47f7e4dc5598e60aee92ac1790b9758f.ppt

- Количество слайдов: 86

Low Ability to respond High Low Likelihood of receiving new information High

NPV in function of P spreadsheet value

50%

50%

50%

Black-Scholes-Merton’s Financial Options Paddock, Siegel & Smith’s Real Options Financial Option Value Real Option Value of an Undeveloped Reserve (F) Current Stock Price Current Value of Developed Reserve (V) Exercise Price of the Option Investment Cost to Develop the Reserve (D) Risk-Free Interest Rate (r)

Managerial Action Is Inserted into the Model

Term Structure from Oil Futures Market

Jump-Reversion Sample Paths

Investment in information (wildcat drilling, etc. ) t=0 Today technical and economic valuation t=T t=1 Possible scenarios after the information arrived during the first year of option term Possible scenarios after the information arrived during the option lease term

20% = (CF ch ) ctor fa nce a

Revelation Distributions

So, refuse the $ 3 million offer!

Inv Jump to MC slide

Investments D 3 > D 2 > D 1

optional wells petroleum reservoir (top view) and the grid of wells

Expected Value confidence interval Higher Risk Lower Risk Expected Value

![confidence interval E[V] Current project value (t=0) Value with good revelation Value with neutral confidence interval E[V] Current project value (t=0) Value with good revelation Value with neutral](https://present5.com/presentation/47f7e4dc5598e60aee92ac1790b9758f/image-73.jpg)

confidence interval E[V] Current project value (t=0) Value with good revelation Value with neutral revelation Value with bad revelation

Posterior Scenarios Invest Well “C” Invest Well “B” 50% 50% 50% Revelation Scenarios NPV 400 350 (with 25% chances) 300 200 250 (with 50% chances) 100 200 150 (with 25% chances) - 200

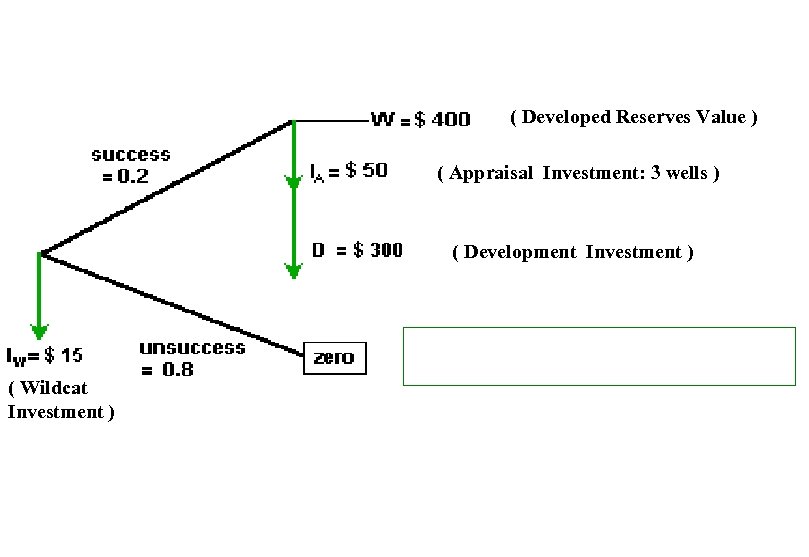

( Developed Reserves Value ) ( Appraisal Investment: 3 wells ) ( Development Investment ) ( Wildcat Investment )

(the probability of jumps) (jump size)

variation of the stochastic variable for time interval dt uncertainty from the continuous-time process (reversion)

47f7e4dc5598e60aee92ac1790b9758f.ppt