d1d81ea07e79cca658b7bfd2547c2484.ppt

- Количество слайдов: 27

MACRO ECONOMICS THE PROBLEM OF INFLATION

INFLATION The rate of change of the general price level.

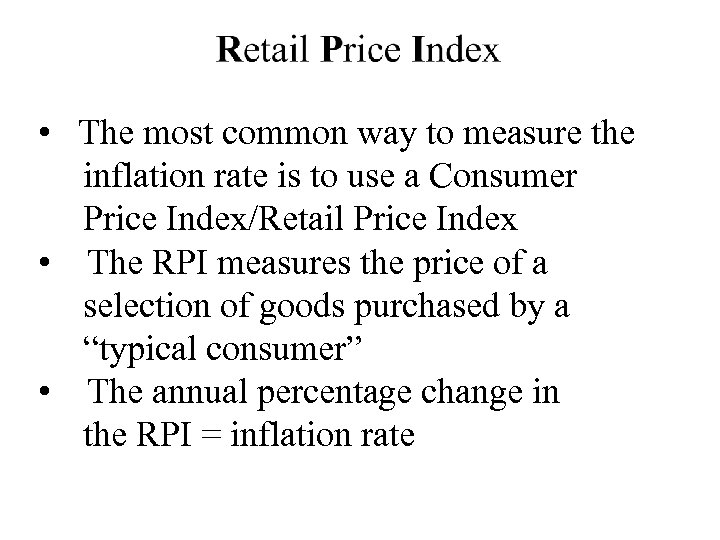

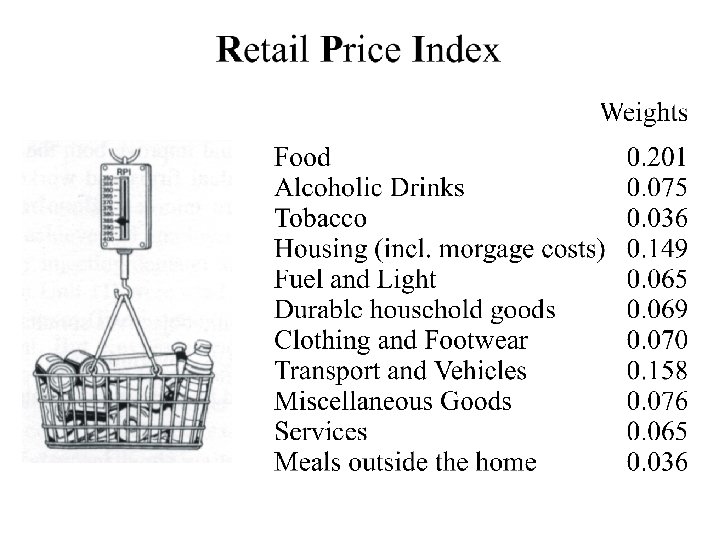

• The most common way to measure the inflation rate is to use a Consumer Price Index/Retail Price Index • The RPI measures the price of a selection of goods purchased by a “typical consumer” • The annual percentage change in the RPI = inflation rate

• Weights are based on information from the Family Expenditure Survey • e. g. if the RPI = 130 in Jan 2002 and 135 in Jan 2003, the annual rate of inflation to Jan 2003 is 3. 8%

• The Retail Price Index may overestimate the actual inflation rate, e. g. - for an individual living in the north and mainly buying food and clothes (where price rises may be limited) - if a rise in the general price level is accompanied by an improvement in quality. Value for money may have increased - the prices in the RPI may not reflect “special offers”/discounting on the highstreet

• The Retail Price Index may overestimate the actual inflation rate, e. g. - As the general price level rises, people may switch to cheaper goods outside the RPI basket (substitution bias)

• The Retail Price Index may underestimate the actual inflation rate, e. g. - for an individual living in the south and mainly buying services (where price rises may be substantial) - A new good may be introduced (e. g. mobile phones). The good is in demand, rising in price but excluded from the RPI basket

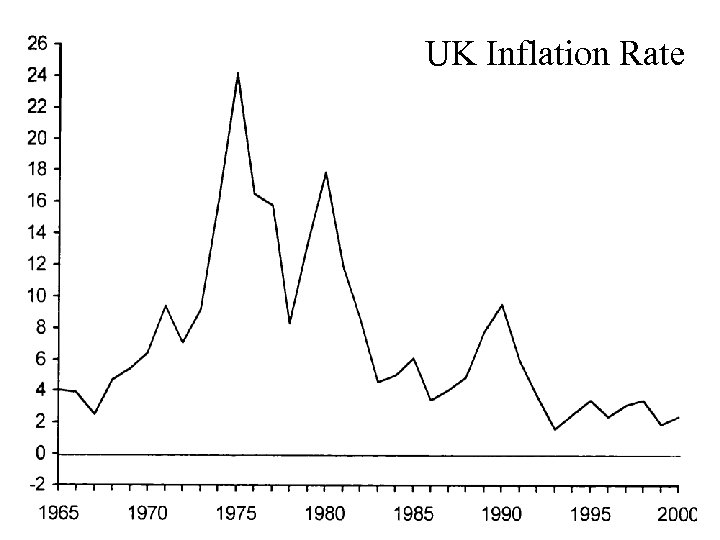

UK Inflation Rate

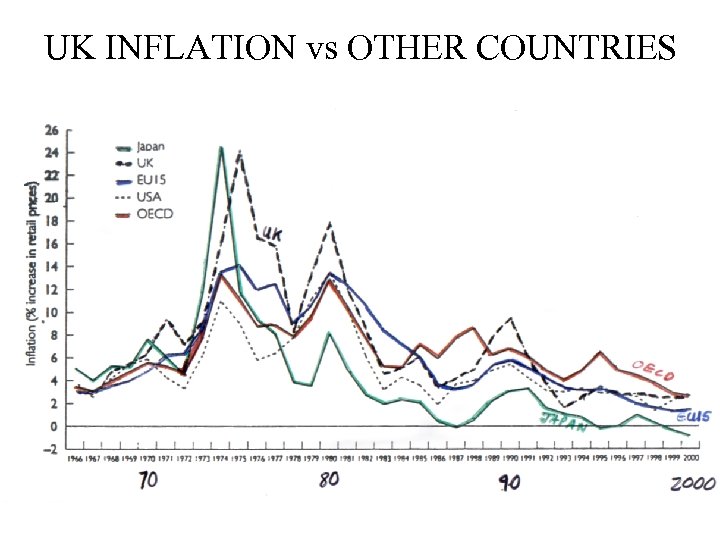

UK INFLATION vs OTHER COUNTRIES • The UK’s inflationary performance has been mixed. Most of our main competitors have performed better. • During the 1960 s only Japan had a worse performance than the UK • During the 1970 s, 1980 s and 1990 s the UK had a worse performance than our main competitors except for some EU countries (e. g Italy)

UK INFLATION vs OTHER COUNTRIES

INFLATION • The Bank of England aims for a low inflation rate (<2. 5%). If the inflation rate exceeds 3. 5% the Governor is compelled to write to the Chancellor of the Exchequer • Since the 1970 s many Governments have made keeping inflation low their number one priority, but WHY?

COSTS OF INFLATION 1) Inflation reduces the (real) purchasing power of money. Money ceases to be a store of value.

COSTS OF INFLATION The decline in the purchasing power of money can be seen by considering the value of one million pounds. There are currently 85000 millionaires in the UK (one for every 500 adults of working age). However it is now much easier to become a millionaire than say in the 1930 s. One million pounds could buy much more goods and services in the 1930 s than today due to inflation.

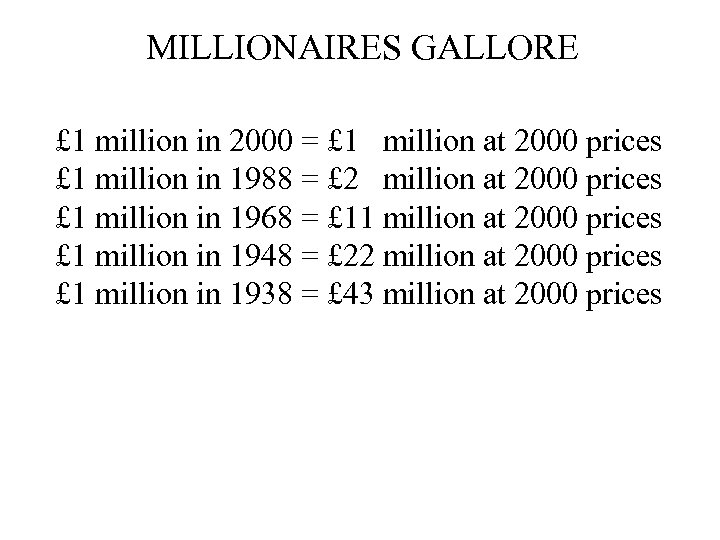

MILLIONAIRES GALLORE £ 1 million in 2000 = £ 1 million at 2000 prices £ 1 million in 1988 = £ 2 million at 2000 prices £ 1 million in 1968 = £ 11 million at 2000 prices £ 1 million in 1948 = £ 22 million at 2000 prices £ 1 million in 1938 = £ 43 million at 2000 prices

COSTS OF INFLATION 2) Those on fixed incomes (e. g. pensioners and students) may suffer a loss of purchasing power. 3) Wage claims by workers involve negotiations e. g BA staff at present 4) Borrowers gain during periods of high inflation while lenders lose.

COSTS OF INFLATION 5) 1) 7) Inflation creates uncertainty possibly harming long-term investment and growth of national income Inflation creates menu costs. Inflation can damage a country’s international competitiveness. Exports are difficult

COSTS OF INFLATION All of the aforementioned costs apply if inflation is unanticipated. However if inflation is anticipated, wages and interest rates can be adjusted so that the real wage and the real interest rate remains unchanged. In the case of anticipated inflation, the costs of inflation are limited to menu costs.

ANTICIPATED INFLATION If inflation is perfectly anticipated Real wages can be held constant Real interest rates are unchanged Therefore no real affect on the economy From this we can see that expectations are important. Necessary adjustments can be made.

CAUSES OF INFLATION Economists distinguish two causes of inflation. 1. DEMAND-PULL INFLATION 2. COST PUSH INFLATION

DEMAND PULL INFLATION Demand pull inflation is caused by persistent rises in total spending in the economy

COST PUSH INFLATION Inflation caused by persistent rises in the costs of production

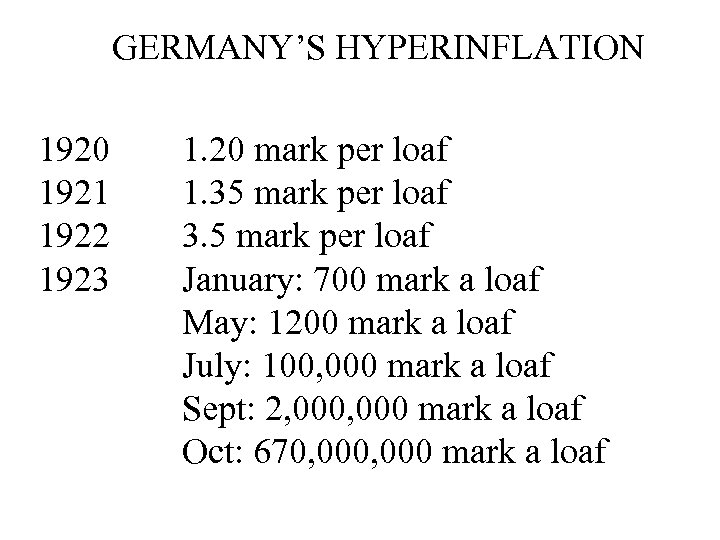

HYPERINFLATION Inflation is most costly during periods of hyperinflation (where prices rise at extremely high rates) e. g. Germany, consider the cost of a loaf of bread in Germany…

GERMANY’S HYPERINFLATION 1914 13 Pfennig per loaf WW 1 starts. Germany invades Belgium and France 1916 1918 1919 19 Pfennig per loaf 22 Pfennig per loaf Hostilities cease on Nov 11 26 Pfennig per loaf A harsh peace treaty that includes heavy demand for reparations on Germany

GERMANY’S HYPERINFLATION 1920 1921 1922 1923 1. 20 mark per loaf 1. 35 mark per loaf 3. 5 mark per loaf January: 700 mark a loaf May: 1200 mark a loaf July: 100, 000 mark a loaf Sept: 2, 000 mark a loaf Oct: 670, 000 mark a loaf

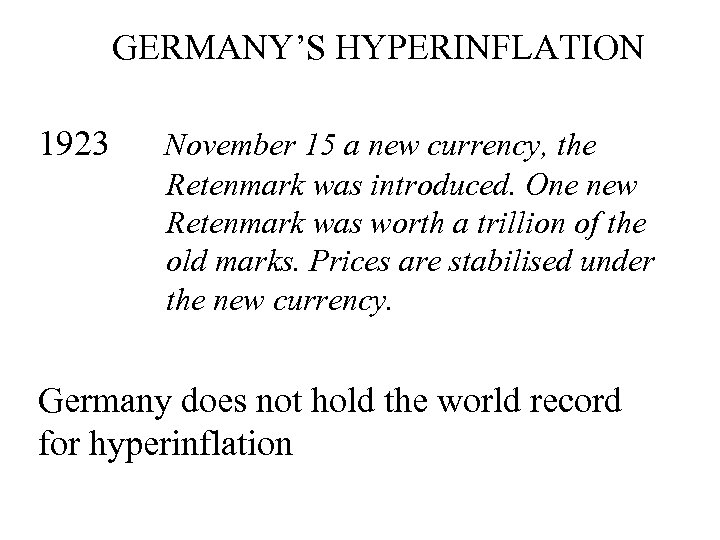

GERMANY’S HYPERINFLATION 1923 November 15 a new currency, the Retenmark was introduced. One new Retenmark was worth a trillion of the old marks. Prices are stabilised under the new currency. Germany does not hold the world record for hyperinflation

HYPERINFLATION: OTHER EXAMPLES

d1d81ea07e79cca658b7bfd2547c2484.ppt