2543b67659d7e07e48b81bc506677ef7.ppt

- Количество слайдов: 7

![Lotte Entertainment Korea Distribution Partnership [Date] CONFIDENTIAL Lotte Entertainment Korea Distribution Partnership [Date] CONFIDENTIAL](https://present5.com/presentation/2543b67659d7e07e48b81bc506677ef7/image-1.jpg)

Lotte Entertainment Korea Distribution Partnership [Date] CONFIDENTIAL

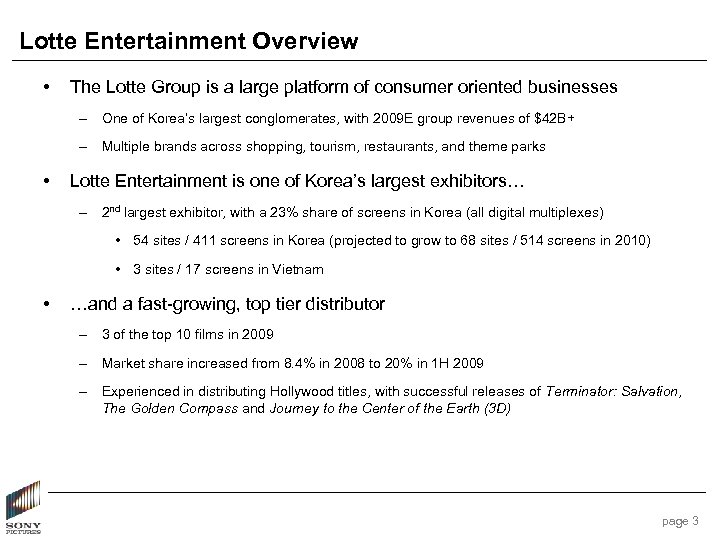

Executive Summary • SPE has been approached by Korea’s Lotte Entertainment to distribute SPE films in Korea and Vietnam – Seeking theatrical rights in Korea and Vietnam, video rights in Korea only – SPE would retain all TV rights • While Korea is a growth market, significant competitive barriers exist – Majority of market is controlled by large, vertical monopolies – Local film quotas have led to a strong local film production market, with Korean films often accounting for 50% or more of the box office in a given year • The terms offered by Lotte represent an opportunity to secure a guaranteed profit stream in Korea at or above historical averages – Potentially attractive economics for theatrical and video rights – Many SPE titles are not theatrically released. Additional releases and box office from SPE titles could drive value in TV market, which is retained by SPE • Opportunities may exist with other Korean distributors, such as CJ page 2

Lotte Entertainment Overview • The Lotte Group is a large platform of consumer oriented businesses – One of Korea’s largest conglomerates, with 2009 E group revenues of $42 B+ – Multiple brands across shopping, tourism, restaurants, and theme parks • Lotte Entertainment is one of Korea’s largest exhibitors… – 2 nd largest exhibitor, with a 23% share of screens in Korea (all digital multiplexes) • 54 sites / 411 screens in Korea (projected to grow to 68 sites / 514 screens in 2010) • 3 sites / 17 screens in Vietnam • …and a fast-growing, top tier distributor – 3 of the top 10 films in 2009 – Market share increased from 8. 4% in 2008 to 20% in 1 H 2009 – Experienced in distributing Hollywood titles, with successful releases of Terminator: Salvation, The Golden Compass and Journey to the Center of the Earth (3 D) page 3

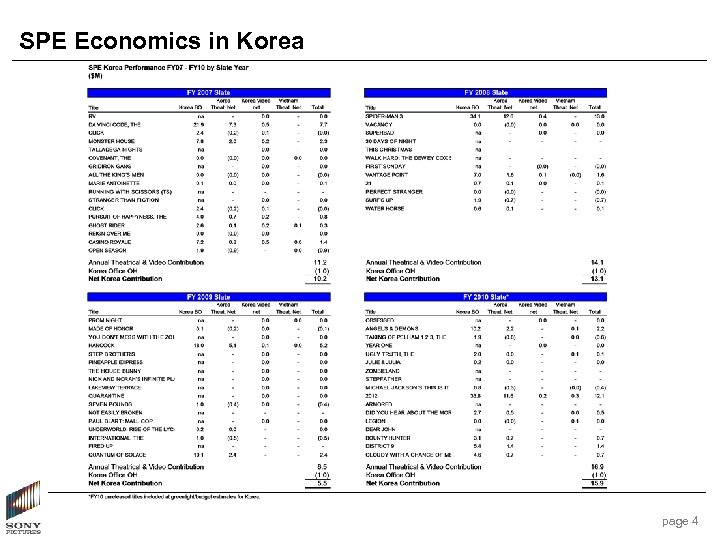

SPE Economics in Korea page 4

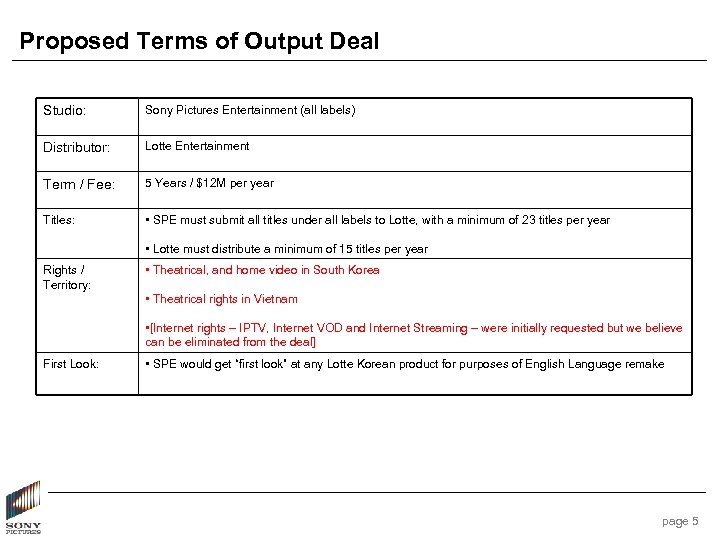

Proposed Terms of Output Deal Studio: Sony Pictures Entertainment (all labels) Distributor: Lotte Entertainment Term / Fee: 5 Years / $12 M per year Titles: • SPE must submit all titles under all labels to Lotte, with a minimum of 23 titles per year • Lotte must distribute a minimum of 15 titles per year Rights / Territory: • Theatrical, and home video in South Korea • Theatrical rights in Vietnam • [Internet rights – IPTV, Internet VOD and Internet Streaming – were initially requested but we believe can be eliminated from the deal] First Look: • SPE would get “first look” at any Lotte Korean product for purposes of English Language remake page 5

Items for Discussion • Additional terms to request – Higher annual license fee and upside participation – Restructure to allow for upfront payment recognizable in year (either “bonus” or “buy-out” payment) – Reasonable / narrow definition of Home Entertainment avoid risk to TV revenues – Subset of films they must take (eg, number of puts or triggers for automatic acceptance) – Ability to license/sub-distribute any rejected films, or non-theatrical product • Other items – Explore alternative partnerships in parallel with Lotte conversations • TV has relationship with CJ, Korea’s largest distributor • CJ has recently done an all-markets deal with Paramount and is rumored to be interested in further Studio deals – Determine accounting treatment • Ability to recognize advance in FY 11 • Methodology for allocating license fees across titles page 6

Next Steps • Senior management agree to proceed or pass • Assuming interest: – Confirm key terms to include in counter – Alert David Bishop, Steve Mosko, and Keith Le. Goy that we plan to engage formally – Express interest to Lotte and provide counter – Initiate discussions with CJ page 7

2543b67659d7e07e48b81bc506677ef7.ppt