2287cc0704b7dbaedb3ac1770be4a2fd.ppt

- Количество слайдов: 62

Macroeconomics 3/19/2018 1

Macroeconomics 3/19/2018 1

Macro topics covered • Big Issues – Business cycles – Unemployment – Inflation • Effects of fiscal policy and role of government – Keynesian “activist” approach • Problems with fiscal policy – New classical “supply-side” approach • Money and monetary policy – money creation and tools of monetary policy – money models – activist and non-activist approach 3/19/2018

Macro topics covered • Big Issues – Business cycles – Unemployment – Inflation • Effects of fiscal policy and role of government – Keynesian “activist” approach • Problems with fiscal policy – New classical “supply-side” approach • Money and monetary policy – money creation and tools of monetary policy – money models – activist and non-activist approach 3/19/2018

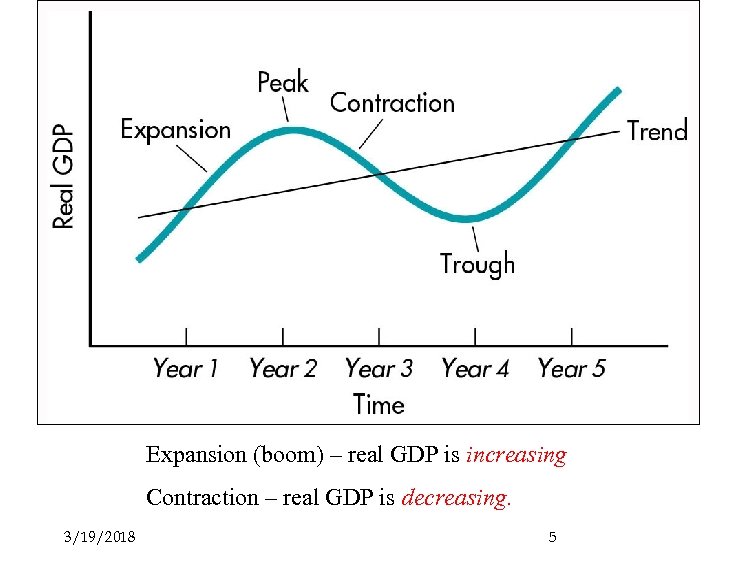

Business Cycles … pattern of rising real GDP followed by falling real GDP Recession … a period in which real GDP falls – Usually at least 2 successive quarters Depression … a severe and prolonged economic contraction “the great depression in the 30’s” – Around 25% of the labor force was unemployed. 3/19/2018 3

Business Cycles … pattern of rising real GDP followed by falling real GDP Recession … a period in which real GDP falls – Usually at least 2 successive quarters Depression … a severe and prolonged economic contraction “the great depression in the 30’s” – Around 25% of the labor force was unemployed. 3/19/2018 3

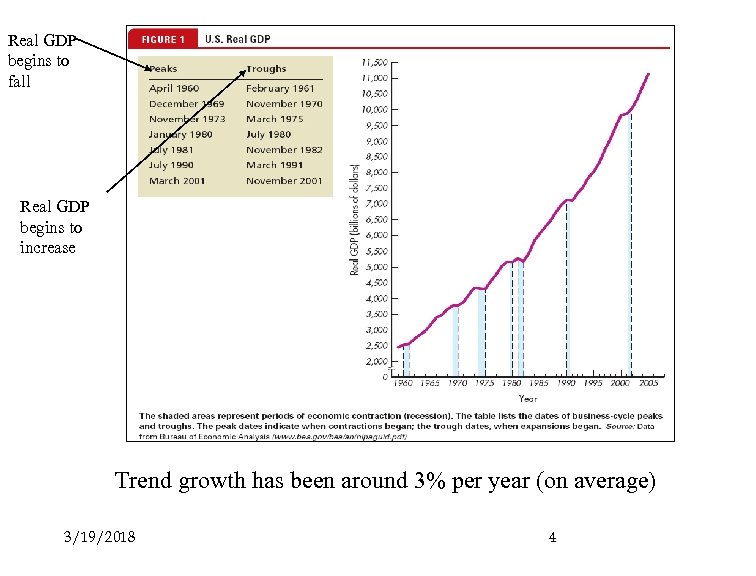

Real GDP begins to fall Real GDP begins to increase Trend growth has been around 3% per year (on average) 3/19/2018 4

Real GDP begins to fall Real GDP begins to increase Trend growth has been around 3% per year (on average) 3/19/2018 4

Expansion (boom) – real GDP is increasing Contraction – real GDP is decreasing. 3/19/2018 5

Expansion (boom) – real GDP is increasing Contraction – real GDP is decreasing. 3/19/2018 5

Unemployment Official Unemployment Rate … the percentage of the labor force that is not working Unemployment rate = [number of people unemployed / number of people in the labor force] • Notice: It is not the unemployment rate of the population. 3/19/2018 6

Unemployment Official Unemployment Rate … the percentage of the labor force that is not working Unemployment rate = [number of people unemployed / number of people in the labor force] • Notice: It is not the unemployment rate of the population. 3/19/2018 6

Labor Force Labor force = all US residents – residents under 16 years – institutionalized adults – adults not looking for work • To be in the labor force an individual must be either looking for a job or in work Therefore (alternative measure) Labor Force = Employed + unemployed – E. g. housemen/women are not included in the labor force. – Retired people are also not in the labor force. – In 2006 the labor force was 152. 8 Million 3/19/2018 7

Labor Force Labor force = all US residents – residents under 16 years – institutionalized adults – adults not looking for work • To be in the labor force an individual must be either looking for a job or in work Therefore (alternative measure) Labor Force = Employed + unemployed – E. g. housemen/women are not included in the labor force. – Retired people are also not in the labor force. – In 2006 the labor force was 152. 8 Million 3/19/2018 7

Other Labor Statistics • Labor Force Participation = Labor Force / population 16 and over • Employment/population ratio = employed people / population 16 and over • Given we have unemployment LFP>EP ratio 3/19/2018 8

Other Labor Statistics • Labor Force Participation = Labor Force / population 16 and over • Employment/population ratio = employed people / population 16 and over • Given we have unemployment LFP>EP ratio 3/19/2018 8

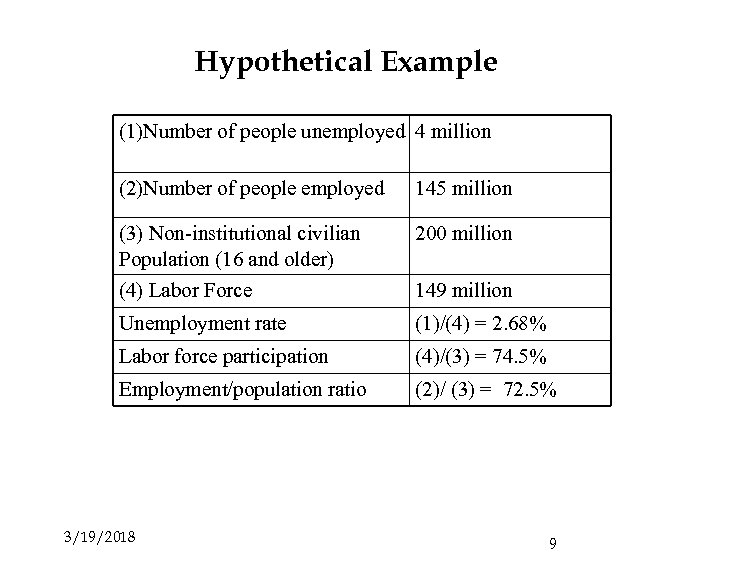

Hypothetical Example (1)Number of people unemployed 4 million (2)Number of people employed 145 million (3) Non-institutional civilian Population (16 and older) 200 million (4) Labor Force 149 million Unemployment rate (1)/(4) = 2. 68% Labor force participation (4)/(3) = 74. 5% Employment/population ratio (2)/ (3) = 72. 5% 3/19/2018 9

Hypothetical Example (1)Number of people unemployed 4 million (2)Number of people employed 145 million (3) Non-institutional civilian Population (16 and older) 200 million (4) Labor Force 149 million Unemployment rate (1)/(4) = 2. 68% Labor force participation (4)/(3) = 74. 5% Employment/population ratio (2)/ (3) = 72. 5% 3/19/2018 9

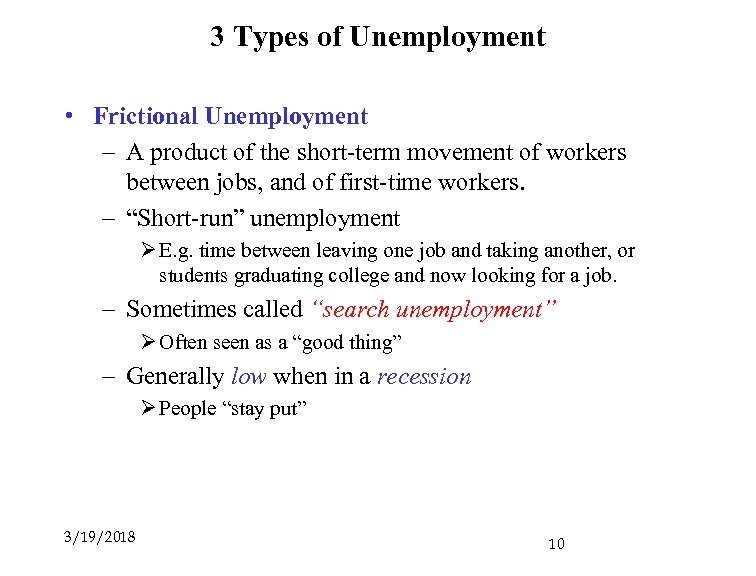

3 Types of Unemployment • Frictional Unemployment – A product of the short-term movement of workers between jobs, and of first-time workers. – “Short-run” unemployment Ø E. g. time between leaving one job and taking another, or students graduating college and now looking for a job. – Sometimes called “search unemployment” Ø Often seen as a “good thing” – Generally low when in a recession Ø People “stay put” 3/19/2018 10

3 Types of Unemployment • Frictional Unemployment – A product of the short-term movement of workers between jobs, and of first-time workers. – “Short-run” unemployment Ø E. g. time between leaving one job and taking another, or students graduating college and now looking for a job. – Sometimes called “search unemployment” Ø Often seen as a “good thing” – Generally low when in a recession Ø People “stay put” 3/19/2018 10

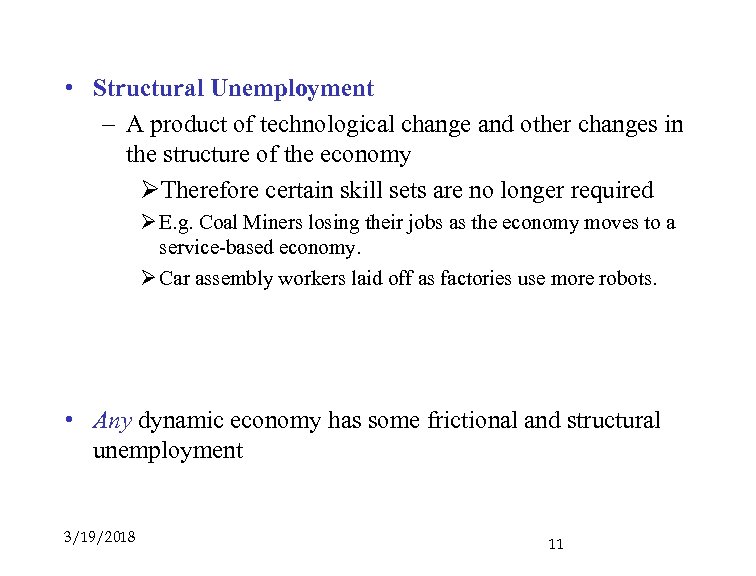

• Structural Unemployment – A product of technological change and other changes in the structure of the economy ØTherefore certain skill sets are no longer required Ø E. g. Coal Miners losing their jobs as the economy moves to a service-based economy. Ø Car assembly workers laid off as factories use more robots. • Any dynamic economy has some frictional and structural unemployment 3/19/2018 11

• Structural Unemployment – A product of technological change and other changes in the structure of the economy ØTherefore certain skill sets are no longer required Ø E. g. Coal Miners losing their jobs as the economy moves to a service-based economy. Ø Car assembly workers laid off as factories use more robots. • Any dynamic economy has some frictional and structural unemployment 3/19/2018 11

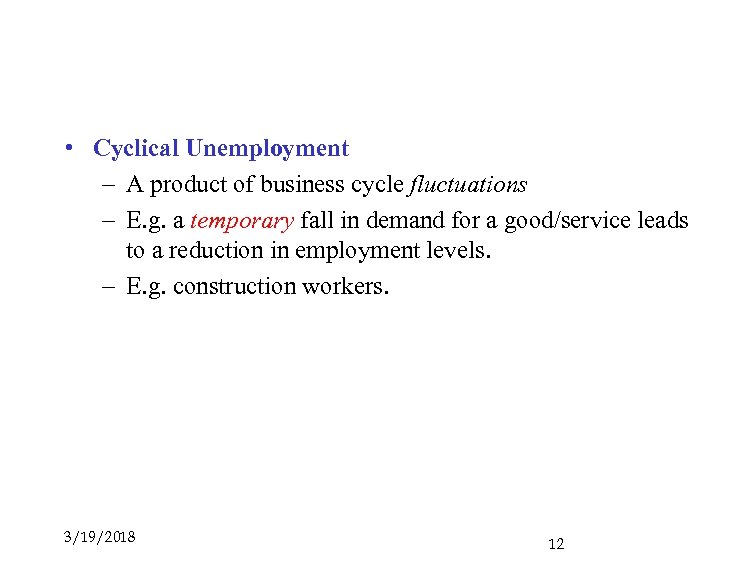

• Cyclical Unemployment – A product of business cycle fluctuations – E. g. a temporary fall in demand for a good/service leads to a reduction in employment levels. – E. g. construction workers. 3/19/2018 12

• Cyclical Unemployment – A product of business cycle fluctuations – E. g. a temporary fall in demand for a good/service leads to a reduction in employment levels. – E. g. construction workers. 3/19/2018 12

Natural Rate of Unemployment … the unemployment rate that exists in the absence of cyclical unemployment. – All economies will have some “natural” rate of unemployment. – Frictional plus structural – Can vary over time. • Estimated to be between 4 -6% • US it is approximately 5% (at the moment) Full Employment …. The level of employment when the economy is at its natural rate of unemployment – For the US it is assumed to be 95% – Sustainable level of employment 13

Natural Rate of Unemployment … the unemployment rate that exists in the absence of cyclical unemployment. – All economies will have some “natural” rate of unemployment. – Frictional plus structural – Can vary over time. • Estimated to be between 4 -6% • US it is approximately 5% (at the moment) Full Employment …. The level of employment when the economy is at its natural rate of unemployment – For the US it is assumed to be 95% – Sustainable level of employment 13

Inflation … a sustained increase in the average level of prices • The higher the price level the lower the real value of money – Purchasing power of a dollar is eroded. – Standard argument with parents and allowances…. Hyperinflation … an extremely high rate of inflation E. g. Zimbabwe. – Can cause a “flight from money”. 3/19/2018 14

Inflation … a sustained increase in the average level of prices • The higher the price level the lower the real value of money – Purchasing power of a dollar is eroded. – Standard argument with parents and allowances…. Hyperinflation … an extremely high rate of inflation E. g. Zimbabwe. – Can cause a “flight from money”. 3/19/2018 14

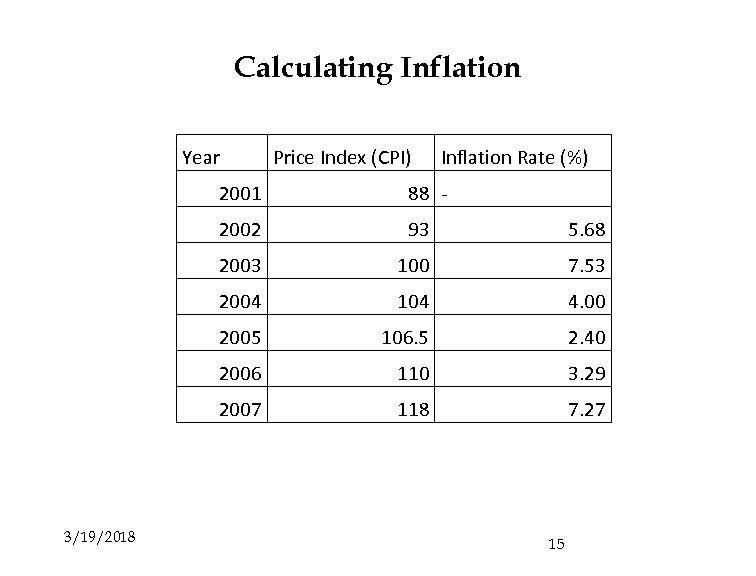

Calculating Inflation Year Price Index (CPI) Inflation Rate (%) 2001 2002 93 5. 68 2003 100 7. 53 2004 104 4. 00 2005 106. 5 2. 40 2006 110 3. 29 2007 3/19/2018 88 - 118 7. 27 15

Calculating Inflation Year Price Index (CPI) Inflation Rate (%) 2001 2002 93 5. 68 2003 100 7. 53 2004 104 4. 00 2005 106. 5 2. 40 2006 110 3. 29 2007 3/19/2018 88 - 118 7. 27 15

Unanticipated and Anticipated Inflation • Unanticipated Inflation – When the increase in prices is a “surprise” for most decision makers – Usually happens when inflation rates vary significantly. • Anticipated Inflation – When the increase in prices was “expected” by most decision makers – Usually happens when Central Banks have a good control on inflation 3/19/2018 16

Unanticipated and Anticipated Inflation • Unanticipated Inflation – When the increase in prices is a “surprise” for most decision makers – Usually happens when inflation rates vary significantly. • Anticipated Inflation – When the increase in prices was “expected” by most decision makers – Usually happens when Central Banks have a good control on inflation 3/19/2018 16

Costs of Inflation • Businesses generally avoid long term projects – Difficult to estimate the profitability of a project if prices (costs) are varying a lot in the future. • Prices no longer reflect relative scarcity – As some prices change slower (sticky) than others – Price no longer reflects all (current) information – More difficult for firms/individuals to make informed decisions. 3/19/2018 17

Costs of Inflation • Businesses generally avoid long term projects – Difficult to estimate the profitability of a project if prices (costs) are varying a lot in the future. • Prices no longer reflect relative scarcity – As some prices change slower (sticky) than others – Price no longer reflects all (current) information – More difficult for firms/individuals to make informed decisions. 3/19/2018 17

• “Shoe leather and Negotiation Costs” – Individuals spend time acquiring information – Cause higher transaction costs when negotiating – Business divert resources from “normal business practices “ to developing methods/forecasts to deal with inflation 3/19/2018 18

• “Shoe leather and Negotiation Costs” – Individuals spend time acquiring information – Cause higher transaction costs when negotiating – Business divert resources from “normal business practices “ to developing methods/forecasts to deal with inflation 3/19/2018 18

Keynesian Economics • Government should alter Aggregate Demand (AD) through manipulating government spending (G) and taxation (T) • Budget Surplus – government revenue (T) greater than government spending (G) • Budget Deficit – government revenue (T) less than government spending (G) • Multiplier effect: A $1 change in spending/taxation causes real GDP to increase by more than $1 3/19/2018 19

Keynesian Economics • Government should alter Aggregate Demand (AD) through manipulating government spending (G) and taxation (T) • Budget Surplus – government revenue (T) greater than government spending (G) • Budget Deficit – government revenue (T) less than government spending (G) • Multiplier effect: A $1 change in spending/taxation causes real GDP to increase by more than $1 3/19/2018 19

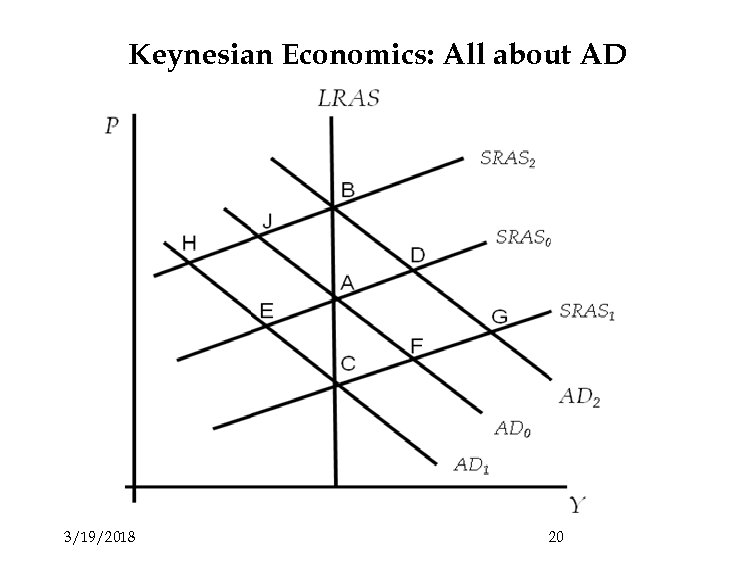

Keynesian Economics: All about AD 3/19/2018 20

Keynesian Economics: All about AD 3/19/2018 20

Crowding Out … a drop in consumption and/or investment caused by changes in government spending. • If Government Spending rises it may drive up interest rates – Running a budget deficit => government borrows the funds • This may reduce Consumption, net exports and particularly Investment • Thus public spending may “crowd out” private sector spending – Public spending replaces private spending… • Multiplier effect is lowered – potentially even zero if there is complete crowding out. 3/19/2018 21

Crowding Out … a drop in consumption and/or investment caused by changes in government spending. • If Government Spending rises it may drive up interest rates – Running a budget deficit => government borrows the funds • This may reduce Consumption, net exports and particularly Investment • Thus public spending may “crowd out” private sector spending – Public spending replaces private spending… • Multiplier effect is lowered – potentially even zero if there is complete crowding out. 3/19/2018 21

Problems with Fiscal Policy • Keynesian Economists argue the supply side is too slow to react to solve an economy’s problems • BUT Fiscal policy has timing issues. – Takes time for policy makers to realize there is a problem with the economy – Takes time for a policy to be implemented – Takes time for a policy to have an effect. 3/19/2018 22

Problems with Fiscal Policy • Keynesian Economists argue the supply side is too slow to react to solve an economy’s problems • BUT Fiscal policy has timing issues. – Takes time for policy makers to realize there is a problem with the economy – Takes time for a policy to be implemented – Takes time for a policy to have an effect. 3/19/2018 22

Automatic Stabilizers • Element of fiscal policy that changes automatically as income (real GDP) changes • E. g. Income tax revenue falls in recessions (when real GDP is falling) and increase during a boom (when real GDP increases) – Unemployment benefits are another example. 3/19/2018 23

Automatic Stabilizers • Element of fiscal policy that changes automatically as income (real GDP) changes • E. g. Income tax revenue falls in recessions (when real GDP is falling) and increase during a boom (when real GDP increases) – Unemployment benefits are another example. 3/19/2018 23

New Classical View of Fiscal Policy • Suppose the government cuts taxes to stimulate the economy – Runs a budget deficit. • Individuals recognize that taxes will have to go up in the future. • Therefore rather than spending the tax cut they merely save it- to pay the higher tax bill in the future • Therefore no change in AD. 3/19/2018 24

New Classical View of Fiscal Policy • Suppose the government cuts taxes to stimulate the economy – Runs a budget deficit. • Individuals recognize that taxes will have to go up in the future. • Therefore rather than spending the tax cut they merely save it- to pay the higher tax bill in the future • Therefore no change in AD. 3/19/2018 24

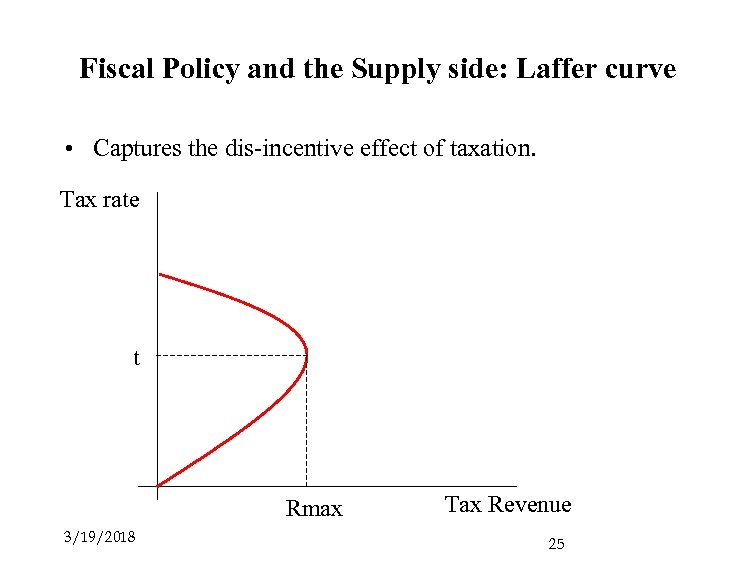

Fiscal Policy and the Supply side: Laffer curve • Captures the dis-incentive effect of taxation. Tax rate t Rmax 3/19/2018 Tax Revenue 25

Fiscal Policy and the Supply side: Laffer curve • Captures the dis-incentive effect of taxation. Tax rate t Rmax 3/19/2018 Tax Revenue 25

Supply-Side effect of Fiscal Policy • The supply-side of the economy (LRAS) is determined by the quantity and quality of resources • Taxes create a disincentive to work, accumulate capital and invest in higher education • Therefore high tax rates can cause to the LRAS to decrease 3/19/2018 26

Supply-Side effect of Fiscal Policy • The supply-side of the economy (LRAS) is determined by the quantity and quality of resources • Taxes create a disincentive to work, accumulate capital and invest in higher education • Therefore high tax rates can cause to the LRAS to decrease 3/19/2018 26

What is Money? • Money … anything that is generally acceptable to sellers in exchange for goods and services • Examples – $ – Cigarettes in WW 2 POW camps • Fiat Money – Money that has no intrinsic value and is not backed by a commodity 3/19/2018 27

What is Money? • Money … anything that is generally acceptable to sellers in exchange for goods and services • Examples – $ – Cigarettes in WW 2 POW camps • Fiat Money – Money that has no intrinsic value and is not backed by a commodity 3/19/2018 27

Liquidity • Liquid Asset … an asset that can easily be exchanged for goods and services • Higher liquidity implies lower returns • Money is the most liquid asset – Therefore has the lowest (zero return). 3/19/2018 28

Liquidity • Liquid Asset … an asset that can easily be exchanged for goods and services • Higher liquidity implies lower returns • Money is the most liquid asset – Therefore has the lowest (zero return). 3/19/2018 28

Functions of Money ‘Money is a matter of functions four – a medium, a measure, a standard and a store’ 3/19/2018 29

Functions of Money ‘Money is a matter of functions four – a medium, a measure, a standard and a store’ 3/19/2018 29

• Medium of exchange – It lowers transactions costs – Do not need the “double coincidence of wants” • Measure of value – All goods and services are priced in common monetary units – Allows us to compare relative prices easily. – Only need one set of prices. 3/19/2018 30

• Medium of exchange – It lowers transactions costs – Do not need the “double coincidence of wants” • Measure of value – All goods and services are priced in common monetary units – Allows us to compare relative prices easily. – Only need one set of prices. 3/19/2018 30

• Store of value – An asset that allows people to shift purchasing power from one period to another – Money retains its value through time usually – Need to control inflation. • Standard of deferred payment – Money may be used to make future payments. – Debt is written in dollar amounts. 3/19/2018 31

• Store of value – An asset that allows people to shift purchasing power from one period to another – Money retains its value through time usually – Need to control inflation. • Standard of deferred payment – Money may be used to make future payments. – Debt is written in dollar amounts. 3/19/2018 31

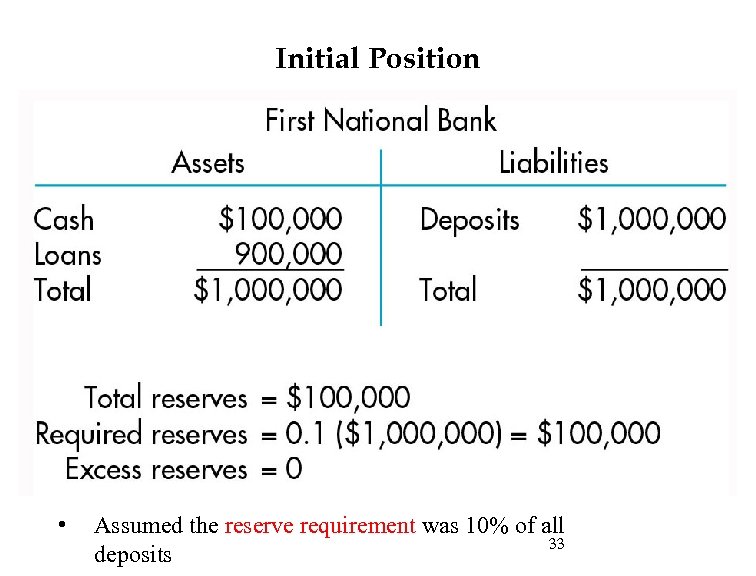

Reserve Requirements • The central bank “the Fed” requires banks to keep a certain percentage of their deposits available as cash reserves – Available for immediate withdrawal. • This percentage is called the reserve requirement (rr) – E. g. the bank has to keep 10% of all their deposits as cash reserves. 32

Reserve Requirements • The central bank “the Fed” requires banks to keep a certain percentage of their deposits available as cash reserves – Available for immediate withdrawal. • This percentage is called the reserve requirement (rr) – E. g. the bank has to keep 10% of all their deposits as cash reserves. 32

Initial Position • Assumed the reserve requirement was 10% of all 33 deposits

Initial Position • Assumed the reserve requirement was 10% of all 33 deposits

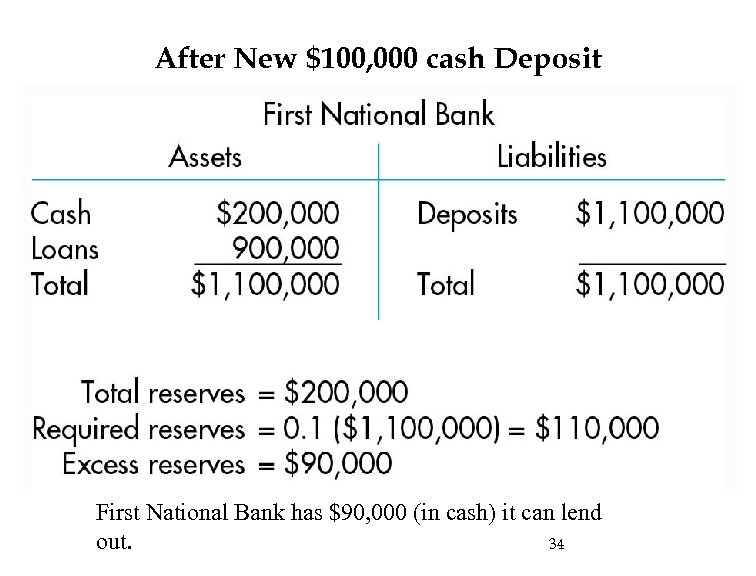

After New $100, 000 cash Deposit First National Bank has $90, 000 (in cash) it can lend out. 34

After New $100, 000 cash Deposit First National Bank has $90, 000 (in cash) it can lend out. 34

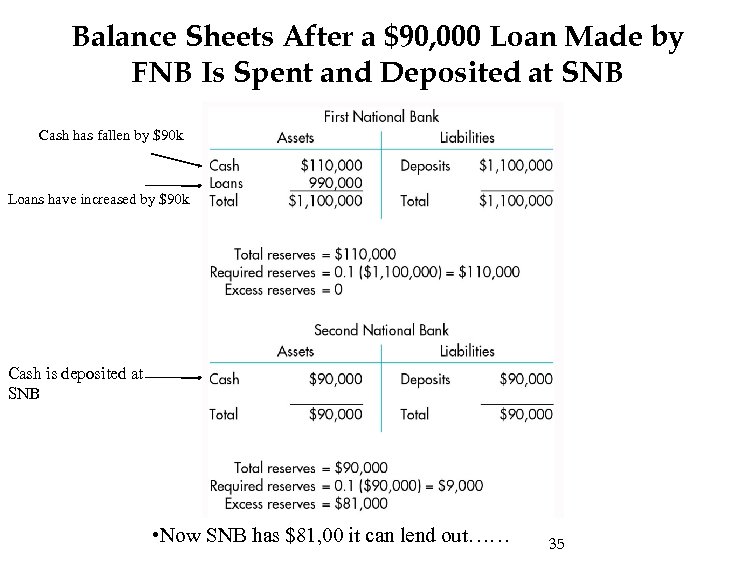

Balance Sheets After a $90, 000 Loan Made by FNB Is Spent and Deposited at SNB Cash has fallen by $90 k Loans have increased by $90 k Cash is deposited at SNB • Now SNB has $81, 00 it can lend out…… 35

Balance Sheets After a $90, 000 Loan Made by FNB Is Spent and Deposited at SNB Cash has fallen by $90 k Loans have increased by $90 k Cash is deposited at SNB • Now SNB has $81, 00 it can lend out…… 35

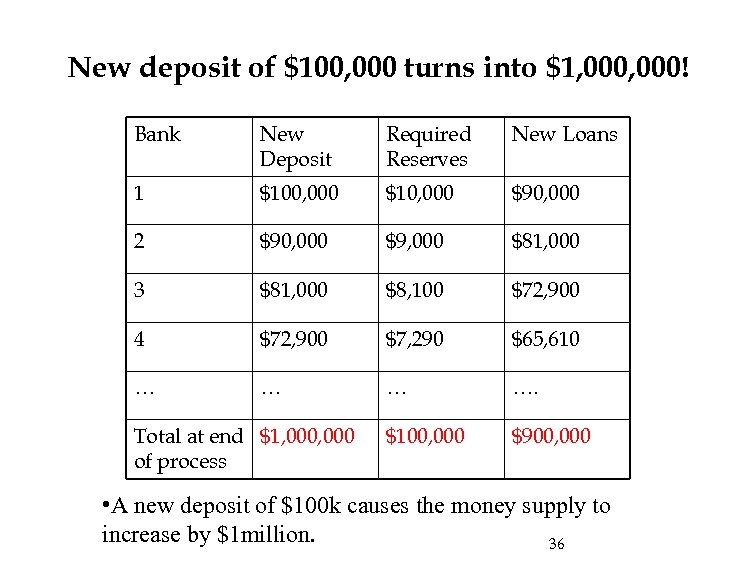

New deposit of $100, 000 turns into $1, 000! Bank New Deposit Required Reserves New Loans 1 $100, 000 $10, 000 $90, 000 2 $90, 000 $9, 000 $81, 000 3 $81, 000 $8, 100 $72, 900 4 $72, 900 $7, 290 $65, 610 … …. $100, 000 $900, 000 Total at end $1, 000 of process • A new deposit of $100 k causes the money supply to increase by $1 million. 36

New deposit of $100, 000 turns into $1, 000! Bank New Deposit Required Reserves New Loans 1 $100, 000 $10, 000 $90, 000 2 $90, 000 $9, 000 $81, 000 3 $81, 000 $8, 100 $72, 900 4 $72, 900 $7, 290 $65, 610 … …. $100, 000 $900, 000 Total at end $1, 000 of process • A new deposit of $100 k causes the money supply to increase by $1 million. 36

Deposit Expansion Multiplier • In our example $100, 000 turns into $1, 000 – why? • Potential Deposit expansion multiplier (DEM) DEM = 1/Reserve Requirement (leakage) Example – If Reserve Requirement is 10% – Deposit expansion multiplier: 1/0. 1 = 10 • Note: we are assuming no “currency drain” i. e. all cash is redeposited with a bank. • We are also assuming that all excess reserves are lent out. 3/19/2018 37

Deposit Expansion Multiplier • In our example $100, 000 turns into $1, 000 – why? • Potential Deposit expansion multiplier (DEM) DEM = 1/Reserve Requirement (leakage) Example – If Reserve Requirement is 10% – Deposit expansion multiplier: 1/0. 1 = 10 • Note: we are assuming no “currency drain” i. e. all cash is redeposited with a bank. • We are also assuming that all excess reserves are lent out. 3/19/2018 37

How does the Fed control the Money Supply? • Reserve Requirements • An increase in the reserve requirement reduces the deposit expansion multiplier and vice versa – Alters the ability of banks to “create money”. – If rr = 10% then DEM = 10 – If rr = 20% then DEM = 5 3/19/2018 38

How does the Fed control the Money Supply? • Reserve Requirements • An increase in the reserve requirement reduces the deposit expansion multiplier and vice versa – Alters the ability of banks to “create money”. – If rr = 10% then DEM = 10 – If rr = 20% then DEM = 5 3/19/2018 38

How does the Fed control the Money Supply? • The Discount Rate … the rate of interest the Fed charges commercial banks when they borrow from it • Sometimes commercial banks borrow to finance lending – Or borrow when they are in financial difficulty. • If the discount rate increases commercial banks will borrow less and the money supply will be reduced • Federal funds rate – The interest rate that a bank charges when it lends excess reserves to another bank. – The discount rate is typically 1 -1. 5% points above the federal fund rate – “form of punishment” 39

How does the Fed control the Money Supply? • The Discount Rate … the rate of interest the Fed charges commercial banks when they borrow from it • Sometimes commercial banks borrow to finance lending – Or borrow when they are in financial difficulty. • If the discount rate increases commercial banks will borrow less and the money supply will be reduced • Federal funds rate – The interest rate that a bank charges when it lends excess reserves to another bank. – The discount rate is typically 1 -1. 5% points above the federal fund rate – “form of punishment” 39

How does the Fed control the Money Supply? • Open Market Operations … the buying and selling of government bonds by the Fed. – Affects the federal funds rate. • Swapping illiquid (bonds) for liquid assets (cash) – Selling bonds for cash reduces the money supply Ø Excess reserves fall => ability to create money falls. – Buying bonds in exchange for cash raises the money supply Ø Excess reserves increases => ability to create money increases. 3/19/2018 40

How does the Fed control the Money Supply? • Open Market Operations … the buying and selling of government bonds by the Fed. – Affects the federal funds rate. • Swapping illiquid (bonds) for liquid assets (cash) – Selling bonds for cash reduces the money supply Ø Excess reserves fall => ability to create money falls. – Buying bonds in exchange for cash raises the money supply Ø Excess reserves increases => ability to create money increases. 3/19/2018 40

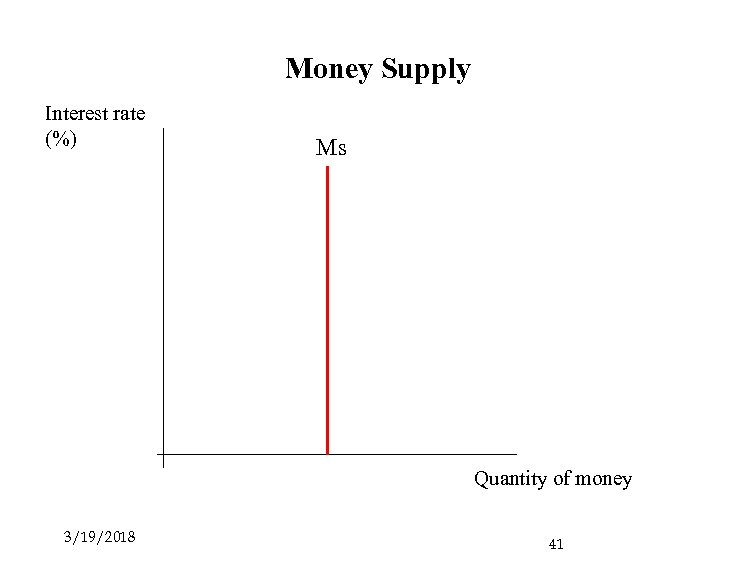

Money Supply Interest rate (%) Ms Quantity of money 3/19/2018 41

Money Supply Interest rate (%) Ms Quantity of money 3/19/2018 41

Money Demand • Transactions Demand … the demand to hold money to buy goods and services – Hold money to finance daily purchases. ØIn the form of cash or in checking account. • Precautionary Demand … the demand for money to cover unplanned transactions or emergencies. – “Saving for a rainy day” 42

Money Demand • Transactions Demand … the demand to hold money to buy goods and services – Hold money to finance daily purchases. ØIn the form of cash or in checking account. • Precautionary Demand … the demand for money to cover unplanned transactions or emergencies. – “Saving for a rainy day” 42

• Asset (Speculative) Demand … the demand for money created by the uncertainty about the value of other assets. – Hold money in expectation that a profitable opportunity will arise. • E. g. stocks and bonds. • If you think bond prices are going fall soon will hold cash today rather than bonds. 3/19/2018 43

• Asset (Speculative) Demand … the demand for money created by the uncertainty about the value of other assets. – Hold money in expectation that a profitable opportunity will arise. • E. g. stocks and bonds. • If you think bond prices are going fall soon will hold cash today rather than bonds. 3/19/2018 43

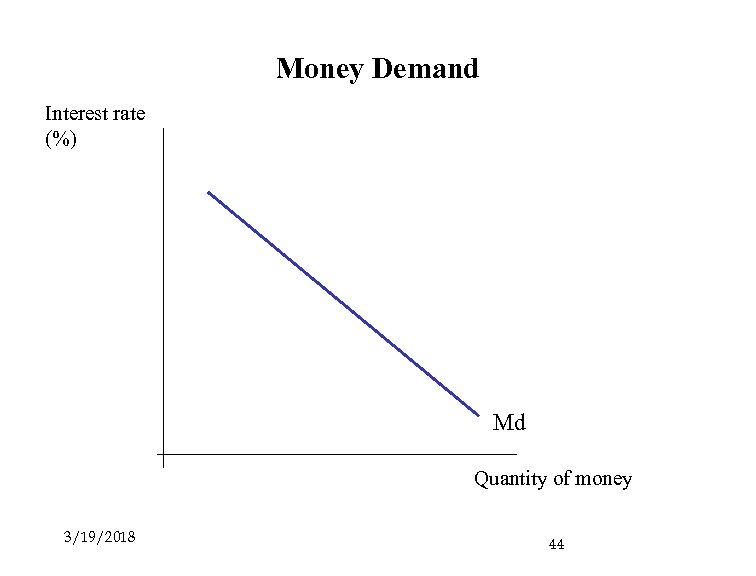

Money Demand Interest rate (%) Md Quantity of money 3/19/2018 44

Money Demand Interest rate (%) Md Quantity of money 3/19/2018 44

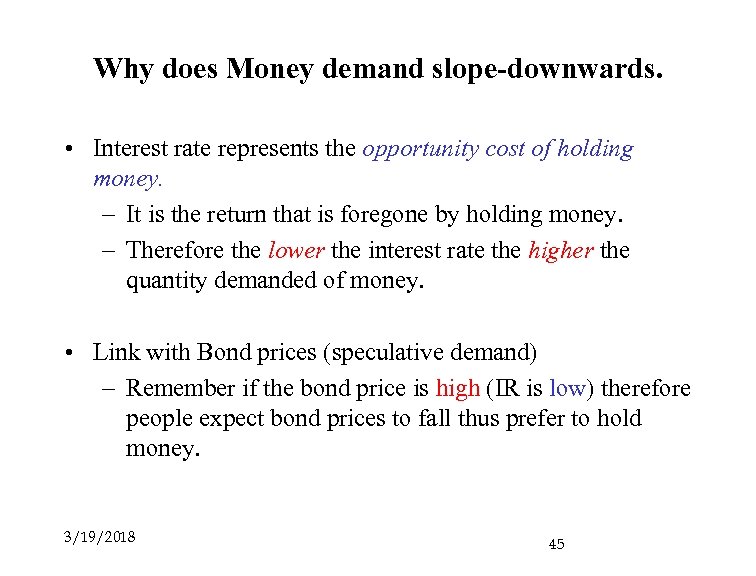

Why does Money demand slope-downwards. • Interest rate represents the opportunity cost of holding money. – It is the return that is foregone by holding money. – Therefore the lower the interest rate the higher the quantity demanded of money. • Link with Bond prices (speculative demand) – Remember if the bond price is high (IR is low) therefore people expect bond prices to fall thus prefer to hold money. 3/19/2018 45

Why does Money demand slope-downwards. • Interest rate represents the opportunity cost of holding money. – It is the return that is foregone by holding money. – Therefore the lower the interest rate the higher the quantity demanded of money. • Link with Bond prices (speculative demand) – Remember if the bond price is high (IR is low) therefore people expect bond prices to fall thus prefer to hold money. 3/19/2018 45

Determinant of Money Demand Nominal GDP – An increase in Nominal GDP (due to price increases or increase in goods and services) causes Money demand to increase. 3/19/2018 46

Determinant of Money Demand Nominal GDP – An increase in Nominal GDP (due to price increases or increase in goods and services) causes Money demand to increase. 3/19/2018 46

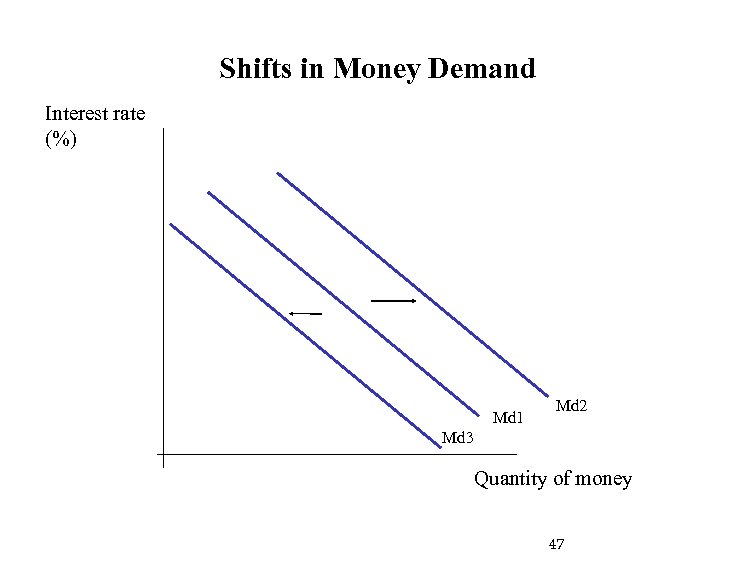

Shifts in Money Demand Interest rate (%) Md 1 Md 2 Md 3 Quantity of money 47

Shifts in Money Demand Interest rate (%) Md 1 Md 2 Md 3 Quantity of money 47

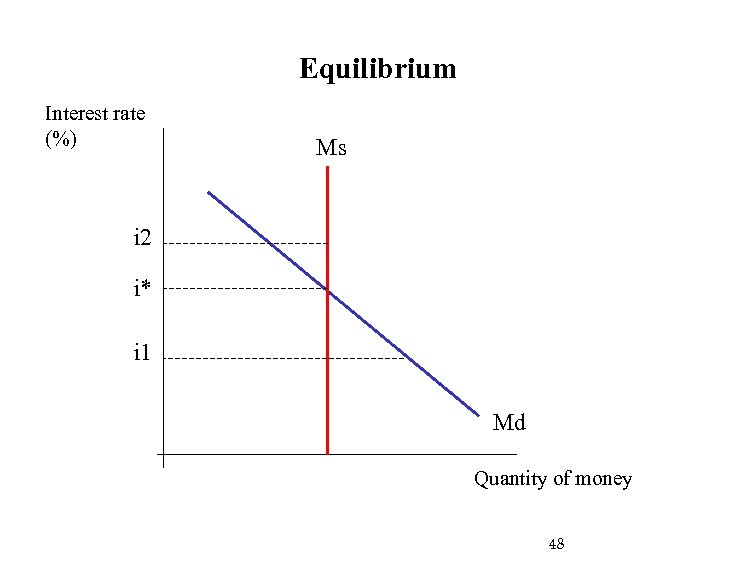

Equilibrium Interest rate (%) Ms i 2 i* i 1 Md Quantity of money 48

Equilibrium Interest rate (%) Ms i 2 i* i 1 Md Quantity of money 48

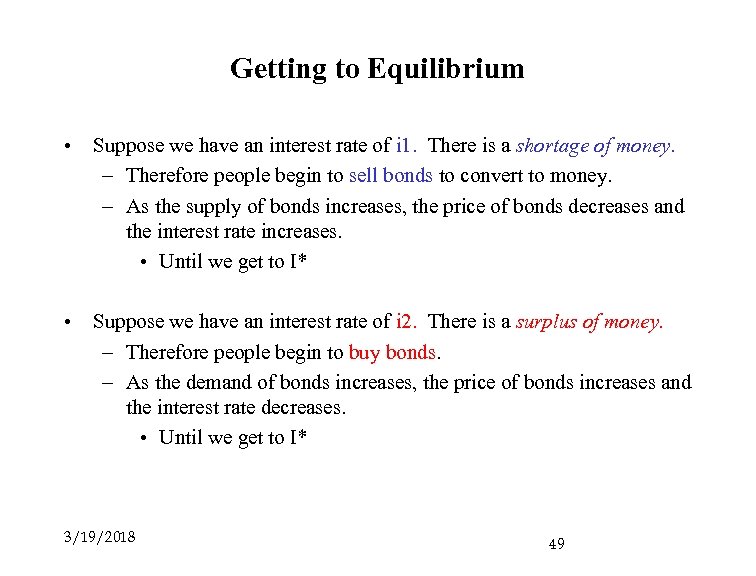

Getting to Equilibrium • Suppose we have an interest rate of i 1. There is a shortage of money. – Therefore people begin to sell bonds to convert to money. – As the supply of bonds increases, the price of bonds decreases and the interest rate increases. • Until we get to I* • Suppose we have an interest rate of i 2. There is a surplus of money. – Therefore people begin to buy bonds. – As the demand of bonds increases, the price of bonds increases and the interest rate decreases. • Until we get to I* 3/19/2018 49

Getting to Equilibrium • Suppose we have an interest rate of i 1. There is a shortage of money. – Therefore people begin to sell bonds to convert to money. – As the supply of bonds increases, the price of bonds decreases and the interest rate increases. • Until we get to I* • Suppose we have an interest rate of i 2. There is a surplus of money. – Therefore people begin to buy bonds. – As the demand of bonds increases, the price of bonds increases and the interest rate decreases. • Until we get to I* 3/19/2018 49

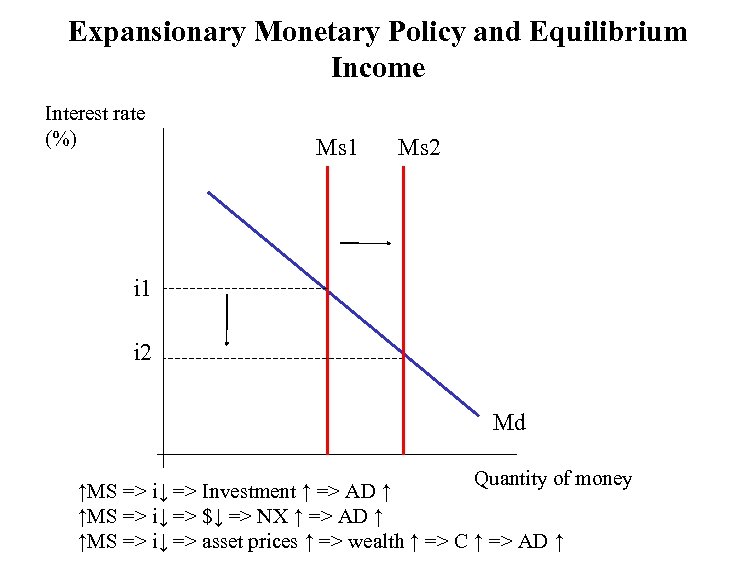

Expansionary Monetary Policy and Equilibrium Income Interest rate (%) Ms 1 Ms 2 i 1 i 2 Md Quantity of money ↑MS => i↓ => Investment ↑ => AD ↑ ↑MS => i↓ => $↓ => NX ↑ => AD ↑ ↑MS => i↓ => asset prices ↑ => wealth ↑ => C ↑ => AD ↑

Expansionary Monetary Policy and Equilibrium Income Interest rate (%) Ms 1 Ms 2 i 1 i 2 Md Quantity of money ↑MS => i↓ => Investment ↑ => AD ↑ ↑MS => i↓ => $↓ => NX ↑ => AD ↑ ↑MS => i↓ => asset prices ↑ => wealth ↑ => C ↑ => AD ↑

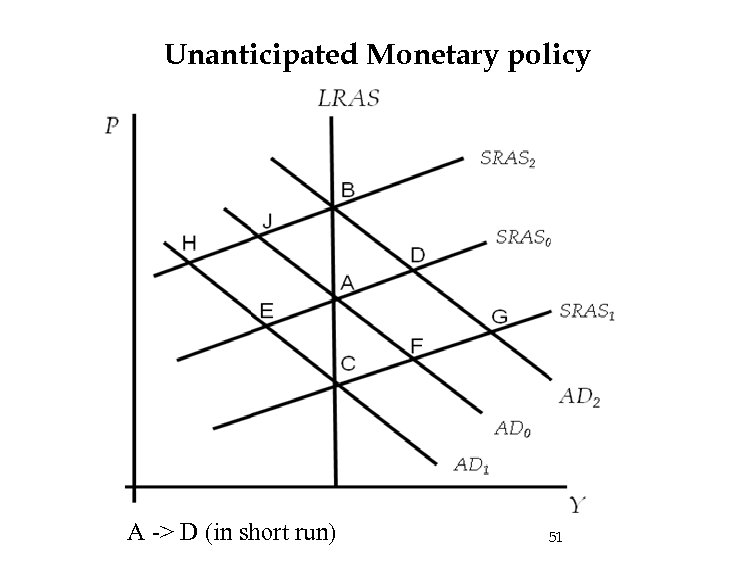

Unanticipated Monetary policy A -> D (in short run) 51

Unanticipated Monetary policy A -> D (in short run) 51

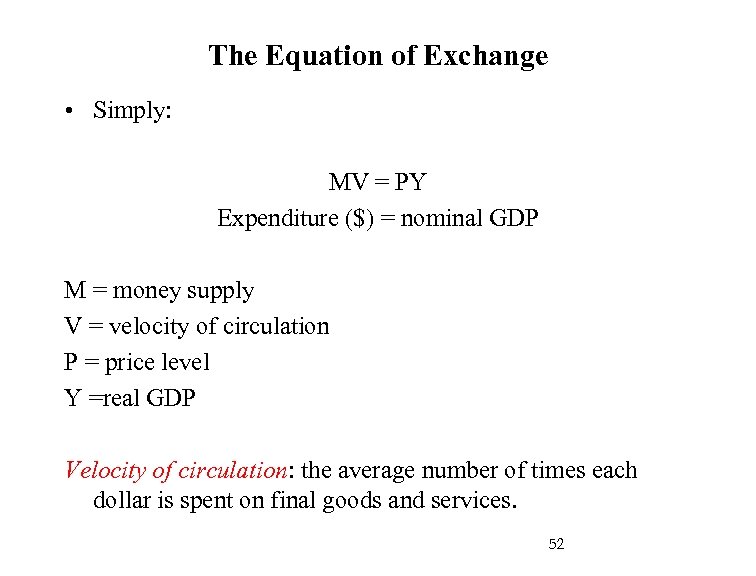

The Equation of Exchange • Simply: MV = PY Expenditure ($) = nominal GDP M = money supply V = velocity of circulation P = price level Y =real GDP Velocity of circulation: the average number of times each dollar is spent on final goods and services. 52

The Equation of Exchange • Simply: MV = PY Expenditure ($) = nominal GDP M = money supply V = velocity of circulation P = price level Y =real GDP Velocity of circulation: the average number of times each dollar is spent on final goods and services. 52

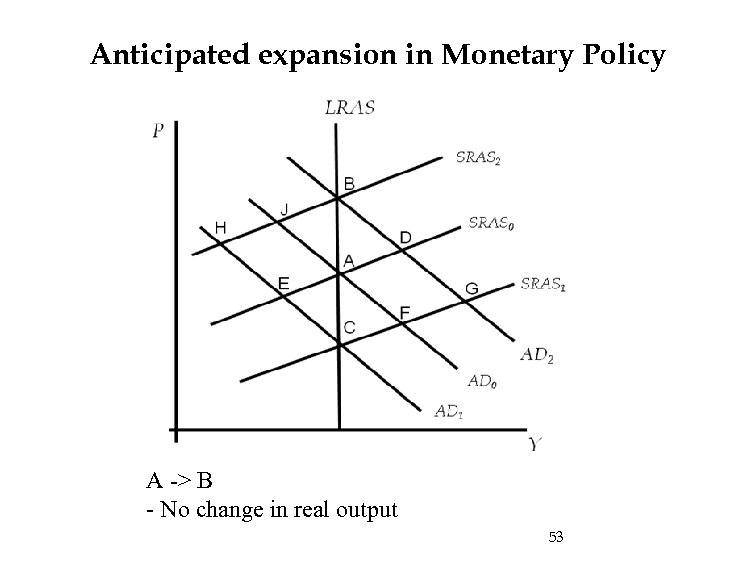

Anticipated expansion in Monetary Policy A -> B - No change in real output 53

Anticipated expansion in Monetary Policy A -> B - No change in real output 53

Economic Stability • Keep unemployment low and inflation low. • Smooth out the business cycle • Activist: – Intervention into the market through Fiscal and Monetary policy to correct recessions/booms • Non-activist: – Maintain steady fiscal and monetary policy – Do not engage in discretionary fiscal policy etc. 3/19/2018 54

Economic Stability • Keep unemployment low and inflation low. • Smooth out the business cycle • Activist: – Intervention into the market through Fiscal and Monetary policy to correct recessions/booms • Non-activist: – Maintain steady fiscal and monetary policy – Do not engage in discretionary fiscal policy etc. 3/19/2018 54

Index of Leading Indicators Leading Indicator … a variable that changes before real output changes – Used to forecast changes in output – Not always successful! • Examples: consumer expectations and Stock prices – “stock prices have predicted 9 of the last 5 recessions. ” • Index of leading Indicators – 10 key indicators • Includes: length of average work week, permits for new housing starts, consumer expectations, change in the index of stock prices 55

Index of Leading Indicators Leading Indicator … a variable that changes before real output changes – Used to forecast changes in output – Not always successful! • Examples: consumer expectations and Stock prices – “stock prices have predicted 9 of the last 5 recessions. ” • Index of leading Indicators – 10 key indicators • Includes: length of average work week, permits for new housing starts, consumer expectations, change in the index of stock prices 55

Index of Leading Indicators • If the index falls for three consecutive months it is taken as a warning the economy is going into a recession – Not always accurate! – Forecasted 12 out of the last 7 recessions 3/19/2018 56

Index of Leading Indicators • If the index falls for three consecutive months it is taken as a warning the economy is going into a recession – Not always accurate! – Forecasted 12 out of the last 7 recessions 3/19/2018 56

Discretionary Policy: Activists • Argue there are enough signals/signs available to determine if/when the economy is facing difficulties – Alter G, T and interest rates as and when needed • Problem – remember the lags! – Recognition Lag: Takes time for policy makers to realize there is a problem with the economy – Administrative Lag: Takes time for a policy to be implemented – Impact lag: Takes time for a policy to have an effect. • Non-activists ague these lags will cause bigger business cycle swings! 57

Discretionary Policy: Activists • Argue there are enough signals/signs available to determine if/when the economy is facing difficulties – Alter G, T and interest rates as and when needed • Problem – remember the lags! – Recognition Lag: Takes time for policy makers to realize there is a problem with the economy – Administrative Lag: Takes time for a policy to be implemented – Impact lag: Takes time for a policy to have an effect. • Non-activists ague these lags will cause bigger business cycle swings! 57

Expectations • Adaptive: Future will look like the past – E. g. best guess of future inflation is what it is has been recently. • Tend to make systematic forecasting errors. – If inflation is increasing over time will continually under-estimate future inflation due to focusing on the past • Tend to adapt/react slower to policy changes 3/19/2018 58

Expectations • Adaptive: Future will look like the past – E. g. best guess of future inflation is what it is has been recently. • Tend to make systematic forecasting errors. – If inflation is increasing over time will continually under-estimate future inflation due to focusing on the past • Tend to adapt/react slower to policy changes 3/19/2018 58

• Rational-Expectations Hypothesis: use all available information about variables and incorporate any policy changes. – E. g. if the government increases the Money supply individuals will built this into their expectation about inflation. – Still will make mistakes due to error/uncertainty 3/19/2018 59

• Rational-Expectations Hypothesis: use all available information about variables and incorporate any policy changes. – E. g. if the government increases the Money supply individuals will built this into their expectation about inflation. – Still will make mistakes due to error/uncertainty 3/19/2018 59

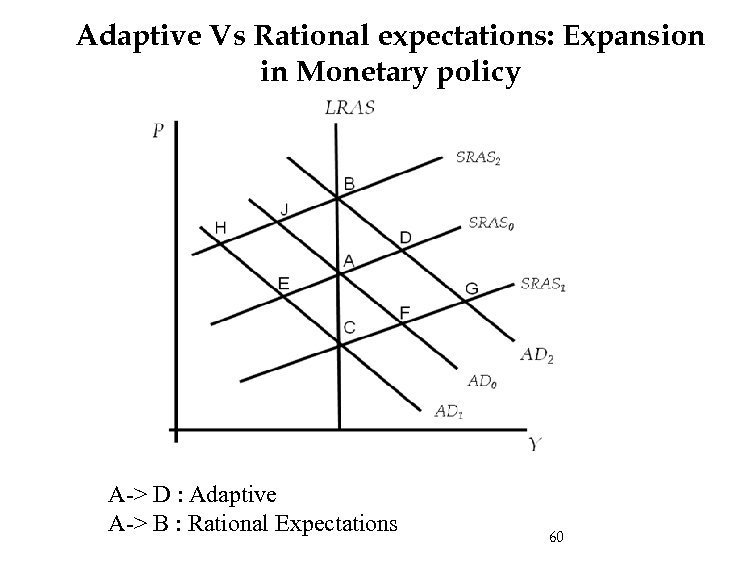

Adaptive Vs Rational expectations: Expansion in Monetary policy A-> D : Adaptive A-> B : Rational Expectations 60

Adaptive Vs Rational expectations: Expansion in Monetary policy A-> D : Adaptive A-> B : Rational Expectations 60

Non-Activists: Monetary Policy • Follow rules rather than discretionary (activist polices) • Monetary Growth rule – Increase the money supply by 3% each year (approx equal to increase in real GDP) • Price Level Rule – Maintain a certain (low) level of inflation 3/19/2018 61

Non-Activists: Monetary Policy • Follow rules rather than discretionary (activist polices) • Monetary Growth rule – Increase the money supply by 3% each year (approx equal to increase in real GDP) • Price Level Rule – Maintain a certain (low) level of inflation 3/19/2018 61

Non-Activists: Fiscal Policy • Maintain a balanced budget over the business cycle • Some years it will be in surplus, other years a deficit. • Difficult to determine if the budget will be balanced over the business cycle given that it is difficult to forecast! • Potentially limit the size of budget deficits/government spending. 3/19/2018 62

Non-Activists: Fiscal Policy • Maintain a balanced budget over the business cycle • Some years it will be in surplus, other years a deficit. • Difficult to determine if the budget will be balanced over the business cycle given that it is difficult to forecast! • Potentially limit the size of budget deficits/government spending. 3/19/2018 62