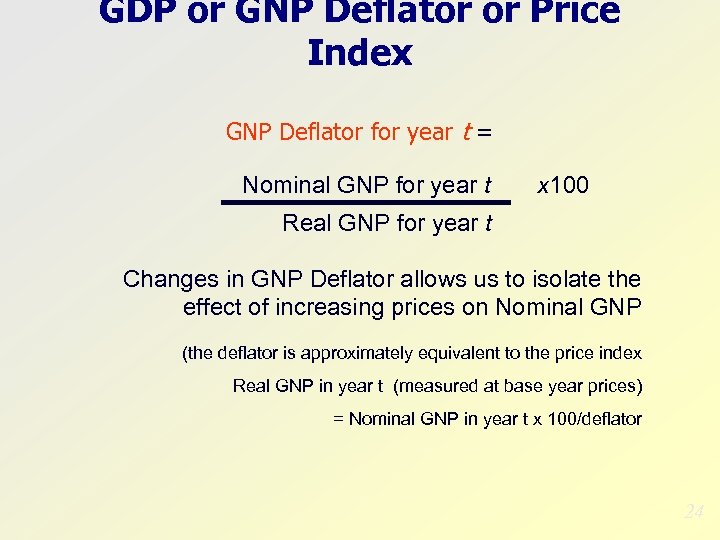

GDP or GNP Deflator or Price Index GNP Deflator for year t = Nominal GNP for year t x 100 Real GNP for year t Changes in GNP Deflator allows us to isolate the effect of increasing prices on Nominal GNP (the deflator is approximately equivalent to the price index Real GNP in year t (measured at base year prices) = Nominal GNP in year t x 100/deflator 24

GDP or GNP Deflator or Price Index GNP Deflator for year t = Nominal GNP for year t x 100 Real GNP for year t Changes in GNP Deflator allows us to isolate the effect of increasing prices on Nominal GNP (the deflator is approximately equivalent to the price index Real GNP in year t (measured at base year prices) = Nominal GNP in year t x 100/deflator 24

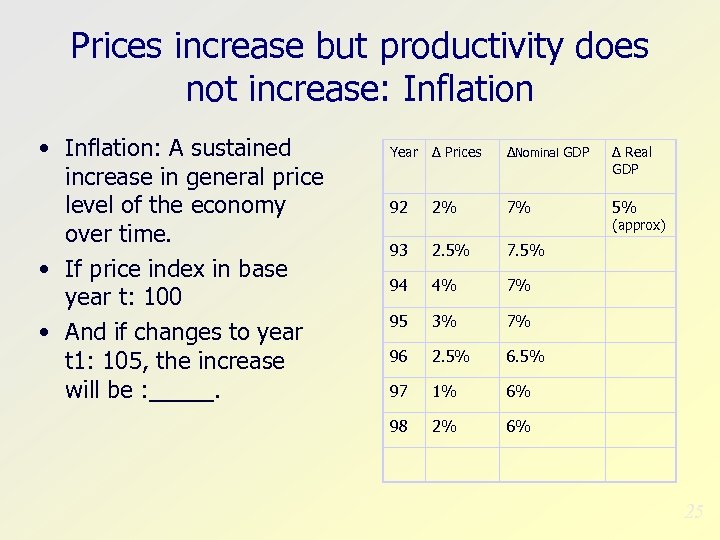

Prices increase but productivity does not increase: Inflation • Inflation: A sustained increase in general price level of the economy over time. • If price index in base year t: 100 • And if changes to year t 1: 105, the increase will be : _____. Year ∆ Prices ∆Nominal GDP ∆ Real GDP 92 2% 7% 5% 93 2. 5% 7. 5% 94 4% 7% 95 3% 7% 96 2. 5% 6. 5% 97 1% 6% 98 2% 6% (approx) 25

Prices increase but productivity does not increase: Inflation • Inflation: A sustained increase in general price level of the economy over time. • If price index in base year t: 100 • And if changes to year t 1: 105, the increase will be : _____. Year ∆ Prices ∆Nominal GDP ∆ Real GDP 92 2% 7% 5% 93 2. 5% 7. 5% 94 4% 7% 95 3% 7% 96 2. 5% 6. 5% 97 1% 6% 98 2% 6% (approx) 25

EXAMPLE 26

EXAMPLE 26

Purchasing Power Parity • Purchasing power parity (PPP) conversion factor. The PPP conversion factor shows how much of a country's currency is needed in that country to buy what $1 would buy in the United States. • By using the PPP conversion factor instead of the currency exchange rate, we can convert a country's GNP per capita calculated in national currency units into GNP per capita in U. S. dollars while taking into account the difference in domestic prices for the same goods. • Thus PPP helps us compare GNPs of different countries more accurately. Because prices are usually lower in developing countries, their GNP per capita expressed in PPP dollars is higher than their GNP per capita expressed in U. S. dollars. 27

Purchasing Power Parity • Purchasing power parity (PPP) conversion factor. The PPP conversion factor shows how much of a country's currency is needed in that country to buy what $1 would buy in the United States. • By using the PPP conversion factor instead of the currency exchange rate, we can convert a country's GNP per capita calculated in national currency units into GNP per capita in U. S. dollars while taking into account the difference in domestic prices for the same goods. • Thus PPP helps us compare GNPs of different countries more accurately. Because prices are usually lower in developing countries, their GNP per capita expressed in PPP dollars is higher than their GNP per capita expressed in U. S. dollars. 27

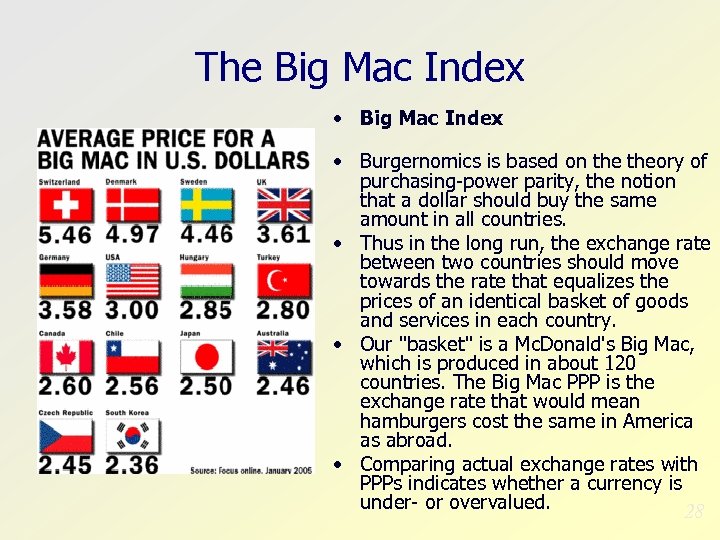

The Big Mac Index • Burgernomics is based on theory of purchasing-power parity, the notion that a dollar should buy the same amount in all countries. • Thus in the long run, the exchange rate between two countries should move towards the rate that equalizes the prices of an identical basket of goods and services in each country. • Our "basket" is a Mc. Donald's Big Mac, which is produced in about 120 countries. The Big Mac PPP is the exchange rate that would mean hamburgers cost the same in America as abroad. • Comparing actual exchange rates with PPPs indicates whether a currency is under- or overvalued. 28

The Big Mac Index • Burgernomics is based on theory of purchasing-power parity, the notion that a dollar should buy the same amount in all countries. • Thus in the long run, the exchange rate between two countries should move towards the rate that equalizes the prices of an identical basket of goods and services in each country. • Our "basket" is a Mc. Donald's Big Mac, which is produced in about 120 countries. The Big Mac PPP is the exchange rate that would mean hamburgers cost the same in America as abroad. • Comparing actual exchange rates with PPPs indicates whether a currency is under- or overvalued. 28

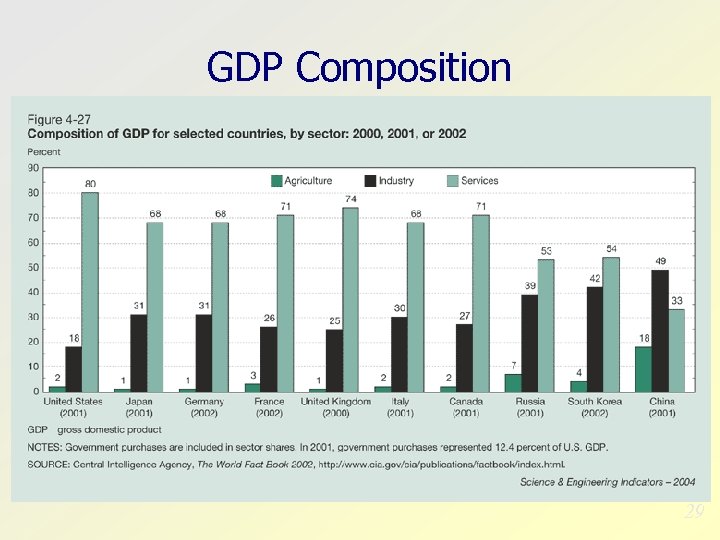

GDP Composition 29

GDP Composition 29

TOTAL GDP enough? • GDP 1: 10, 000$ • Population 1: 5, millions – Gdp / capita: 2$ • GDP 2: 10, 000$ • Pop 2: 700, 000 – Gdp/capita: 14. 2$ • GDP 3: 50, 000 • Pop 3: 28 millions – Gdp/capita: 1. 78$ 30

TOTAL GDP enough? • GDP 1: 10, 000$ • Population 1: 5, millions – Gdp / capita: 2$ • GDP 2: 10, 000$ • Pop 2: 700, 000 – Gdp/capita: 14. 2$ • GDP 3: 50, 000 • Pop 3: 28 millions – Gdp/capita: 1. 78$ 30

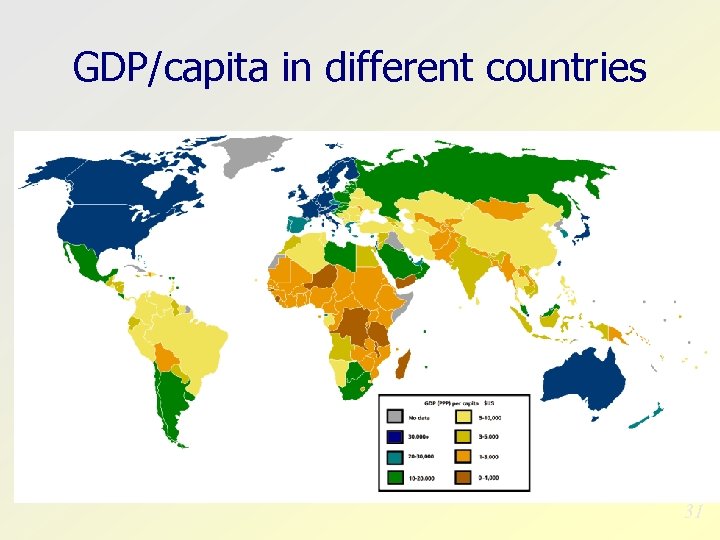

GDP/capita in different countries 31

GDP/capita in different countries 31

GDP per capita 32

GDP per capita 32

GDP AND GDP/Capita WORLD 33

GDP AND GDP/Capita WORLD 33

POPULATION GROWTH RATE 34

POPULATION GROWTH RATE 34

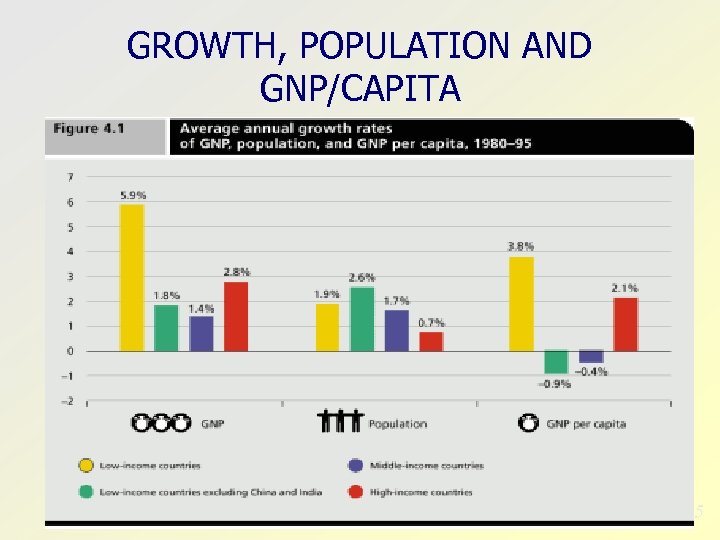

GROWTH, POPULATION AND GNP/CAPITA 35

GROWTH, POPULATION AND GNP/CAPITA 35

Income per capita 36

Income per capita 36

GNP per capita growth rates 37

GNP per capita growth rates 37

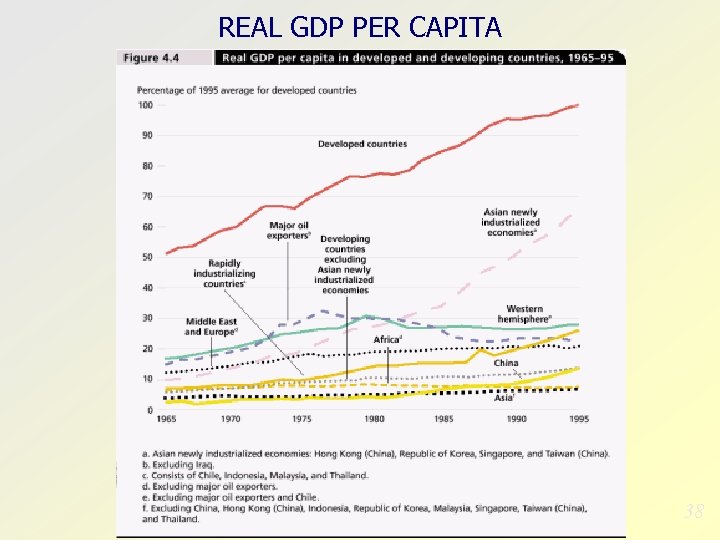

REAL GDP PER CAPITA 38

REAL GDP PER CAPITA 38

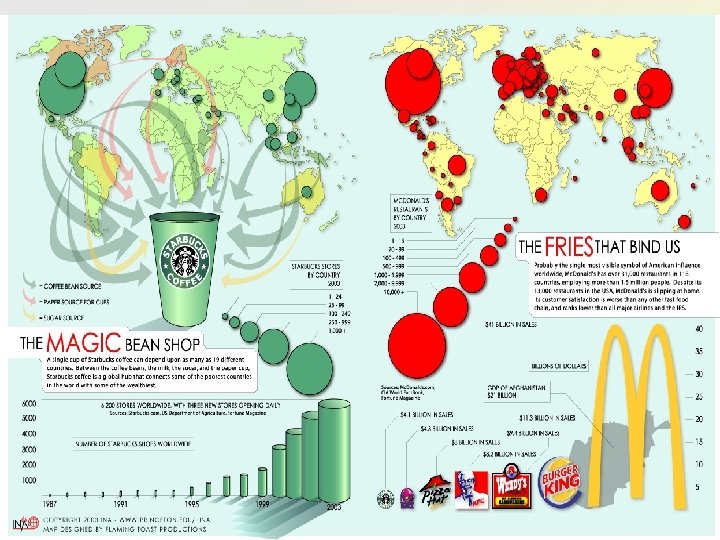

National Income and Firm Sales 39

National Income and Firm Sales 39

TOTAL GDP is ok, but not enough… GDP measures production in an economy…HOWEVER: • Does NOT take in account other variables like: – – Does not separate K or C goods. Underground economy is not taken in account Externalities are not taken in account. Subsistence activities or household activities are not taken in account. – Other issues which reflect standard of living. Education, Health, environment, security, freedom, discrimination, etc… – Income distribution (inequality) 40

TOTAL GDP is ok, but not enough… GDP measures production in an economy…HOWEVER: • Does NOT take in account other variables like: – – Does not separate K or C goods. Underground economy is not taken in account Externalities are not taken in account. Subsistence activities or household activities are not taken in account. – Other issues which reflect standard of living. Education, Health, environment, security, freedom, discrimination, etc… – Income distribution (inequality) 40

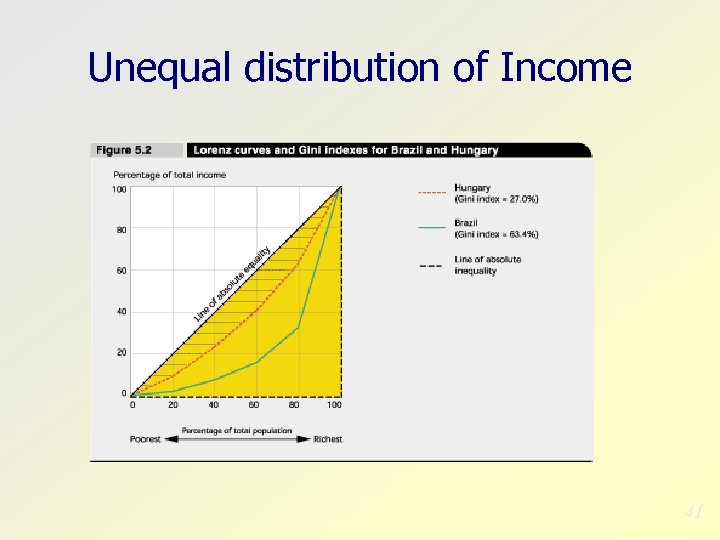

Unequal distribution of Income 41

Unequal distribution of Income 41

THEREFORE: DEVELOPMENT INDEXES ARE NEEDED TO MEASURE the STANDARD OF LIVING IN AN ECONOMY. 42 World dev

THEREFORE: DEVELOPMENT INDEXES ARE NEEDED TO MEASURE the STANDARD OF LIVING IN AN ECONOMY. 42 World dev

Growth and Development • Millennium Development Goals 43

Growth and Development • Millennium Development Goals 43

Growth and Development

Growth and Development

WHY COUNTRIES GROW? • Technology= increase in productivity of other factors. 45

WHY COUNTRIES GROW? • Technology= increase in productivity of other factors. 45

Economic Growth • Growth: An increase in an economy's ability to produce goods and services which brings about a rise in standards of living. • The increase over time in the capacity of an economy to produce goods and services and (ideally) to improve the well-being of its citizens. 46

Economic Growth • Growth: An increase in an economy's ability to produce goods and services which brings about a rise in standards of living. • The increase over time in the capacity of an economy to produce goods and services and (ideally) to improve the well-being of its citizens. 46

Development • Economic Development: The process of improving the quality of human life through increasing per capita income, reducing poverty, and enhancing individual economic opportunities. • Economic Development: is typically measured in terms of jobs and income, but it also includes improvements in human development, education, health, choice, and environmental sustainability The power of one: hyperlink 47

Development • Economic Development: The process of improving the quality of human life through increasing per capita income, reducing poverty, and enhancing individual economic opportunities. • Economic Development: is typically measured in terms of jobs and income, but it also includes improvements in human development, education, health, choice, and environmental sustainability The power of one: hyperlink 47

DEVELOPMENT 48

DEVELOPMENT 48

HOWEVER: Difficulties in measuring development • Subjective Variables (culture and religion? ) • Not available statistics • Different indicators to compare development between countries and Institutions. (U. N. , WB, WTO, IMF, etc) • LDC, MDC, etc… 49

HOWEVER: Difficulties in measuring development • Subjective Variables (culture and religion? ) • Not available statistics • Different indicators to compare development between countries and Institutions. (U. N. , WB, WTO, IMF, etc) • LDC, MDC, etc… 49

World Bank Income Classification: • Income group: Economies are divided according to 2006 GNI per capita. • The groups are: – low income: $905 or less; – lower middle income: $906 - $3, 595; – upper middle income: $3, 596 - $11, 115; and – high income: $11, 116 or more. 50

World Bank Income Classification: • Income group: Economies are divided according to 2006 GNI per capita. • The groups are: – low income: $905 or less; – lower middle income: $906 - $3, 595; – upper middle income: $3, 596 - $11, 115; and – high income: $11, 116 or more. 50

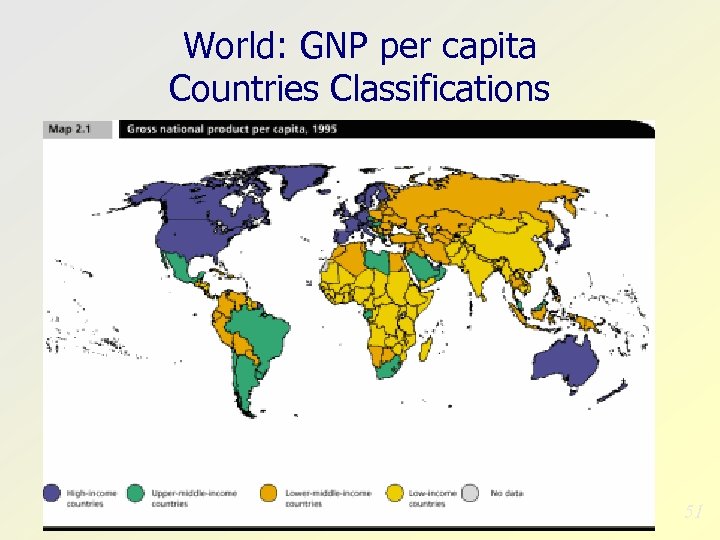

World: GNP per capita Countries Classifications 51

World: GNP per capita Countries Classifications 51

U. N. HDI Classification 52

U. N. HDI Classification 52

High Human development • • • 1 -Iceland Norway Australia Canada Ireland Sweden Switzerland Japan Netherlands France Finland United States Spain Denmark Austria United Kingdom Belgium Luxembourg New Zealand Italy Hong Kong, China (SAR) Germany Israel Greece Singapore Korea, Rep. of Slovenia Cyprus Portugal Brunei Darussalam Barbados Czech Republic Kuwait Malta Qatar Hungary Poland Argentina United Arab Emirates Chile Bahrain Slovakia Lithuania Estonia Latvia Uruguay Croatia Costa Rica Bahamas Seychelles Cuba Mexico Bulgaria Saint Kitts Nevis Tonga Libyan Arab Jamahiriya Antigua and Barbuda Oman Trinidad and Tobago Romania Saudi Arabia Panama Malaysia Belarus Mauritius Bosnia Herzegovina Russian Federation Albania Macedonia, TFYR Brazil-70 53

High Human development • • • 1 -Iceland Norway Australia Canada Ireland Sweden Switzerland Japan Netherlands France Finland United States Spain Denmark Austria United Kingdom Belgium Luxembourg New Zealand Italy Hong Kong, China (SAR) Germany Israel Greece Singapore Korea, Rep. of Slovenia Cyprus Portugal Brunei Darussalam Barbados Czech Republic Kuwait Malta Qatar Hungary Poland Argentina United Arab Emirates Chile Bahrain Slovakia Lithuania Estonia Latvia Uruguay Croatia Costa Rica Bahamas Seychelles Cuba Mexico Bulgaria Saint Kitts Nevis Tonga Libyan Arab Jamahiriya Antigua and Barbuda Oman Trinidad and Tobago Romania Saudi Arabia Panama Malaysia Belarus Mauritius Bosnia Herzegovina Russian Federation Albania Macedonia, TFYR Brazil-70 53

Medium Human Development • • • Dominica Saint Lucia Kazakhstan Venezuela, Rep. Bov. Colombia Ukraine Samoa Thailand Dominican Republic Belize China Grenada Armenia Turkey Suriname Jordan Peru Lebanon Ecuador Philippines Tunisia Saint Vincent and the Grenadines Fiji Iran, Islamic Rep. of Paraguay Georgia Guyana Azerbaijan Sri Lanka Maldives Jamaica Cape Verde El Salvador Algeria Viet Nam Occupied Palestinian Territories Indonesia Syrian Arab Republic Turkmenistan Nicaragua Moldova Egypt Uzbekistan Mongolia Honduras Kyrgyzstan Bolivia Guatemala Gabon Vanuatu South Africa • • Tajikistan São Tomé and Principe Botswana Namibia Morocco Equatorial Guinea India Solomon Islands Lao, People's Dem. Rep. Cambodia Myanmar Bhutan Comoros Ghana Pakistan Mauritania Lesotho Congo Bangladesh Swaziland Nepal Madagascar Cameroon Papua New Guinea Haiti Sudan Kenya Djibouti Timor-Leste Zimbabwe Togo Yemen Uganda Gambia 54

Medium Human Development • • • Dominica Saint Lucia Kazakhstan Venezuela, Rep. Bov. Colombia Ukraine Samoa Thailand Dominican Republic Belize China Grenada Armenia Turkey Suriname Jordan Peru Lebanon Ecuador Philippines Tunisia Saint Vincent and the Grenadines Fiji Iran, Islamic Rep. of Paraguay Georgia Guyana Azerbaijan Sri Lanka Maldives Jamaica Cape Verde El Salvador Algeria Viet Nam Occupied Palestinian Territories Indonesia Syrian Arab Republic Turkmenistan Nicaragua Moldova Egypt Uzbekistan Mongolia Honduras Kyrgyzstan Bolivia Guatemala Gabon Vanuatu South Africa • • Tajikistan São Tomé and Principe Botswana Namibia Morocco Equatorial Guinea India Solomon Islands Lao, People's Dem. Rep. Cambodia Myanmar Bhutan Comoros Ghana Pakistan Mauritania Lesotho Congo Bangladesh Swaziland Nepal Madagascar Cameroon Papua New Guinea Haiti Sudan Kenya Djibouti Timor-Leste Zimbabwe Togo Yemen Uganda Gambia 54

Low Human Development • Senegal Eritrea Nigeria Tanzania, U. Rep. of Guinea Rwanda • Angola Benin Malawi Zambia Côte d'Ivoire Burundi Congo, Dem. Rep. Ethiopia Chad Central African Republic Mozambique Mali • Niger Guinea-Bissau Burkina Faso Sierra Leone 55

Low Human Development • Senegal Eritrea Nigeria Tanzania, U. Rep. of Guinea Rwanda • Angola Benin Malawi Zambia Côte d'Ivoire Burundi Congo, Dem. Rep. Ethiopia Chad Central African Republic Mozambique Mali • Niger Guinea-Bissau Burkina Faso Sierra Leone 55