fd3a216d802f22ea995b2c95fa1bb3ae.ppt

- Количество слайдов: 25

“Macroeconomics of Housing Markets” Discussion of the papers presented in Session 4 Timo Wollmershäuser (Ifo Institute Munich, University of Munich, CESifo)

“Macroeconomics of Housing Markets” Discussion of the papers presented in Session 4 Timo Wollmershäuser (Ifo Institute Munich, University of Munich, CESifo)

Session overview § Session 4: Housing, Credit and Monetary Policy 1. 2. 3. § Tobias Duemmler and Stephan Kienle, “User costs of housing when households face a credit constraint - Evidence for Germany” Sébastian Frappa, Jean-Stéphane Mésonnier, “The housing price boom of the late 90 s: Did inflation targeting matter? ” Vladimir Borgy, Laurent Clerc and Jean-Paul Renne, “Asset boom-bust cycles and credit: what is the scope of macro prudential supervision? ” The Duemmler/Kienle paper is about a particular aspect of macroeconomic modeling. § It investigates the implications and the empirical evidence of credit constraints for households’ housing demand decisions. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Session overview § Session 4: Housing, Credit and Monetary Policy 1. 2. 3. § Tobias Duemmler and Stephan Kienle, “User costs of housing when households face a credit constraint - Evidence for Germany” Sébastian Frappa, Jean-Stéphane Mésonnier, “The housing price boom of the late 90 s: Did inflation targeting matter? ” Vladimir Borgy, Laurent Clerc and Jean-Paul Renne, “Asset boom-bust cycles and credit: what is the scope of macro prudential supervision? ” The Duemmler/Kienle paper is about a particular aspect of macroeconomic modeling. § It investigates the implications and the empirical evidence of credit constraints for households’ housing demand decisions. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Session overview § The other two papers have a clear policy focus They try to shed some light on the causes of asset price booms. § They aim at drawing conclusions for monetary and regulatory policies. § These two papers are complementary: § • One focuses on institutions (inflation targeting versus no inflation targeting). • The other follows a pure time series approach. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Session overview § The other two papers have a clear policy focus They try to shed some light on the causes of asset price booms. § They aim at drawing conclusions for monetary and regulatory policies. § These two papers are complementary: § • One focuses on institutions (inflation targeting versus no inflation targeting). • The other follows a pure time series approach. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Tobias Duemmler and Stephan Kienle “User costs of housing when households face a credit constraint - Evidence for Germany” “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Tobias Duemmler and Stephan Kienle “User costs of housing when households face a credit constraint - Evidence for Germany” “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Duemmler/Kienle paper § The paper theoretically derives a housing demand equation from the first-order conditions of a representative household that draws utility from the consumption of non-durable goods and the use of housing services. § It shows that if in the maximization procedure the household is subject to a credit constraint (implying that the real value of credit is limited to a positive fraction of the real stock of housing), the user costs of housing are not only determined by the real market value of a new house, the real costs of mortgage debt and the depreciation rate § but also by an additional term that is determined by the loanto-value ratio and the gap between consumer and house price inflation. § “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Duemmler/Kienle paper § The paper theoretically derives a housing demand equation from the first-order conditions of a representative household that draws utility from the consumption of non-durable goods and the use of housing services. § It shows that if in the maximization procedure the household is subject to a credit constraint (implying that the real value of credit is limited to a positive fraction of the real stock of housing), the user costs of housing are not only determined by the real market value of a new house, the real costs of mortgage debt and the depreciation rate § but also by an additional term that is determined by the loanto-value ratio and the gap between consumer and house price inflation. § “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Duemmler/Kienle paper § The authors estimate the resulting housing demand equation for the German economy and try to find out whether the assumption that credit constraints have an impact on the households’ decision problem really matters. § Their results indicate § § that credit constraints play a significant role that in periods where consumer prices are rising faster than house prices (as is the case in Germany from the mid 1990 s on) the user costs of housing (the shadow price of housing services) for constrained households is higher than for unconstrained households “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Duemmler/Kienle paper § The authors estimate the resulting housing demand equation for the German economy and try to find out whether the assumption that credit constraints have an impact on the households’ decision problem really matters. § Their results indicate § § that credit constraints play a significant role that in periods where consumer prices are rising faster than house prices (as is the case in Germany from the mid 1990 s on) the user costs of housing (the shadow price of housing services) for constrained households is higher than for unconstrained households “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Discussion of the Duemmler/Kienle paper § General comments A very thorough cointegration analysis, including all the tests that a referee would like to see. § A very interesting approach to get an indirect estimate of the loan-to-value ratio. § You are denoting the loan-to-value ratio as marginal loan-tovalue ratio. It is not clear to me why you are emphasizing this marginal nature of your estimate several times in your paper. Since in your empirical set-up you are using macroeconomic time series, I would rather call the resulting estimate as average loan-to-value ratio. § “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Discussion of the Duemmler/Kienle paper § General comments A very thorough cointegration analysis, including all the tests that a referee would like to see. § A very interesting approach to get an indirect estimate of the loan-to-value ratio. § You are denoting the loan-to-value ratio as marginal loan-tovalue ratio. It is not clear to me why you are emphasizing this marginal nature of your estimate several times in your paper. Since in your empirical set-up you are using macroeconomic time series, I would rather call the resulting estimate as average loan-to-value ratio. § “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

User costs derived from a theoretical model § The Steady-state of a consolidated first-order condition of the maximization problem of a representative household that faces a credit constraint is given by: § The credit constraint is defined as: § If we assume a fully constrained household and set the loan-to-value ratio to zero, the user cost definition collapses to which, however, equals the user costs definition resulting from the maximization problem of a household without credit constraint. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

User costs derived from a theoretical model § The Steady-state of a consolidated first-order condition of the maximization problem of a representative household that faces a credit constraint is given by: § The credit constraint is defined as: § If we assume a fully constrained household and set the loan-to-value ratio to zero, the user cost definition collapses to which, however, equals the user costs definition resulting from the maximization problem of a household without credit constraint. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Empirical paper without data appendix § What are the sources of the time series used for the regressions? § House price data and flow of funds data is only available on an annual basis in Germany: How did you construct quarterly data? § What kind of interest rate was used to calculate the user costs of housing? “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Empirical paper without data appendix § What are the sources of the time series used for the regressions? § House price data and flow of funds data is only available on an annual basis in Germany: How did you construct quarterly data? § What kind of interest rate was used to calculate the user costs of housing? “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Estimate of the steady-state inflation gap § If the mean (the steady state) of the inflation gap was zero, the existence of credit constraints would be irrelevant for calculating the user costs of housing. It seems that the sample chosen by the authors (1982 -2007) is driven by this precondition. § If the sample started before 1980 or after 1985 (which would probably render the sample too short for a reasonable cointegration analysis), the simple mean of the inflation gap wouldn’t be statistically different from zero. § “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Estimate of the steady-state inflation gap § If the mean (the steady state) of the inflation gap was zero, the existence of credit constraints would be irrelevant for calculating the user costs of housing. It seems that the sample chosen by the authors (1982 -2007) is driven by this precondition. § If the sample started before 1980 or after 1985 (which would probably render the sample too short for a reasonable cointegration analysis), the simple mean of the inflation gap wouldn’t be statistically different from zero. § “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

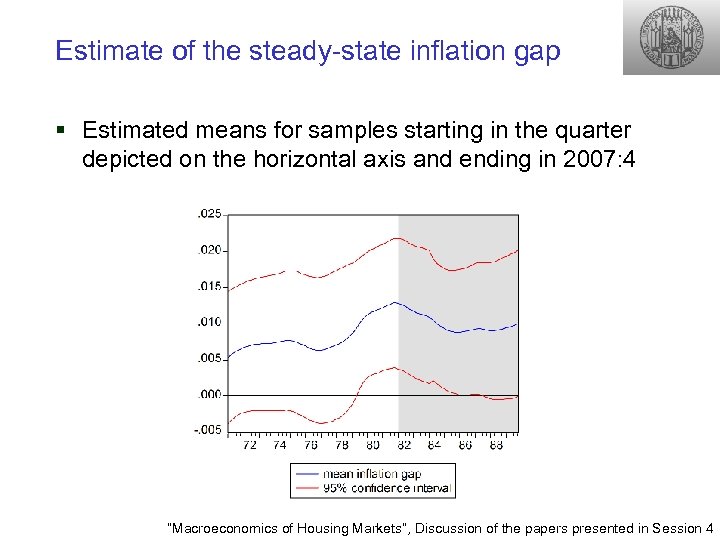

Estimate of the steady-state inflation gap § Estimated means for samples starting in the quarter depicted on the horizontal axis and ending in 2007: 4 “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Estimate of the steady-state inflation gap § Estimated means for samples starting in the quarter depicted on the horizontal axis and ending in 2007: 4 “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

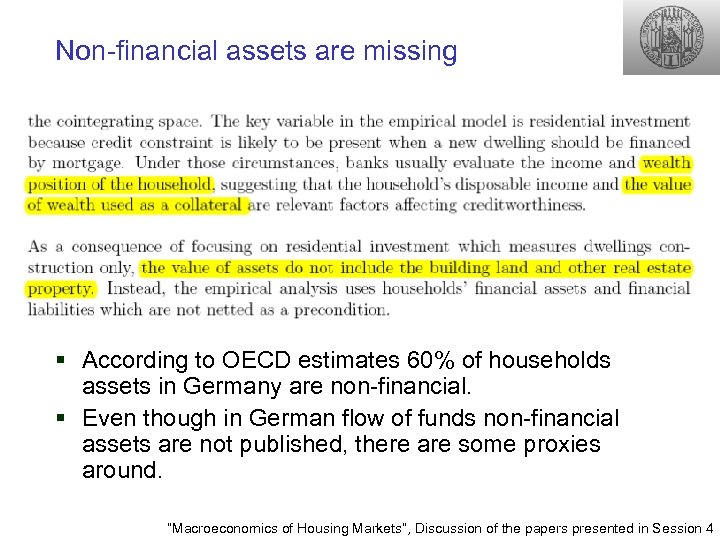

Non-financial assets are missing § According to OECD estimates 60% of households assets in Germany are non-financial. § Even though in German flow of funds non-financial assets are not published, there are some proxies around. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Non-financial assets are missing § According to OECD estimates 60% of households assets in Germany are non-financial. § Even though in German flow of funds non-financial assets are not published, there are some proxies around. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

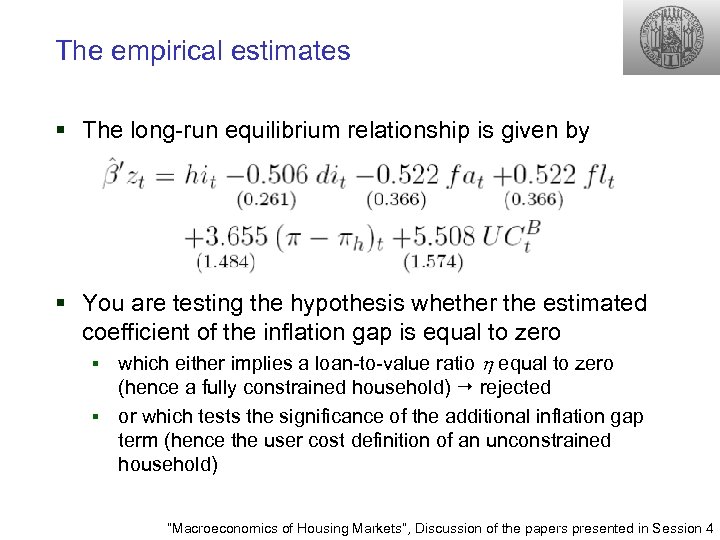

The empirical estimates § The long-run equilibrium relationship is given by § You are testing the hypothesis whether the estimated coefficient of the inflation gap is equal to zero which either implies a loan-to-value ratio equal to zero (hence a fully constrained household) rejected § or which tests the significance of the additional inflation gap term (hence the user cost definition of an unconstrained household) § “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

The empirical estimates § The long-run equilibrium relationship is given by § You are testing the hypothesis whether the estimated coefficient of the inflation gap is equal to zero which either implies a loan-to-value ratio equal to zero (hence a fully constrained household) rejected § or which tests the significance of the additional inflation gap term (hence the user cost definition of an unconstrained household) § “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Sébastian Frappa, Jean-Stéphane Mésonnier “The housing price boom of the late 90 s: Did inflation targeting matter? ” “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Sébastian Frappa, Jean-Stéphane Mésonnier “The housing price boom of the late 90 s: Did inflation targeting matter? ” “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Frappa/Méssonier paper § FM present an empirical study about the consequences of inflation targeting (IT) policies for financial stability. § Hypothesis: § Since IT central banks primarily aim at stabilizing inflation over a 2 -3 years horizon, such a policy could actively contribute to damaging financial stability at longer horizons. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Frappa/Méssonier paper § FM present an empirical study about the consequences of inflation targeting (IT) policies for financial stability. § Hypothesis: § Since IT central banks primarily aim at stabilizing inflation over a 2 -3 years horizon, such a policy could actively contribute to damaging financial stability at longer horizons. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Frappa/Méssonier paper § The reason for putting up this hypothesis is that central banks tend to neglect monetary and financial developments which are deemed irrelevant for future inflation in the short to medium term: Either because financial imbalances do not materialize into consumer price inflation in the short and medium term. § Or because inflation expectations of many investors may still be above the target (in particular in the transition phase to a credible IT regime), which reduces ex-ante real interest rates and stimulates investment e. g. in housing. § “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Frappa/Méssonier paper § The reason for putting up this hypothesis is that central banks tend to neglect monetary and financial developments which are deemed irrelevant for future inflation in the short to medium term: Either because financial imbalances do not materialize into consumer price inflation in the short and medium term. § Or because inflation expectations of many investors may still be above the target (in particular in the transition phase to a credible IT regime), which reduces ex-ante real interest rates and stimulates investment e. g. in housing. § “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Frappa/Méssonier paper § The empirical approach is a program evaluation methodology which is composed of two steps. § In the first step FM estimate a propensity score using a pooled probit regression for 17 industrial countries where the dependent variable is an inflation targeting dummy (equal to 1 if IT is adopted) § and the RHS variables are the factors deemed to influence both the choice of an inflation targeting strategy and the dynamics of house prices (real interest rate, real disposable income, fixed exchange rate regime, private credit-to-GDP ratio, mortgage market sophistication). § “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Frappa/Méssonier paper § The empirical approach is a program evaluation methodology which is composed of two steps. § In the first step FM estimate a propensity score using a pooled probit regression for 17 industrial countries where the dependent variable is an inflation targeting dummy (equal to 1 if IT is adopted) § and the RHS variables are the factors deemed to influence both the choice of an inflation targeting strategy and the dynamics of house prices (real interest rate, real disposable income, fixed exchange rate regime, private credit-to-GDP ratio, mortgage market sophistication). § “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Frappa/Méssonier paper § In the second step they match the treated and untreated units according to their propensity scores in order to get estimates of the conditional treatment effect § They are in particular interested in the effect of IT adoption on the real (and nominal) growth rate of house prices and on the price-to-rent ratio. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Frappa/Méssonier paper § In the second step they match the treated and untreated units according to their propensity scores in order to get estimates of the conditional treatment effect § They are in particular interested in the effect of IT adoption on the real (and nominal) growth rate of house prices and on the price-to-rent ratio. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Frappa/Méssonier paper § The main result of their paper is that they find evidence of a positive and significant effect of running an IT strategy on housing price inflation and the house price to rent ratio. § When they calculate an average of the findings across all model variants, inflation targeting is associated with an increase in real housing price growth by 2. 2 percentage points, while the price to rent ratio is increased by 10 percentage points. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Frappa/Méssonier paper § The main result of their paper is that they find evidence of a positive and significant effect of running an IT strategy on housing price inflation and the house price to rent ratio. § When they calculate an average of the findings across all model variants, inflation targeting is associated with an increase in real housing price growth by 2. 2 percentage points, while the price to rent ratio is increased by 10 percentage points. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Vladimir Borgy, Laurent Clerc and Jean-Paul Renne “Asset boom-bust cycles and credit: what is the scope of macro prudential supervision? ” “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Vladimir Borgy, Laurent Clerc and Jean-Paul Renne “Asset boom-bust cycles and credit: what is the scope of macro prudential supervision? ” “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Borgy/Clerc/Renne paper § This paper tries to give some advice on how regulatory policies (in particular macro-prudential policies) should be designed in order to prevent the build-up of asset price bubbles. § The discussion mainly centers around the question of rules (automatic stabilizers) versus discretion (statedependent policies) in the policy design. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Borgy/Clerc/Renne paper § This paper tries to give some advice on how regulatory policies (in particular macro-prudential policies) should be designed in order to prevent the build-up of asset price bubbles. § The discussion mainly centers around the question of rules (automatic stabilizers) versus discretion (statedependent policies) in the policy design. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Borgy/Clerc/Renne paper § The empirical approach focuses on 2 asset prices (stock prices and house prices) for a panel of 18 OECD countries (1970 -2008) § First step BCR identify asset price booms and busts and distinguish between costly and non-costly boom periods. § A major goal is to get results that are robust across different empirical identification methods. § Here: 4 univariate backward-looking filters that decompose the asset price series into trend and cycle. § “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Borgy/Clerc/Renne paper § The empirical approach focuses on 2 asset prices (stock prices and house prices) for a panel of 18 OECD countries (1970 -2008) § First step BCR identify asset price booms and busts and distinguish between costly and non-costly boom periods. § A major goal is to get results that are robust across different empirical identification methods. § Here: 4 univariate backward-looking filters that decompose the asset price series into trend and cycle. § “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Borgy/Clerc/Renne paper § Second step BCR identify the macro determinants of asset price booms (identified in step 1) and compare the determinants of costly booms with those of non-costly booms. § The methods used are § • a non-parametric (Kruskall-Wallis) test, which tests for the equality of population medians among groups • a non-linear probability (logit) model § Here again BCR aim at identifying macro determinants that are robust across the univariate filtering methods. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Borgy/Clerc/Renne paper § Second step BCR identify the macro determinants of asset price booms (identified in step 1) and compare the determinants of costly booms with those of non-costly booms. § The methods used are § • a non-parametric (Kruskall-Wallis) test, which tests for the equality of population medians among groups • a non-linear probability (logit) model § Here again BCR aim at identifying macro determinants that are robust across the univariate filtering methods. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Borgy/Clerc/Renne paper § Results § In comparison to stock price booms, house price booms • are more robustly identified across the different filter techniques • more frequently end up in costly recessions • are less correlated across countries § Concerning the determinants, • credit variables • and above-trend real activity play a significant role in triggering asset price booms. • Interest rates have a significant negative impact on the build-up pf asset price booms, but a positive impact on the economic costs following the boom. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Borgy/Clerc/Renne paper § Results § In comparison to stock price booms, house price booms • are more robustly identified across the different filter techniques • more frequently end up in costly recessions • are less correlated across countries § Concerning the determinants, • credit variables • and above-trend real activity play a significant role in triggering asset price booms. • Interest rates have a significant negative impact on the build-up pf asset price booms, but a positive impact on the economic costs following the boom. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Borgy/Clerc/Renne paper § Their main policy conclusion is that since not all asset price booms (in particular stock price booms) turn into costly recessions, it would detrimental to implement rule-based macro-prudential policies. § They rather recommend state-dependent policies that address excess-credit developments instead of all credit expansions per se. § However, it is still an open issue on how to distinguish excess-credit developments from “normal” credit expansions in real time. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4

Summary of the Borgy/Clerc/Renne paper § Their main policy conclusion is that since not all asset price booms (in particular stock price booms) turn into costly recessions, it would detrimental to implement rule-based macro-prudential policies. § They rather recommend state-dependent policies that address excess-credit developments instead of all credit expansions per se. § However, it is still an open issue on how to distinguish excess-credit developments from “normal” credit expansions in real time. “Macroeconomics of Housing Markets”, Discussion of the papers presented in Session 4