b0f03f24eaf41d6f5e8b1a0ec64d7d0c.ppt

- Количество слайдов: 15

MACROECONOMIC EQUILIBRIUM The External Balance Cypher and Dietz, Ch. 15

Exchange Rates Exchange rate • The number of units of a foreign currency that can be obtained for each unit of the domestic currency, OR • The number of units of domestic currency required to buy a unit of some foreign currency. Exchange rate regimes • Floating exchange rates: supply and demand determined. • Fixed exchange rates: central authority determined. • Managed Float: mixture of supply & demand central authority. Crawling peg Band exchange rate

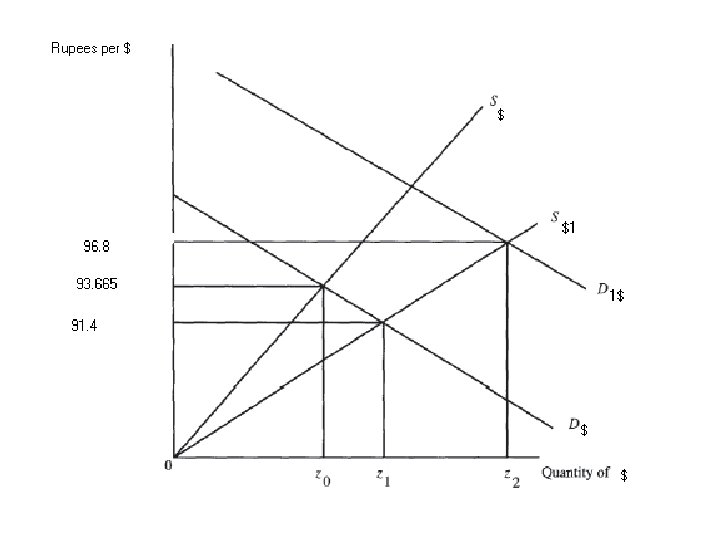

Supply and Demand in the Market for Foreign Currency Example: Market for U. S. $ in Sri Lanka Demand for US $ in Sri Lanka (those supplying rupees in return for $) • • importers of foreign goods into Sri Lanka sri lankans traveling abroad sri lankans investing abroad any one else currently holding rupees and needs $ in return Supply of US $ into Sri Lanka (those supplying $ in return for rupees) • exported of Sri Lankan goods into foreign countries • foreigners traveling to Sri Lanka • foreigners investing in Sri Lanka • any one else currently holding $ and needs rupees in return

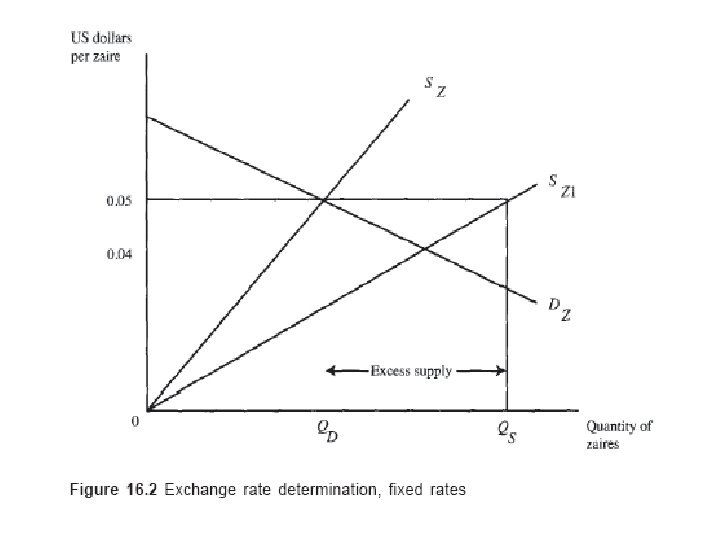

Fixed Exchange Rate System Under a fixed exchange rate system, an increase in demand foreign currency (or decrease in supply thereof) can lead to a shortage of hard foreign currency (shortage of US $ in this case). The shortage of US $ can be met by the following measures: • Government can sell $ from its official foreign exchange reserves • If insufficient dollars are held as reserves, the government can use administrative means to ration the foreign ER market such that the available dollars go to priority groups, for example – import licenses (for essential goods) – limits on the no. of rupees that can be exchanged for $, etc. Hence Risks of the fixed ER regime: • emergence of black / parallel markets. • depletion of foreign ER reserves

Exchange Rates Exchange rate • The number of units of a foreign currency that can be obtained for each unit of the domestic currency, OR • The number of units of domestic currency required to buy a unit of some foreign currency. Exchange rate regimes • Floating exchange rates: supply and demand determined. • Fixed exchange rates: central authority determined. • Managed Float: mixture of supply & demand central authority. Crawling peg Band exchange rate

Real Exchange Rates (RER) versus Nominal Exchange Rates (NER) RER differs from the NER when a country’s inflation rate differs from the inflations rates of its trading partners. Given: US $ and the Mexican peso; NER at the beginning of 2005 is $1 = 12 pesos Inflation rate in Mexico in 2004 = 20% Inflation rate in the U. S. in 2004 = 0% If NER is FIXED; then RER will change such that the Mexican peso will have appreciated vis a vis the US $. For the RER to remain the same despite the inflation differential between the two countries, the NER would need to change under a floating ER system, such that US $ 1 = 14. 4 pesos

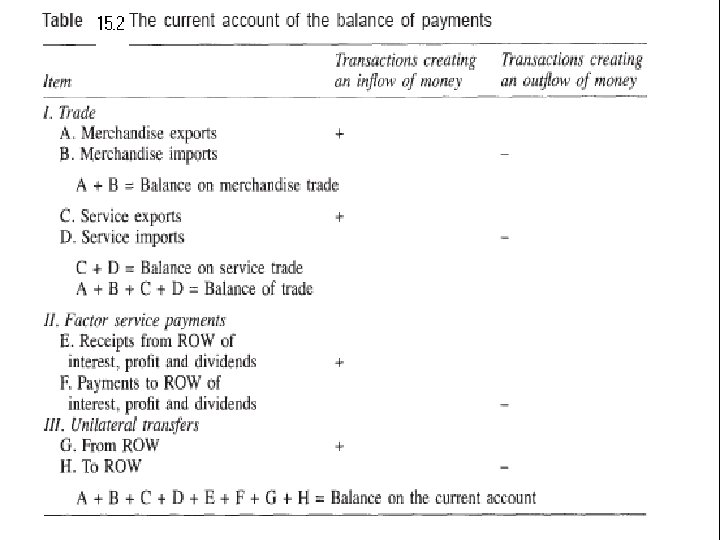

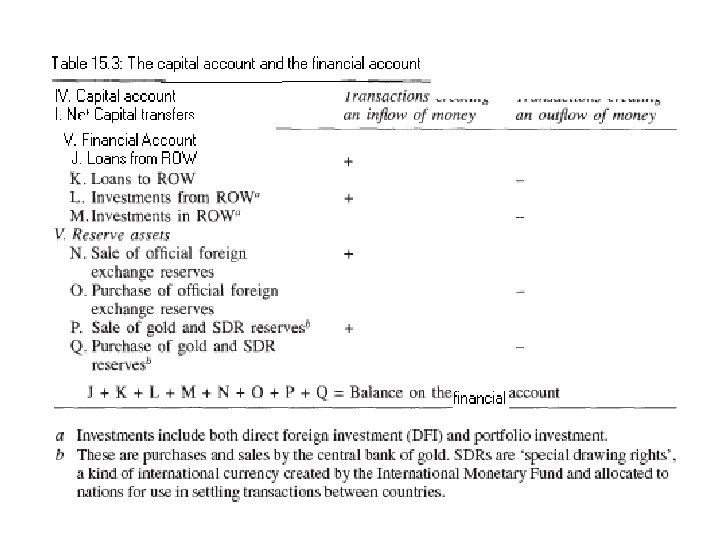

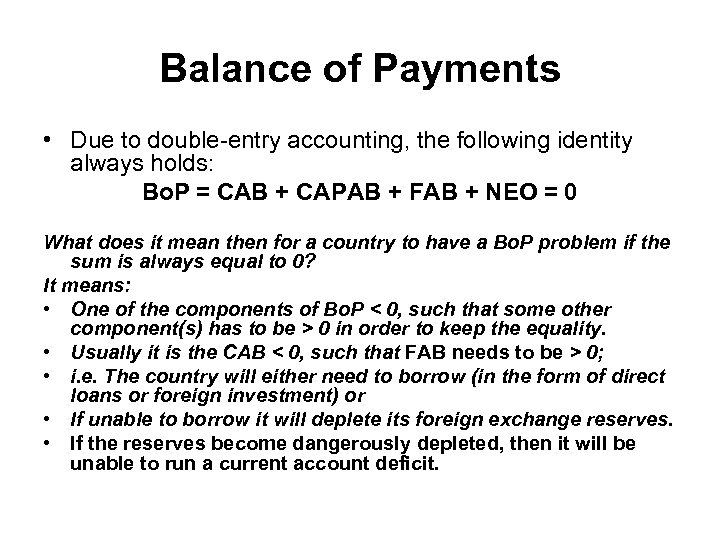

Balance of Payments Composed of four parts: • Current account balance • Capital account balance • Financial account balance • Net errors and omissions Due to double-entry accounting, the following identity always holds: Bo. P = CAB + CAPAB + FAB + NEO = 0

Balance of Payments • Due to double-entry accounting, the following identity always holds: Bo. P = CAB + CAPAB + FAB + NEO = 0 What does it mean then for a country to have a Bo. P problem if the sum is always equal to 0? It means: • One of the components of Bo. P < 0, such that some other component(s) has to be > 0 in order to keep the equality. • Usually it is the CAB < 0, such that FAB needs to be > 0; • i. e. The country will either need to borrow (in the form of direct loans or foreign investment) or • If unable to borrow it will deplete its foreign exchange reserves. • If the reserves become dangerously depleted, then it will be unable to run a current account deficit.

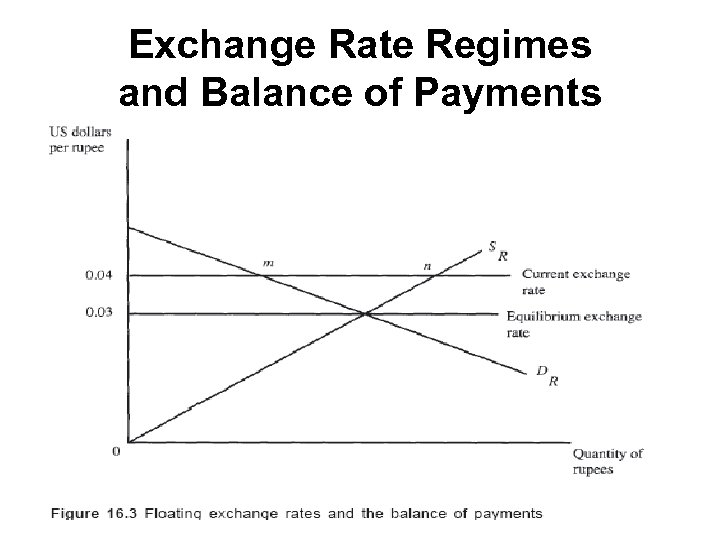

Exchange Rate Regimes and Balance of Payments

Monitoring the Balance of Payments • A beneficial current account deficit • A debilitating current account deficit

Austerity measures to deal with a debilitating current account deficit • Devaluation of the currency; • Reduction in inflation rate via greater control of the fiscal deficit and the money supply that create and perpetuate inflation (“stabilization policies”); • An increase in domestic interest rates and a reduction in trade barriers with the ROW (“adjustment policies”); • Limits on wage increases to less than the inflation rate; • Lay-offs of government employees; • Privatization of state enterprises, etc.

b0f03f24eaf41d6f5e8b1a0ec64d7d0c.ppt