af589fd6e9b8a04dda286c0e59c30dcc.ppt

- Количество слайдов: 12

Macroeconomics

Macroeconomics

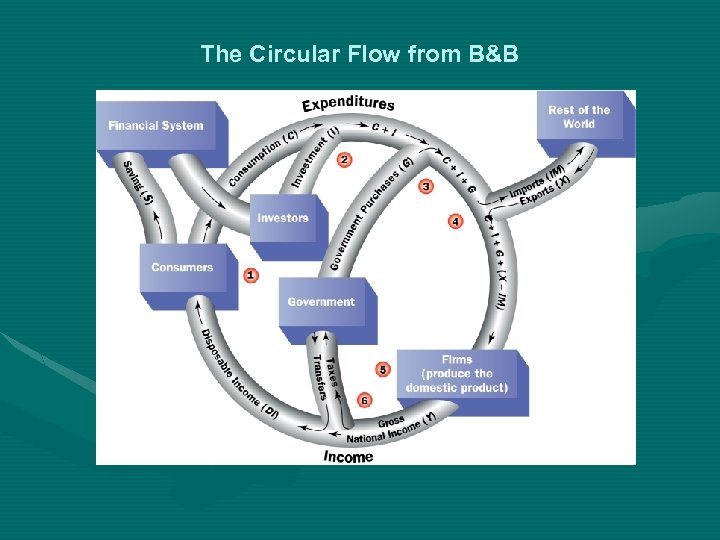

Important Definitions • National Income – The total income of all individuals in the economy, BEFORE taxes are taken out. • Disposable Income – The total income of all individuals in the economy, AFTER taxes are taken out. • Domestic Product – Gross National Income = Gross Domestic Product – GNI = GDP = C + I + G + (X - M) B&B p. 538 -9

Important Definitions • National Income – The total income of all individuals in the economy, BEFORE taxes are taken out. • Disposable Income – The total income of all individuals in the economy, AFTER taxes are taken out. • Domestic Product – Gross National Income = Gross Domestic Product – GNI = GDP = C + I + G + (X - M) B&B p. 538 -9

AD Defined • Aggregate Demand = Total Spending on goods and services in a period of time at a given price • Aggregate Demand = the total amount that all consumers, business firms and government agencies spend on final goods and services • These definitions differ slightly, but the important thing is what they have in common: – Total spending on goods & services across an entire economy.

AD Defined • Aggregate Demand = Total Spending on goods and services in a period of time at a given price • Aggregate Demand = the total amount that all consumers, business firms and government agencies spend on final goods and services • These definitions differ slightly, but the important thing is what they have in common: – Total spending on goods & services across an entire economy.

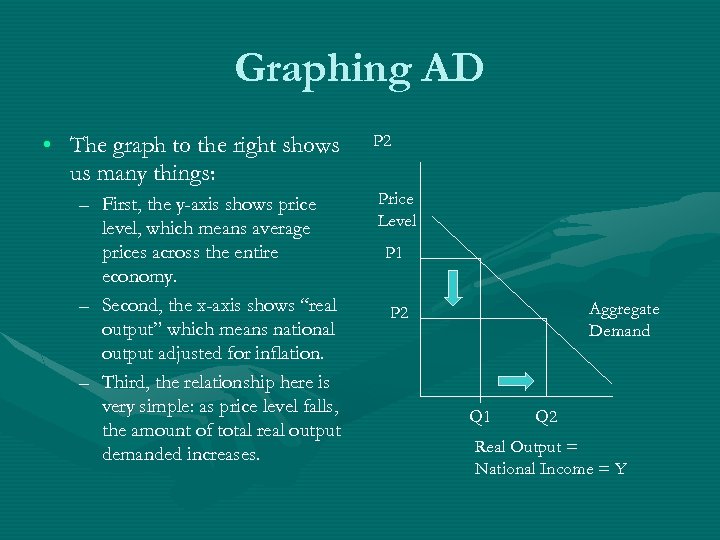

Graphing AD • The graph to the right shows us many things: – First, the y-axis shows price level, which means average prices across the entire economy. – Second, the x-axis shows “real output” which means national output adjusted for inflation. – Third, the relationship here is very simple: as price level falls, the amount of total real output demanded increases. P 2 Price Level P 1 Aggregate Demand P 2 Q 1 Q 2 Real Output = National Income = Y

Graphing AD • The graph to the right shows us many things: – First, the y-axis shows price level, which means average prices across the entire economy. – Second, the x-axis shows “real output” which means national output adjusted for inflation. – Third, the relationship here is very simple: as price level falls, the amount of total real output demanded increases. P 2 Price Level P 1 Aggregate Demand P 2 Q 1 Q 2 Real Output = National Income = Y

Components of AD: C+I+G+(X-M) • Aggregate Demand shows all the spending in a national economy. Therefore it equals the spending of households, firms and the government. Imports & Exports represent spending that either comes into a nation’s economy or leaves it. • C = Consumer spending on domestic goods & services – Durable (lasting longer than one year) – Non-durable goods (used up immediately) • I = Investment (firms spending capital to maintain production replacement - or to expand production - induced) • G = Government Spending (everything from schools to law enforcement to military goods) • (X - M) = Exports minus imports this gives us the net injection or leakage from the purchase and sale of goods to foreign or from foreign nations.

Components of AD: C+I+G+(X-M) • Aggregate Demand shows all the spending in a national economy. Therefore it equals the spending of households, firms and the government. Imports & Exports represent spending that either comes into a nation’s economy or leaves it. • C = Consumer spending on domestic goods & services – Durable (lasting longer than one year) – Non-durable goods (used up immediately) • I = Investment (firms spending capital to maintain production replacement - or to expand production - induced) • G = Government Spending (everything from schools to law enforcement to military goods) • (X - M) = Exports minus imports this gives us the net injection or leakage from the purchase and sale of goods to foreign or from foreign nations.

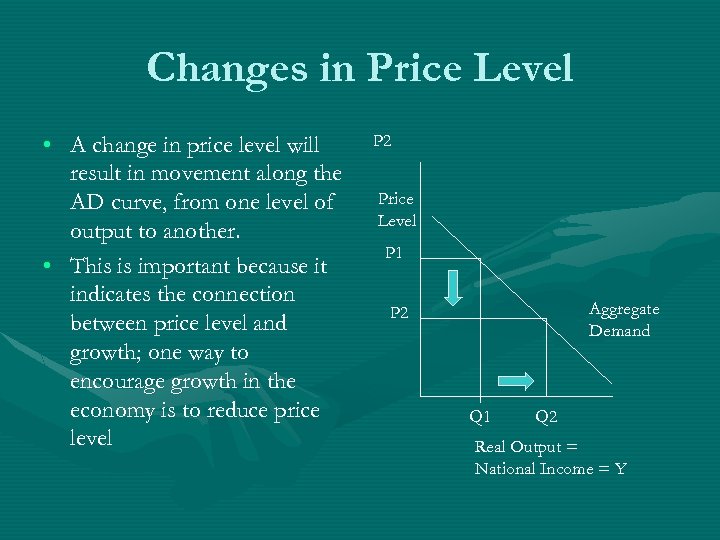

Changes in Price Level • A change in price level will result in movement along the AD curve, from one level of output to another. • This is important because it indicates the connection between price level and growth; one way to encourage growth in the economy is to reduce price level P 2 Price Level P 1 Aggregate Demand P 2 Q 1 Q 2 Real Output = National Income = Y

Changes in Price Level • A change in price level will result in movement along the AD curve, from one level of output to another. • This is important because it indicates the connection between price level and growth; one way to encourage growth in the economy is to reduce price level P 2 Price Level P 1 Aggregate Demand P 2 Q 1 Q 2 Real Output = National Income = Y

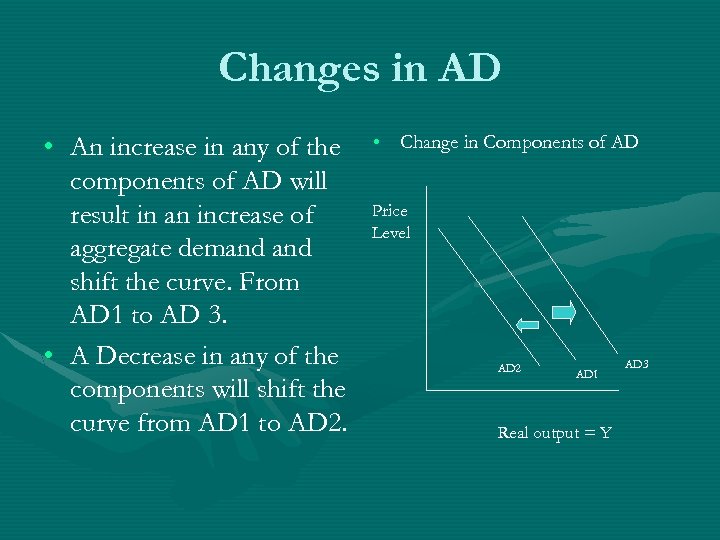

Changes in AD • An increase in any of the components of AD will result in an increase of aggregate demand shift the curve. From AD 1 to AD 3. • A Decrease in any of the components will shift the curve from AD 1 to AD 2. • Change in Components of AD Price Level AD 2 AD 1 Real output = Y AD 3

Changes in AD • An increase in any of the components of AD will result in an increase of aggregate demand shift the curve. From AD 1 to AD 3. • A Decrease in any of the components will shift the curve from AD 1 to AD 2. • Change in Components of AD Price Level AD 2 AD 1 Real output = Y AD 3

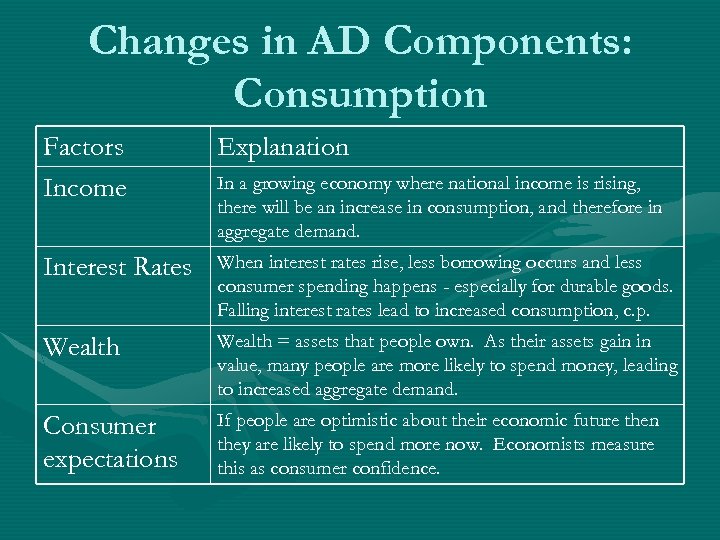

Changes in AD Components: Consumption Factors Income Explanation Interest Rates When interest rates rise, less borrowing occurs and less consumer spending happens - especially for durable goods. Falling interest rates lead to increased consumption, c. p. Wealth = assets that people own. As their assets gain in value, many people are more likely to spend money, leading to increased aggregate demand. Consumer expectations If people are optimistic about their economic future then they are likely to spend more now. Economists measure this as consumer confidence. In a growing economy where national income is rising, there will be an increase in consumption, and therefore in aggregate demand.

Changes in AD Components: Consumption Factors Income Explanation Interest Rates When interest rates rise, less borrowing occurs and less consumer spending happens - especially for durable goods. Falling interest rates lead to increased consumption, c. p. Wealth = assets that people own. As their assets gain in value, many people are more likely to spend money, leading to increased aggregate demand. Consumer expectations If people are optimistic about their economic future then they are likely to spend more now. Economists measure this as consumer confidence. In a growing economy where national income is rising, there will be an increase in consumption, and therefore in aggregate demand.

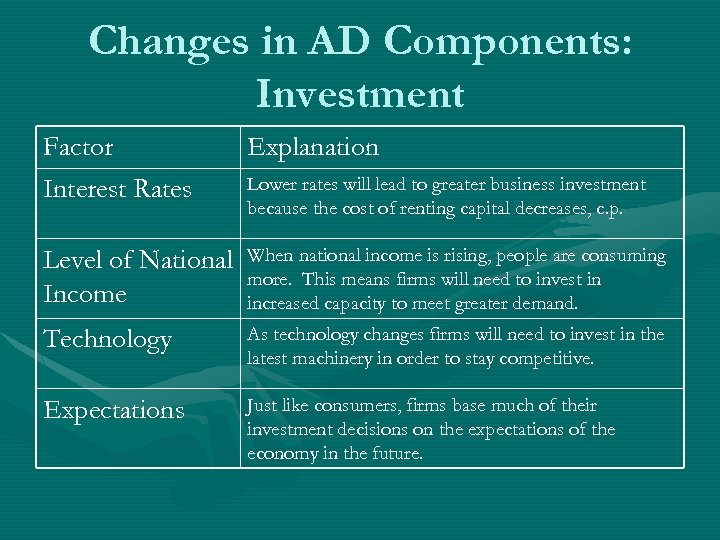

Changes in AD Components: Investment Factor Interest Rates Explanation Level of National Income When national income is rising, people are consuming more. This means firms will need to invest in increased capacity to meet greater demand. Technology As technology changes firms will need to invest in the latest machinery in order to stay competitive. Expectations Just like consumers, firms base much of their investment decisions on the expectations of the economy in the future. Lower rates will lead to greater business investment because the cost of renting capital decreases, c. p.

Changes in AD Components: Investment Factor Interest Rates Explanation Level of National Income When national income is rising, people are consuming more. This means firms will need to invest in increased capacity to meet greater demand. Technology As technology changes firms will need to invest in the latest machinery in order to stay competitive. Expectations Just like consumers, firms base much of their investment decisions on the expectations of the economy in the future. Lower rates will lead to greater business investment because the cost of renting capital decreases, c. p.

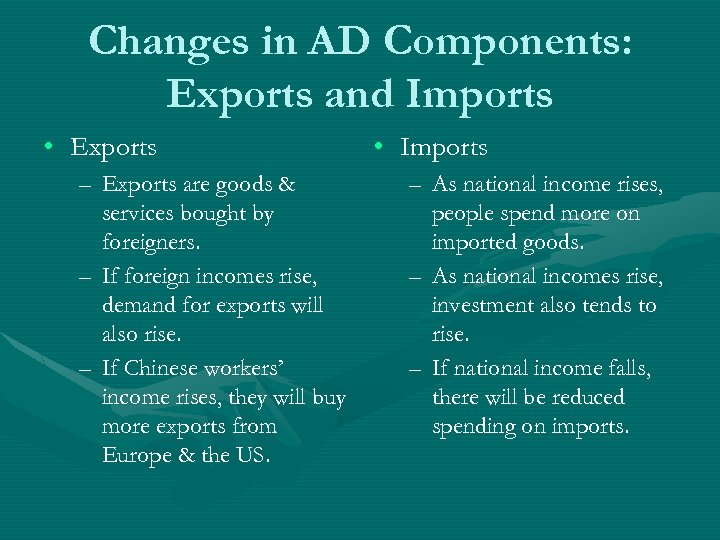

Changes in AD Components: Exports and Imports • Exports – Exports are goods & services bought by foreigners. – If foreign incomes rise, demand for exports will also rise. – If Chinese workers’ income rises, they will buy more exports from Europe & the US. • Imports – As national income rises, people spend more on imported goods. – As national incomes rise, investment also tends to rise. – If national income falls, there will be reduced spending on imports.

Changes in AD Components: Exports and Imports • Exports – Exports are goods & services bought by foreigners. – If foreign incomes rise, demand for exports will also rise. – If Chinese workers’ income rises, they will buy more exports from Europe & the US. • Imports – As national income rises, people spend more on imported goods. – As national incomes rise, investment also tends to rise. – If national income falls, there will be reduced spending on imports.

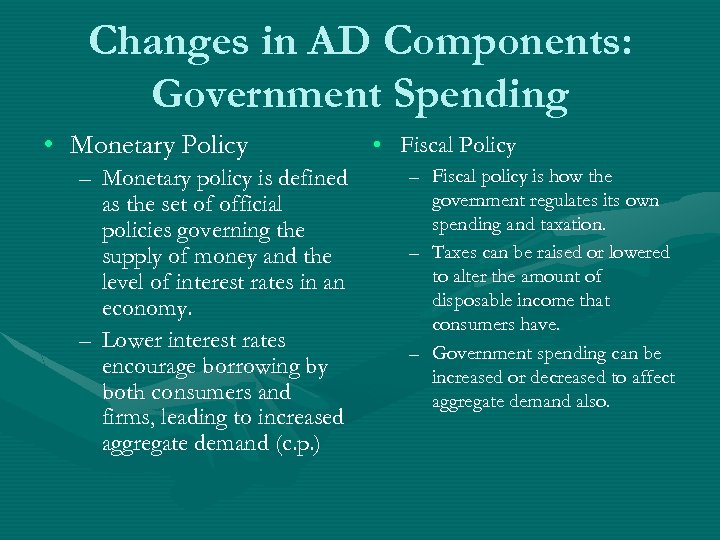

Changes in AD Components: Government Spending • Monetary Policy – Monetary policy is defined as the set of official policies governing the supply of money and the level of interest rates in an economy. – Lower interest rates encourage borrowing by both consumers and firms, leading to increased aggregate demand (c. p. ) • Fiscal Policy – Fiscal policy is how the government regulates its own spending and taxation. – Taxes can be raised or lowered to alter the amount of disposable income that consumers have. – Government spending can be increased or decreased to affect aggregate demand also.

Changes in AD Components: Government Spending • Monetary Policy – Monetary policy is defined as the set of official policies governing the supply of money and the level of interest rates in an economy. – Lower interest rates encourage borrowing by both consumers and firms, leading to increased aggregate demand (c. p. ) • Fiscal Policy – Fiscal policy is how the government regulates its own spending and taxation. – Taxes can be raised or lowered to alter the amount of disposable income that consumers have. – Government spending can be increased or decreased to affect aggregate demand also.

The Circular Flow from B&B

The Circular Flow from B&B