08be108b2027cc8e0721b583cd624c11.ppt

- Количество слайдов: 12

M&A Prof. Alex Triantis Robert H. Smith School of Business September 18, 2008 © 2008 Robert H. Smith School of Business University of Maryland

The Good (for so long) Source: moneycentral. msn. com © 2008 Robert H. Smith School of Business, University of Maryland

The Bad (turned good) Source: moneycentral. msn. com © 2008 Robert H. Smith School of Business, University of Maryland

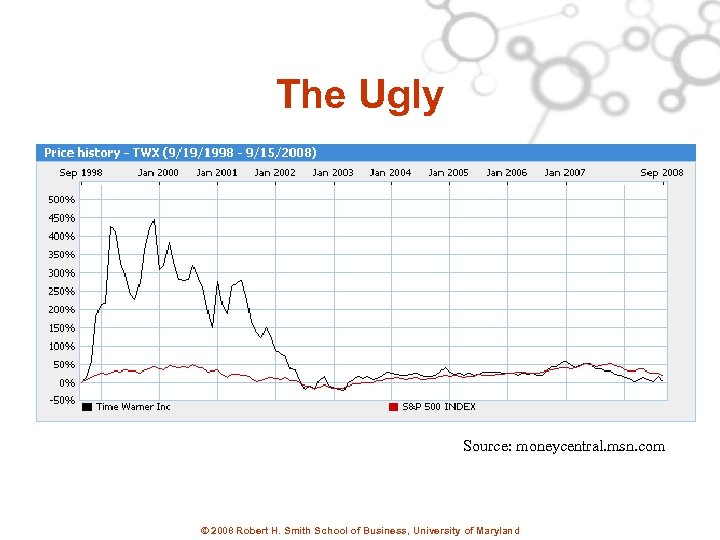

The Ugly Source: moneycentral. msn. com © 2008 Robert H. Smith School of Business, University of Maryland

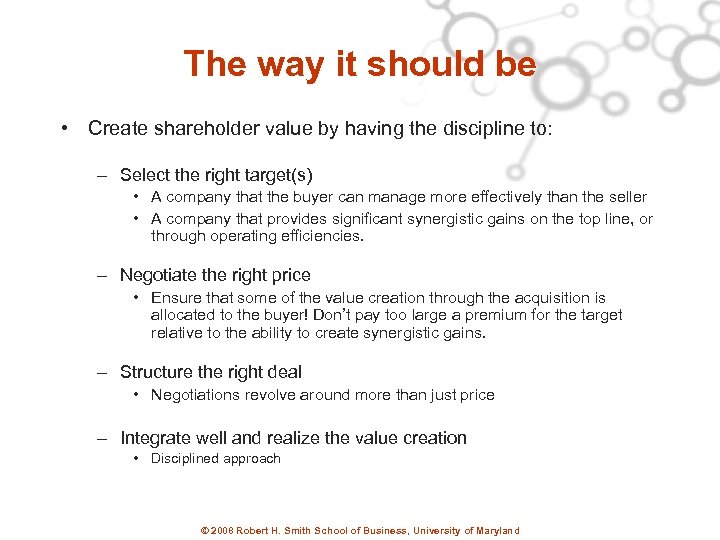

The way it should be • Create shareholder value by having the discipline to: – Select the right target(s) • A company that the buyer can manage more effectively than the seller • A company that provides significant synergistic gains on the top line, or through operating efficiencies. – Negotiate the right price • Ensure that some of the value creation through the acquisition is allocated to the buyer! Don’t pay too large a premium for the target relative to the ability to create synergistic gains. – Structure the right deal • Negotiations revolve around more than just price – Integrate well and realize the value creation • Disciplined approach © 2008 Robert H. Smith School of Business, University of Maryland

Common sources of synergies • Revenue Enhancement Synergies – Cross-selling by the two firms’ sales forces; leverage distribution channels – Cross-branding between the target’s and buyer’s products – Leveraging technology (combined R&D) and technical expertise (personnel, IP, etc. ) • Cost Reduction Synergies – – – – • Economies of scale (horizontal mergers) Greater purchasing power vis-à-vis suppliers Elimination of supply chain intermediaries (vertical mergers) Logistics and distribution improvements Closing the target’s HQ Transfer of technology/know-how Other G&A cost takeout Other synergies – Tax related efficiencies – Relax financial constraints – Reduce cash buffer © 2008 Robert H. Smith School of Business, University of Maryland

Success Factors • Disciplined strategy: make vs. buy – what is the fundamental economic rationale for buying, and at what price? (Alternatives include minority investment, JVs, strategic alliances, long-term contracts. ) • Rinse and repeat: Serial acquirers are more successful. They get better at estimating synergies that can realistically be captured, and better at PMI. “String of pearls”… • Proactively seek (private) targets, and not through an IB-organized auction. • Stick close to home: “bolt-on acquisitions”. This also avoids chasing hot sectors. • Pay with cash rather than stock. • Earn-outs and other incentives for target management. • Management of acquirer has skin in the game. © 2008 Robert H. Smith School of Business, University of Maryland

Current state of M&A • Are deals getting done in this environment? • How does deal volume in 2008 compare to prior years? • Comparable to 2007? » OR • Fewer than half of the deals as in 2007? » OR • Worst year in the last two decades? © 2008 Robert H. Smith School of Business, University of Maryland

Key M&A drivers to consider • Liquidity affects ability to do deals – Credit supply drying up; structured debt market is dormant • Financial buyers have drastically curtailed acquisitions • Strategic buyers in key industries are still acquiring – But, deals are much more tentative • Risk affects appetite to do deals • Other common drivers of M&A cycles: – Rapid technological change? Yes – Regulatory changes? Not so much © 2008 Robert H. Smith School of Business, University of Maryland

What deals are getting done? • Rescue (workout) M&A – JP Morgan / Bear Stearns; Bof. A / Merrill; Barclay / Lehman • Value investment (Mars / Wrigley) – Better deals in colder M&A markets • Commodities/materials (proposed BHP / Rio Tinto) • Cross-border deals (weak $): In. Bev / Anheuser-Busch © 2008 Robert H. Smith School of Business, University of Maryland

Deal structure and execution • Big MAC attack! – Options are valuable when risk is high! – Material Adverse Change with exclusions (which ones? ) • Corporate Governance in a post-SOX world • Due Diligence, as always – “In God we trust, everyone else must bring data!” – Scrutinize legal, accounting, tax, IP, environmental, insurance, property, finance, operational, HR and IT issues © 2008 Robert H. Smith School of Business, University of Maryland

Thank You Alex Triantis Professor and Department Chair, Finance atriantis@rhsmith. umd. edu © 2008 Robert H. Smith School of Business, University of Maryland

08be108b2027cc8e0721b583cd624c11.ppt