f23404918285cb44f02914ccb65680c1.ppt

- Количество слайдов: 32

Lowe’s Companies, Inc. (LOW) Jack Hainline | Alex Stepien | Sisi Lee | Patrick Quirke PRESENTED ON TUESDAY, APRIL 26, 2011

Lowe’s Companies, Inc. (LOW) Jack Hainline | Alex Stepien | Sisi Lee | Patrick Quirke PRESENTED ON TUESDAY, APRIL 26, 2011

Table of Contents Company Overview SWOT Analysis Management Assessment Industry Analysis Competitive Analysis Valuation Recommendation 2

Table of Contents Company Overview SWOT Analysis Management Assessment Industry Analysis Competitive Analysis Valuation Recommendation 2

Company Overview Founded in 1946 NYSE listed (LOW) since 1961 2 nd largest home improvement retailer in the world Headquartered in Mooresville, North Carolina Employs about 161, 000 people Operates 1, 749 stores, including 1, 723 stores in the United States, 24 stores in Canada, and 2 in Mexico Data from Yahoo Finance 3

Company Overview Founded in 1946 NYSE listed (LOW) since 1961 2 nd largest home improvement retailer in the world Headquartered in Mooresville, North Carolina Employs about 161, 000 people Operates 1, 749 stores, including 1, 723 stores in the United States, 24 stores in Canada, and 2 in Mexico Data from Yahoo Finance 3

Key Financials (FY 2010) FY ‘ 10 Sales: $48. 8 B up 3. 4% Market Capitalization: $34. 76 B P/E: 18. 55 Current Share Price: $26. 34 Gross Margin: 35. 14% up. 28% Operating Margin: 17. 31% EBIT Margin: 7. 29% up. 70% Net Earnings Margin: 4. 12% up from 3. 78% ROA: 5. 8% ROE: 10. 7% Data from Lowe’s 2010 Annual Report 4

Key Financials (FY 2010) FY ‘ 10 Sales: $48. 8 B up 3. 4% Market Capitalization: $34. 76 B P/E: 18. 55 Current Share Price: $26. 34 Gross Margin: 35. 14% up. 28% Operating Margin: 17. 31% EBIT Margin: 7. 29% up. 70% Net Earnings Margin: 4. 12% up from 3. 78% ROA: 5. 8% ROE: 10. 7% Data from Lowe’s 2010 Annual Report 4

Products and Services Home improvement: appliances, lumber, paint, millwork, building materials, lawn & landscape products, flooring, electric, etc. A typical Lowe’s store stocks approximately 40, 000 items with hundreds of items available through special order Installation services: flooring, millwork, cabinets, and countertops (6% of sales) Extended protections & repair services: extended plans on many products in key categories 5 Source: Lowe’s 2010 10 -K

Products and Services Home improvement: appliances, lumber, paint, millwork, building materials, lawn & landscape products, flooring, electric, etc. A typical Lowe’s store stocks approximately 40, 000 items with hundreds of items available through special order Installation services: flooring, millwork, cabinets, and countertops (6% of sales) Extended protections & repair services: extended plans on many products in key categories 5 Source: Lowe’s 2010 10 -K

Selling Channels Stores: retail home improvement stores generally open 7 days a week and average approx. 113, 000 sq. ft. of retail selling space, plus 32, 000 sq. ft. of outdoor garden center selling space Lowes. com: 24/7 shopping experience aimed to help reduce the complexity of product decisions and improvement projects by providing online product information, customer reviews, buying guides, and how-to videos (< 1% of sales) Job site/In-home selling: specialists available to consumers and commercial business customers to assist them in selecting products and services to purchase for a project 6 Source: Lowe’s 2010 10 -K

Selling Channels Stores: retail home improvement stores generally open 7 days a week and average approx. 113, 000 sq. ft. of retail selling space, plus 32, 000 sq. ft. of outdoor garden center selling space Lowes. com: 24/7 shopping experience aimed to help reduce the complexity of product decisions and improvement projects by providing online product information, customer reviews, buying guides, and how-to videos (< 1% of sales) Job site/In-home selling: specialists available to consumers and commercial business customers to assist them in selecting products and services to purchase for a project 6 Source: Lowe’s 2010 10 -K

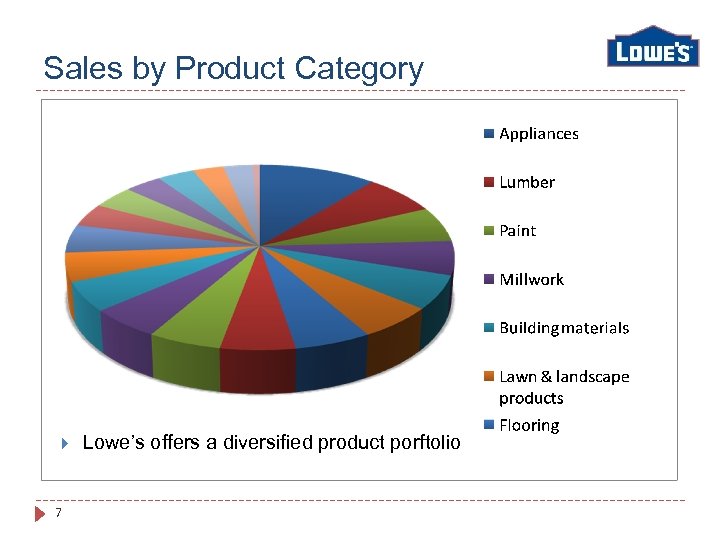

Sales by Product Category 7 Lowe’s offers a diversified product porftolio

Sales by Product Category 7 Lowe’s offers a diversified product porftolio

SWOT Analysis Strengths 8 Strong product diversification Launched mobile site in December Duopolistic pricing Ability to stay in business through housing bust Weaknesses Large planned capital expenditures on technology Customer service model will increase SG&A Duopolistic pricing Slowed store growth

SWOT Analysis Strengths 8 Strong product diversification Launched mobile site in December Duopolistic pricing Ability to stay in business through housing bust Weaknesses Large planned capital expenditures on technology Customer service model will increase SG&A Duopolistic pricing Slowed store growth

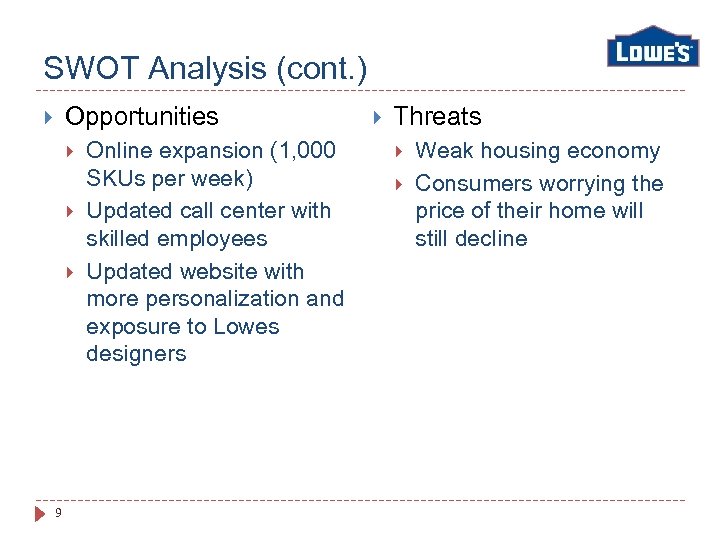

SWOT Analysis (cont. ) Opportunities 9 Online expansion (1, 000 SKUs per week) Updated call center with skilled employees Updated website with more personalization and exposure to Lowes designers Threats Weak housing economy Consumers worrying the price of their home will still decline

SWOT Analysis (cont. ) Opportunities 9 Online expansion (1, 000 SKUs per week) Updated call center with skilled employees Updated website with more personalization and exposure to Lowes designers Threats Weak housing economy Consumers worrying the price of their home will still decline

Management Discussion & Analysis Capture market share in discretionary, small ticket purchases now… …to better capture market share of big ticket purchases when they return Invest in technological enhancements to improve efficiency Corporate infrastructure Distribution Base price optimization Selective new store openings, close underperforming stores 10 Future store expansion in under-penetrated US, Canada urban markets Source: Lowe’s 2010 10 -K

Management Discussion & Analysis Capture market share in discretionary, small ticket purchases now… …to better capture market share of big ticket purchases when they return Invest in technological enhancements to improve efficiency Corporate infrastructure Distribution Base price optimization Selective new store openings, close underperforming stores 10 Future store expansion in under-penetrated US, Canada urban markets Source: Lowe’s 2010 10 -K

Management Discussion & Analysis Transformation from a home improvement “retailer” to home improvement “company” “My. Lowes” web portal with increased user functionality Upgraded call center Mobile site launch and mobile application launch Project Specialist Exteriors (PSEs) and District Commercial Account Specialists (DCASs) Normalize SG&A structure 11 69% mix of FT versus PT employees, compared to HD’s 59% mix of FT v PT January 2011: Lowe’s will replace 1, 700 FT employees with 8, 000 to 9, 000 PT employees Source: Lowe’s 2010 10 -K

Management Discussion & Analysis Transformation from a home improvement “retailer” to home improvement “company” “My. Lowes” web portal with increased user functionality Upgraded call center Mobile site launch and mobile application launch Project Specialist Exteriors (PSEs) and District Commercial Account Specialists (DCASs) Normalize SG&A structure 11 69% mix of FT versus PT employees, compared to HD’s 59% mix of FT v PT January 2011: Lowe’s will replace 1, 700 FT employees with 8, 000 to 9, 000 PT employees Source: Lowe’s 2010 10 -K

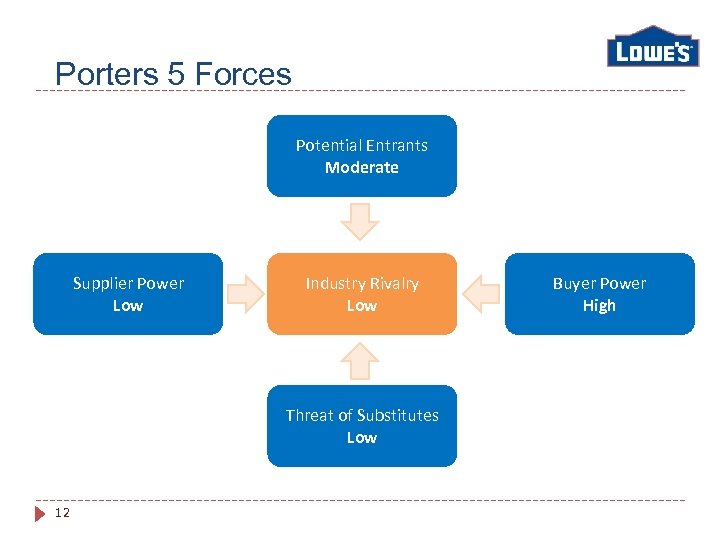

Porters 5 Forces Potential Entrants Moderate Supplier Power Low Industry Rivalry Low Threat of Substitutes Low 12 Buyer Power High

Porters 5 Forces Potential Entrants Moderate Supplier Power Low Industry Rivalry Low Threat of Substitutes Low 12 Buyer Power High

Threat of New Entrants: Moderate Large companies (LOW, HD) enjoy economies of scale Small companies compete effectively in niche areas Offer specialty products and services 13 Cater to contractors Serve areas of limited customer concentration unattractive to larger companies

Threat of New Entrants: Moderate Large companies (LOW, HD) enjoy economies of scale Small companies compete effectively in niche areas Offer specialty products and services 13 Cater to contractors Serve areas of limited customer concentration unattractive to larger companies

Supplier Power: Low HD, LOW leverage consolidation in negotiations Higher supplier concentration 14 Work with variety of suppliers to acquire essential inputs No single supplier accounts for more than 8% of Lowe’s total input purchases Source: Lowe’s 2010 10 -K

Supplier Power: Low HD, LOW leverage consolidation in negotiations Higher supplier concentration 14 Work with variety of suppliers to acquire essential inputs No single supplier accounts for more than 8% of Lowe’s total input purchases Source: Lowe’s 2010 10 -K

Buyer Power: Moderate Cautious consumer spending 15 Pull back of discretionary, big ticket purchases Retailers increase private label penetration

Buyer Power: Moderate Cautious consumer spending 15 Pull back of discretionary, big ticket purchases Retailers increase private label penetration

Threat of Substitutes: Low Market share protected by business segment cyclicality Cross/Up-Selling efforts reduce substitution initiatives 16 Better tailor customer experience Increasing website functionality and usability

Threat of Substitutes: Low Market share protected by business segment cyclicality Cross/Up-Selling efforts reduce substitution initiatives 16 Better tailor customer experience Increasing website functionality and usability

Rivalry: Low Nearly duopolistic operating environment Disciplined sales optimization in tough economic environment 17 Substantial support to profitability Benign competition

Rivalry: Low Nearly duopolistic operating environment Disciplined sales optimization in tough economic environment 17 Substantial support to profitability Benign competition

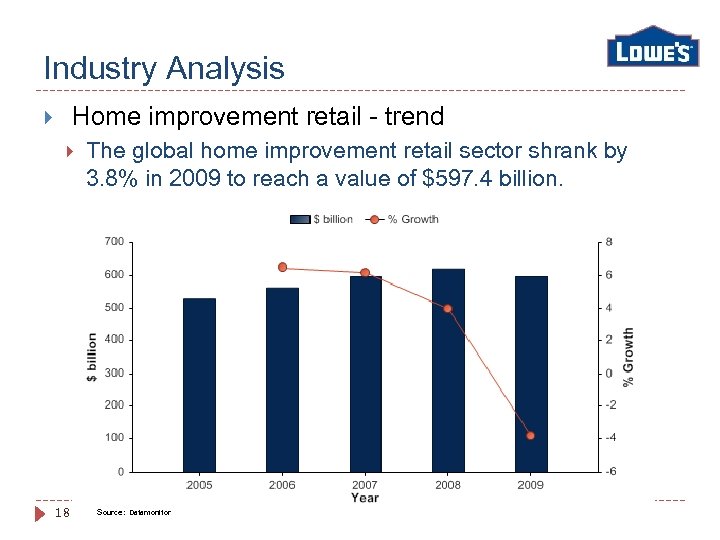

Industry Analysis Home improvement retail - trend 18 The global home improvement retail sector shrank by 3. 8% in 2009 to reach a value of $597. 4 billion. Source: Datamonitor 3/16/2018

Industry Analysis Home improvement retail - trend 18 The global home improvement retail sector shrank by 3. 8% in 2009 to reach a value of $597. 4 billion. Source: Datamonitor 3/16/2018

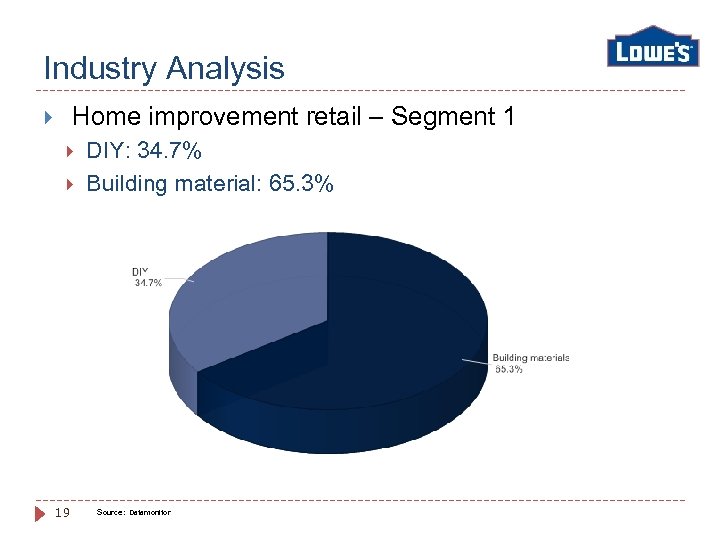

Industry Analysis Home improvement retail – Segment 1 19 DIY: 34. 7% Building material: 65. 3% Source: Datamonitor

Industry Analysis Home improvement retail – Segment 1 19 DIY: 34. 7% Building material: 65. 3% Source: Datamonitor

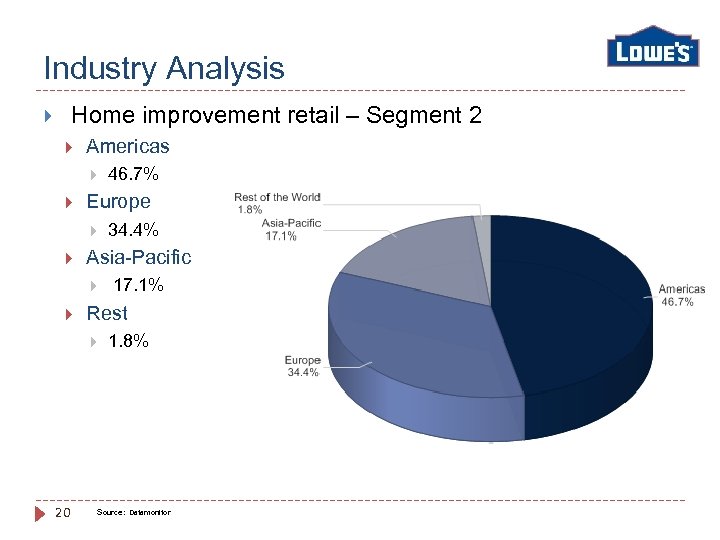

Industry Analysis Home improvement retail – Segment 2 Americas Europe 17. 1% Rest 20 34. 4% Asia-Pacific 46. 7% 1. 8% Source: Datamonitor

Industry Analysis Home improvement retail – Segment 2 Americas Europe 17. 1% Rest 20 34. 4% Asia-Pacific 46. 7% 1. 8% Source: Datamonitor

Industry Analysis - Macro Unemployment rate 9. 0% for 2011 Home prices Decline another 5% to 8% during 2011 Consumer credit Lower Real disposable personal income 2. 6% for 2011 21 Source: Lowe’s 2010 10 -K

Industry Analysis - Macro Unemployment rate 9. 0% for 2011 Home prices Decline another 5% to 8% during 2011 Consumer credit Lower Real disposable personal income 2. 6% for 2011 21 Source: Lowe’s 2010 10 -K

Industry Analysis - Macro Housing turnover Increase in 2011 Home ownership levels 67. 2% as of 2009 to 66. 5% as of 2010 Inflation as the prices of raw materials, oil and foreign manufacturing wages continue to increase Moderately improving consumer demand 22 Source: Lowe’s 2010 10 -K

Industry Analysis - Macro Housing turnover Increase in 2011 Home ownership levels 67. 2% as of 2009 to 66. 5% as of 2010 Inflation as the prices of raw materials, oil and foreign manufacturing wages continue to increase Moderately improving consumer demand 22 Source: Lowe’s 2010 10 -K

Industry Analysis - Micro Factors that determine customer choice Location of stores 1/3 customer Customer service Price competition (promotion) Factors that determine individual company decisions IT investment (operational synergies) Cash to Cash Cycle and other turnover Capital lease vs operating lease 23 HD: 34% for core technology Balance sheet presentation Depreciation: Leasehold improvements (tax shield) Source: 2010 U. S. Home Improvement Retailer Satisfaction Study

Industry Analysis - Micro Factors that determine customer choice Location of stores 1/3 customer Customer service Price competition (promotion) Factors that determine individual company decisions IT investment (operational synergies) Cash to Cash Cycle and other turnover Capital lease vs operating lease 23 HD: 34% for core technology Balance sheet presentation Depreciation: Leasehold improvements (tax shield) Source: 2010 U. S. Home Improvement Retailer Satisfaction Study

Industry Analysis - Micro Expansion activities Domestic expansion – new stores International expansion Merger & acquisition Joint venture Lowe’s entered joint venture agreement with Australian retailer Woolworths Limited during 2009 CPEX – expansion 24 Forward integration: distributors Backward integration: supplier Horizontal integration: other home improvement companies LOW: 45% store expansion HD: 9% for new stores

Industry Analysis - Micro Expansion activities Domestic expansion – new stores International expansion Merger & acquisition Joint venture Lowe’s entered joint venture agreement with Australian retailer Woolworths Limited during 2009 CPEX – expansion 24 Forward integration: distributors Backward integration: supplier Horizontal integration: other home improvement companies LOW: 45% store expansion HD: 9% for new stores

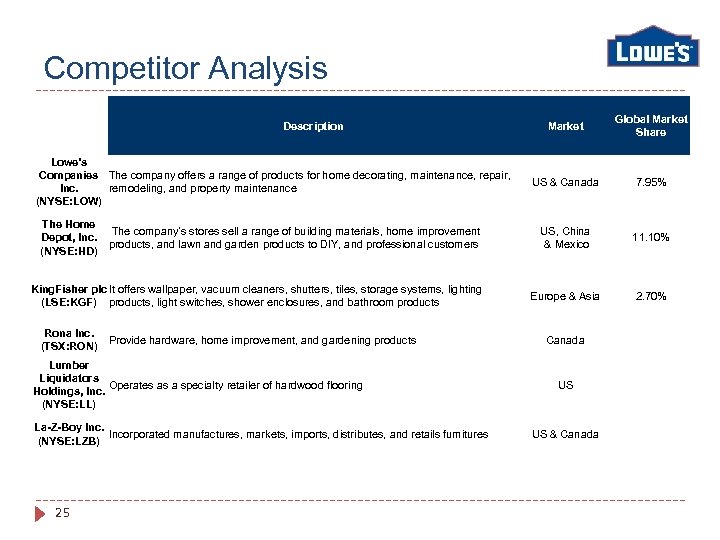

Competitor Analysis Description Lowe's Companies The company offers a range of products for home decorating, maintenance, repair, Inc. remodeling, and property maintenance (NYSE: LOW) The Home The company’s stores sell a range of building materials, home improvement Depot, Inc. products, and lawn and garden products to DIY, and professional customers (NYSE: HD) King. Fisher plc It offers wallpaper, vacuum cleaners, shutters, tiles, storage systems, lighting (LSE: KGF) products, light switches, shower enclosures, and bathroom products Rona Inc. (TSX: RON) Provide hardware, home improvement, and gardening products Lumber Liquidators Operates as a specialty retailer of hardwood flooring Holdings, Inc. (NYSE: LL) La-Z-Boy Incorporated manufactures, markets, imports, distributes, and retails furnitures (NYSE: LZB) 25 Market Global Market Share US & Canada 7. 95% US, China & Mexico 11. 10% Europe & Asia 2. 70% Canada US US & Canada

Competitor Analysis Description Lowe's Companies The company offers a range of products for home decorating, maintenance, repair, Inc. remodeling, and property maintenance (NYSE: LOW) The Home The company’s stores sell a range of building materials, home improvement Depot, Inc. products, and lawn and garden products to DIY, and professional customers (NYSE: HD) King. Fisher plc It offers wallpaper, vacuum cleaners, shutters, tiles, storage systems, lighting (LSE: KGF) products, light switches, shower enclosures, and bathroom products Rona Inc. (TSX: RON) Provide hardware, home improvement, and gardening products Lumber Liquidators Operates as a specialty retailer of hardwood flooring Holdings, Inc. (NYSE: LL) La-Z-Boy Incorporated manufactures, markets, imports, distributes, and retails furnitures (NYSE: LZB) 25 Market Global Market Share US & Canada 7. 95% US, China & Mexico 11. 10% Europe & Asia 2. 70% Canada US US & Canada

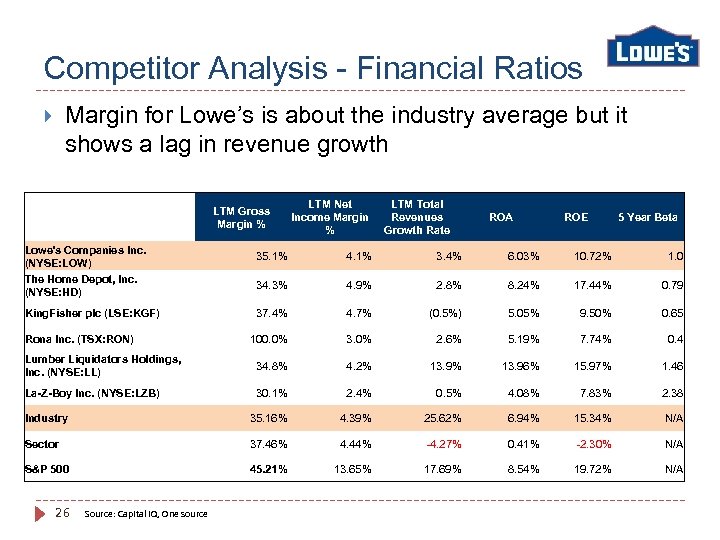

Competitor Analysis - Financial Ratios Margin for Lowe’s is about the industry average but it shows a lag in revenue growth Lowe's Companies Inc. (NYSE: LOW) The Home Depot, Inc. (NYSE: HD) LTM Gross Margin % LTM Net Income Margin % LTM Total Revenues Growth Rate ROA ROE 5 Year Beta 35. 1% 4. 1% 3. 4% 6. 03% 10. 72% 1. 0 34. 3% 4. 9% 2. 8% 8. 24% 17. 44% 0. 79 37. 4% 4. 7% (0. 5%) 5. 05% 9. 50% 0. 65 100. 0% 3. 0% 2. 6% 5. 19% 7. 74% 0. 4 Lumber Liquidators Holdings, Inc. (NYSE: LL) 34. 8% 4. 2% 13. 96% 15. 97% 1. 46 La-Z-Boy Inc. (NYSE: LZB) 30. 1% 2. 4% 0. 5% 4. 08% 7. 83% 2. 38 Industry 35. 16% 4. 39% 25. 62% 6. 94% 15. 34% N/A Sector 37. 46% 4. 44% -4. 27% 0. 41% -2. 30% N/A S&P 500 45. 21% 13. 65% 17. 69% 8. 54% 19. 72% N/A King. Fisher plc (LSE: KGF) Rona Inc. (TSX: RON) 26 Source: Capital IQ, One source

Competitor Analysis - Financial Ratios Margin for Lowe’s is about the industry average but it shows a lag in revenue growth Lowe's Companies Inc. (NYSE: LOW) The Home Depot, Inc. (NYSE: HD) LTM Gross Margin % LTM Net Income Margin % LTM Total Revenues Growth Rate ROA ROE 5 Year Beta 35. 1% 4. 1% 3. 4% 6. 03% 10. 72% 1. 0 34. 3% 4. 9% 2. 8% 8. 24% 17. 44% 0. 79 37. 4% 4. 7% (0. 5%) 5. 05% 9. 50% 0. 65 100. 0% 3. 0% 2. 6% 5. 19% 7. 74% 0. 4 Lumber Liquidators Holdings, Inc. (NYSE: LL) 34. 8% 4. 2% 13. 96% 15. 97% 1. 46 La-Z-Boy Inc. (NYSE: LZB) 30. 1% 2. 4% 0. 5% 4. 08% 7. 83% 2. 38 Industry 35. 16% 4. 39% 25. 62% 6. 94% 15. 34% N/A Sector 37. 46% 4. 44% -4. 27% 0. 41% -2. 30% N/A S&P 500 45. 21% 13. 65% 17. 69% 8. 54% 19. 72% N/A King. Fisher plc (LSE: KGF) Rona Inc. (TSX: RON) 26 Source: Capital IQ, One source

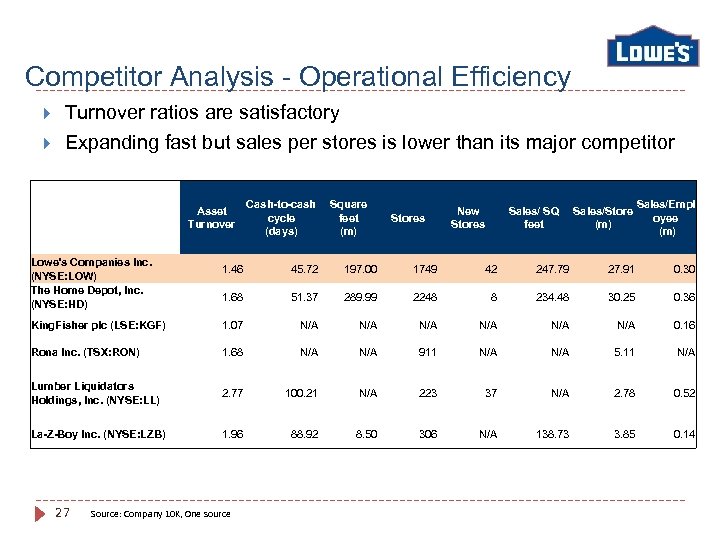

Competitor Analysis - Operational Efficiency Turnover ratios are satisfactory Expanding fast but sales per stores is lower than its major competitor Lowe's Companies Inc. (NYSE: LOW) The Home Depot, Inc. (NYSE: HD) Asset Turnover Cash-to-cash Square cycle feet (days) (m) Stores New Stores Sales/ SQ Sales/Store feet (m) Sales/Empl oyee (m) 1. 46 45. 72 197. 00 1749 42 247. 79 27. 91 0. 30 1. 68 51. 37 289. 99 2248 8 234. 48 30. 25 0. 36 King. Fisher plc (LSE: KGF) 1. 07 N/A N/A N/A 0. 16 Rona Inc. (TSX: RON) 1. 68 N/A 911 N/A 5. 11 N/A Lumber Liquidators Holdings, Inc. (NYSE: LL) 2. 77 100. 21 N/A 223 37 N/A 2. 78 0. 52 La-Z-Boy Inc. (NYSE: LZB) 1. 96 88. 92 8. 50 306 N/A 138. 73 3. 85 0. 14 27 Source: Company 10 K, One source

Competitor Analysis - Operational Efficiency Turnover ratios are satisfactory Expanding fast but sales per stores is lower than its major competitor Lowe's Companies Inc. (NYSE: LOW) The Home Depot, Inc. (NYSE: HD) Asset Turnover Cash-to-cash Square cycle feet (days) (m) Stores New Stores Sales/ SQ Sales/Store feet (m) Sales/Empl oyee (m) 1. 46 45. 72 197. 00 1749 42 247. 79 27. 91 0. 30 1. 68 51. 37 289. 99 2248 8 234. 48 30. 25 0. 36 King. Fisher plc (LSE: KGF) 1. 07 N/A N/A N/A 0. 16 Rona Inc. (TSX: RON) 1. 68 N/A 911 N/A 5. 11 N/A Lumber Liquidators Holdings, Inc. (NYSE: LL) 2. 77 100. 21 N/A 223 37 N/A 2. 78 0. 52 La-Z-Boy Inc. (NYSE: LZB) 1. 96 88. 92 8. 50 306 N/A 138. 73 3. 85 0. 14 27 Source: Company 10 K, One source

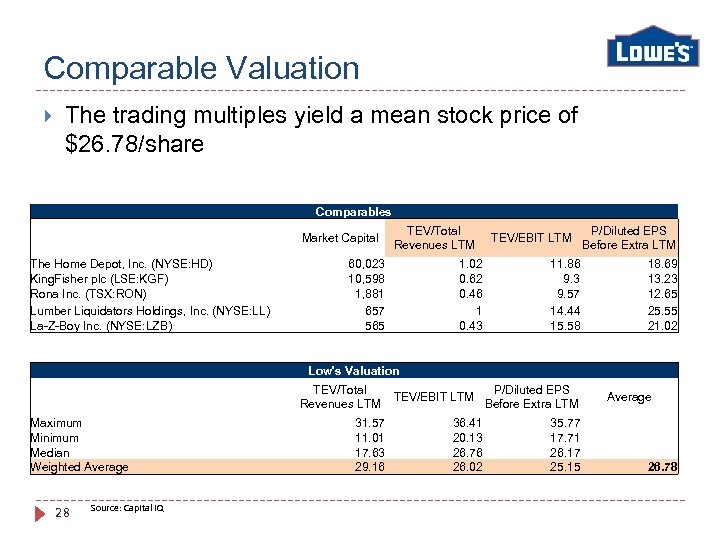

Comparable Valuation The trading multiples yield a mean stock price of $26. 78/share Comparables The Home Depot, Inc. (NYSE: HD) King. Fisher plc (LSE: KGF) Rona Inc. (TSX: RON) Lumber Liquidators Holdings, Inc. (NYSE: LL) La-Z-Boy Inc. (NYSE: LZB) Market Capital TEV/Total Revenues LTM 60, 023 10, 598 1, 881 657 565 1. 02 0. 62 0. 46 1 0. 43 TEV/EBIT LTM P/Diluted EPS Before Extra LTM 11. 86 9. 3 9. 57 14. 44 15. 58 18. 69 13. 23 12. 65 25. 55 21. 02 Low's Valuation Maximum Minimum Median Weighted Average 28 Source: Capital IQ TEV/Total P/Diluted EPS TEV/EBIT LTM Revenues LTM Before Extra LTM 31. 57 11. 01 17. 63 29. 16 36. 41 20. 13 26. 76 26. 02 35. 77 17. 71 26. 17 25. 15 Average 26. 78

Comparable Valuation The trading multiples yield a mean stock price of $26. 78/share Comparables The Home Depot, Inc. (NYSE: HD) King. Fisher plc (LSE: KGF) Rona Inc. (TSX: RON) Lumber Liquidators Holdings, Inc. (NYSE: LL) La-Z-Boy Inc. (NYSE: LZB) Market Capital TEV/Total Revenues LTM 60, 023 10, 598 1, 881 657 565 1. 02 0. 62 0. 46 1 0. 43 TEV/EBIT LTM P/Diluted EPS Before Extra LTM 11. 86 9. 3 9. 57 14. 44 15. 58 18. 69 13. 23 12. 65 25. 55 21. 02 Low's Valuation Maximum Minimum Median Weighted Average 28 Source: Capital IQ TEV/Total P/Diluted EPS TEV/EBIT LTM Revenues LTM Before Extra LTM 31. 57 11. 01 17. 63 29. 16 36. 41 20. 13 26. 76 26. 02 35. 77 17. 71 26. 17 25. 15 Average 26. 78

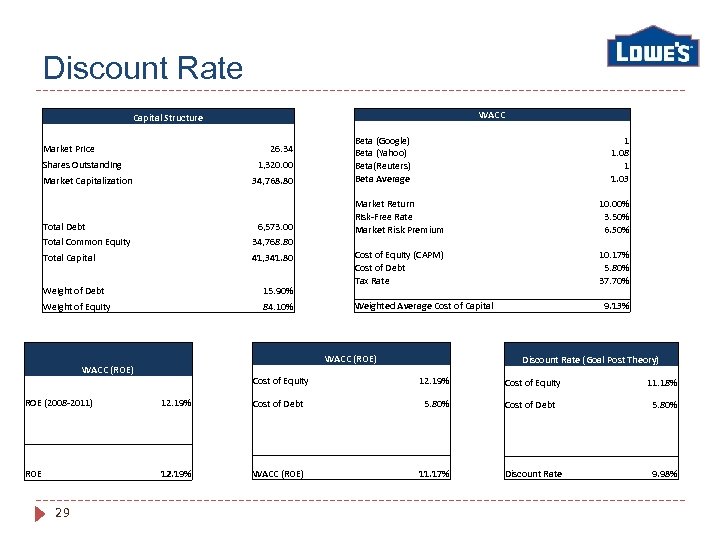

Discount Rate Capital Structure Market Price 26. 34 Shares Outstanding 1, 320. 00 Market Capitalization 34, 768. 80 Total Debt 6, 573. 00 Total Common Equity 34, 768. 80 Total Capital 41, 341. 80 Weight of Debt 15. 90% Weight of Equity 84. 10% WACC (ROE) ROE (2008 -2011) WACC Beta (Google) Beta (Yahoo) Beta(Reuters) Beta Average Market Return Risk-Free Rate Market Risk Premium Cost of Equity (CAPM) Cost of Debt Tax Rate Weighted Average Cost of Capital 1 1. 08 1 1. 03 10. 00% 3. 50% 6. 50% 10. 17% 5. 80% 37. 70% 9. 13% Discount Rate (Goal Post Theory) Cost of Equity 12. 19% Cost of Equity 11. 18% Cost of Debt 5. 80% ROE 12. 19% 29 WACC (ROE) 11. 17% Discount Rate 9. 98%

Discount Rate Capital Structure Market Price 26. 34 Shares Outstanding 1, 320. 00 Market Capitalization 34, 768. 80 Total Debt 6, 573. 00 Total Common Equity 34, 768. 80 Total Capital 41, 341. 80 Weight of Debt 15. 90% Weight of Equity 84. 10% WACC (ROE) ROE (2008 -2011) WACC Beta (Google) Beta (Yahoo) Beta(Reuters) Beta Average Market Return Risk-Free Rate Market Risk Premium Cost of Equity (CAPM) Cost of Debt Tax Rate Weighted Average Cost of Capital 1 1. 08 1 1. 03 10. 00% 3. 50% 6. 50% 10. 17% 5. 80% 37. 70% 9. 13% Discount Rate (Goal Post Theory) Cost of Equity 12. 19% Cost of Equity 11. 18% Cost of Debt 5. 80% ROE 12. 19% 29 WACC (ROE) 11. 17% Discount Rate 9. 98%

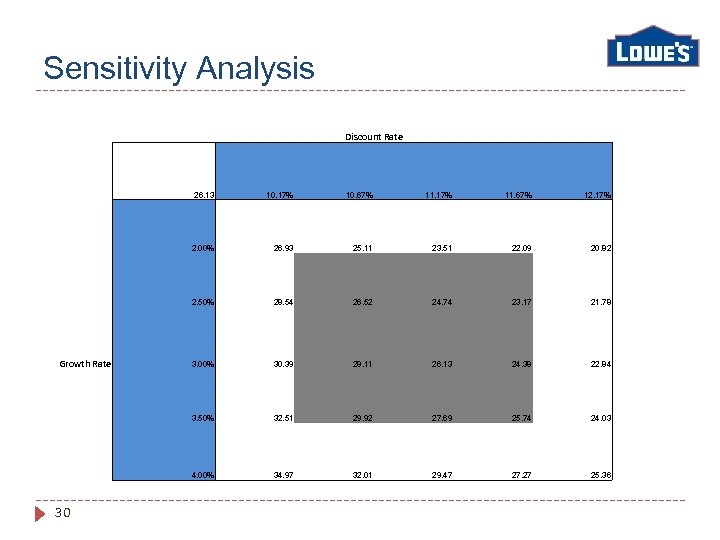

Sensitivity Analysis Discount Rate 26. 13 11. 17% 11. 67% 12. 17% 26. 93 25. 11 23. 51 22. 09 20. 82 2. 50% 28. 54 26. 52 24. 74 23. 17 21. 78 3. 00% 30. 39 28. 11 26. 13 24. 38 22. 84 3. 50% 32. 51 29. 92 27. 69 25. 74 24. 03 4. 00% 30 10. 67% 2. 00% Growth Rate 10. 17% 34. 97 32. 01 29. 47 27. 27 25. 36

Sensitivity Analysis Discount Rate 26. 13 11. 17% 11. 67% 12. 17% 26. 93 25. 11 23. 51 22. 09 20. 82 2. 50% 28. 54 26. 52 24. 74 23. 17 21. 78 3. 00% 30. 39 28. 11 26. 13 24. 38 22. 84 3. 50% 32. 51 29. 92 27. 69 25. 74 24. 03 4. 00% 30 10. 67% 2. 00% Growth Rate 10. 17% 34. 97 32. 01 29. 47 27. 27 25. 36

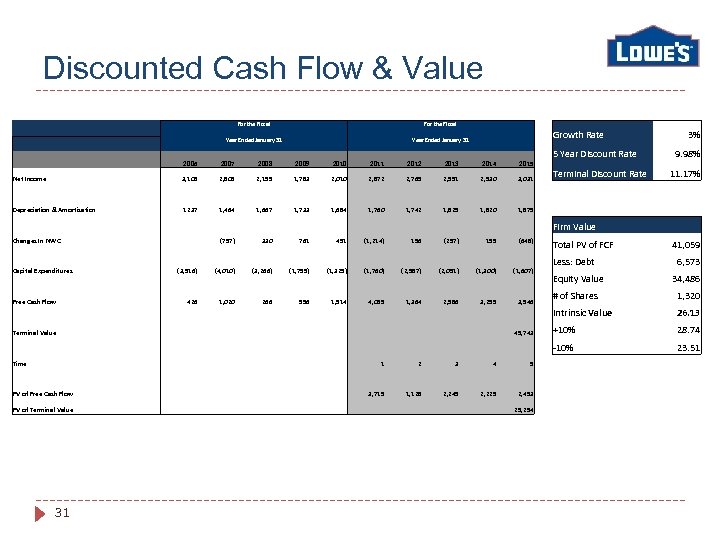

Discounted Cash Flow & Value For the Fiscal Year Ended January 31 Growth Rate 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Net Income 3, 105 2, 809 2, 195 1, 783 2, 010 2, 872 2, 765 2, 991 2, 930 3, 031 1, 760 1, 742 1, 829 1, 820 5 Year Discount Rate 9. 98% 1, 684 3% Depreciation & Amortization 1237 Changes In NWC 1, 464 1, 667 1, 733 Capital Expenditures (757) 330 761 (1, 214) (3, 916) (4, 010) (3, 266) (1, 799) (1, 329) Free Cash Flow 451 156 (1, 760) (257) (2, 987) 195 (2, 091) 426 1, 020 266 956 1, 914 4, 085 1, 364 2, 986 3, 255 Terminal Value Time PV of Free Cash Flow PV of Terminal Value 31 1 2 3, 715 Firm Value (648) (1, 607) 3 1, 128 2, 245 5 2, 225 Less: Debt Equity Value 41, 059 6, 573 34, 486 2, 453 29, 294 # of Shares 1, 320 26. 13 +10% 28. 74 -10% Total PV of FCF Intrinsic Value 3, 946 49, 743 4 11. 17% 1, 875 (1, 300) Terminal Discount Rate 23. 51

Discounted Cash Flow & Value For the Fiscal Year Ended January 31 Growth Rate 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Net Income 3, 105 2, 809 2, 195 1, 783 2, 010 2, 872 2, 765 2, 991 2, 930 3, 031 1, 760 1, 742 1, 829 1, 820 5 Year Discount Rate 9. 98% 1, 684 3% Depreciation & Amortization 1237 Changes In NWC 1, 464 1, 667 1, 733 Capital Expenditures (757) 330 761 (1, 214) (3, 916) (4, 010) (3, 266) (1, 799) (1, 329) Free Cash Flow 451 156 (1, 760) (257) (2, 987) 195 (2, 091) 426 1, 020 266 956 1, 914 4, 085 1, 364 2, 986 3, 255 Terminal Value Time PV of Free Cash Flow PV of Terminal Value 31 1 2 3, 715 Firm Value (648) (1, 607) 3 1, 128 2, 245 5 2, 225 Less: Debt Equity Value 41, 059 6, 573 34, 486 2, 453 29, 294 # of Shares 1, 320 26. 13 +10% 28. 74 -10% Total PV of FCF Intrinsic Value 3, 946 49, 743 4 11. 17% 1, 875 (1, 300) Terminal Discount Rate 23. 51

Recommendation DCF Value: $26. 13 +10% $28. 74 -10% $23. 51 Comps Value: $26. 78 Sensitivity Analysis Price Range: $20. 82 - $34. 97 Price as of Close 4/25/2011: $26. 34 Recommendation: Place on Watch List 32

Recommendation DCF Value: $26. 13 +10% $28. 74 -10% $23. 51 Comps Value: $26. 78 Sensitivity Analysis Price Range: $20. 82 - $34. 97 Price as of Close 4/25/2011: $26. 34 Recommendation: Place on Watch List 32