e14e63c715529aace01e580f1e7e5f19.ppt

- Количество слайдов: 33

Macroeconomics Introduction to Edwin G. Dolan Best Value Textbooks 4 th edition Chapter 23 Strategies and Rules for Monetary Policy Dolan, Economics Combined Version 4 e, Ch. 23

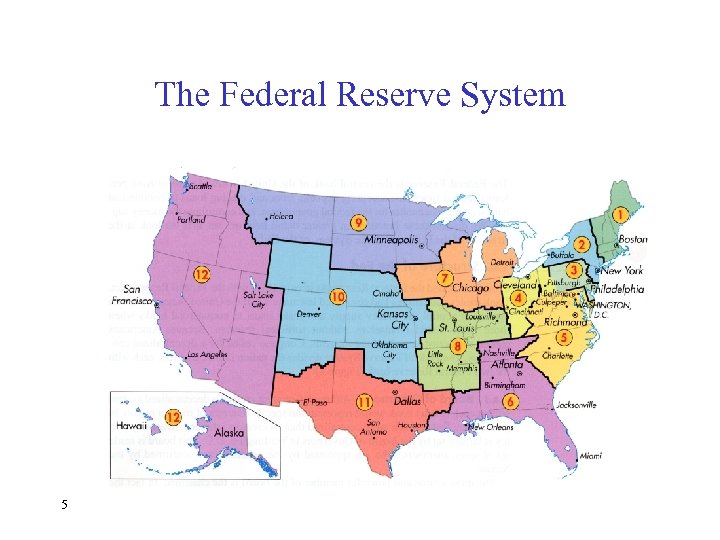

The Federal Reserve System Ø The Federal Reserve System (“the Fed”) serves as the central bank for the United States. Ø A central bank typically has the following functions: Ø It is the banks’ bank: it accepts deposits from and makes loans to commercial banks. Ø It acts as banker for the federal government. Ø It controls the money supply. Ø Performs certain regulatory functions for the financial industry. 2 Copyright © Houghton Mifflin Company. All rights reserved.

Structure of the Federal Reserve System The primary elements in the Federal Reserve System are: 1. The Board of Governors 2. The Regional Federal Reserve District Banks (FRBs) 3. The Federal Open Market Committee (FOMC) 3 Copyright © Houghton Mifflin Company. All rights reserved.

The Federal Reserve Banks Ø 12 District banks Ø Nine directors Ø The directors appoint the district president who is approved by the Board of Governors 4 Copyright © Houghton Mifflin Company. All rights reserved.

The Federal Reserve System 5 Copyright © Houghton Mifflin Company. All rights reserved.

The Board of Governors Ø Seven members Ø Appointed by the President Ø Confirmed by the Senate Ben Bernanke, FED Chairman Ø Serve 14 -year term Ø Terms are staggered so that one comes vacant every two years Ø President appoints a member as Chairman to serve a four -year term 6 Copyright © Houghton Mifflin Company. All rights reserved.

Federal Open Market Committee (FOMC) Ø Meets approximately every six weeks to review the economy Ø Made up of the following voting members: Ø 7 members of the Board of Governors Ø 5 of the FRB presidents (they rotate yearly) = 12 FOMC members 7 Copyright © Houghton Mifflin Company. All rights reserved.

Functions of the Fed (1) Ø Banking Services and Supervision Ø It supplies currency to banks through its 12 district banks. Ø It holds the reserves of banks in the district bank of each bank. Ø It processes and routes checks to banks through its district banks and processing centers. Ø It makes loans to banks—it is the “lender of last resort”, the “banker’s bank”. Ø It supervises and regulate banks, ensuring that they operate in a sound and prudent manner. Ø It is the banker for the U. S. government. It sells government securities for the U. S. Treasury. 8 Copyright © Houghton Mifflin Company. All rights reserved.

Functions of the Fed (2) Ø Controlling the Money Supply Ø The money supply is varied through the course of the year to meet seasonal fluctuations in the demand for money. This helps keep interest rates less volatile. Ø Example: 4 th quarter holiday season creates an increased demand for money to buy gifts. Ø The Fed also changes the money supply to achieve policy goals set by the FOMC. 9 Copyright © Houghton Mifflin Company. All rights reserved.

Policy Goals of the Fed Ø Ultimate Goal: Economic growth with stable prices. This means greater output (GDP) and a low, steady rate of inflation. Ø Intermediate Targets: Ø The Fed does not control output or the prices directly. It does control the money supply. Ø The Fed establishes target growth rates for the money supply, which it believes are consistent with its ultimate goals. Ø The money supply growth rate becomes an intermediate target, an objective used to achieve some ultimate policy goal. 10 Copyright © Houghton Mifflin Company. All rights reserved.

Vocabulary Ø Contractionary Policy: A government policy intending to slow the economy to prevent inflation. ØMonetary Policy Examples: Reduce money supply, increase interest rate, increase foreign exchange rate ØPolicy Instrument (Tool): Sell Bonds, Increase the Discount Rate, Increase required reserve ratio, sell foreign currency/buy dollars in foreign exchange markets

Vocabulary Ø Expansionary Policy: A government policy intending to speed or expand the economy to bring an end to recession, increase employment, or prevent deflation. ØMonetary Policy Examples: Expand money supply, decrease interest rate, decrease foreign exchange rate ØPolicy Instrument (Tool): Buy Bonds, Decrease the discount rate, Decrease required reserve ration, buy foreign currency/sell dollars in foreign exchange markets

Lags Ø Inside lags are delays between Ø Outside lags are delays between the time a decision is the time a problem develops made and the time actions and the time a decision is affect the economy taken to do something about it Ø Examples: Ø Delays in data collection Ø Time needed to conduct meetings, prepare reports, and reach decisions Ø Delays in implementing a decision Ø Delays in movements along and shifts in aggregate supply and demand curves Dolan, Economics Combined Version 4 e, Ch. 23

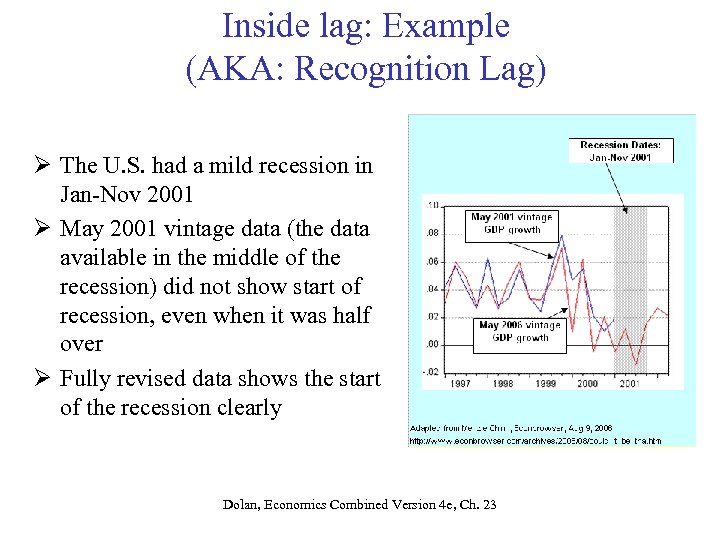

Inside lag: Example (AKA: Recognition Lag) Ø The U. S. had a mild recession in Jan-Nov 2001 Ø May 2001 vintage data (the data available in the middle of the recession) did not show start of recession, even when it was half over Ø Fully revised data shows the start of the recession clearly Dolan, Economics Combined Version 4 e, Ch. 23

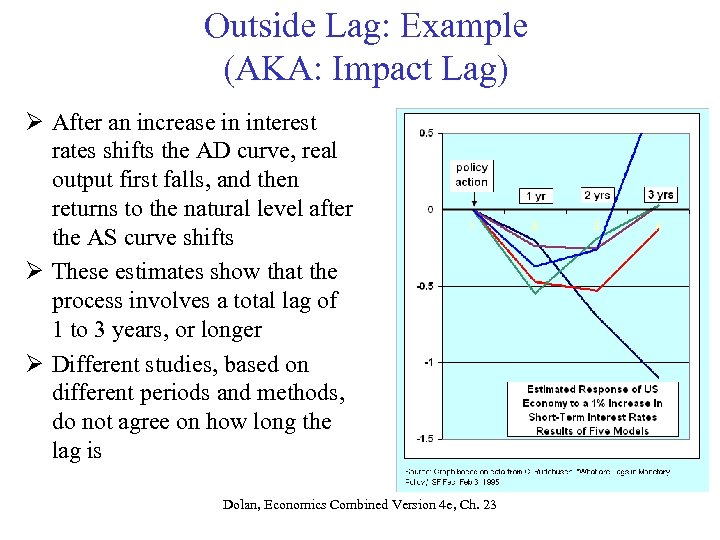

Outside Lag: Example (AKA: Impact Lag) Ø After an increase in interest rates shifts the AD curve, real output first falls, and then returns to the natural level after the AS curve shifts Ø These estimates show that the process involves a total lag of 1 to 3 years, or longer Ø Different studies, based on different periods and methods, do not agree on how long the lag is Dolan, Economics Combined Version 4 e, Ch. 23

Forecasting Errors Ø To overcome the problem of lags, policymakers must try to act in advance, based on forecasts Ø However, forecasts are not accurate. On average, forecasts of GDP growth have an error of about Ø 1 percent for 1 year forecasts in developed countries Ø 2 percent for 2 year forecasts in developed countries Ø 3 percent for 2 year forecasts in developing countries Ø Forecasts are least accurate at turning points in the business cycle, just when they are needed most Dolan, Economics Combined Version 4 e, Ch. 23

Time-Inconsistency Ø Time-inconsistency means the tendency to make decisions that have good consequences in the short run, but bad consequences in the long run Ø Example from everyday life: You stop taking your antibiotic medication because of bad side effects before you are completely cured Ø Example from macroeconomics: Before an election, policymakers use excessive expansionary policy or avoid needed contractionary policy Dolan, Economics Combined Version 4 e, Ch. 23

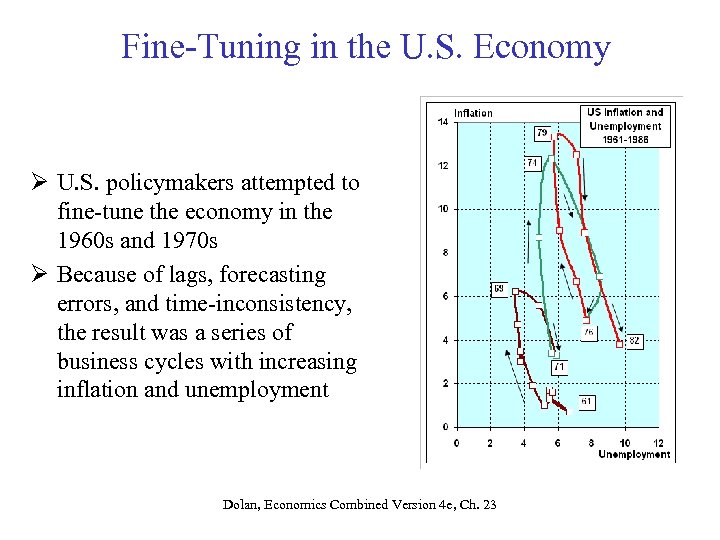

Fine-Tuning in the U. S. Economy Ø U. S. policymakers attempted to fine-tune the economy in the 1960 s and 1970 s Ø Because of lags, forecasting errors, and time-inconsistency, the result was a series of business cycles with increasing inflation and unemployment Dolan, Economics Combined Version 4 e, Ch. 23

Fine-tuning vs. Policy Rules Ø Fine-tuning uses frequent discretionary policy to make small adjustments to aggregate demand Ø Preset policy rules aim to provide a transparent and credible framework for business and household decisions “The notion that central banks can provide a low-cost, overthe-counter “aspirin” that will alleviate almost any ill that a society can face is no longer credible” — Robert Poole President, Federal Reserve Bank of St. Louis Dolan, Economics Combined Version 4 e, Ch. 23

Instruments, Targets, and Goals Ø A policy instrument is a variable that is directly under control of policymakers. Ø An operating target is a variable that responds immediately, or almost immediately, to the use of a policy instrument. Ø An intermediate target is a variable that responds to the use of a policy instrument or a change in operating target with a significant lag. Ø A policy goal is a long-run objective of economic policy that is important for economic welfare. Dolan, Economics Combined Version 4 e, Ch. 23

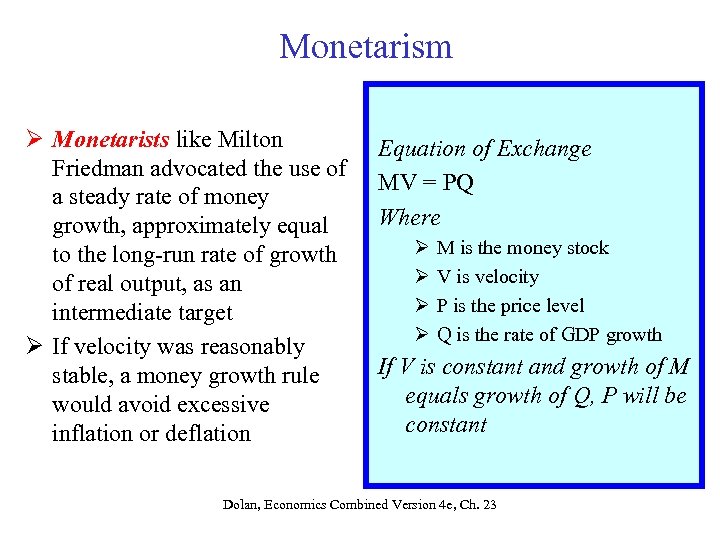

Monetarism Ø Monetarists like Milton Friedman advocated the use of a steady rate of money growth, approximately equal to the long-run rate of growth of real output, as an intermediate target Ø If velocity was reasonably stable, a money growth rule would avoid excessive inflation or deflation Equation of Exchange MV = PQ Where Ø Ø M is the money stock V is velocity P is the price level Q is the rate of GDP growth If V is constant and growth of M equals growth of Q, P will be constant Dolan, Economics Combined Version 4 e, Ch. 23

Inflation targeting Ø The rate of inflation averaged over one or two years is the main intermediate target Ø Interest rates are used as the operating target Ø Open market operations are used as the main policy instrument Dolan, Economics Combined Version 4 e, Ch. 23

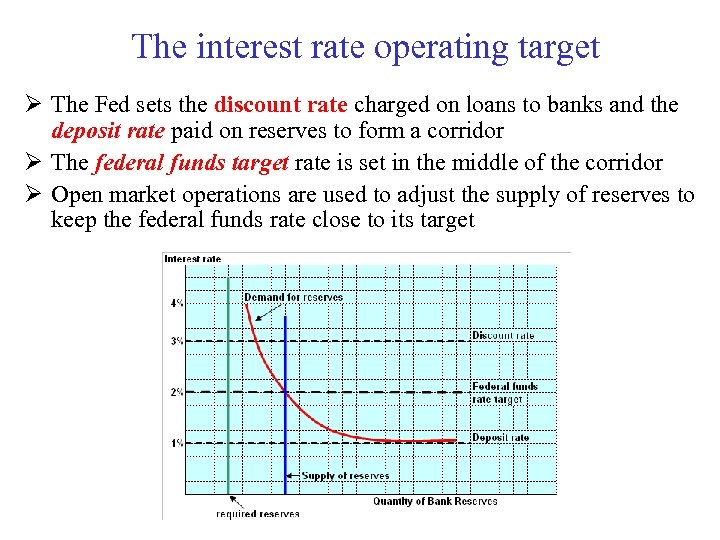

The interest rate operating target Ø The Fed sets the discount rate charged on loans to banks and the deposit rate paid on reserves to form a corridor Ø The federal funds target rate is set in the middle of the corridor Ø Open market operations are used to adjust the supply of reserves to keep the federal funds rate close to its target Dolan, Economics Combined Version 4 e, Ch. 23

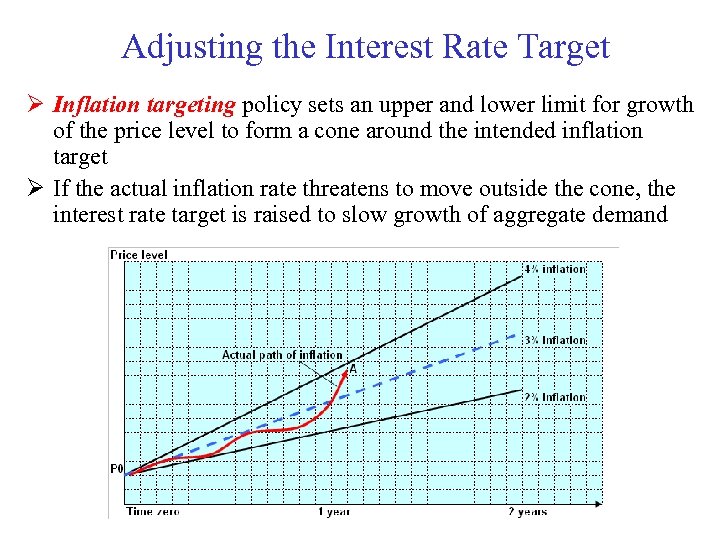

Adjusting the Interest Rate Target Ø Inflation targeting policy sets an upper and lower limit for growth of the price level to form a cone around the intended inflation target Ø If the actual inflation rate threatens to move outside the cone, the interest rate target is raised to slow growth of aggregate demand Dolan, Economics Combined Version 4 e, Ch. 23

A Taylor Rule: An example of a potential “rule” Ø A Taylor Rule uses both the inflation rate and the output gap as intermediate targets Ø The interest rate operating target is raised if either the inflation rate or output gap increases Ø The interest rate is lowered if inflation or the output gap decreases Ø To avoid lags in measuring the output gap, a variation of the Taylor rule uses employment data Dolan, Economics Combined Version 4 e, Ch. 23

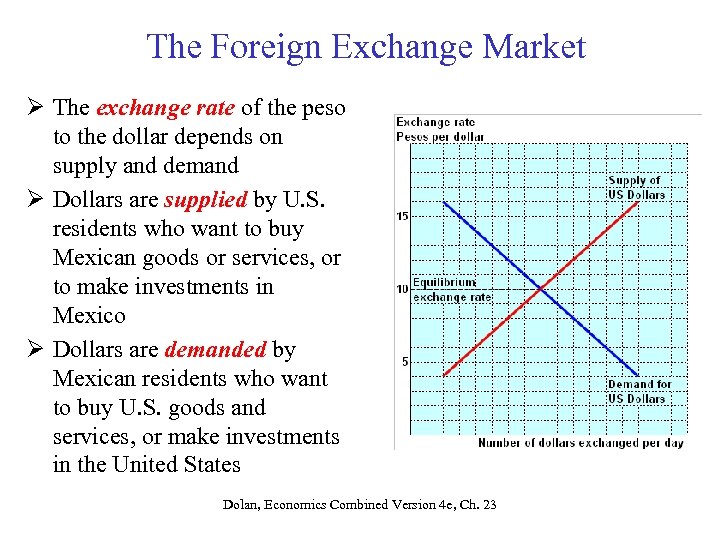

The Foreign Exchange Market Ø The exchange rate of the peso to the dollar depends on supply and demand Ø Dollars are supplied by U. S. residents who want to buy Mexican goods or services, or to make investments in Mexico Ø Dollars are demanded by Mexican residents who want to buy U. S. goods and services, or make investments in the United States Dolan, Economics Combined Version 4 e, Ch. 23

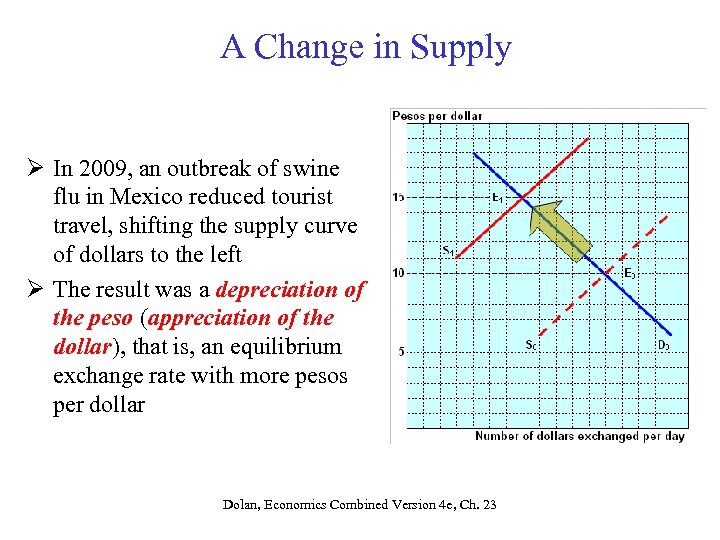

A Change in Supply Ø In 2009, an outbreak of swine flu in Mexico reduced tourist travel, shifting the supply curve of dollars to the left Ø The result was a depreciation of the peso (appreciation of the dollar), that is, an equilibrium exchange rate with more pesos per dollar Dolan, Economics Combined Version 4 e, Ch. 23

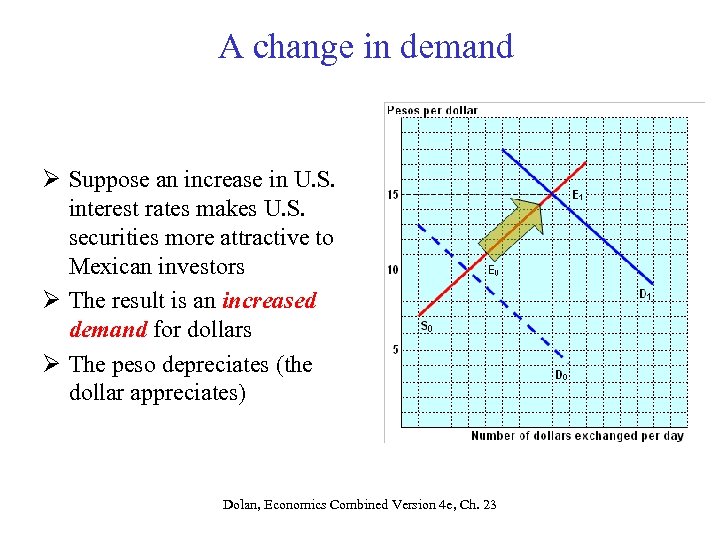

A change in demand Ø Suppose an increase in U. S. interest rates makes U. S. securities more attractive to Mexican investors Ø The result is an increased demand for dollars Ø The peso depreciates (the dollar appreciates) Dolan, Economics Combined Version 4 e, Ch. 23

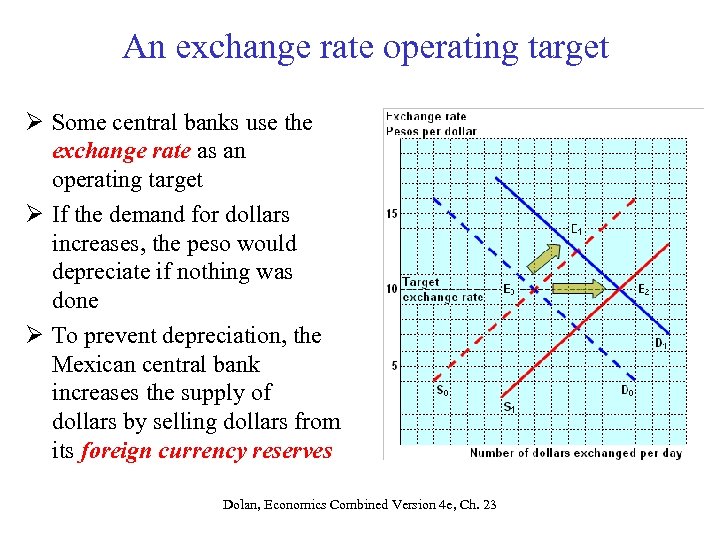

An exchange rate operating target Ø Some central banks use the exchange rate as an operating target Ø If the demand for dollars increases, the peso would depreciate if nothing was done Ø To prevent depreciation, the Mexican central bank increases the supply of dollars by selling dollars from its foreign currency reserves Dolan, Economics Combined Version 4 e, Ch. 23

Reasons for an Exchange Rate Target Two principal reasons to maintain an exchange rate target Ø To reduce the risks and costs of international trade in goods and services Ø To anchor the domestic currency to a stable foreign currency in order to fight inflation When in works Ø An exchange rate target works best for small countries with flexible economies, strong trading links to the currency partner, and low exposure to external shocks Ø Countries that do not want to use an exchange rate in the long run can use an exchange rate target temporarily to stop inflation, but then they should have an exit strategy Dolan, Economics Combined Version 4 e, Ch. 23

Appendix to Chapter 23 Demand Supply for Money Dolan, Economics Combined Version 4 e, Ch. 23

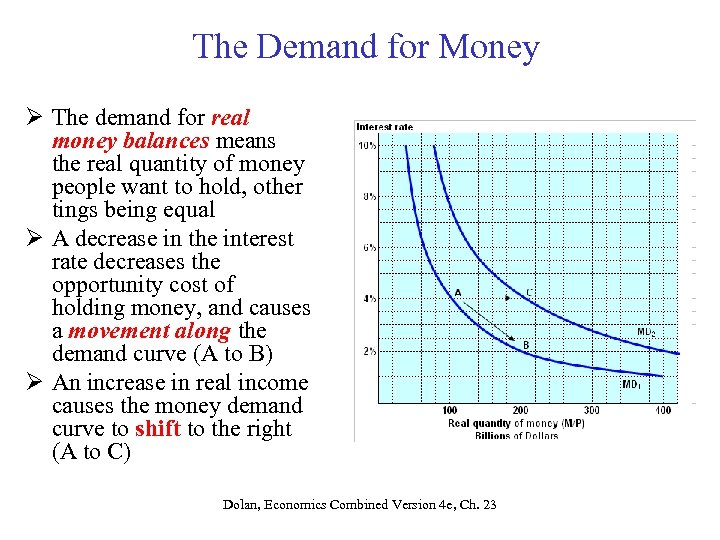

The Demand for Money Ø The demand for real money balances means the real quantity of money people want to hold, other tings being equal Ø A decrease in the interest rate decreases the opportunity cost of holding money, and causes a movement along the demand curve (A to B) Ø An increase in real income causes the money demand curve to shift to the right (A to C) Dolan, Economics Combined Version 4 e, Ch. 23

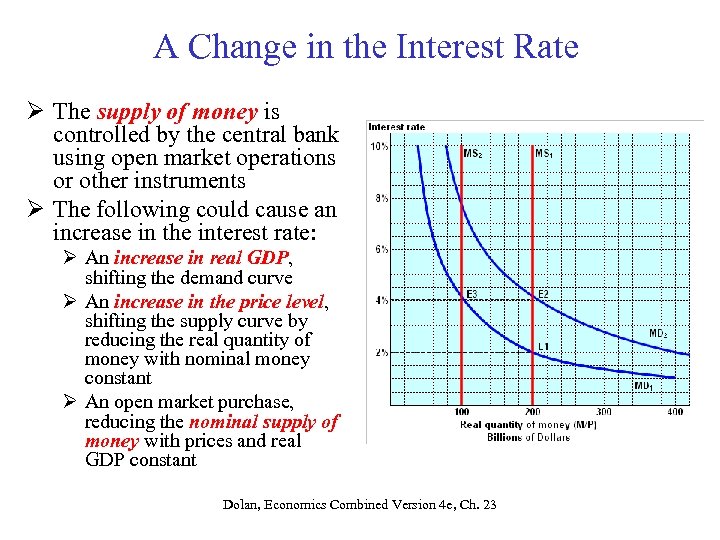

A Change in the Interest Rate Ø The supply of money is controlled by the central bank using open market operations or other instruments Ø The following could cause an increase in the interest rate: Ø An increase in real GDP, shifting the demand curve Ø An increase in the price level, shifting the supply curve by reducing the real quantity of money with nominal money constant Ø An open market purchase, reducing the nominal supply of money with prices and real GDP constant Dolan, Economics Combined Version 4 e, Ch. 23

e14e63c715529aace01e580f1e7e5f19.ppt