19b127f44c1e4630f05f55ef537a00f9.ppt

- Количество слайдов: 65

MACROECONOMICS LECTURE 2

MACROECONOMICS LECTURE 2

FISCAL POLICY • There a variety of ways in which policy makers can influence the economy • Fiscal policy is the government’s decisions about spending and taxes; it is where the government uses changes in government spending or taxes to influence the economy

FISCAL POLICY • There a variety of ways in which policy makers can influence the economy • Fiscal policy is the government’s decisions about spending and taxes; it is where the government uses changes in government spending or taxes to influence the economy

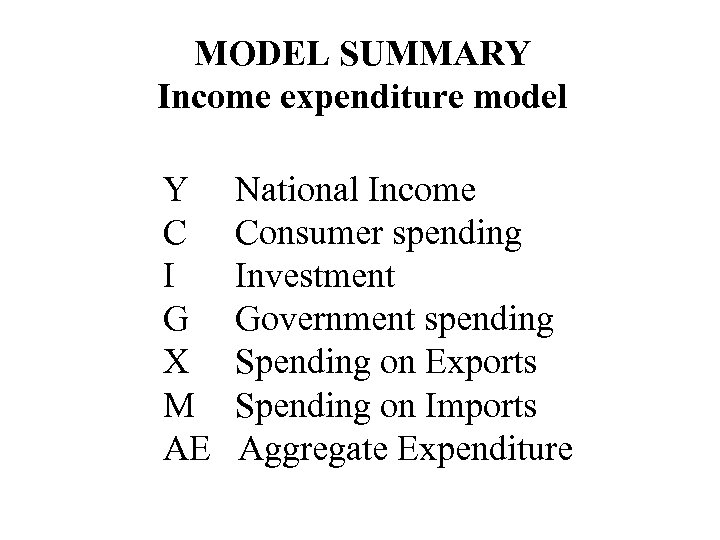

MODEL SUMMARY Income expenditure model Y C I G X M AE National Income Consumer spending Investment Government spending Spending on Exports Spending on Imports Aggregate Expenditure

MODEL SUMMARY Income expenditure model Y C I G X M AE National Income Consumer spending Investment Government spending Spending on Exports Spending on Imports Aggregate Expenditure

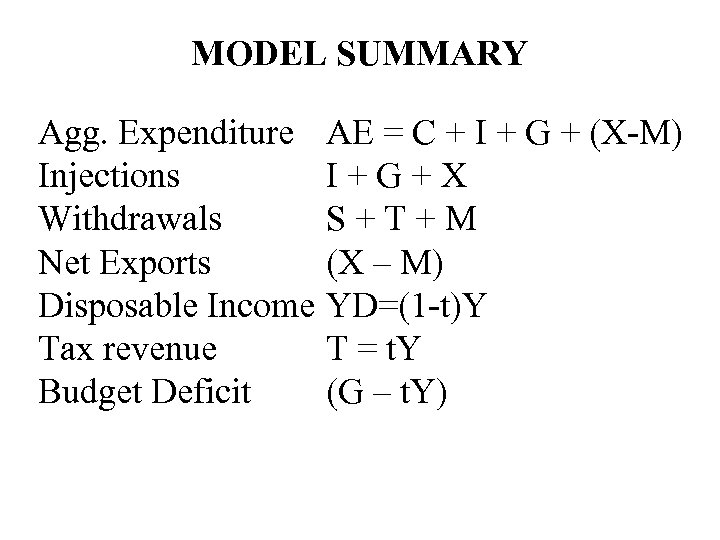

MODEL SUMMARY Agg. Expenditure Injections Withdrawals Net Exports Disposable Income Tax revenue Budget Deficit AE = C + I + G + (X-M) I+G+X S+T+M (X – M) YD=(1 -t)Y T = t. Y (G – t. Y)

MODEL SUMMARY Agg. Expenditure Injections Withdrawals Net Exports Disposable Income Tax revenue Budget Deficit AE = C + I + G + (X-M) I+G+X S+T+M (X – M) YD=(1 -t)Y T = t. Y (G – t. Y)

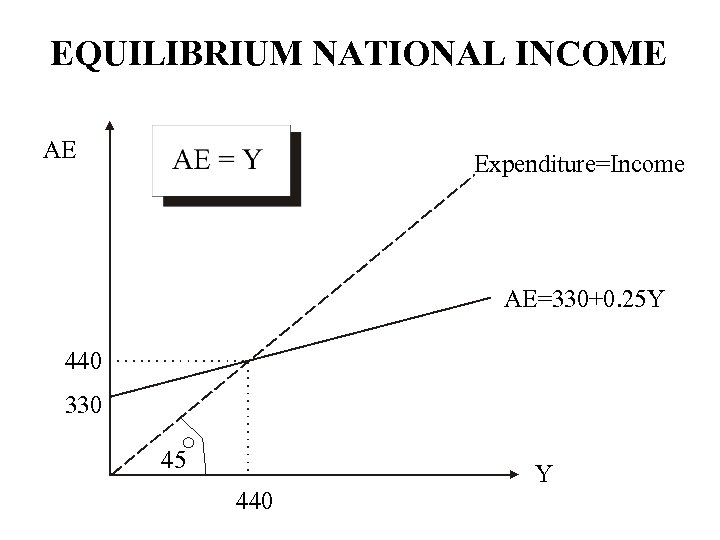

EQUILIBRIUM NATIONAL INCOME AE Expenditure=Income AE=330+0. 25 Y 440 330 45 440 Y

EQUILIBRIUM NATIONAL INCOME AE Expenditure=Income AE=330+0. 25 Y 440 330 45 440 Y

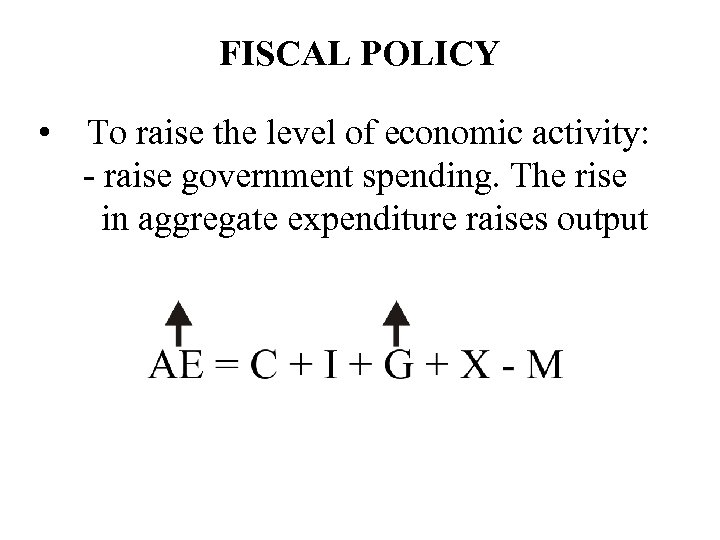

FISCAL POLICY • To raise the level of economic activity: - raise government spending. The rise in aggregate expenditure raises output

FISCAL POLICY • To raise the level of economic activity: - raise government spending. The rise in aggregate expenditure raises output

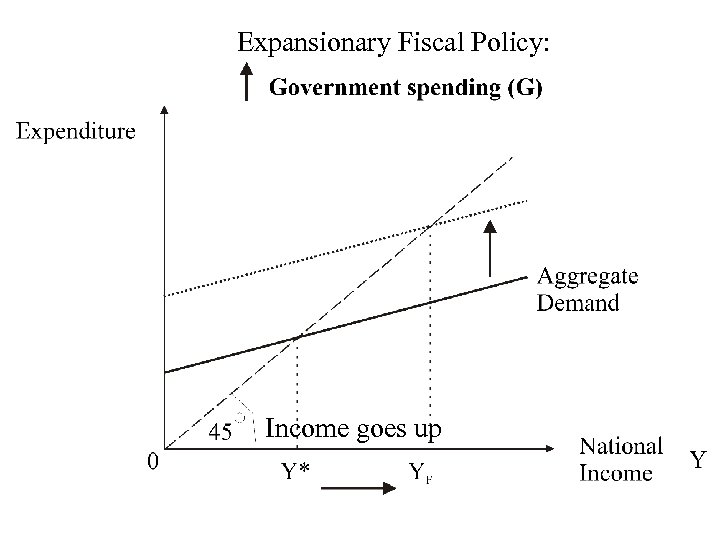

Expansionary Fiscal Policy: Income goes up

Expansionary Fiscal Policy: Income goes up

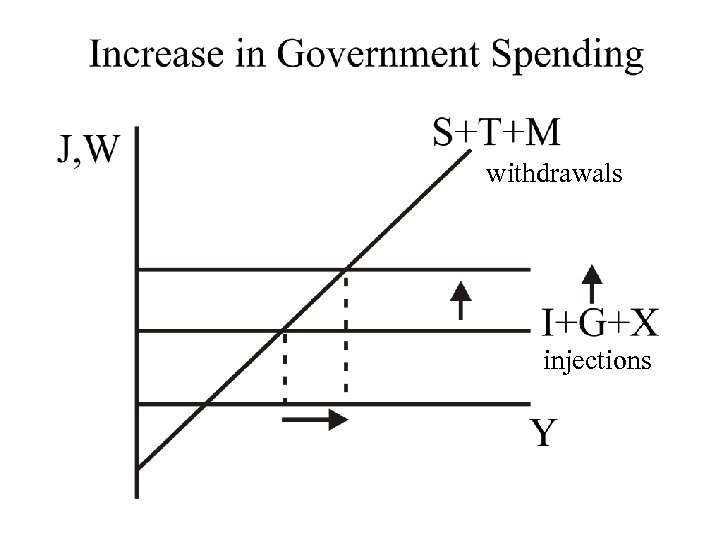

withdrawals injections

withdrawals injections

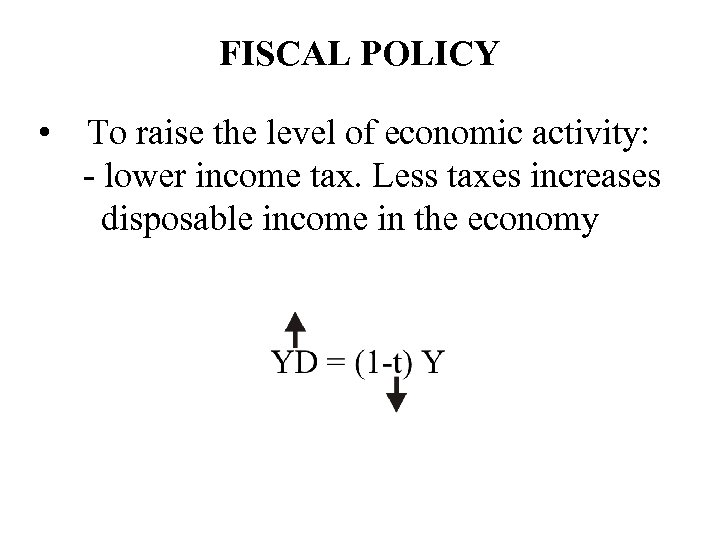

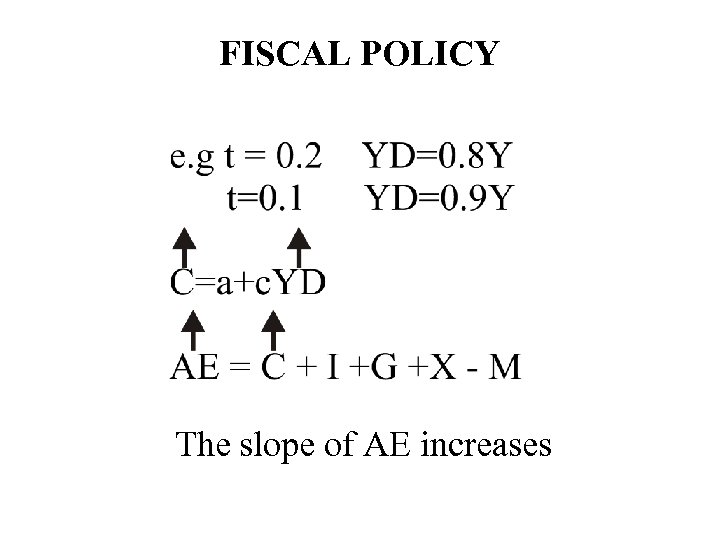

FISCAL POLICY • To raise the level of economic activity: - lower income tax. Less taxes increases disposable income in the economy

FISCAL POLICY • To raise the level of economic activity: - lower income tax. Less taxes increases disposable income in the economy

FISCAL POLICY The slope of AE increases

FISCAL POLICY The slope of AE increases

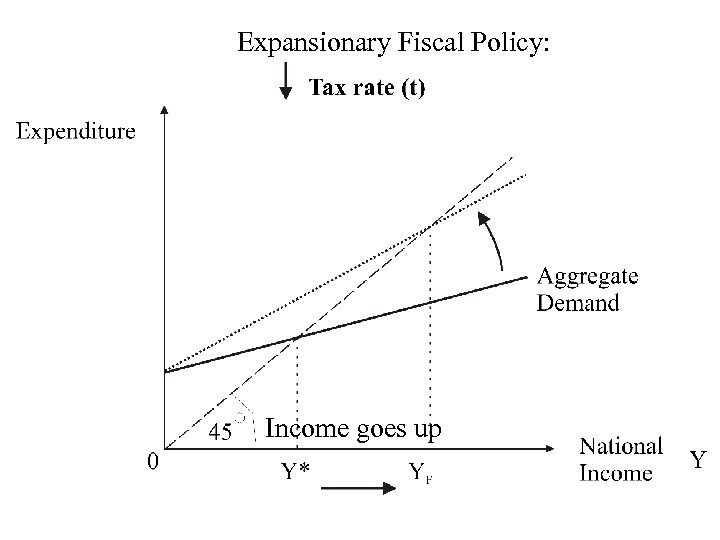

Expansionary Fiscal Policy: Income goes up

Expansionary Fiscal Policy: Income goes up

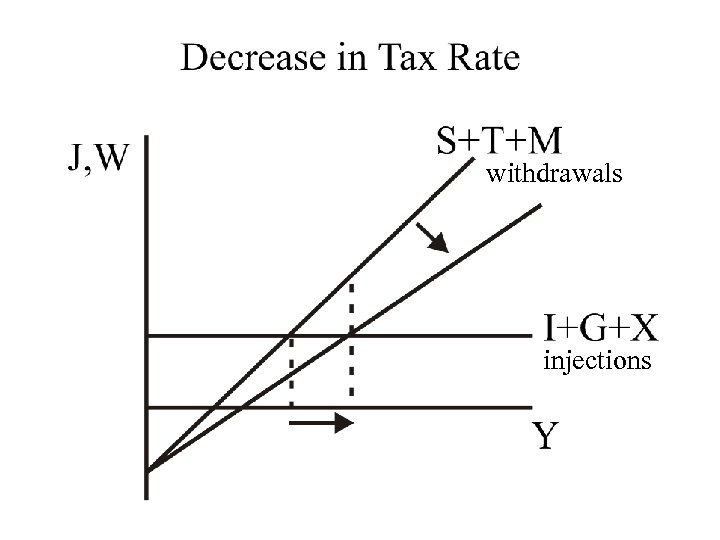

withdrawals injections

withdrawals injections

Conversely: To lower economic activity (Y) - lower government spending - raise taxes Graphically this looks like this…

Conversely: To lower economic activity (Y) - lower government spending - raise taxes Graphically this looks like this…

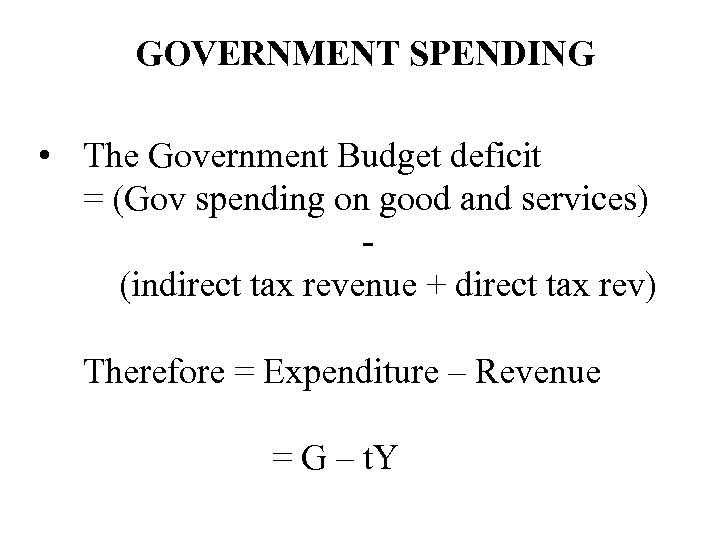

GOVERNMENT SPENDING • The Government Budget deficit = (Gov spending on good and services) (indirect tax revenue + direct tax rev) Therefore = Expenditure – Revenue = G – t. Y

GOVERNMENT SPENDING • The Government Budget deficit = (Gov spending on good and services) (indirect tax revenue + direct tax rev) Therefore = Expenditure – Revenue = G – t. Y

FISCAL POLICY • When considering fiscal policy we need to be aware of: The Multiplier Effect

FISCAL POLICY • When considering fiscal policy we need to be aware of: The Multiplier Effect

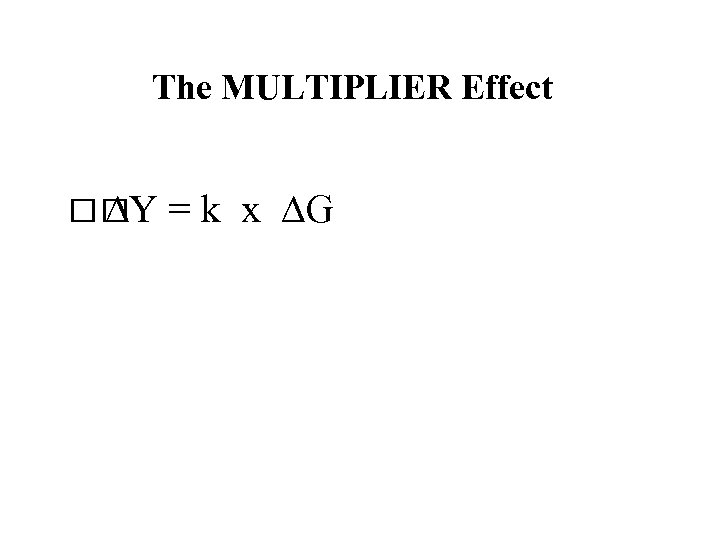

The MULTIPLIER Effect Y = k x G

The MULTIPLIER Effect Y = k x G

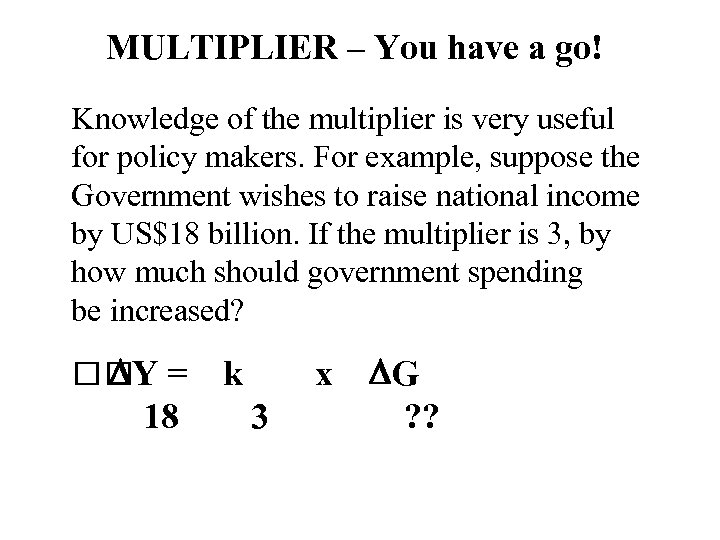

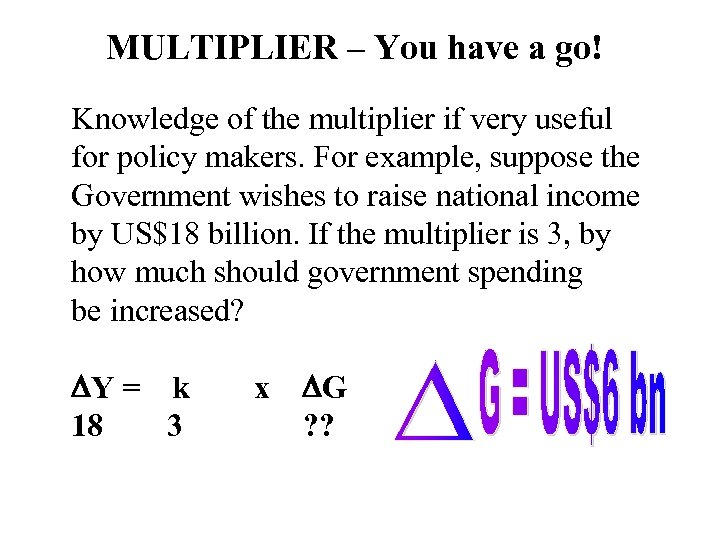

MULTIPLIER – You have a go! Knowledge of the multiplier is very useful for policy makers. For example, suppose the Government wishes to raise national income by US$18 billion. If the multiplier is 3, by how much should government spending be increased? = Y 18 k x 3 G ? ?

MULTIPLIER – You have a go! Knowledge of the multiplier is very useful for policy makers. For example, suppose the Government wishes to raise national income by US$18 billion. If the multiplier is 3, by how much should government spending be increased? = Y 18 k x 3 G ? ?

MULTIPLIER – You have a go! Knowledge of the multiplier if very useful for policy makers. For example, suppose the Government wishes to raise national income by US$18 billion. If the multiplier is 3, by how much should government spending be increased? Y = k 18 3 x G ? ?

MULTIPLIER – You have a go! Knowledge of the multiplier if very useful for policy makers. For example, suppose the Government wishes to raise national income by US$18 billion. If the multiplier is 3, by how much should government spending be increased? Y = k 18 3 x G ? ?

NEXT TOPIC • As well as using fiscal policy to influence the economy, governments can also use Monetary Policy • In England, the Bank of England is responsible for Monetary Policy • To understand what is meant by Monetary Policy we must first understand what is meant by “Money”

NEXT TOPIC • As well as using fiscal policy to influence the economy, governments can also use Monetary Policy • In England, the Bank of England is responsible for Monetary Policy • To understand what is meant by Monetary Policy we must first understand what is meant by “Money”

MONEY • Historically many items have served as money e. g. dogs teeth (admiralty islands), sea shells (Africa), gold (19 th Century), cigarettes (prisoner of war camps) notes and coins (legal tender) • To serve as “money” an item must fulfill as number of functions…

MONEY • Historically many items have served as money e. g. dogs teeth (admiralty islands), sea shells (Africa), gold (19 th Century), cigarettes (prisoner of war camps) notes and coins (legal tender) • To serve as “money” an item must fulfill as number of functions…

FUNCTIONS OF MONEY Medium of Exchange Money provides medium for exchange of goods and services; is more efficient than barter, which wastes resources.

FUNCTIONS OF MONEY Medium of Exchange Money provides medium for exchange of goods and services; is more efficient than barter, which wastes resources.

BARTER ECONOMY • A barter economy is inefficient: people spend a lot of time and effort finding people who want to swap • As an example of a barter economy, consider the following account of life without money, during the 1800 s, from the World Development Report (1989)…

BARTER ECONOMY • A barter economy is inefficient: people spend a lot of time and effort finding people who want to swap • As an example of a barter economy, consider the following account of life without money, during the 1800 s, from the World Development Report (1989)…

FUNCTIONS OF MONEY Store of value Money can be used to make purchases in the future Unit of Account A unit in which prices are quoted and accounts are kept. Standard of Deferred Payment A unit of account over time: enables borrowing and lending.

FUNCTIONS OF MONEY Store of value Money can be used to make purchases in the future Unit of Account A unit in which prices are quoted and accounts are kept. Standard of Deferred Payment A unit of account over time: enables borrowing and lending.

FUNCTIONS OF MONEY • Money is any generally accepted means of payment for delivery of goods or the settlement of debt • Notes and coins are “legal tender” so legally they must be accepted as means of payment for goods and services. But how about a current account?

FUNCTIONS OF MONEY • Money is any generally accepted means of payment for delivery of goods or the settlement of debt • Notes and coins are “legal tender” so legally they must be accepted as means of payment for goods and services. But how about a current account?

MONEY

MONEY

MONEY

MONEY

MONEY SUPPLY value of total stock of money, the medium of exchange, in circulation. M 0= notes and coins in circulation outside the BOJ + bank’s cash reserves at the BOJ (narrow money)

MONEY SUPPLY value of total stock of money, the medium of exchange, in circulation. M 0= notes and coins in circulation outside the BOJ + bank’s cash reserves at the BOJ (narrow money)

MONEY SUPPLY M 2 = notes and coins held by the public + dollar retail deposits at JA banks and building societies M 4 = M 2 + all other private sector interest bearing deposits (including time deposits) of banks and building societies, and certificates of deposits. (broad money)

MONEY SUPPLY M 2 = notes and coins held by the public + dollar retail deposits at JA banks and building societies M 4 = M 2 + all other private sector interest bearing deposits (including time deposits) of banks and building societies, and certificates of deposits. (broad money)

MONEY SUPPLY M 0 M 2 M 4

MONEY SUPPLY M 0 M 2 M 4

MONEY SUPPLY Deposits form the largest part of M 2 and M 4. Banks and building societies create money by lending out their excess reserves.

MONEY SUPPLY Deposits form the largest part of M 2 and M 4. Banks and building societies create money by lending out their excess reserves.

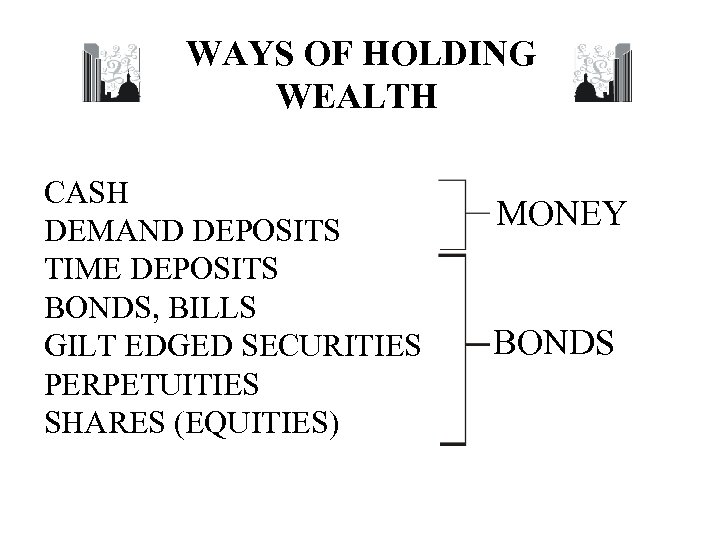

WAYS OF HOLDING WEALTH CASH DEMAND DEPOSITS TIME DEPOSITS BONDS, BILLS GILT EDGED SECURITIES PERPETUITIES SHARES (EQUITIES) MONEY BONDS

WAYS OF HOLDING WEALTH CASH DEMAND DEPOSITS TIME DEPOSITS BONDS, BILLS GILT EDGED SECURITIES PERPETUITIES SHARES (EQUITIES) MONEY BONDS

WAYS OF HOLDING WEALTH

WAYS OF HOLDING WEALTH

DEMAND FOR MONEY Why do people hold money? We identify a number of motives for holding their wealth as money (rather than any other form of financial instrument)

DEMAND FOR MONEY Why do people hold money? We identify a number of motives for holding their wealth as money (rather than any other form of financial instrument)

DEMAND FOR MONEY Transactions Motive Money is held to finance known transactions Precautionary Motive People hold money to meet unforeseen contingencies

DEMAND FOR MONEY Transactions Motive Money is held to finance known transactions Precautionary Motive People hold money to meet unforeseen contingencies

DEMAND FOR MONEY Asset Motive People hold money as a low risk component of a mixed portfolio Precautionary Motive People hold money to exploit a profitable opportunity to invest in bonds which may arise.

DEMAND FOR MONEY Asset Motive People hold money as a low risk component of a mixed portfolio Precautionary Motive People hold money to exploit a profitable opportunity to invest in bonds which may arise.

DEMAND FOR MONEY How does the “demand for money” change when there is a: Change in the interest rate? Change in income? Change in price?

DEMAND FOR MONEY How does the “demand for money” change when there is a: Change in the interest rate? Change in income? Change in price?

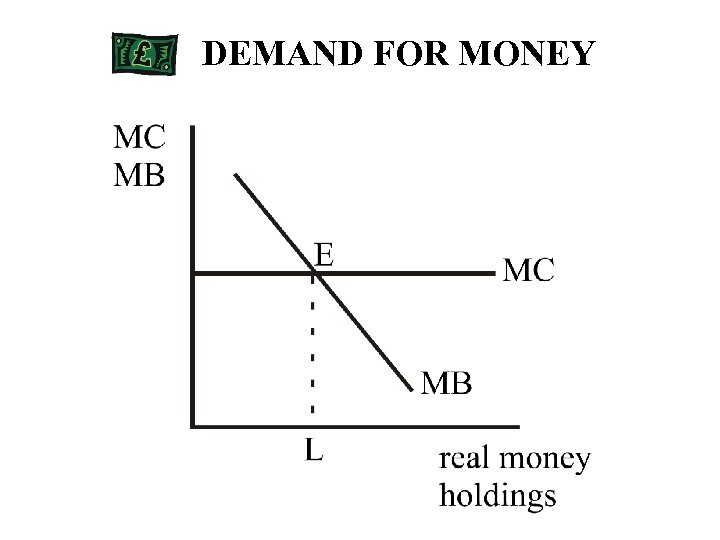

DEMAND FOR MONEY People hold money up to the point at which the marginal benefit of holding money just equals its marginal cost in interest forgone.

DEMAND FOR MONEY People hold money up to the point at which the marginal benefit of holding money just equals its marginal cost in interest forgone.

DEMAND FOR MONEY

DEMAND FOR MONEY

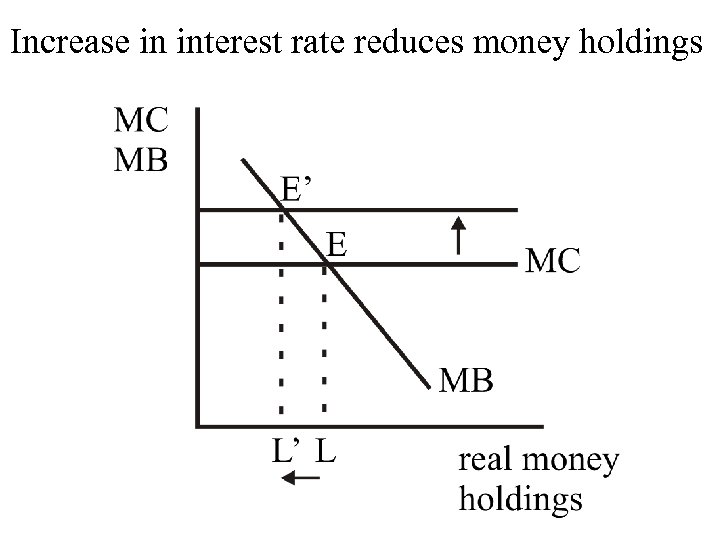

Increase in interest rate reduces money holdings

Increase in interest rate reduces money holdings

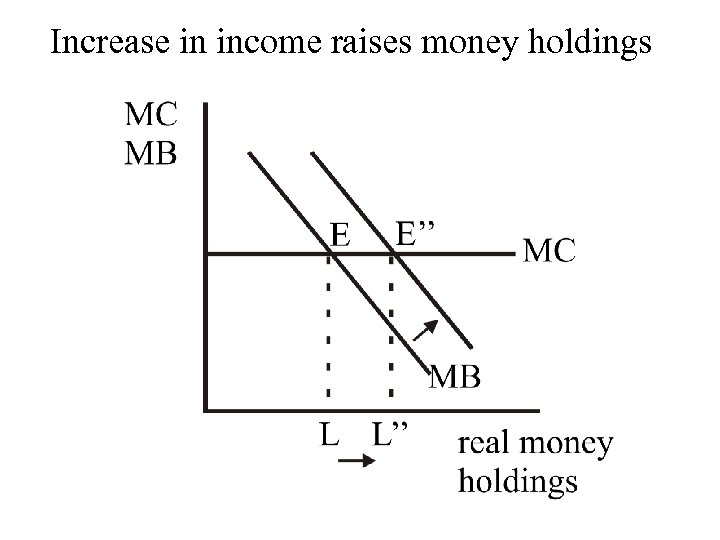

Increase in income raises money holdings

Increase in income raises money holdings

DEMAND FOR MONEY Let us distinguish between: Nominal Money Demand is in terms of so many pounds Real Money Demand is in terms of so many units of goods and services that the money can buy

DEMAND FOR MONEY Let us distinguish between: Nominal Money Demand is in terms of so many pounds Real Money Demand is in terms of so many units of goods and services that the money can buy

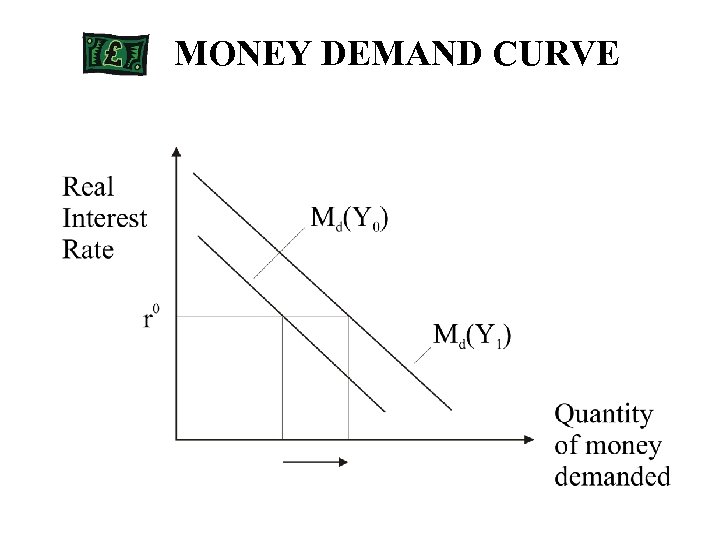

DEMAND FOR MONEY We can take these findings and construct another curve, the so called “money demand” schedule or the “liquidity preference” curve. As the interest rates, money demand falls… As income rises, money demand increases…

DEMAND FOR MONEY We can take these findings and construct another curve, the so called “money demand” schedule or the “liquidity preference” curve. As the interest rates, money demand falls… As income rises, money demand increases…

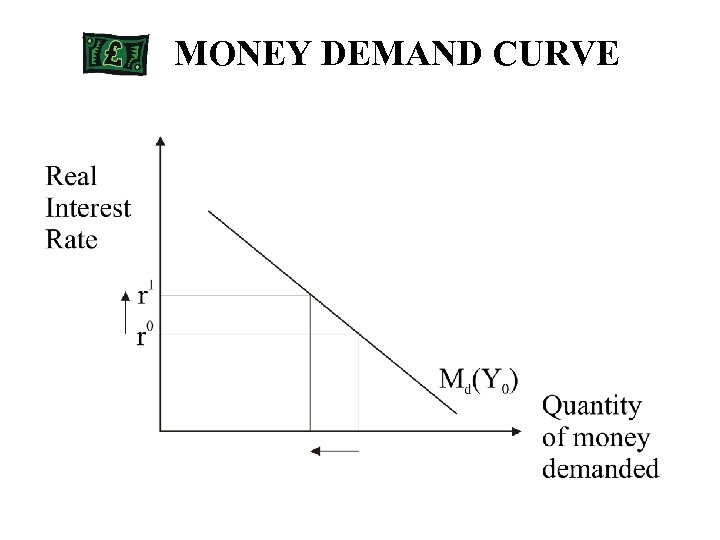

MONEY DEMAND CURVE

MONEY DEMAND CURVE

MONEY DEMAND CURVE

MONEY DEMAND CURVE

MONEY SUPPLY CURVE

MONEY SUPPLY CURVE

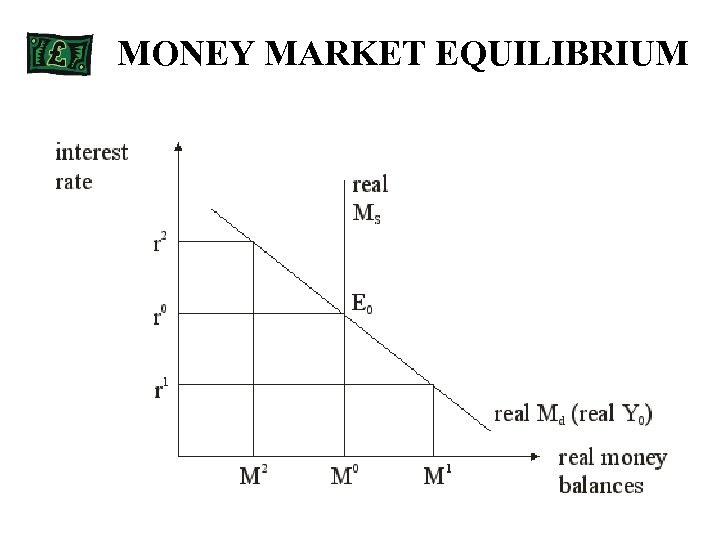

MONEY MARKET EQUILIBRIUM

MONEY MARKET EQUILIBRIUM

MONEY MARKET EQUILIBRIUM Money market equilibrium occurs when the quantity of real money balances demanded equals the quantity supplied.

MONEY MARKET EQUILIBRIUM Money market equilibrium occurs when the quantity of real money balances demanded equals the quantity supplied.

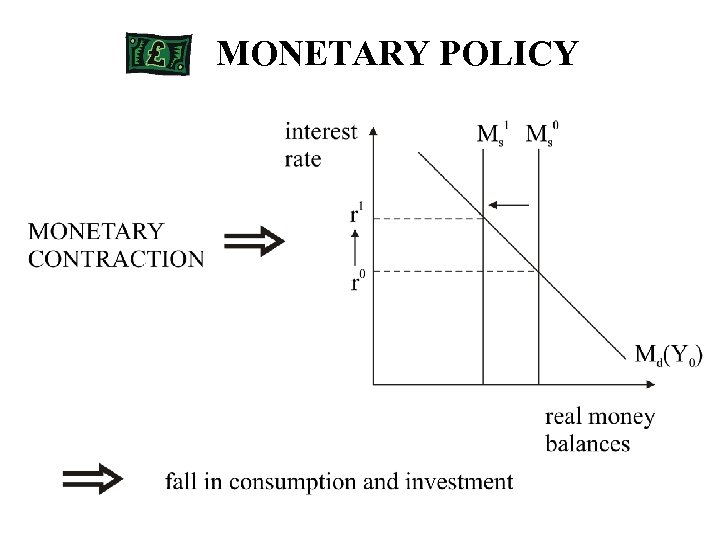

MONETARY POLICY Monetary policy is used when the Bank of Jamaica deliberately alters the supply of money or the interest rate in order to influence the level of aggregate demand in the economy and therefore output, employment and prices.

MONETARY POLICY Monetary policy is used when the Bank of Jamaica deliberately alters the supply of money or the interest rate in order to influence the level of aggregate demand in the economy and therefore output, employment and prices.

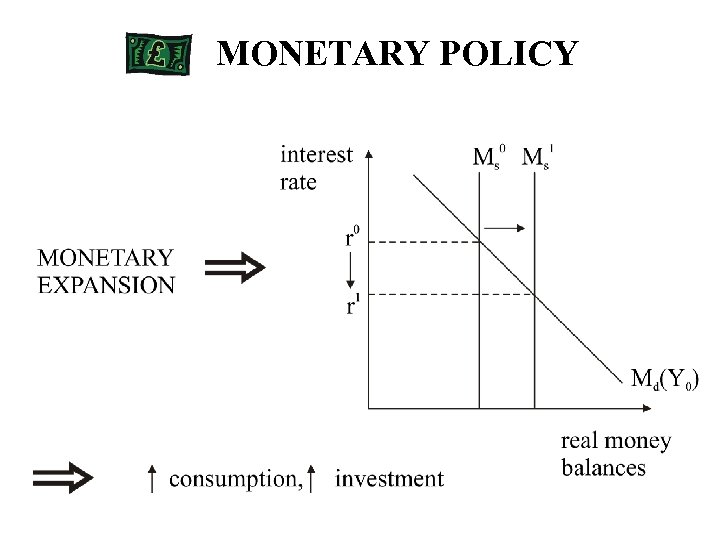

MONETARY POLICY

MONETARY POLICY

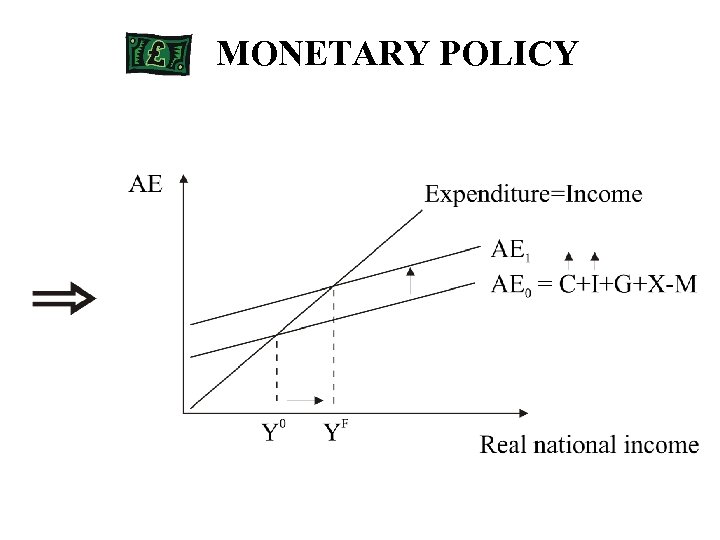

MONETARY POLICY

MONETARY POLICY

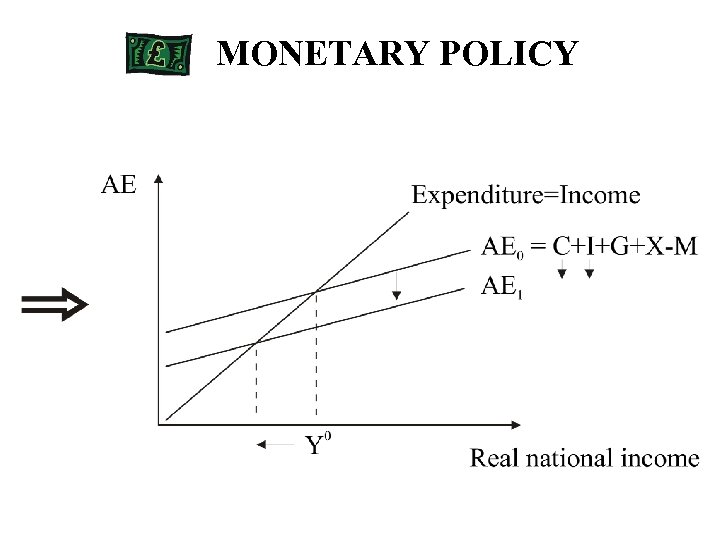

MONETARY POLICY

MONETARY POLICY

MONETARY POLICY

MONETARY POLICY

MONETARY POLICY

MONETARY POLICY

PRACTICAL PROBLEMS TIME LAGS POLITICAL PRESSURE EVASION OF CONTROLS UNCERTAINTY ABOUT MONEY DEMAND EXCHANGE RATE REGIME

PRACTICAL PROBLEMS TIME LAGS POLITICAL PRESSURE EVASION OF CONTROLS UNCERTAINTY ABOUT MONEY DEMAND EXCHANGE RATE REGIME

MIXING POLICIES • It is possible to mix policies. A given level of AD can be achieved either by: i) Loose Fiscal Policy (high G, low t) and a Tight Monetary Policy (high r). This gives a large public sector and a relatively small private sector

MIXING POLICIES • It is possible to mix policies. A given level of AD can be achieved either by: i) Loose Fiscal Policy (high G, low t) and a Tight Monetary Policy (high r). This gives a large public sector and a relatively small private sector

MIXING POLICIES • (ii) Tight Fiscal Policy (low G, high t) and a Loose Monetary Policy (low r). This would give a small public sector and a relatively large private sector. • (iii) Demand Management is the use of monetary policy and fiscal policy to stabilize output near the level of potential output

MIXING POLICIES • (ii) Tight Fiscal Policy (low G, high t) and a Loose Monetary Policy (low r). This would give a small public sector and a relatively large private sector. • (iii) Demand Management is the use of monetary policy and fiscal policy to stabilize output near the level of potential output

There is another type of policy… (iv) SUPPLY SIDE POLICIES Supply side economics is the pursuit of policies aimed not at increasing aggregate demand but aggregate supply. Supply side policies include:

There is another type of policy… (iv) SUPPLY SIDE POLICIES Supply side economics is the pursuit of policies aimed not at increasing aggregate demand but aggregate supply. Supply side policies include: