HJG MacroEng Final.pptx

- Количество слайдов: 63

Macroeconomic environment and perspectives in Colombia Hernando José Gómez Moscow, Oct 11 2016

Table of contents 1 International context 2 Where are we coming from – a long term view 3 Macroeconomic, fiscal situation, and perspectives 4 Colombia in the regional context

International Context

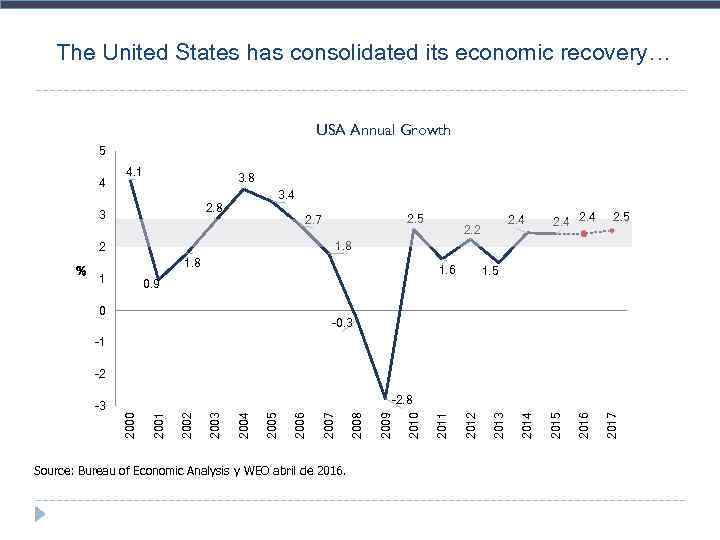

The United States has consolidated its economic recovery… USA Annual Growth 5 4 4. 1 3. 8 3. 4 2. 8 3 2. 4 2. 2 2. 4 2. 5 1. 8 2 % 2. 5 2. 7 1. 8 1 1. 6 1. 5 0. 9 0 -0. 3 -1 -2 Source: Bureau of Economic Analysis y WEO abril de 2016. 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 -2. 8 2000 -3

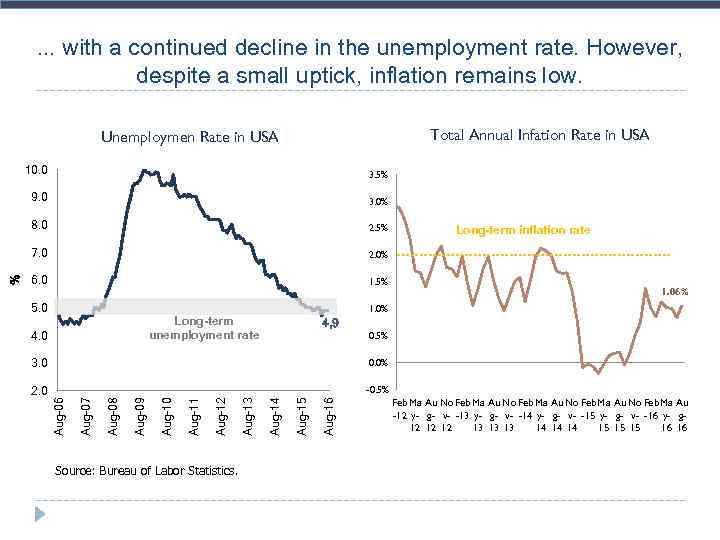

. . . with a continued decline in the unemployment rate. However, despite a small uptick, inflation remains low. Total Annual Infation Rate in USA Unemploymen Rate in USA 3. 5% 9. 0 3. 0% 8. 0 2. 5% 7. 0 2. 0% 6. 0 1. 5% 5. 0 4. 0 Long-term inflation rate Inflación de largo plazo 1. 06% 1. 0% Long-term unemployment rate 4, 9 0. 5% Source: Bureau of Labor Statistics. Aug-16 Aug-15 Aug-14 Aug-13 Aug-12 Aug-11 Aug-10 -0. 5% Aug-09 2. 0 Aug-08 0. 0% Aug-07 3. 0 Aug-06 % 10. 0 Feb Ma Au No Feb Ma Au -12 y- g- v- -13 y- g- v- -14 y- g- v- -15 y- g- v- -16 y- g 12 12 12 13 13 13 14 14 14 15 15 15 16 16

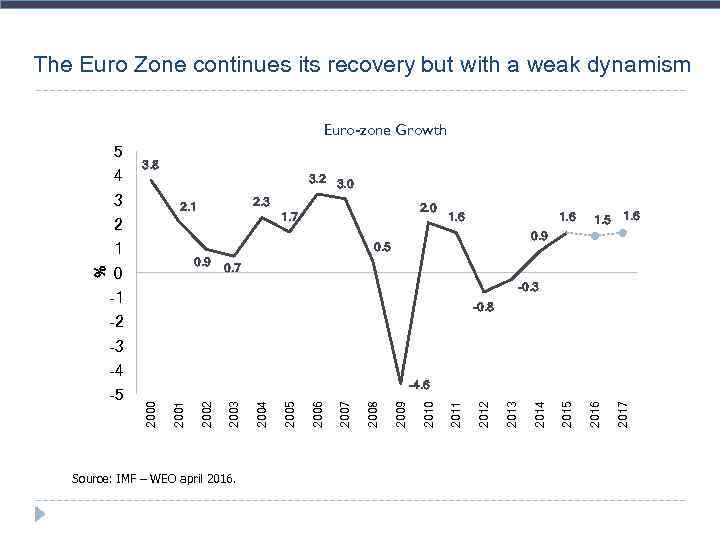

The Euro Zone continues its recovery but with a weak dynamism Euro-zone Growth 5 4 3. 8 3. 2 3. 0 3 2. 1 2 % 1 2. 0 1. 7 1. 6 0. 9 0. 5 0 1. 5 0. 7 -0. 3 -1 -0. 8 -2 -3 -4 Source: IMF – WEO april 2016. 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 -4. 6 2000 -5

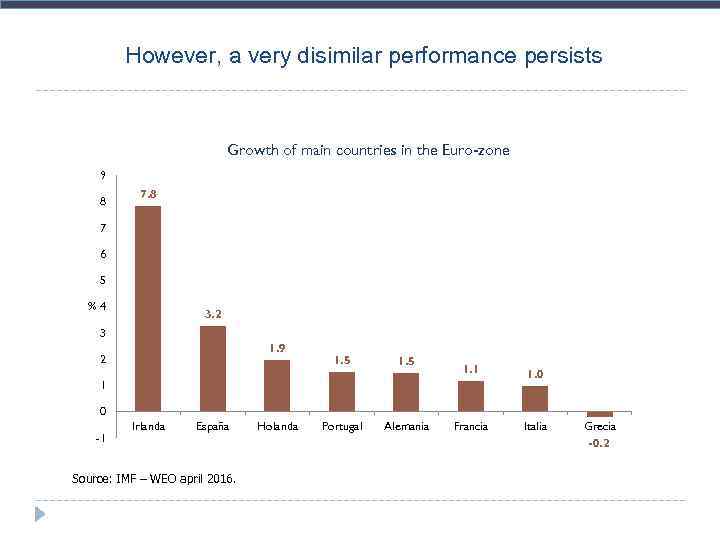

However, a very disimilar performance persists Growth of main countries in the Euro-zone 9 8 7 6 5 %4 3. 2 3 1. 9 2 1. 5 Portugal Alemania 1. 1 1. 0 Francia Italia 1 0 -1 Irlanda España Source: IMF – WEO april 2016. Holanda Grecia -0. 2

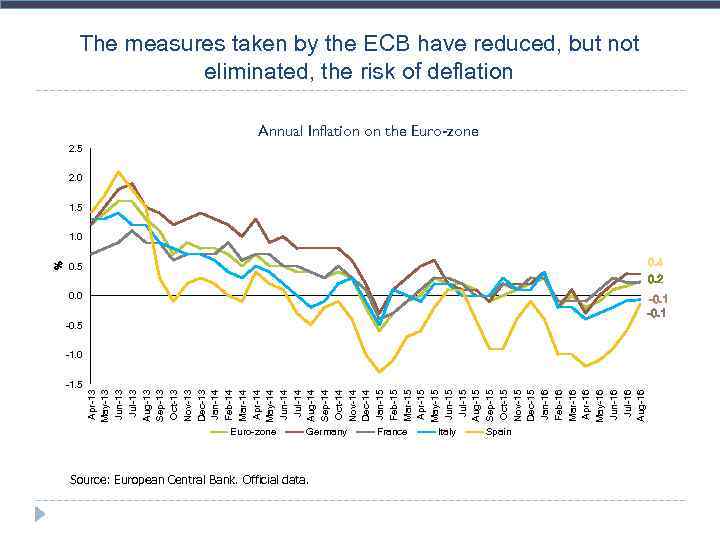

-1. 5 Apr-13 May-13 Jun-13 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 % The measures taken by the ECB have reduced, but not eliminated, the risk of deflation Annual Inflation on the Euro-zone 2. 5 2. 0 1. 5 1. 0 0. 5 -0. 5 0. 4 0. 2 0. 0 -0. 1 -1. 0 Euro-zone Germany Source: European Central Bank. Official data. France Italy Spain

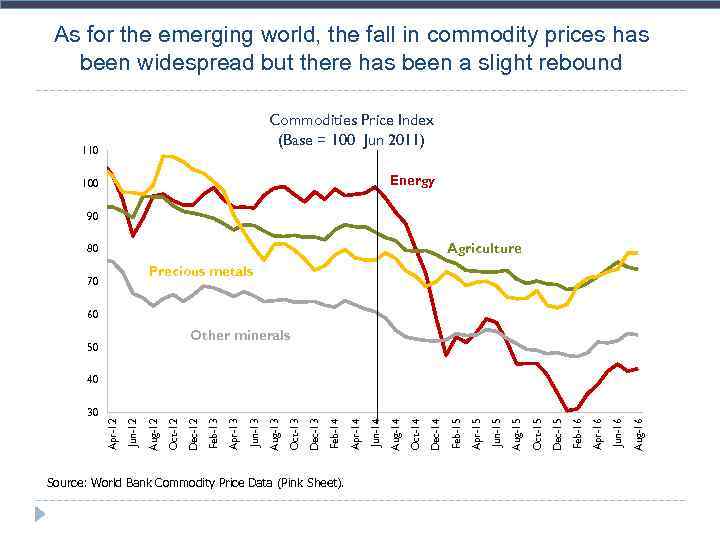

As for the emerging world, the fall in commodity prices has been widespread but there has been a slight rebound Commodities Price Index (Base = 100 Jun 2011) 110 Energy 100 90 Agriculture 80 Precious metals 70 60 Other minerals 50 Source: World Bank Commodity Price Data (Pink Sheet). Aug-16 Jun-16 Apr-16 Feb-16 Dec-15 Oct-15 Aug-15 Jun-15 Apr-15 Feb-15 Dec-14 Oct-14 Aug-14 Jun-14 Apr-14 Feb-14 Dec-13 Oct-13 Aug-13 Jun-13 Apr-13 Feb-13 Dec-12 Oct-12 Aug-12 Apr-12 30 Jun-12 40

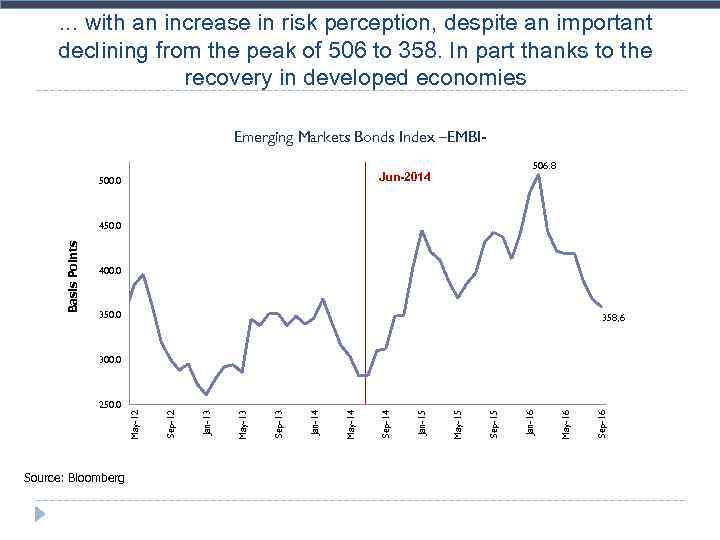

. . . with an increase in risk perception, despite an important declining from the peak of 506 to 358. In part thanks to the recovery in developed economies Emerging Markets Bonds Index –EMBI 506. 8 Jun-2014 500. 0 Basis Points 450. 0 400. 0 358, 6 300. 0 Source: Bloomberg Sep-16 May-16 Jan-16 Sep-15 May-15 Jan-15 Sep-14 May-14 Jan-14 Sep-13 May-13 Jan-13 Sep-12 May-12 250. 0

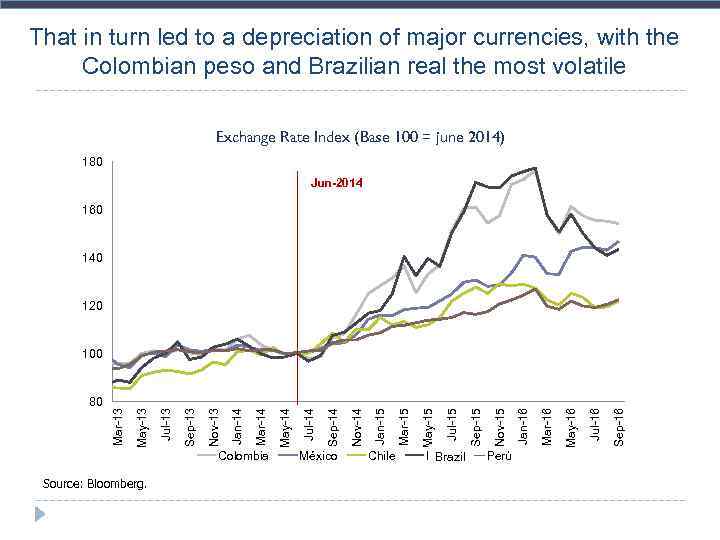

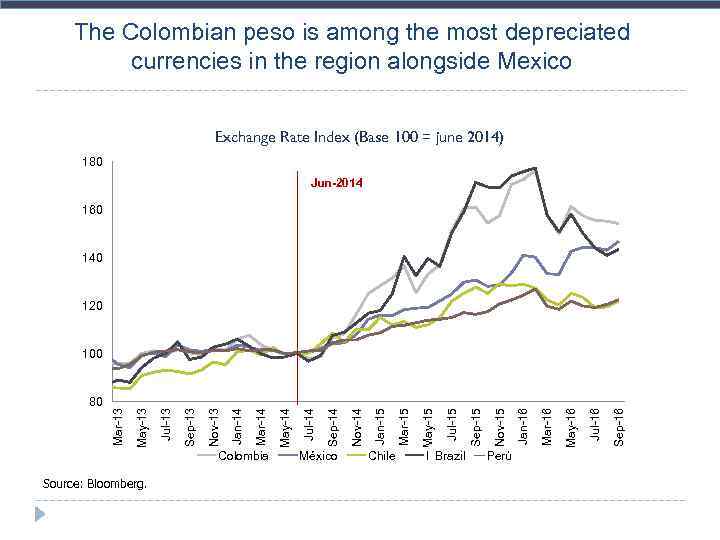

That in turn led to a depreciation of major currencies, with the Colombian peso and Brazilian real the most volatile Exchange Rate Index (Base 100 = june 2014) 180 Jun-2014 160 140 120 Colombia Source: Bloomberg. México Chile Brasil Brazil Perú Sep-16 Jul-16 May-16 Mar-16 Jan-16 Nov-15 Sep-15 Jul-15 May-15 Mar-15 Jan-15 Nov-14 Sep-14 Jul-14 May-14 Mar-14 Jan-14 Nov-13 Sep-13 Jul-13 May-13 80 Mar-13 100

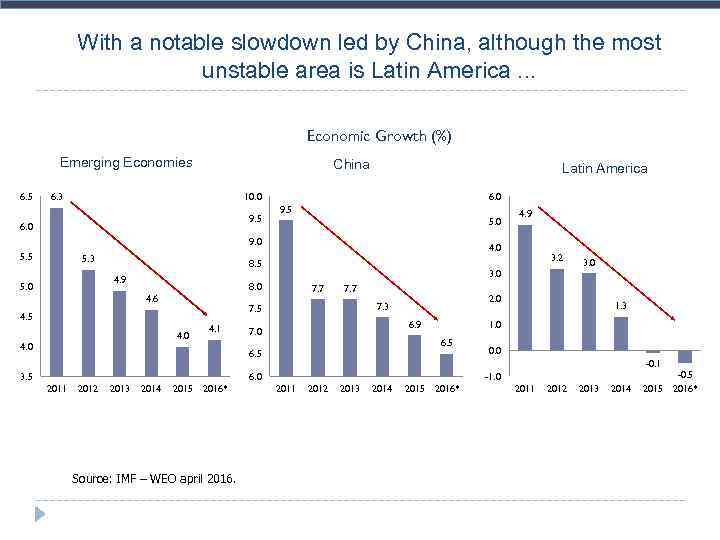

With a notable slowdown led by China, although the most unstable area is Latin America. . . Economic Growth (%) Emerging Economies 6. 5 China Latin America 10. 0 6. 3 9. 5 6. 0 9. 5 5. 0 9. 0 5. 5 5. 3 4. 0 8. 5 4. 9 5. 0 4. 0 7. 7 4. 1 6. 9 7. 0 2012 2013 2014 2015 2016* Source: IMF – WEO april 2016. 0. 0 -0. 1 6. 0 2011 1. 3 1. 0 6. 5 3. 0 2. 0 7. 3 7. 5 4. 5 3. 2 3. 0 8. 0 4. 6 4. 9 -1. 0 2011 2012 2013 2014 2015 2016* 2011 2012 2013 2014 2015 -0. 5 2016*

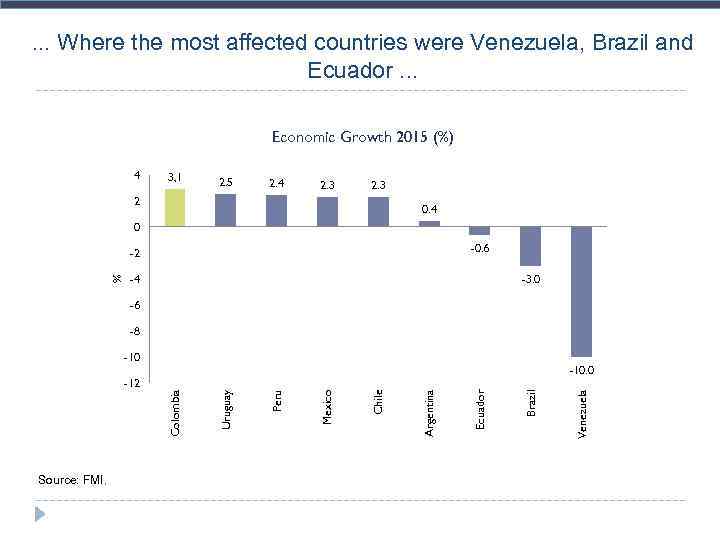

. . . Where the most affected countries were Venezuela, Brazil and Ecuador. . . Economic Growth 2015 (%) 4 3, 1 2. 5 2. 4 2. 3 2 0. 4 0 -0. 6 % -2 -4 -3. 0 -6 -8 -10 Source: FMI. Venezuela Brazil Ecuador Argentina Chile Mexico Peru Uruguay -10. 0 Colombia -12

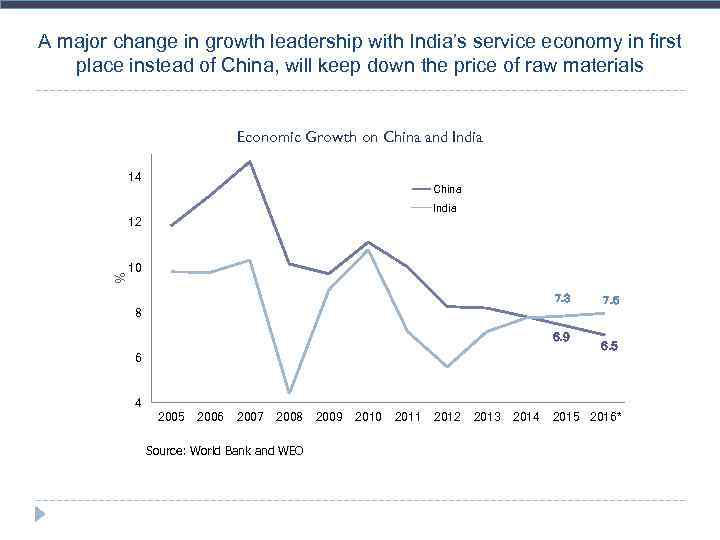

A major change in growth leadership with India’s service economy in first place instead of China, will keep down the price of raw materials Economic Growth on China and India 14 China India % 12 10 7. 3 8 6. 9 6 7. 5 6. 5 4 2005 2006 2007 2008 Source: World Bank and WEO 2009 2010 2011 2012 2013 2014 2015 2016*

Where are we coming from? – A long term view

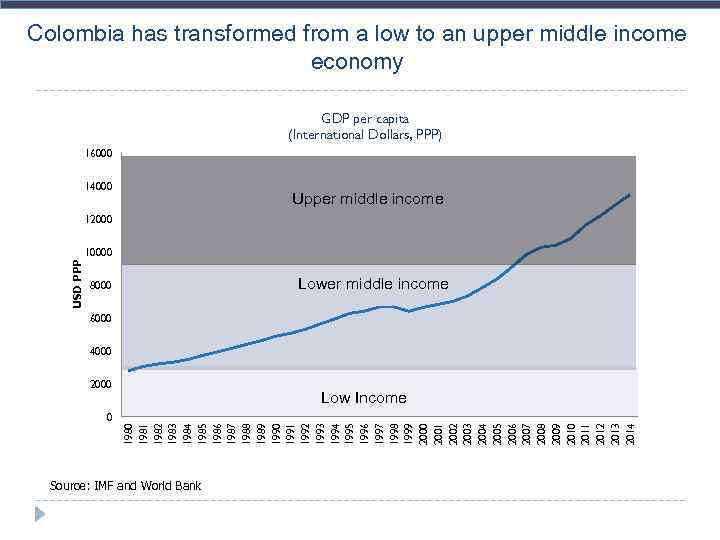

Colombia has transformed from a low to an upper middle income economy GDP per capita (International Dollars, PPP) 16000 14000 Upper middle income 12000 USD PPP 10000 Lower middle income 8000 6000 4000 2000 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 0 Low Income Source: IMF and World Bank

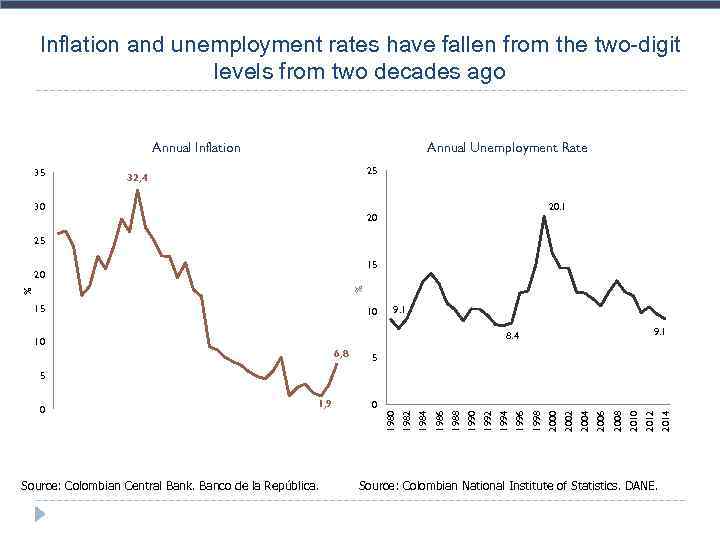

Inflation and unemployment rates have fallen from the two-digit levels from two decades ago Annual Inflation 35 Annual Unemployment Rate 25 32, 4 30 20. 1 20 25 15 % % 20 15 10 9. 1 8. 4 10 6, 8 5 5 Source: Colombian Central Bank. Banco de la República. Source: Colombian National Institute of Statistics. DANE. 2014 2012 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 0 1982 1, 9 1980 0

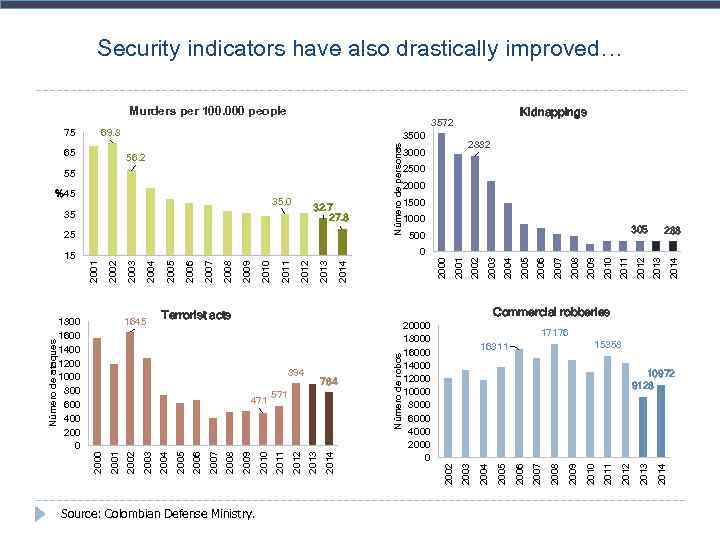

Security indicators have also drastically improved… Murders per 100. 000 people Source: Colombian Defense Ministry. 2014 2013 2012 2011 2010 2009 2008 2007 17176 15358 16311 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 10972 9128 2004 20000 18000 16000 14000 12000 10000 8000 6000 4000 2000 0 2003 2014 2013 2012 Número de robos 764 571 2010 2009 2008 2007 2006 2005 2004 471 2003 288 Commercial robberies Terrorist acts 894 2002 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 1645 2001 1800 1600 1400 1200 1000 800 600 400 200 0 305 500 0 2000 Número de ataques 15 1000 2006 25 1500 2005 32. 7 27. 8 2004 35. 0 35 2000 2003 %45 2500 2001 55 2882 3000 2000 56. 2 Número de personas 65 3500 2002 69. 8 2002 75 Kidnappings 3572

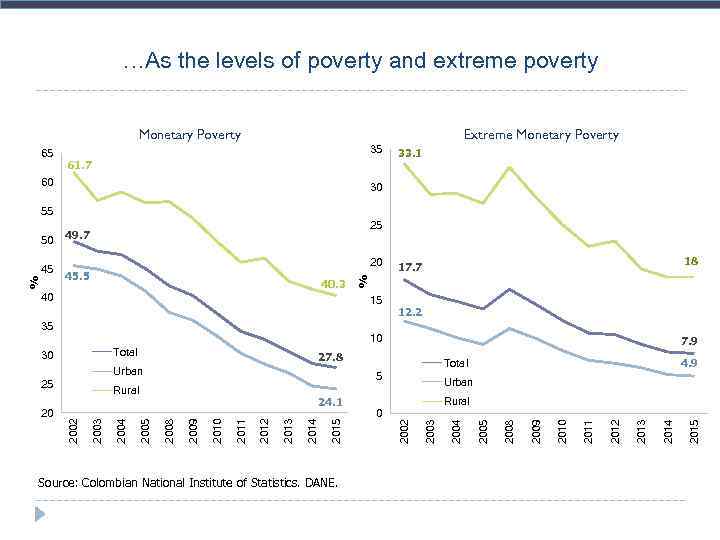

…As the levels of poverty and extreme poverty Monetary Poverty 65 Extreme Monetary Poverty 35 61. 7 60 33. 1 30 55 20 40. 3 40 15 35 18 17. 7 12. 2 10 27. 8 Source: Colombian National Institute of Statistics. DANE. 2014 2013 2012 2011 2010 2009 Rural 0 2008 2015 2013 2012 2011 2010 2009 2008 2005 2004 2003 2002 2014 24. 1 20 Urban 2003 Rural 4. 9 Total 5 2005 Urban 25 7. 9 2004 Total 30 2015 45. 5 2002 % 45 25 49. 7 % 50

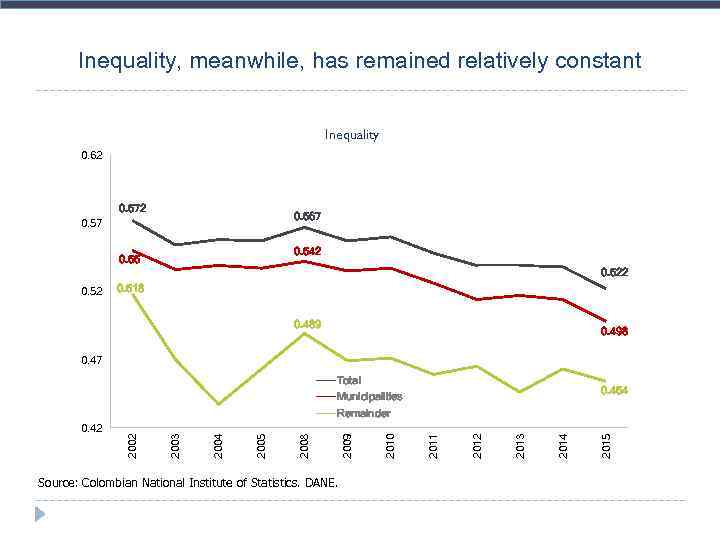

Inequality, meanwhile, has remained relatively constant Inequality 0. 62 0. 572 0. 567 0. 542 0. 55 0. 522 0. 518 0. 489 0. 498 0. 47 Total 0. 454 Municipalities Remainder Source: Colombian National Institute of Statistics. DANE. 2015 2014 2013 2012 2011 2010 2009 2008 2005 2004 2003 2002 0. 42

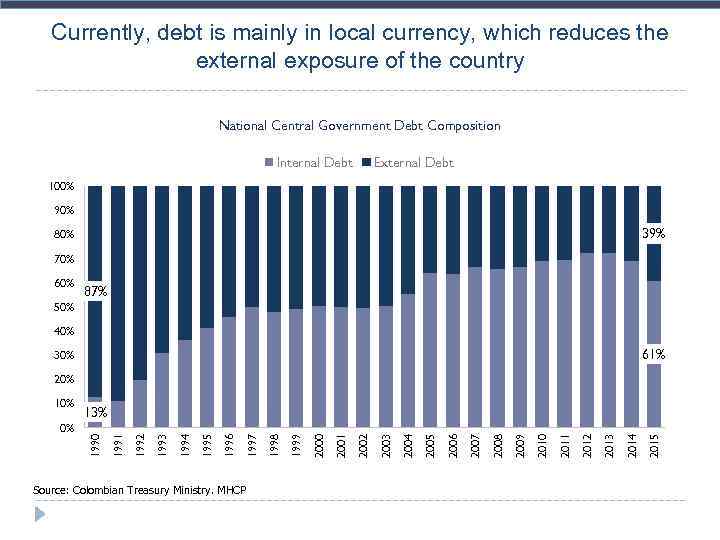

Currently, debt is mainly in local currency, which reduces the external exposure of the country National Central Government Debt Composition Internal Debt External Debt 100% 90% 39% 80% 70% 60% 87% 50% 40% 61% 30% 20% Source: Colombian Treasury Ministry. MHCP 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 13% 1991 0% 1990 10%

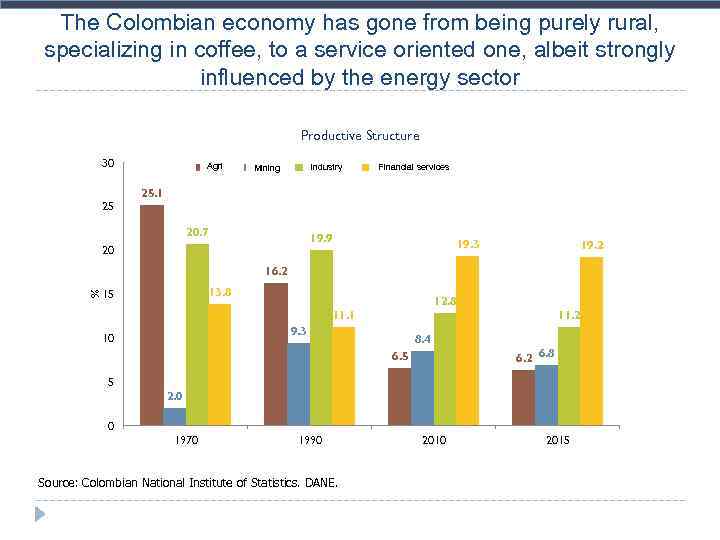

The Colombian economy has gone from being purely rural, specializing in coffee, to a service oriented one, albeit strongly influenced by the energy sector Productive Structure 30 25 Agri Agro Mining Minas Industry Industria Financial Financieros Servicios services 25. 1 20. 7 19. 9 20 19. 3 19. 2 % 16. 2 13. 8 15 12. 8 11. 2 11. 1 9. 3 10 8. 4 6. 2 6. 8 6. 5 5 2. 0 0 1970 1990 Source: Colombian National Institute of Statistics. DANE. 2010 2015

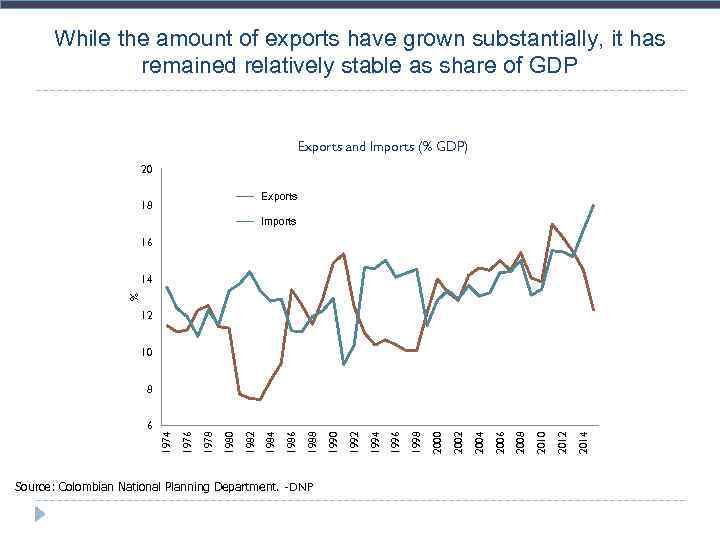

While the amount of exports have grown substantially, it has remained relatively stable as share of GDP Exports and Imports (% GDP) 20 Exportaciones Exports 18 Imports Importaciones 16 % 14 12 10 Source: Colombian National Planning Department. -DNP 2014 2012 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 6 1974 8

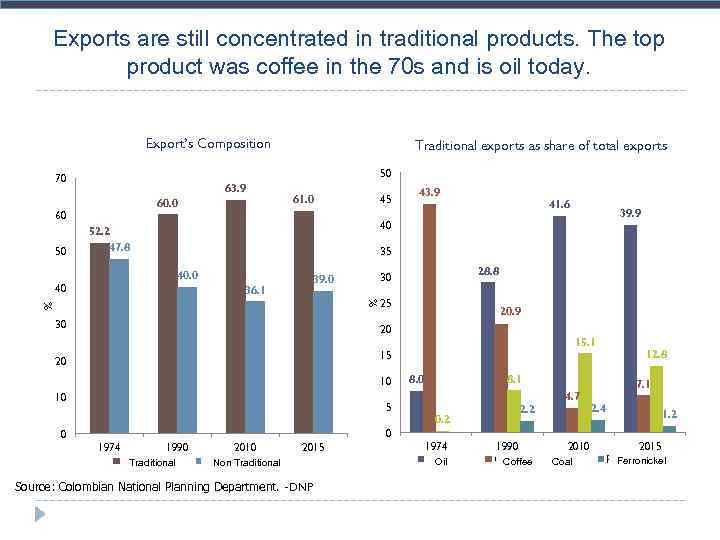

Exports are still concentrated in traditional products. The top product was coffee in the 70 s and is oil today. Export’s Composition 50 70 63. 9 60. 0 60 50 Traditional exports as share of total exports 45 61. 0 41. 6 39. 9 40 52. 2 47. 8 35 40. 0 40 43. 9 % % 36. 1 30 28. 8 30 39. 0 25 20. 9 20 15. 1 15 20 10 10 5 8. 1 8. 0 4. 7 0. 2 2. 2 12. 8 7. 1 2. 4 1. 2 0 0 1974 1990 Tradicionales Traditional 2010 No tradicionales Non Traditional 2015 Source: Colombian National Planning Department. -DNP 1974 Petróleo Oil 1990 2010 Café Carbón Coal Coffee 2015 Ferroníquel Ferronickel

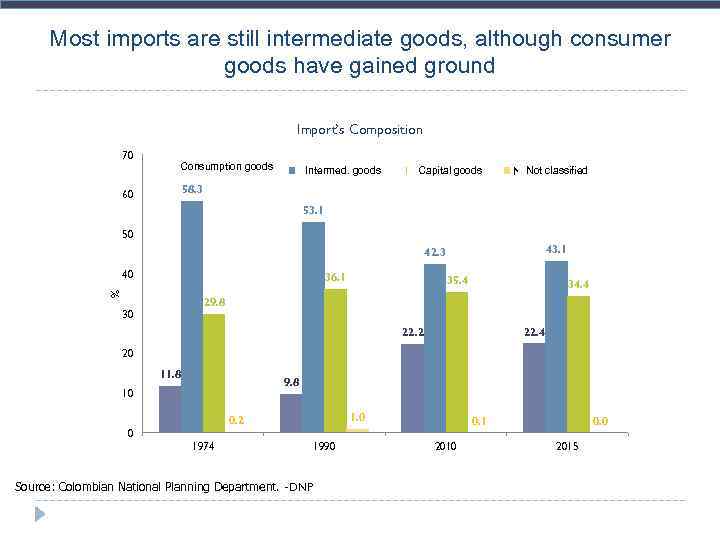

Most imports are still intermediate goods, although consumer goods have gained ground Import’s Composition 70 Consumption goods Bienes de Consumo Intermed. goods Bienes Intermedios Capital Bienes de goods No. Not classified clasificados 58. 3 60 53. 1 50 43. 1 42. 3 40 % 36. 1 35. 4 34. 4 29. 8 30 22. 4 22. 2 20 11. 8 9. 8 10 1. 0 0. 2 0 1974 Source: Colombian National Planning Department. -DNP 1990 0. 1 2010 0. 0 2015

Macroeconomic, fiscal context, and perspectives

Macroeconomic and fiscal context Perspectives

Macroeconomic and fiscal context Perspectives

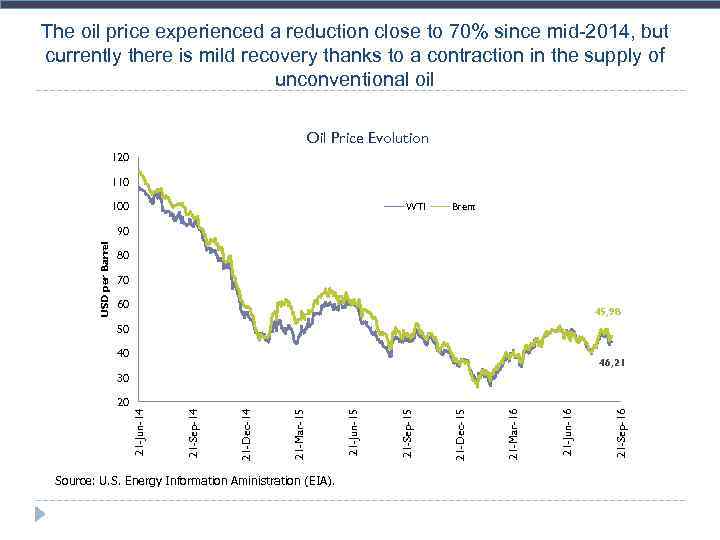

The oil price experienced a reduction close to 70% since mid-2014, but currently there is mild recovery thanks to a contraction in the supply of unconventional oil Oil Price Evolution 120 110 100 WTI Brent USD per Barrel 90 80 70 60 45, 98 50 40 46, 21 Source: U. S. Energy Information Aministration (EIA). 21 -Sep-16 21 -Jun-16 21 -Mar-16 21 -Dec-15 21 -Sep-15 21 -Jun-15 21 -Mar-15 21 -Dec-14 21 -Sep-14 20 21 -Jun-14 30

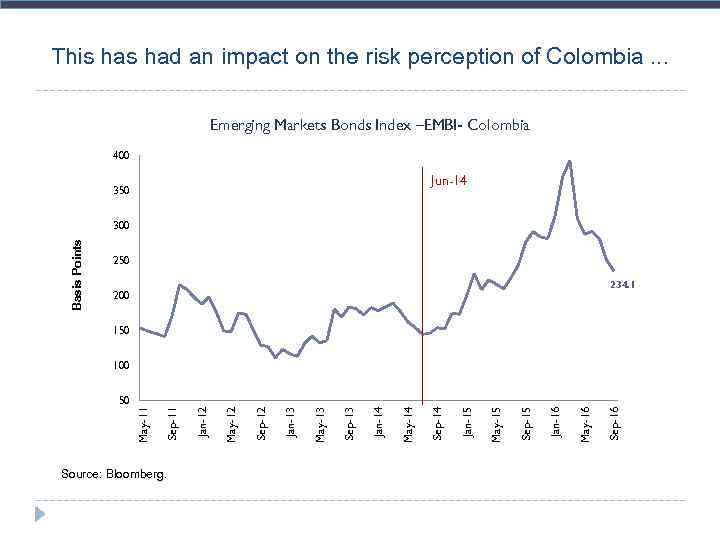

This had an impact on the risk perception of Colombia. . . Emerging Markets Bonds Index –EMBI- Colombia 400 Jun-14 350 Basis Points 300 250 234. 1 200 150 100 Source: Bloomberg. Sep-16 May-16 Jan-16 Sep-15 May-15 Jan-15 Sep-14 May-14 Jan-14 Sep-13 May-13 Jan-13 Sep-12 May-12 Jan-12 Sep-11 May-11 50

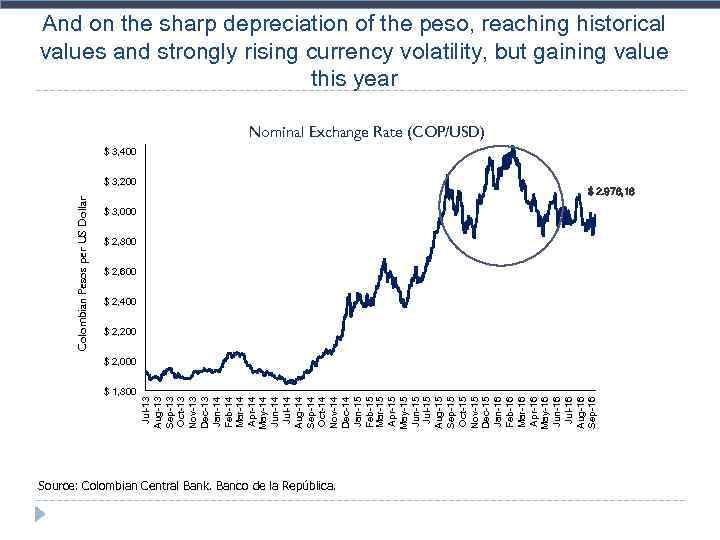

And on the sharp depreciation of the peso, reaching historical values and strongly rising currency volatility, but gaining value this year Nominal Exchange Rate (COP/USD) $ 3, 400 Colombian Pesos per US Dollar $ 3, 200 $ 2. 976, 16 $ 3, 000 $ 2, 800 $ 2, 600 $ 2, 400 $ 2, 200 $ 1, 800 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 $ 2, 000 Source: Colombian Central Bank. Banco de la República.

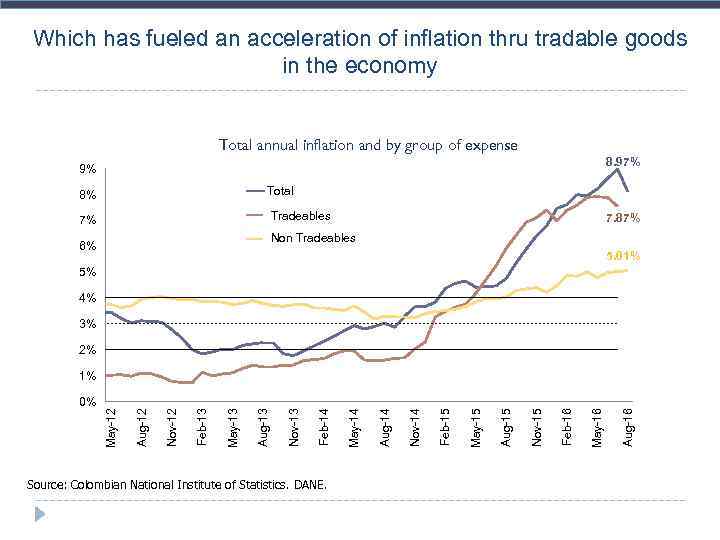

Which has fueled an acceleration of inflation thru tradable goods in the economy Total annual inflation and by group of expense 8. 97% 9% 8% Total 7% Transables Tradeables 7. 87% Non Tradeables No Transables 6% 5. 01% 5% 4% 3% 2% Source: Colombian National Institute of Statistics. DANE. Aug-16 May-16 Feb-16 Nov-15 Aug-15 May-15 Feb-15 Nov-14 Aug-14 May-14 Feb-14 Nov-13 Aug-13 May-13 Feb-13 Nov-12 Aug-12 0% May-12 1%

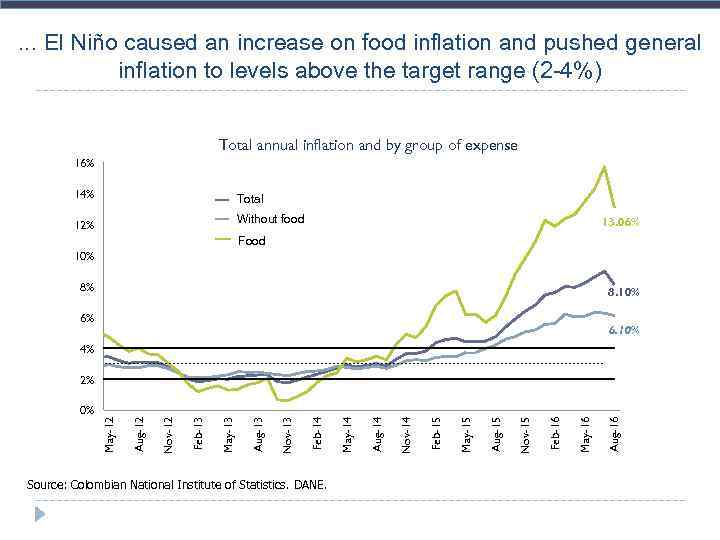

. . . El Niño caused an increase on food inflation and pushed general inflation to levels above the target range (2 -4%) Total annual inflation and by group of expense 16% 14% Total 12% Without food Sin Alimentos 13. 06% Alimentos Food 10% 8% 8. 10% 6% 6. 10% 4% Source: Colombian National Institute of Statistics. DANE. Aug-16 May-16 Feb-16 Nov-15 Aug-15 May-15 Feb-15 Nov-14 Aug-14 May-14 Feb-14 Nov-13 Aug-13 May-13 Feb-13 Nov-12 Aug-12 0% May-12 2%

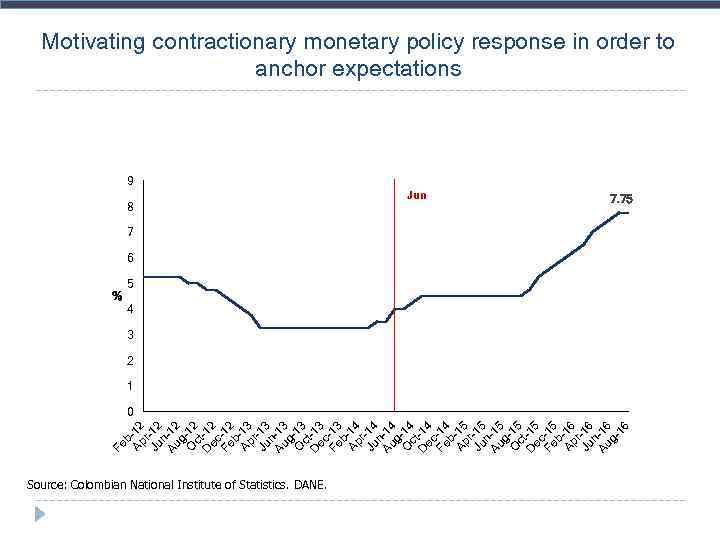

Fe b Ap -12 r Ju -12 n Au -12 g O -12 c D t-12 ec Fe -12 b Ap -13 r Ju -13 n Au -13 g O -13 c D t-13 ec Fe -13 b Ap -14 r Ju -14 n Au -14 g O -14 c D t-14 ec Fe -14 b Ap -15 r Ju -15 n Au -15 g O -15 c D t-15 ec Fe -15 b Ap -16 r Ju -16 n Au -16 g 16 Motivating contractionary monetary policy response in order to anchor expectations 9 8 % Source: Colombian National Institute of Statistics. DANE. Jun 7. 75 7 6 5 4 3 2 1 0

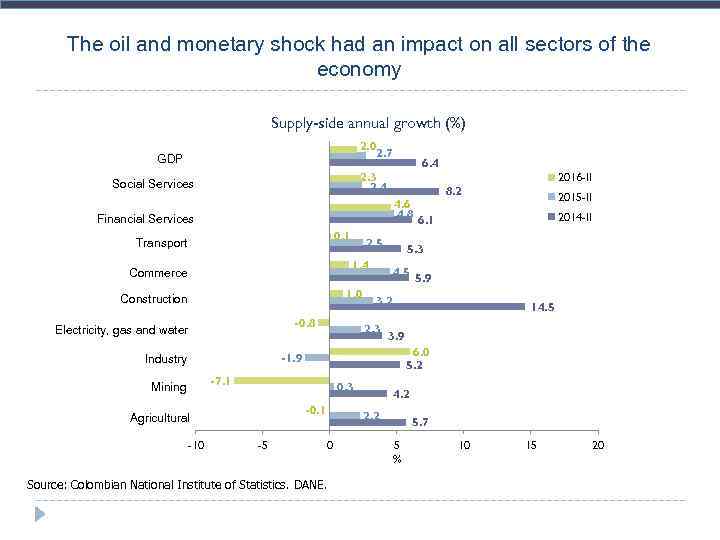

The oil and monetary shock had an impact on all sectors of the economy Supply-side annual growth (%) 2. 0 PIB GDP 2. 7 6. 4 2. 3 2. 4 Social sociales Servicios Services 2016 -II 4. 6 4. 8 Servicios Financieros Financial Services 0. 1 Transporte Transport 2. 5 1. 0 Construction Construcción -0. 8 Electricidad, gas agua Electricity, gas andywater Industria Industry 4. 5 3. 9 6. 0 5. 2 -7. 1 0. 3 -0. 1 Agro Agricultural -10 -5 5. 9 14. 5 -1. 9 Mining Minas 2014 -II 6. 1 3. 2 2. 3 2015 -II 5. 3 1. 4 Comercio Commerce 8. 2 4. 2 2. 2 0 Source: Colombian National Institute of Statistics. DANE. 5. 7 5 % 10 15 20

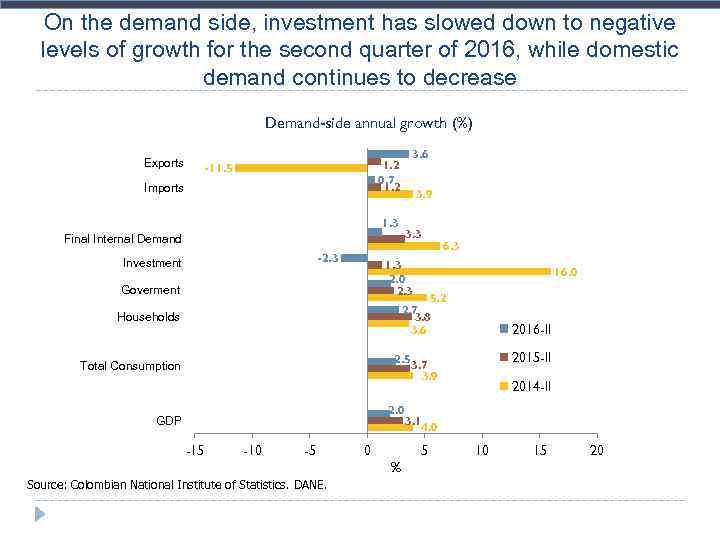

On the demand side, investment has slowed down to negative levels of growth for the second quarter of 2016, while domestic demand continues to decrease Demand-side annual growth (%) EX Exports 3. 6 1. 2 0. 7 1. 2 -11. 5 Imports IM 3. 9 1. 3 3. 3 Final Interna Demanda Final. Demand -2. 3 Investment Inversión 6. 3 1. 3 2. 0 2. 3 Goverment Gobierno 16. 0 5. 2 2. 7 3. 8 3. 6 Households Hogares 2016 -II 2015 -II 2. 53. 7 3. 9 Total Consumption Consumo Total 2. 0 PIB GDP -15 -10 -5 0 Source: Colombian National Institute of Statistics. DANE. 3. 14. 0 5 % 2014 -II 10 15 20

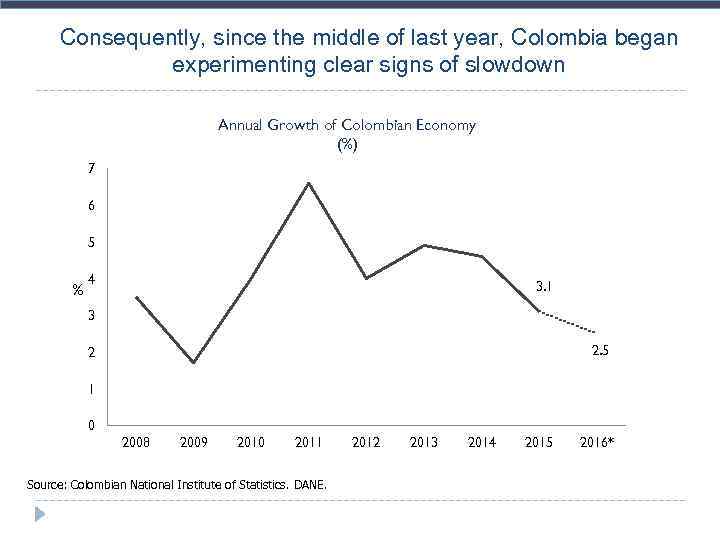

Consequently, since the middle of last year, Colombia began experimenting clear signs of slowdown Annual Growth of Colombian Economy (%) 7 6 5 % 4 3. 1 3 2. 5 2 1 0 2008 2009 2010 2011 Source: Colombian National Institute of Statistics. DANE. 2012 2013 2014 2015 2016*

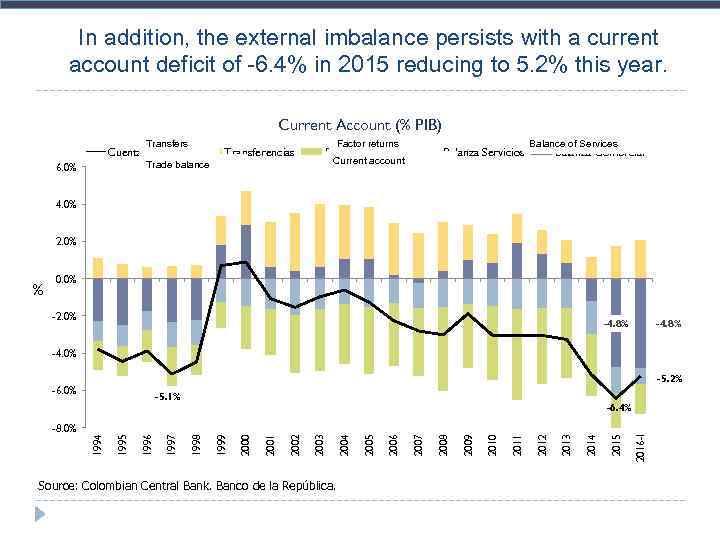

In addition, the external imbalance persists with a current account deficit of -6. 4% in 2015 reducing to 5. 2% this year. Current Account (% PIB) Transfers Cuenta Corriente Trade balance 6. 0% Transferencias Factor returns Renta de Factores Current account Balanza Servicios Balance of Services Balanza Comercial 4. 0% 2. 0% % 0. 0% -2. 0% -4. 8% -4. 0% -5. 2% Source: Colombian Central Bank. Banco de la República. 2016 -I 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 -6. 4% 1998 1997 1996 1995 1994 -8. 0% -5. 1% 2015 -6. 0%

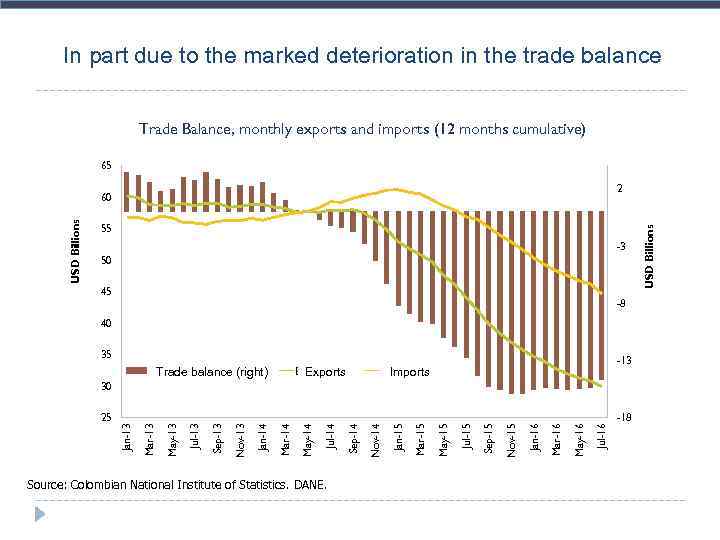

In part due to the marked deterioration in the trade balance Trade Balance, monthly exports and imports (12 months cumulative) 65 USD Billions 55 -3 50 45 -8 40 35 Balanza comercial (eje der. ) Trade balance (right) Exportaciones Exports -13 Importaciones Imports Source: Colombian National Institute of Statistics. DANE. Jul-16 May-16 Mar-16 Jan-16 Nov-15 Sep-15 Jul-15 May-15 Mar-15 Jan-15 Nov-14 Sep-14 Jul-14 May-14 Mar-14 Jan-14 Nov-13 Sep-13 May-13 Mar-13 Jan-13 25 Jul-13 30 -18 USD Billions 2 60

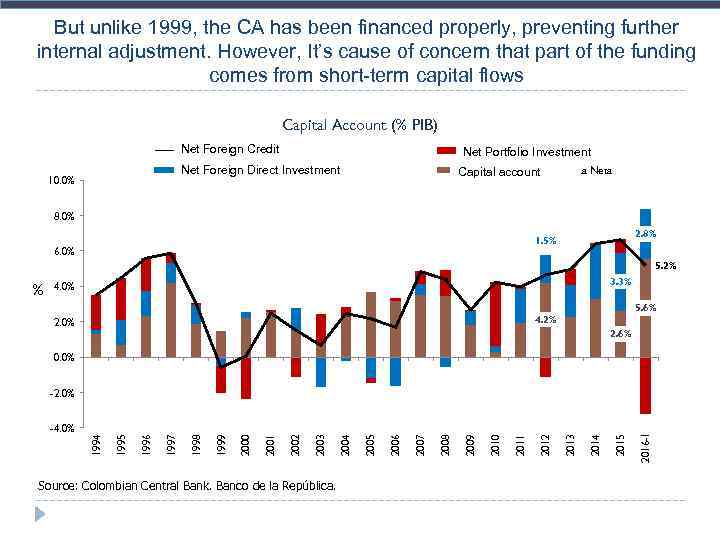

But unlike 1999, the CA has been financed properly, preventing further internal adjustment. However, It’s cause of concern that part of the funding comes from short-term capital flows Capital Account (% PIB) Net Foreign Credit Cuenta de Capitales Crédito Externo. Investment Net Portfolio Neto Inversión de Portafolio Investment Net Foreign Direct Neta Inversión Extranjera Capital account Directa Neta 10. 0% 8. 0% 2. 8% 1. 5% 6. 0% 5. 2% % 3. 3% 4. 0% 5. 6% 4. 2% 2. 0% 2. 6% 0. 0% Source: Colombian Central Bank. Banco de la República. 2016 -I 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 -4. 0% 1994 -2. 0%

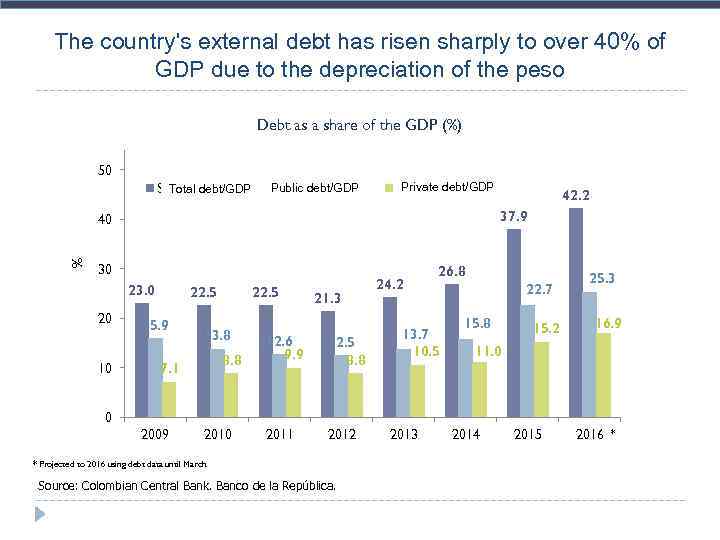

The country's external debt has risen sharply to over 40% of GDP due to the depreciation of the peso Debt as a share of the GDP (%) 50 Total debt/GDP Saldo Total / PIB Public debt/GDP Saldo Pública/PIB Private debt/GDP Saldo Privada /PIB 37. 9 % 40 30 23. 0 20 10 42. 2 22. 5 15. 9 22. 5 13. 8 8. 8 7. 1 21. 3 12. 6 9. 9 12. 5 8. 8 2011 2012 24. 2 26. 8 13. 7 10. 5 22. 7 15. 8 15. 2 25. 3 16. 9 11. 0 0 2009 2010 * Projected to 2016 using debt data until March. Source: Colombian Central Bank. Banco de la República. 2013 2014 2015 2016 *

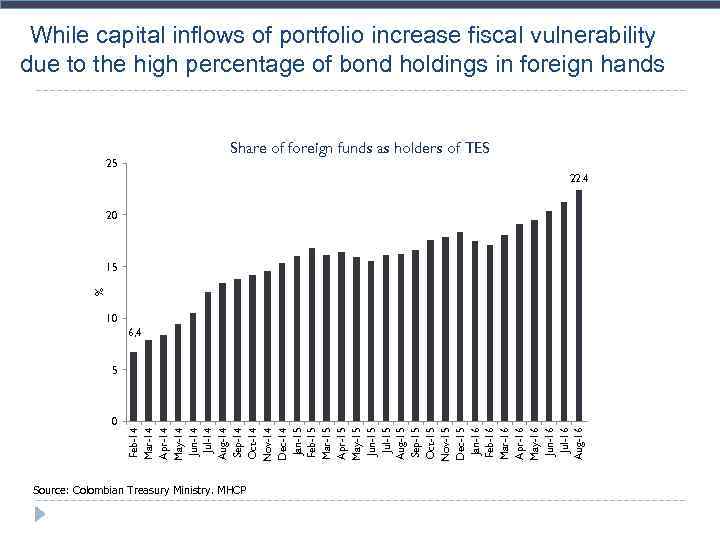

While capital inflows of portfolio increase fiscal vulnerability due to the high percentage of bond holdings in foreign hands Share of foreign funds as holders of TES 25 22. 4 20 % 15 10 6, 4 0 Feb-14 Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 5 Source: Colombian Treasury Ministry. MHCP

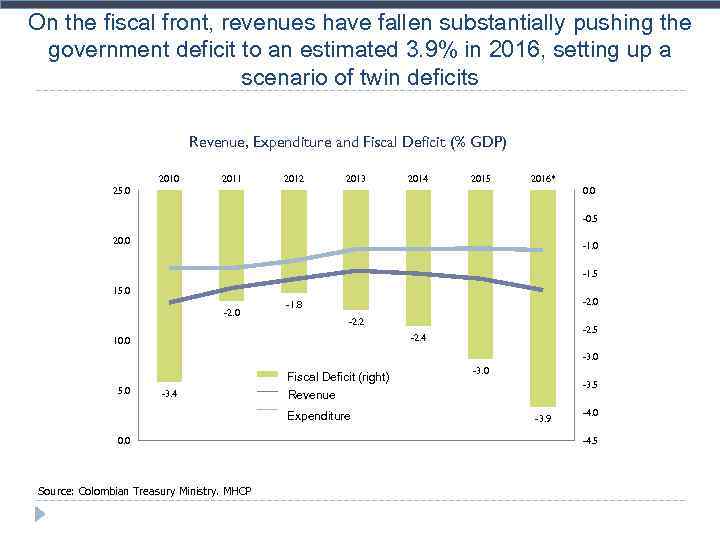

On the fiscal front, revenues have fallen substantially pushing the government deficit to an estimated 3. 9% in 2016, setting up a scenario of twin deficits Revenue, Expenditure and Fiscal Deficit (% GDP) 2010 2011 2012 2013 2014 2015 2016* 25. 0 0. 0 -0. 5 20. 0 -1. 5 15. 0 -2. 0 -1. 8 -2. 2 -2. 5 -2. 4 10. 0 -3. 0 Déficit fiscal (eje der. ) Fiscal Deficit (right) 5. 0 -3. 4 Expenditure Source: Colombian Treasury Ministry. MHCP -3. 5 Ingresos Revenue Gastos 0. 0 -3. 9 -4. 0 -4. 5

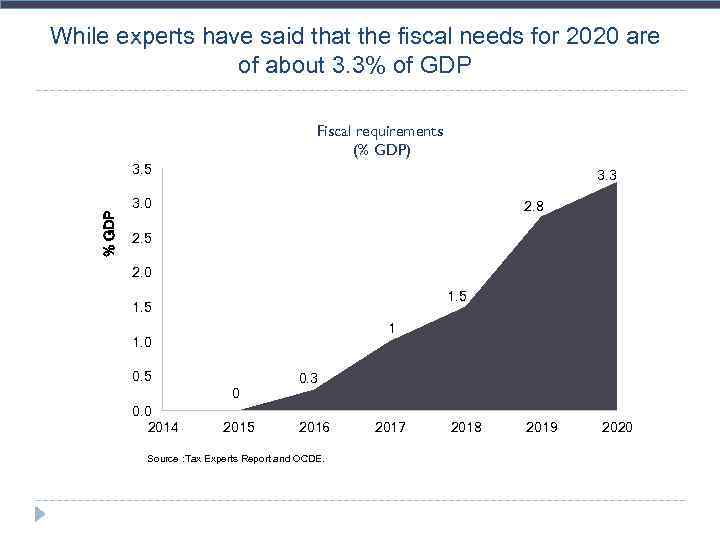

While experts have said that the fiscal needs for 2020 are of about 3. 3% of GDP Fiscal requirements (% GDP) % GDP 3. 5 3. 3 3. 0 2. 8 2. 5 2. 0 1. 5 1 1. 0 0. 5 0 0. 0 2014 2015 0. 3 2016 Source : Tax Experts Report and OCDE. 2017 2018 2019 2020

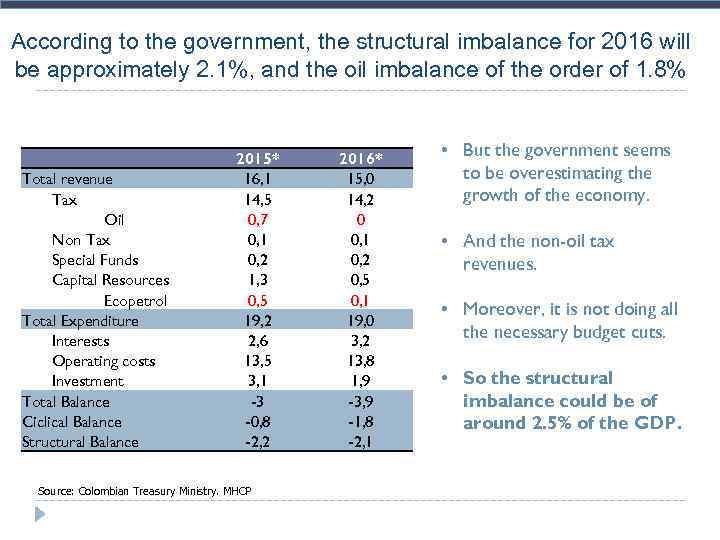

According to the government, the structural imbalance for 2016 will be approximately 2. 1%, and the oil imbalance of the order of 1. 8% Total revenue Tax Oil Non Tax Special Funds Capital Resources Ecopetrol Total Expenditure Interests Operating costs Investment Total Balance Ciclical Balance Structural Balance 2015* 16, 1 14, 5 0, 7 0, 1 0, 2 1, 3 0, 5 19, 2 2, 6 13, 5 3, 1 -3 -0, 8 -2, 2 Source: Colombian Treasury Ministry. MHCP 2016* 15, 0 14, 2 0 0, 1 0, 2 0, 5 0, 1 19, 0 3, 2 13, 8 1, 9 -3, 9 -1, 8 -2, 1 • But the government seems to be overestimating the growth of the economy. • And the non-oil tax revenues. • Moreover, it is not doing all the necessary budget cuts. • So the structural imbalance could be of around 2. 5% of the GDP.

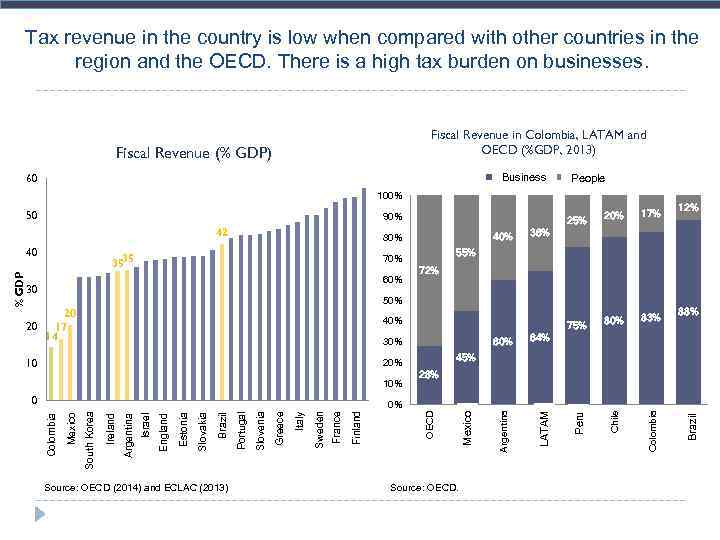

Tax revenue in the country is low when compared with other countries in the region and the OECD. There is a high tax burden on businesses. Fiscal Revenue in Colombia, LATAM and OECD (%GDP, 2013) Fiscal Revenue (% GDP) Empresas Business 60 Personas People 90% 42 80% 3535 40% 30 17% 80% 83% 12% 36% 55% 70% 60% 72% 50% 40% 20% Source: OECD (2014) and ECLAC (2013) 45% Source: OECD. Brasil Brazil México Mexico 0% Perú Peru 28% OECD Finalandia Finland Grancia France Secia Sweden Italia Italy Grecia Greece Eslovenia Slovenia Portugal Brasil Brazil Slovakia Eslovaquia Estonia England Inglaterra Israel Argentina Irlanda Ireland México Mexico Corea del Sur South Korea 10% 0 60% 30% América Latina LATAM 10 75% 88% 64% Argentina 20 20 17 14 Colombia % GDP 40 25% 20% Colombia 50 Chile 100%

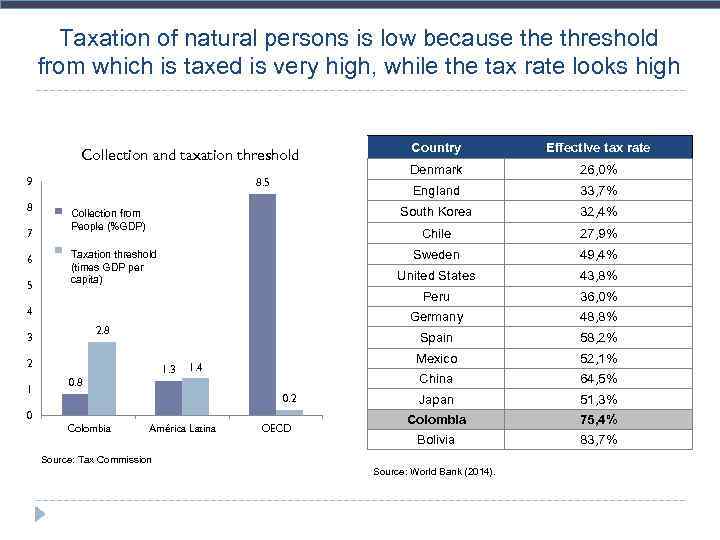

Taxation of natural persons is low because threshold from which is taxed is very high, while the tax rate looks high 8 7 6 5 3 1 1. 3 0. 2 0 Colombia América Latina OECD 36, 0% 48, 8% 58, 2% 52, 1% China 0. 8 43, 8% Mexico 1. 4 49, 4% Spain 2 27, 9% Germany 2. 8 32, 4% Peru 4 33, 7% United States Umbral pago renta Taxation threshold (veces PIB perper (times GDP cápita) capita) 26, 0% Sweden Recaudo personas Collection from (% PIB) (%GDP) People Denmark Chile 8. 5 Effective tax rate South Korea 9 Country England Collection and taxation threshold 64, 5% Japan 51, 3% Colombia 75, 4% Bolivia 83, 7% Source: Tax Commission Source: World Bank (2014).

Macroeconomic and fiscal situation Perspectives

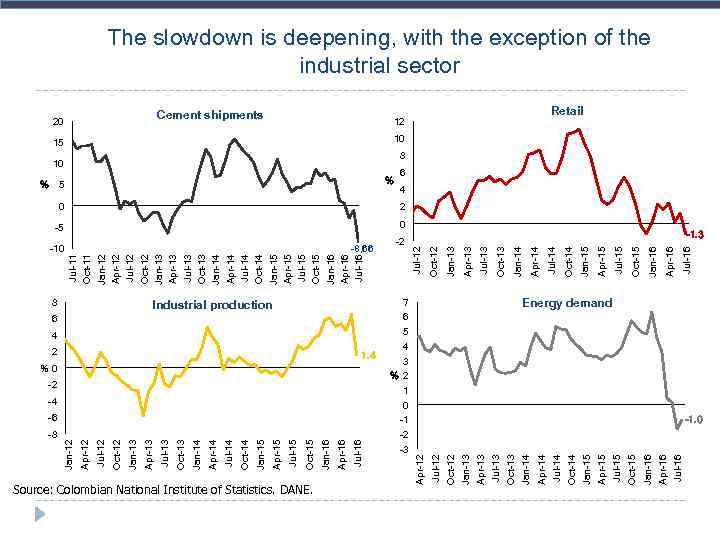

-8 -4 -6 Jan-14 Jul-14 Jan-15 Jul-15 Jan-16 Jul-16 Apr-16 -2 Oct-15 1. 4 Apr-15 %0 Jul-16 Apr-16 Jan-16 Oct-15 Jul-15 Apr-15 Jan-15 Oct-14 Jul-14 Apr-14 Jan-14 Oct-13 Jul-13 Apr-13 12 Oct-14 4 Apr-14 6 7 6 5 4 3 %2 1 0 -1 -2 -3 Oct-13 Industrial production Jul-13 -8, 66 -2 Apr-13 2 -5 Jan-13 0 Jan-13 % Oct-12 % 5 Jul-12 10 Jul-12 15 Oct-12 2 Jul-16 Apr-16 Cement shipments Apr-12 Source: Colombian National Institute of Statistics. DANE. Jan-16 Oct-15 Jul-15 Apr-15 Jan-15 Oct-14 Jul-14 Apr-14 Jan-14 Oct-13 20 Jul-13 8 Apr-13 Jan-13 Oct-12 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 Jul-15 Oct-15 Jan-16 Apr-16 Jul-16 -10 Apr-12 Jan-12 The slowdown is deepening, with the exception of the industrial sector Retail 10 8 6 4 0 -1. 3 Energy demand -1. 0

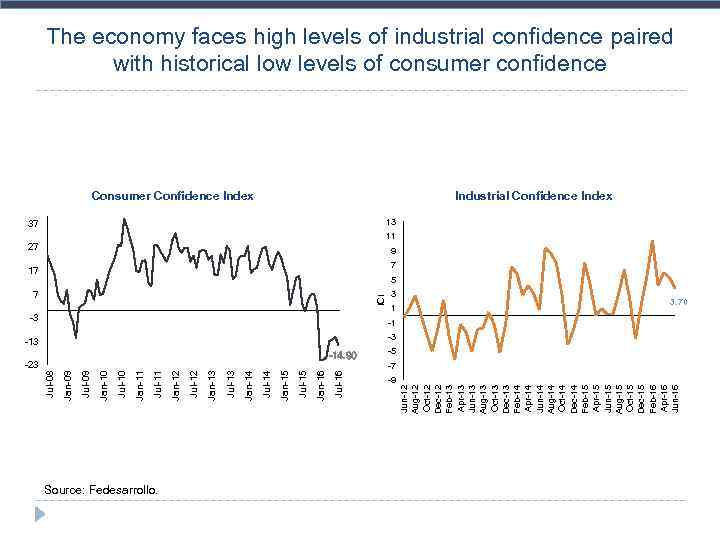

-23 Source: Fedesarrollo. 7 ICI Consumer Confidence Index 37 27 17 -3 -14. 90 3 1 Jun-12 Aug-12 Oct-12 Dec-12 Feb-13 Apr-13 Jun-13 Aug-13 Oct-13 Dec-13 Feb-14 Apr-14 Jun-14 Aug-14 Oct-14 Dec-14 Feb-15 Apr-15 Jun-15 Aug-15 Oct-15 Dec-15 Feb-16 Apr-16 Jun-16 Jul-16 Jan-16 Jul-15 Jan-15 Jul-14 Jan-14 Jul-13 Jan-13 Jul-12 Jan-12 Jul-11 Jan-11 Jul-10 Jan-10 Jul-09 Jan-09 Jul-08 The economy faces high levels of industrial confidence paired with historical low levels of consumer confidence Industrial Confidence Index 13 11 9 7 5 3. 70 -1 -3 -5 -7 -9

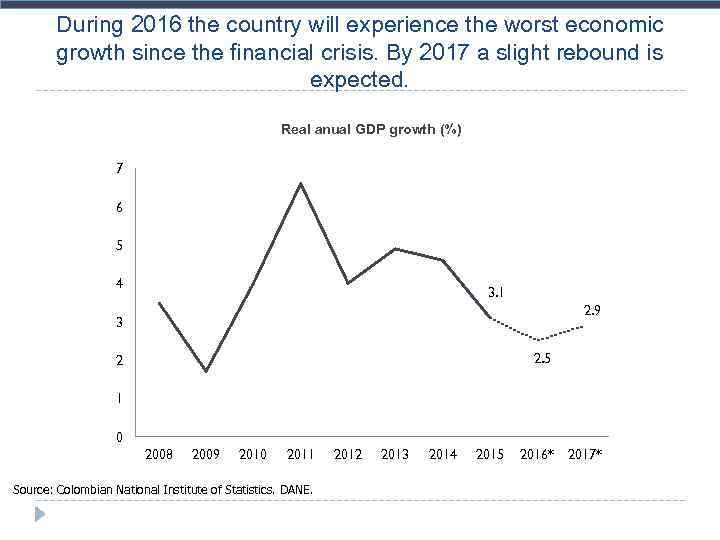

During 2016 the country will experience the worst economic growth since the financial crisis. By 2017 a slight rebound is expected. Real anual GDP growth (%) 7 6 5 4 3. 1 2. 9 3 2. 5 2 1 0 2008 2009 2010 2011 Source: Colombian National Institute of Statistics. DANE. 2012 2013 2014 2015 2016* 2017*

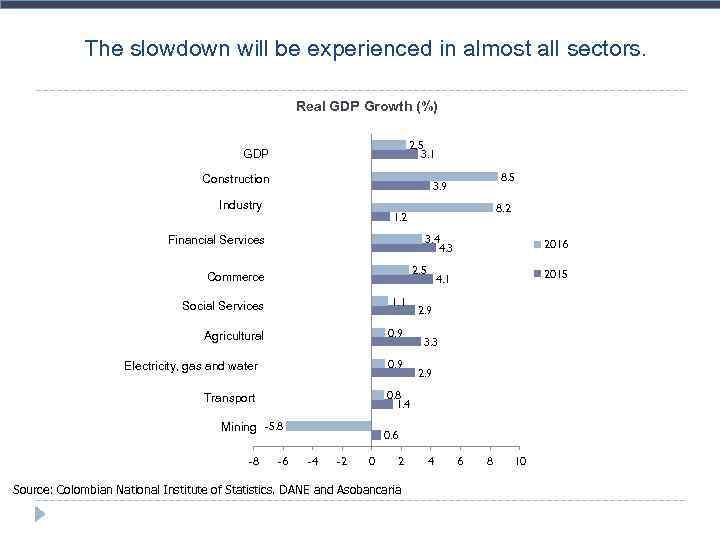

The slowdown will be experienced in almost all sectors. Real GDP Growth (%) 2, 5 3. 1 PIBGDP Construction Contrucción Industry Industria 8. 2 1. 2 3. 4 4. 3 Financial Services Servicios Financieros 2. 5 Comercio Commerce Social Services Servicios Sociales 1. 1 Agricultural Agro 0. 9 Electricity, gas and water Electricidad, agua y gas 2016 2015 4. 1 2. 9 3. 3 2. 9 0. 8 1. 4 Transporte Mining -5. 8 Minas -8 8. 5 3. 9 -6 0. 6 -4 -2 0 2 Source: Colombian National Institute of Statistics. DANE and Asobancaria 4 6 8 10

Colombia in the regional context

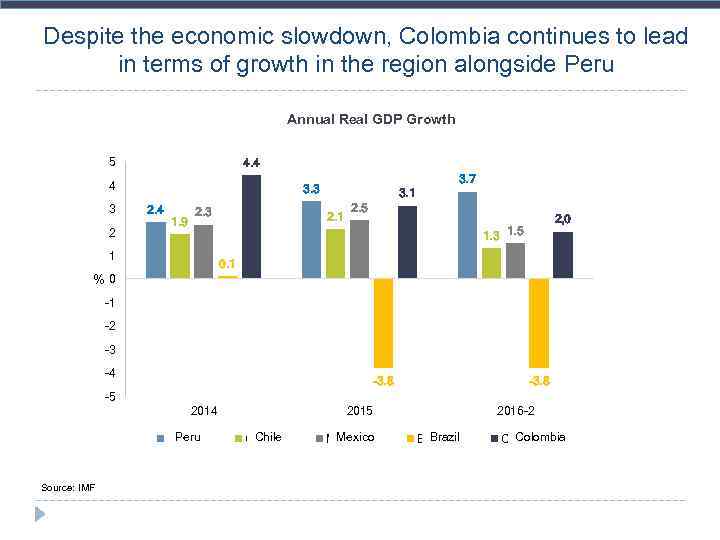

Despite the economic slowdown, Colombia continues to lead in terms of growth in the region alongside Peru Annual Real GDP Growth 5 4. 4 4 3 2 3. 7 3. 3 2. 4 1. 9 2. 3 3. 1 2. 5 2, 0 1. 3 1. 5 1 0. 1 %0 -1 -2 -3 -4 -3. 8 -5 2014 Peru Perú Source: IMF 2015 Chile Mexico México 2016 -2 Brazil Brasil Colombia

The Colombian peso is among the most depreciated currencies in the region alongside Mexico Exchange Rate Index (Base 100 = june 2014) 180 Jun-2014 160 140 120 Colombia Source: Bloomberg. México Chile Brasil Brazil Perú Sep-16 Jul-16 May-16 Mar-16 Jan-16 Nov-15 Sep-15 Jul-15 May-15 Mar-15 Jan-15 Nov-14 Sep-14 Jul-14 May-14 Mar-14 Jan-14 Nov-13 Sep-13 Jul-13 May-13 80 Mar-13 100

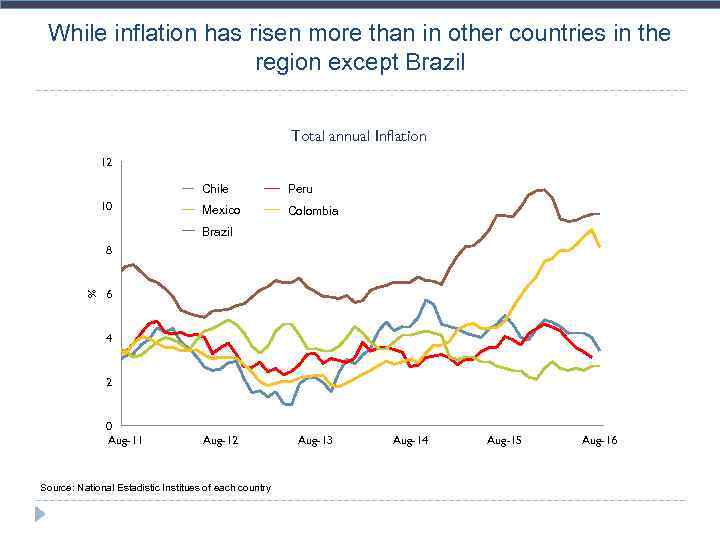

While inflation has risen more than in other countries in the region except Brazil Total annual Inflation 12 Chile 10 Peru Perú México Mexico Colombia Brasil Brazil % 8 6 4 2 0 Aug-11 Aug-12 Source: National Estadistic Institues of each country Aug-13 Aug-14 Aug-15 Aug-16

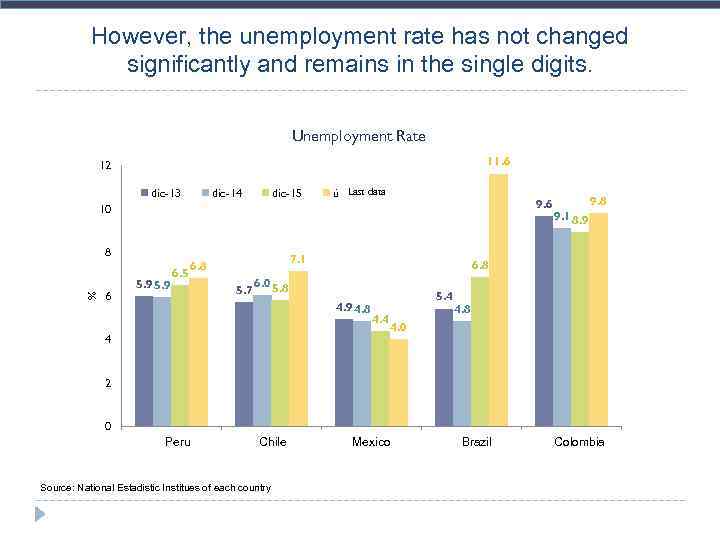

However, the unemployment rate has not changed significantly and remains in the single digits. Unemployment Rate 11. 6 12 dic-13 dic-14 dic-15 Last data último dato 9. 6 10 % 8 6 5. 9 6. 5 7. 1 6. 8 5. 7 9. 8 9. 1 8. 9 6. 8 6. 0 5. 8 4. 9 4. 8 5. 4 4 4. 8 4. 0 2 0 Perú Peru Chile Source: National Estadistic Institues of each country México Mexico Brasil Brazil Colomiba Colombia

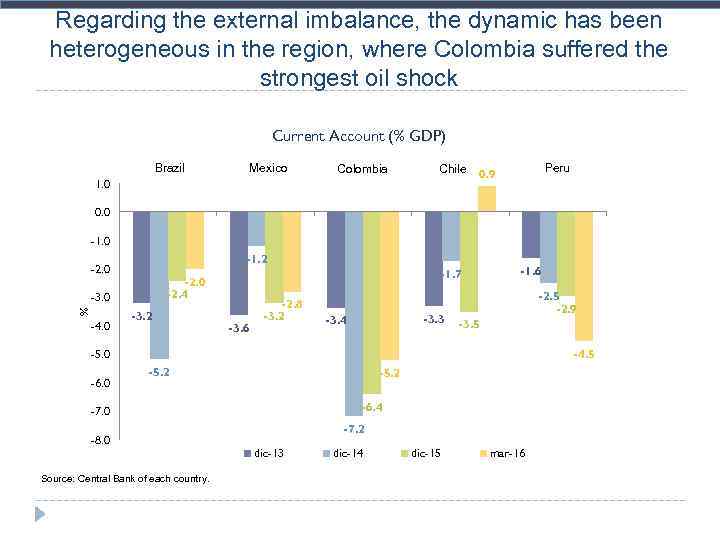

Regarding the external imbalance, the dynamic has been heterogeneous in the region, where Colombia suffered the strongest oil shock Current Account (% GDP) Brazil Brasil Mexico México Colombia 1. 0 Peru Perú Chile 0. 9 Chile 0. 0 -1. 2 -2. 0 % -3. 0 -4. 0 -1. 7 -2. 0 -2. 4 -3. 2 -3. 6 -2. 8 -3. 2 -3. 3 -3. 4 -1. 6 -2. 5 -2. 9 -3. 5 -4. 5 -5. 0 -6. 0 -5. 2 -6. 4 -7. 0 -7. 2 -8. 0 dic-13 Source: Central Bank of each country. dic-14 dic-15 mar-16

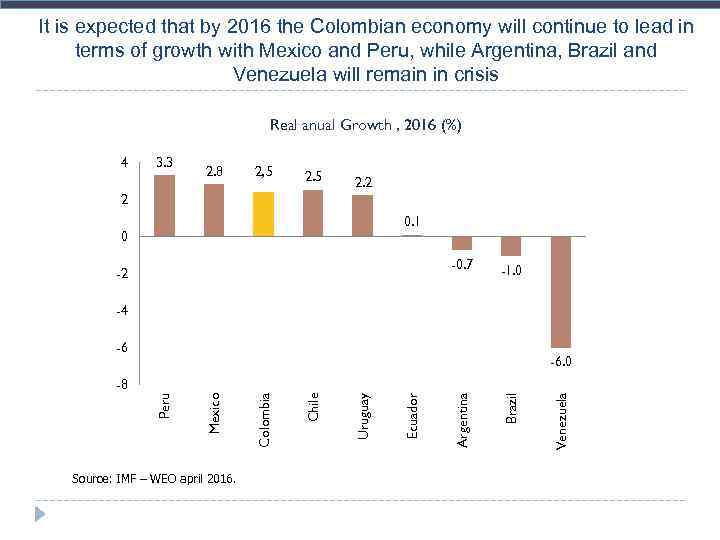

It is expected that by 2016 the Colombian economy will continue to lead in terms of growth with Mexico and Peru, while Argentina, Brazil and Venezuela will remain in crisis Real anual Growth , 2016 (%) 4 3. 3 2. 8 2, 5 2. 2 2 0. 1 0 -0. 7 -2 -1. 0 -4 -6 -6. 0 Source: IMF – WEO april 2016. Venezuela Brazil Argentina Ecuador Uruguay Chile Colombia Mexico Peru -8

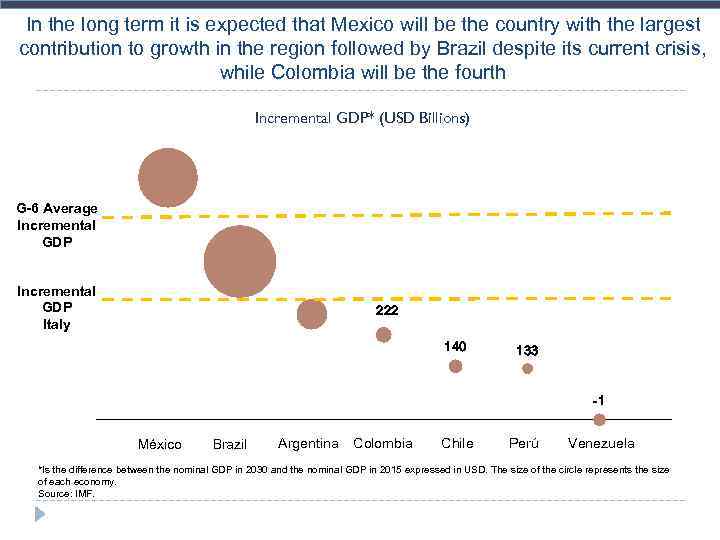

In the long term it is expected that Mexico will be the country with the largest contribution to growth in the region followed by Brazil despite its current crisis, while Colombia will be the fourth Incremental GDP* (USD Billions) 637 G-6 Average Incremental GDP 416 Incremental GDP Italy 277 222 140 133 -1 México Brazil Brasil Argentina Colombia Chile Perú Venezuela *Is the difference between the nominal GDP in 2030 and the nominal GDP in 2015 expressed in USD. The size of the circle represents the size of each economy. Source: IMF.

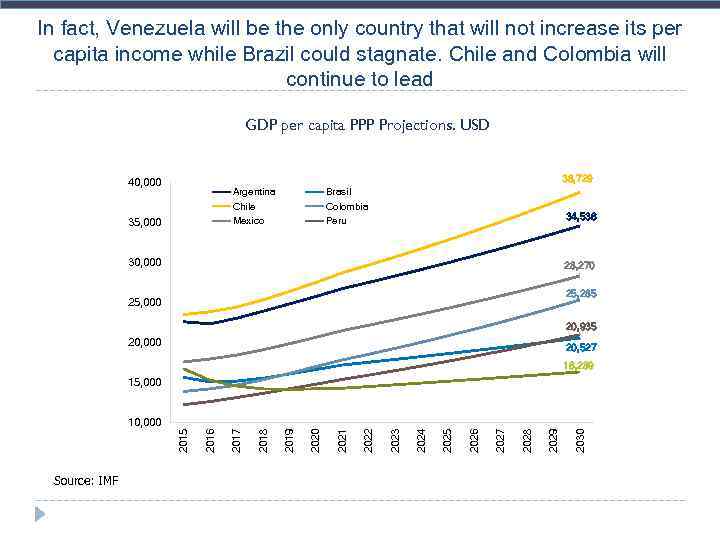

In fact, Venezuela will be the only country that will not increase its per capita income while Brazil could stagnate. Chile and Colombia will continue to lead GDP per capita PPP Projections. USD 38, 729 40, 000 Argentina Chile Mexico 35, 000 Brasil Colombia Peru 34, 536 30, 000 28, 270 25, 285 25, 000 20, 935 20, 000 20, 527 16, 289 15, 000 Source: IMF 2030 2029 2028 2027 2026 2025 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 10, 000

Conclusions In the present global economic environment Latin America growth was sharply reduced and its average rate of inflation increased. In the case of Colombia and the Pacific Alliance countries the impact has been less severe due to their flexible exchange rate regimes and responsible fiscal policies. Nevertheless, in the next few years the greatest challenge will be to find new sources of growth that will have to involve the diversification of their exports. In order to achieve this they need to attract high quality FDI and better competitiveness policies

THANK YOU

HJG MacroEng Final.pptx