311dbbabfe79f51c7451d2e288f486e3.ppt

- Количество слайдов: 140

LUCUMA EXPORT MARKET - USA PHASES I, II & III REPORT 04 Diciembre 2006

LUCUMA EXPORT MARKET - USA PHASES I, II & III REPORT 04 Diciembre 2006

INTRODUCCIÓN La siguiente presentación ha sido preparada siguiendo estrictamente los puntos definidos en los Términos de Referencia para la consultoría: “Estudio para la selección de un mercado objetivo para la exportación de Lúcuma y la elaboración de plan de acción para promover las exportaciones del referido producto al mercado seleccionado”. El presente documento constituye el informe preliminar de la consultoría, que incluye, como se estipula en el contrato, sólo los puntos 1 -4 descritos en los Términos de Referencia. El informe consta de un total de 37 vistas (diapositivas) elaboradas por la empresa consultora – Tiara International Conuslting, con apoyo de au asociada para temas agrarios, ACM Perú. 2

INTRODUCCIÓN La siguiente presentación ha sido preparada siguiendo estrictamente los puntos definidos en los Términos de Referencia para la consultoría: “Estudio para la selección de un mercado objetivo para la exportación de Lúcuma y la elaboración de plan de acción para promover las exportaciones del referido producto al mercado seleccionado”. El presente documento constituye el informe preliminar de la consultoría, que incluye, como se estipula en el contrato, sólo los puntos 1 -4 descritos en los Términos de Referencia. El informe consta de un total de 37 vistas (diapositivas) elaboradas por la empresa consultora – Tiara International Conuslting, con apoyo de au asociada para temas agrarios, ACM Perú. 2

ANÁLISIS DE LOS CULTIVOS DE LÚCUMA EXISTENTES Y SU PRODUCCIÓN 1. 1 Evaluar la extensión de tierras cultivadas con Lúcuma . – Total hectáreas de lúcuma: Si bien las cifras oficiales señalan alrededor de 850 ha, ese dato no se ajusta a la realidad del cultivo. – Los especialistas, conjuntamente con los asociados de Prolúcuma, consideran que existen por encima de 1500 ha plantadas (entre 1700 y 1800). – Sólo en Huaral hay más de 100 (Prolucuma Huaral). – Total de hectáreas en producción actualmente 500 – 600 ha hasta 800 quizás y total de hectáreas en crecimiento 700 a 800 ha. – Los beneficiarios consideran que es importante el tema de calidad y saber cuál es la oferta de calidad y no saber cuántas hectáreas hay en general. 1. 2 Evaluar la producción de Lúcuma en términos de rendimiento por hectárea. – En Promedio se ha llegado hasta 15 toneladas y pudiera ser más si es que no existiera alternancia y se tuvieran ecotipos seleccionados por lugar de producción, con poca variabilidad genética. – Existen 120 biotipos de Lúcuma y hay casos que muestran en una misma chacra hasta 36 variedades; esta gran diversidad genética genera una baja producción. – Cada viverista ofrece sus selecciones al mercado, pero hay poco respaldo científico en esas ventas y es poco lo que hace el SENASA para garantizar la pureza y la sanidad vegetal en los plantones. 1. 3 Estimar el crecimiento de las áreas cultivadas en los últimos diez años. – La data es insuficiente para poder determinar este punto. 3

ANÁLISIS DE LOS CULTIVOS DE LÚCUMA EXISTENTES Y SU PRODUCCIÓN 1. 1 Evaluar la extensión de tierras cultivadas con Lúcuma . – Total hectáreas de lúcuma: Si bien las cifras oficiales señalan alrededor de 850 ha, ese dato no se ajusta a la realidad del cultivo. – Los especialistas, conjuntamente con los asociados de Prolúcuma, consideran que existen por encima de 1500 ha plantadas (entre 1700 y 1800). – Sólo en Huaral hay más de 100 (Prolucuma Huaral). – Total de hectáreas en producción actualmente 500 – 600 ha hasta 800 quizás y total de hectáreas en crecimiento 700 a 800 ha. – Los beneficiarios consideran que es importante el tema de calidad y saber cuál es la oferta de calidad y no saber cuántas hectáreas hay en general. 1. 2 Evaluar la producción de Lúcuma en términos de rendimiento por hectárea. – En Promedio se ha llegado hasta 15 toneladas y pudiera ser más si es que no existiera alternancia y se tuvieran ecotipos seleccionados por lugar de producción, con poca variabilidad genética. – Existen 120 biotipos de Lúcuma y hay casos que muestran en una misma chacra hasta 36 variedades; esta gran diversidad genética genera una baja producción. – Cada viverista ofrece sus selecciones al mercado, pero hay poco respaldo científico en esas ventas y es poco lo que hace el SENASA para garantizar la pureza y la sanidad vegetal en los plantones. 1. 3 Estimar el crecimiento de las áreas cultivadas en los últimos diez años. – La data es insuficiente para poder determinar este punto. 3

ANÁLISIS DE LOS CULTIVOS DE LÚCUMA EXISTENTES Y SU PRODUCCIÓN (CONT. ) 1. 4 Estimar el crecimiento de la producción de Lúcuma el mismo periodo. – La producción total por hectárea (el rendimiento/ha) se va a incrementar en el Perú en los próximos años, dado que las plantaciones mdernas sembradas en los últimos 5 -8 años empezarán a alcanzar sus máximos rendimientos, elevando el ratio promedio de Tm/ha. Sin embargo, es difícil obtener una cifra confiable de esto. 1. 5 Estimar el costo de producción de Lúcuma. – – – El riego tecnificado es recomendable en algunas áreas de la costa y es el costo más alto dentro de los componentes de los costos de instalación. US$ 2500/ha (riego tecnificado) vs. US$ 850/ha con baja tecnologia (riego por gravedad). Si bien algunas plantaciones en la costa son conducidas por riego por gravedad, dado que el Peru es una de las zonas más secas de todo el hemisferio, en el mediano plazo, será imprescindible la instalación de riego tecnificado. El costo del manejo en comparación con otros frutales es mucho menor, especialmente porque la lúcuma se considera un cultivo rústico que requiere aplicaciones de controladores fitosanitarios en menor frecuencia. Costo de mantenimiento fluctúa entre US$ 1000 a US$ 1200 el primer año; dependiendo del sistema de riego que se haya considerado. Los costos de mantenimiento del cultivo (s/incluir cosecha) son de unos US$ 850 del segundo año en adelante. 4

ANÁLISIS DE LOS CULTIVOS DE LÚCUMA EXISTENTES Y SU PRODUCCIÓN (CONT. ) 1. 4 Estimar el crecimiento de la producción de Lúcuma el mismo periodo. – La producción total por hectárea (el rendimiento/ha) se va a incrementar en el Perú en los próximos años, dado que las plantaciones mdernas sembradas en los últimos 5 -8 años empezarán a alcanzar sus máximos rendimientos, elevando el ratio promedio de Tm/ha. Sin embargo, es difícil obtener una cifra confiable de esto. 1. 5 Estimar el costo de producción de Lúcuma. – – – El riego tecnificado es recomendable en algunas áreas de la costa y es el costo más alto dentro de los componentes de los costos de instalación. US$ 2500/ha (riego tecnificado) vs. US$ 850/ha con baja tecnologia (riego por gravedad). Si bien algunas plantaciones en la costa son conducidas por riego por gravedad, dado que el Peru es una de las zonas más secas de todo el hemisferio, en el mediano plazo, será imprescindible la instalación de riego tecnificado. El costo del manejo en comparación con otros frutales es mucho menor, especialmente porque la lúcuma se considera un cultivo rústico que requiere aplicaciones de controladores fitosanitarios en menor frecuencia. Costo de mantenimiento fluctúa entre US$ 1000 a US$ 1200 el primer año; dependiendo del sistema de riego que se haya considerado. Los costos de mantenimiento del cultivo (s/incluir cosecha) son de unos US$ 850 del segundo año en adelante. 4

ANÁLISIS DE LOS CULTIVOS DE LÚCUMA EXISTENTES Y SU PRODUCCIÓN (CONT. ) 1. 6 Enumerar los beneficios medicinales del uso de Lúcuma como complemento dietético. – Este punto no se consideró aplicable. En todo caso, de manera popular se conoce que la pepa de la lúcuma es buena para controlar la caída del cabello. Fruta con gran cantidad de proteínas, carbohidratos y azúcares. También contiene vitaminas y minerales. En todo caso no se considera la lúcuma un cultivo cuya aceptación en el mercado este estrechamente vinculada a sus propiedades nutraceúticas, por lo que este tema no se desarolló a profundidad. Más aun, para explotar estas cualidades, las supuestas propiedades deberán estar respaldadas por estudios clínicos a nivel internacional 1. 7 Estimar el crecimiento del área de cultivo contra el incremento de rendimiento/ha – La data es insuficiente para poder determinar este punto. 5

ANÁLISIS DE LOS CULTIVOS DE LÚCUMA EXISTENTES Y SU PRODUCCIÓN (CONT. ) 1. 6 Enumerar los beneficios medicinales del uso de Lúcuma como complemento dietético. – Este punto no se consideró aplicable. En todo caso, de manera popular se conoce que la pepa de la lúcuma es buena para controlar la caída del cabello. Fruta con gran cantidad de proteínas, carbohidratos y azúcares. También contiene vitaminas y minerales. En todo caso no se considera la lúcuma un cultivo cuya aceptación en el mercado este estrechamente vinculada a sus propiedades nutraceúticas, por lo que este tema no se desarolló a profundidad. Más aun, para explotar estas cualidades, las supuestas propiedades deberán estar respaldadas por estudios clínicos a nivel internacional 1. 7 Estimar el crecimiento del área de cultivo contra el incremento de rendimiento/ha – La data es insuficiente para poder determinar este punto. 5

6

6

7

7

8

8

VENTAJAS Y DESVENTAJAS DE LA LÚCUMA n Ventajas: – – – – De acuerdo a los actuales clientes, el sabor y el aroma son los prinicplaes atractivos. También el color. Las tendencias mundiales hacia lo étnico y el probar productos nuevos son una ventaja para la lúcuma. La parte industrial no aumenta no tiene un alto impacto en el costo de producción de derivados. Es decir, daría igual procesar una lúcuma o un mango; por lo que se considera que los costos de procesamientos no incrementan el precio comparándolo con otras frutas. El árbol es rústico, tiene pocas plagas y enfermedades Frutal semi caducifolio, adaptado desde el nivel del mar hasta los 2800 msnm. El cultivo de la lúcuma se adapta a diferentes clases de suelo, teniendo tolerancia media a la salinidad. El ph óptimo de este es 7 (neutro). Este cultivo por sus características es posible de llevarlo de forma casi orgánica, con un mínimo indispensable de agroquímicos. 9

VENTAJAS Y DESVENTAJAS DE LA LÚCUMA n Ventajas: – – – – De acuerdo a los actuales clientes, el sabor y el aroma son los prinicplaes atractivos. También el color. Las tendencias mundiales hacia lo étnico y el probar productos nuevos son una ventaja para la lúcuma. La parte industrial no aumenta no tiene un alto impacto en el costo de producción de derivados. Es decir, daría igual procesar una lúcuma o un mango; por lo que se considera que los costos de procesamientos no incrementan el precio comparándolo con otras frutas. El árbol es rústico, tiene pocas plagas y enfermedades Frutal semi caducifolio, adaptado desde el nivel del mar hasta los 2800 msnm. El cultivo de la lúcuma se adapta a diferentes clases de suelo, teniendo tolerancia media a la salinidad. El ph óptimo de este es 7 (neutro). Este cultivo por sus características es posible de llevarlo de forma casi orgánica, con un mínimo indispensable de agroquímicos. 9

VENTAJAS Y DESVENTAJAS DE LA LÚCUMA (CONT. ) n Desventajas: – Producto caro: tiene baja productividad y altos costos de instalación porque se demora 4 a 5 años en entrar en producción (costo acumulado de instalación y mantenimiento). El costo final de producción por kilo repercute en su potencial precio de venta. – Heterogeneidad de producto: Eso también se debe a que los pequeños productores tienen pocas hectáreas con una alta diversidad genética, enfrenteda además a una diversidad de limas y a tecnologías de manejo, que finalmente producen calidades distintas. – No está estandarizada la planta ni el producto cosechado. Los parámetros de distinción entre primera, segunda y tercerca, varían. – El precio de la pulpa ofrecido en los mercados internacionales, es demasiado caro y el cliente pierde interés. – Falta de estrategias de promoción y difusión de la información por parte de Prolúcuma. – Falta de cantidad de hectáreas y estacionalidad hace difícil poder programar los volúmenes de exportación. – En verano la Lúcuma es muy rica amarilla pero en invierno cambia, puede ofrecer 4 colores: blanquisca, blanca dulce, blanca desabrida y marronesca – los expertos recomiendan que hay que agostar la planta y no dejar que la fruta salga en invierno. 10

VENTAJAS Y DESVENTAJAS DE LA LÚCUMA (CONT. ) n Desventajas: – Producto caro: tiene baja productividad y altos costos de instalación porque se demora 4 a 5 años en entrar en producción (costo acumulado de instalación y mantenimiento). El costo final de producción por kilo repercute en su potencial precio de venta. – Heterogeneidad de producto: Eso también se debe a que los pequeños productores tienen pocas hectáreas con una alta diversidad genética, enfrenteda además a una diversidad de limas y a tecnologías de manejo, que finalmente producen calidades distintas. – No está estandarizada la planta ni el producto cosechado. Los parámetros de distinción entre primera, segunda y tercerca, varían. – El precio de la pulpa ofrecido en los mercados internacionales, es demasiado caro y el cliente pierde interés. – Falta de estrategias de promoción y difusión de la información por parte de Prolúcuma. – Falta de cantidad de hectáreas y estacionalidad hace difícil poder programar los volúmenes de exportación. – En verano la Lúcuma es muy rica amarilla pero en invierno cambia, puede ofrecer 4 colores: blanquisca, blanca dulce, blanca desabrida y marronesca – los expertos recomiendan que hay que agostar la planta y no dejar que la fruta salga en invierno. 10

11

11

LA LÚCUMA Y SUS DERIVADOS 2. 1 y 2. 2 Identificar las características, nombres y ventajas de los derivados de la Lúcuma. – Pulpa: producto libre de cutículas, cáscara y pepa. Se ha logrado hasta un 65% de rendimiento; dependiendo de la temporada. Conversion 2 a 1 de fruta a pulpa. – Congelado: § trozos IQF § trozos congelado en bloques § pasta - de producción – manual – mecánica. – Harina: Conversion de fruta fresca a harina es 5 a 1. Contiene humedad de 10% máximo. Adecuadamente almacenado (cerrado herméticamente, en ambiente fresco, seco y oscuro) puede durar hasta doce meses. – Liofilizado: tiene un sabor más intenso que la harina y conserva el aroma. Conversion de fruta fresca a liofilizado es 5 a 1 igual que para la harina. Es un producto con un mercado más específico; dado que es un poco complicado de utilizar. La mayoría de sistemas agroindustriales para producir derivados lácteos (yogures y/o helados) utilizan pulpas de frutas congeladas. Su humedad final es de 4% máximo. – Pulpa congelada: congelada por el sistema de túnel por aire forzado, logrando una temperatura estable de -18 °C. en el centro térmico del producto. 12

LA LÚCUMA Y SUS DERIVADOS 2. 1 y 2. 2 Identificar las características, nombres y ventajas de los derivados de la Lúcuma. – Pulpa: producto libre de cutículas, cáscara y pepa. Se ha logrado hasta un 65% de rendimiento; dependiendo de la temporada. Conversion 2 a 1 de fruta a pulpa. – Congelado: § trozos IQF § trozos congelado en bloques § pasta - de producción – manual – mecánica. – Harina: Conversion de fruta fresca a harina es 5 a 1. Contiene humedad de 10% máximo. Adecuadamente almacenado (cerrado herméticamente, en ambiente fresco, seco y oscuro) puede durar hasta doce meses. – Liofilizado: tiene un sabor más intenso que la harina y conserva el aroma. Conversion de fruta fresca a liofilizado es 5 a 1 igual que para la harina. Es un producto con un mercado más específico; dado que es un poco complicado de utilizar. La mayoría de sistemas agroindustriales para producir derivados lácteos (yogures y/o helados) utilizan pulpas de frutas congeladas. Su humedad final es de 4% máximo. – Pulpa congelada: congelada por el sistema de túnel por aire forzado, logrando una temperatura estable de -18 °C. en el centro térmico del producto. 12

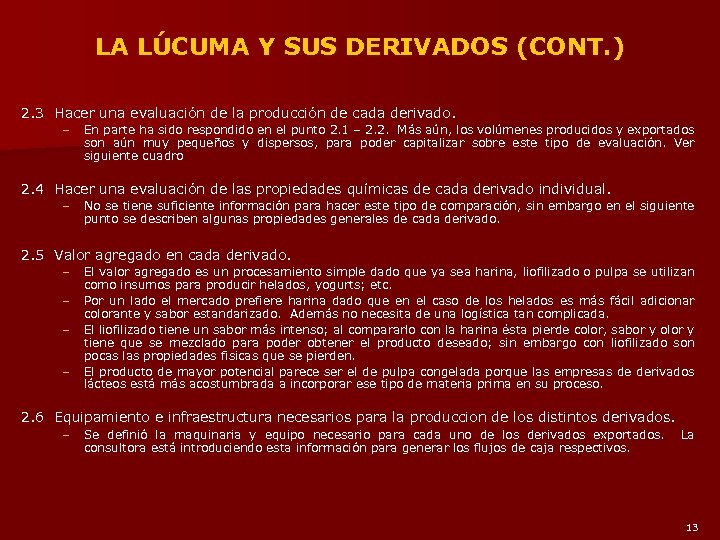

LA LÚCUMA Y SUS DERIVADOS (CONT. ) 2. 3 Hacer una evaluación de la producción de cada derivado. – En parte ha sido respondido en el punto 2. 1 – 2. 2. Más aún, los volúmenes producidos y exportados son aún muy pequeños y dispersos, para poder capitalizar sobre este tipo de evaluación. Ver siguiente cuadro 2. 4 Hacer una evaluación de las propiedades químicas de cada derivado individual. – No se tiene suficiente información para hacer este tipo de comparación, sin embargo en el siguiente punto se describen algunas propiedades generales de cada derivado. 2. 5 Valor agregado en cada derivado. – – El valor agregado es un procesamiento simple dado que ya sea harina, liofilizado o pulpa se utilizan como insumos para producir helados, yogurts; etc. Por un lado el mercado prefiere harina dado que en el caso de los helados es más fácil adicionar colorante y sabor estandarizado. Además no necesita de una logística tan complicada. El liofilizado tiene un sabor más intenso; al compararlo con la harina ésta pierde color, sabor y olor y tiene que se mezclado para poder obtener el producto deseado; sin embargo con liofilizado son pocas las propiedades fisicas que se pierden. El producto de mayor potencial parece ser el de pulpa congelada porque las empresas de derivados lácteos está más acostumbrada a incorporar ese tipo de materia prima en su proceso. 2. 6 Equipamiento e infraestructura necesarios para la produccion de los distintos derivados. – Se definió la maquinaria y equipo necesario para cada uno de los derivados exportados. La consultora está introduciendo esta información para generar los flujos de caja respectivos. 13

LA LÚCUMA Y SUS DERIVADOS (CONT. ) 2. 3 Hacer una evaluación de la producción de cada derivado. – En parte ha sido respondido en el punto 2. 1 – 2. 2. Más aún, los volúmenes producidos y exportados son aún muy pequeños y dispersos, para poder capitalizar sobre este tipo de evaluación. Ver siguiente cuadro 2. 4 Hacer una evaluación de las propiedades químicas de cada derivado individual. – No se tiene suficiente información para hacer este tipo de comparación, sin embargo en el siguiente punto se describen algunas propiedades generales de cada derivado. 2. 5 Valor agregado en cada derivado. – – El valor agregado es un procesamiento simple dado que ya sea harina, liofilizado o pulpa se utilizan como insumos para producir helados, yogurts; etc. Por un lado el mercado prefiere harina dado que en el caso de los helados es más fácil adicionar colorante y sabor estandarizado. Además no necesita de una logística tan complicada. El liofilizado tiene un sabor más intenso; al compararlo con la harina ésta pierde color, sabor y olor y tiene que se mezclado para poder obtener el producto deseado; sin embargo con liofilizado son pocas las propiedades fisicas que se pierden. El producto de mayor potencial parece ser el de pulpa congelada porque las empresas de derivados lácteos está más acostumbrada a incorporar ese tipo de materia prima en su proceso. 2. 6 Equipamiento e infraestructura necesarios para la produccion de los distintos derivados. – Se definió la maquinaria y equipo necesario para cada uno de los derivados exportados. La consultora está introduciendo esta información para generar los flujos de caja respectivos. 13

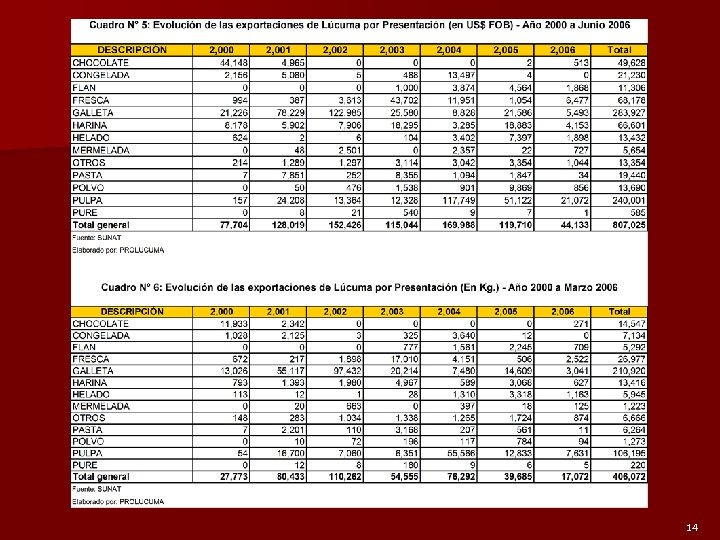

14

14

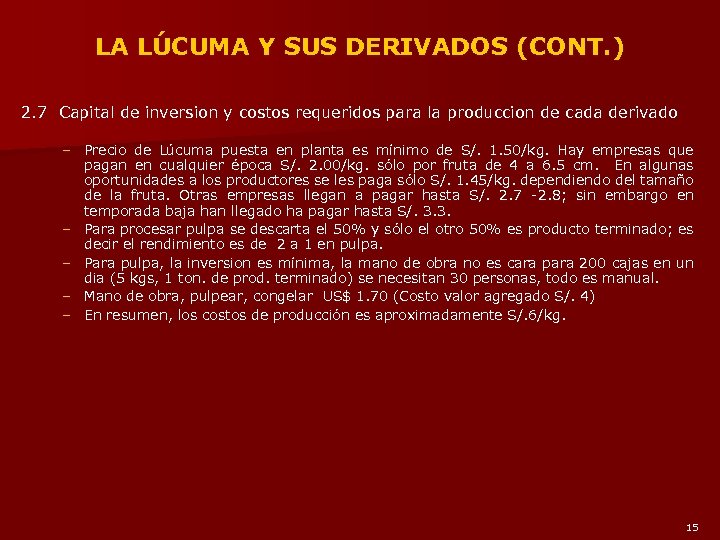

LA LÚCUMA Y SUS DERIVADOS (CONT. ) 2. 7 Capital de inversion y costos requeridos para la produccion de cada derivado – Precio de Lúcuma puesta en planta es mínimo de S/. 1. 50/kg. Hay empresas que pagan en cualquier época S/. 2. 00/kg. sólo por fruta de 4 a 6. 5 cm. En algunas oportunidades a los productores se les paga sólo S/. 1. 45/kg. dependiendo del tamaño de la fruta. Otras empresas llegan a pagar hasta S/. 2. 7 -2. 8; sin embargo en temporada baja han llegado ha pagar hasta S/. 3. 3. – Para procesar pulpa se descarta el 50% y sólo el otro 50% es producto terminado; es decir el rendimiento es de 2 a 1 en pulpa. – Para pulpa, la inversion es mínima, la mano de obra no es cara para 200 cajas en un dia (5 kgs, 1 ton. de prod. terminado) se necesitan 30 personas, todo es manual. – Mano de obra, pulpear, congelar US$ 1. 70 (Costo valor agregado S/. 4) – En resumen, los costos de producción es aproximadamente S/. 6/kg. 15

LA LÚCUMA Y SUS DERIVADOS (CONT. ) 2. 7 Capital de inversion y costos requeridos para la produccion de cada derivado – Precio de Lúcuma puesta en planta es mínimo de S/. 1. 50/kg. Hay empresas que pagan en cualquier época S/. 2. 00/kg. sólo por fruta de 4 a 6. 5 cm. En algunas oportunidades a los productores se les paga sólo S/. 1. 45/kg. dependiendo del tamaño de la fruta. Otras empresas llegan a pagar hasta S/. 2. 7 -2. 8; sin embargo en temporada baja han llegado ha pagar hasta S/. 3. 3. – Para procesar pulpa se descarta el 50% y sólo el otro 50% es producto terminado; es decir el rendimiento es de 2 a 1 en pulpa. – Para pulpa, la inversion es mínima, la mano de obra no es cara para 200 cajas en un dia (5 kgs, 1 ton. de prod. terminado) se necesitan 30 personas, todo es manual. – Mano de obra, pulpear, congelar US$ 1. 70 (Costo valor agregado S/. 4) – En resumen, los costos de producción es aproximadamente S/. 6/kg. 15

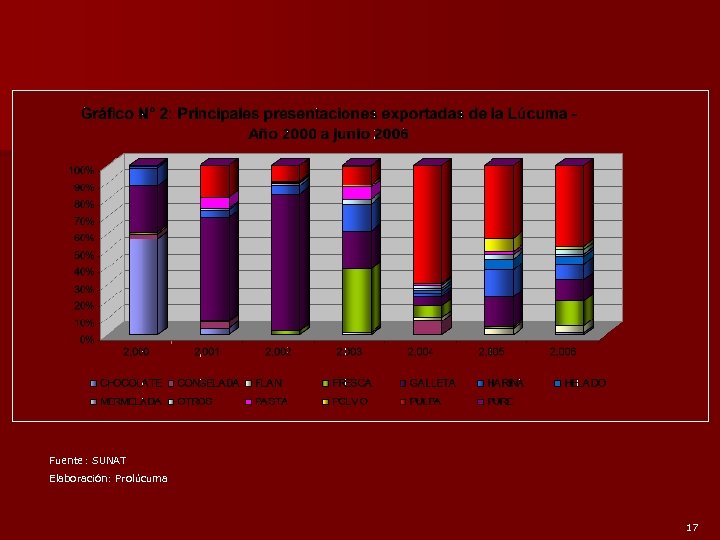

Fuente: SUNAT Elaboración: Prolúcuma 16

Fuente: SUNAT Elaboración: Prolúcuma 16

Fuente: SUNAT Elaboración: Prolúcuma 17

Fuente: SUNAT Elaboración: Prolúcuma 17

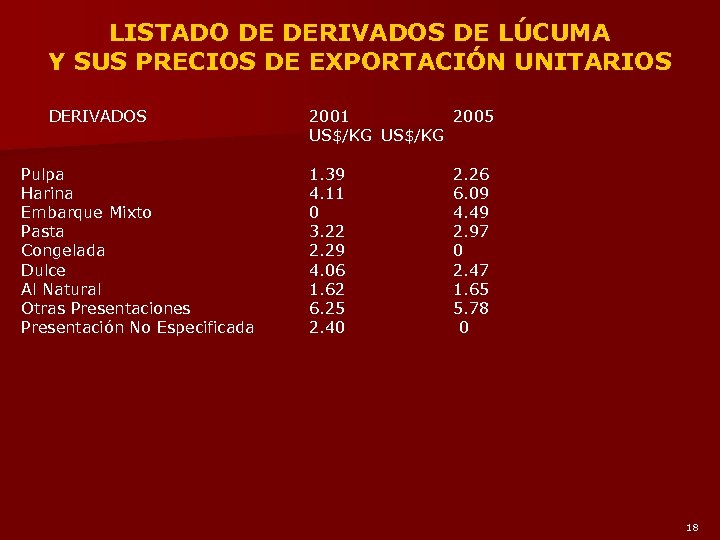

LISTADO DE DERIVADOS DE LÚCUMA Y SUS PRECIOS DE EXPORTACIÓN UNITARIOS DERIVADOS Pulpa Harina Embarque Mixto Pasta Congelada Dulce Al Natural Otras Presentaciones Presentación No Especificada 2001 2005 US$/KG 1. 39 4. 11 0 3. 22 2. 29 4. 06 1. 62 6. 25 2. 40 2. 26 6. 09 4. 49 2. 97 0 2. 47 1. 65 5. 78 0 18

LISTADO DE DERIVADOS DE LÚCUMA Y SUS PRECIOS DE EXPORTACIÓN UNITARIOS DERIVADOS Pulpa Harina Embarque Mixto Pasta Congelada Dulce Al Natural Otras Presentaciones Presentación No Especificada 2001 2005 US$/KG 1. 39 4. 11 0 3. 22 2. 29 4. 06 1. 62 6. 25 2. 40 2. 26 6. 09 4. 49 2. 97 0 2. 47 1. 65 5. 78 0 18

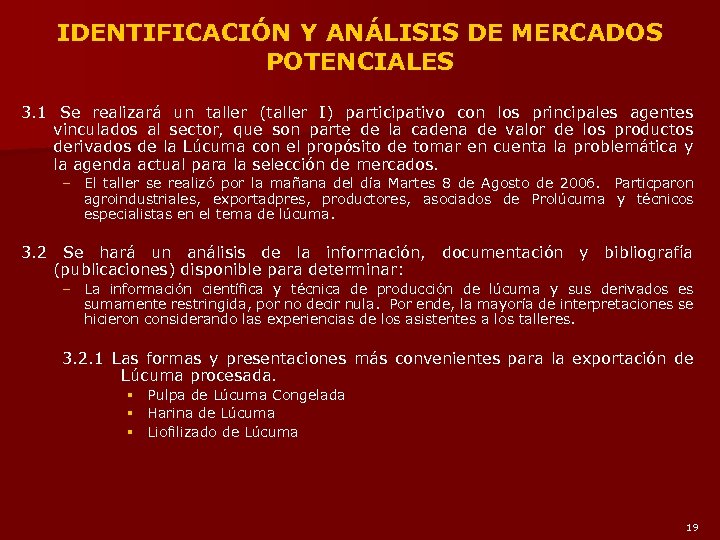

IDENTIFICACIÓN Y ANÁLISIS DE MERCADOS POTENCIALES 3. 1 Se realizará un taller (taller I) participativo con los principales agentes vinculados al sector, que son parte de la cadena de valor de los productos derivados de la Lúcuma con el propósito de tomar en cuenta la problemática y la agenda actual para la selección de mercados. – El taller se realizó por la mañana del día Martes 8 de Agosto de 2006. Particparon agroindustriales, exportadpres, productores, asociados de Prolúcuma y técnicos especialistas en el tema de lúcuma. 3. 2 Se hará un análisis de la información, documentación y bibliografía (publicaciones) disponible para determinar: – La información científica y técnica de producción de lúcuma y sus derivados es sumamente restringida, por no decir nula. Por ende, la mayoría de interpretaciones se hicieron considerando las experiencias de los asistentes a los talleres. 3. 2. 1 Las formas y presentaciones más convenientes para la exportación de Lúcuma procesada. § § § Pulpa de Lúcuma Congelada Harina de Lúcuma Liofilizado de Lúcuma 19

IDENTIFICACIÓN Y ANÁLISIS DE MERCADOS POTENCIALES 3. 1 Se realizará un taller (taller I) participativo con los principales agentes vinculados al sector, que son parte de la cadena de valor de los productos derivados de la Lúcuma con el propósito de tomar en cuenta la problemática y la agenda actual para la selección de mercados. – El taller se realizó por la mañana del día Martes 8 de Agosto de 2006. Particparon agroindustriales, exportadpres, productores, asociados de Prolúcuma y técnicos especialistas en el tema de lúcuma. 3. 2 Se hará un análisis de la información, documentación y bibliografía (publicaciones) disponible para determinar: – La información científica y técnica de producción de lúcuma y sus derivados es sumamente restringida, por no decir nula. Por ende, la mayoría de interpretaciones se hicieron considerando las experiencias de los asistentes a los talleres. 3. 2. 1 Las formas y presentaciones más convenientes para la exportación de Lúcuma procesada. § § § Pulpa de Lúcuma Congelada Harina de Lúcuma Liofilizado de Lúcuma 19

IDENTIFICACIÓN Y ANÁLISIS DE MERCADOS POTENCIALES (CONT. ) 3. 3 Se levantará información estadística confiable y desagregada. Esto incluirá precio FOB y CIF, volumen y destinos. – Precio de venta al público es de US$ 2. 20 ó US$ 2. 30/libra de pulpa. Es decir el precio por un kilogramo es de unos US$ 5. – Hay productores que compran lúcuma de Noviembre a Febrero y lo vende en Setiembre u Octubre; entonces se tiene un costo de almacenamiento en frío adicional, de US$ 30 mensuales. El producto congelado dura hasta 1. 5 años en almacen. – Los costos involucrados son: costo de bajar el contenedor; almacenaje; comisiones de venta y de crédito; costo de bolsas y cajas; costo de transporte; exportación, costo de FDA (riesgo no tarifario de hasta US$ 800); costo de “intensive search” en USA (más de US$ 1, 000 para ver si el contenedor contiene droga). En caso que el contenedor queda en “hold” hay que pagarle los gastos a la naviera porque el producto no se puede bajar del barco. A veces la autorizacion del FDA se puede demorar más de un mes. En cargas secas se tiene más problemas que en cargas congeladas. En congelado se puede quedar la carga inmobilizada de 15 a 20 días. – No hay seguro contra las inspecciones - el importador asume todos los costos. – En un contenedor se pueden transportar de 4 a 5 TM de pulpa. Por lo general los importadores compran producto un mes antes que se le acabe el contenedor anterior, por lo que generalmente se tiene una rotación de 3 a 4 meses. – Aproximadamente US$ 50, 000 es el costo de un contenedor lleno de producto. El flete no tiene un impacto fuerte; en cambio el precio final si tiene gran impacto en poder acceder al mercado o no. – Todos estos datos se incluirán en los flujos a desarrollar en el modelo financiero final. 20

IDENTIFICACIÓN Y ANÁLISIS DE MERCADOS POTENCIALES (CONT. ) 3. 3 Se levantará información estadística confiable y desagregada. Esto incluirá precio FOB y CIF, volumen y destinos. – Precio de venta al público es de US$ 2. 20 ó US$ 2. 30/libra de pulpa. Es decir el precio por un kilogramo es de unos US$ 5. – Hay productores que compran lúcuma de Noviembre a Febrero y lo vende en Setiembre u Octubre; entonces se tiene un costo de almacenamiento en frío adicional, de US$ 30 mensuales. El producto congelado dura hasta 1. 5 años en almacen. – Los costos involucrados son: costo de bajar el contenedor; almacenaje; comisiones de venta y de crédito; costo de bolsas y cajas; costo de transporte; exportación, costo de FDA (riesgo no tarifario de hasta US$ 800); costo de “intensive search” en USA (más de US$ 1, 000 para ver si el contenedor contiene droga). En caso que el contenedor queda en “hold” hay que pagarle los gastos a la naviera porque el producto no se puede bajar del barco. A veces la autorizacion del FDA se puede demorar más de un mes. En cargas secas se tiene más problemas que en cargas congeladas. En congelado se puede quedar la carga inmobilizada de 15 a 20 días. – No hay seguro contra las inspecciones - el importador asume todos los costos. – En un contenedor se pueden transportar de 4 a 5 TM de pulpa. Por lo general los importadores compran producto un mes antes que se le acabe el contenedor anterior, por lo que generalmente se tiene una rotación de 3 a 4 meses. – Aproximadamente US$ 50, 000 es el costo de un contenedor lleno de producto. El flete no tiene un impacto fuerte; en cambio el precio final si tiene gran impacto en poder acceder al mercado o no. – Todos estos datos se incluirán en los flujos a desarrollar en el modelo financiero final. 20

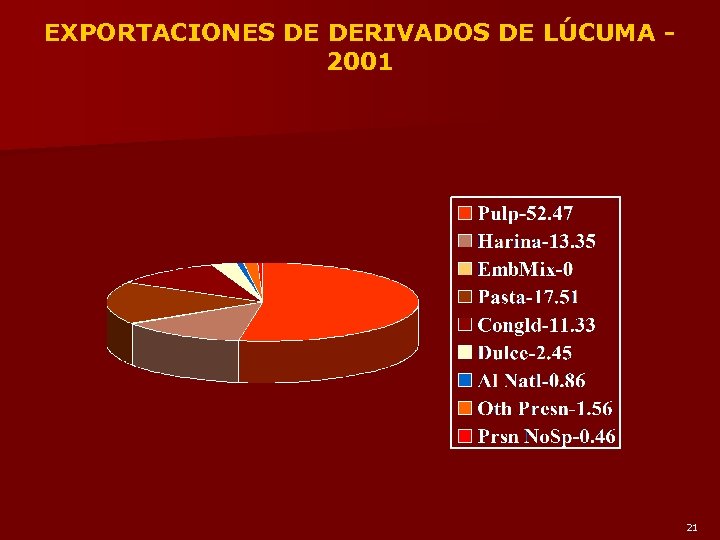

EXPORTACIONES DE DERIVADOS DE LÚCUMA - 2001 21

EXPORTACIONES DE DERIVADOS DE LÚCUMA - 2001 21

EXPORTACIONES DE DERIVADOS DE LÚCUMA - 2005 22

EXPORTACIONES DE DERIVADOS DE LÚCUMA - 2005 22

EXPORTACIONES DE LÚCUMA A VARIOS PAÍSES EN UN AÑO TÍPICO 23

EXPORTACIONES DE LÚCUMA A VARIOS PAÍSES EN UN AÑO TÍPICO 23

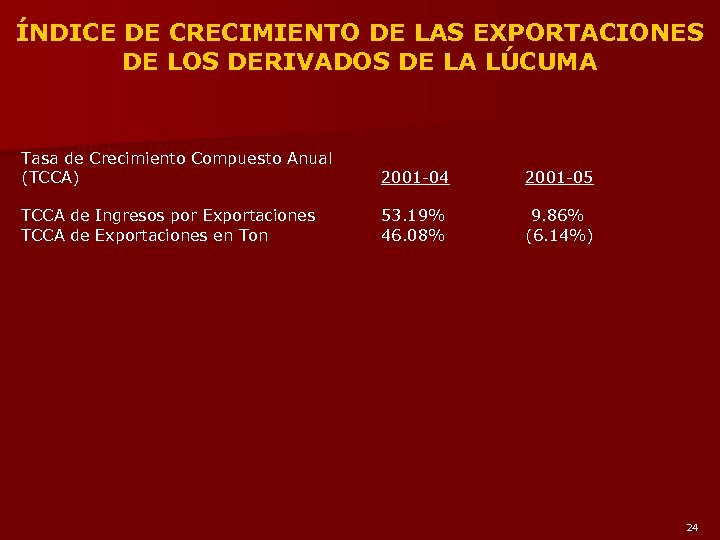

ÍNDICE DE CRECIMIENTO DE LAS EXPORTACIONES DE LOS DERIVADOS DE LA LÚCUMA Tasa de Crecimiento Compuesto Anual (TCCA) 2001 -04 2001 -05 TCCA de Ingresos por Exportaciones TCCA de Exportaciones en Ton 53. 19% 46. 08% 9. 86% (6. 14%) 24

ÍNDICE DE CRECIMIENTO DE LAS EXPORTACIONES DE LOS DERIVADOS DE LA LÚCUMA Tasa de Crecimiento Compuesto Anual (TCCA) 2001 -04 2001 -05 TCCA de Ingresos por Exportaciones TCCA de Exportaciones en Ton 53. 19% 46. 08% 9. 86% (6. 14%) 24

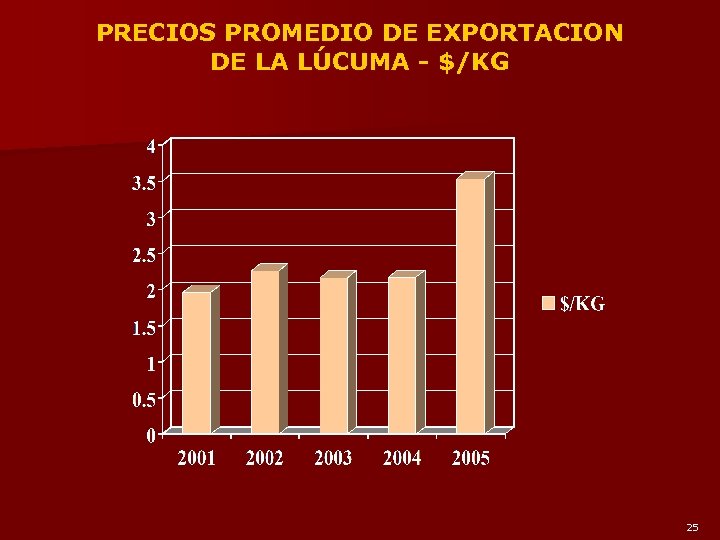

PRECIOS PROMEDIO DE EXPORTACION DE LA LÚCUMA - $/KG 25

PRECIOS PROMEDIO DE EXPORTACION DE LA LÚCUMA - $/KG 25

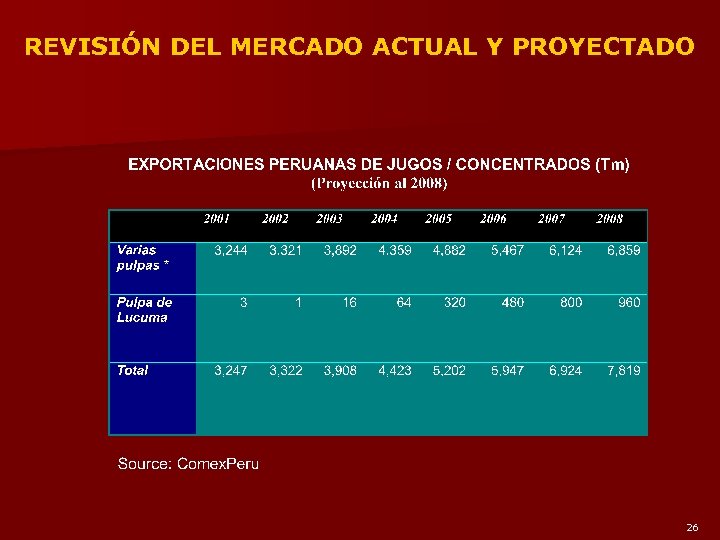

REVISIÓN DEL MERCADO ACTUAL Y PROYECTADO 26

REVISIÓN DEL MERCADO ACTUAL Y PROYECTADO 26

27

27

28

28

IDENTIFICACIÓN Y ANÁLISIS DE MERCADOS POTENCIALES (CONT. ) 3. 3. 1 Selección de una terna de los potenciales países/mercados donde el producto pueda ingresar exitosamente. § El principal destino es EEUU; sin embargo han habido unas exportaciones a Chile y Japón, el resto de la produccion se vende en el mercado local. § Se investigarán los usos más importantes del producto en USA y también las exportaciones chilenas (mercados y usos). § A partir de las experiencias de exportaciones actuales, la consultora preparó expresamente una matriz para evaluar los mercados potenciales de manera participativa. 3. 4 Se realizará una presentación y se elaborarán documentos informativos sobre los mercados seleccionados y los criterios utilizados para la selección de la terna de mercados. – Se hizo una presentación en el taller I y se discutieron los temas referidos en el programa que se adjunta. 29

IDENTIFICACIÓN Y ANÁLISIS DE MERCADOS POTENCIALES (CONT. ) 3. 3. 1 Selección de una terna de los potenciales países/mercados donde el producto pueda ingresar exitosamente. § El principal destino es EEUU; sin embargo han habido unas exportaciones a Chile y Japón, el resto de la produccion se vende en el mercado local. § Se investigarán los usos más importantes del producto en USA y también las exportaciones chilenas (mercados y usos). § A partir de las experiencias de exportaciones actuales, la consultora preparó expresamente una matriz para evaluar los mercados potenciales de manera participativa. 3. 4 Se realizará una presentación y se elaborarán documentos informativos sobre los mercados seleccionados y los criterios utilizados para la selección de la terna de mercados. – Se hizo una presentación en el taller I y se discutieron los temas referidos en el programa que se adjunta. 29

PROGRAMA DEL TALLER I I. - Coordinación y Presentación de los Puntos a Discutir: 9: 10 am II. - Discusión sobre el punto 1: 9: 45 am 1. ANÁLISIS DE LOS CULTIVOS DE LÚCUMA EXISTENTES Y SU PRODUCCIÓN: 1. 1 Evaluar la extensión de tierras cultivadas y rendimientos de Lúcuma. 1. 2 Estimar el crecimiento de las áreas cultivadas y producción de Lúcuma en los últimos diez años 1. 3 Estimar el costo de producción de Lúcuma. 1. 4 Estimar el crecimiento del área de cultivo contra el incremento de rendimiento por hectárea. III. - Coffee Break: 11: 15 am IV. - Discusión sobre el punto 2: 11: 45 am 2. LÚCUMA Y SUS DERIVADOS 2. 1 Identificar las características y ventajas de los derivados de la Lúcuma. 2. 2 Hacer una evaluación de la producción y propiedades químicas de cada derivado individual. 2. 3 Valor agregado en cada derivado. 2. 4 Equipamiento e infraestructura necesarios para la producción de los distintos derivados. 2. 5 Capital de inversión y costos requeridos para la producción de cada derivado. V. - Conclusiones: 1: 00 pm 30

PROGRAMA DEL TALLER I I. - Coordinación y Presentación de los Puntos a Discutir: 9: 10 am II. - Discusión sobre el punto 1: 9: 45 am 1. ANÁLISIS DE LOS CULTIVOS DE LÚCUMA EXISTENTES Y SU PRODUCCIÓN: 1. 1 Evaluar la extensión de tierras cultivadas y rendimientos de Lúcuma. 1. 2 Estimar el crecimiento de las áreas cultivadas y producción de Lúcuma en los últimos diez años 1. 3 Estimar el costo de producción de Lúcuma. 1. 4 Estimar el crecimiento del área de cultivo contra el incremento de rendimiento por hectárea. III. - Coffee Break: 11: 15 am IV. - Discusión sobre el punto 2: 11: 45 am 2. LÚCUMA Y SUS DERIVADOS 2. 1 Identificar las características y ventajas de los derivados de la Lúcuma. 2. 2 Hacer una evaluación de la producción y propiedades químicas de cada derivado individual. 2. 3 Valor agregado en cada derivado. 2. 4 Equipamiento e infraestructura necesarios para la producción de los distintos derivados. 2. 5 Capital de inversión y costos requeridos para la producción de cada derivado. V. - Conclusiones: 1: 00 pm 30

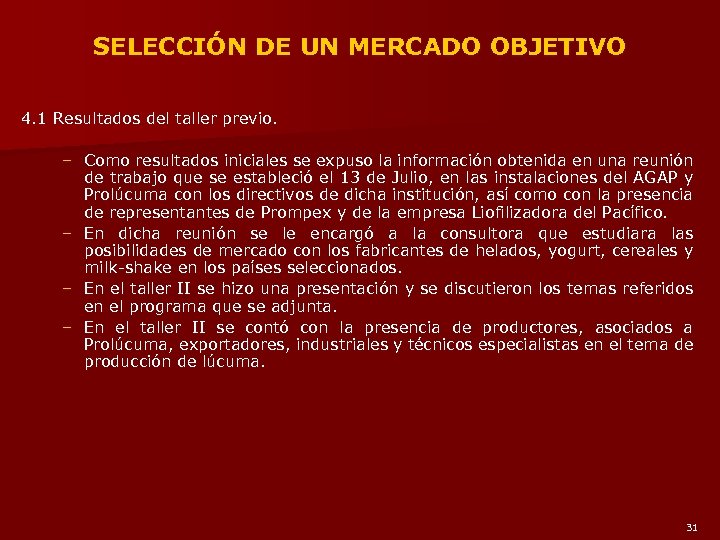

SELECCIÓN DE UN MERCADO OBJETIVO 4. 1 Resultados del taller previo. – Como resultados iniciales se expuso la información obtenida en una reunión de trabajo que se estableció el 13 de Julio, en las instalaciones del AGAP y Prolúcuma con los directivos de dicha institución, así como con la presencia de representantes de Prompex y de la empresa Liofilizadora del Pacífico. – En dicha reunión se le encargó a la consultora que estudiara las posibilidades de mercado con los fabricantes de helados, yogurt, cereales y milk-shake en los países seleccionados. – En el taller II se hizo una presentación y se discutieron los temas referidos en el programa que se adjunta. – En el taller II se contó con la presencia de productores, asociados a Prolúcuma, exportadores, industriales y técnicos especialistas en el tema de producción de lúcuma. 31

SELECCIÓN DE UN MERCADO OBJETIVO 4. 1 Resultados del taller previo. – Como resultados iniciales se expuso la información obtenida en una reunión de trabajo que se estableció el 13 de Julio, en las instalaciones del AGAP y Prolúcuma con los directivos de dicha institución, así como con la presencia de representantes de Prompex y de la empresa Liofilizadora del Pacífico. – En dicha reunión se le encargó a la consultora que estudiara las posibilidades de mercado con los fabricantes de helados, yogurt, cereales y milk-shake en los países seleccionados. – En el taller II se hizo una presentación y se discutieron los temas referidos en el programa que se adjunta. – En el taller II se contó con la presencia de productores, asociados a Prolúcuma, exportadores, industriales y técnicos especialistas en el tema de producción de lúcuma. 31

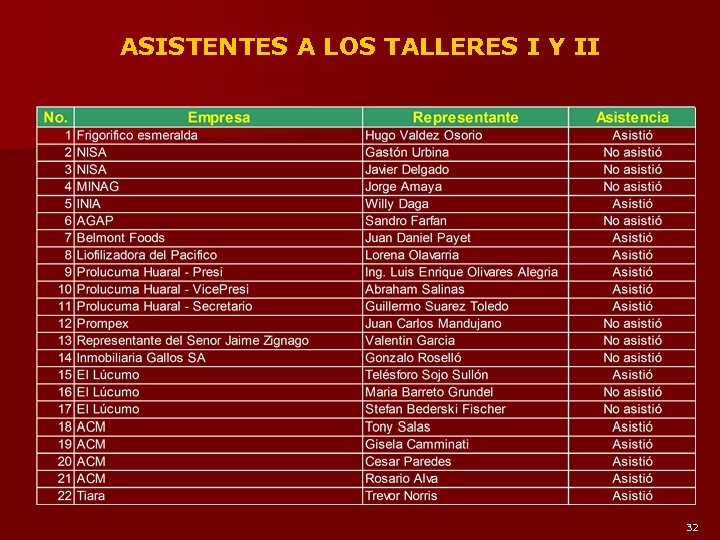

ASISTENTES A LOS TALLERES I Y II 32

ASISTENTES A LOS TALLERES I Y II 32

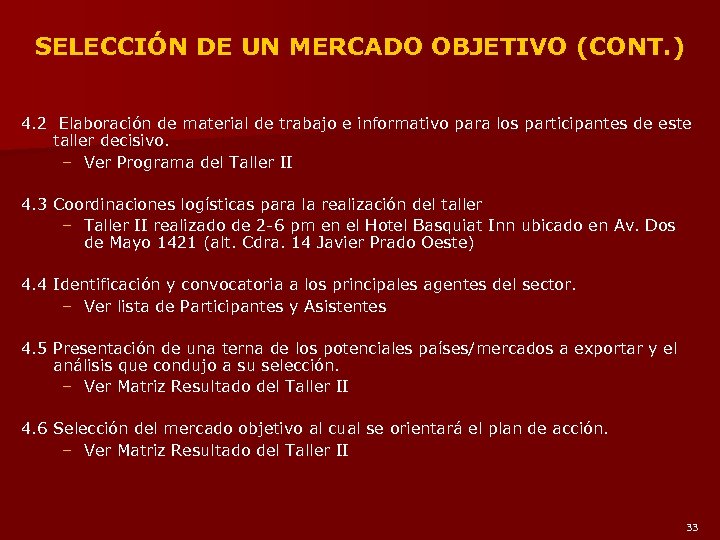

SELECCIÓN DE UN MERCADO OBJETIVO (CONT. ) 4. 2 Elaboración de material de trabajo e informativo para los participantes de este taller decisivo. – Ver Programa del Taller II 4. 3 Coordinaciones logísticas para la realización del taller – Taller II realizado de 2 -6 pm en el Hotel Basquiat Inn ubicado en Av. Dos de Mayo 1421 (alt. Cdra. 14 Javier Prado Oeste) 4. 4 Identificación y convocatoria a los principales agentes del sector. – Ver lista de Participantes y Asistentes 4. 5 Presentación de una terna de los potenciales países/mercados a exportar y el análisis que condujo a su selección. – Ver Matriz Resultado del Taller II 4. 6 Selección del mercado objetivo al cual se orientará el plan de acción. – Ver Matriz Resultado del Taller II 33

SELECCIÓN DE UN MERCADO OBJETIVO (CONT. ) 4. 2 Elaboración de material de trabajo e informativo para los participantes de este taller decisivo. – Ver Programa del Taller II 4. 3 Coordinaciones logísticas para la realización del taller – Taller II realizado de 2 -6 pm en el Hotel Basquiat Inn ubicado en Av. Dos de Mayo 1421 (alt. Cdra. 14 Javier Prado Oeste) 4. 4 Identificación y convocatoria a los principales agentes del sector. – Ver lista de Participantes y Asistentes 4. 5 Presentación de una terna de los potenciales países/mercados a exportar y el análisis que condujo a su selección. – Ver Matriz Resultado del Taller II 4. 6 Selección del mercado objetivo al cual se orientará el plan de acción. – Ver Matriz Resultado del Taller II 33

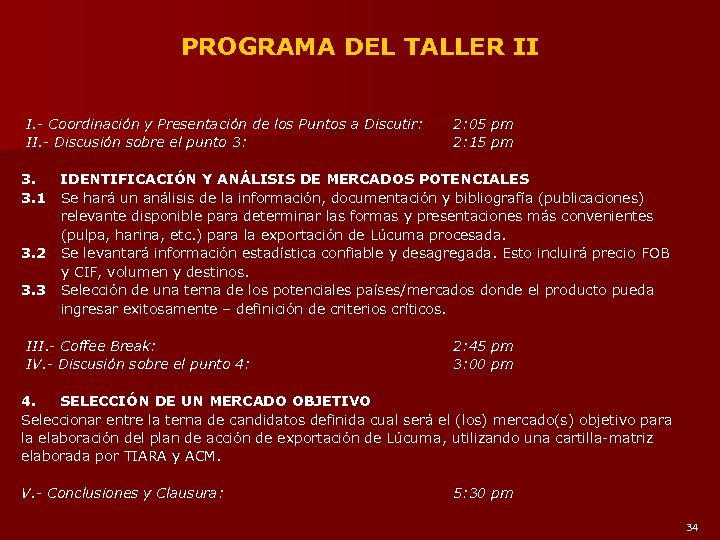

PROGRAMA DEL TALLER II I. - Coordinación y Presentación de los Puntos a Discutir: 2: 05 pm II. - Discusión sobre el punto 3: 2: 15 pm 3. IDENTIFICACIÓN Y ANÁLISIS DE MERCADOS POTENCIALES 3. 1 Se hará un análisis de la información, documentación y bibliografía (publicaciones) relevante disponible para determinar las formas y presentaciones más convenientes (pulpa, harina, etc. ) para la exportación de Lúcuma procesada. 3. 2 Se levantará información estadística confiable y desagregada. Esto incluirá precio FOB y CIF, volumen y destinos. 3. 3 Selección de una terna de los potenciales países/mercados donde el producto pueda ingresar exitosamente – definición de criterios críticos. III. - Coffee Break: 2: 45 pm IV. - Discusión sobre el punto 4: 3: 00 pm 4. SELECCIÓN DE UN MERCADO OBJETIVO Seleccionar entre la terna de candidatos definida cual será el (los) mercado(s) objetivo para la elaboración del plan de acción de exportación de Lúcuma , utilizando una cartilla-matriz elaborada por TIARA y ACM. V. - Conclusiones y Clausura: 5: 30 pm 34

PROGRAMA DEL TALLER II I. - Coordinación y Presentación de los Puntos a Discutir: 2: 05 pm II. - Discusión sobre el punto 3: 2: 15 pm 3. IDENTIFICACIÓN Y ANÁLISIS DE MERCADOS POTENCIALES 3. 1 Se hará un análisis de la información, documentación y bibliografía (publicaciones) relevante disponible para determinar las formas y presentaciones más convenientes (pulpa, harina, etc. ) para la exportación de Lúcuma procesada. 3. 2 Se levantará información estadística confiable y desagregada. Esto incluirá precio FOB y CIF, volumen y destinos. 3. 3 Selección de una terna de los potenciales países/mercados donde el producto pueda ingresar exitosamente – definición de criterios críticos. III. - Coffee Break: 2: 45 pm IV. - Discusión sobre el punto 4: 3: 00 pm 4. SELECCIÓN DE UN MERCADO OBJETIVO Seleccionar entre la terna de candidatos definida cual será el (los) mercado(s) objetivo para la elaboración del plan de acción de exportación de Lúcuma , utilizando una cartilla-matriz elaborada por TIARA y ACM. V. - Conclusiones y Clausura: 5: 30 pm 34

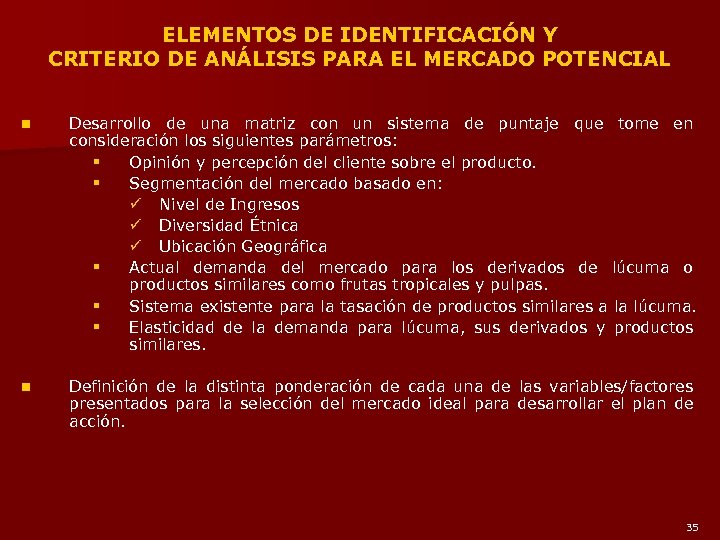

ELEMENTOS DE IDENTIFICACIÓN Y CRITERIO DE ANÁLISIS PARA EL MERCADO POTENCIAL n Desarrollo de una matriz con un sistema de puntaje que tome en consideración los siguientes parámetros: § Opinión y percepción del cliente sobre el producto. § Segmentación del mercado basado en: ü Nivel de Ingresos ü Diversidad Étnica ü Ubicación Geográfica § Actual demanda del mercado para los derivados de lúcuma o productos similares como frutas tropicales y pulpas. § Sistema existente para la tasación de productos similares a la lúcuma. § Elasticidad de la demanda para lúcuma, sus derivados y productos similares. n Definición de la distinta ponderación de cada una de las variables/factores presentados para la selección del mercado ideal para desarrollar el plan de acción. 35

ELEMENTOS DE IDENTIFICACIÓN Y CRITERIO DE ANÁLISIS PARA EL MERCADO POTENCIAL n Desarrollo de una matriz con un sistema de puntaje que tome en consideración los siguientes parámetros: § Opinión y percepción del cliente sobre el producto. § Segmentación del mercado basado en: ü Nivel de Ingresos ü Diversidad Étnica ü Ubicación Geográfica § Actual demanda del mercado para los derivados de lúcuma o productos similares como frutas tropicales y pulpas. § Sistema existente para la tasación de productos similares a la lúcuma. § Elasticidad de la demanda para lúcuma, sus derivados y productos similares. n Definición de la distinta ponderación de cada una de las variables/factores presentados para la selección del mercado ideal para desarrollar el plan de acción. 35

36

36

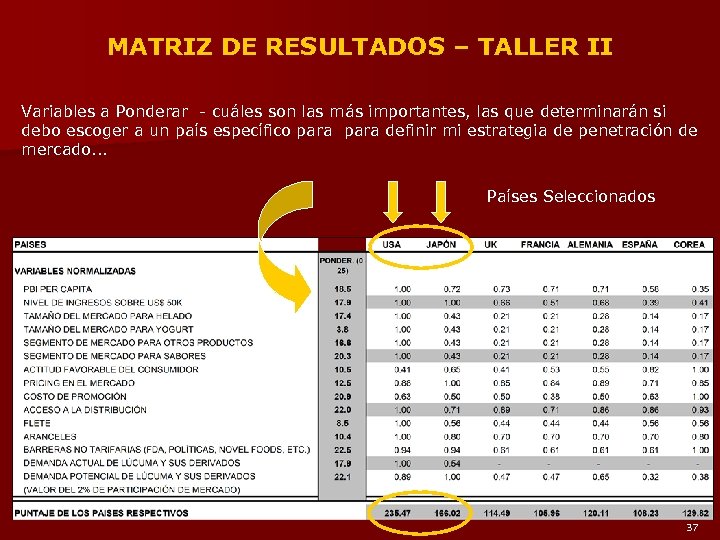

MATRIZ DE RESULTADOS – TALLER II Variables a Ponderar - cuáles son las más importantes, las que determinarán si debo escoger a un país específico para definir mi estrategia de penetración de mercado. . . Países Seleccionados 37

MATRIZ DE RESULTADOS – TALLER II Variables a Ponderar - cuáles son las más importantes, las que determinarán si debo escoger a un país específico para definir mi estrategia de penetración de mercado. . . Países Seleccionados 37

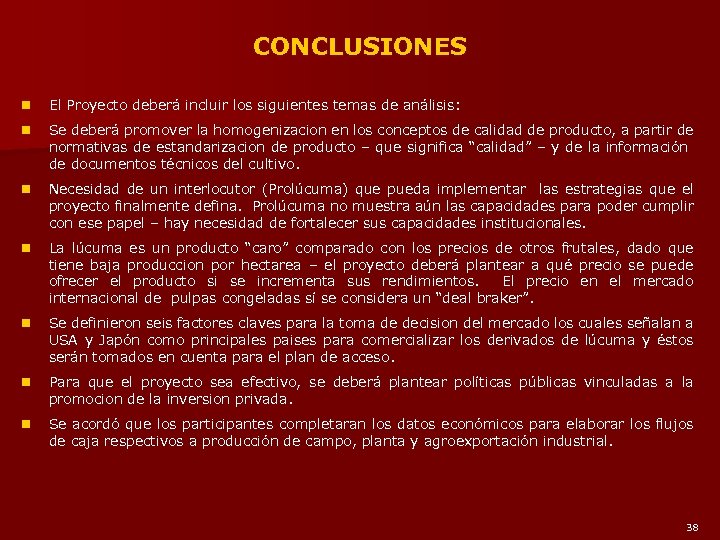

CONCLUSIONES n El Proyecto deberá incluir los siguientes temas de análisis: n Se deberá promover la homogenizacion en los conceptos de calidad de producto, a partir de normativas de estandarizacion de producto – que significa “calidad” – y de la información de documentos técnicos del cultivo. n Necesidad de un interlocutor (Prolúcuma) que pueda implementar las estrategias que el proyecto finalmente defina. Prolúcuma no muestra aún las capacidades para poder cumplir con ese papel – hay necesidad de fortalecer sus capacidades institucionales. n La lúcuma es un producto “caro” comparado con los precios de otros frutales, dado que tiene baja produccion por hectarea – el proyecto deberá plantear a qué precio se puede ofrecer el producto si se incrementa sus rendimientos. El precio en el mercado internacional de pulpas congeladas sí se considera un “deal braker”. n Se definieron seis factores claves para la toma de decision del mercado los cuales señalan a USA y Japón como principales paises para comercializar los derivados de lúcuma y éstos serán tomados en cuenta para el plan de acceso. n Para que el proyecto sea efectivo, se deberá plantear políticas públicas vinculadas a la promocion de la inversion privada. n Se acordó que los participantes completaran los datos económicos para elaborar los flujos de caja respectivos a producción de campo, planta y agroexportación industrial. 38

CONCLUSIONES n El Proyecto deberá incluir los siguientes temas de análisis: n Se deberá promover la homogenizacion en los conceptos de calidad de producto, a partir de normativas de estandarizacion de producto – que significa “calidad” – y de la información de documentos técnicos del cultivo. n Necesidad de un interlocutor (Prolúcuma) que pueda implementar las estrategias que el proyecto finalmente defina. Prolúcuma no muestra aún las capacidades para poder cumplir con ese papel – hay necesidad de fortalecer sus capacidades institucionales. n La lúcuma es un producto “caro” comparado con los precios de otros frutales, dado que tiene baja produccion por hectarea – el proyecto deberá plantear a qué precio se puede ofrecer el producto si se incrementa sus rendimientos. El precio en el mercado internacional de pulpas congeladas sí se considera un “deal braker”. n Se definieron seis factores claves para la toma de decision del mercado los cuales señalan a USA y Japón como principales paises para comercializar los derivados de lúcuma y éstos serán tomados en cuenta para el plan de acceso. n Para que el proyecto sea efectivo, se deberá plantear políticas públicas vinculadas a la promocion de la inversion privada. n Se acordó que los participantes completaran los datos económicos para elaborar los flujos de caja respectivos a producción de campo, planta y agroexportación industrial. 38

LUCUMA EXPORT MARKET - USA PHASES II & III REPORT

LUCUMA EXPORT MARKET - USA PHASES II & III REPORT

TARIFF ISSUES U. S. -Peru Trade Promotion Agreement (USPTA), Andean Trade Promotion and Drug Eradication Act (ATPDEA), The Free Trade Agreement (FTA)/Trato del Libre Comercio (TLC): – – – Presently there are no tariffs on products such as Lucuma from Peru. Although Peru and the United States have negotiated a holistic free trade agreement (FTA/TLC), as of December 2006 it has not been fully ratified by both countries for unrelated internal political reasons which occurred in both countries since its negotiation. Nonetheless, exports from Peru are currently tariff free due to the ongoing Andean Trade Promotion and Drug Eradication Act (ATPDEA) which is due to expire at the end of 2006. Due to the election results in the USA of November 2006, which changed the majority in the US Senate and House of Representatives to the Democrat Party, the future of the ratification process of the Free Trade Agreement (FTA/TLC) is unclear. However, it is likely (and assumed for this report) that either the ATPDEA will be extended (likely) or the Free Trade Agreement will be ratified prior to the swearing-in of the new Democrat Majority (possible) or the new U. S. Congress will ratify it immediately (unlikely). Should there be no preferential trade agreement in force, many of the assumptions, particularly those dependent to pricing must be reconsidered. As an “exotic” product, the absence of a trade agreement would affect Lucuma much less than other Peruvian Exports (such as cotton garments). 40

TARIFF ISSUES U. S. -Peru Trade Promotion Agreement (USPTA), Andean Trade Promotion and Drug Eradication Act (ATPDEA), The Free Trade Agreement (FTA)/Trato del Libre Comercio (TLC): – – – Presently there are no tariffs on products such as Lucuma from Peru. Although Peru and the United States have negotiated a holistic free trade agreement (FTA/TLC), as of December 2006 it has not been fully ratified by both countries for unrelated internal political reasons which occurred in both countries since its negotiation. Nonetheless, exports from Peru are currently tariff free due to the ongoing Andean Trade Promotion and Drug Eradication Act (ATPDEA) which is due to expire at the end of 2006. Due to the election results in the USA of November 2006, which changed the majority in the US Senate and House of Representatives to the Democrat Party, the future of the ratification process of the Free Trade Agreement (FTA/TLC) is unclear. However, it is likely (and assumed for this report) that either the ATPDEA will be extended (likely) or the Free Trade Agreement will be ratified prior to the swearing-in of the new Democrat Majority (possible) or the new U. S. Congress will ratify it immediately (unlikely). Should there be no preferential trade agreement in force, many of the assumptions, particularly those dependent to pricing must be reconsidered. As an “exotic” product, the absence of a trade agreement would affect Lucuma much less than other Peruvian Exports (such as cotton garments). 40

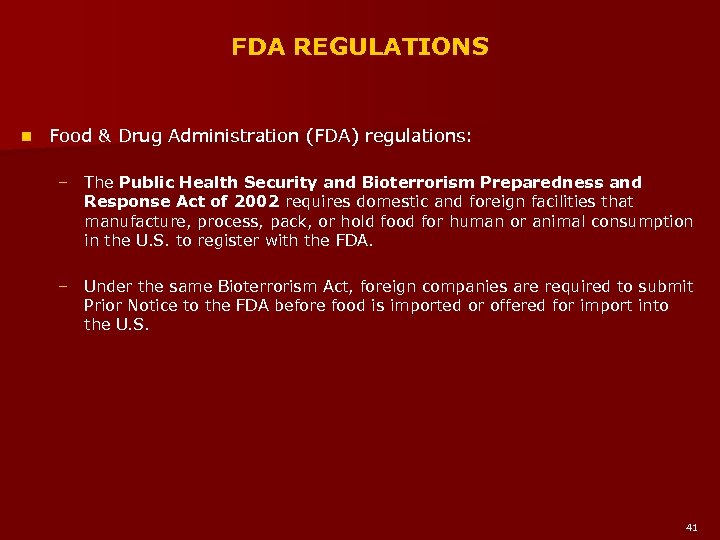

FDA REGULATIONS n Food & Drug Administration (FDA) regulations: – The Public Health Security and Bioterrorism Preparedness and Response Act of 2002 requires domestic and foreign facilities that manufacture, process, pack, or hold food for human or animal consumption in the U. S. to register with the FDA. – Under the same Bioterrorism Act, foreign companies are required to submit Prior Notice to the FDA before food is imported or offered for import into the U. S. 41

FDA REGULATIONS n Food & Drug Administration (FDA) regulations: – The Public Health Security and Bioterrorism Preparedness and Response Act of 2002 requires domestic and foreign facilities that manufacture, process, pack, or hold food for human or animal consumption in the U. S. to register with the FDA. – Under the same Bioterrorism Act, foreign companies are required to submit Prior Notice to the FDA before food is imported or offered for import into the U. S. 41

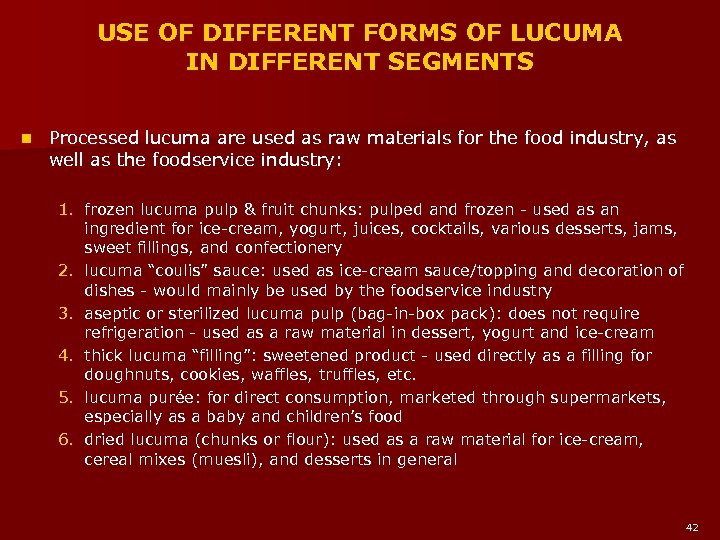

USE OF DIFFERENT FORMS OF LUCUMA IN DIFFERENT SEGMENTS n Processed lucuma are used as raw materials for the food industry, as well as the foodservice industry: 1. frozen lucuma pulp & fruit chunks: pulped and frozen - used as an ingredient for ice-cream, yogurt, juices, cocktails, various desserts, jams, sweet fillings, and confectionery 2. lucuma “coulis” sauce: used as ice-cream sauce/topping and decoration of dishes - would mainly be used by the foodservice industry 3. aseptic or sterilized lucuma pulp (bag-in-box pack): does not require refrigeration - used as a raw material in dessert, yogurt and ice-cream 4. thick lucuma “filling”: sweetened product - used directly as a filling for doughnuts, cookies, waffles, truffles, etc. 5. lucuma purée: for direct consumption, marketed through supermarkets, especially as a baby and children’s food 6. dried lucuma (chunks or flour): used as a raw material for ice-cream, cereal mixes (muesli), and desserts in general 42

USE OF DIFFERENT FORMS OF LUCUMA IN DIFFERENT SEGMENTS n Processed lucuma are used as raw materials for the food industry, as well as the foodservice industry: 1. frozen lucuma pulp & fruit chunks: pulped and frozen - used as an ingredient for ice-cream, yogurt, juices, cocktails, various desserts, jams, sweet fillings, and confectionery 2. lucuma “coulis” sauce: used as ice-cream sauce/topping and decoration of dishes - would mainly be used by the foodservice industry 3. aseptic or sterilized lucuma pulp (bag-in-box pack): does not require refrigeration - used as a raw material in dessert, yogurt and ice-cream 4. thick lucuma “filling”: sweetened product - used directly as a filling for doughnuts, cookies, waffles, truffles, etc. 5. lucuma purée: for direct consumption, marketed through supermarkets, especially as a baby and children’s food 6. dried lucuma (chunks or flour): used as a raw material for ice-cream, cereal mixes (muesli), and desserts in general 42

POTENTIAL MARKET SEGMENTS n Ice cream n Yogurt n Flavored milk & milkshakes n Sweet spreads n Confectionery n Bread & bakery products n Breakfast cereal n Foodservice & restaurants 43

POTENTIAL MARKET SEGMENTS n Ice cream n Yogurt n Flavored milk & milkshakes n Sweet spreads n Confectionery n Bread & bakery products n Breakfast cereal n Foodservice & restaurants 43

INDUSTRY COMMERCIAL EVENTS IN USA n n n n n Americas Food & Beverage Show & Conference in Miami, FL – November 8~10, 2006 National Ice Cream Retailers Convention in Savannah, GA – November 8~11, 2006 Expo Comida Latina in New York, NY – November 14~15, 2006 Dairy Forum in Orlando, FL – January 14~17, 2007 Winter Int’l Fancy Food & Confection Show in San Francisco, CA – January 21~23, 2007 World Ag Expo in Tulare, CA – February 14~16, 2007 North America Pizza & Ice Cream Show in Columbus, OH – February 25~26, 2007 Western Candy Conference in San Diego, CA – March 21~25, 2007 Supply. Side East Show in Secaucus, NJ – April 30~May 2, 2007 Spring International Fancy Food & Confection Show in Chicago, IL – May 6~8, 2007 Dairy-Deli-Bake Seminar & Expo in Anaheim, CA – June 3~5, 2007 Summer Int’l Fancy Food & Confection Show in New York, NY – July 8~10, 2007 American Bakery Expo in Las Vegas, NV – September 8~10, 2007 National Confectioners Assoc. All Candy Expo in Chicago, IL – September 17~19, 2007 World Dairy Expo in Madison, WI – October 2~6, 2007 International Baking Industry Expo in Orlando, FL – October 7~10, 2007 Worldwide Food Expo in Chicago, IL – October 24~27, USA 44

INDUSTRY COMMERCIAL EVENTS IN USA n n n n n Americas Food & Beverage Show & Conference in Miami, FL – November 8~10, 2006 National Ice Cream Retailers Convention in Savannah, GA – November 8~11, 2006 Expo Comida Latina in New York, NY – November 14~15, 2006 Dairy Forum in Orlando, FL – January 14~17, 2007 Winter Int’l Fancy Food & Confection Show in San Francisco, CA – January 21~23, 2007 World Ag Expo in Tulare, CA – February 14~16, 2007 North America Pizza & Ice Cream Show in Columbus, OH – February 25~26, 2007 Western Candy Conference in San Diego, CA – March 21~25, 2007 Supply. Side East Show in Secaucus, NJ – April 30~May 2, 2007 Spring International Fancy Food & Confection Show in Chicago, IL – May 6~8, 2007 Dairy-Deli-Bake Seminar & Expo in Anaheim, CA – June 3~5, 2007 Summer Int’l Fancy Food & Confection Show in New York, NY – July 8~10, 2007 American Bakery Expo in Las Vegas, NV – September 8~10, 2007 National Confectioners Assoc. All Candy Expo in Chicago, IL – September 17~19, 2007 World Dairy Expo in Madison, WI – October 2~6, 2007 International Baking Industry Expo in Orlando, FL – October 7~10, 2007 Worldwide Food Expo in Chicago, IL – October 24~27, USA 44

DEMAND FOR SIMILAR PRODUCTS n Mangoes n Peaches n Strawberries n Others 45

DEMAND FOR SIMILAR PRODUCTS n Mangoes n Peaches n Strawberries n Others 45

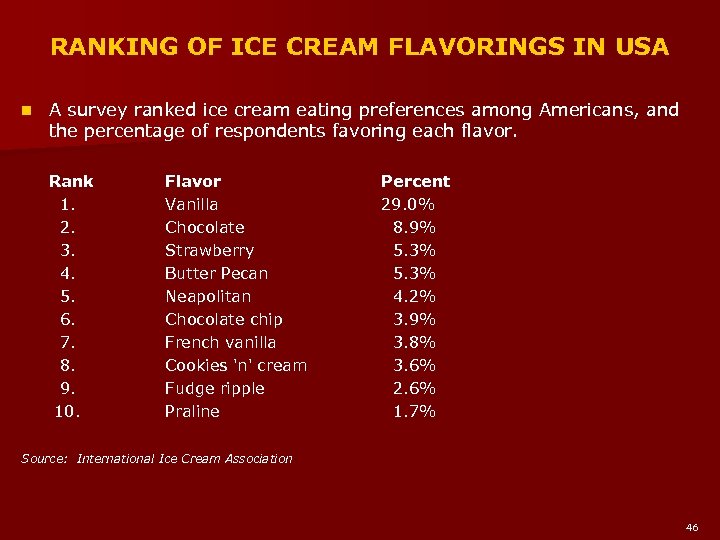

RANKING OF ICE CREAM FLAVORINGS IN USA n A survey ranked ice cream eating preferences among Americans, and the percentage of respondents favoring each flavor. Rank 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Flavor Vanilla Chocolate Strawberry Butter Pecan Neapolitan Chocolate chip French vanilla Cookies 'n' cream Fudge ripple Praline Percent 29. 0% 8. 9% 5. 3% 4. 2% 3. 9% 3. 8% 3. 6% 2. 6% 1. 7% Source: International Ice Cream Association 46

RANKING OF ICE CREAM FLAVORINGS IN USA n A survey ranked ice cream eating preferences among Americans, and the percentage of respondents favoring each flavor. Rank 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Flavor Vanilla Chocolate Strawberry Butter Pecan Neapolitan Chocolate chip French vanilla Cookies 'n' cream Fudge ripple Praline Percent 29. 0% 8. 9% 5. 3% 4. 2% 3. 9% 3. 8% 3. 6% 2. 6% 1. 7% Source: International Ice Cream Association 46

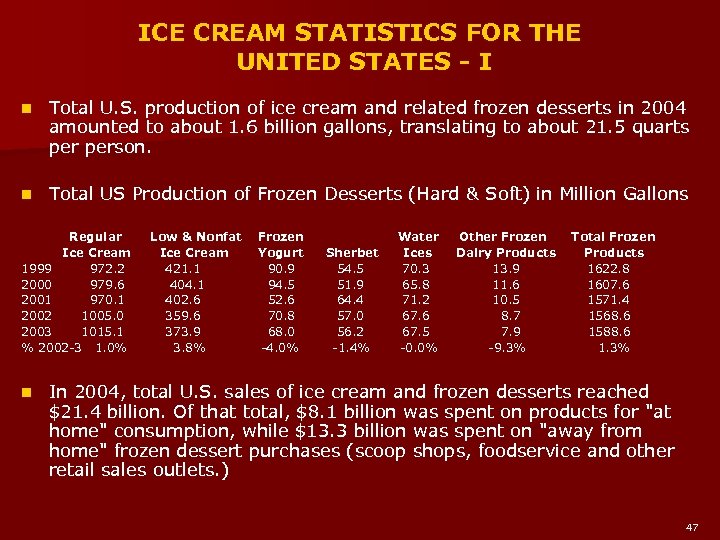

ICE CREAM STATISTICS FOR THE UNITED STATES - I n Total U. S. production of ice cream and related frozen desserts in 2004 amounted to about 1. 6 billion gallons, translating to about 21. 5 quarts person. n Total US Production of Frozen Desserts (Hard & Soft) in Million Gallons Regular Low & Nonfat Frozen Water Other Frozen Total Frozen Ice Cream Yogurt Sherbet Ices Dairy Products 1999 972. 2 421. 1 90. 9 54. 5 70. 3 13. 9 1622. 8 2000 979. 6 404. 1 94. 5 51. 9 65. 8 11. 6 1607. 6 2001 970. 1 402. 6 52. 6 64. 4 71. 2 10. 5 1571. 4 2002 1005. 0 359. 6 70. 8 57. 0 67. 6 8. 7 1568. 6 2003 1015. 1 373. 9 68. 0 56. 2 67. 5 7. 9 1588. 6 % 2002 -3 1. 0% 3. 8% -4. 0% -1. 4% -0. 0% -9. 3% 1. 3% n In 2004, total U. S. sales of ice cream and frozen desserts reached $21. 4 billion. Of that total, $8. 1 billion was spent on products for "at home" consumption, while $13. 3 billion was spent on "away from home" frozen dessert purchases (scoop shops, foodservice and other retail sales outlets. ) 47

ICE CREAM STATISTICS FOR THE UNITED STATES - I n Total U. S. production of ice cream and related frozen desserts in 2004 amounted to about 1. 6 billion gallons, translating to about 21. 5 quarts person. n Total US Production of Frozen Desserts (Hard & Soft) in Million Gallons Regular Low & Nonfat Frozen Water Other Frozen Total Frozen Ice Cream Yogurt Sherbet Ices Dairy Products 1999 972. 2 421. 1 90. 9 54. 5 70. 3 13. 9 1622. 8 2000 979. 6 404. 1 94. 5 51. 9 65. 8 11. 6 1607. 6 2001 970. 1 402. 6 52. 6 64. 4 71. 2 10. 5 1571. 4 2002 1005. 0 359. 6 70. 8 57. 0 67. 6 8. 7 1568. 6 2003 1015. 1 373. 9 68. 0 56. 2 67. 5 7. 9 1588. 6 % 2002 -3 1. 0% 3. 8% -4. 0% -1. 4% -0. 0% -9. 3% 1. 3% n In 2004, total U. S. sales of ice cream and frozen desserts reached $21. 4 billion. Of that total, $8. 1 billion was spent on products for "at home" consumption, while $13. 3 billion was spent on "away from home" frozen dessert purchases (scoop shops, foodservice and other retail sales outlets. ) 47

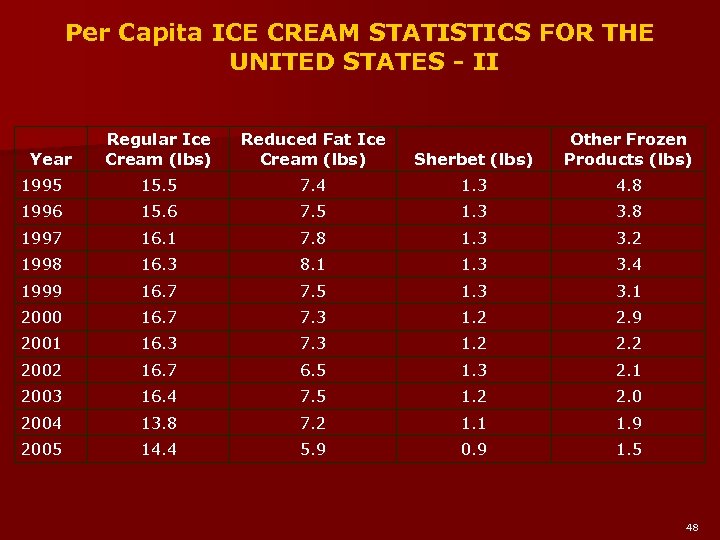

Per Capita ICE CREAM STATISTICS FOR THE UNITED STATES - II Regular Ice Cream (lbs) Reduced Fat Ice Cream (lbs) Sherbet (lbs) Other Frozen Products (lbs) 1995 15. 5 7. 4 1. 3 4. 8 1996 15. 6 7. 5 1. 3 3. 8 1997 16. 1 7. 8 1. 3 3. 2 1998 16. 3 8. 1 1. 3 3. 4 1999 16. 7 7. 5 1. 3 3. 1 2000 16. 7 7. 3 1. 2 2. 9 2001 16. 3 7. 3 1. 2 2002 16. 7 6. 5 1. 3 2. 1 2003 16. 4 7. 5 1. 2 2. 0 2004 13. 8 7. 2 1. 1 1. 9 2005 14. 4 5. 9 0. 9 1. 5 Year 48

Per Capita ICE CREAM STATISTICS FOR THE UNITED STATES - II Regular Ice Cream (lbs) Reduced Fat Ice Cream (lbs) Sherbet (lbs) Other Frozen Products (lbs) 1995 15. 5 7. 4 1. 3 4. 8 1996 15. 6 7. 5 1. 3 3. 8 1997 16. 1 7. 8 1. 3 3. 2 1998 16. 3 8. 1 1. 3 3. 4 1999 16. 7 7. 5 1. 3 3. 1 2000 16. 7 7. 3 1. 2 2. 9 2001 16. 3 7. 3 1. 2 2002 16. 7 6. 5 1. 3 2. 1 2003 16. 4 7. 5 1. 2 2. 0 2004 13. 8 7. 2 1. 1 1. 9 2005 14. 4 5. 9 0. 9 1. 5 Year 48

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - I n Dreyers Grand Ice Cream (subsidiary of Nestle) – Company website: http: //www. dreyers. com/ – 5929 College Ave. , Oakland, CA 94618 Tel: 510 -652 -8187 – 2005 sales: $188. 7 million – Dreyers Grand is one of the three largest ice cream producer in the U. S. – The company’s ice cream brands include: Dreyers, Edy’s, Healthy Choice, and Haagen-Dazs – Dreyers Grand has about 15% market share 49

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - I n Dreyers Grand Ice Cream (subsidiary of Nestle) – Company website: http: //www. dreyers. com/ – 5929 College Ave. , Oakland, CA 94618 Tel: 510 -652 -8187 – 2005 sales: $188. 7 million – Dreyers Grand is one of the three largest ice cream producer in the U. S. – The company’s ice cream brands include: Dreyers, Edy’s, Healthy Choice, and Haagen-Dazs – Dreyers Grand has about 15% market share 49

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - II n Good Humor-Breyers Ice Cream / Unilever Ice Cream – Company website: http: //www. icecreamusa. com – PO Box 19007, Green Bay, WI 54307 Tel: 920 -499 -5151 – Unilever is one of the three largest manufacturer of branded packaged ice cream and frozen novelty products in the U. S. – The company’s ice cream brands include: Breyers, Good Humor, Klondike, Popsicle, and Ben & Jerry’s – Unilever has about 15% market share n Ben & Jerry’s Homemade (subsidiary of Unilever) – Company website: http: //www. benjerry. com – 30 Community Drive, South Burlington, VT 05403 Tel: 802 -846 -1500 – 2005 sales: $272 million – Ben & Jerry’s is a maker of super premium ice cream – The company also operates/franchises more than 430 scoop shops in North America 50

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - II n Good Humor-Breyers Ice Cream / Unilever Ice Cream – Company website: http: //www. icecreamusa. com – PO Box 19007, Green Bay, WI 54307 Tel: 920 -499 -5151 – Unilever is one of the three largest manufacturer of branded packaged ice cream and frozen novelty products in the U. S. – The company’s ice cream brands include: Breyers, Good Humor, Klondike, Popsicle, and Ben & Jerry’s – Unilever has about 15% market share n Ben & Jerry’s Homemade (subsidiary of Unilever) – Company website: http: //www. benjerry. com – 30 Community Drive, South Burlington, VT 05403 Tel: 802 -846 -1500 – 2005 sales: $272 million – Ben & Jerry’s is a maker of super premium ice cream – The company also operates/franchises more than 430 scoop shops in North America 50

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - III n Blue Bunny (Wells’ Dairy Inc. ) – Company website: http: //www. bluebunny. com – 1 Blue Bunny Dr. , Le Mars, IA 51031 Tel: 712 -546 -4000 – 2005 sales: $850 million – Blue Bunny is one of the three largest manufacturer of ice cream and frozen desserts in the U. S. – The company’s ice cream brands include: Blue Bunny, Bomb Pop, Carb Freedom, Sweet Freedom, Health Smart, and Incrediples – Blue Bunny has about 15% market share 51

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - III n Blue Bunny (Wells’ Dairy Inc. ) – Company website: http: //www. bluebunny. com – 1 Blue Bunny Dr. , Le Mars, IA 51031 Tel: 712 -546 -4000 – 2005 sales: $850 million – Blue Bunny is one of the three largest manufacturer of ice cream and frozen desserts in the U. S. – The company’s ice cream brands include: Blue Bunny, Bomb Pop, Carb Freedom, Sweet Freedom, Health Smart, and Incrediples – Blue Bunny has about 15% market share 51

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - IV n Kemps (business segment of HP Hood) – Company website: http: //www. kemps. com – 1270 Energy Lane, St. Paul, MN 55108 Tel: 651 -379 -6500 – Estimated 2005 sales (Hoovers): $750 million – Kemps manufactures and markets milk, ice cream, and related dairy products – The company’s ice cream brands include: Kemps, Caribou Coffee, Pillsbury, and Twins – Kemps has about 6%~8% market share 52

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - IV n Kemps (business segment of HP Hood) – Company website: http: //www. kemps. com – 1270 Energy Lane, St. Paul, MN 55108 Tel: 651 -379 -6500 – Estimated 2005 sales (Hoovers): $750 million – Kemps manufactures and markets milk, ice cream, and related dairy products – The company’s ice cream brands include: Kemps, Caribou Coffee, Pillsbury, and Twins – Kemps has about 6%~8% market share 52

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - V n Cool. Brands International – Company website: http: //www. eskimopie. com – 4175 Veteran's Memorial Highway, 3 rd Fl. , Ronkonkoma, NY 11779 Tel: 631 -737 -9700 – 2005 sales: $385. 1 million – Cool. Brands manufactures and distributes ice cream and other frozen treats – The company’s ice cream brands include: Eskimo Pie, Godiva, Disney, Crayola, Yoplait, Better for Kids, Snapple on Ice, No Pudge, Tropicana, Care Bears, Trix, Whole. Fruit, Fruit-a-Freeze, and the Sopranos – Cool. Brands has about 4%~5% market share 53

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - V n Cool. Brands International – Company website: http: //www. eskimopie. com – 4175 Veteran's Memorial Highway, 3 rd Fl. , Ronkonkoma, NY 11779 Tel: 631 -737 -9700 – 2005 sales: $385. 1 million – Cool. Brands manufactures and distributes ice cream and other frozen treats – The company’s ice cream brands include: Eskimo Pie, Godiva, Disney, Crayola, Yoplait, Better for Kids, Snapple on Ice, No Pudge, Tropicana, Care Bears, Trix, Whole. Fruit, Fruit-a-Freeze, and the Sopranos – Cool. Brands has about 4%~5% market share 53

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - VI n Blue Bell Creameries – Company website: http: //www. bluebell. com – 1101 S. Horton, Brenham, TX 77833 Tel: 979 -836 -7977 – Estimated 2005 sales (Hoovers): $280 million – Blue Bell is a regional ice cream manufacturer in the southern U. S. – The company makes ice cream, yogurt, frozen treats, sherbet, low-fat ice creams, and sugar-free ice creams – Blue Bell manufactures 18 year-round ice cream flavors and 29 rotational flavors – Blue Bell has about 4% market share 54

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - VI n Blue Bell Creameries – Company website: http: //www. bluebell. com – 1101 S. Horton, Brenham, TX 77833 Tel: 979 -836 -7977 – Estimated 2005 sales (Hoovers): $280 million – Blue Bell is a regional ice cream manufacturer in the southern U. S. – The company makes ice cream, yogurt, frozen treats, sherbet, low-fat ice creams, and sugar-free ice creams – Blue Bell manufactures 18 year-round ice cream flavors and 29 rotational flavors – Blue Bell has about 4% market share 54

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - VII n Roberts Dairy – Company website: http: //www. robertsdairy. com – 2901 Cuming St. , Omaha, NE 68131 Tel: 402 -344 -4321 – Estimated 2005 sales (Hoovers): $276. 9 million – Roberts Dairy produces fluid milk, cultured and frozen dairy products – The company brands include: Roberts and Hiland-Roberts as well as private labels – Roberts Dairy has about 1%~2% market share 55

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - VII n Roberts Dairy – Company website: http: //www. robertsdairy. com – 2901 Cuming St. , Omaha, NE 68131 Tel: 402 -344 -4321 – Estimated 2005 sales (Hoovers): $276. 9 million – Roberts Dairy produces fluid milk, cultured and frozen dairy products – The company brands include: Roberts and Hiland-Roberts as well as private labels – Roberts Dairy has about 1%~2% market share 55

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - VIII n Stonyfield Farm – Company website: http: //www. stonyfield. com – 10 Burton Dr. , Londonderry, NH 03053 Tel: 603 -473 -4040 – Estimated 2005 sales (Hoovers): $140 million – Stonyfield is a producer of natural and organic yogurt and ice cream – The company is a leader among health-food store brands – Group Danone owns approximately 85% of Stoneyfield Farm – Stonyfield has less than 1% market share 56

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - VIII n Stonyfield Farm – Company website: http: //www. stonyfield. com – 10 Burton Dr. , Londonderry, NH 03053 Tel: 603 -473 -4040 – Estimated 2005 sales (Hoovers): $140 million – Stonyfield is a producer of natural and organic yogurt and ice cream – The company is a leader among health-food store brands – Group Danone owns approximately 85% of Stoneyfield Farm – Stonyfield has less than 1% market share 56

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - IX n Ciao Bella Gelato – Company website: http: //www. ciaobellagelato. com – 231 40 th St. , Irvington, NJ 07111 Tel: 973 -373 -1200 – Ciao Bella is a manufacturer of gelato and sorbet – The company offers unique flavors such as blueberry, chocolate jalapeno, fromage blanc, ginger, mango, lychee, passion fruit, cassis, and zabaione – The company’s brands include: Ciao Bella, Sarabeth’s, and Gotham – Ciao Bella manufactures 46 gelato flavors, 33 sorbet flavors, 7 frozen yogurt flavors, and 8 seasonal flavors – Ciao Bella has less than 1% market share 57

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - IX n Ciao Bella Gelato – Company website: http: //www. ciaobellagelato. com – 231 40 th St. , Irvington, NJ 07111 Tel: 973 -373 -1200 – Ciao Bella is a manufacturer of gelato and sorbet – The company offers unique flavors such as blueberry, chocolate jalapeno, fromage blanc, ginger, mango, lychee, passion fruit, cassis, and zabaione – The company’s brands include: Ciao Bella, Sarabeth’s, and Gotham – Ciao Bella manufactures 46 gelato flavors, 33 sorbet flavors, 7 frozen yogurt flavors, and 8 seasonal flavors – Ciao Bella has less than 1% market share 57

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - X n Zambeedo Ice Cream – Company website: http: //www. zambeedo. com – 38245 Murrieta Hot Springs Rd. , #F-105, Murrieta, CA 92563 Tel: 951 -461 -9932 – Zambeedo is a manufacturer of specialty ice cream – The company’s products are sold through health and natural food stores – Zambeedo’s unique flavors include Crème de Rose, Crème de Menthe, and Crème de Chai – Zambeedo has less than 1% market share 58

CUSTOMER ANALYSIS – ICE CREAM MANUFACTURERS - X n Zambeedo Ice Cream – Company website: http: //www. zambeedo. com – 38245 Murrieta Hot Springs Rd. , #F-105, Murrieta, CA 92563 Tel: 951 -461 -9932 – Zambeedo is a manufacturer of specialty ice cream – The company’s products are sold through health and natural food stores – Zambeedo’s unique flavors include Crème de Rose, Crème de Menthe, and Crème de Chai – Zambeedo has less than 1% market share 58

CUSTOMER ANALYSIS – ICE CREAM RETAIL CHAIN - I n Baskin Robbins (Dunkin’ Brands) – Company website: http: //www. baskinrobbins. com – 130 Royall Street, Canton, MA 02021 Tel: 781 -737 -3000 – Estimated 2005 sales (QSR): $555 million – Baskin Robbins operates the world’s largest chain of ice cream specialty shops – The company owns more than 5, 600 retail shops in 40 countries – Baskin Robbins serves 22 permanent ice cream flavors, 12 seasonal flavors, 15 regional flavors, 3 sherbet/sorbet flavors, and 3 frozen yogurt flavors 59

CUSTOMER ANALYSIS – ICE CREAM RETAIL CHAIN - I n Baskin Robbins (Dunkin’ Brands) – Company website: http: //www. baskinrobbins. com – 130 Royall Street, Canton, MA 02021 Tel: 781 -737 -3000 – Estimated 2005 sales (QSR): $555 million – Baskin Robbins operates the world’s largest chain of ice cream specialty shops – The company owns more than 5, 600 retail shops in 40 countries – Baskin Robbins serves 22 permanent ice cream flavors, 12 seasonal flavors, 15 regional flavors, 3 sherbet/sorbet flavors, and 3 frozen yogurt flavors 59

CUSTOMER ANALYSIS – ICE CREAM RETAIL CHAIN - II n Carvel Corporation (FOCUS Brands) – Company website: http: //www. carvel. com – 200 Glenridge Point Pkwy, Suite 200, Atlanta, GA 30342 Tel: 404 -255 -3250 – Estimated 2005 sales: $86. 5 million – Carvel sells soft serve ice cream and other frozen treats, including character -shaped frozen ice cream cakes – The company has a chain of more than 540 franchised ice cream shops in more than 25 states, primarily in the Northeast – Carvel also sells ice cream cakes through approximately 8, 500 supermarkets nationwide 60

CUSTOMER ANALYSIS – ICE CREAM RETAIL CHAIN - II n Carvel Corporation (FOCUS Brands) – Company website: http: //www. carvel. com – 200 Glenridge Point Pkwy, Suite 200, Atlanta, GA 30342 Tel: 404 -255 -3250 – Estimated 2005 sales: $86. 5 million – Carvel sells soft serve ice cream and other frozen treats, including character -shaped frozen ice cream cakes – The company has a chain of more than 540 franchised ice cream shops in more than 25 states, primarily in the Northeast – Carvel also sells ice cream cakes through approximately 8, 500 supermarkets nationwide 60

CUSTOMER ANALYSIS – ICE CREAM RETAIL CHAIN - III n Coldstone Creamery – Company website: http: //www. coldstonecreamery. com – 9311 E. Via de Ventura, Scottsdale, AZ 85258 Tel: 480 -362 -4800 – Coldstone sells custom ice cream creations through it chain of “upscale” retail locations – The company operates more than 1, 350 stores – At Coldstone retail locations, customers combine their favorite ice cream flavor with any number of “mix-ins” (i. e. candies, chocolate, fruits, nuts, sauces, etc. ) to create their personalized ice cream – Coldstone makes 33 different ice cream flavors – The company offers 11. 5 million possible ice cream creations 61

CUSTOMER ANALYSIS – ICE CREAM RETAIL CHAIN - III n Coldstone Creamery – Company website: http: //www. coldstonecreamery. com – 9311 E. Via de Ventura, Scottsdale, AZ 85258 Tel: 480 -362 -4800 – Coldstone sells custom ice cream creations through it chain of “upscale” retail locations – The company operates more than 1, 350 stores – At Coldstone retail locations, customers combine their favorite ice cream flavor with any number of “mix-ins” (i. e. candies, chocolate, fruits, nuts, sauces, etc. ) to create their personalized ice cream – Coldstone makes 33 different ice cream flavors – The company offers 11. 5 million possible ice cream creations 61

CUSTOMER ANALYSIS – ICE CREAM RETAIL CHAIN - IV n International Dairy Queen (Berkshire Hathaway) – Company website: http: //www. dairyqueen. com – 7505 Metro Blvd. , Edina, MN 55439 Tel: 952 -830 -0200 – 2005 sales: $108. 1 million – Dairy Queen is a leading franchiser of frozen treat stores, which also serves a full line of typical “fast food” – The company has more than 5, 600 locations – Dairy Queen is popular for their ice cream treats, such as “sundaes” and “soft ice cream” cones 62

CUSTOMER ANALYSIS – ICE CREAM RETAIL CHAIN - IV n International Dairy Queen (Berkshire Hathaway) – Company website: http: //www. dairyqueen. com – 7505 Metro Blvd. , Edina, MN 55439 Tel: 952 -830 -0200 – 2005 sales: $108. 1 million – Dairy Queen is a leading franchiser of frozen treat stores, which also serves a full line of typical “fast food” – The company has more than 5, 600 locations – Dairy Queen is popular for their ice cream treats, such as “sundaes” and “soft ice cream” cones 62

CUSTOMER ANALYSIS – ICE CREAM RETAIL CHAIN - V n Maggie. Moo’s – Company website: http: //www. maggiemoos. com – 10025 Governor Warfield Pkwy, Suite 301, Columbia, MD 21044 Tel: 410 -740 -2100 – Estimated 2005 sales: $60 million – Maggie. Moo’s retail shops serves super premium ice cream – The ice cream is made fresh daily at the retail location – Maggie. Moo’s allows customers to mix in fruits, nuts, or candies to create custom ice cream flavors 63

CUSTOMER ANALYSIS – ICE CREAM RETAIL CHAIN - V n Maggie. Moo’s – Company website: http: //www. maggiemoos. com – 10025 Governor Warfield Pkwy, Suite 301, Columbia, MD 21044 Tel: 410 -740 -2100 – Estimated 2005 sales: $60 million – Maggie. Moo’s retail shops serves super premium ice cream – The ice cream is made fresh daily at the retail location – Maggie. Moo’s allows customers to mix in fruits, nuts, or candies to create custom ice cream flavors 63

CUSTOMER ANALYSIS – ICE CREAM RETAIL CHAIN - VI n Marble Slab Creamery – Company website: http: //www. marbleslabcreamery. com – 3100 S. Gessner, Suite 305, Houston, TX 77063 Tel: 713 -780 -3601 – Estimated 2005 sales (QSR): $90 million – Marble Slab operates a chain of more than 540 franchised frozen treat outlets in 35 states – The company serves about 40 flavors of homemade ice cream upon which “mix-ins” are combined to create personalized ice cream flavors 64

CUSTOMER ANALYSIS – ICE CREAM RETAIL CHAIN - VI n Marble Slab Creamery – Company website: http: //www. marbleslabcreamery. com – 3100 S. Gessner, Suite 305, Houston, TX 77063 Tel: 713 -780 -3601 – Estimated 2005 sales (QSR): $90 million – Marble Slab operates a chain of more than 540 franchised frozen treat outlets in 35 states – The company serves about 40 flavors of homemade ice cream upon which “mix-ins” are combined to create personalized ice cream flavors 64

CUSTOMER ANALYSIS – ICE CREAM RETAIL CHAIN - VII n TCBY – The Country’s Best Yogurt (Mrs. Fields Famous Brands) – Company website: http: //www. tcby. com – 2855 E. Cottonwood Pkwy, Suite 400, Salt Lake City, UT 84121 Tel: 801 -736 -5600 – TCBY franchises serve frozen yogurt treats at its retail locations – The company has more than 1, 300 locations nationwide – TCBY serves 17 different hand-scooped frozen yogurt flavors and 41 softserved flavors 65

CUSTOMER ANALYSIS – ICE CREAM RETAIL CHAIN - VII n TCBY – The Country’s Best Yogurt (Mrs. Fields Famous Brands) – Company website: http: //www. tcby. com – 2855 E. Cottonwood Pkwy, Suite 400, Salt Lake City, UT 84121 Tel: 801 -736 -5600 – TCBY franchises serve frozen yogurt treats at its retail locations – The company has more than 1, 300 locations nationwide – TCBY serves 17 different hand-scooped frozen yogurt flavors and 41 softserved flavors 65

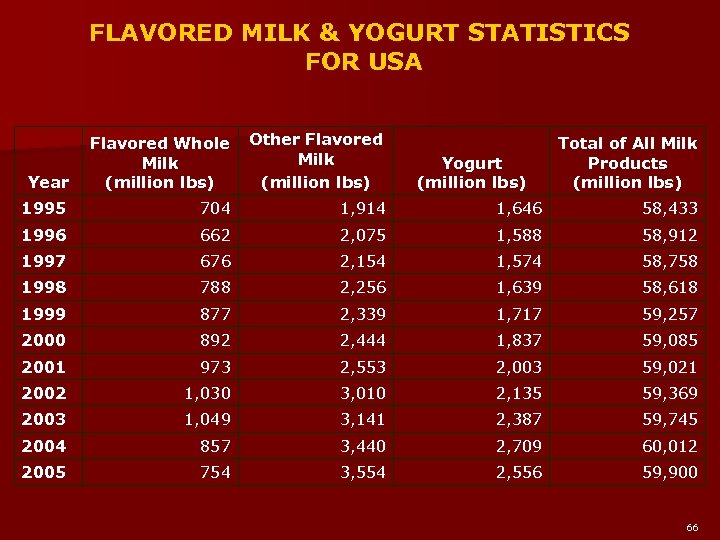

FLAVORED MILK & YOGURT STATISTICS FOR USA Year Flavored Whole Other Flavored Milk (million lbs) Yogurt (million lbs) Total of All Milk Products (million lbs) 1995 704 1, 914 1, 646 58, 433 1996 662 2, 075 1, 588 58, 912 1997 676 2, 154 1, 574 58, 758 1998 788 2, 256 1, 639 58, 618 1999 877 2, 339 1, 717 59, 257 2000 892 2, 444 1, 837 59, 085 2001 973 2, 553 2, 003 59, 021 2002 1, 030 3, 010 2, 135 59, 369 2003 1, 049 3, 141 2, 387 59, 745 2004 857 3, 440 2, 709 60, 012 2005 754 3, 554 2, 556 59, 900 66

FLAVORED MILK & YOGURT STATISTICS FOR USA Year Flavored Whole Other Flavored Milk (million lbs) Yogurt (million lbs) Total of All Milk Products (million lbs) 1995 704 1, 914 1, 646 58, 433 1996 662 2, 075 1, 588 58, 912 1997 676 2, 154 1, 574 58, 758 1998 788 2, 256 1, 639 58, 618 1999 877 2, 339 1, 717 59, 257 2000 892 2, 444 1, 837 59, 085 2001 973 2, 553 2, 003 59, 021 2002 1, 030 3, 010 2, 135 59, 369 2003 1, 049 3, 141 2, 387 59, 745 2004 857 3, 440 2, 709 60, 012 2005 754 3, 554 2, 556 59, 900 66

MARKET SEGMENT – YOGURT – MANUFACTURERS - I n Yoplait (General Mills) – Company website: http: //www. yoplait. com – 1 General Mills Blvd. , Minneapolis, MN 55426 Tel: 763 -764 -7600 – 2006 sales: $1, 096 million – Yoplait manufactures and markets yogurt products – The company sells 95 different flavors of yogurt and 14 flavors of drinkable yogurt – Yoplait has about 34% market share 67

MARKET SEGMENT – YOGURT – MANUFACTURERS - I n Yoplait (General Mills) – Company website: http: //www. yoplait. com – 1 General Mills Blvd. , Minneapolis, MN 55426 Tel: 763 -764 -7600 – 2006 sales: $1, 096 million – Yoplait manufactures and markets yogurt products – The company sells 95 different flavors of yogurt and 14 flavors of drinkable yogurt – Yoplait has about 34% market share 67

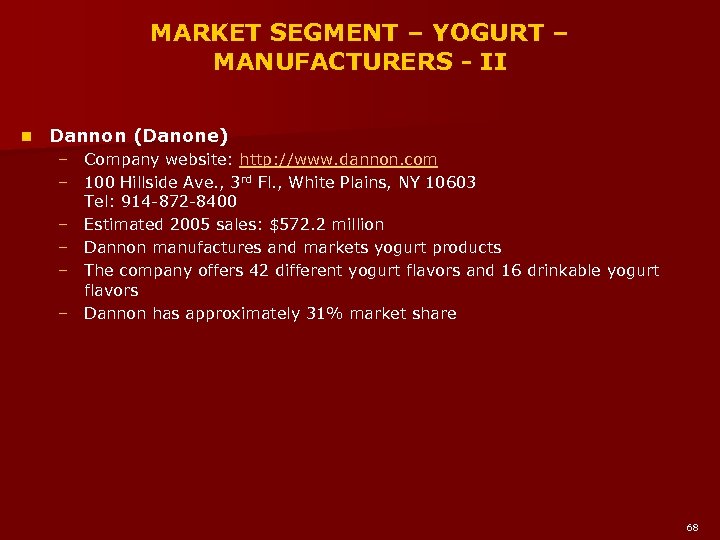

MARKET SEGMENT – YOGURT – MANUFACTURERS - II n Dannon (Danone) – Company website: http: //www. dannon. com – 100 Hillside Ave. , 3 rd Fl. , White Plains, NY 10603 Tel: 914 -872 -8400 – Estimated 2005 sales: $572. 2 million – Dannon manufactures and markets yogurt products – The company offers 42 different yogurt flavors and 16 drinkable yogurt flavors – Dannon has approximately 31% market share 68

MARKET SEGMENT – YOGURT – MANUFACTURERS - II n Dannon (Danone) – Company website: http: //www. dannon. com – 100 Hillside Ave. , 3 rd Fl. , White Plains, NY 10603 Tel: 914 -872 -8400 – Estimated 2005 sales: $572. 2 million – Dannon manufactures and markets yogurt products – The company offers 42 different yogurt flavors and 16 drinkable yogurt flavors – Dannon has approximately 31% market share 68

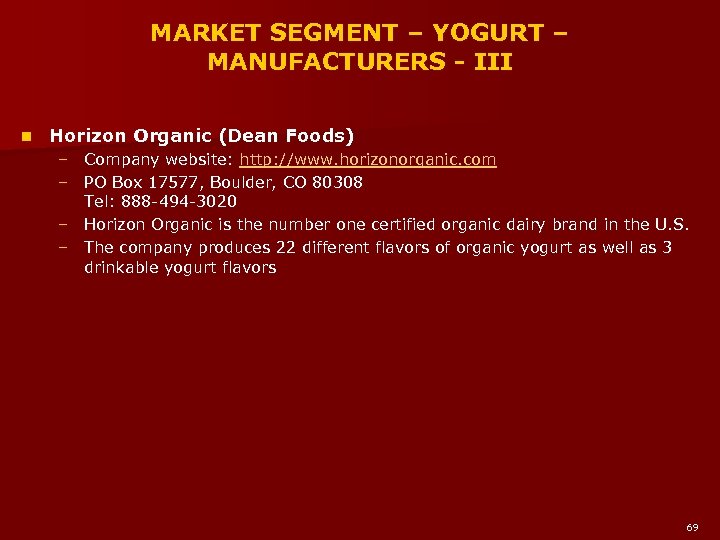

MARKET SEGMENT – YOGURT – MANUFACTURERS - III n Horizon Organic (Dean Foods) – Company website: http: //www. horizonorganic. com – PO Box 17577, Boulder, CO 80308 Tel: 888 -494 -3020 – Horizon Organic is the number one certified organic dairy brand in the U. S. – The company produces 22 different flavors of organic yogurt as well as 3 drinkable yogurt flavors 69

MARKET SEGMENT – YOGURT – MANUFACTURERS - III n Horizon Organic (Dean Foods) – Company website: http: //www. horizonorganic. com – PO Box 17577, Boulder, CO 80308 Tel: 888 -494 -3020 – Horizon Organic is the number one certified organic dairy brand in the U. S. – The company produces 22 different flavors of organic yogurt as well as 3 drinkable yogurt flavors 69

MARKET SEGMENT – YOGURT – MANUFACTURERS - IV n Light n’ Lively (Kraft) – Company website: http: //www. kraftfoods. com – 3 Lakes Dr. , Northfield, IL 60093 Tel: 847 -646 -2000 – Kraft sells cottage cheese and yogurt under its Light n’ Lively brand n Mountain High Yoghurt – – Company website: http: //www. mountainhighyoghurt. com 1325 West oxford Ave. , Englewood, CO 80110 Mountain High produces and sells all natural European style yogurt The company offers 19 different flavors of yogurt 70

MARKET SEGMENT – YOGURT – MANUFACTURERS - IV n Light n’ Lively (Kraft) – Company website: http: //www. kraftfoods. com – 3 Lakes Dr. , Northfield, IL 60093 Tel: 847 -646 -2000 – Kraft sells cottage cheese and yogurt under its Light n’ Lively brand n Mountain High Yoghurt – – Company website: http: //www. mountainhighyoghurt. com 1325 West oxford Ave. , Englewood, CO 80110 Mountain High produces and sells all natural European style yogurt The company offers 19 different flavors of yogurt 70

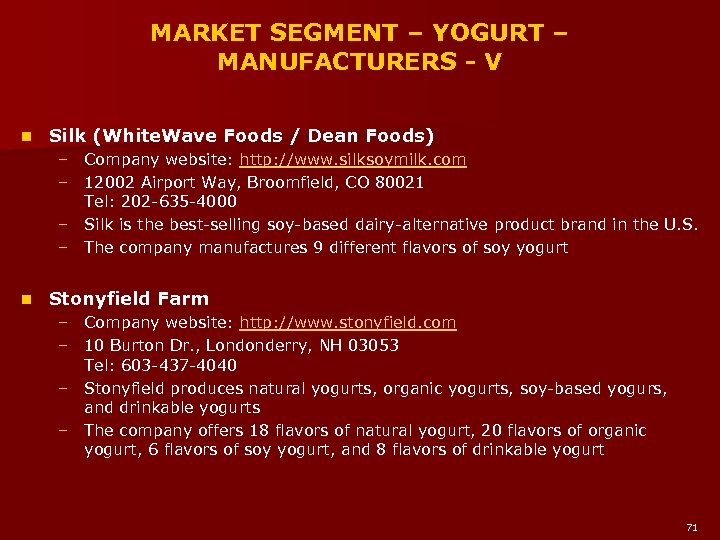

MARKET SEGMENT – YOGURT – MANUFACTURERS - V n Silk (White. Wave Foods / Dean Foods) – Company website: http: //www. silksoymilk. com – 12002 Airport Way, Broomfield, CO 80021 Tel: 202 -635 -4000 – Silk is the best-selling soy-based dairy-alternative product brand in the U. S. – The company manufactures 9 different flavors of soy yogurt n Stonyfield Farm – Company website: http: //www. stonyfield. com – 10 Burton Dr. , Londonderry, NH 03053 Tel: 603 -437 -4040 – Stonyfield produces natural yogurts, organic yogurts, soy-based yogurs, and drinkable yogurts – The company offers 18 flavors of natural yogurt, 20 flavors of organic yogurt, 6 flavors of soy yogurt, and 8 flavors of drinkable yogurt 71

MARKET SEGMENT – YOGURT – MANUFACTURERS - V n Silk (White. Wave Foods / Dean Foods) – Company website: http: //www. silksoymilk. com – 12002 Airport Way, Broomfield, CO 80021 Tel: 202 -635 -4000 – Silk is the best-selling soy-based dairy-alternative product brand in the U. S. – The company manufactures 9 different flavors of soy yogurt n Stonyfield Farm – Company website: http: //www. stonyfield. com – 10 Burton Dr. , Londonderry, NH 03053 Tel: 603 -437 -4040 – Stonyfield produces natural yogurts, organic yogurts, soy-based yogurs, and drinkable yogurts – The company offers 18 flavors of natural yogurt, 20 flavors of organic yogurt, 6 flavors of soy yogurt, and 8 flavors of drinkable yogurt 71

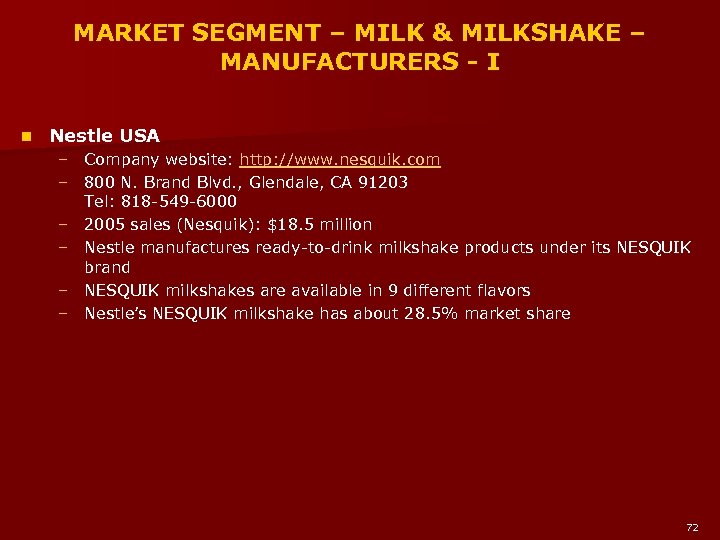

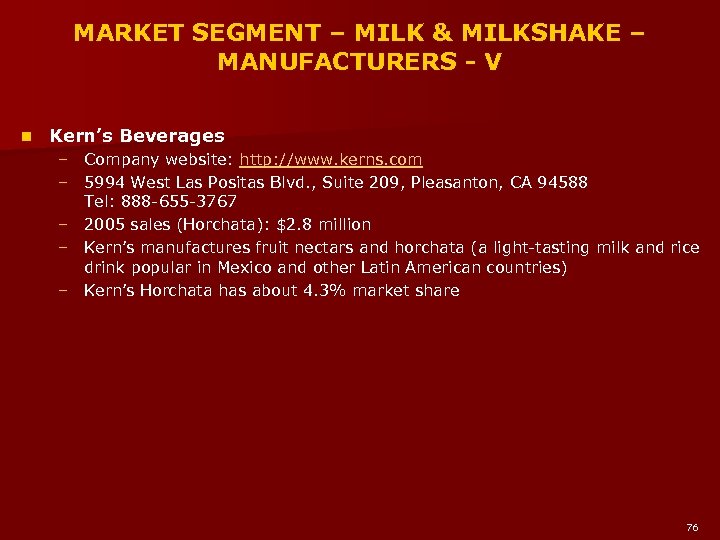

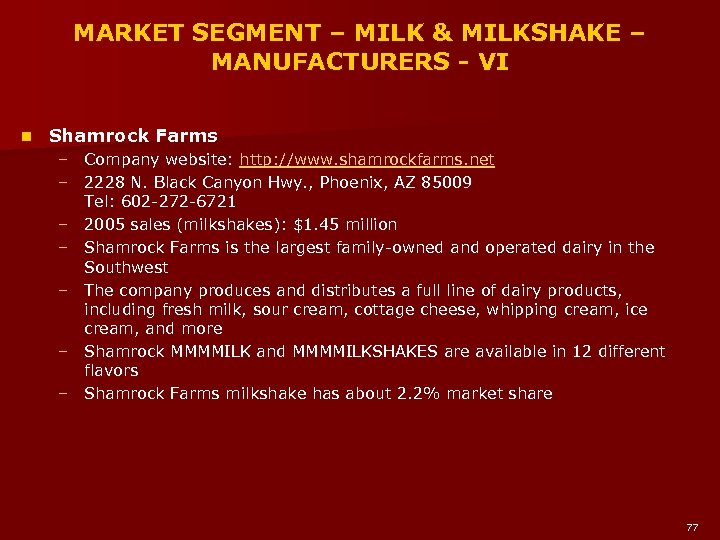

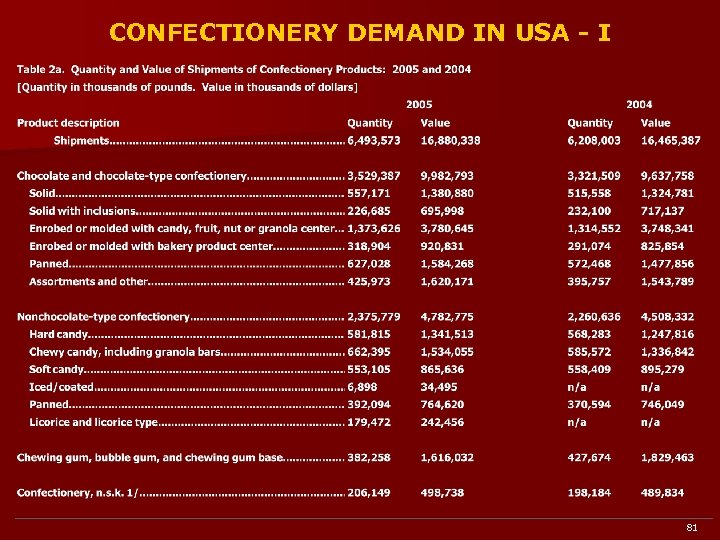

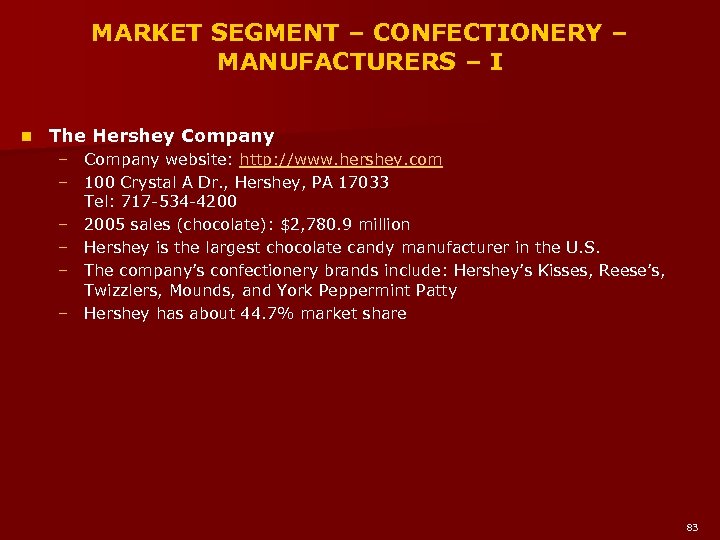

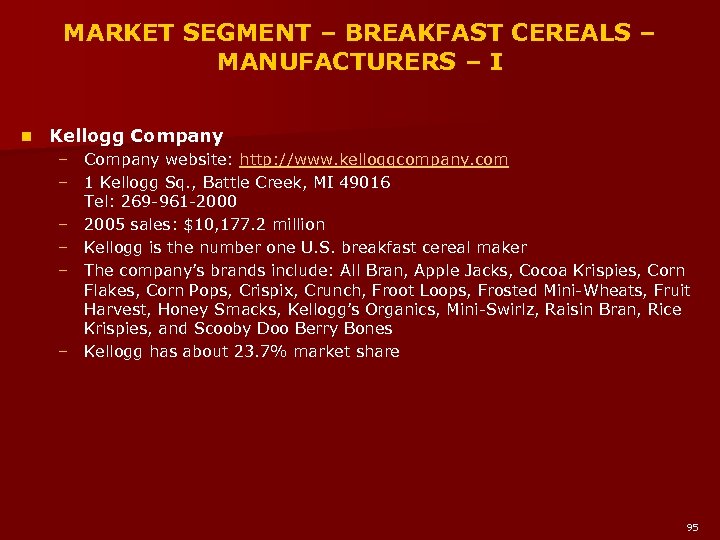

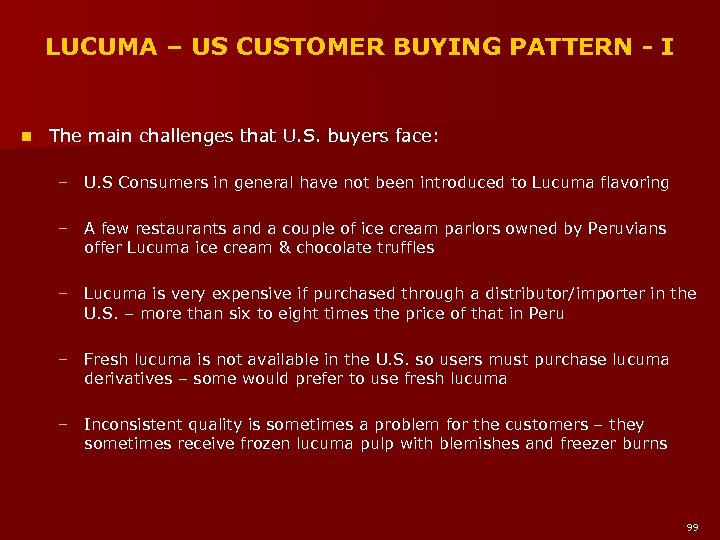

MARKET SEGMENT – MILK & MILKSHAKE – MANUFACTURERS - I n Nestle USA – Company website: http: //www. nesquik. com – 800 N. Brand Blvd. , Glendale, CA 91203 Tel: 818 -549 -6000 – 2005 sales (Nesquik): $18. 5 million – Nestle manufactures ready-to-drink milkshake products under its NESQUIK brand – NESQUIK milkshakes are available in 9 different flavors – Nestle’s NESQUIK milkshake has about 28. 5% market share 72