00d45216cc13a34c28c66c8de5e967cc.ppt

- Количество слайдов: 23

Macroeconomics - ECO 2013 2004 Summer Term B June 21 – July 30, 2004

Lecture 9: Monday, July 12 th Review Quiz 3 on Chapters 7 & 8 Review Mid-term Progress Reports Class Attendance Extra Credit: Attend FTAA Debate Chapter 9: Building the Aggregate Expenditures Model Chapter 10: Aggregate Expenditures Next Class on Wednesday, July 14 th

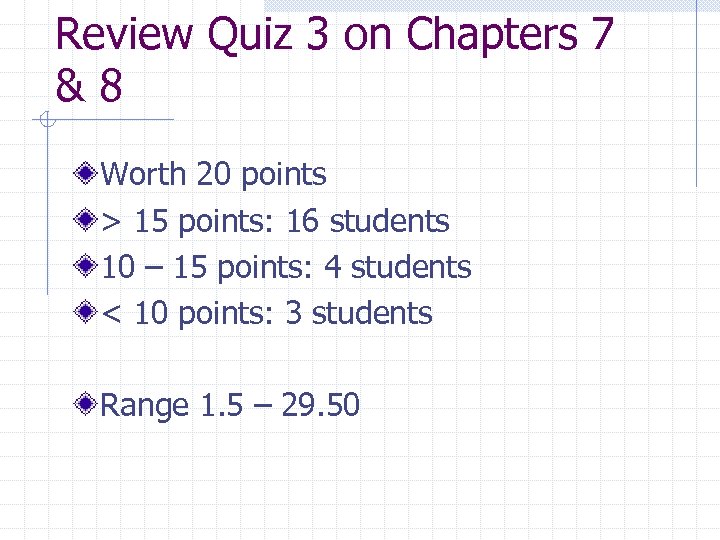

Review Quiz 3 on Chapters 7 &8 Worth 20 points > 15 points: 16 students 10 – 15 points: 4 students < 10 points: 3 students Range 1. 5 – 29. 50

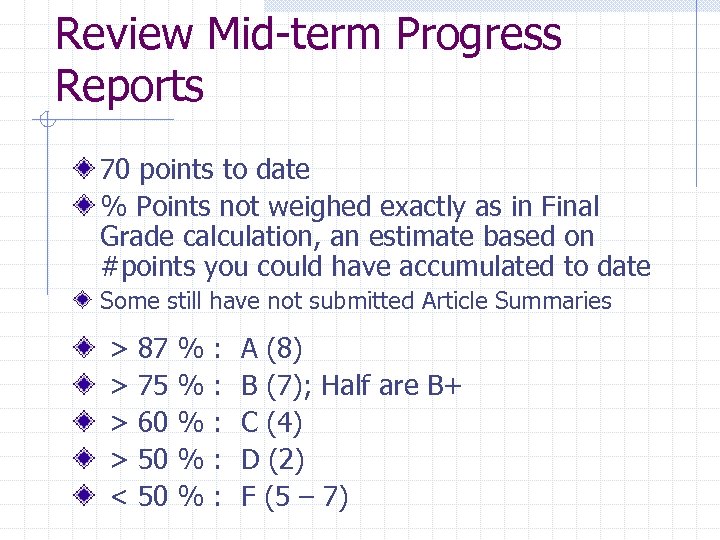

Review Mid-term Progress Reports 70 points to date % Points not weighed exactly as in Final Grade calculation, an estimate based on #points you could have accumulated to date Some still have not submitted Article Summaries > > < 87 75 60 50 50 % % % : : : A (8) B (7); Half are B+ C (4) D (2) F (5 – 7)

Class Attendance

Extra Credit Attend FTAA Debate Thursday, July 15 th 3: 30 – 7: 00 PM FIU University Park Campus: MARC Pavilion Center Cost: $15

Chapter 9: Building the Aggregate Expenditures Model Simplifying Assumptions for Private Closed Economy n n n For now, we ignore government expenditures, taxes, exports & imports All savings = personal savings Depreciation, Net Foreign Factor Income are zero Aggregate spending consists of Consumption & Investment GDP, NI, PI, & DI are equal

Tools of Aggregate Expenditures Model Amount of goods & services produced, level of employment depend directly on level of aggregate expenditures (total spending) Businesses will produce only a level of output that they think they can profitably sell Begin with excess production capacity and unemployed labor increase in aggregate expenditures will increase total output & employment but not raise price level Assume inflation is zero

Consumption & Saving Personal Savings means Not Spending Personal Savings = Disposable Income (DI) – Consumptions (C) Most important determinant of Consumption is Income, Disposable Income DI is also determinant of Saving Break-Even Income: Income level at which households plan to consume their entire income

Average Propensities Average Propensity to Consume (APC) = Consumption / Income Average Propensity to Save (APS) = Savings / Income APC + APS = 1 Highest APC countries are Canada & U. S.

Marginal Propensities Marginal Propensity to Consume (MPC) = Consumption / Income Marginal Propensity to Save (MPS) = Savings / Income

Nonincome Determinants of Consumption & Savings Wealth: real & financial assets n Wealthier households consume more Expectations on future prices & income n Expected inflation triggers current spending, less savings Taxation Household Debt n n Increase in debt means increased current consumption High debt triggers consumption reduction to pay off loans

Investment Business will invest in all projects for which the expected rate of return exceeds interest rate Expected ROR (r): n Investment spending is guided by profit motive Real Interest Rate n n Financial cost of borrowing money “capital” Apply the interest rate (i) to borrowed amount Firm undertakes profitable projects only when r i n Real interest rate is less inflation

Investment Demand Curve Shows the total monetary amounts that will be invested by a economy at various possible real interest rates Shifts are caused by: n n n Cost of acquiring, operating, & maintaining capital goods Business Taxes Technology Stock of Capital goods on hand Business Expectations

Investment Schedule Investment v. Real GDP Ig Shows the amount of investment at each level of GDP Investment Schedule is Unstable Factors: n n Durability of Capital & Variability of Expectations Irregularity of Innovation

Equilibrium GDP In closed economy, aggregate expenditures (GDP) consist only of consumption (C) + investment (Ig) n Total level of goods produced = C + Ig Equilibrium Output: Output whose production creates total spending just sufficient to purchase that output No overproduction n No excess of total spending At Equilibrium GDP, C + Ig = GDP n

Disequilibrium At levels of GDP below equilibrium, economy wants to spend at higher levels n Greater output will increase employment & total income At levels of GDP above equilibrium, economy wants to spend less, cut production, decline output fewer jobs, decline in total income

Say’s Law Act of producing goods generates income equal to the value of the goods produced Production of any output automatically provides the income needed to buy that output Supply creates its own demand

Chapter 10: Aggregate Expenditures Net Exports Government

International Trade & Equilibrium Output In an open economy, Net Exports = Exports – Imports GDP = C + Ig + Xn GDP = C + Ig + (X – M) Positive Net Exports increases aggregate expenditures & GDP beyond what they would be in closed economy Negative Net Exports reduced aggregate expenditures & GDP below what they would be in closed economy

International Economic Linkages Prosperity Abroad n Rising incomes among foreign trading partner allows U. S. to sell more goods abroad, raising U. S. exports Tariffs n n When other countries restrict their imports to stimulate their economies, they are reducing U. S. exports, depressing U. S. economy U. S. can retaliate by imposing own trade barriers on foreign products Exchange Rates n Depreciation of the dollar relative to other currencies enables people abroad to obtain more $/ unit of own currencies

Government Add government spending and taxes to model Simplifying Assumptions n n n Levels of investment & net exports are independent of level of GDP Gov’t purchases can’t affect private spending Gov’t tax revenues w w Disposable Income < Personal Income GDP, NI, PI remain equal Fixed taxes are collected No inflation

Next Class on Wednesday, July 14 th Chapters 11, 12 & 16 Review Progress Reports Third Article Summaries Due

00d45216cc13a34c28c66c8de5e967cc.ppt