31eeeaa0337feaf67c74dae28fd77788.ppt

- Количество слайдов: 75

Macroeconomics

Macroeconomics

Essential Questions 1) Why & how is economic activity measured? 2) How do fiscal policy decisions affect the nation’s economy? 3) How can monetary policy through interest rates contribute to price stability, employment and economic growth?

Essential Questions 1) Why & how is economic activity measured? 2) How do fiscal policy decisions affect the nation’s economy? 3) How can monetary policy through interest rates contribute to price stability, employment and economic growth?

Macroeconomics Study of the economics of a nation as a whole The big picture Measuring the “health” of a nation’s economy Key economic indicators are used ◦ Gross Domestic Product (GDP) ◦ Consumer Price Index (CPI) ◦ Unemployment Rate

Macroeconomics Study of the economics of a nation as a whole The big picture Measuring the “health” of a nation’s economy Key economic indicators are used ◦ Gross Domestic Product (GDP) ◦ Consumer Price Index (CPI) ◦ Unemployment Rate

Practice EOCT Q: Which choice describes a macroeconomic calculation? a. b. c. d. Calculating a family’s monthly budget Calculating a firm’s annual profits Calculating the unemployment rate Calculating the interest on a personal loan

Practice EOCT Q: Which choice describes a macroeconomic calculation? a. b. c. d. Calculating a family’s monthly budget Calculating a firm’s annual profits Calculating the unemployment rate Calculating the interest on a personal loan

Gross Domestic Product Expressed in $$ terms instead of # of products Only value of final goods is used, not value of inputs ◦ Count 15 shirts? Or count 15 shirts x $20 each? ◦ Count bread, but not wheat and flour ◦ Don’t count resales (used cars, real estate) Only goods/services produced within borders ◦ American or Foreign companies, but not American co overseas

Gross Domestic Product Expressed in $$ terms instead of # of products Only value of final goods is used, not value of inputs ◦ Count 15 shirts? Or count 15 shirts x $20 each? ◦ Count bread, but not wheat and flour ◦ Don’t count resales (used cars, real estate) Only goods/services produced within borders ◦ American or Foreign companies, but not American co overseas

Cont’d Durable goods vs. Nondurable goods Durable goods are goods that have a reasonable expectation of lasting more than 2 years ◦ Automobiles, Tv’s Nondurable goods are goods that have a relatively short life span ◦ Food, pencils

Cont’d Durable goods vs. Nondurable goods Durable goods are goods that have a reasonable expectation of lasting more than 2 years ◦ Automobiles, Tv’s Nondurable goods are goods that have a relatively short life span ◦ Food, pencils

GDP, Cont’d Nominal GDP is NOT adjusted for increased prices (inflation) Real GDP is adjusted for changing prices Increase in real GDP=good economic performance Decrease in real GDP=poor economic performance Economic Growth=% change in real GDP from one year to the next

GDP, Cont’d Nominal GDP is NOT adjusted for increased prices (inflation) Real GDP is adjusted for changing prices Increase in real GDP=good economic performance Decrease in real GDP=poor economic performance Economic Growth=% change in real GDP from one year to the next

GDP, Cont’d Calculating GDP ◦ Most common way is to use the expenditure approach vs income approach GDP = C + I + G + Xn C = consumer spending ◦ Durable (last long time) + nondurable (short life) I = investment spending (business spending) G = government spending Xn = exports – imports (net exports)

GDP, Cont’d Calculating GDP ◦ Most common way is to use the expenditure approach vs income approach GDP = C + I + G + Xn C = consumer spending ◦ Durable (last long time) + nondurable (short life) I = investment spending (business spending) G = government spending Xn = exports – imports (net exports)

Economic Growth How much has the Real GDP changed from one time period to the next? Expressed in % terms. Calculate: Year 2 -Year 1 x 100= Year 1

Economic Growth How much has the Real GDP changed from one time period to the next? Expressed in % terms. Calculate: Year 2 -Year 1 x 100= Year 1

Practice EOCT Questions: a. b. c. d. Which of the following is not included when calculating GDP? A refrigerator made in North Carolina and sold at Best Buy Nails purchased for construction of a home Toyotas made in TN and sold in Mexico Papa John’s pizza I ate last night

Practice EOCT Questions: a. b. c. d. Which of the following is not included when calculating GDP? A refrigerator made in North Carolina and sold at Best Buy Nails purchased for construction of a home Toyotas made in TN and sold in Mexico Papa John’s pizza I ate last night

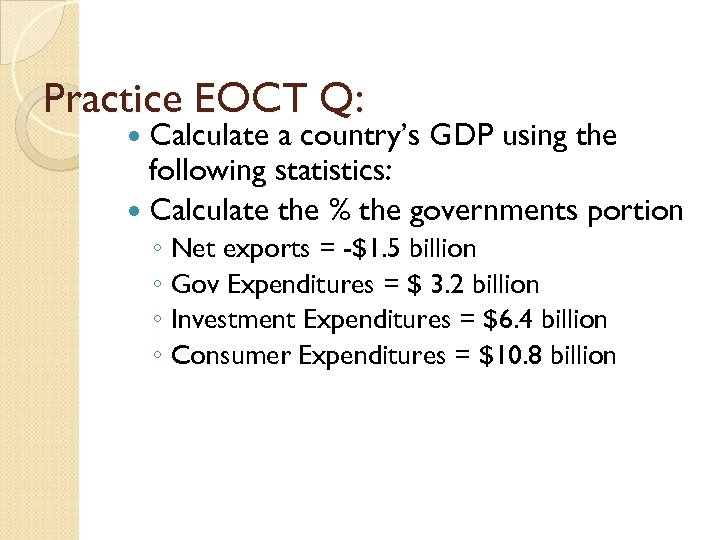

Practice EOCT Q: Calculate a country’s GDP using the following statistics: Calculate the % the governments portion ◦ Net exports = -$1. 5 billion ◦ Gov Expenditures = $ 3. 2 billion ◦ Investment Expenditures = $6. 4 billion ◦ Consumer Expenditures = $10. 8 billion

Practice EOCT Q: Calculate a country’s GDP using the following statistics: Calculate the % the governments portion ◦ Net exports = -$1. 5 billion ◦ Gov Expenditures = $ 3. 2 billion ◦ Investment Expenditures = $6. 4 billion ◦ Consumer Expenditures = $10. 8 billion

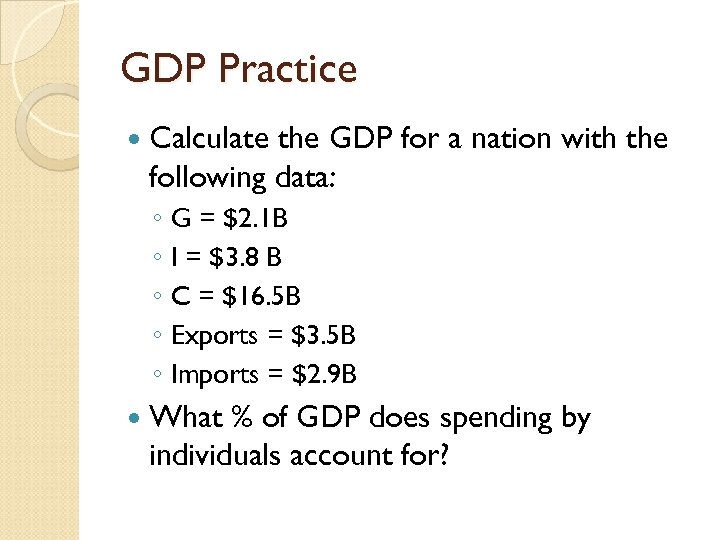

GDP Practice Calculate the GDP for a nation with the following data: ◦ G = $2. 1 B ◦ I = $3. 8 B ◦ C = $16. 5 B ◦ Exports = $3. 5 B ◦ Imports = $2. 9 B What % of GDP does spending by individuals account for?

GDP Practice Calculate the GDP for a nation with the following data: ◦ G = $2. 1 B ◦ I = $3. 8 B ◦ C = $16. 5 B ◦ Exports = $3. 5 B ◦ Imports = $2. 9 B What % of GDP does spending by individuals account for?

Inflation and CPI What is happening with prices? Inflation rate is needed to find Real GDP Calculate the CPI (consumer price index) in order to calculate the rate of inflation

Inflation and CPI What is happening with prices? Inflation rate is needed to find Real GDP Calculate the CPI (consumer price index) in order to calculate the rate of inflation

Inflation = average prices are increasing ◦ Goods and services become too expensive Deflation = average prices are decreasing ◦ Producers aren’t making as much profit Stagflation= prices and unemployment are rising simultaneously ◦ Double economic nightmare as goods cost more and more people are out of work Hyperinflation=extreme rise in prices

Inflation = average prices are increasing ◦ Goods and services become too expensive Deflation = average prices are decreasing ◦ Producers aren’t making as much profit Stagflation= prices and unemployment are rising simultaneously ◦ Double economic nightmare as goods cost more and more people are out of work Hyperinflation=extreme rise in prices

Inflation affects people’s purchasing power ◦ People on fixed income are hurt most ◦ Workers who receive cost-of-living increases (COLA’s) aren’t Measure Inflation rate using the Consumer Price Index

Inflation affects people’s purchasing power ◦ People on fixed income are hurt most ◦ Workers who receive cost-of-living increases (COLA’s) aren’t Measure Inflation rate using the Consumer Price Index

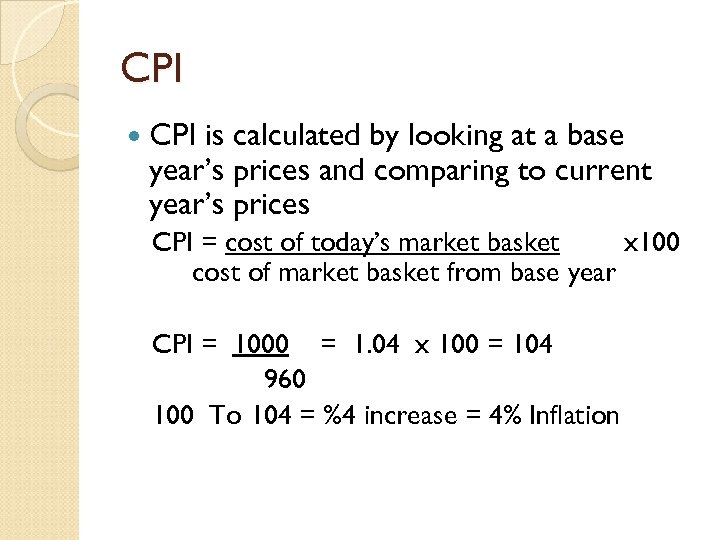

CPI is calculated by looking at a base year’s prices and comparing to current year’s prices CPI = cost of today’s market basket x 100 cost of market basket from base year CPI = 1000 = 1. 04 x 100 = 104 960 100 To 104 = %4 increase = 4% Inflation

CPI is calculated by looking at a base year’s prices and comparing to current year’s prices CPI = cost of today’s market basket x 100 cost of market basket from base year CPI = 1000 = 1. 04 x 100 = 104 960 100 To 104 = %4 increase = 4% Inflation

2010= $1455 2015= $1600 CPI= Inflation Rate=

2010= $1455 2015= $1600 CPI= Inflation Rate=

1960= 710 2000= 1145 CPI= Inflation Rate=

1960= 710 2000= 1145 CPI= Inflation Rate=

1977= 1035 2015= 1195 CPI= Inflation Rate=

1977= 1035 2015= 1195 CPI= Inflation Rate=

2013= 1365 2015= 1360 CPI= Inflation Rate=

2013= 1365 2015= 1360 CPI= Inflation Rate=

EOCT Practice Q: The consumer price index is a measure of a. Gross domestic product b. Aggregate supply c. Aggregate demand d. Inflation

EOCT Practice Q: The consumer price index is a measure of a. Gross domestic product b. Aggregate supply c. Aggregate demand d. Inflation

Practice EOCT Q: a. b. c. d. When is the benefit for workers to have a contract with a cost of living adjustment? During a recession During a depression During an inflationary period During a strike, or work stoppage

Practice EOCT Q: a. b. c. d. When is the benefit for workers to have a contract with a cost of living adjustment? During a recession During a depression During an inflationary period During a strike, or work stoppage

Calculate Market basket in 2010= 1545 Market basket in 2011=1610

Calculate Market basket in 2010= 1545 Market basket in 2011=1610

Unemployment Rate of unemployment = # of people looking for work / number of people in workforce Workforce = ◦ Over age 16 ◦ Employed or unemployed and… ◦ Actively looking for job within last 30 days Some people CHOOSE not to work household production, age, illness, Frustration

Unemployment Rate of unemployment = # of people looking for work / number of people in workforce Workforce = ◦ Over age 16 ◦ Employed or unemployed and… ◦ Actively looking for job within last 30 days Some people CHOOSE not to work household production, age, illness, Frustration

Unemployment, cont’d 4 types of unemployment ◦ Frictional Left one job and looking for another, changing careers, ◦ Seasonal unemployment Unemployed due to seasons, agricultural workers, construction workers ◦ Structural Skills don’t match employers needs, computer skills ◦ Cyclical Due to a business cycle contraction, less spending results in less production resulting in layoffs and closings

Unemployment, cont’d 4 types of unemployment ◦ Frictional Left one job and looking for another, changing careers, ◦ Seasonal unemployment Unemployed due to seasons, agricultural workers, construction workers ◦ Structural Skills don’t match employers needs, computer skills ◦ Cyclical Due to a business cycle contraction, less spending results in less production resulting in layoffs and closings

EOCT Practice Q: The government begins funding training programs to teach computer repair to unemployed adults. Which kind of unemployment would this help the MOST? a. Frictional b. Seasonal c. Structural d. Cyclical

EOCT Practice Q: The government begins funding training programs to teach computer repair to unemployed adults. Which kind of unemployment would this help the MOST? a. Frictional b. Seasonal c. Structural d. Cyclical

700, 000 are working 35, 000 have given up looking for work 22, 800 are still looking for work How many people are in the Labor Force? What is the unemployment rate?

700, 000 are working 35, 000 have given up looking for work 22, 800 are still looking for work How many people are in the Labor Force? What is the unemployment rate?

1, 800, 000 are working 49, 000 are looking for work 22, 536 have stopped looking Calculate the unemployment rate

1, 800, 000 are working 49, 000 are looking for work 22, 536 have stopped looking Calculate the unemployment rate

EOCT Practice Q: Sam is a 14 year old looking for a weekend babysitting job. Is he calculated in the labor force?

EOCT Practice Q: Sam is a 14 year old looking for a weekend babysitting job. Is he calculated in the labor force?

Aggregate Demand Supply AD and AS affect GDP, Inflation and Unemployment rates!! AD = Total amount of goods and services people in an economy are willing to buy. AS = Total amount of goods and services that all producers in an economy are willing to provide Usually when consumer demand changes, causing prices to change, producers can respond relatively quickly to changing prices. Not so easy for an entire economy. AD shifts to the left (decrease), results in less being bought, wide spread price changes take time, products don’t get sold, producers need to cut production, people get laid off (bad).

Aggregate Demand Supply AD and AS affect GDP, Inflation and Unemployment rates!! AD = Total amount of goods and services people in an economy are willing to buy. AS = Total amount of goods and services that all producers in an economy are willing to provide Usually when consumer demand changes, causing prices to change, producers can respond relatively quickly to changing prices. Not so easy for an entire economy. AD shifts to the left (decrease), results in less being bought, wide spread price changes take time, products don’t get sold, producers need to cut production, people get laid off (bad).

AD/AS Cont’d Production cuts resulting in layoffs leads to decrease in GDP. Decreasing GDP for 6 months or more is a Recession. When prices drop to meet equilibrium again, the economy enters a recovery. Recession lasting long time and GDP decrease is severe, economy has entered Depression.

AD/AS Cont’d Production cuts resulting in layoffs leads to decrease in GDP. Decreasing GDP for 6 months or more is a Recession. When prices drop to meet equilibrium again, the economy enters a recovery. Recession lasting long time and GDP decrease is severe, economy has entered Depression.

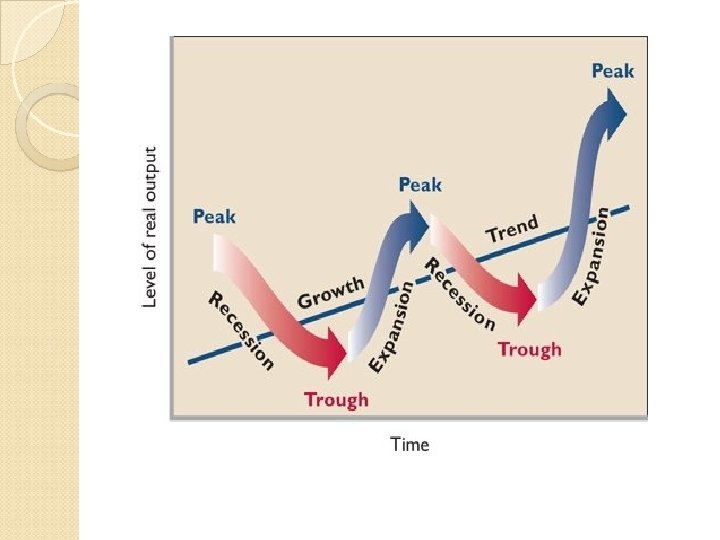

Business Cycle (Ups and Downs) Economic Expansion – time of increasing employment, income and general prosperity Peak – moment before contraction Economic Contraction – dwindling business activity; unemployment Trough – lowest point of contraction, economy has “bottomed out”

Business Cycle (Ups and Downs) Economic Expansion – time of increasing employment, income and general prosperity Peak – moment before contraction Economic Contraction – dwindling business activity; unemployment Trough – lowest point of contraction, economy has “bottomed out”

End

End

Practice EOCT Q: If aggregate demand real GDP are beginning to fall and the unemployment rate is beginning to rise, what conclusion can you draw? a. The economy is in an expansion phase b. The economy is facing a slowdown c. The economy is in recovery d. Aggregate supply is increasing

Practice EOCT Q: If aggregate demand real GDP are beginning to fall and the unemployment rate is beginning to rise, what conclusion can you draw? a. The economy is in an expansion phase b. The economy is facing a slowdown c. The economy is in recovery d. Aggregate supply is increasing

Two Competing Theories In order to stabilize a declining economy 1. Supply-side economics -make it easier for suppliers to supply more, they have to hire more, more people working and spending their money, etc 2. Demand-side economics -increase demand, suppliers want to supply more and need to hire more, more people working and spending their money, etc

Two Competing Theories In order to stabilize a declining economy 1. Supply-side economics -make it easier for suppliers to supply more, they have to hire more, more people working and spending their money, etc 2. Demand-side economics -increase demand, suppliers want to supply more and need to hire more, more people working and spending their money, etc

Fighting Unemployment and Inflation Fiscal Policy ◦ How the government chooses to tax citizens and businesses and spend the revenue it raises ◦ Fiscal Policy is set by Congress and the President ◦ Attempting to manipulate GDP to fight unemployment and inflation

Fighting Unemployment and Inflation Fiscal Policy ◦ How the government chooses to tax citizens and businesses and spend the revenue it raises ◦ Fiscal Policy is set by Congress and the President ◦ Attempting to manipulate GDP to fight unemployment and inflation

Fiscal policy Governments policies of tax and spend Raise taxes/lower taxes Increase gov. spending/decrease gov. spending Fiscal Conservatives; ie Ronald Reagan, Newt Gingrich: lower taxes, less spending, “social needs met by individuals, organizations, businesses” Fiscal Liberals; ie Ted Kennedy, FDR: more active and involved government and willing to pay higher taxes for it

Fiscal policy Governments policies of tax and spend Raise taxes/lower taxes Increase gov. spending/decrease gov. spending Fiscal Conservatives; ie Ronald Reagan, Newt Gingrich: lower taxes, less spending, “social needs met by individuals, organizations, businesses” Fiscal Liberals; ie Ted Kennedy, FDR: more active and involved government and willing to pay higher taxes for it

Fiscal Policy Expansionary: Used to expand the economy (raise employment, lower prices) 1. Increase federal spending 2. Decrease federal taxes Contractionary: Used to contract the economy (slow spending, raise prices) 1. Decrease federal spending 2. Increase federal taxes

Fiscal Policy Expansionary: Used to expand the economy (raise employment, lower prices) 1. Increase federal spending 2. Decrease federal taxes Contractionary: Used to contract the economy (slow spending, raise prices) 1. Decrease federal spending 2. Increase federal taxes

Taxes Impact of taxes ◦ Resource allocation Increases costs of inputs, therefore, it causes a decrease in supply Causes prices to go up, leads to less revenue for businesses, and fewer jobs ◦ Behavior adjustment Sin Taxes Meant to raise revenues and reduce consumption ◦ Productivity and growth If taxes get too high, people loose the incentive to work harder and be more productive

Taxes Impact of taxes ◦ Resource allocation Increases costs of inputs, therefore, it causes a decrease in supply Causes prices to go up, leads to less revenue for businesses, and fewer jobs ◦ Behavior adjustment Sin Taxes Meant to raise revenues and reduce consumption ◦ Productivity and growth If taxes get too high, people loose the incentive to work harder and be more productive

Taxes cont. How do we decide who pays taxes? ◦ 2 principles Benefit principle of taxation Those who benefit from services should pay Pay based on how much you use a service Ex. Gas taxes Ability to pay principle People should pay according to their ability, regardless of the benefits they receive Assumes that persons with higher incomes suffer less discomfort paying taxes than persons with lower incomes

Taxes cont. How do we decide who pays taxes? ◦ 2 principles Benefit principle of taxation Those who benefit from services should pay Pay based on how much you use a service Ex. Gas taxes Ability to pay principle People should pay according to their ability, regardless of the benefits they receive Assumes that persons with higher incomes suffer less discomfort paying taxes than persons with lower incomes

Taxes cont. Types of taxes ◦ Proportional Tax % of tax is the same across the board Same impact on everyone ◦ Progressive Tax Higher the income, higher the proportion and vice versa Larger impact on people with higher incomes ◦ Regressive Tax Larger impact on people with lower incomes

Taxes cont. Types of taxes ◦ Proportional Tax % of tax is the same across the board Same impact on everyone ◦ Progressive Tax Higher the income, higher the proportion and vice versa Larger impact on people with higher incomes ◦ Regressive Tax Larger impact on people with lower incomes

Examples of Taxes Income Tax: $$ coming out of your paycheck (Progressive) Sales Tax: $$ added on to purchases (Regressive) FICA Tax: $$ taken out of pay for SS benefits (Proportional)

Examples of Taxes Income Tax: $$ coming out of your paycheck (Progressive) Sales Tax: $$ added on to purchases (Regressive) FICA Tax: $$ taken out of pay for SS benefits (Proportional)

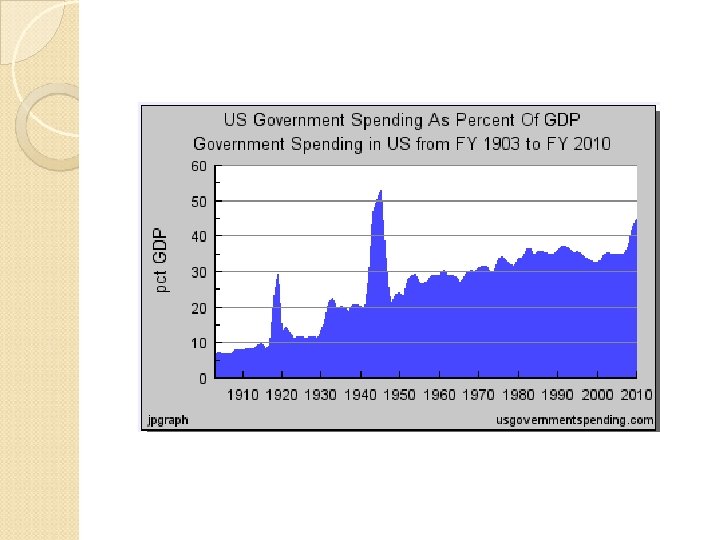

Government Spending ◦ Increased tremendously since Great Depression under the New Deal ◦ Attempt to pull nation out of depression (recover, relief, reform) ◦ Increased spending in 60’s under Great Society ◦ Attempt to bridge the income gap ◦ Increased in 2000’s ◦ Attack of 9/11 leading to two wars ◦ Recession of 2007

Government Spending ◦ Increased tremendously since Great Depression under the New Deal ◦ Attempt to pull nation out of depression (recover, relief, reform) ◦ Increased spending in 60’s under Great Society ◦ Attempt to bridge the income gap ◦ Increased in 2000’s ◦ Attack of 9/11 leading to two wars ◦ Recession of 2007

Government Spending cont. Federal Deficits and the National Debt ◦ Deficit spending Spending more than is collected in revenues History Largest deficits in relative terms occurred during WWII 80’s had very large deficits Decreased throughout the 90’s Now is very large…how large? http: //www. babylontoday. com/national_debt_clock. htm The government sells bonds to pay for deficit spending This continually adds to the National Debt All the deficits combined Has grown almost continuously since 1900

Government Spending cont. Federal Deficits and the National Debt ◦ Deficit spending Spending more than is collected in revenues History Largest deficits in relative terms occurred during WWII 80’s had very large deficits Decreased throughout the 90’s Now is very large…how large? http: //www. babylontoday. com/national_debt_clock. htm The government sells bonds to pay for deficit spending This continually adds to the National Debt All the deficits combined Has grown almost continuously since 1900

Government Spending cont. Negative effects of deficit spending ◦ Crowding Out Effect Higher than normal interest rates that heavy government borrowing causes Balanced Budget ◦ Neither surplus nor deficit ◦ Difficult Wars Entitlements Broad social programs to provide minimum health, nutritional, and income level for eligible individuals

Government Spending cont. Negative effects of deficit spending ◦ Crowding Out Effect Higher than normal interest rates that heavy government borrowing causes Balanced Budget ◦ Neither surplus nor deficit ◦ Difficult Wars Entitlements Broad social programs to provide minimum health, nutritional, and income level for eligible individuals

Fiscal Policies ◦ 2 Types Automatic Stabilizers Some tax/spending automatically rise or fall with changes in level of national economic activity For example: when economy suffers and people become unemployed, government spending for unemployment benefits automatically increases while revenues from sales taxes fall Discretionary fiscal policy Taking direct action during an upturn or a downturn For example: when economy suffers and Congress enacts legislation to decrease income tax

Fiscal Policies ◦ 2 Types Automatic Stabilizers Some tax/spending automatically rise or fall with changes in level of national economic activity For example: when economy suffers and people become unemployed, government spending for unemployment benefits automatically increases while revenues from sales taxes fall Discretionary fiscal policy Taking direct action during an upturn or a downturn For example: when economy suffers and Congress enacts legislation to decrease income tax

Fiscal Policies Both types have issue with lag time (time for the policy to take effect), but Discretionary is worse 1. Recognition Lag = problem has to be recognized 2. Administrative Lag = members of the legislative and executive branches of gov must agree on what spending or tax changes to adopt 3. Operational Lag = still takes time for those actions to have an effect on the economy

Fiscal Policies Both types have issue with lag time (time for the policy to take effect), but Discretionary is worse 1. Recognition Lag = problem has to be recognized 2. Administrative Lag = members of the legislative and executive branches of gov must agree on what spending or tax changes to adopt 3. Operational Lag = still takes time for those actions to have an effect on the economy

Expansionary or Contractionary? The economy is suffering from its worst slowdown in 30 years. Unemployment has reached 10%

Expansionary or Contractionary? The economy is suffering from its worst slowdown in 30 years. Unemployment has reached 10%

The annual inflation rate is slowing and now stands at 2. 5%

The annual inflation rate is slowing and now stands at 2. 5%

We have some good news and some bad news: The unemployment rate has fallen to the lowest level in a decade, 2. 3%. But inflation has risen to 8%.

We have some good news and some bad news: The unemployment rate has fallen to the lowest level in a decade, 2. 3%. But inflation has risen to 8%.

The unemployment rate remains steady at 11%.

The unemployment rate remains steady at 11%.

The annual inflation rate is 8. 5% and rising.

The annual inflation rate is 8. 5% and rising.

Money ◦ Before Money Barter Economy Moneyless economy that relies on trade ◦ What is money? Any substance that functions as a medium of exchange Generally accepted as payment Standard of value Place on dollar amount on just about anything Store of value Goods can be converted into money and stored for long periods of time

Money ◦ Before Money Barter Economy Moneyless economy that relies on trade ◦ What is money? Any substance that functions as a medium of exchange Generally accepted as payment Standard of value Place on dollar amount on just about anything Store of value Goods can be converted into money and stored for long periods of time

Money Characteristics of money ◦ ◦ Portability Durability Divisibility Limited Availability Gold Standard VS Fiat Standard ◦ Gold Standard Monetary standard in which the basic currency is equal to and can be exchanged for gold. Money feels more secure because it can be exchanged for gold Prevents the government from printing too much paper currency Disadvantage is that a growing economy needs a growing money supply ◦ Fiat Standard Money system based on faith Use a managed money supply

Money Characteristics of money ◦ ◦ Portability Durability Divisibility Limited Availability Gold Standard VS Fiat Standard ◦ Gold Standard Monetary standard in which the basic currency is equal to and can be exchanged for gold. Money feels more secure because it can be exchanged for gold Prevents the government from printing too much paper currency Disadvantage is that a growing economy needs a growing money supply ◦ Fiat Standard Money system based on faith Use a managed money supply

Monetary Policy Federal Reserve Goal is to help maintain economic stability Established in 1913 after the panic of 1907 Prior to establishment money supply was erratic, unstable Federal Open Market Committee makes important decisions

Monetary Policy Federal Reserve Goal is to help maintain economic stability Established in 1913 after the panic of 1907 Prior to establishment money supply was erratic, unstable Federal Open Market Committee makes important decisions

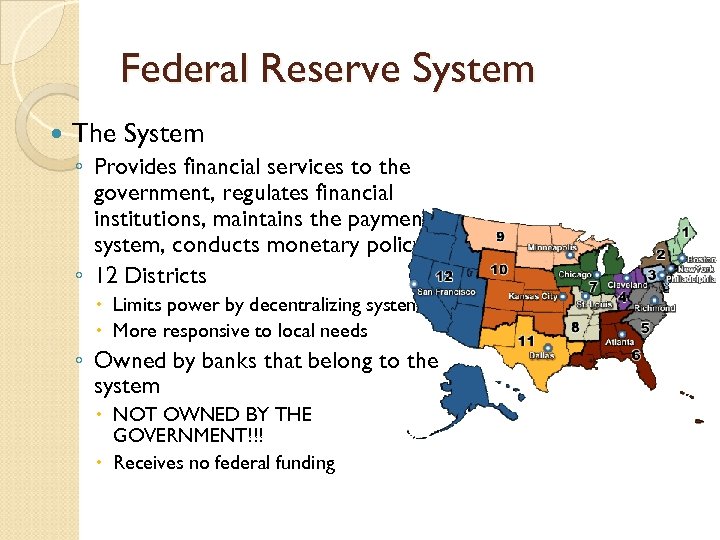

Federal Reserve System The System ◦ Provides financial services to the government, regulates financial institutions, maintains the payments system, conducts monetary policy ◦ 12 Districts Limits power by decentralizing system More responsive to local needs ◦ Owned by banks that belong to the system NOT OWNED BY THE GOVERNMENT!!! Receives no federal funding

Federal Reserve System The System ◦ Provides financial services to the government, regulates financial institutions, maintains the payments system, conducts monetary policy ◦ 12 Districts Limits power by decentralizing system More responsive to local needs ◦ Owned by banks that belong to the system NOT OWNED BY THE GOVERNMENT!!! Receives no federal funding

Federal Reserve System Structure ◦ Board of Governors 7 members appointed by president for 14 year terms Confirmed by the Senate to staggered terms 1 new member every 2 years One member serves as chairperson Currently Janet Yellen Board sets policies for the Fed and the member banks ◦ 12 District Banks ◦ Member banks

Federal Reserve System Structure ◦ Board of Governors 7 members appointed by president for 14 year terms Confirmed by the Senate to staggered terms 1 new member every 2 years One member serves as chairperson Currently Janet Yellen Board sets policies for the Fed and the member banks ◦ 12 District Banks ◦ Member banks

Federal Reserve System Structure cont. ◦ Federal Open Market Committee (FOMC) 7 members of the board and 5 districts presidents who serve 1 year rotating terms Meets about 8 times a year Make decisions about growth of money supply and interest rates. ◦ Federal Advisory Council 12 members appointed by the 12 regional banks Offer advise on the overall health of the economy

Federal Reserve System Structure cont. ◦ Federal Open Market Committee (FOMC) 7 members of the board and 5 districts presidents who serve 1 year rotating terms Meets about 8 times a year Make decisions about growth of money supply and interest rates. ◦ Federal Advisory Council 12 members appointed by the 12 regional banks Offer advise on the overall health of the economy

Federal Reserve System Responsibilities of the Fed ◦ Mergers Regulates bank mergers ◦ Clears Checks You write a check to Publix deposits the check in Publix’s bank then place money in Publix’s account Publix’s bank deposits the check at the Fed then places money in Publix’s bank Fed deposits check in your bank Your bank takes money out of your account and gives it to the Fed Your bank then gives you the cancelled check ◦ Currency Replaces old currency and stores currency

Federal Reserve System Responsibilities of the Fed ◦ Mergers Regulates bank mergers ◦ Clears Checks You write a check to Publix deposits the check in Publix’s bank then place money in Publix’s account Publix’s bank deposits the check at the Fed then places money in Publix’s bank Fed deposits check in your bank Your bank takes money out of your account and gives it to the Fed Your bank then gives you the cancelled check ◦ Currency Replaces old currency and stores currency

Challenges Fighting unemployment and declining GDP Fighting inflation

Challenges Fighting unemployment and declining GDP Fighting inflation

Tools Open Market Operations/Often…like breathing ◦ Bonds/securities ◦ Buys and sells Discount rates/Occasionally…like getting the flu ◦ Rate of interest charged on loans to banks ◦ Raises and lowers Reserve Requirements/Rarely…like open-heart surgery ◦ ◦ Amount banks are required to keep on hand changes the minimum reserves Higher=tighter money policy Lower=easier money policy

Tools Open Market Operations/Often…like breathing ◦ Bonds/securities ◦ Buys and sells Discount rates/Occasionally…like getting the flu ◦ Rate of interest charged on loans to banks ◦ Raises and lowers Reserve Requirements/Rarely…like open-heart surgery ◦ ◦ Amount banks are required to keep on hand changes the minimum reserves Higher=tighter money policy Lower=easier money policy

Open Market Operations Buy bonds=puts money in the system, increases money supply, consumers have more cash, spend more, helps to raise GDP Sell bonds=takes money out of the system, decreases money supply, consumers have less cash, helps slow GDP

Open Market Operations Buy bonds=puts money in the system, increases money supply, consumers have more cash, spend more, helps to raise GDP Sell bonds=takes money out of the system, decreases money supply, consumers have less cash, helps slow GDP

Discount Rate Raise interest rates=less consumer spending Lower interest rates=more consumer spending

Discount Rate Raise interest rates=less consumer spending Lower interest rates=more consumer spending

Required Reserve Ratio Raise reserves=less money for banks to loan out, interest rates go up, less consumer spending Lower reserves=more money banks can loan out, interest rates go down, more consumer spending

Required Reserve Ratio Raise reserves=less money for banks to loan out, interest rates go up, less consumer spending Lower reserves=more money banks can loan out, interest rates go down, more consumer spending

Money Creation Money Multiplier Effect = money being created in the economic system Money is not created by printing, but by banks doing their business…lending Money Multiplier Formula = ◦ Deposit x 1/RRR(Required Reserve Ratio)

Money Creation Money Multiplier Effect = money being created in the economic system Money is not created by printing, but by banks doing their business…lending Money Multiplier Formula = ◦ Deposit x 1/RRR(Required Reserve Ratio)

Suzy deposits $1000 in her checking acct. RRR = 10% $900 is loaned to Julie who gives it to John for a car John deposits $900 10% RRR $810 is loaned to Sam Total money supply is: $1000+$900+$810=$2710 (MME!)

Suzy deposits $1000 in her checking acct. RRR = 10% $900 is loaned to Julie who gives it to John for a car John deposits $900 10% RRR $810 is loaned to Sam Total money supply is: $1000+$900+$810=$2710 (MME!)

Calculate the MME: You deposit $500 and the RRR is 10% If the bank loans out all the money, how much money is put into the money supply?

Calculate the MME: You deposit $500 and the RRR is 10% If the bank loans out all the money, how much money is put into the money supply?

Answer: $500 x 1/. 10= $5000

Answer: $500 x 1/. 10= $5000

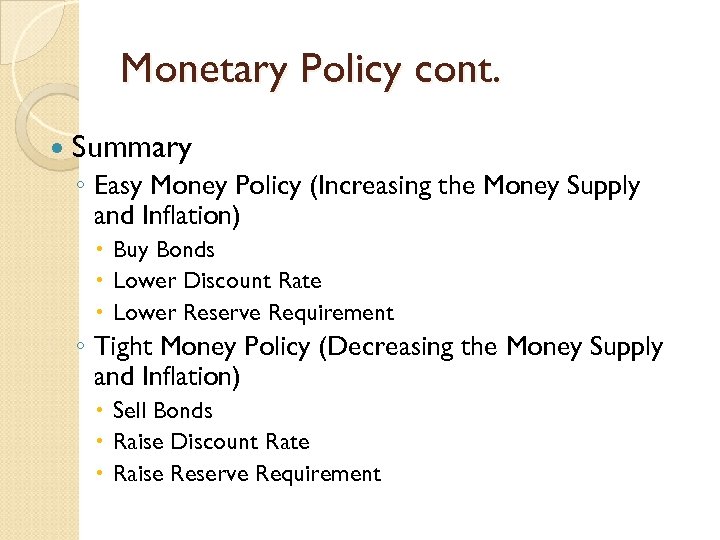

Monetary Policy cont. Summary ◦ Easy Money Policy (Increasing the Money Supply and Inflation) Buy Bonds Lower Discount Rate Lower Reserve Requirement ◦ Tight Money Policy (Decreasing the Money Supply and Inflation) Sell Bonds Raise Discount Rate Raise Reserve Requirement

Monetary Policy cont. Summary ◦ Easy Money Policy (Increasing the Money Supply and Inflation) Buy Bonds Lower Discount Rate Lower Reserve Requirement ◦ Tight Money Policy (Decreasing the Money Supply and Inflation) Sell Bonds Raise Discount Rate Raise Reserve Requirement

EOCT Practice Q’s 1. Which of the following is responsible for the monetary policy of the U. S. ? A. Congress B. The President C. The Senate D. The Federal Reserve System

EOCT Practice Q’s 1. Which of the following is responsible for the monetary policy of the U. S. ? A. Congress B. The President C. The Senate D. The Federal Reserve System

2. When the Fed sells government securities, or bonds, on the open market, what effect does this action have on the economy? A. increases money supply; increases consumer demand Increases money supply; reduces inflation risk Decreases money supply; increases consumer demand Decreases money supply; reduces inflation risk

2. When the Fed sells government securities, or bonds, on the open market, what effect does this action have on the economy? A. increases money supply; increases consumer demand Increases money supply; reduces inflation risk Decreases money supply; increases consumer demand Decreases money supply; reduces inflation risk

3. a. b. c. d. If GDP is decreasing and the unemployment rate is increasing, which fiscal policy would the government MOST likely use? Increase taxes Decrease taxes Increase bank reserves Decrease spending

3. a. b. c. d. If GDP is decreasing and the unemployment rate is increasing, which fiscal policy would the government MOST likely use? Increase taxes Decrease taxes Increase bank reserves Decrease spending

4. If the inflation rate is rising too fast, which fiscal policy would make the MOST sense? a. Increase taxes b. Decrease taxes c. Increase spending d. Decrease bank reserves

4. If the inflation rate is rising too fast, which fiscal policy would make the MOST sense? a. Increase taxes b. Decrease taxes c. Increase spending d. Decrease bank reserves