d626291b629fed78feba23395dea6727.ppt

- Количество слайдов: 24

MACROECONOMICS AND THE GLOBAL BUSINESS ENVIRONMENT 2 nd edition The Current Account, the Balance of Payments, and National Wealth 1

19 -2 Current Account (NA) National Accounts Approach to the Current Account n GNI (GNP) = income generated by domestically owned factors of production anywhere in the world n GDP = C + I + G + NX n GNI = GDP + NFP (net factor payments from abroad) n NFP = payments to domestically owned factors (labor and capital) located abroad minus payments to foreign factors located domestically n Payments: (1) net dividends, interest, rent to residents owing 2 assets abroad and (2) net wages to residents working abroad

19 -3 Current Account (NA) n GNI = GDP + NFP n total income earned n GNDI = GDP + NFT n GNDI = gross national disposable income n NFT = net unilateral transfers abroad n n remittances, foreign aid total income available 3

19 -4 Current Account (NA) n Private sector net income = private sector income earned at home (Y or GDP) and abroad (NFP + NFT) payments from the government sector (transfers, TR, and interest on government debt, INT) – taxes paid to government (T) = Y + NFP+NFT + TR + INT – T n Public sector net income = taxes – transfers – interest payments = T – TR – INT 4

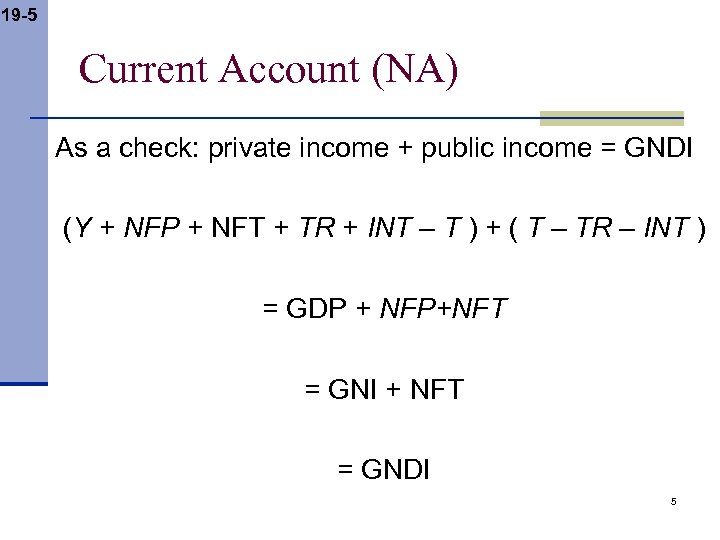

19 -5 Current Account (NA) As a check: private income + public income = GNDI (Y + NFP + NFT + TR + INT – T ) + ( T – TR – INT ) = GDP + NFP+NFT = GNI + NFT = GNDI 5

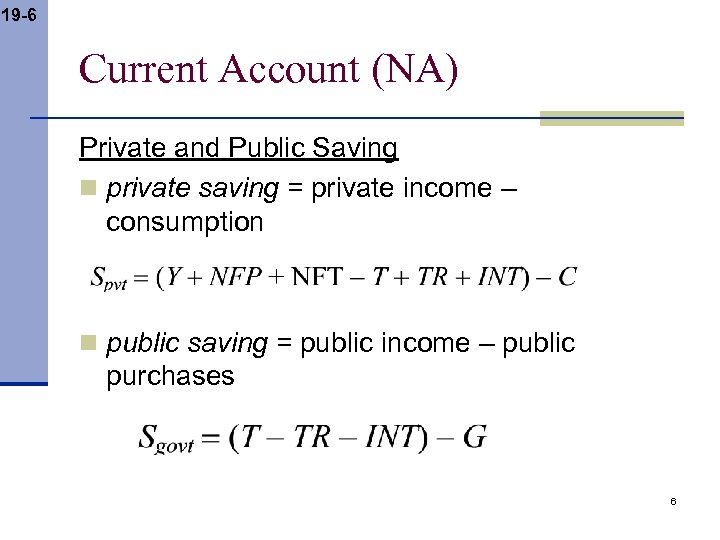

19 -6 Current Account (NA) Private and Public Saving n private saving = private income – consumption n public saving = public income – public purchases 6

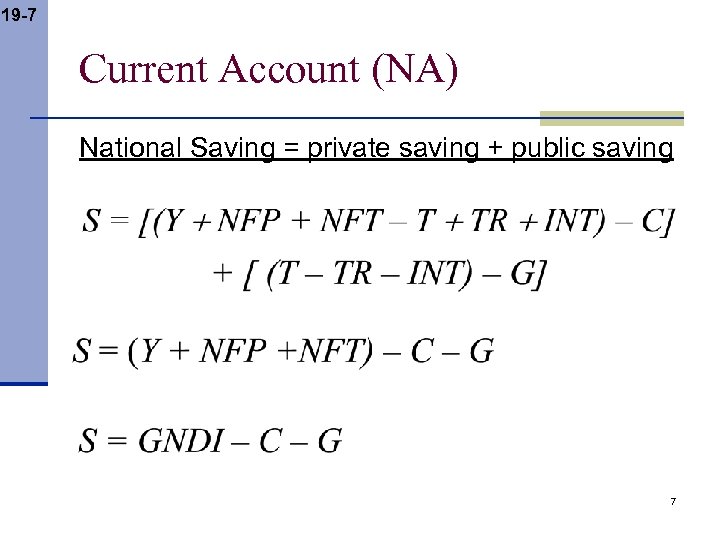

19 -7 Current Account (NA) National Saving = private saving + public saving 7

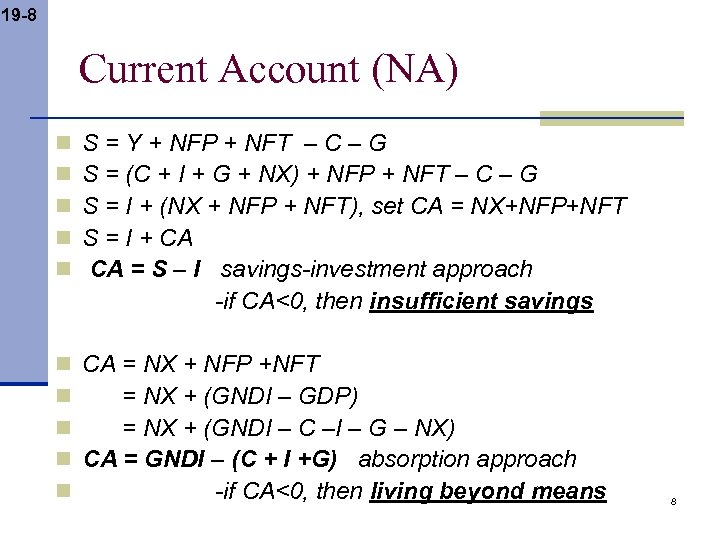

19 -8 Current Account (NA) n n n S = Y + NFP + NFT – C – G S = (C + I + G + NX) + NFP + NFT – C – G S = I + (NX + NFP + NFT), set CA = NX+NFP+NFT S = I + CA CA = S – I savings-investment approach -if CA<0, then insufficient savings n CA = NX + NFP +NFT n = NX + (GNDI – GDP) n = NX + (GNDI – C –I – G – NX) n CA = GNDI – (C + I +G) absorption approach n -if CA<0, then living beyond means 8

19 -9 Current Account (CA) Why Current Account Deficits? n CA = S – I n CA = Spvt + Sgovt – I n investment boom: generally good n fall in private saving: good or bad Attending graduate school: good n Luxurious living: bad n n fall in government saving: good or bad n Public investment : can be good n Running chronic deficits: bad 9

19 -10 Current Account (BOP) Balance of Payments (BOP) Accounting n Why BOP Accounting? BOP analysis helps us understand current account imbalances n BOP analysis helps us understand economic crisis driven by volatile international financial flows n n The accounting record of a country’s international transactions 10

19 -11 Current Account (BOP) Balance of payments accounting n Any transaction that involves a flow of funds into the United States is a credit (+) n item (enters with a plus sign); for example, exports n Any transaction involving a flow of funds out of the United States is a debit (–) n item (enters with a minus sign); for example, imports 11

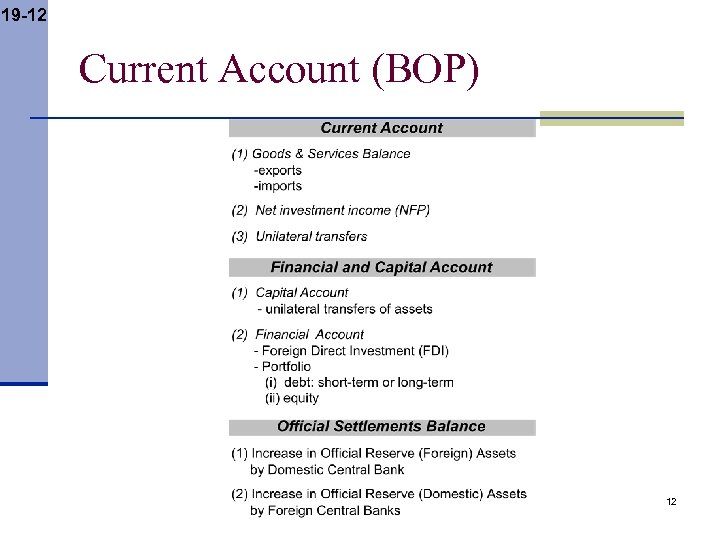

19 -12 Current Account (BOP) 12

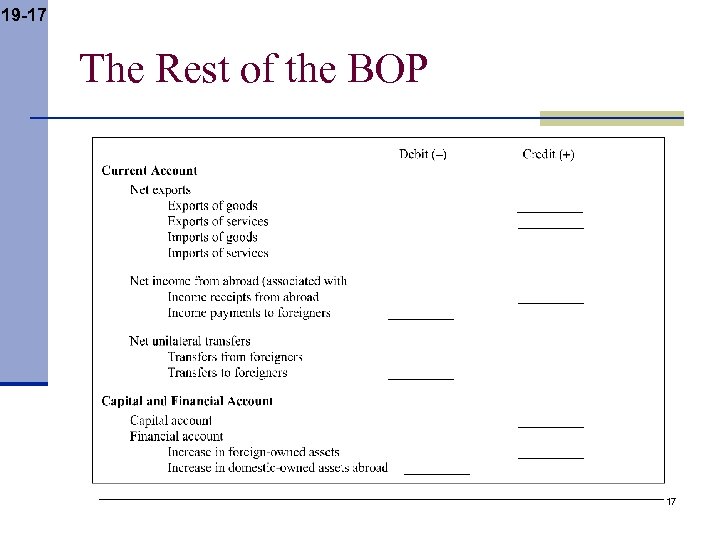

19 -13 Current Account (BOP) (1) Net exports of goods and services n services: n n U. S. family vacations in Mexico—import of tourism services (debit, funds flow out of U. S. ) Foreign student in U. S. —export of education services (credit, funds flow into U. S. ) (2) Net income from abroad (similar to NFP) n income receipts from abroad minus income payments to abroad n Income received from abroad is a credit item, since it causes funds to flow into the United States n Payment of income to foreigners is a debit item n Net income from abroad is part of the current account, and is about equal to NFP, net factor payments n Examples-U. S. : n n (1) income from residents working abroad (2) investment income from abroad…interest payments, dividends, royalties, etc. (3) Net unilateral transfers (similar to NFT) n Payments made from one country to another that do not correspond to a good, service, or asset (if they were, where would they be counted? ) n Negative net unilateral transfers for United States, since United States is a net donor to 13 other countries

19 -14 Current Account (BOP) n Sum of net exports of goods and services, net income from abroad, and net unilateral transfers is the current account balance Positive current account balance implies current account surplus n Negative current account balance implies current account deficit n n Note: Can have CA<0 with NX>0 n you can have trade surplus and have massive debt payments (NFP) 14

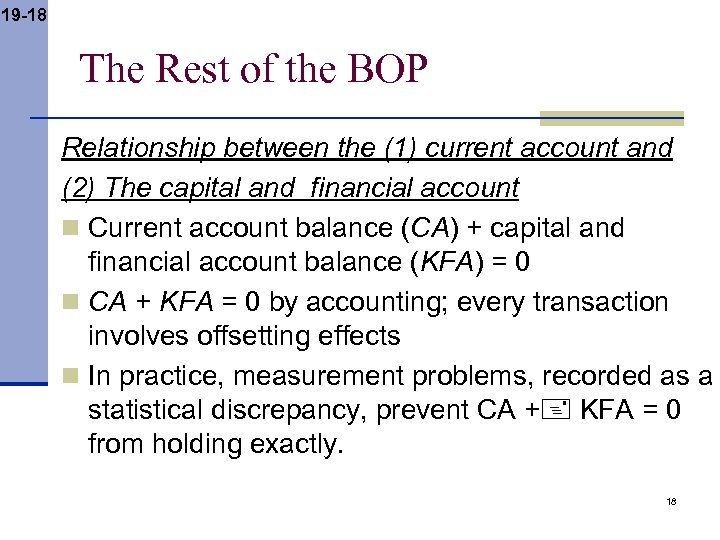

19 -15 The Rest of the BOP Capital and Financial Account n The capital account part n the net flow of unilateral transfers of assets (debt forgiveness, personal assets migrants take with them, transfer of real estate such as a military base or embassy) n The financial account part n trades in existing assets, either real (for example, buildings) or financial (for example, stocks and bonds) n FDI n Portfolio n debt n equity 15

19 -16 The Rest of the BOP n Note: capital and financial account used to be called capital account…so it’s common to still here people say the “current account and the capital account” n “capital account crisis” n Most transactions appear in the financial account n When home country sells assets to foreign country, that is a capital inflow for the home country and a credit (+) item in the capital and financial account n U. S. government sells t-bills to foreigners n When assets are purchased from a foreign country, there is a capital outflow from the home country and a debit (–) item in the capital and financial account 16

19 -17 The Rest of the BOP 17

19 -18 The Rest of the BOP Relationship between the (1) current account and (2) The capital and financial account n Current account balance (CA) + capital and financial account balance (KFA) = 0 n CA + KFA = 0 by accounting; every transaction involves offsetting effects n In practice, measurement problems, recorded as a statistical discrepancy, prevent CA + KFA = 0 from holding exactly. 18

19 -19 The Rest of the BOP The official settlements balance n Transactions in official reserve assets are conducted by central banks of countries n Official reserve assets are assets (foreign government securities, bank deposits, and SDRs of the IMF, gold) used in making international payments n Central banks buy (or sell) official reserve assets with (or to obtain) their own currencies n Official settlements balance n (1) Also called the balance of payments, it equals the net increase in a country’s official reserve assets n (2) For the United States, the net increase in official reserve assets is the rise in U. S. government reserve assets minus foreign central bank holdings of U. S. dollar assets n Having a balance of payments surplus means a country is increasing its official reserve assets; a balance of payments deficit is a reduction 19 in official reserve assets

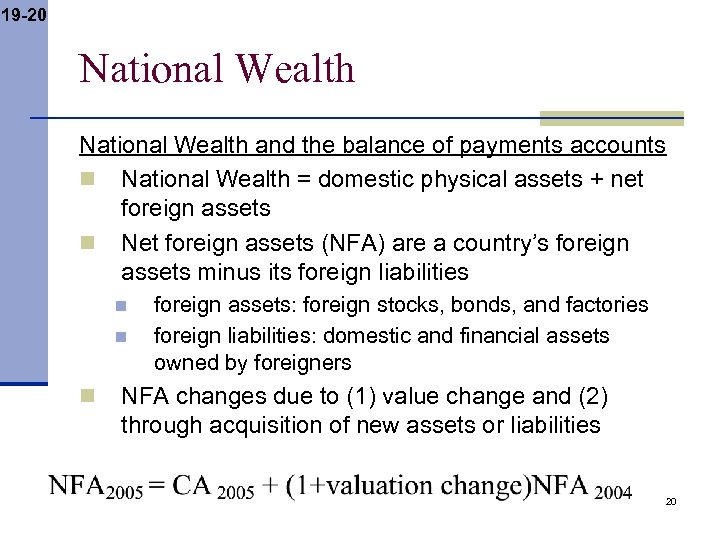

19 -20 National Wealth and the balance of payments accounts n National Wealth = domestic physical assets + net foreign assets n Net foreign assets (NFA) are a country’s foreign assets minus its foreign liabilities n n n foreign assets: foreign stocks, bonds, and factories foreign liabilities: domestic and financial assets owned by foreigners NFA changes due to (1) value change and (2) through acquisition of new assets or liabilities 20

19 -21 National Wealth n A current account surplus implies a capital and financial account deficit, and thus a net increase in holdings of foreign assets n a financial outflow…excess savings to the world and getting in return (1) IOUs, or (2) other assets, or (3) foreign liabilities reduced n A current account deficit implies a capital and financial account surplus, and thus a net decline in holdings of foreign assets n a financial inflow…pulling in excess savings from the world and giving out(1) IOUs, or (2) other assets, or (3) or reducing foreign assets) n International Investment Position = NFA n International Investment Position ≠ External Debt n however, large portions of current account deficits are often 21 finance by external debt

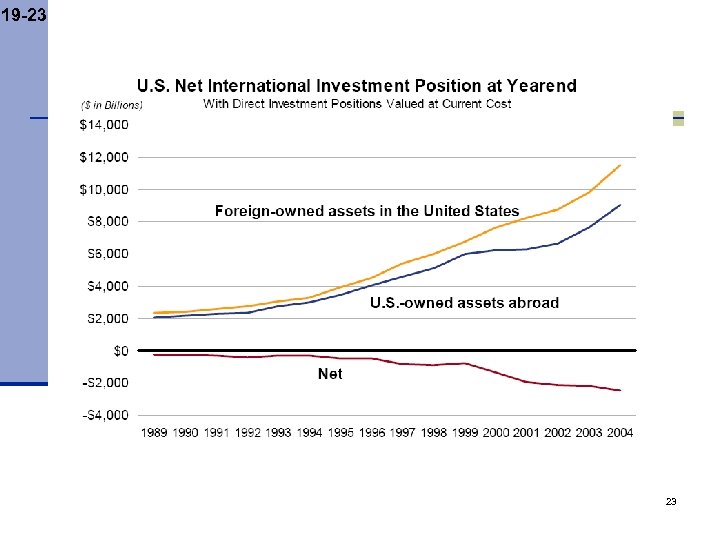

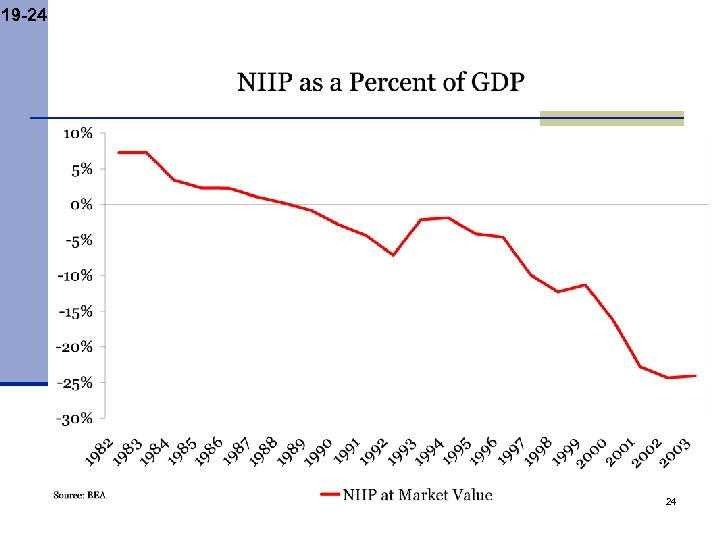

19 -22 National Wealth n U. S. International Investment Position n Largest “debtor” to the world in absolute dollars ($2. 43 trillion, 2003, 22% of GDP) n What really matters is not size of net foreign liabilities but country’s wealth (physical and human capital) n If net foreign liabilities rises and wealth rises, there’s no problem (collateral offsets debt) n U. S. wealth isn’t rising as much as net foreign liabilities which is worrisome 22

19 -23 23

19 -24 24

d626291b629fed78feba23395dea6727.ppt