97a06518dfee5463a7875d1fad630580.ppt

- Количество слайдов: 16

M&A Today: Technology, Information and Business Services What Buyers Want SSA Global Shelley Isenberg SVP Acquisitions and Corporate Development February 12, 2004

Agenda § Direction of the Enterprise Resource Planning Software Industry § About SSA § Acquisitions § § a tactic to achieve the strategy what buyers want & what they can provide “land mines” and how to deal with them Summary

Direction of the ERP Industry § Many acquisitions in our space § Investors seek to exit as they don’t see the expected results § Too many ERP players, not enough customers § Less expensive to buy software than build it § Less expensive to acquire customers that organically grow the base § Mid market is seen as the “sweet spot”

About SSA § Mission Statement Our mission is to help customers move their businesses forward faster by: § Delivering the right solutions § Implementing it quickly § Making it pay § Industry Ranking § #1 enterprise software provider in the manufacturing space § #4 player in the extended ERP market § Financial Highlights § Revenue this FY will be $700+m § EBITA 20+% § Global Footprint § 3, 600 employees § 47 direct and 74 affiliate offices worldwide § Company Mantra § “Acquire market share; develop customer share” § “Keep customers for life”

Strategy (since FY 02) § Become a global market leader in mid-market ERP space § Vertically focused § Triple customer base § Provide more of an “end to end” offering § Morph from a “software company” to a “solutions provider” § Get more of “customer’s share of wallet” § Grow revenues from approx. $130 m (FY 01) to over $1 b (FY 04)

Tactics to Achieve our Strategy § 10% organic growth § Significant acquisitive growth § Maintain 20% margins § Commoditize pricing

Why SSA Acquires Value Creation: § Cheapest way to grow § Fastest way to grow § Large customer base provides opportunities: § cross selling § commoditize pricing § recurring revenue base § Synergistic cost cutting by fully integrating § Create end to end offering to get more of customers’ IT spend

Target Profiles § Customer Base Targets § § 30+ % recurring revenue § Manufacturing or distribution industry focus § Global or regional § § $20+ m to $400 m in revenue Unprofitable Extension Product Targets § Proven successful product § J 2 EE, Java, Web. Sphere technology § Fill a “white space” within our “end to end” offering § Target has a good product in need of global distribution arm § Unprofitable

Target Selection To be qualified, a target must satisfy our 4 M’s: § Money § valuation § currency § Motivation § willing seller § Method § transaction structure § Match § fit (technology, culture, industry, sector, etc. )

Value Proposition From Sellers Perspective We Provide: § speed § history of successful “win/win” deals § certainty of outcome § cash § continuity of business § pragmatic due diligence review § opportunity for sr. management to exit if they want to (i. e. no handcuffs)

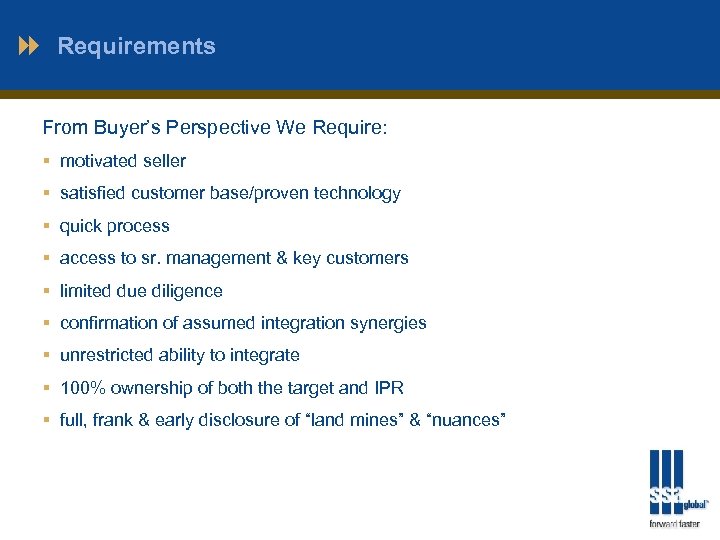

Requirements From Buyer’s Perspective We Require: § motivated seller § satisfied customer base/proven technology § quick process § access to sr. management & key customers § limited due diligence § confirmation of assumed integration synergies § unrestricted ability to integrate § 100% ownership of both the target and IPR § full, frank & early disclosure of “land mines” & “nuances”

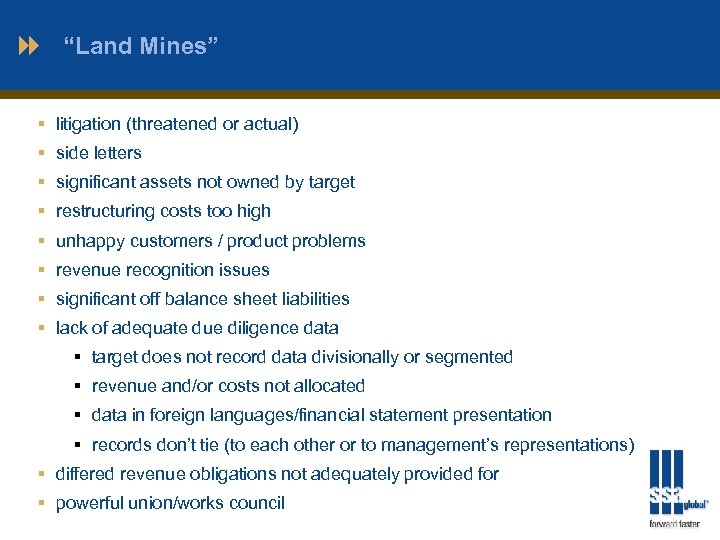

“Land Mines” § litigation (threatened or actual) § side letters § significant assets not owned by target § restructuring costs too high § unhappy customers / product problems § revenue recognition issues § significant off balance sheet liabilities § lack of adequate due diligence data § target does not record data divisionally or segmented § revenue and/or costs not allocated § data in foreign languages/financial statement presentation § records don’t tie (to each other or to management’s representations) § differed revenue obligations not adequately provided for § powerful union/works council

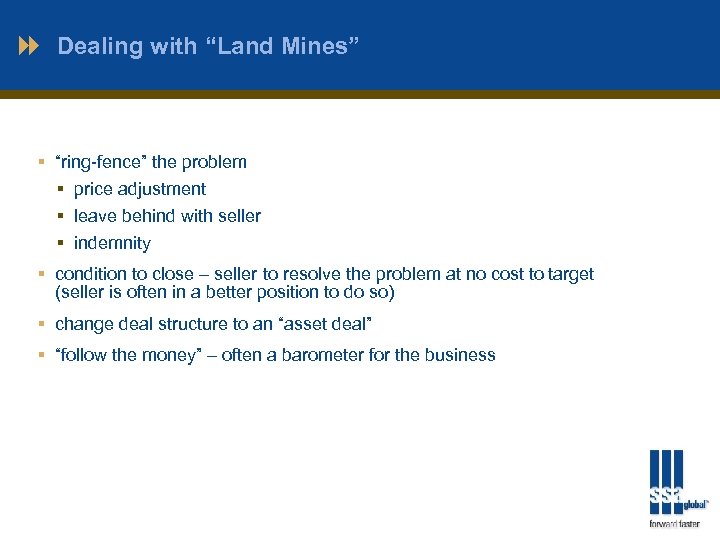

Dealing with “Land Mines” § “ring-fence” the problem § price adjustment § leave behind with seller § indemnity § condition to close – seller to resolve the problem at no cost to target (seller is often in a better position to do so) § change deal structure to an “asset deal” § “follow the money” – often a barometer for the business

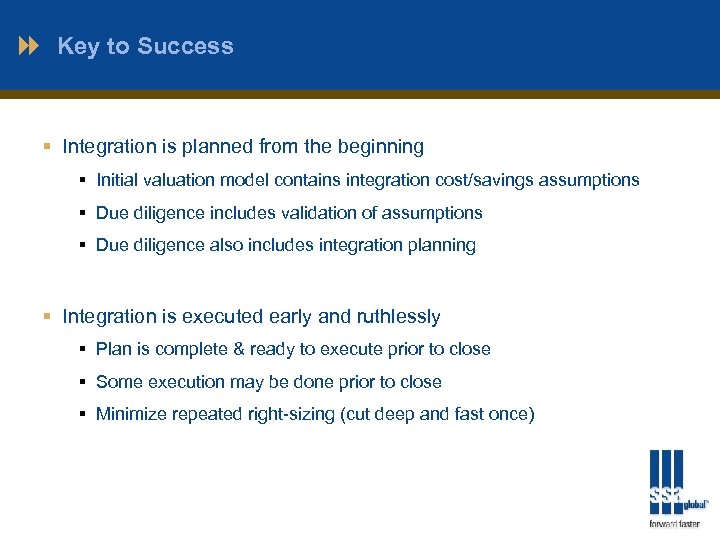

Key to Success § Integration is planned from the beginning § Initial valuation model contains integration cost/savings assumptions § Due diligence includes validation of assumptions § Due diligence also includes integration planning § Integration is executed early and ruthlessly § Plan is complete & ready to execute prior to close § Some execution may be done prior to close § Minimize repeated right-sizing (cut deep and fast once)

Summary § it’s key for buyers to make their expectation clear to sellers upfront § similarly, buyers should make it clear as to what they can offer to the seller § the earlier “land mines” are revealed so they can be addressed the better …last minute surprises often lead to worse results for the seller § it’s a small world – reputations are important in the M&A field

THANK YOU

97a06518dfee5463a7875d1fad630580.ppt