M A N A G E M E N T S I M U LA T I ON Performance Mgt & Assessment

M A N A G E M E N T S I M U LA T I ON Performance Mgt & Assessment

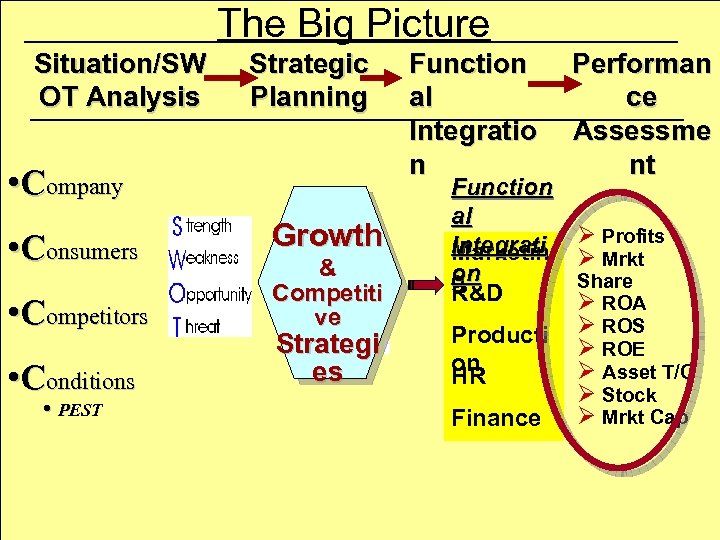

M A N A G E M E N T Situation/SW OT Analysis S I M U LA T I ON The Big Picture Strategic Planning • Company • Consumers • Competitors • Conditions • PEST Growth & Competiti ve Strategi es Function al Integratio n Function al Integrati Marketin on g R&D Producti on HR Finance Performan ce Assessme nt Ø Profits Ø Mrkt Share Ø ROA Ø ROS Ø ROE Ø Asset T/O Ø Stock Ø Mrkt Cap

M A N A G E M E N T Situation/SW OT Analysis S I M U LA T I ON The Big Picture Strategic Planning • Company • Consumers • Competitors • Conditions • PEST Growth & Competiti ve Strategi es Function al Integratio n Function al Integrati Marketin on g R&D Producti on HR Finance Performan ce Assessme nt Ø Profits Ø Mrkt Share Ø ROA Ø ROS Ø ROE Ø Asset T/O Ø Stock Ø Mrkt Cap

M A N A G E M E N T Success Measures S I M U LA T I ON • • Cumulative Profits Ending Market Share ROS Asset Turnover ROA ROE Ending Stock Price Market Cap. Performance Measures- Defined Performance Measures-Dynamics

M A N A G E M E N T Success Measures S I M U LA T I ON • • Cumulative Profits Ending Market Share ROS Asset Turnover ROA ROE Ending Stock Price Market Cap. Performance Measures- Defined Performance Measures-Dynamics

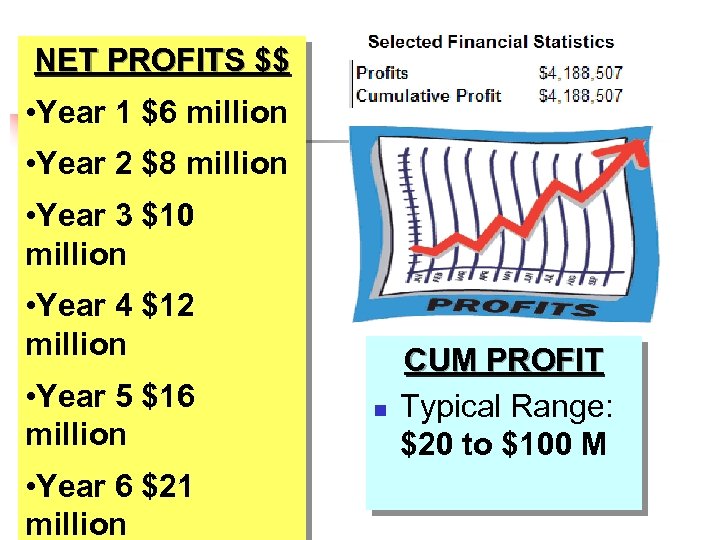

NET PROFITS $$ • Year 1 $6 million • Year 2 $8 million • Year 3 $10 million • Year 4 $12 million • Year 5 $16 million • Year 6 $21 million n CUM PROFIT Typical Range: $20 to $100 M

NET PROFITS $$ • Year 1 $6 million • Year 2 $8 million • Year 3 $10 million • Year 4 $12 million • Year 5 $16 million • Year 6 $21 million n CUM PROFIT Typical Range: $20 to $100 M

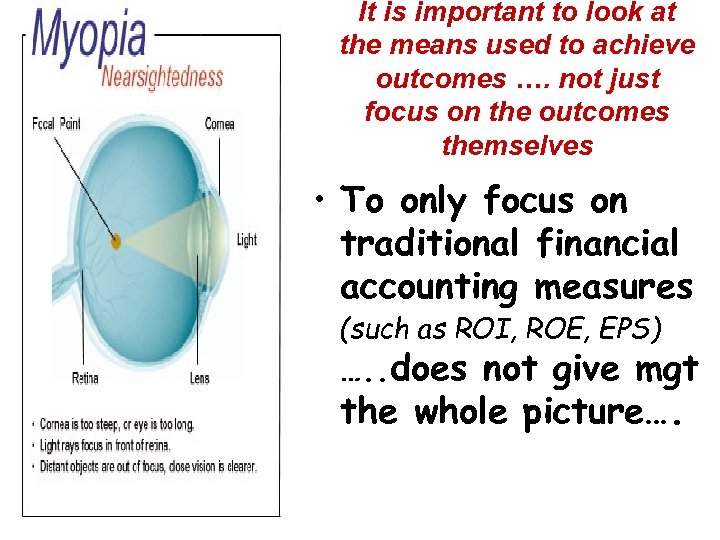

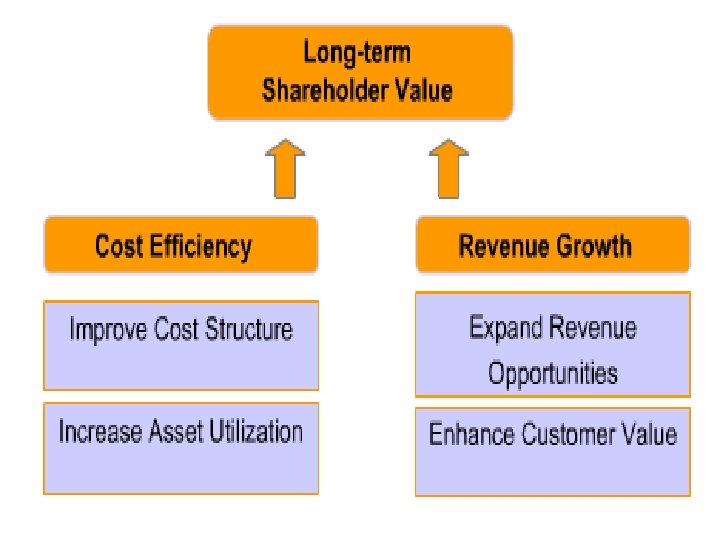

M A N A G E M E N T S I M U LA T I ON It is important to look at the means used to achieve outcomes …. not just focus on the outcomes themselves • To only focus on traditional financial accounting measures (such as ROI, ROE, EPS) …. . does not give mgt the whole picture….

M A N A G E M E N T S I M U LA T I ON It is important to look at the means used to achieve outcomes …. not just focus on the outcomes themselves • To only focus on traditional financial accounting measures (such as ROI, ROE, EPS) …. . does not give mgt the whole picture….

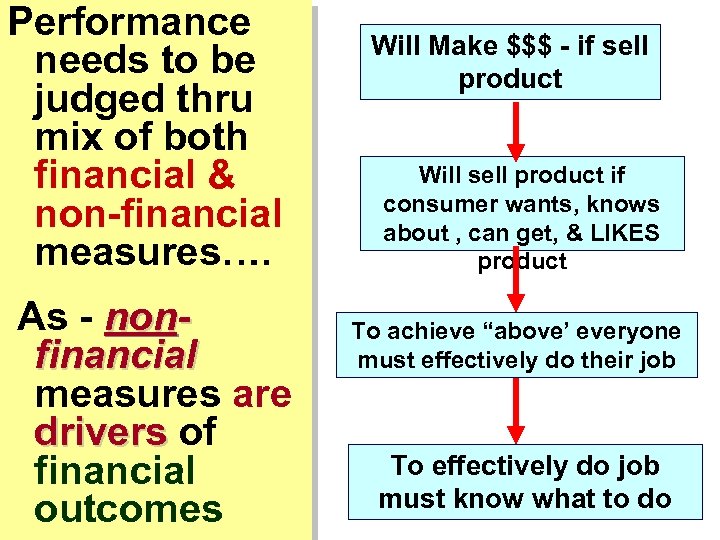

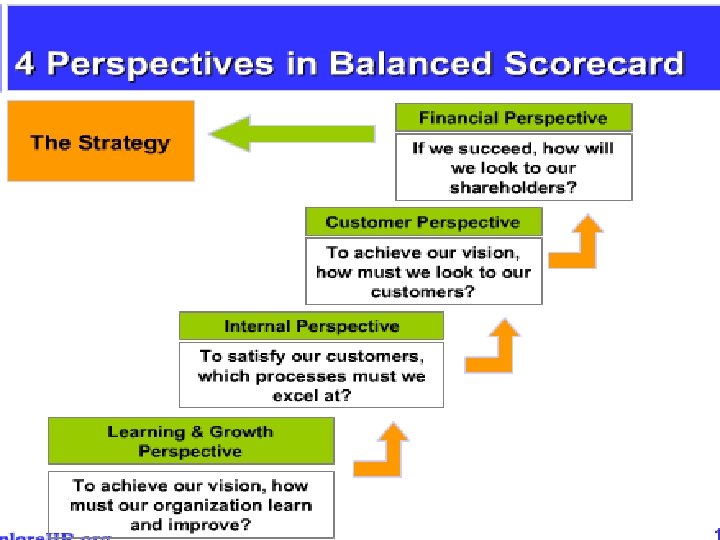

Performance needs to be judged thru mix of both financial & non-financial measures…. M A N A G E M E N T S I M U LA T I ON As - nonfinancial measures are drivers of financial outcomes Will Make $$$ - if sell product Will sell product if consumer wants, knows about , can get, & LIKES product To achieve “above’ everyone must effectively do their job To effectively do job must know what to do

Performance needs to be judged thru mix of both financial & non-financial measures…. M A N A G E M E N T S I M U LA T I ON As - nonfinancial measures are drivers of financial outcomes Will Make $$$ - if sell product Will sell product if consumer wants, knows about , can get, & LIKES product To achieve “above’ everyone must effectively do their job To effectively do job must know what to do

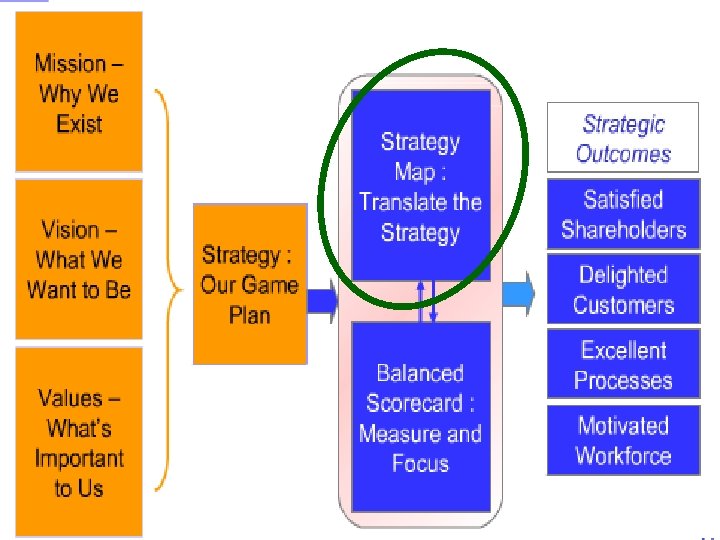

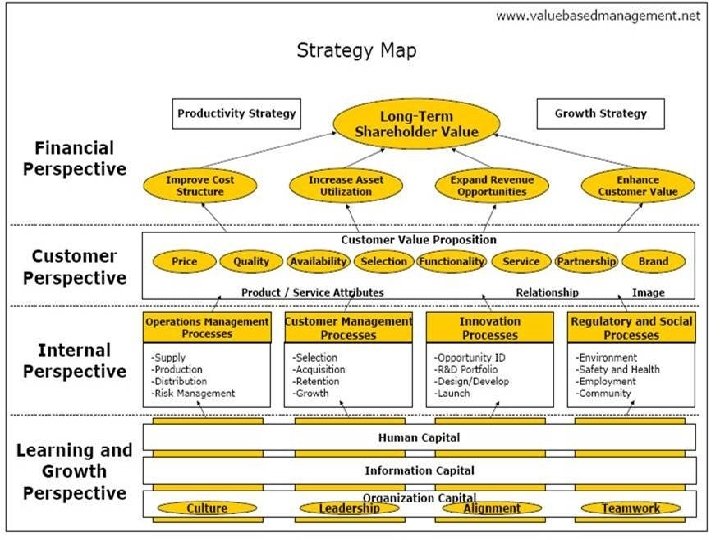

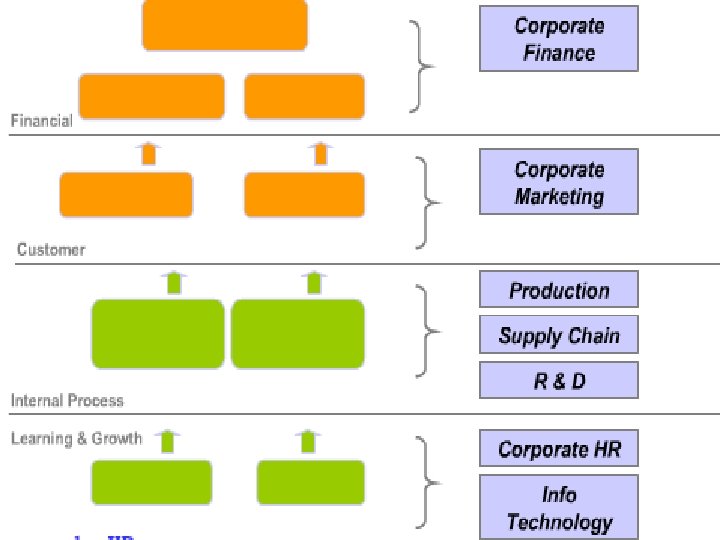

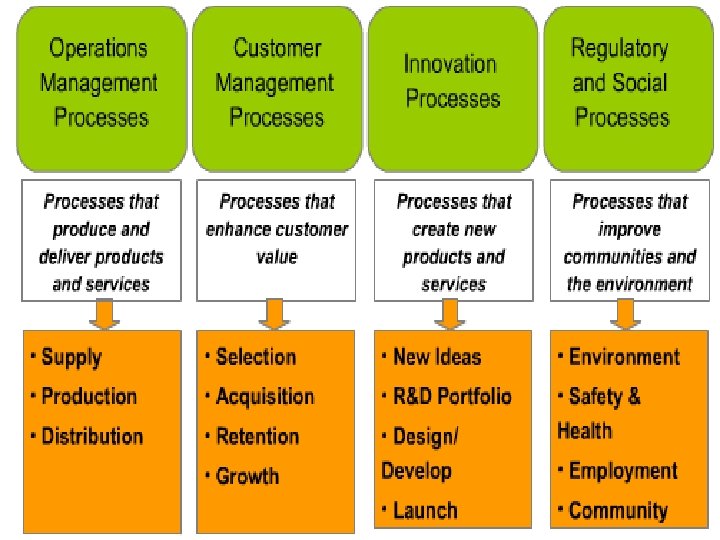

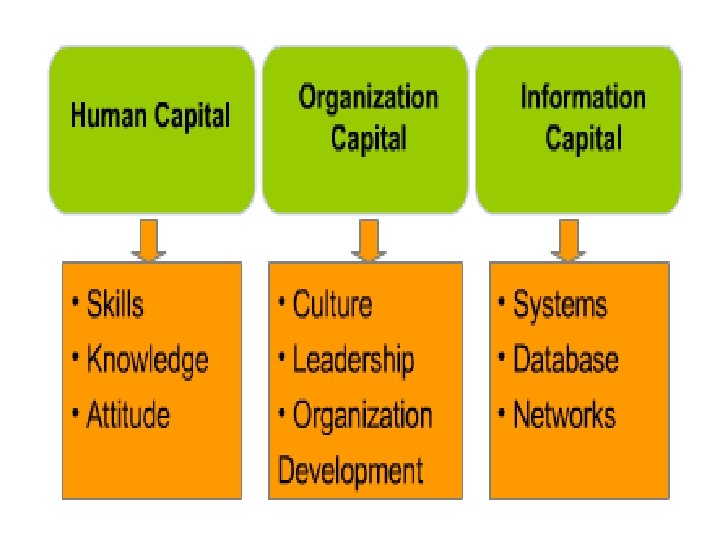

M A N A G E M E N T Strategic Thinking- the ten big ideas S I M U LA T I ON 9 9. Metrics that matter Balanced score card- a system that attempts to balance financial performance w/ consideration of customer's perspective, learning & growth perspective, & internal business process

M A N A G E M E N T Strategic Thinking- the ten big ideas S I M U LA T I ON 9 9. Metrics that matter Balanced score card- a system that attempts to balance financial performance w/ consideration of customer's perspective, learning & growth perspective, & internal business process

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

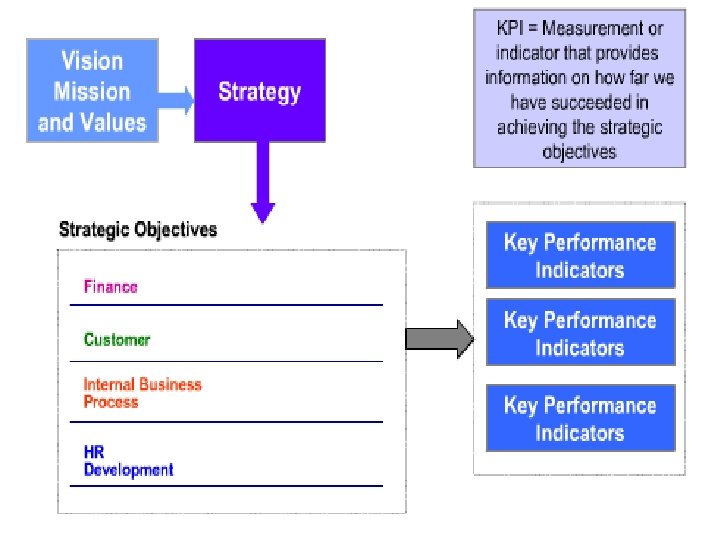

M A N A G E M E N T S I M U LA T I ON Balanced Scorecard Puts Mission- Vision. Values & Strategy At Top of Assessment System

M A N A G E M E N T S I M U LA T I ON Balanced Scorecard Puts Mission- Vision. Values & Strategy At Top of Assessment System

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

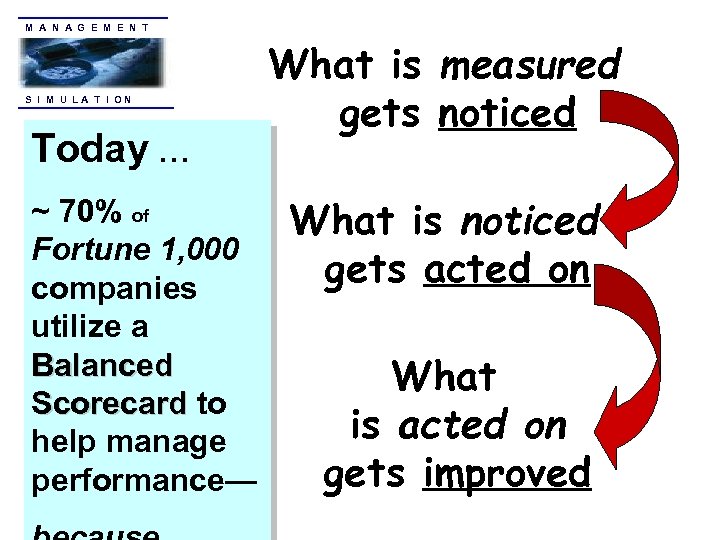

M A N A G E M E N T S I M U LA T I ON Today … ~ 70% of Fortune 1, 000 companies utilize a Balanced Scorecard to help manage performance— What is measured gets noticed What is noticed gets acted on What is acted on gets improved

M A N A G E M E N T S I M U LA T I ON Today … ~ 70% of Fortune 1, 000 companies utilize a Balanced Scorecard to help manage performance— What is measured gets noticed What is noticed gets acted on What is acted on gets improved

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

M A N A G E M E N T S I M U LA T I ON

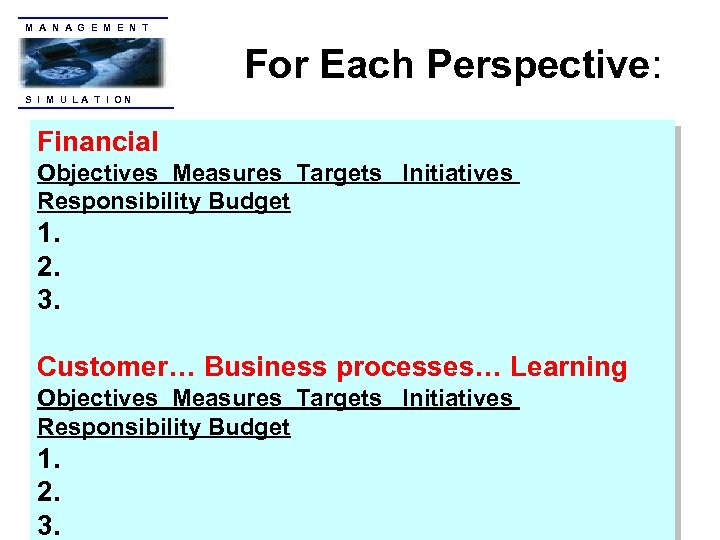

M A N A G E M E N T For Each Perspective: S I M U LA T I ON Financial Objectives Measures Targets Initiatives Responsibility Budget 1. 2. 3. Customer… Business processes… Learning Objectives Measures Targets Initiatives Responsibility Budget 1. 2. 3.

M A N A G E M E N T For Each Perspective: S I M U LA T I ON Financial Objectives Measures Targets Initiatives Responsibility Budget 1. 2. 3. Customer… Business processes… Learning Objectives Measures Targets Initiatives Responsibility Budget 1. 2. 3.

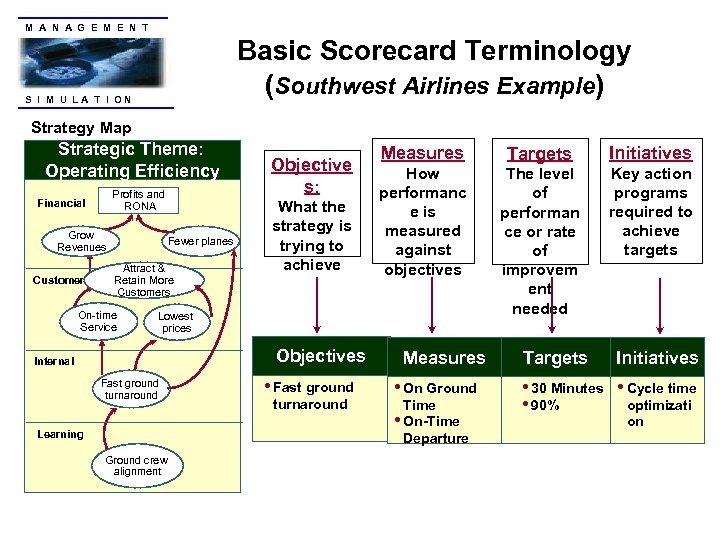

M A N A G E M E N T Basic Scorecard Terminology (Southwest Airlines Example) S I M U LA T I ON Strategy Map Strategic Theme: Operating Efficiency Profits and RONA Financial Grow Revenues Customer Fewer planes Attract & Retain More Customers On-time Service Objective s: What the strategy is trying to achieve Measures Targets Initiatives How performanc e is measured against objectives The level of performan ce or rate of improvem ent needed Key action programs required to achieve targets Lowest prices Objectives Internal Fast ground turnaround Learning Ground crew alignment • Fast ground turnaround Measures • On Ground Time • On-Time Departure Targets Initiatives • 30 Minutes • Cycle time • 90% optimizati on

M A N A G E M E N T Basic Scorecard Terminology (Southwest Airlines Example) S I M U LA T I ON Strategy Map Strategic Theme: Operating Efficiency Profits and RONA Financial Grow Revenues Customer Fewer planes Attract & Retain More Customers On-time Service Objective s: What the strategy is trying to achieve Measures Targets Initiatives How performanc e is measured against objectives The level of performan ce or rate of improvem ent needed Key action programs required to achieve targets Lowest prices Objectives Internal Fast ground turnaround Learning Ground crew alignment • Fast ground turnaround Measures • On Ground Time • On-Time Departure Targets Initiatives • 30 Minutes • Cycle time • 90% optimizati on

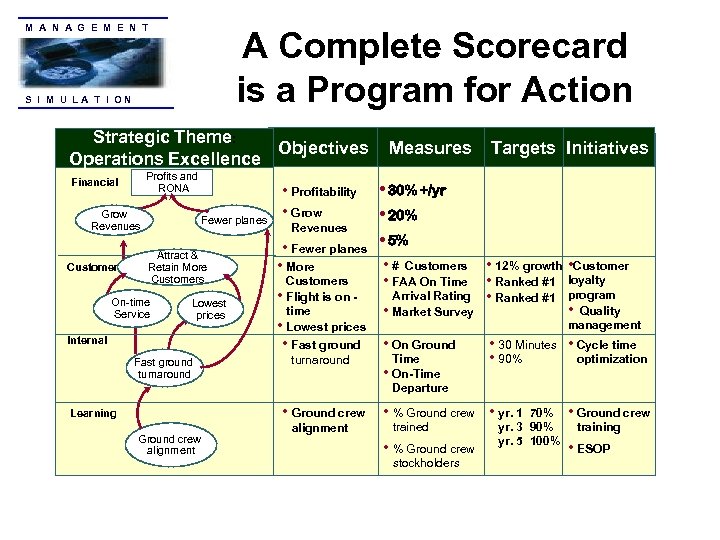

M A N A G E M E N T A Complete Scorecard is a Program for Action S I M U LA T I ON Strategic Theme: : Strategic Theme Objectives Operations Efficiency Operating Excellence Profits and RONA Financial Grow Revenues Customer Fewer planes Attract & Retain More Customers On-time Service Lowest prices Internal Fast ground turnaround • Profitability • Grow Revenues turnaround Ground crew alignment Targets Initiatives • 30% +/yr • 20% • 5% • Fewer planes • # Customers • More Customers • FAA On Time Arrival Rating • Flight is on time • Market Survey • Lowest prices • Fast ground • On Ground • Ground crew Learning Measures Time • On-Time Departure • 12% growth • Customer • Ranked #1 loyalty • Ranked #1 program • Quality management • 30 Minutes • Cycle time • 90% optimization • % Ground crew • yr. 1 trained • % Ground crew stockholders 70% yr. 3 90% yr. 5 100% • Ground crew training • ESOP

M A N A G E M E N T A Complete Scorecard is a Program for Action S I M U LA T I ON Strategic Theme: : Strategic Theme Objectives Operations Efficiency Operating Excellence Profits and RONA Financial Grow Revenues Customer Fewer planes Attract & Retain More Customers On-time Service Lowest prices Internal Fast ground turnaround • Profitability • Grow Revenues turnaround Ground crew alignment Targets Initiatives • 30% +/yr • 20% • 5% • Fewer planes • # Customers • More Customers • FAA On Time Arrival Rating • Flight is on time • Market Survey • Lowest prices • Fast ground • On Ground • Ground crew Learning Measures Time • On-Time Departure • 12% growth • Customer • Ranked #1 loyalty • Ranked #1 program • Quality management • 30 Minutes • Cycle time • 90% optimization • % Ground crew • yr. 1 trained • % Ground crew stockholders 70% yr. 3 90% yr. 5 100% • Ground crew training • ESOP

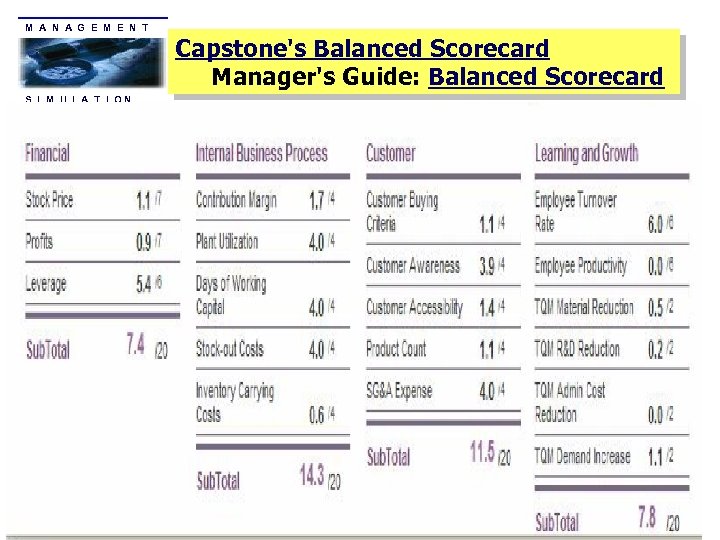

M A N A G E M E N T S I M U LA T I ON Capstone's Balanced Scorecard Manager's Guide: Balanced Scorecard

M A N A G E M E N T S I M U LA T I ON Capstone's Balanced Scorecard Manager's Guide: Balanced Scorecard

M A N A G E M E N T S I M U LA T I ON Additional Tools/Techniques for Managing & Assessing Your Performance: 1. Accurate Sales Forecasting 2. Marketing. Evaluation Checklist 3. Round Analysis & Analyst Report

M A N A G E M E N T S I M U LA T I ON Additional Tools/Techniques for Managing & Assessing Your Performance: 1. Accurate Sales Forecasting 2. Marketing. Evaluation Checklist 3. Round Analysis & Analyst Report

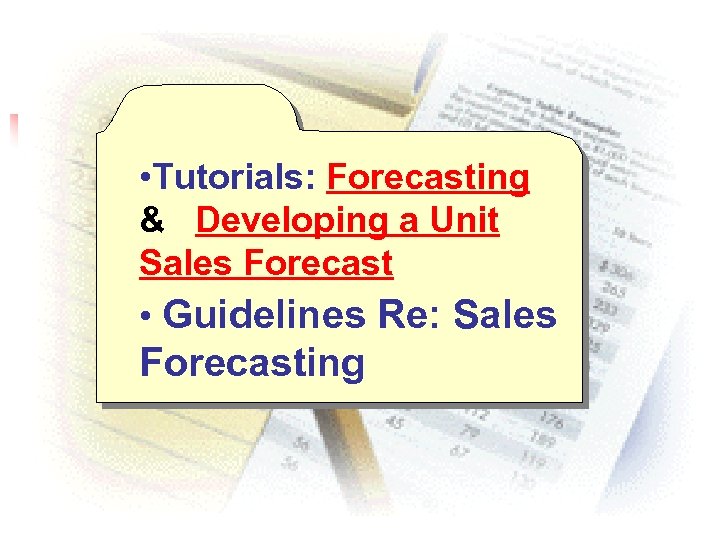

• Tutorials: Forecasting & Developing a Unit Sales Forecast • Guidelines Re: Sales Forecasting

• Tutorials: Forecasting & Developing a Unit Sales Forecast • Guidelines Re: Sales Forecasting

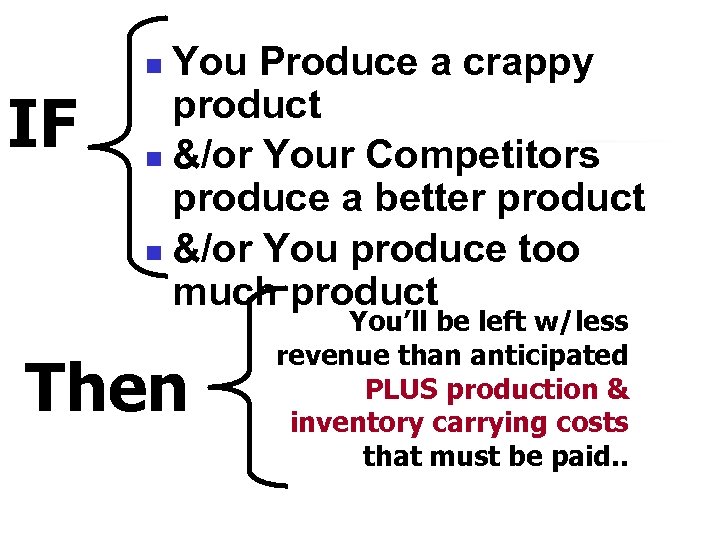

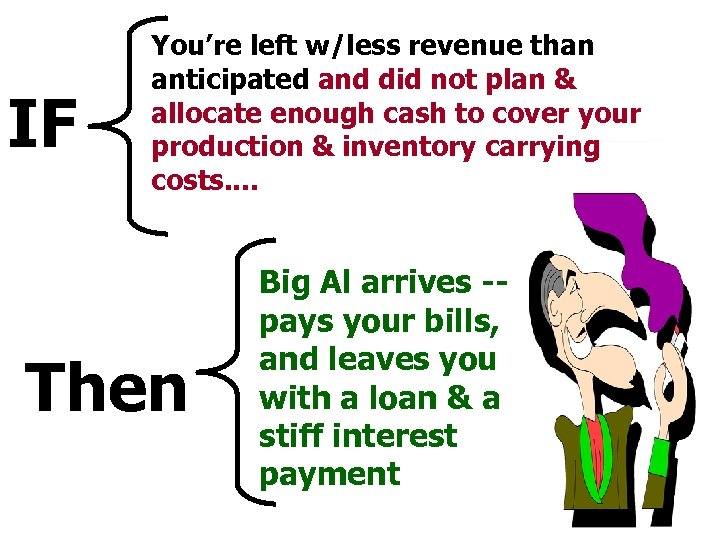

You Produce a crappy product n &/or Your Competitors produce a better product n &/or You produce too much product n IF Then You’ll be left w/less revenue than anticipated PLUS production & inventory carrying costs that must be paid. .

You Produce a crappy product n &/or Your Competitors produce a better product n &/or You produce too much product n IF Then You’ll be left w/less revenue than anticipated PLUS production & inventory carrying costs that must be paid. .

IF You’re left w/less revenue than anticipated and did not plan & allocate enough cash to cover your production & inventory carrying costs. . Then Big Al arrives -pays your bills, and leaves you with a loan & a stiff interest payment

IF You’re left w/less revenue than anticipated and did not plan & allocate enough cash to cover your production & inventory carrying costs. . Then Big Al arrives -pays your bills, and leaves you with a loan & a stiff interest payment

In order to: • Avoid “Big AL” & a Liquidity Crisis- Need to: • Maintain Adequate working capital & cash reserves • Have realistic/ accurate sales forecasts

In order to: • Avoid “Big AL” & a Liquidity Crisis- Need to: • Maintain Adequate working capital & cash reserves • Have realistic/ accurate sales forecasts

Sales Forecasting 1. Quick N’ Dirty 2. Consumer Pref’s 3. Best / Worst Case

Sales Forecasting 1. Quick N’ Dirty 2. Consumer Pref’s 3. Best / Worst Case

Estimate Your FAIR SHARE Answer 2 Q’s: 1. What will average product sell in this segment next round? 2. To what degree is your product above or below average- on consumers'’ buying criteria?

Estimate Your FAIR SHARE Answer 2 Q’s: 1. What will average product sell in this segment next round? 2. To what degree is your product above or below average- on consumers'’ buying criteria?

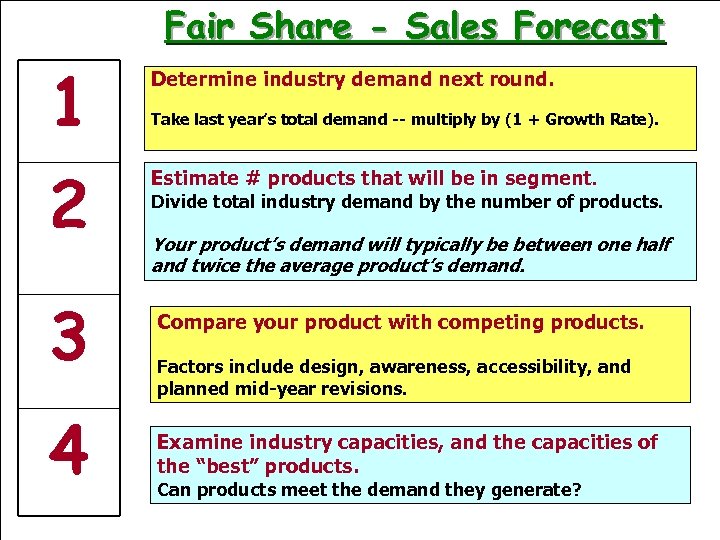

Fair Share - Sales Forecast 1 2 3 4 Determine industry demand next round. Take last year’s total demand -- multiply by (1 + Growth Rate). Estimate # products that will be in segment. Divide total industry demand by the number of products. Your product’s demand will typically be between one half and twice the average product’s demand. Compare your product with competing products. Factors include design, awareness, accessibility, and planned mid-year revisions. Examine industry capacities, and the capacities of the “best” products. Can products meet the demand they generate?

Fair Share - Sales Forecast 1 2 3 4 Determine industry demand next round. Take last year’s total demand -- multiply by (1 + Growth Rate). Estimate # products that will be in segment. Divide total industry demand by the number of products. Your product’s demand will typically be between one half and twice the average product’s demand. Compare your product with competing products. Factors include design, awareness, accessibility, and planned mid-year revisions. Examine industry capacities, and the capacities of the “best” products. Can products meet the demand they generate?

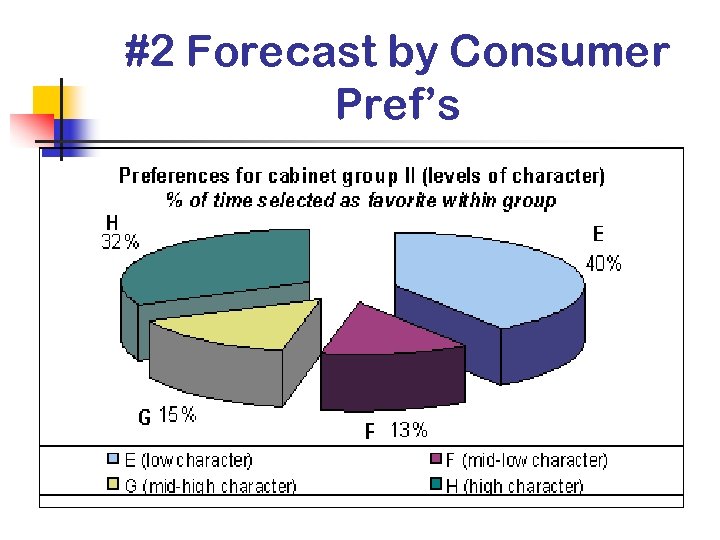

#2 Forecast by Consumer Pref’s

#2 Forecast by Consumer Pref’s

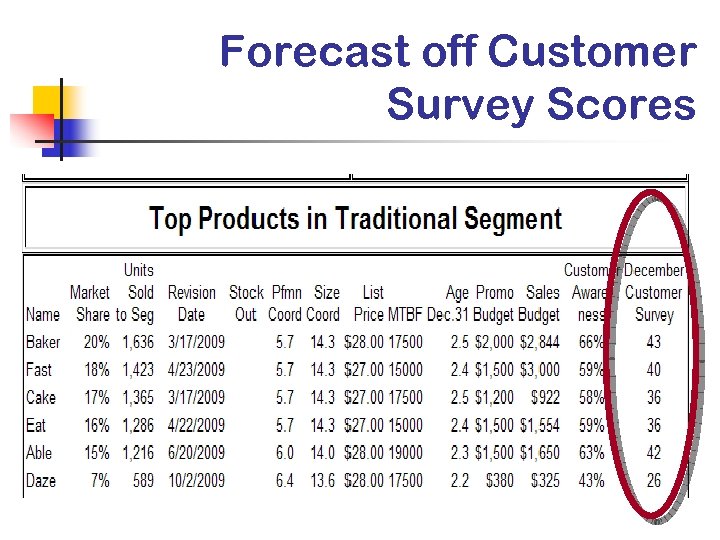

Forecast off Customer Survey Scores

Forecast off Customer Survey Scores

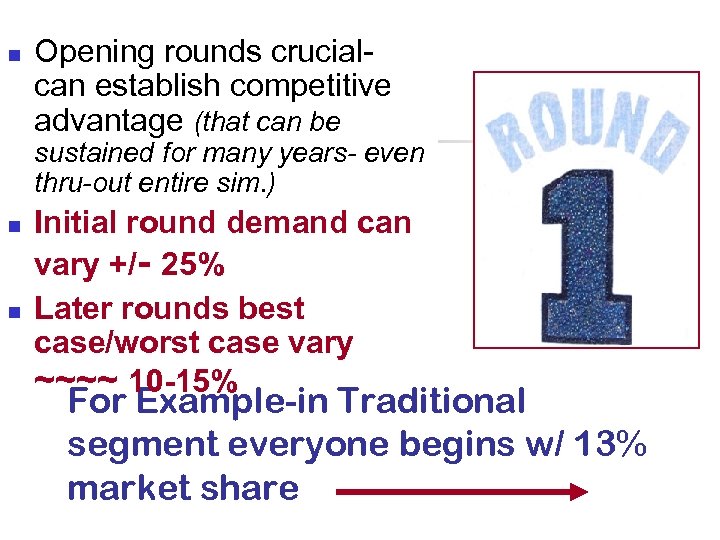

n Opening rounds crucialcan establish competitive advantage (that can be sustained for many years- even thru-out entire sim. ) n n Initial round demand can vary +/- 25% Later rounds best case/worst case vary ~~~~ 10 -15% For Example-in Traditional segment everyone begins w/ 13% market share

n Opening rounds crucialcan establish competitive advantage (that can be sustained for many years- even thru-out entire sim. ) n n Initial round demand can vary +/- 25% Later rounds best case/worst case vary ~~~~ 10 -15% For Example-in Traditional segment everyone begins w/ 13% market share

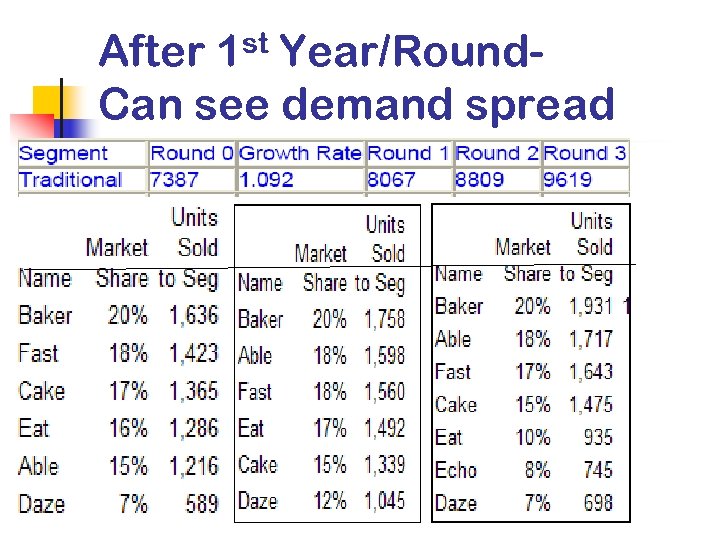

After 1 st Year/Round. Can see demand spread

After 1 st Year/Round. Can see demand spread

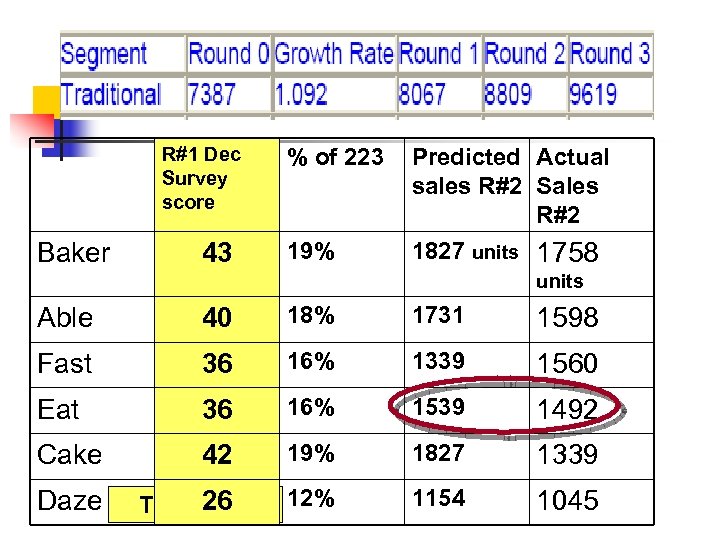

R#1 Dec Survey score Baker 43 % of 223 19% Predicted Actual sales R#2 Sales R#2 1827 units 1758 units Able 40 18% 1731 1598 Fast 36 16% 1339 1560 Eat 36 16% 1539 1492 Cake 42 19% 1827 1339 12% 1154 1045 Daze 26 Total=223

R#1 Dec Survey score Baker 43 % of 223 19% Predicted Actual sales R#2 Sales R#2 1827 units 1758 units Able 40 18% 1731 1598 Fast 36 16% 1339 1560 Eat 36 16% 1539 1492 Cake 42 19% 1827 1339 12% 1154 1045 Daze 26 Total=223

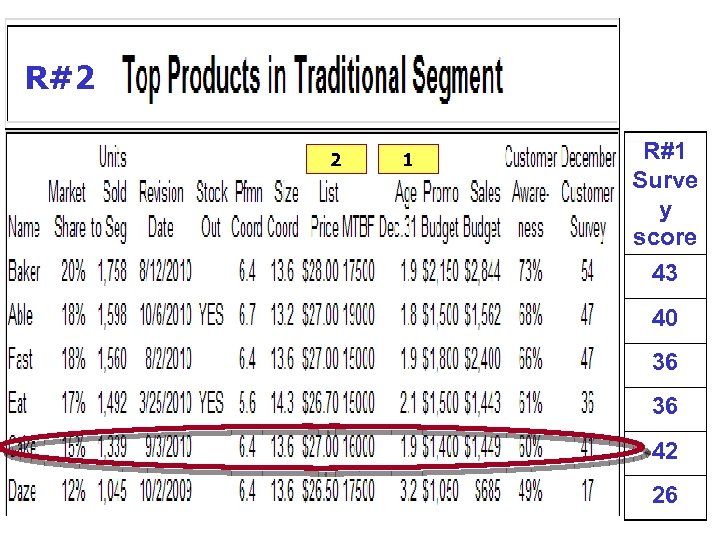

R#2 2 1 R#1 Surve y score 43 40 36 36 42 26

R#2 2 1 R#1 Surve y score 43 40 36 36 42 26

CAS E CAS

CAS E CAS

n Worst Case: n BIG INVENTORY/ little cash n Best case: n Lots of CASH / little Inventory

n Worst Case: n BIG INVENTORY/ little cash n Best case: n Lots of CASH / little Inventory

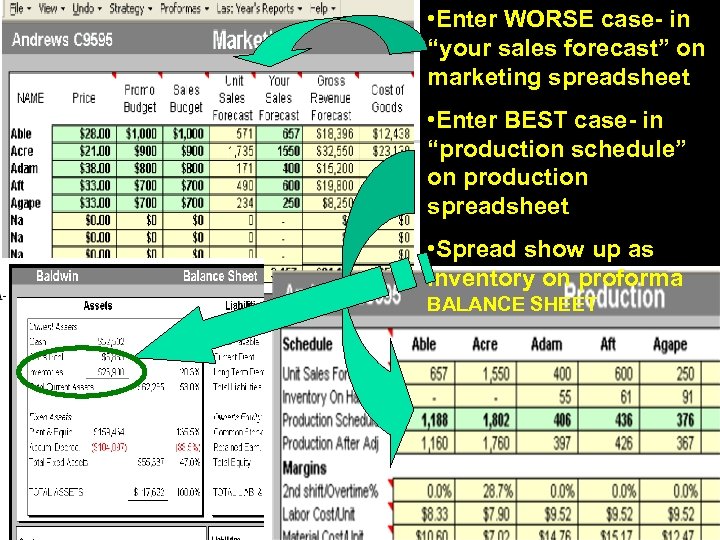

• Enter WORSE case- in “your sales forecast” on marketing spreadsheet • Enter BEST case- in “production schedule” on production spreadsheet • Spread show up as inventory on proforma BALANCE SHEET

• Enter WORSE case- in “your sales forecast” on marketing spreadsheet • Enter BEST case- in “production schedule” on production spreadsheet • Spread show up as inventory on proforma BALANCE SHEET

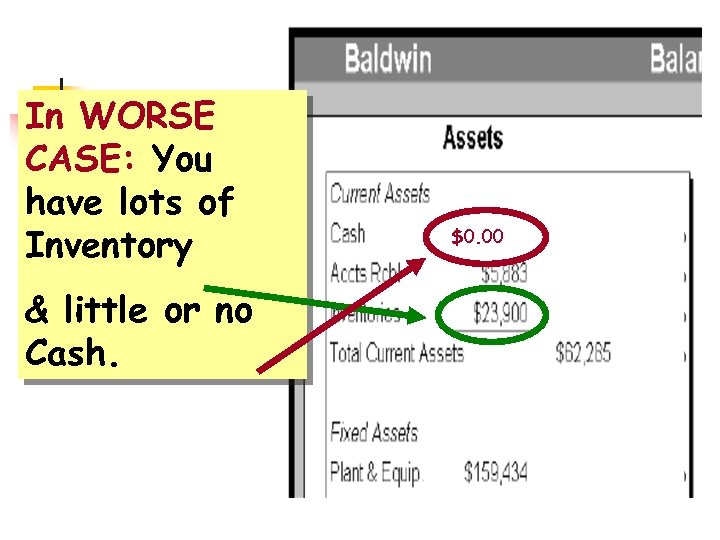

In WORSE CASE: You have lots of Inventory & little or no Cash. $0. 00

In WORSE CASE: You have lots of Inventory & little or no Cash. $0. 00

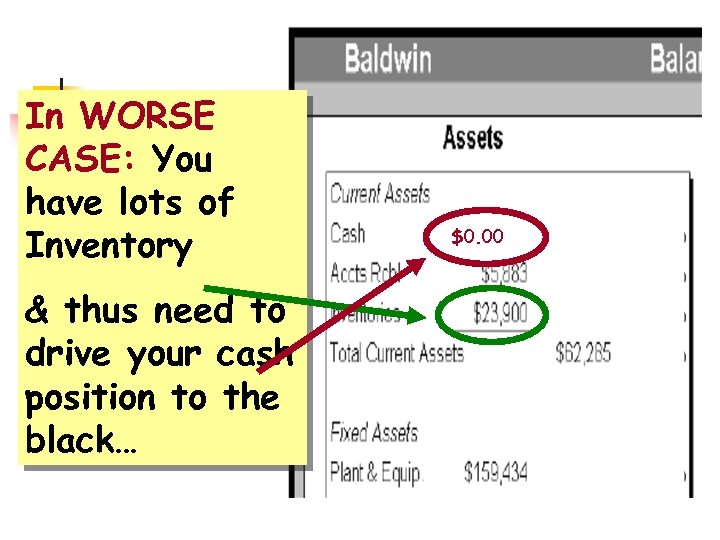

In WORSE CASE: You have lots of Inventory & thus need to drive your cash position to the black… $0. 00

In WORSE CASE: You have lots of Inventory & thus need to drive your cash position to the black… $0. 00

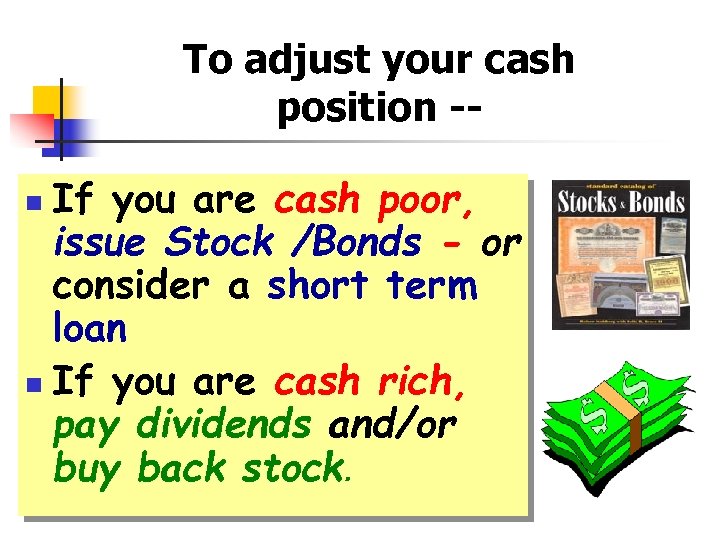

To adjust your cash position -If you are cash poor, issue Stock /Bonds - or consider a short term loan n If you are cash rich, pay dividends and/or buy back stock. n

To adjust your cash position -If you are cash poor, issue Stock /Bonds - or consider a short term loan n If you are cash rich, pay dividends and/or buy back stock. n

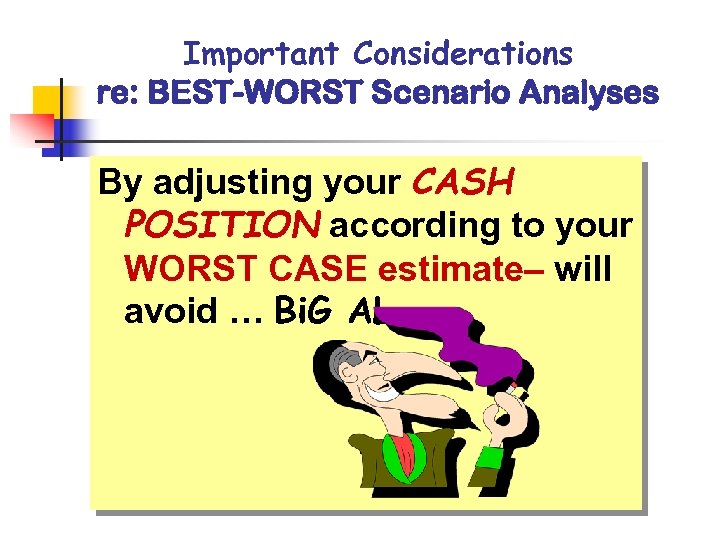

Important Considerations re: BEST-WORST Scenario Analyses By adjusting your CASH POSITION according to your WORST CASE estimate– will avoid … Bi. G AL

Important Considerations re: BEST-WORST Scenario Analyses By adjusting your CASH POSITION according to your WORST CASE estimate– will avoid … Bi. G AL

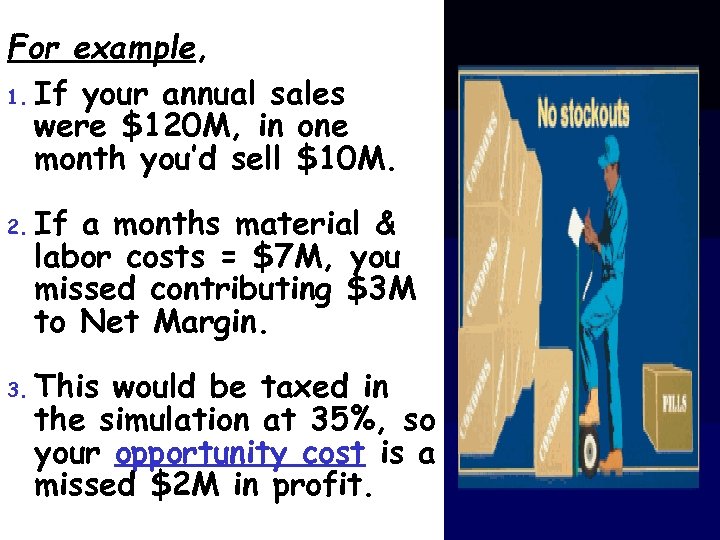

Important Considerations re: BEST-WORST Scenario Analyses By adjusting production according to BEST CASE estimate– will minimize loss of profit due to Stock-outs n Fixed costs (marketing, R&D, interest or depreciation) n already covered Thus, any additional sales would only incur variable (production) costs

Important Considerations re: BEST-WORST Scenario Analyses By adjusting production according to BEST CASE estimate– will minimize loss of profit due to Stock-outs n Fixed costs (marketing, R&D, interest or depreciation) n already covered Thus, any additional sales would only incur variable (production) costs

For example, 1. If your annual sales were $120 M, in one month you’d sell $10 M. 2. 3. If a months material & labor costs = $7 M, you missed contributing $3 M to Net Margin. This would be taxed in the simulation at 35%, so your opportunity cost is a missed $2 M in profit.

For example, 1. If your annual sales were $120 M, in one month you’d sell $10 M. 2. 3. If a months material & labor costs = $7 M, you missed contributing $3 M to Net Margin. This would be taxed in the simulation at 35%, so your opportunity cost is a missed $2 M in profit.

How Big is your Slinky? n Worst Case: n BIG INVENTORY/ no cash– risk seeing Big Al n Best case: n Lots of CASH / no Inventory -you risk

How Big is your Slinky? n Worst Case: n BIG INVENTORY/ no cash– risk seeing Big Al n Best case: n Lots of CASH / no Inventory -you risk

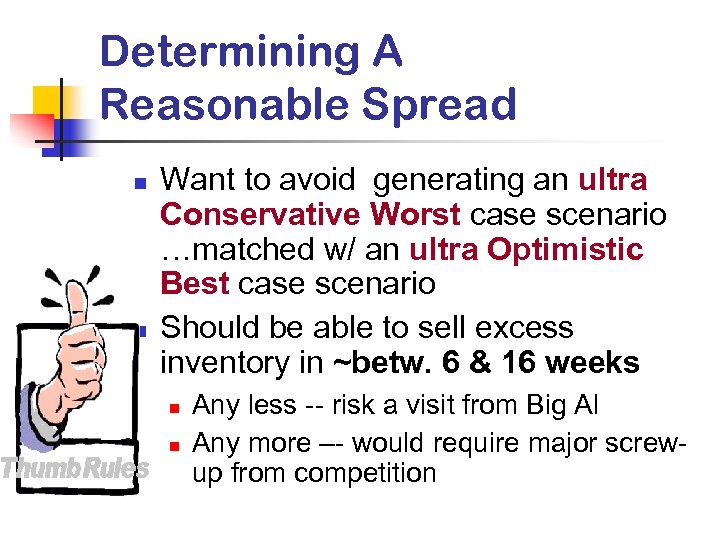

Determining A Reasonable Spread n n Want to avoid generating an ultra Conservative Worst case scenario …matched w/ an ultra Optimistic Best case scenario Should be able to sell excess inventory in ~betw. 6 & 16 weeks n n Any less -- risk a visit from Big Al Any more –- would require major screwup from competition

Determining A Reasonable Spread n n Want to avoid generating an ultra Conservative Worst case scenario …matched w/ an ultra Optimistic Best case scenario Should be able to sell excess inventory in ~betw. 6 & 16 weeks n n Any less -- risk a visit from Big Al Any more –- would require major screwup from competition

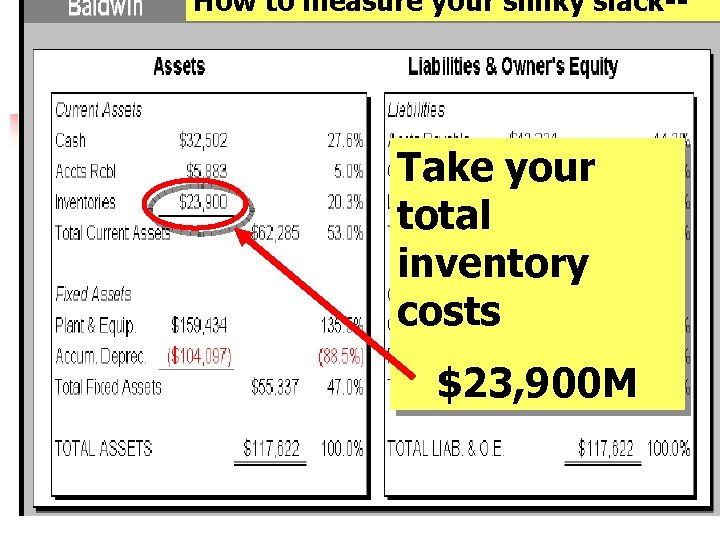

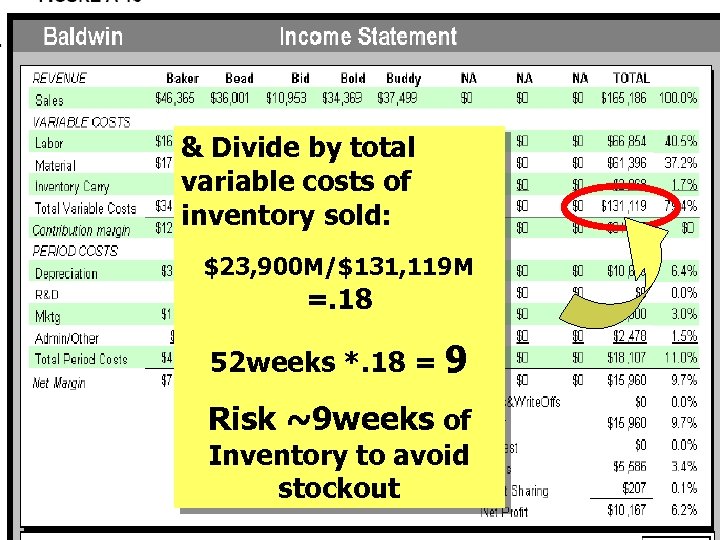

How to measure your slinky slack-- Take your total inventory costs $23, 900 M

How to measure your slinky slack-- Take your total inventory costs $23, 900 M

& Divide by total variable costs of inventory sold: $23, 900 M/$131, 119 M =. 18 52 weeks *. 18 = 9 Risk ~9 weeks of Inventory to avoid stockout

& Divide by total variable costs of inventory sold: $23, 900 M/$131, 119 M =. 18 52 weeks *. 18 = 9 Risk ~9 weeks of Inventory to avoid stockout

Additional Tools/Techniques for Managing & Assessing Your Performance: 1. Accurate Sales Forecasting 2. Marketing. Evaluation Checklist 3. Round Analysis & Analyst Report

Additional Tools/Techniques for Managing & Assessing Your Performance: 1. Accurate Sales Forecasting 2. Marketing. Evaluation Checklist 3. Round Analysis & Analyst Report

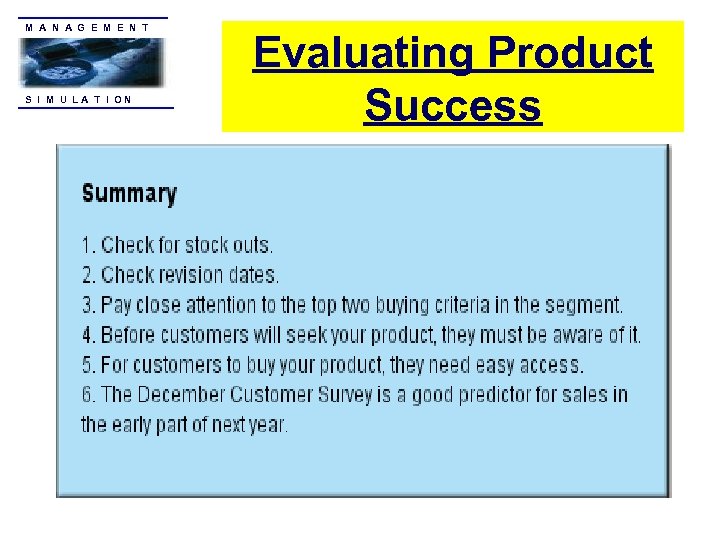

M A N A G E M E N T S I M U LA T I ON Evaluating Product Success

M A N A G E M E N T S I M U LA T I ON Evaluating Product Success

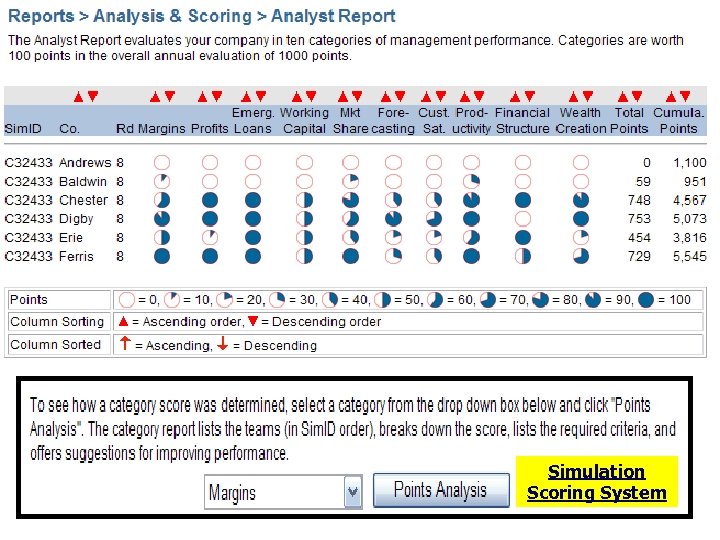

M A N A G E M E N T S I M U LA T I ON Simulation Scoring System

M A N A G E M E N T S I M U LA T I ON Simulation Scoring System

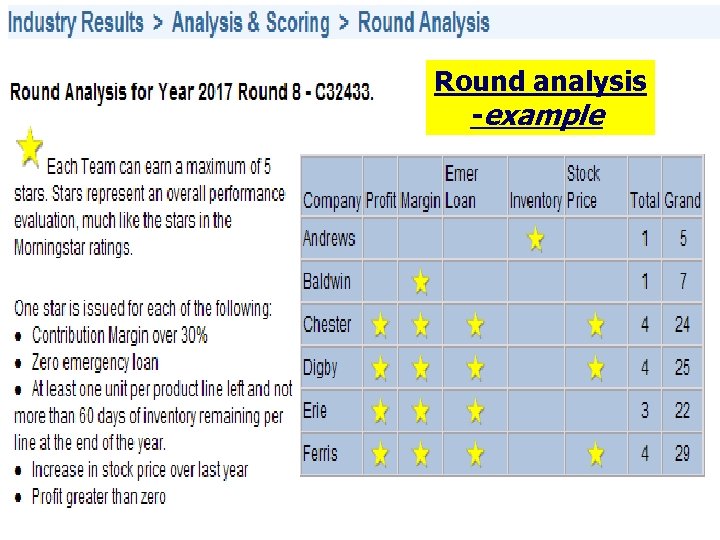

M A N A G E M E N T S I M U LA T I ON Round analysis -example

M A N A G E M E N T S I M U LA T I ON Round analysis -example

M A N A G E M E N T S I M U LA T I ON One more thing to think about: The Relationship between Your Strategy & Success Measures

M A N A G E M E N T S I M U LA T I ON One more thing to think about: The Relationship between Your Strategy & Success Measures

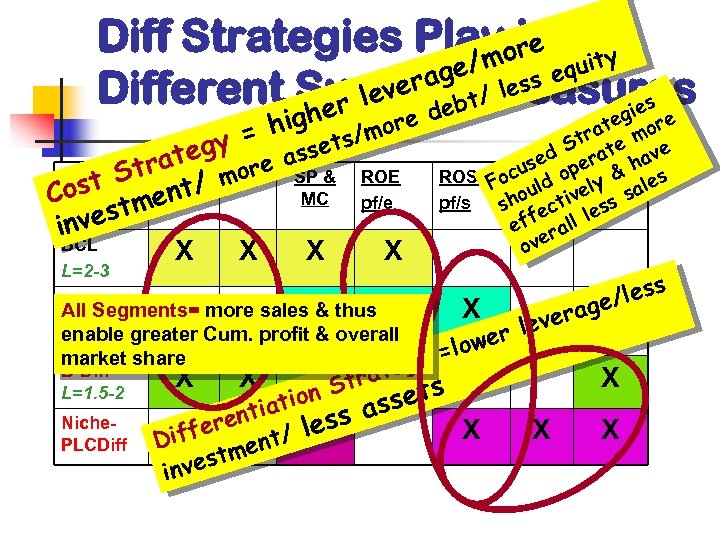

Diff Strategies Playointoity re ge/m ss equ vera bt/Measures Different Success le e s er l de gie h hig s/more y = sset ateg MSre a. SP & ROE Str. Profit mo ost ment/ C MC pf/e t s inve BCL X X ate more r St ate ve d er use op. ROA ha s & ROS Foc. AT d l vely sale ou pf/s shs/aecti pf/as s ff all le e r ove L=2 -3 All Segments= more sales. X thus X & X r Niche & leve enable greater Cum. profit & overall r PLC owe l market share gy = B-Diff L=1. 5 -2 Niche. PLCDiff s s e/le ag Cost- X Strate s t n atio s asse i rent Xs X ffe / le Di nt X X e i m vest n X X X

Diff Strategies Playointoity re ge/m ss equ vera bt/Measures Different Success le e s er l de gie h hig s/more y = sset ateg MSre a. SP & ROE Str. Profit mo ost ment/ C MC pf/e t s inve BCL X X ate more r St ate ve d er use op. ROA ha s & ROS Foc. AT d l vely sale ou pf/s shs/aecti pf/as s ff all le e r ove L=2 -3 All Segments= more sales. X thus X & X r Niche & leve enable greater Cum. profit & overall r PLC owe l market share gy = B-Diff L=1. 5 -2 Niche. PLCDiff s s e/le ag Cost- X Strate s t n atio s asse i rent Xs X ffe / le Di nt X X e i m vest n X X X

M A R KE T I N G M A N A G E M E N T • Select Success Measures & Determine Relative Weightings • Need to enter weightings – prior to round-1

M A R KE T I N G M A N A G E M E N T • Select Success Measures & Determine Relative Weightings • Need to enter weightings – prior to round-1

This week’s assignment: 1) Draft- Financial Objectives & Tactics 2) Draft- Mission & Vision Statements

This week’s assignment: 1) Draft- Financial Objectives & Tactics 2) Draft- Mission & Vision Statements