0f52d9953e49664cd5f4ca76711c20fd.ppt

- Количество слайдов: 23

MACROECONOMIC OBJECTIVES • Economic Growth - Governments try to achieve high rates of growth which can be sustained in the long run. Also it is important to achieve stable rates that can be maintained and thus avoid both booms (when the rate is too high) and recessions (when the rate is too low). - Ireland performed exceptionally well from 1994 - 2007) in what is referred to as the Celtic Tiger. However, due to an unsustainable property bubble and the international credit crunch we then suffered a severe recession. This problem of recession has affected many developed economies in the most serious economic crisis since the Great Depression Wikipedia Reference • Employment and Unemployment - Governments aim to create new jobs (net) and keep unemployment as low as possible. Unemployment was until mid 2007 in Ireland about 4. 5% but is now rising sharply (14. 3% at end of 2011). Though the rate of unemployment has now stabilised this reflects the fact that emigration (especially of young job seekers) has rapidly increased from Ireland in past two years.

MACROECONOMIC OBJECTIVES (con) • Inflation - Again Governments try to keep the figure low so as to enhance competitiveness. Inflation in Ireland was worryingly higher than our EU neighbours in recent years (around 4% in 2007). However due to recession the inflation rate then fell rapidly (- 4. 5% in 2009 and - 1. 0% in 2010) before rising again in 2011 to 2. 6% • The Balance of Payments - This relates to trade transactions with other countries. If we export more in value terms of goods and services than we import, then we obtain a balance of payments surplus. - The Balance of Payments bears a close relationship to the exchange rate. In general a favourable balance of payments tends to be associated with a strong currency. - Governments can pursue other intermediate objectives in pursuit of the above primary goals. These could include control of interest rates, taxation, money supply and government expenditure and other areas such as industrial policy, public sector reform and industrial policy.

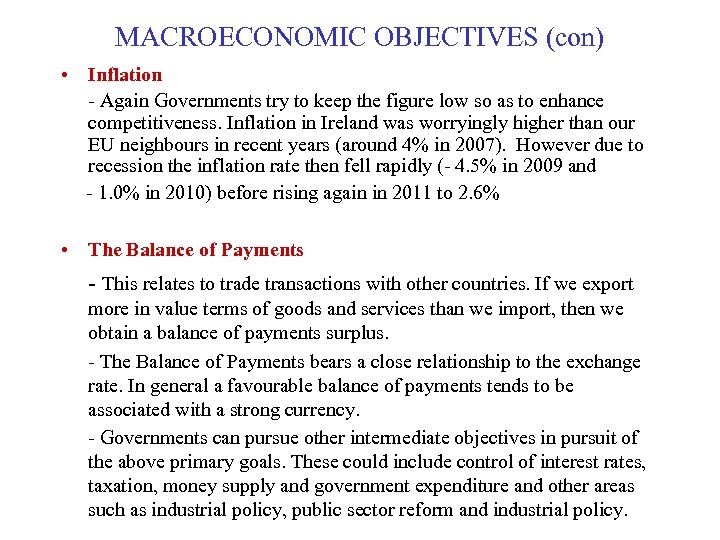

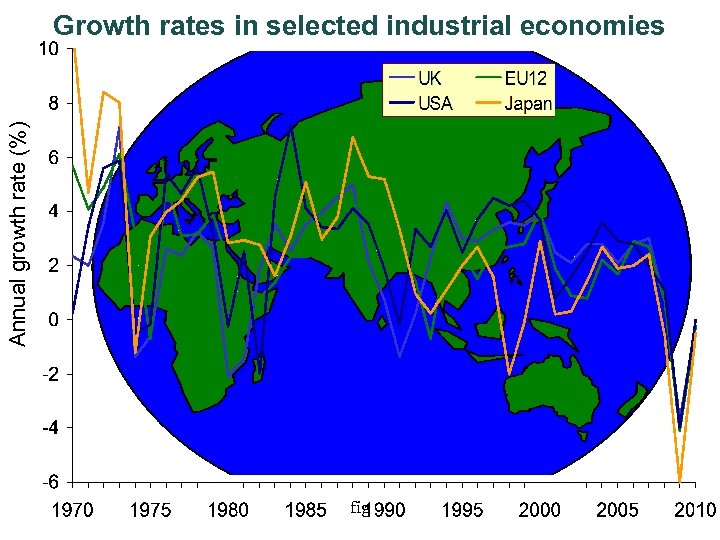

Economic growth (average % per annum), Unemployment (average %), Inflation (average % per annum)

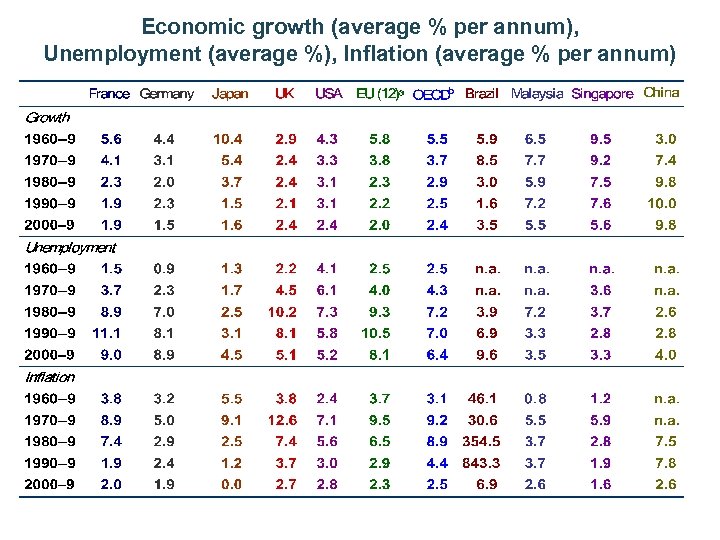

Annual growth rate (%) Growth rates in selected industrial economies fig

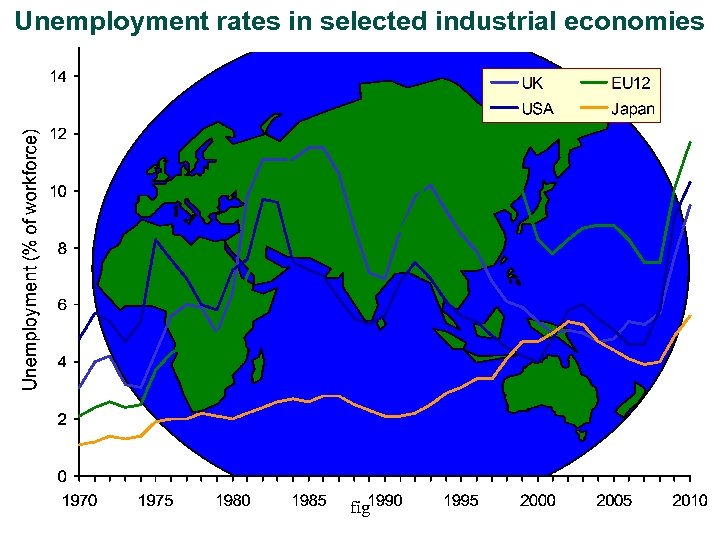

Unemployment rates in selected industrial economies fig

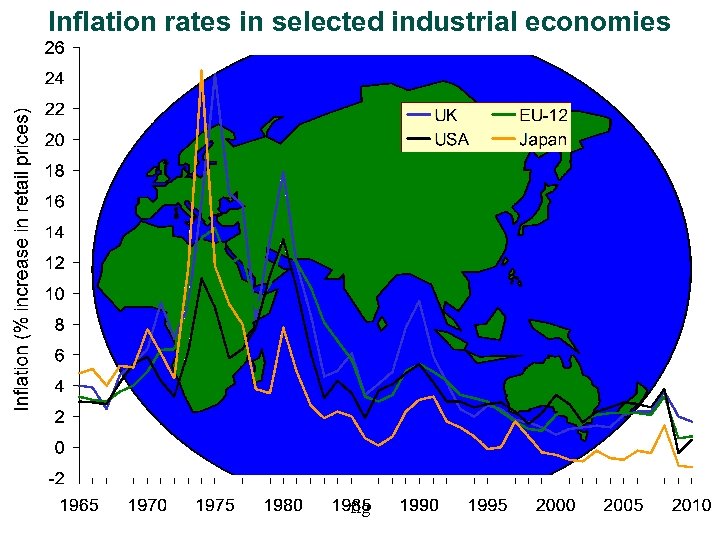

Inflation rates in selected industrial economies fig

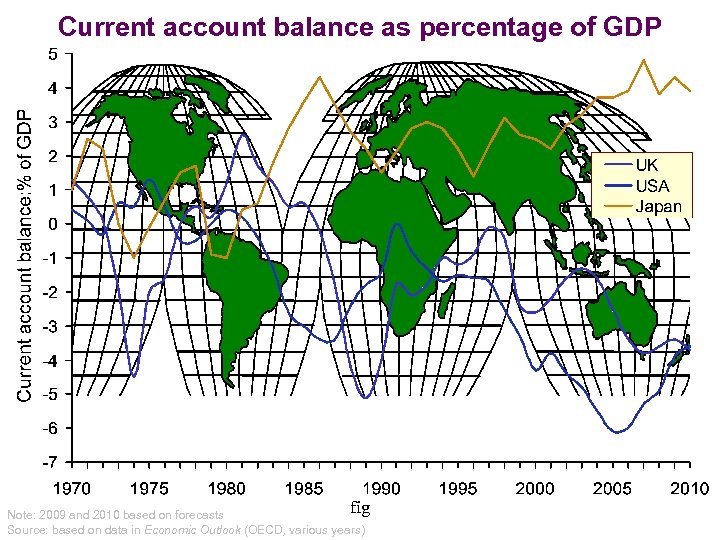

Current account balance as percentage of GDP fig Note: 2009 and 2010 based on forecasts Source: based on data in Economic Outlook (OECD, various years)

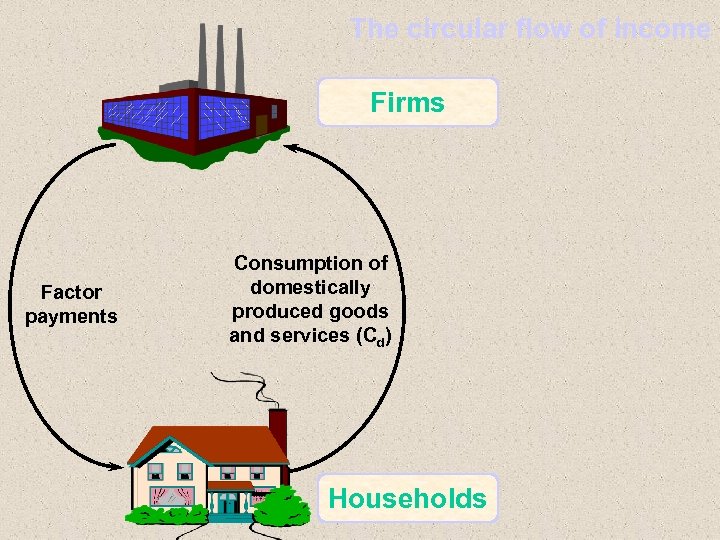

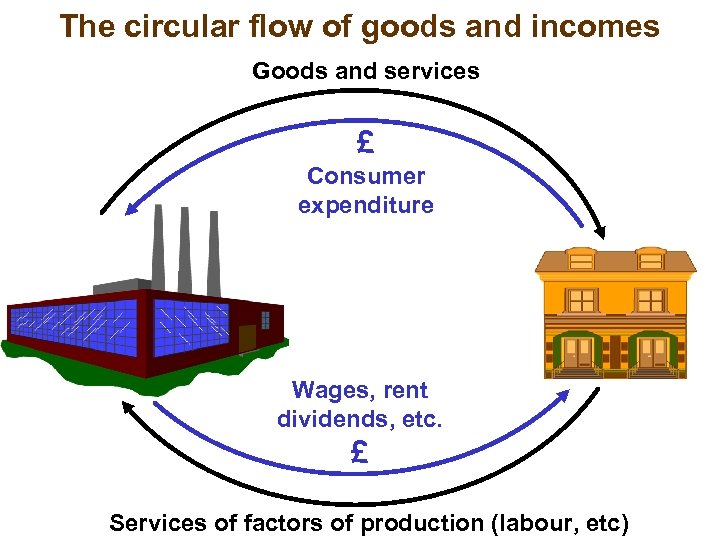

THE CIRCULAR FLOW OF INCOME • The Circular Flow of Income provides a simple model of the economy made up of two groups that shows how firms (producers) and households (consumers) are interconnected • Each group plays two roles. - The firms are the producers of the goods and services in the economy. However they equally are the employers of all the factors of production (such as labour). - The households are the consumers of the goods and services. Equally they are the suppliers of the factors of production. - The households receive income (for supply of the factors of production to the firms). In turn they generate expenditure (in payment for goods and services purchased). - Thus there is continual flow of income and expenditure in the economy. The firms keep paying out income; in turn they receive back expenditure (when the goods produced are purchased).

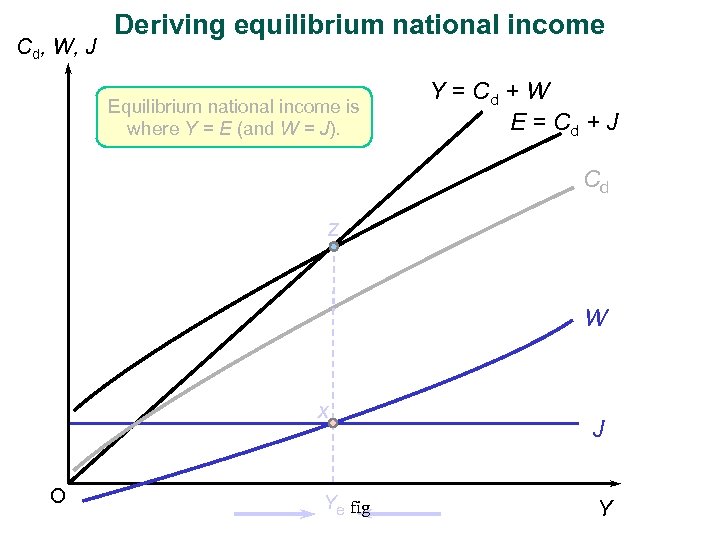

THE CIRCULAR FLOW OF INCOME (con) • An economy is in equilibrium when Income = Expenditure (or Aggregate Demand) • If you think about it, you will see that this is quite logical. Imagine during the year that all the firms in the economy pay out € 100 bl. income to households. Now if all this money is disposed of as expenditure then the firms will receive back € 100 bl. and be in the position to pay out exactly the same amount in income the following year. Therefore when Income = Expenditure, the overall level of economic activity remains unchanged.

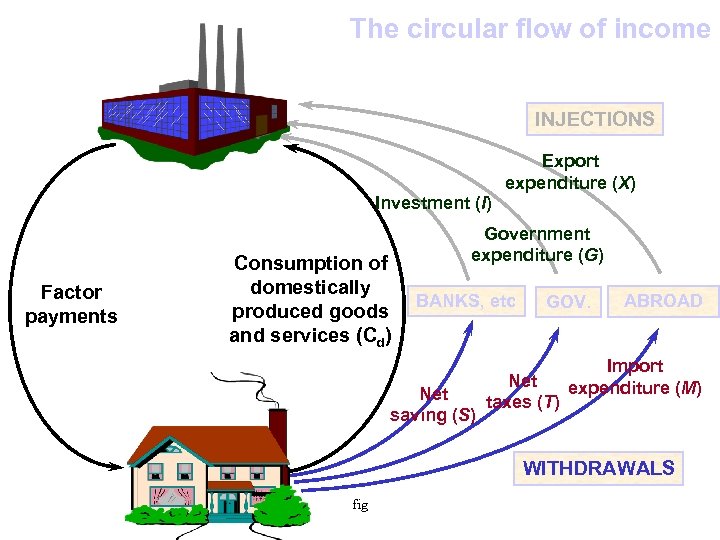

The circular flow of income Firms Factor payments Consumption of domestically produced goods and services (Cd) Households

WITHDRAWALS AND INJECTIONS However in practice there can be withdrawals from and injections into the income-expenditure flow • The main withdrawals (W) are • - Savings (S). A person can opt to save some money (e. g. in a bank) rather than spend it. - Taxation (T). The government can legally take money off citizens thus reducing their capacity to spend. - Imports (M). When we buy imports e. g. a Japanese car the money goes abroad (out of the domestic economy). Likewise there are 3 corresponding injections (J) - Investment (I). People can borrow money from banks (e. g. for a new house) thus increasing spending power. - Government Expenditure (G). Money that is raised in tax revenue is largely on health, education, social welfare etc. - Exports (X). When we export goods e. g. food, additional money comes into economy.

WITHDRAWALS AND INJECTIONS (con) So therefore when we allow for all these withdrawals and injections, equilibrium in economy entails that W = J i. e. S + T + M = I + G + X - Imagine a bath that is full of water with the stopper out at the bottom and the tap running. - Now if the amount going out through the bottom (withdrawals) is exactly matched by the amount coming in through the taps (injections), then the bath will remain full with the level of water unchanged. - Likewise with the economy! When withdrawals (money going out) are exactly matched by money coming in (injections), then it remains in equilibrium (i. e. with level of activity unchanged). - However if W > J then the level of economic activity will fall causing recession. - If J > W then the level of activity will rise in money terms causing inflation. It is important to realise that too much money coming into economy will lead to a rise in the general price level. Ultimately this could lead to income falling (as competitiveness with other countries could be eroded).

The circular flow of goods and incomes Goods and services £ Consumer expenditure Wages, rent dividends, etc. £ Services of factors of production (labour, etc)

The circular flow of income INJECTIONS Export expenditure (X) Investment (I) Factor payments Consumption of domestically produced goods and services (Cd) Government expenditure (G) BANKS, etc Net saving (S) GOV. ABROAD Import Net expenditure (M) taxes (T) WITHDRAWALS fig

Cd, W, J Deriving equilibrium national income Equilibrium national income is where Y = E (and W = J). Y = Cd + W E = Cd + J Cd z W x O Ye fig J Y

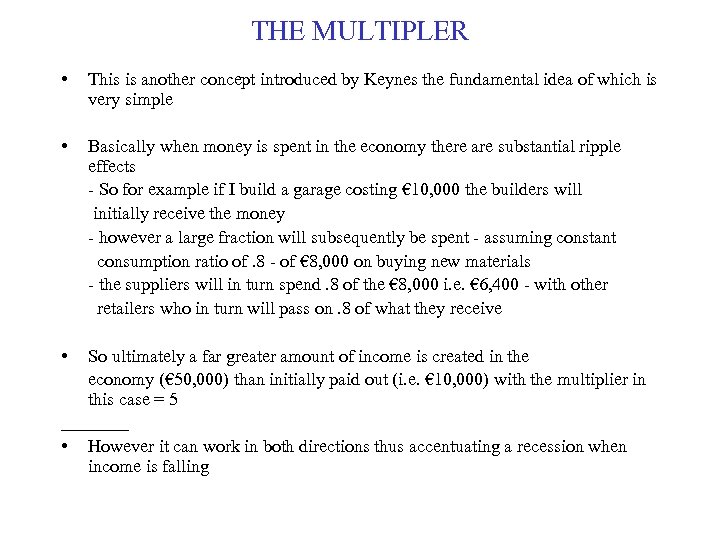

THE MULTIPLER • This is another concept introduced by Keynes the fundamental idea of which is very simple • Basically when money is spent in the economy there are substantial ripple effects - So for example if I build a garage costing € 10, 000 the builders will initially receive the money - however a large fraction will subsequently be spent - assuming constant consumption ratio of. 8 - of € 8, 000 on buying new materials - the suppliers will in turn spend. 8 of the € 8, 000 i. e. € 6, 400 - with other retailers who in turn will pass on. 8 of what they receive • So ultimately a far greater amount of income is created in the economy (€ 50, 000) than initially paid out (i. e. € 10, 000) with the multiplier in this case = 5 • However it can work in both directions thus accentuating a recession when income is falling

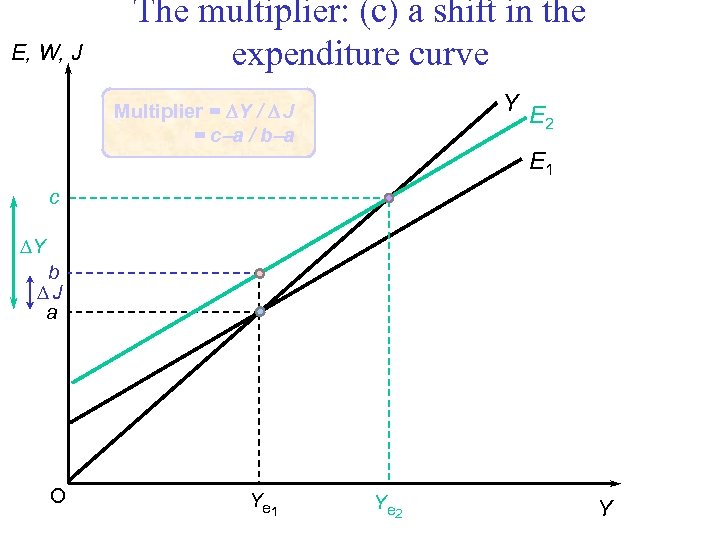

E, W, J The multiplier: (c) a shift in the expenditure curve Y Multiplier = DY / D J = c -a / b -a E 2 E 1 c DY b DJ a O Y e 1 Y e 2 Y

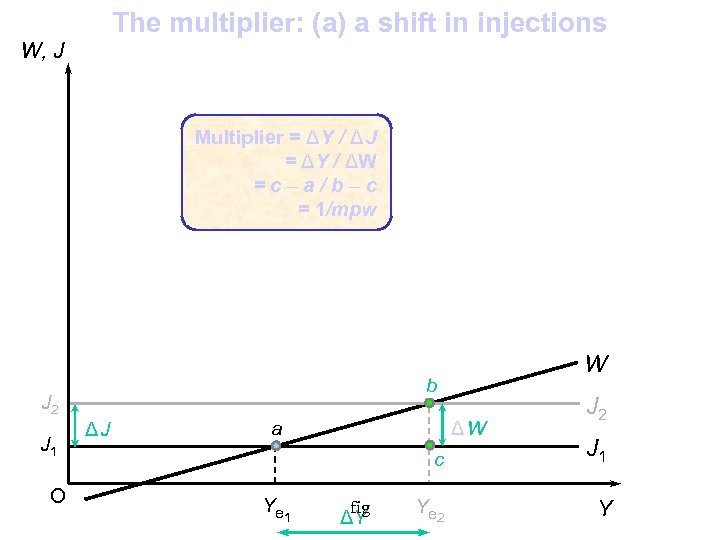

The multiplier: (a) a shift in injections W, J Multiplier = ΔY / Δ J = ΔY / ΔW =c–a/b–c = 1/mpw b J 2 J 1 O W ΔJ a ΔW J 2 c Y e 1 fig ΔY J 1 Y e 2 Y

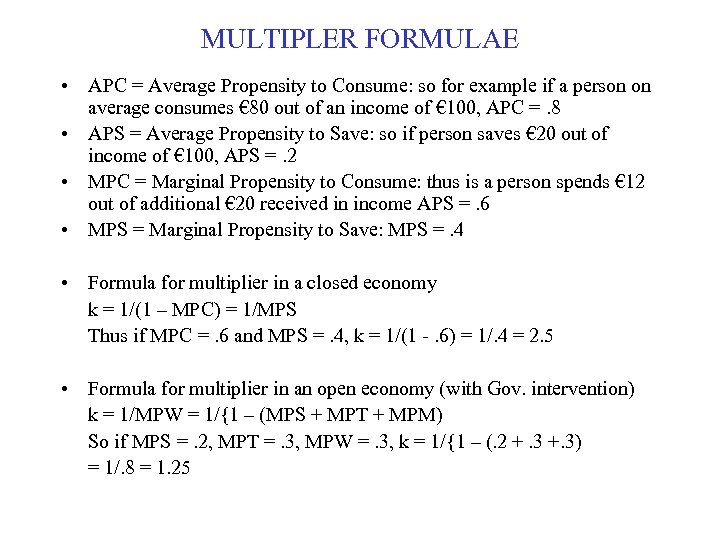

MULTIPLER FORMULAE • APC = Average Propensity to Consume: so for example if a person on average consumes € 80 out of an income of € 100, APC =. 8 • APS = Average Propensity to Save: so if person saves € 20 out of income of € 100, APS =. 2 • MPC = Marginal Propensity to Consume: thus is a person spends € 12 out of additional € 20 received in income APS =. 6 • MPS = Marginal Propensity to Save: MPS =. 4 • Formula for multiplier in a closed economy k = 1/(1 – MPC) = 1/MPS Thus if MPC =. 6 and MPS =. 4, k = 1/(1 -. 6) = 1/. 4 = 2. 5 • Formula for multiplier in an open economy (with Gov. intervention) k = 1/MPW = 1/{1 – (MPS + MPT + MPM) So if MPS =. 2, MPT =. 3, MPW =. 3, k = 1/{1 – (. 2 +. 3) = 1/. 8 = 1. 25

MULTIPLER AND ACCELERATOR • The accelerator relates to a relationship between investment and growth whereby it is postulated that the level of investment is directly related to changes in the rate of growth in the economy This would mean that when there is a downturn in growth in the economy this will lead to a drop in investment compounding the downturn Likewise when growth rates improve (as in a boom) the levels of investment themselves increase thus “accelerating” the rate of growth • Multiplier and accelerator effects tend to work together: initially an increase in expenditure (say consumer) will lead to an increase in the growth rate which in turn will lead to an accelerator effect (via investment) further increasing growth However these combined effects can operate in both a positive and negative fashion So booms and slumps tend to be compounded through multiplier accelerator effects

MEASUREMENT OF NATIONAL INCOME • National Income represents the value in money terms of what is produced in an economy on an annual basis. When divided by population to obtain income per capita it provides the conventional measurement of the standard of living. Economic growth then represents the real change in National Income from year to year. There are three ways of measuring National Income 1. Income Approach This is the attempt to measure the total amount paid out in income during the year. There are problems with this approach. For example farming income is difficult to measure accurately. Also activity in the underground economy will not be assessed. 2. Expenditure Approach This is the measurement of the total amount spent in an economy during the year. Again there can be problems. Capital expenditure in the private sector is hard to assess. Also smuggling activity (between countries) would distort figures. 3. Output Approach This is the measurement of the value added at each stage of production which is measured accurately would also provide a valid measurement of economic activity. However the main difficulty here is the problem of double counting. See http: //www. cso. ie/statistics/nationalingp. htm

NATIONAL INCOME CONCEPTS There are different National Income concepts • The one that is officially used in Europe is GDP (Gross Domestic Product) at market prices. • However this is not very valid for Ireland as it does not take account of outflows of money that have been generated in the country (especially the profits of multinational companies). • So a more accurate figure for Ireland is GNP (Gross National Product) at market prices. • Net measurements can also be taken (i. e. that do not include depreciation). • Also measurements can be at market prices (as for expenditure) or factor cost (for income). • An alternative measurement of human welfare is provided through the United Nations Human Development Index (HDI). • This includes three components • 1. Life Expectancy at birth • 2. Education based on literacy levels and years of schooling • 3. GDP per capita.

COMPARISONS OF NATIONAL INCOME • Many problems can arise both in measuring national income an making comparisons between countries - quality of information can vary from country to country - differences as between income and wealth measurements - in poorer nations money may not be widely used therefore much activity may be unmeasured - exchange rates can distort comparisons (e. g. falling dollar vis a vis the euro - distribution of income can vary widely - climatic differences can be important and lifestyles may significantly differ between countries - cost of living variations can be significant - diseconomies of growth can lead to national income rising due to the very problems caused by its rise in the first place (e. g. the need to build new roads because of traffic congestion) - many feel that income measurements as a standard of welfare too restrictive and that factors like education and life expectancy should be also taken into account

0f52d9953e49664cd5f4ca76711c20fd.ppt