4037fcd8c76b2739153e3cc68a9ffabe.ppt

- Количество слайдов: 60

MABS APPROACH TO AGRICULTURAL MICROFINANCE Module 4, Session 2 MAP Loan Forms: The CIBI Form: Format & Analysis

Introduction q The Credit Investigation and Background Investigation (CIBI) report is considered as the primary tool of the bank in screening its MF clients. q It shows the results of the activities done by the bank to establish the loan applicant’s character and repayment capacity q This session will focus on equipping the participants with skills on how to gather data relevant to the preparation of the CI/BI report. 2

Session Objectives At the end of this session, participants will be able to: 1. Prepare a complete and exhaustive CIBI report for new borrowers which focuses on the client’s character and capacity to pay 2. Prepare a complete and exhaustive CIBI report for repeat borrowers which focuses on repayment behavior on past loans and results of AO’s monitoring of client’s activities. 3

Who prepares the CIBI Report? q Account Officers prepare the CIBI report by gathering and evaluating information, and establishing applicant’s creditworthiness. q MFU Supervisors review and validate the accuracy of information contained in the CIBI report of the AO 4

How to conduct the CIBI 1. Bring the applicant’s Loan Application and CIBI Forms when you conduct the CIBI. Study the information about the applicant for easier and faster verification in the field. 2. Conduct the interview with the character references. Follow the flow process provided in the overview module. 3. Refer to the Loan Application for information that the AO can use in interviewing character references. 5

Types of CIBI Report q CIBI Report for New Borrowers (CIBI-N) q CIBI Report for Repeat Borrower (CIBI-R) 6

New Borrowers CIBI Report

The CIBI–New Form o The CIBI form for new borrowers is a seven-page document composed of four-parts namely: 1) Results of interview with client, 2) Character references, 3) Character and cash flow analysis, and 4) AO & Supervisors Findings and Recommendations. 8

Outline of the CIBI-N Form Part 1 – Results of Interview with the Client I. Personal Information II. Business Information III. Market Risk Analysis IV. Payment Records V. Inventory of Business Assets VI. Merchandise Inventory VII. Inventory of Personal Assets VIII. Balance Sheet 9

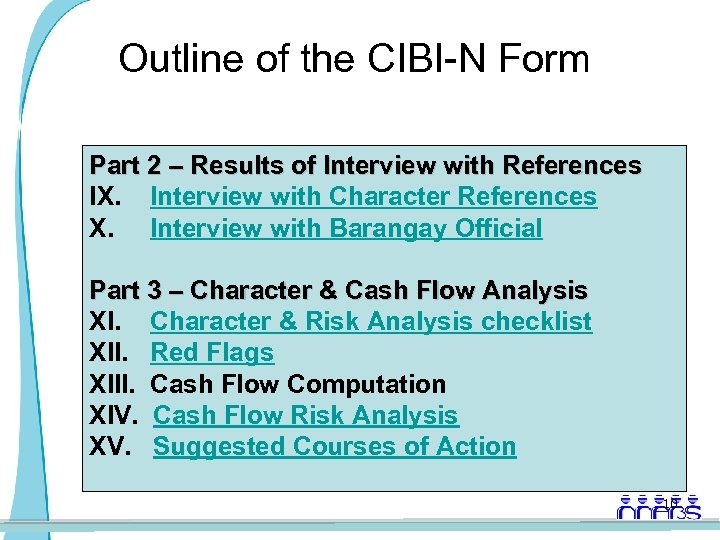

Outline of the CIBI-N Form Part 2 – Results of Interview with References IX. Interview with Character References X. Interview with Barangay Official Part 3 – Character & Cash Flow Analysis XI. Character & Risk Analysis checklist XII. Red Flags XIII. Cash Flow Computation XIV. Cash Flow Risk Analysis XV. Suggested Courses of Action 10

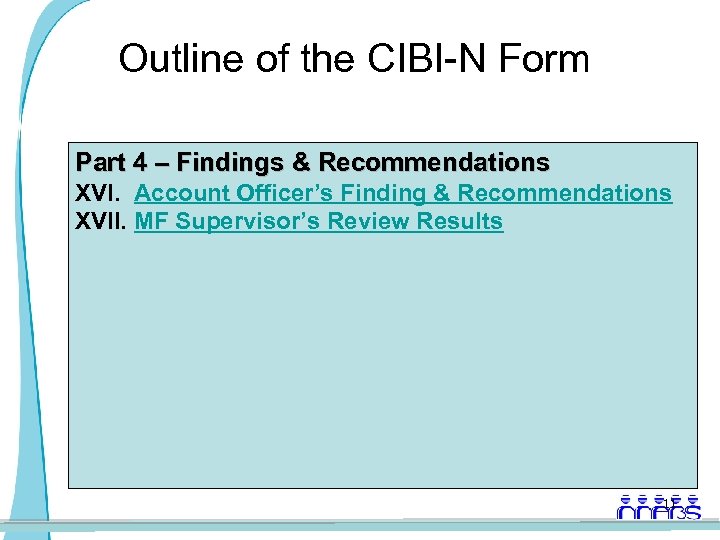

Outline of the CIBI-N Form Part 4 – Findings & Recommendations XVI. Account Officer’s Finding & Recommendations XVII. MF Supervisor’s Review Results 11

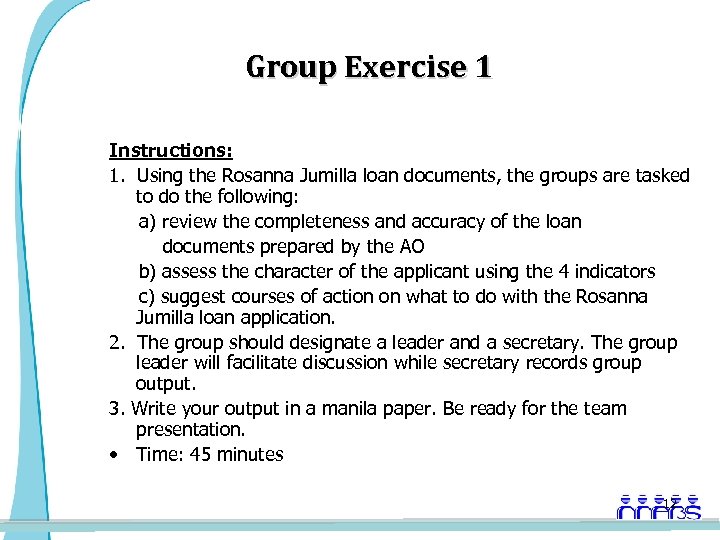

Group Exercise 1 Instructions: 1. Using the Rosanna Jumilla loan documents, the groups are tasked to do the following: a) review the completeness and accuracy of the loan documents prepared by the AO b) assess the character of the applicant using the 4 indicators c) suggest courses of action on what to do with the Rosanna Jumilla loan application. 2. The group should designate a leader and a secretary. The group leader will facilitate discussion while secretary records group output. 3. Write your output in a manila paper. Be ready for the team presentation. • Time: 45 minutes 12

Repeat Borrowers CIBI Form

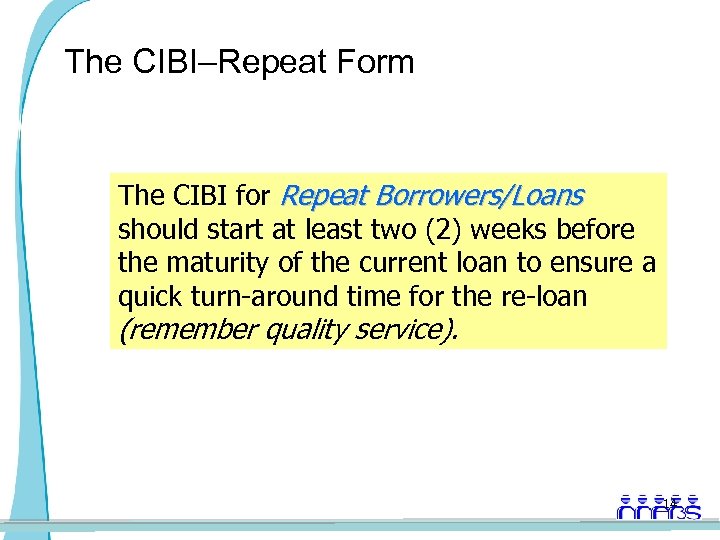

The CIBI–Repeat Form The CIBI for Repeat Borrowers/Loans should start at least two (2) weeks before the maturity of the current loan to ensure a quick turn-around time for the re-loan (remember quality service). 14

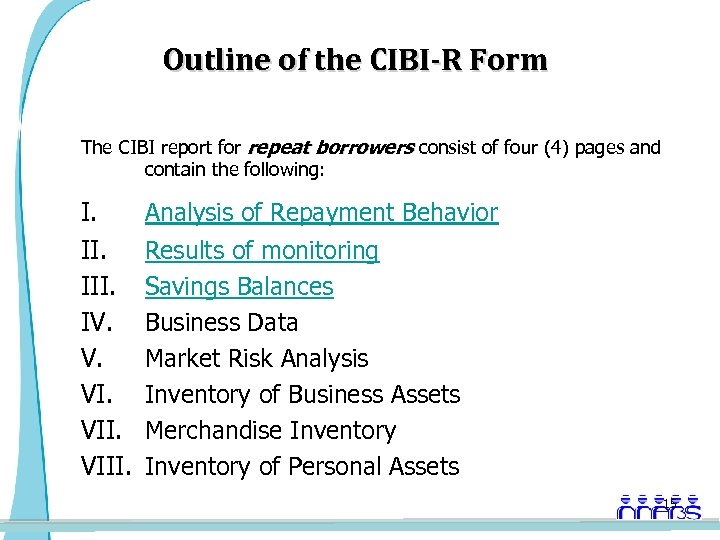

Outline of the CIBI-R Form The CIBI report for repeat borrowers consist of four (4) pages and contain the following: I. III. IV. V. VIII. Analysis of Repayment Behavior Results of monitoring Savings Balances Business Data Market Risk Analysis Inventory of Business Assets Merchandise Inventory of Personal Assets 15

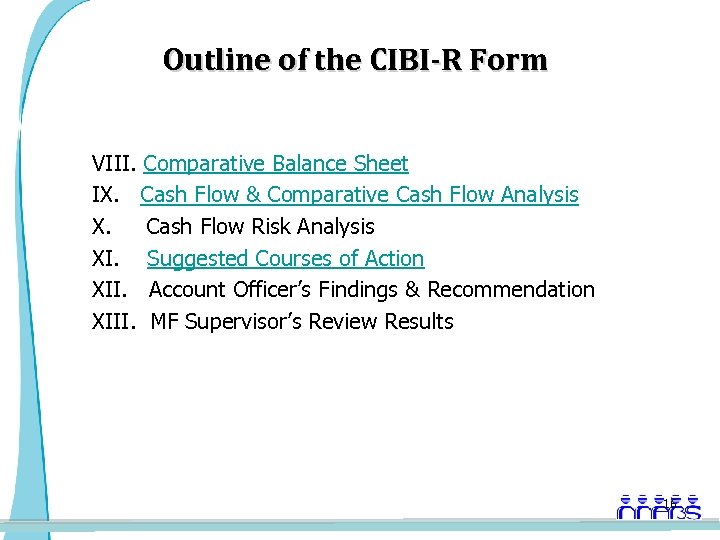

Outline of the CIBI-R Form VIII. Comparative Balance Sheet IX. Cash Flow & Comparative Cash Flow Analysis X. Cash Flow Risk Analysis XI. Suggested Courses of Action XII. Account Officer’s Findings & Recommendation XIII. MF Supervisor’s Review Results 16

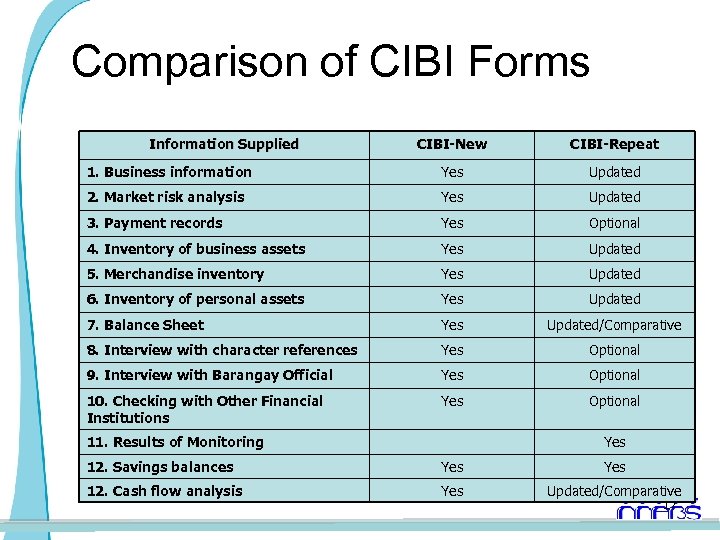

Comparison of CIBI Forms Information Supplied CIBI-New CIBI-Repeat 1. Business information Yes Updated 2. Market risk analysis Yes Updated 3. Payment records Yes Optional 4. Inventory of business assets Yes Updated 5. Merchandise inventory Yes Updated 6. Inventory of personal assets Yes Updated 7. Balance Sheet Yes Updated/Comparative 8. Interview with character references Yes Optional 9. Interview with Barangay Official Yes Optional 10. Checking with Other Financial Institutions Yes Optional 11. Results of Monitoring Yes 12. Savings balances Yes 12. Cash flow analysis Yes Updated/Comparative 17

Repayment Capacity CASH FLOW ANALYSIS The preparation of the Cash Flow will be presented in detail in the next module (Preparing the Client’s Cash flow). 18

Group Exercise 2 Instructions: 1. In this exercise, a list of possible repayment scenarios is given to you. 2. The group should designate a leader and a secretary. The group leader will facilitate discussion while secretary records group output. 3. As a group, discuss and analyze these scenarios and come up with what you think are the best courses of action. 4. Write your output in a manila paper. Be ready for the team presentation. • Time: 45 minutes 19

To Summarize q A thorough and properly accomplished CIBI gives the Account Officer a clear basis for recommending the approval or rejection of a loan application. q A thorough and properly accomplished CIBI report provides a vivid description of the life story of a loan applicant to the members of the credit committee who are tasked to deliberate and approve the loan application. 20

To Summarize q The information in the CIBI Report only becomes relevant when analyzed in the light of character indicators. The character indicators provide the bank with ideas as to the level of risks it faces when granting to a particular loan applicant. q The results of the character analysis when combined with the results of the cash flow analysis puts the bank in a better position to ultimately determine the loan amount it wants to expose to an applicant-borrower without compromising ability to repay. 21

To Summarize q Therefore, the use of the CIBI tools – character and cash flow analyses - decrease the bank’s level of risk when extending loans to micro borrowers who do not have hard collateral and credit history. 22

LINKS

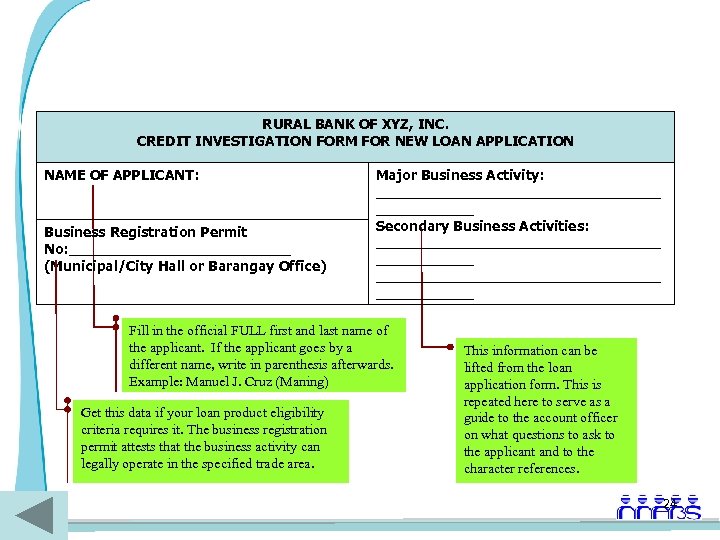

RURAL BANK OF XYZ, INC. CREDIT INVESTIGATION FORM FOR NEW LOAN APPLICATION NAME OF APPLICANT: Business Registration Permit No: _____________ (Municipal/City Hall or Barangay Office) Major Business Activity: ________________ Secondary Business Activities: ________________________________ Fill in the official FULL first and last name of the applicant. If the applicant goes by a different name, write in parenthesis afterwards. Example: Manuel J. Cruz (Maning) Get this data if your loan product eligibility criteria requires it. The business registration permit attests that the business activity can legally operate in the specified trade area. This information can be lifted from the loan application form. This is repeated here to serve as a guide to the account officer on what questions to ask to the applicant and to the character references. 24

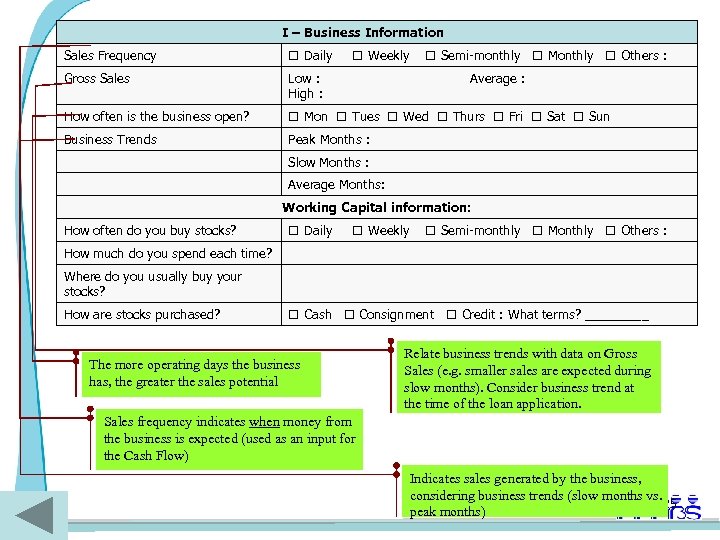

I – Business Information Sales Frequency Daily Weekly Semi-monthly Monthly Others : Gross Sales Low : High : How often is the business open? Mon Tues Wed Thurs Fri Sat Sun Business Trends Peak Months : Average : Slow Months : Average Months: Working Capital information: How often do you buy stocks? Daily Weekly Semi-monthly Monthly Others : How much do you spend each time? Where do you usually buy your stocks? How are stocks purchased? Cash Consignment Credit : What terms? _____ The more operating days the business has, the greater the sales potential Relate business trends with data on Gross Sales (e. g. smaller sales are expected during slow months). Consider business trend at the time of the loan application. Sales frequency indicates when money from the business is expected (used as an input for the Cash Flow) Indicates sales generated by the business, considering business trends (slow months vs. 25 peak months)

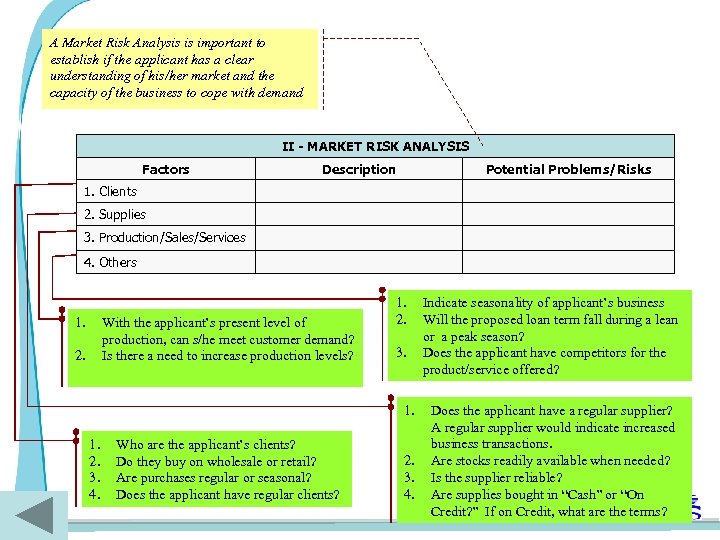

A Market Risk Analysis is important to establish if the applicant has a clear understanding of his/her market and the capacity of the business to cope with demand II - MARKET RISK ANALYSIS Factors Description Potential Problems/Risks 1. Clients 2. Supplies 3. Production/Sales/Services 4. Others 1. With the applicant’s present level of production, can s/he meet customer demand? Is there a need to increase production levels? 2. 1. 2. 3. 1. 1. 2. 3. 4. Who are the applicant’s clients? Do they buy on wholesale or retail? Are purchases regular or seasonal? Does the applicant have regular clients? 2. 3. 4. Indicate seasonality of applicant’s business Will the proposed loan term fall during a lean or a peak season? Does the applicant have competitors for the product/service offered? Does the applicant have a regular supplier? A regular supplier would indicate increased business transactions. Are stocks readily available when needed? Is the supplier reliable? Are supplies bought in “Cash” or “On 26 Credit? ” If on Credit, what are the terms?

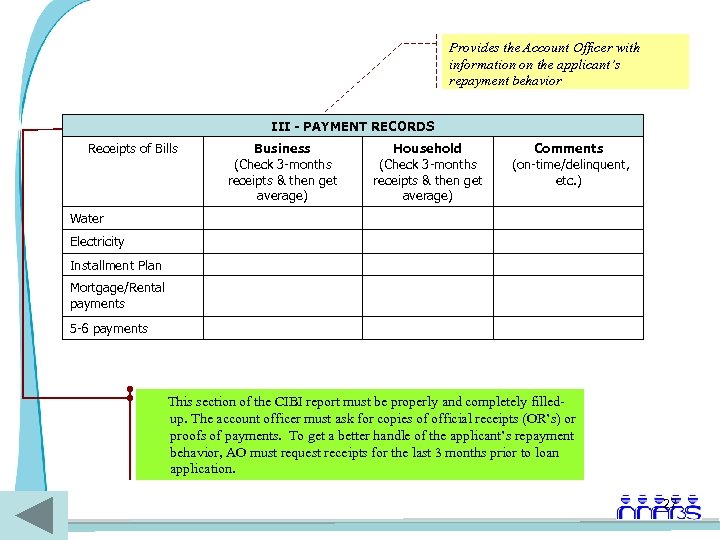

Provides the Account Officer with information on the applicant’s repayment behavior III - PAYMENT RECORDS Receipts of Bills Business (Check 3 -months receipts & then get average) Household (Check 3 -months receipts & then get average) Comments (on-time/delinquent, etc. ) Water Electricity Installment Plan Mortgage/Rental payments 5 -6 payments This section of the CIBI report must be properly and completely filledup. The account officer must ask for copies of official receipts (OR’s) or proofs of payments. To get a better handle of the applicant’s repayment behavior, AO must request receipts for the last 3 months prior to loan application. 27

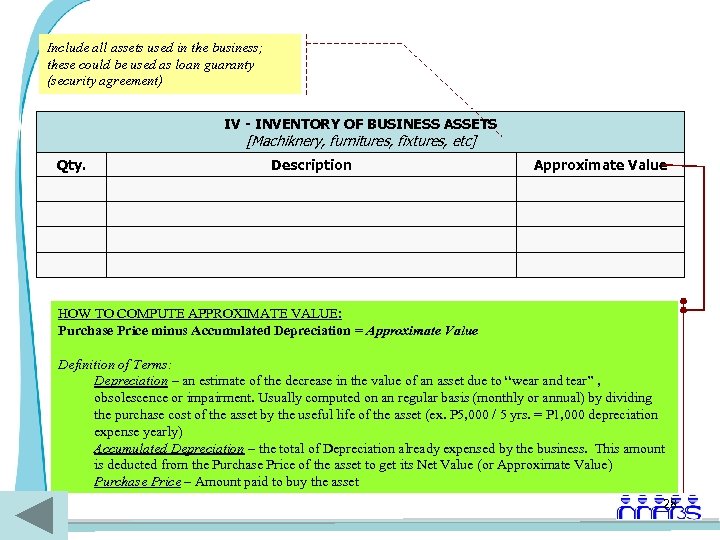

Include all assets used in the business; these could be used as loan guaranty (security agreement) IV - INVENTORY OF BUSINESS ASSETS [Machiknery, furnitures, fixtures, etc] Qty. Description Approximate Value HOW TO COMPUTE APPROXIMATE VALUE: Purchase Price minus Accumulated Depreciation = Approximate Value Definition of Terms: Depreciation – an estimate of the decrease in the value of an asset due to “wear and tear” , obsolescence or impairment. Usually computed on an regular basis (monthly or annual) by dividing the purchase cost of the asset by the useful life of the asset (ex. P 5, 000 / 5 yrs. = P 1, 000 depreciation expense yearly) Accumulated Depreciation – the total of Depreciation already expensed by the business. This amount is deducted from the Purchase Price of the asset to get its Net Value (or Approximate Value) Purchase Price – Amount paid to buy the asset 28

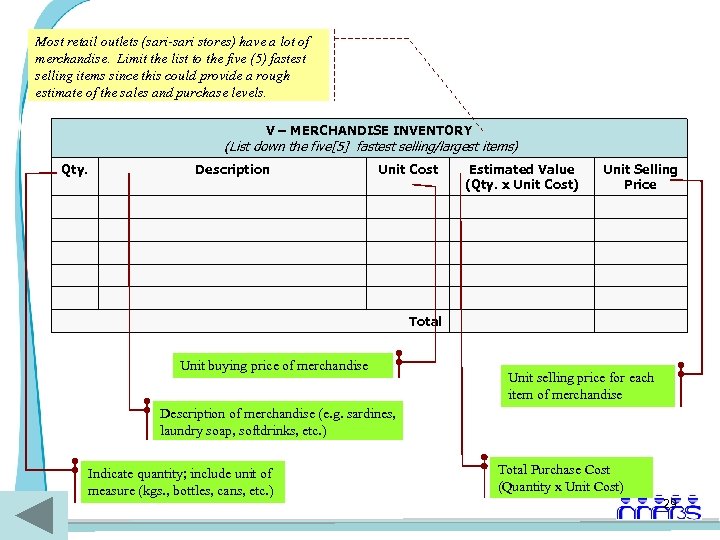

Most retail outlets (sari-sari stores) have a lot of merchandise. Limit the list to the five (5) fastest selling items since this could provide a rough estimate of the sales and purchase levels. V – MERCHANDISE INVENTORY (List down the five[5] fastest selling/largest items) Qty. Description Unit Cost Estimated Value (Qty. x Unit Cost) Unit Selling Price Total Unit buying price of merchandise Unit selling price for each item of merchandise Description of merchandise (e. g. sardines, laundry soap, softdrinks, etc. ) Indicate quantity; include unit of measure (kgs. , bottles, cans, etc. ) Total Purchase Cost (Quantity x Unit Cost) 29

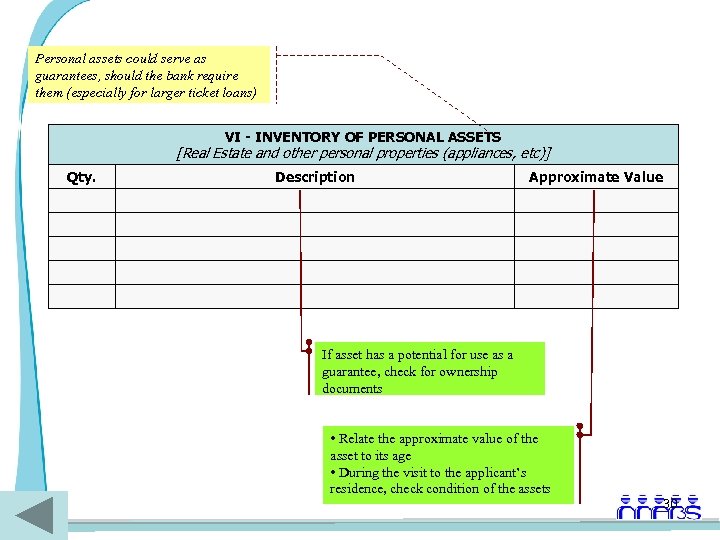

Personal assets could serve as guarantees, should the bank require them (especially for larger ticket loans) VI - INVENTORY OF PERSONAL ASSETS [Real Estate and other personal properties (appliances, etc)] Qty. Description Approximate Value If asset has a potential for use as a guarantee, check for ownership documents • Relate the approximate value of the asset to its age • During the visit to the applicant’s residence, check condition of the assets 30

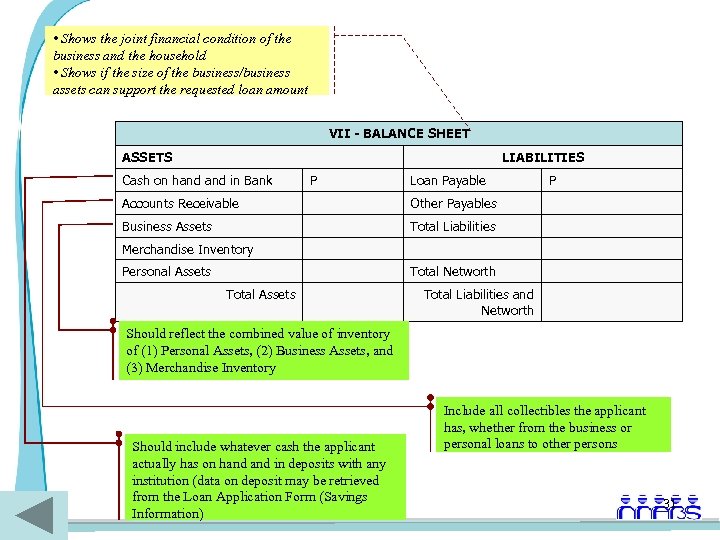

• Shows the joint financial condition of the business and the household • Shows if the size of the business/business assets can support the requested loan amount VII - BALANCE SHEET ASSETS LIABILITIES Cash on hand in Bank P Loan Payable Accounts Receivable Other Payables Business Assets P Total Liabilities Merchandise Inventory Personal Assets Total Networth Total Assets Total Liabilities and Networth Should reflect the combined value of inventory of (1) Personal Assets, (2) Business Assets, and (3) Merchandise Inventory Should include whatever cash the applicant actually has on hand in deposits with any institution (data on deposit may be retrieved from the Loan Application Form (Savings Information) Include all collectibles the applicant has, whether from the business or personal loans to other persons 31

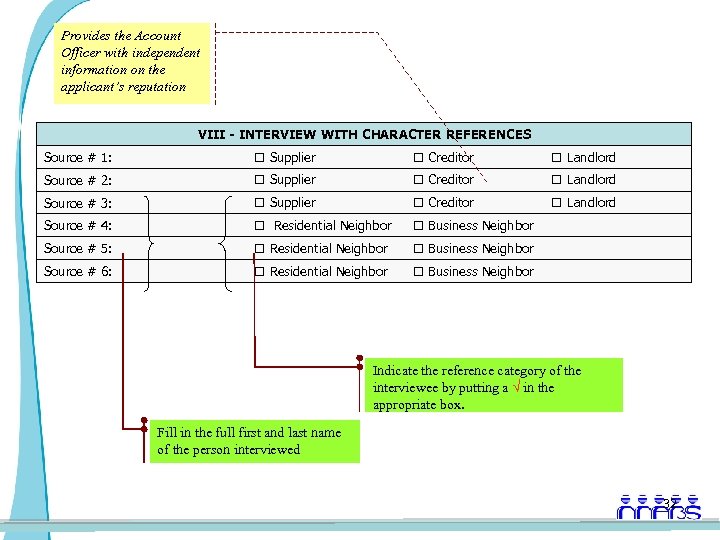

Provides the Account Officer with independent information on the applicant’s reputation VIII - INTERVIEW WITH CHARACTER REFERENCES Source # 1: Supplier Creditor Landlord Source # 2: Supplier Creditor Landlord Source # 3: Supplier Creditor Landlord Source # 4: Residential Neighbor Business Neighbor Source # 5: Residential Neighbor Business Neighbor Source # 6: Residential Neighbor Business Neighbor Indicate the reference category of the interviewee by putting a √ in the appropriate box. Fill in the full first and last name of the person interviewed 32

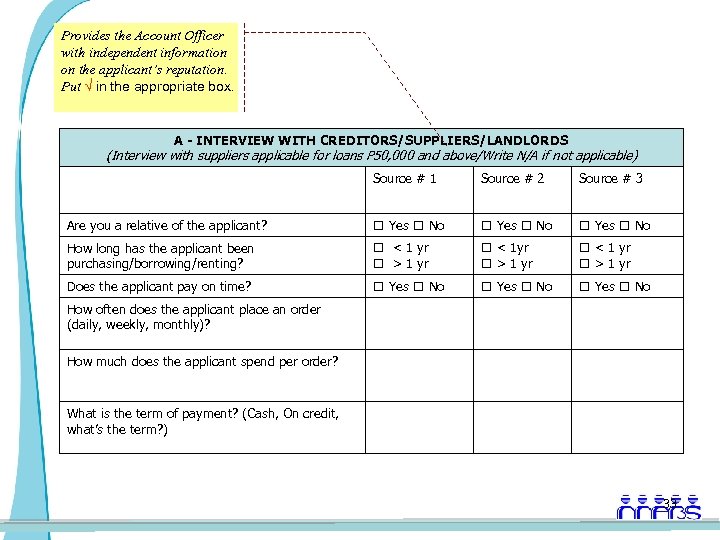

Provides the Account Officer with independent information on the applicant’s reputation. Put √ in the appropriate box. A - INTERVIEW WITH CREDITORS/SUPPLIERS/LANDLORDS (Interview with suppliers applicable for loans P 50, 000 and above/Write N/A if not applicable) Source # 1 Source # 2 Source # 3 Are you a relative of the applicant? Yes No How long has the applicant been purchasing/borrowing/renting? < 1 yr > 1 yr Does the applicant pay on time? Yes No How often does the applicant place an order (daily, weekly, monthly)? How much does the applicant spend per order? What is the term of payment? (Cash, On credit, what’s the term? ) 33

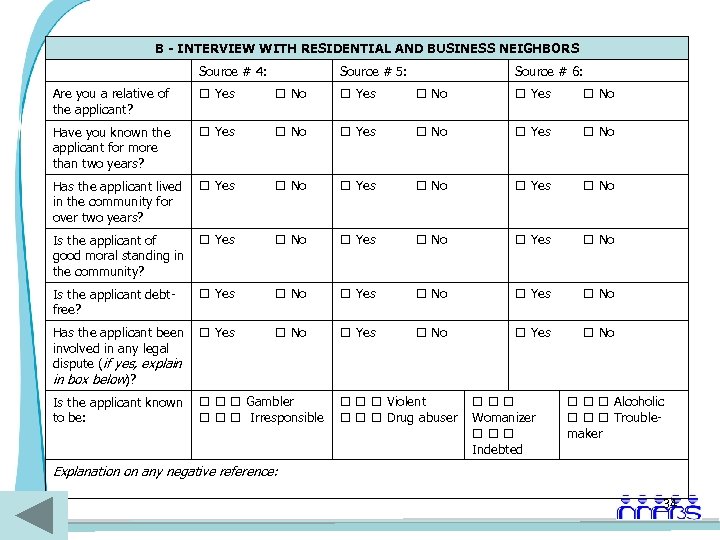

B - INTERVIEW WITH RESIDENTIAL AND BUSINESS NEIGHBORS Source # 4: Source # 5: Source # 6: Are you a relative of the applicant? Yes No Have you known the applicant for more than two years? Yes No Has the applicant lived in the community for over two years? Yes No Is the applicant of good moral standing in the community? Yes No Is the applicant debtfree? Yes No Has the applicant been involved in any legal dispute (if yes, explain in box below)? Yes No Is the applicant known to be: Gambler Irresponsible Violent Drug abuser Womanizer Indebted Alcoholic Troublemaker Explanation on any negative reference: 34

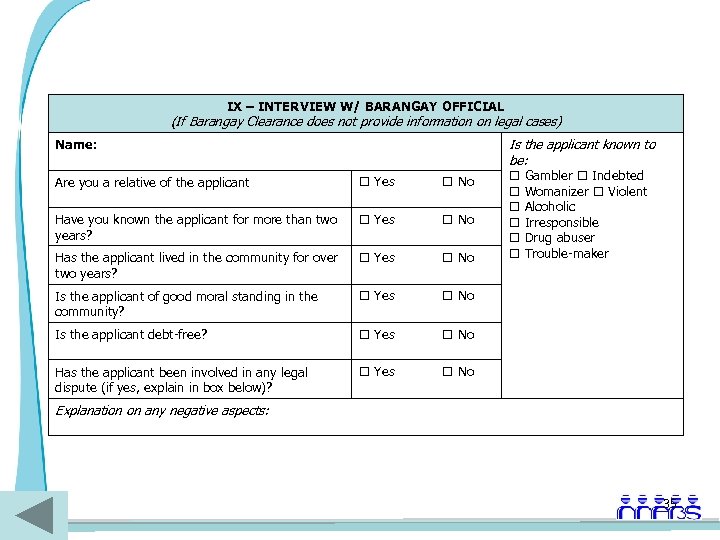

IX – INTERVIEW W/ BARANGAY OFFICIAL (If Barangay Clearance does not provide information on legal cases) Is the applicant known to be: Name: Are you a relative of the applicant Yes No Have you known the applicant for more than two years? Yes No Has the applicant lived in the community for over two years? Yes No Is the applicant of good moral standing in the community? Yes No Has the applicant been involved in any legal dispute (if yes, explain in box below)? Yes Gambler Indebted Womanizer Violent Alcoholic Irresponsible Drug abuser Trouble-maker No Is the applicant debt-free? No Explanation on any negative aspects: 35

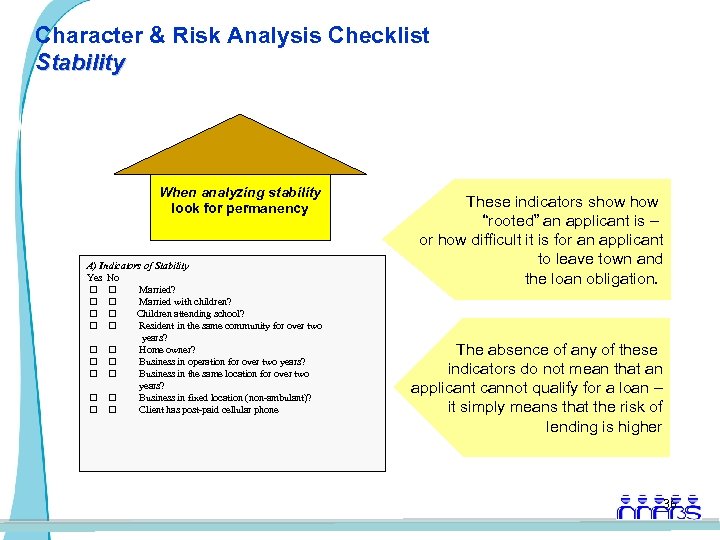

Character & Risk Analysis Checklist Stability When analyzing stability look for permanency A) Indicators of Stability Yes No Married? Married with children? Children attending school? Resident in the same community for over two years? Home owner? Business in operation for over two years? Business in the same location for over two years? Business in fixed location (non-ambulant)? Client has post-paid cellular phone These indicators show “rooted” an applicant is – or how difficult it is for an applicant to leave town and the loan obligation. The absence of any of these indicators do not mean that an applicant cannot qualify for a loan – it simply means that the risk of lending is higher 36

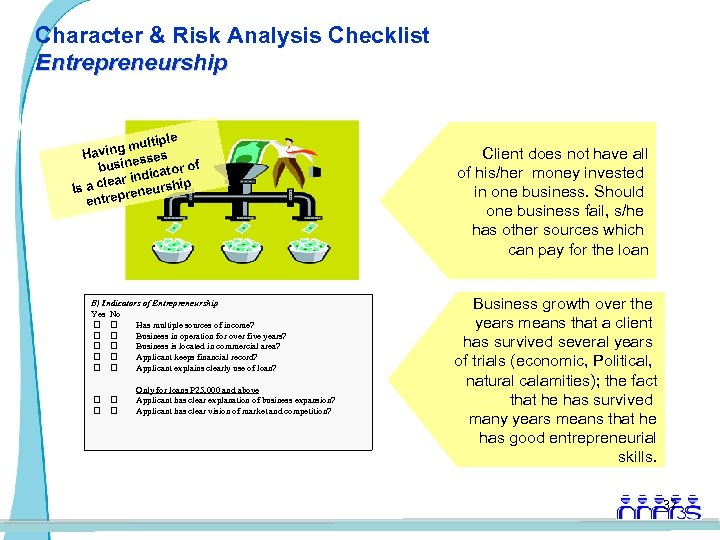

Character & Risk Analysis Checklist Entrepreneurship ultiple ing m Hav esses busin icator of r ind a clea neurship Is re entrep B) Indicators of Entrepreneurship Yes No Has multiple sources of income? Business in operation for over five years? Business is located in commercial area? Applicant keeps financial record? Applicant explains clearly use of loan? Only for loans P 25, 000 and above Applicant has clear explanation of business expansion? Applicant has clear vision of market and competition? Client does not have all of his/her money invested in one business. Should one business fail, s/he has other sources which can pay for the loan Business growth over the years means that a client has survived several years of trials (economic, Political, natural calamities); the fact that he has survived many years means that he has good entrepreneurial skills. 37

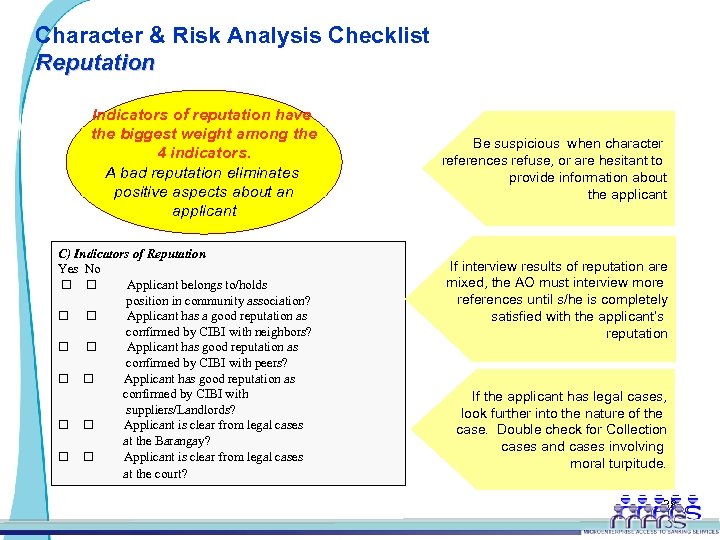

Character & Risk Analysis Checklist Reputation Indicators of reputation have the biggest weight among the 4 indicators. A bad reputation eliminates positive aspects about an applicant C) Indicators of Reputation Yes No Applicant belongs to/holds position in community association? Applicant has a good reputation as confirmed by CIBI with neighbors? Applicant has good reputation as confirmed by CIBI with peers? Applicant has good reputation as confirmed by CIBI with suppliers/Landlords? Applicant is clear from legal cases at the Barangay? Applicant is clear from legal cases at the court? Be suspicious when character references refuse, or are hesitant to provide information about the applicant If interview results of reputation are mixed, the AO must interview more references until s/he is completely satisfied with the applicant’s reputation If the applicant has legal cases, look further into the nature of the case. Double check for Collection cases and cases involving moral turpitude. 38

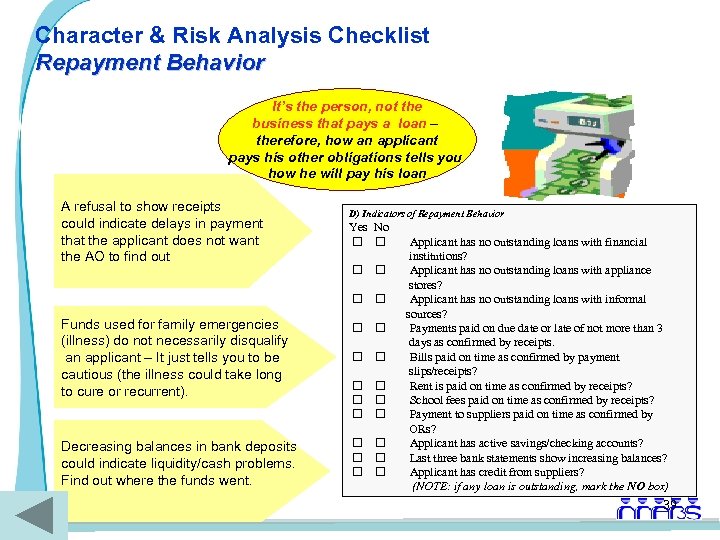

Character & Risk Analysis Checklist Repayment Behavior It’s the person, not the business that pays a loan – therefore, how an applicant pays his other obligations tells you how he will pay his loan A refusal to show receipts could indicate delays in payment that the applicant does not want the AO to find out D) Indicators of Repayment Behavior Yes No Funds used for family emergencies (illness) do not necessarily disqualify an applicant – It just tells you to be cautious (the illness could take long to cure or recurrent). Decreasing balances in bank deposits could indicate liquidity/cash problems. Find out where the funds went. Applicant has no outstanding loans with financial institutions? Applicant has no outstanding loans with appliance stores? Applicant has no outstanding loans with informal sources? Payments paid on due date or late of not more than 3 days as confirmed by receipts. Bills paid on time as confirmed by payment slips/receipts? Rent is paid on time as confirmed by receipts? School fees paid on time as confirmed by receipts? Payment to suppliers paid on time as confirmed by ORs? Applicant has active savings/checking accounts? Last three bank statements show increasing balances? Applicant has credit from suppliers? (NOTE: if any loan is outstanding, mark the NO box) 39

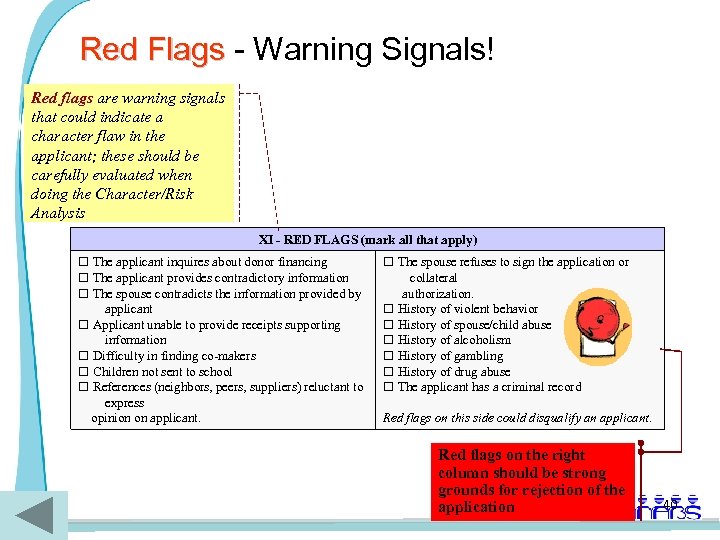

Red Flags - Warning Signals! Red flags are warning signals that could indicate a character flaw in the applicant; these should be carefully evaluated when doing the Character/Risk Analysis XI - RED FLAGS (mark all that apply) The applicant inquires about donor financing The applicant provides contradictory information The spouse contradicts the information provided by applicant Applicant unable to provide receipts supporting information Difficulty in finding co-makers Children not sent to school References (neighbors, peers, suppliers) reluctant to express opinion on applicant. The spouse refuses to sign the application or collateral authorization. History of violent behavior History of spouse/child abuse History of alcoholism History of gambling History of drug abuse The applicant has a criminal record. Red flags on this side could disqualify an applicant. Red flags on the right column should be strong grounds for rejection of the application 40

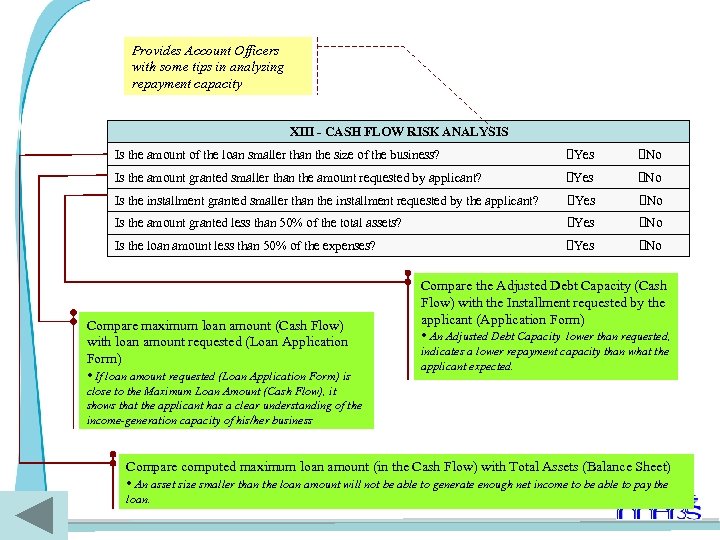

Provides Account Officers with some tips in analyzing repayment capacity XIII - CASH FLOW RISK ANALYSIS Is the amount of the loan smaller than the size of the business? Yes No Is the amount granted smaller than the amount requested by applicant? Yes No Is the installment granted smaller than the installment requested by the applicant? Yes No Is the amount granted less than 50% of the total assets? Yes No Is the loan amount less than 50% of the expenses? Yes No Compare maximum loan amount (Cash Flow) with loan amount requested (Loan Application Form) • If loan amount requested (Loan Application Form) is Compare the Adjusted Debt Capacity (Cash Flow) with the Installment requested by the applicant (Application Form) • An Adjusted Debt Capacity lower than requested, indicates a lower repayment capacity than what the applicant expected. close to the Maximum Loan Amount (Cash Flow), it shows that the applicant has a clear understanding of the income-generation capacity of his/her business Compare computed maximum loan amount (in the Cash Flow) with Total Assets (Balance Sheet) • An asset size smaller than the loan amount will not be able to generate enough net income to be able to pay the loan. 41

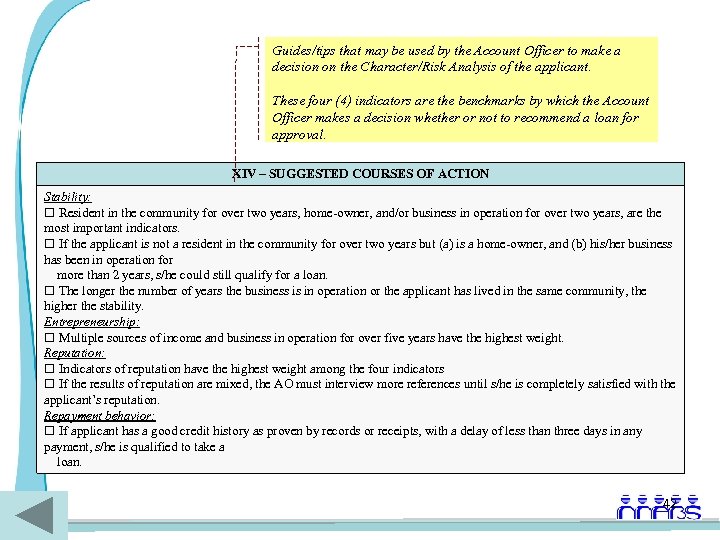

Guides/tips that may be used by the Account Officer to make a decision on the Character/Risk Analysis of the applicant. These four (4) indicators are the benchmarks by which the Account Officer makes a decision whether or not to recommend a loan for approval. XIV – SUGGESTED COURSES OF ACTION Stability: Resident in the community for over two years, home-owner, and/or business in operation for over two years, are the most important indicators. If the applicant is not a resident in the community for over two years but (a) is a home-owner, and (b) his/her business has been in operation for more than 2 years, s/he could still qualify for a loan. The longer the number of years the business is in operation or the applicant has lived in the same community, the higher the stability. Entrepreneurship: Multiple sources of income and business in operation for over five years have the highest weight. Reputation: Indicators of reputation have the highest weight among the four indicators If the results of reputation are mixed, the AO must interview more references until s/he is completely satisfied with the applicant’s reputation. Repayment behavior: If applicant has a good credit history as proven by records or receipts, with a delay of less than three days in any payment, s/he is qualified to take a loan. 42

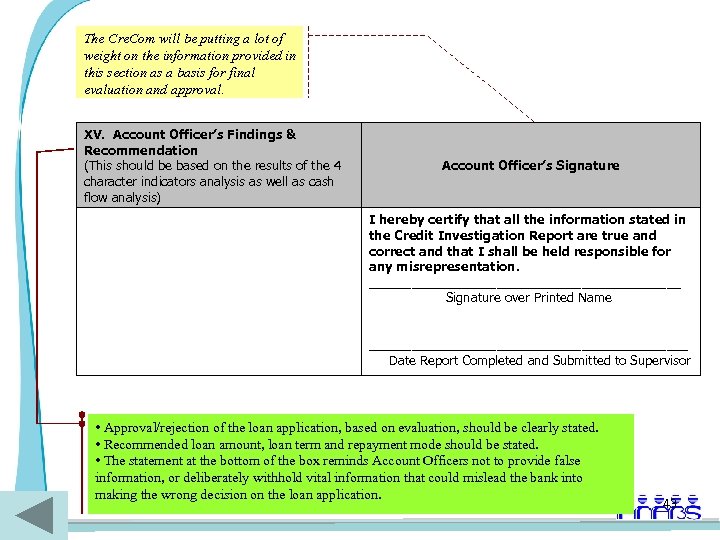

The Cre. Com will be putting a lot of weight on the information provided in this section as a basis for final evaluation and approval. XV. Account Officer’s Findings & Recommendation (This should be based on the results of the 4 character indicators analysis as well as cash flow analysis) Account Officer’s Signature I hereby certify that all the information stated in the Credit Investigation Report are true and correct and that I shall be held responsible for any misrepresentation. ______________________ Signature over Printed Name _______________________ Date Report Completed and Submitted to Supervisor • Approval/rejection of the loan application, based on evaluation, should be clearly stated. • Recommended loan amount, loan term and repayment mode should be stated. • The statement at the bottom of the box reminds Account Officers not to provide false information, or deliberately withhold vital information that could mislead the bank into making the wrong decision on the loan application. 43

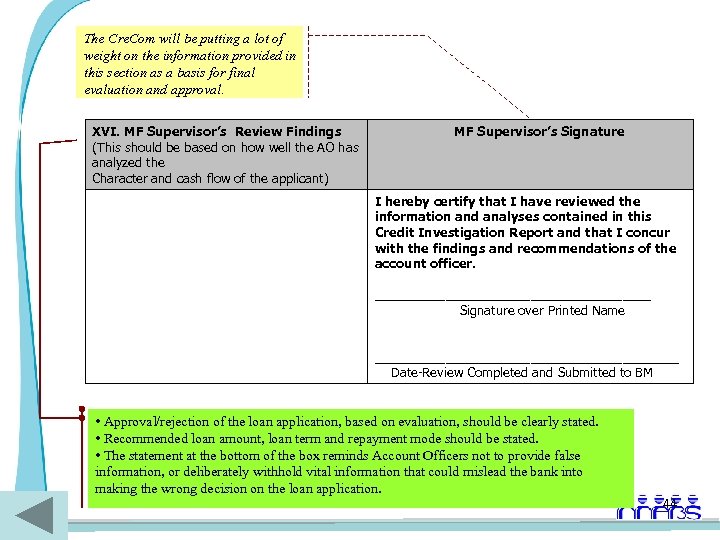

The Cre. Com will be putting a lot of weight on the information provided in this section as a basis for final evaluation and approval. XVI. MF Supervisor’s Review Findings (This should be based on how well the AO has analyzed the Character and cash flow of the applicant) MF Supervisor’s Signature I hereby certify that I have reviewed the information and analyses contained in this Credit Investigation Report and that I concur with the findings and recommendations of the account officer. ____________________ Signature over Printed Name ______________________ Date-Review Completed and Submitted to BM • Approval/rejection of the loan application, based on evaluation, should be clearly stated. • Recommended loan amount, loan term and repayment mode should be stated. • The statement at the bottom of the box reminds Account Officers not to provide false information, or deliberately withhold vital information that could mislead the bank into making the wrong decision on the loan application. 44

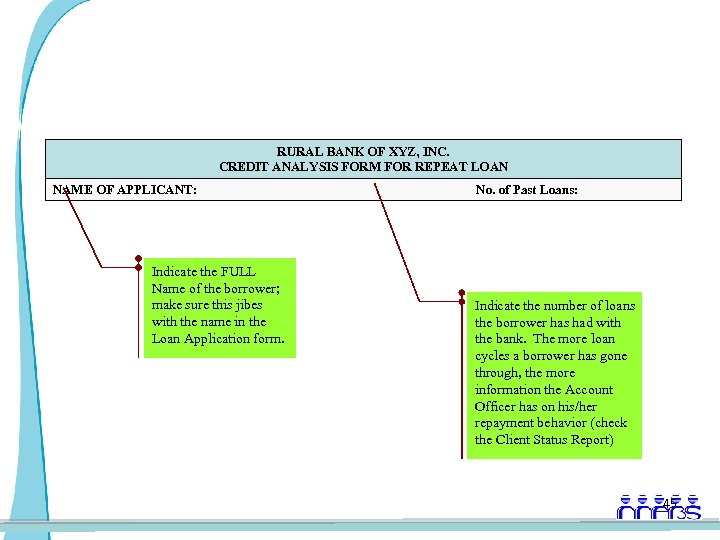

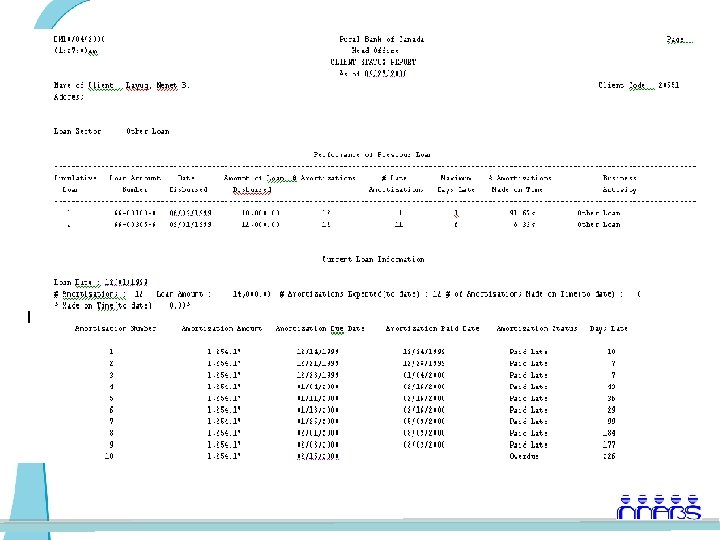

RURAL BANK OF XYZ, INC. CREDIT ANALYSIS FORM FOR REPEAT LOAN NAME OF APPLICANT: Indicate the FULL Name of the borrower; make sure this jibes with the name in the Loan Application form. No. of Past Loans: Indicate the number of loans the borrower has had with the bank. The more loan cycles a borrower has gone through, the more information the Account Officer has on his/her repayment behavior (check the Client Status Report) 45

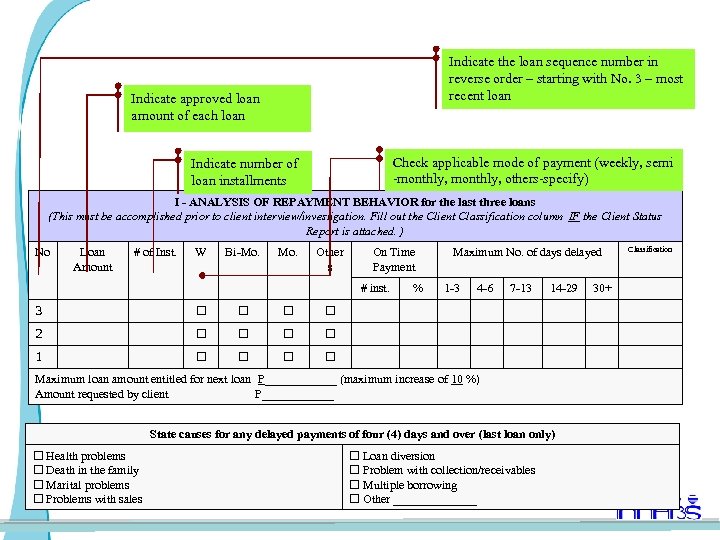

Indicate the loan sequence number in reverse order – starting with No. 3 – most recent loan Indicate approved loan amount of each loan Check applicable mode of payment (weekly, semi -monthly, others-specify) Indicate number of loan installments I - ANALYSIS OF REPAYMENT BEHAVIOR for the last three loans (This must be accomplished prior to client interview/investigation. Fill out the Client Classification column IF the Client Status Report is attached. ) No Loan Amount # of Inst. W Bi-Mo. Other s On Time Payment # inst. 3 4 -6 7 -13 14 -29 30+ 1 1 -3 Classification 2 % Maximum No. of days delayed Maximum loan amount entitled for next loan P______ (maximum increase of 10 %) Amount requested by client P______ State causes for any delayed payments of four (4) days and over (last loan only) Health problems Death in the family Marital problems Problems with sales Loan diversion Problem with collection/receivables Multiple borrowing Other _______ 46

What do delays in payment suggest? L Payments over 7 days past due indicate that the loan amount is too large L Partial payments indicate that the loan amount is too large L A steady decline in the number of installments paid on time could mean the loan amount is becoming too large 48

A borrower’s repayment behavior determines the Client’s Classification. The Client Classification serves as a guide for determining increases in loan amount for the next loan cycle. 49

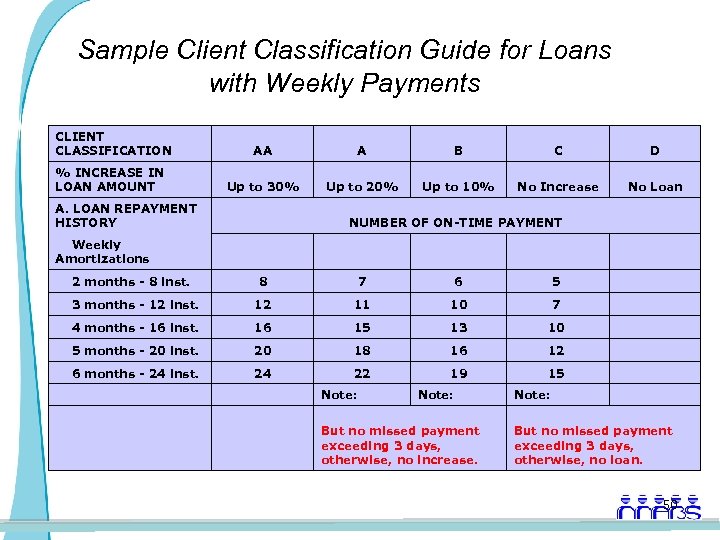

Sample Client Classification Guide for Loans with Weekly Payments CLIENT CLASSIFICATION AA A B C D % INCREASE IN LOAN AMOUNT Up to 30% Up to 20% Up to 10% No Increase No Loan A. LOAN REPAYMENT HISTORY NUMBER OF ON-TIME PAYMENT Weekly Amortizations 2 months - 8 inst. 8 7 6 5 3 months - 12 inst. 12 11 10 7 4 months - 16 inst. 16 15 13 10 5 months - 20 inst. 20 18 16 12 6 months - 24 inst. 24 22 19 15 Note: But no missed payment exceeding 3 days, otherwise, no increase. Note: But no missed payment exceeding 3 days, otherwise, no loan. 50

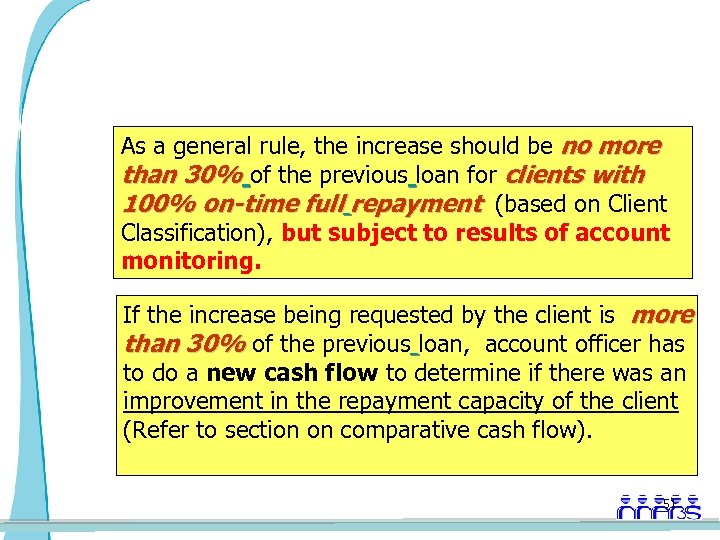

As a general rule, the increase should be no more than 30% of the previous loan for clients with 100% on-time full repayment (based on Client Classification), but subject to results of account monitoring. If the increase being requested by the client is more than 30% of the previous loan, account officer has to do a new cash flow to determine if there was an improvement in the repayment capacity of the client (Refer to section on comparative cash flow). 51

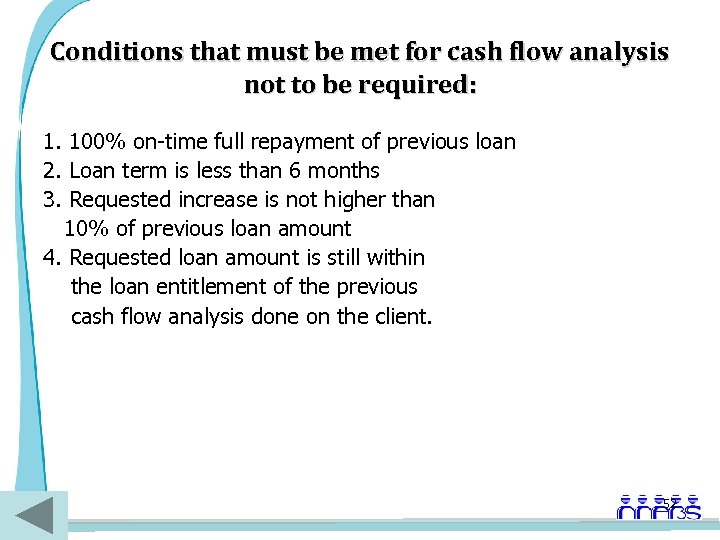

Conditions that must be met for cash flow analysis not to be required: 1. 100% on-time full repayment of previous loan 2. Loan term is less than 6 months 3. Requested increase is not higher than 10% of previous loan amount 4. Requested loan amount is still within the loan entitlement of the previous cash flow analysis done on the client. 52

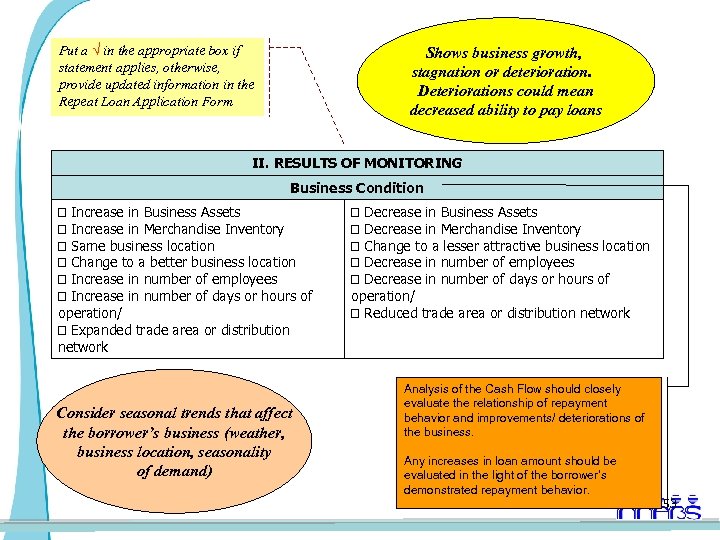

Put a √ in the appropriate box if statement applies, otherwise, provide updated information in the Repeat Loan Application Form Shows business growth, stagnation or deterioration. Deteriorations could mean decreased ability to pay loans II. RESULTS OF MONITORING Business Condition Increase in Business Assets Increase in Merchandise Inventory Same business location Change to a better business location Increase in number of employees Increase in number of days or hours of operation/ Expanded trade area or distribution network Consider seasonal trends that affect the borrower’s business (weather, business location, seasonality of demand) Decrease in Business Assets Decrease in Merchandise Inventory Change to a lesser attractive business location Decrease in number of employees Decrease in number of days or hours of operation/ Reduced trade area or distribution network Analysis of the Cash Flow should closely evaluate the relationship of repayment behavior and improvements/ deteriorations of the business. Any increases in loan amount should be evaluated in the light of the borrower’s demonstrated repayment behavior. 53

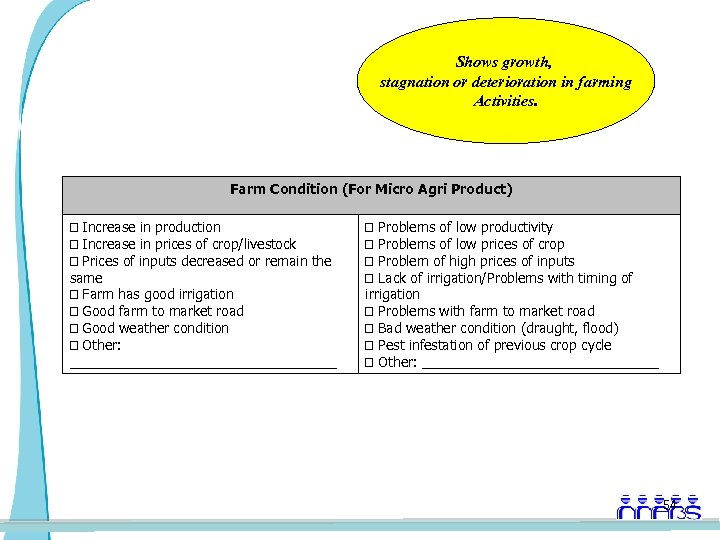

Shows growth, stagnation or deterioration in farming Activities. Farm Condition (For Micro Agri Product) Increase in production Increase in prices of crop/livestock Prices of inputs decreased or remain the same Farm has good irrigation Good farm to market road Good weather condition Other: __________________ Problems of low productivity Problems of low prices of crop Problem of high prices of inputs Lack of irrigation/Problems with timing of irrigation Problems with farm to market road Bad weather condition (draught, flood) Pest infestation of previous crop cycle Other: ________________ 54

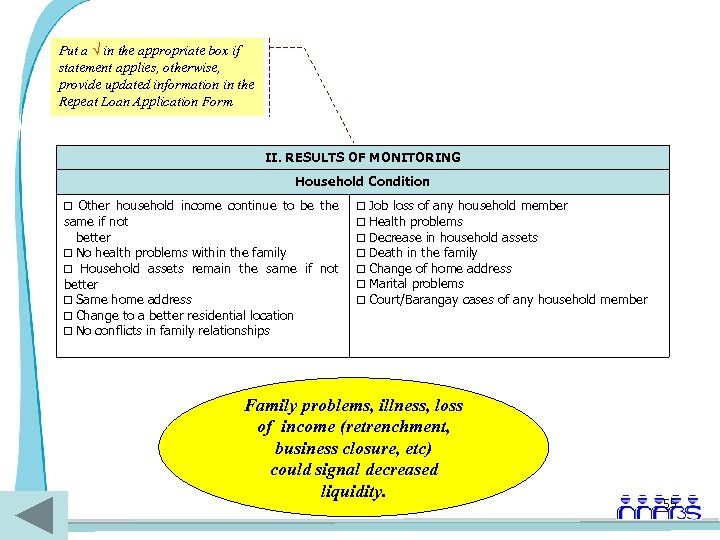

Put a √ in the appropriate box if statement applies, otherwise, provide updated information in the Repeat Loan Application Form II. RESULTS OF MONITORING Household Condition Other household income continue to be the same if not better No health problems within the family Household assets remain the same if not better Same home address Change to a better residential location No conflicts in family relationships Job loss of any household member Health problems Decrease in household assets Death in the family Change of home address Marital problems Court/Barangay cases of any household member Family problems, illness, loss of income (retrenchment, business closure, etc) could signal decreased liquidity. 55

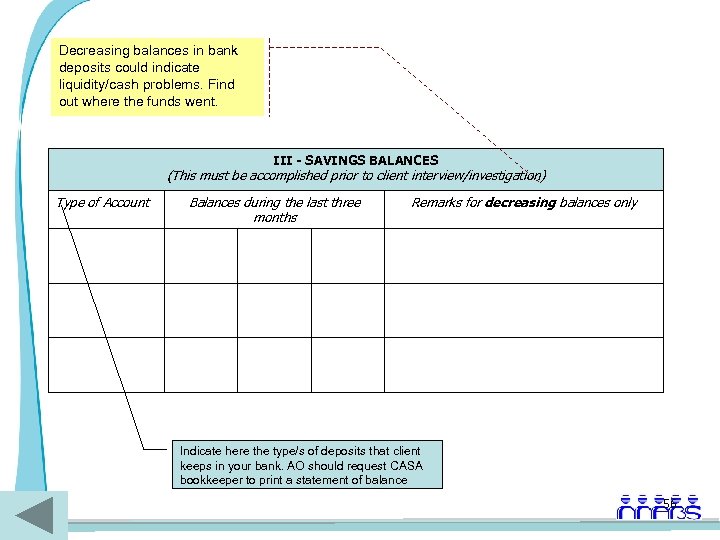

Decreasing balances in bank deposits could indicate liquidity/cash problems. Find out where the funds went. III - SAVINGS BALANCES (This must be accomplished prior to client interview/investigation) Type of Account Balances during the last three months Remarks for decreasing balances only Indicate here the type/s of deposits that client keeps in your bank. AO should request CASA bookkeeper to print a statement of balance 56

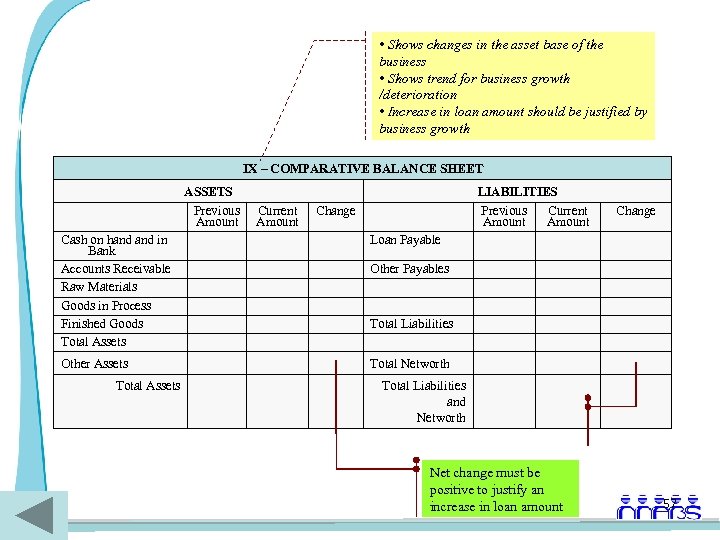

• Shows changes in the asset base of the business • Shows trend for business growth /deterioration • Increase in loan amount should be justified by business growth IX – COMPARATIVE BALANCE SHEET ASSETS Previous Amount Current Amount LIABILITIES Previous Current Amount Change Cash on hand in Bank Accounts Receivable Raw Materials Goods in Process Finished Goods Total Assets Loan Payable Other Assets Change Total Networth Total Assets Other Payables Total Liabilities and Networth Net change must be positive to justify an increase in loan amount 57

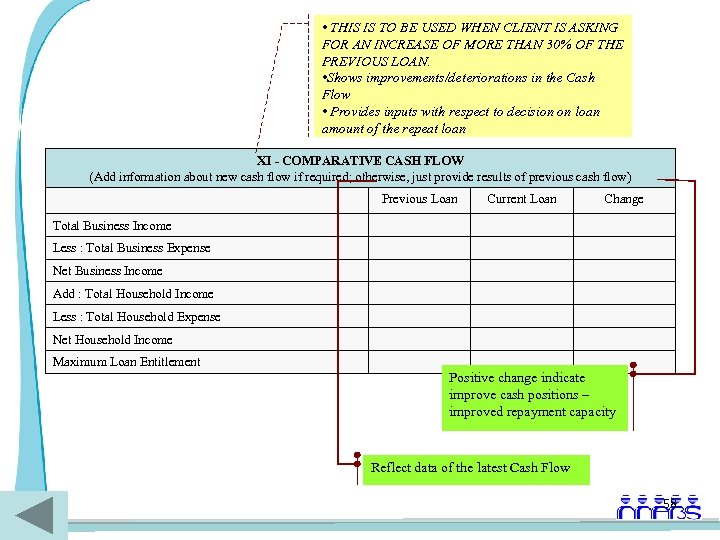

• THIS IS TO BE USED WHEN CLIENT IS ASKING FOR AN INCREASE OF MORE THAN 30% OF THE PREVIOUS LOAN. • Shows improvements/deteriorations in the Cash Flow • Provides inputs with respect to decision on loan amount of the repeat loan XI - COMPARATIVE CASH FLOW (Add information about new cash flow if required; otherwise, just provide results of previous cash flow) Previous Loan Current Loan Change Total Business Income Less : Total Business Expense Net Business Income Add : Total Household Income Less : Total Household Expense Net Household Income Maximum Loan Entitlement Positive change indicate improve cash positions – improved repayment capacity Reflect data of the latest Cash Flow 58

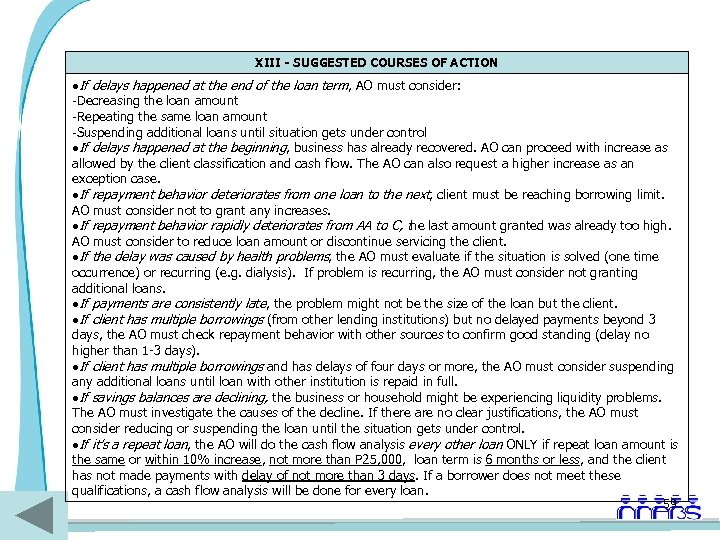

XIII - SUGGESTED COURSES OF ACTION If delays happened at the end of the loan term, AO must consider: -Decreasing the loan amount -Repeating the same loan amount -Suspending additional loans until situation gets under control If delays happened at the beginning, business has already recovered. AO can proceed with increase as allowed by the client classification and cash flow. The AO can also request a higher increase as an exception case. If repayment behavior deteriorates from one loan to the next, client must be reaching borrowing limit. AO must consider not to grant any increases. If repayment behavior rapidly deteriorates from AA to C, the last amount granted was already too high. AO must consider to reduce loan amount or discontinue servicing the client. If the delay was caused by health problems, the AO must evaluate if the situation is solved (one time occurrence) or recurring (e. g. dialysis). If problem is recurring, the AO must consider not granting additional loans. If payments are consistently late, the problem might not be the size of the loan but the client. If client has multiple borrowings (from other lending institutions) but no delayed payments beyond 3 days, the AO must check repayment behavior with other sources to confirm good standing (delay no higher than 1 -3 days). If client has multiple borrowings and has delays of four days or more, the AO must consider suspending any additional loans until loan with other institution is repaid in full. If savings balances are declining, the business or household might be experiencing liquidity problems. The AO must investigate the causes of the decline. If there are no clear justifications, the AO must consider reducing or suspending the loan until the situation gets under control. If it’s a repeat loan, the AO will do the cash flow analysis every other loan ONLY if repeat loan amount is the same or within 10% increase, not more than P 25, 000, loan term is 6 months or less, and the client has not made payments with delay of not more than 3 days. If a borrower does not meet these qualifications, a cash flow analysis will be done for every loan. 59

Thank you

4037fcd8c76b2739153e3cc68a9ffabe.ppt