7d7ffd65c7811d15555bf3a4dea251a6.ppt

- Количество слайдов: 26

Losses, Leverage, and Liquidity The Road Ahead for Risk Management Carl Tannenbaum Vice President, Risk Specialist Division Federal Reserve Bank of Chicago

Losses, Leverage, and Liquidity The Road Ahead for Risk Management Carl Tannenbaum Vice President, Risk Specialist Division Federal Reserve Bank of Chicago

Presentation Outline • Risk and Reinforcement: When Moods Add to Models Risk Conference, April 2009 Page 2

Presentation Outline • Risk and Reinforcement: When Moods Add to Models Risk Conference, April 2009 Page 2

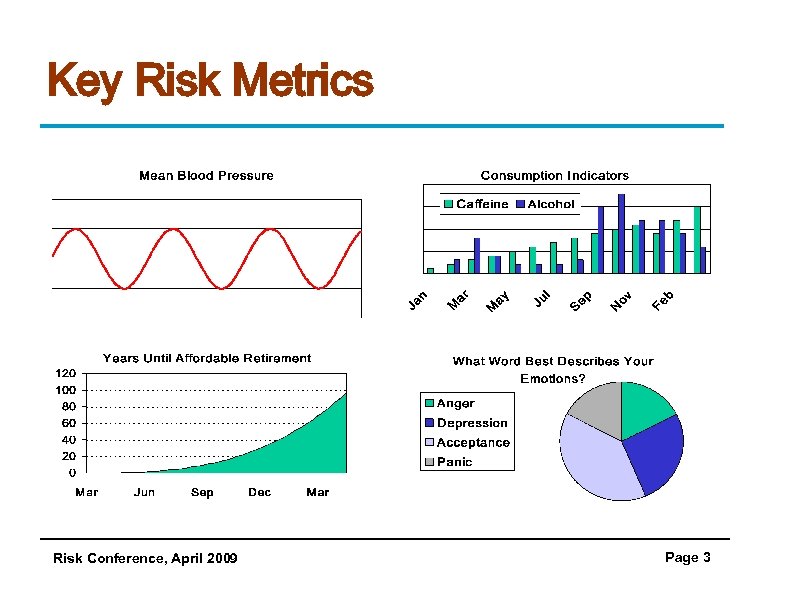

Key Risk Metrics Risk Conference, April 2009 Page 3

Key Risk Metrics Risk Conference, April 2009 Page 3

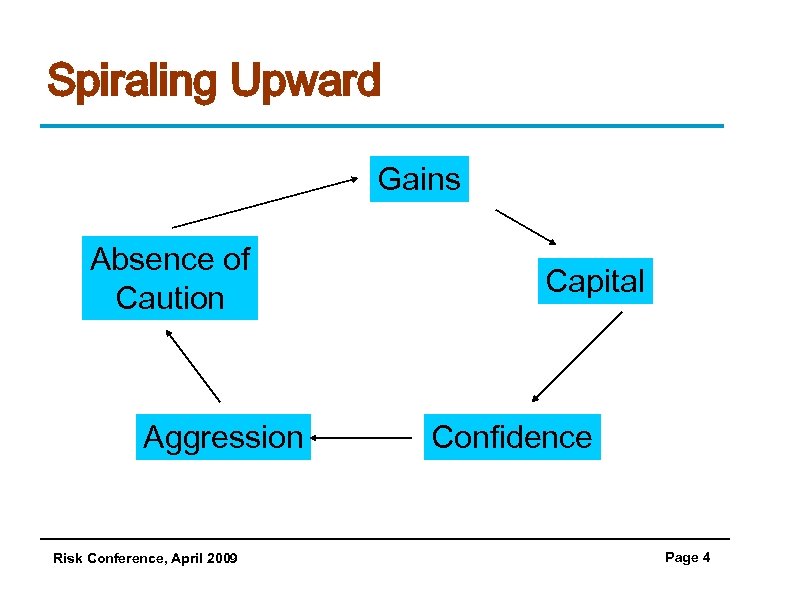

Spiraling Upward Gains Absence of Caution Aggression Risk Conference, April 2009 Capital Confidence Page 4

Spiraling Upward Gains Absence of Caution Aggression Risk Conference, April 2009 Capital Confidence Page 4

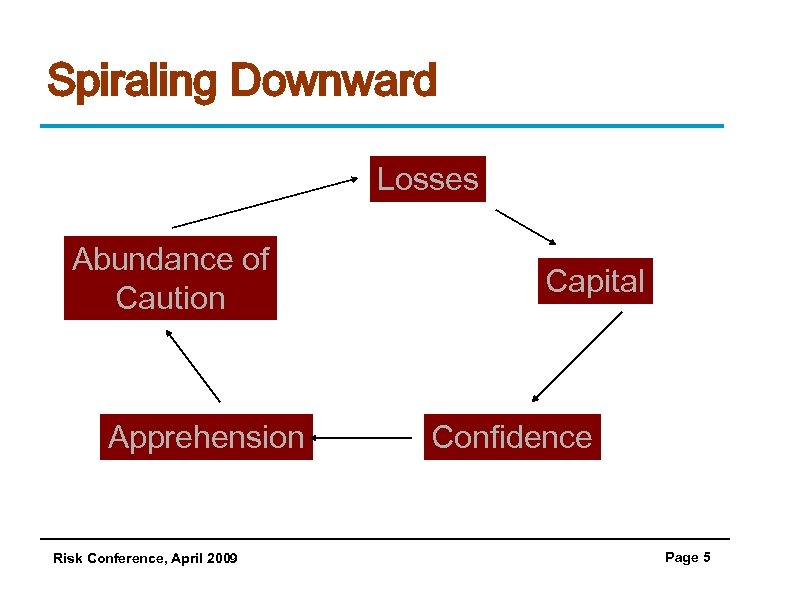

Spiraling Downward Losses Abundance of Caution Apprehension Risk Conference, April 2009 Capital Confidence Page 5

Spiraling Downward Losses Abundance of Caution Apprehension Risk Conference, April 2009 Capital Confidence Page 5

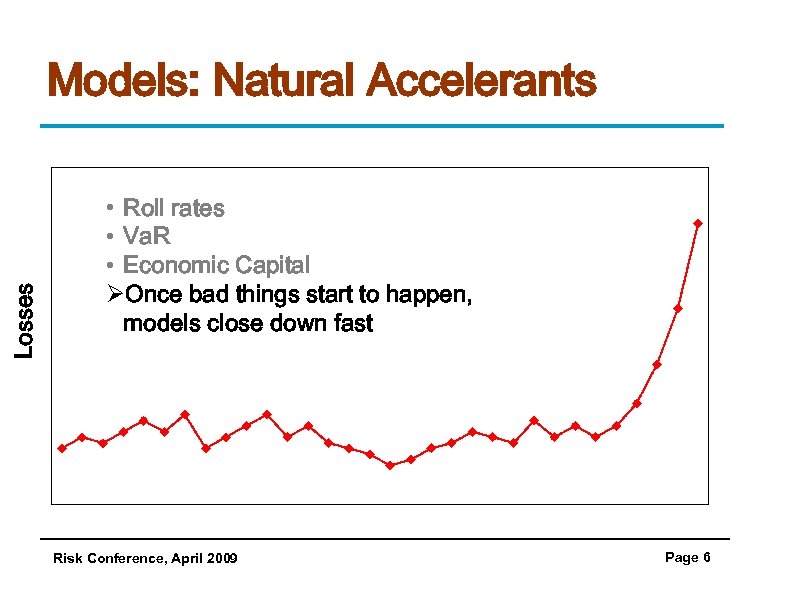

Losses Models: Natural Accelerants • Roll rates • Va. R • Economic Capital ØOnce bad things start to happen, models close down fast Risk Conference, April 2009 Page 6

Losses Models: Natural Accelerants • Roll rates • Va. R • Economic Capital ØOnce bad things start to happen, models close down fast Risk Conference, April 2009 Page 6

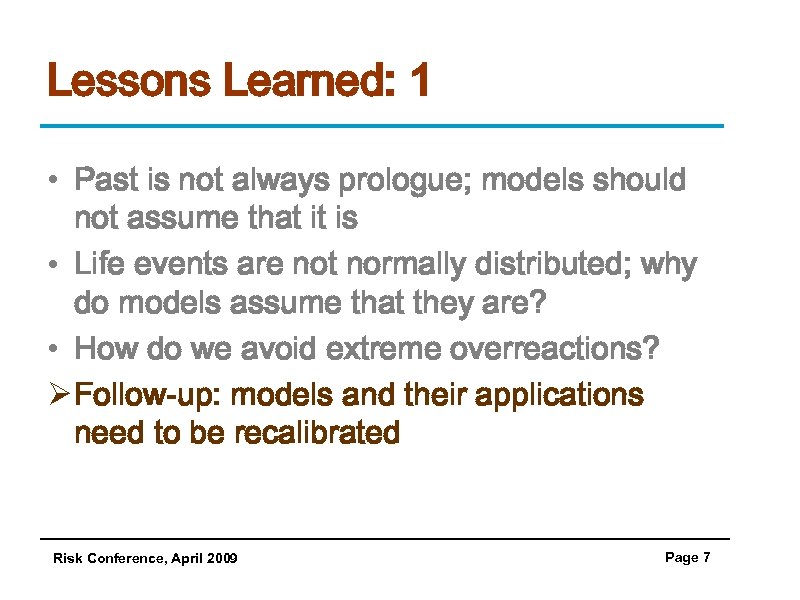

Lessons Learned: 1 • Past is not always prologue; models should not assume that it is • Life events are not normally distributed; why do models assume that they are? • How do we avoid extreme overreactions? Ø Follow-up: models and their applications need to be recalibrated Risk Conference, April 2009 Page 7

Lessons Learned: 1 • Past is not always prologue; models should not assume that it is • Life events are not normally distributed; why do models assume that they are? • How do we avoid extreme overreactions? Ø Follow-up: models and their applications need to be recalibrated Risk Conference, April 2009 Page 7

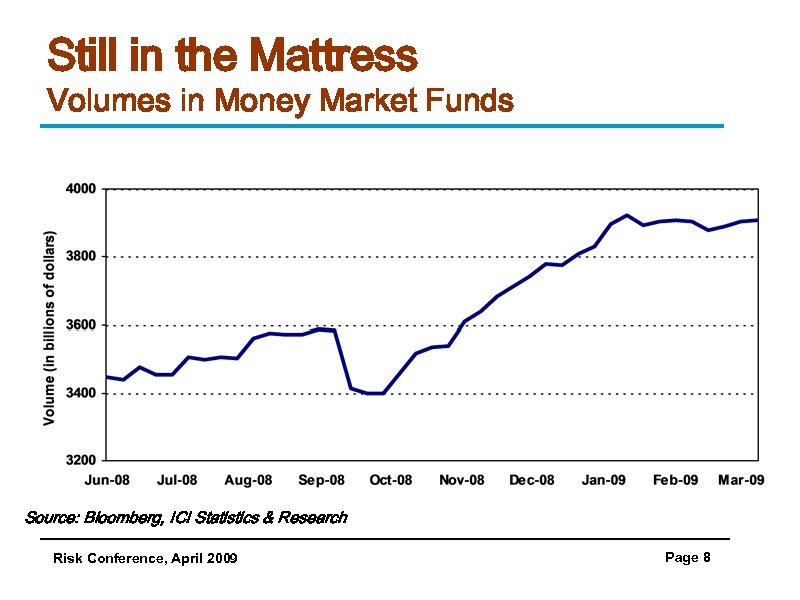

Still in the Mattress Volumes in Money Market Funds Source: Bloomberg, ICI Statistics & Research Risk Conference, April 2009 Page 8

Still in the Mattress Volumes in Money Market Funds Source: Bloomberg, ICI Statistics & Research Risk Conference, April 2009 Page 8

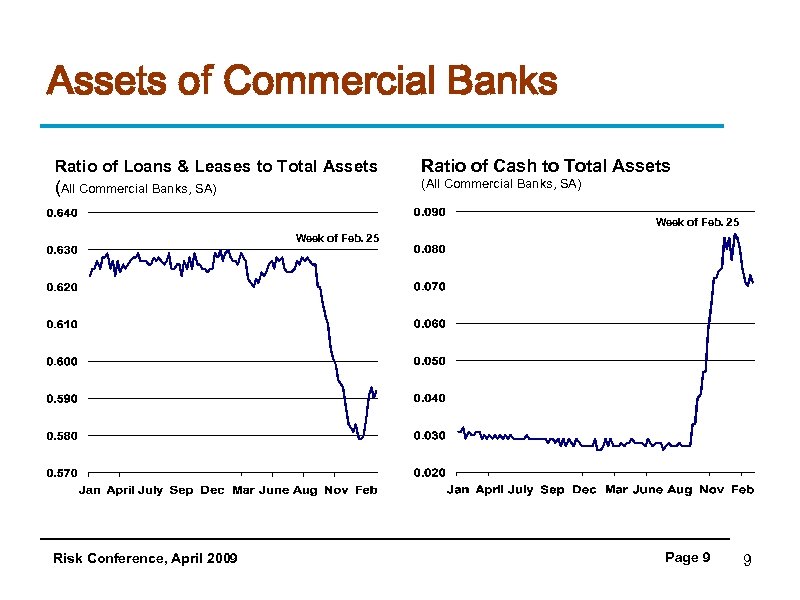

Assets of Commercial Banks Ratio of Loans & Leases to Total Assets Ratio of Cash to Total Assets (All Commercial Banks, SA) Week of Feb. 25 Risk Conference, April 2009 Page 9 9

Assets of Commercial Banks Ratio of Loans & Leases to Total Assets Ratio of Cash to Total Assets (All Commercial Banks, SA) Week of Feb. 25 Risk Conference, April 2009 Page 9 9

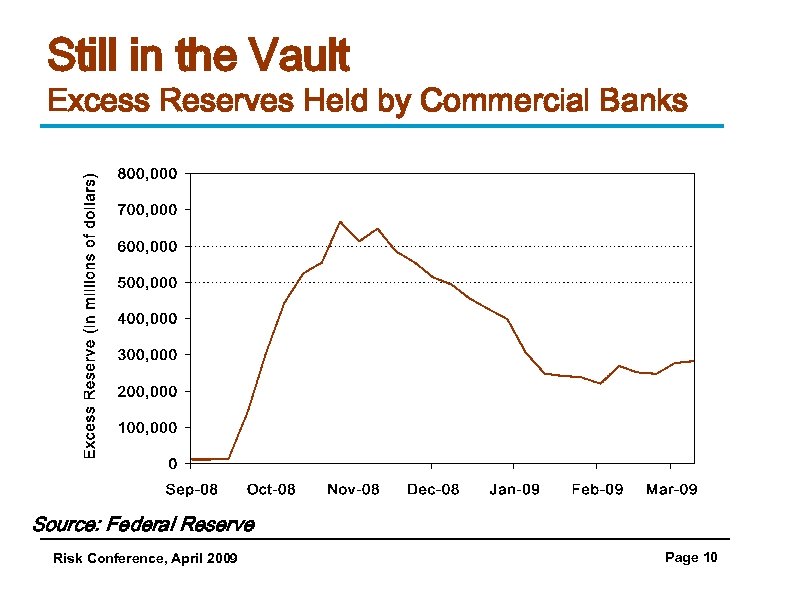

Still in the Vault Excess Reserves Held by Commercial Banks Source: Federal Reserve Risk Conference, April 2009 Page 10

Still in the Vault Excess Reserves Held by Commercial Banks Source: Federal Reserve Risk Conference, April 2009 Page 10

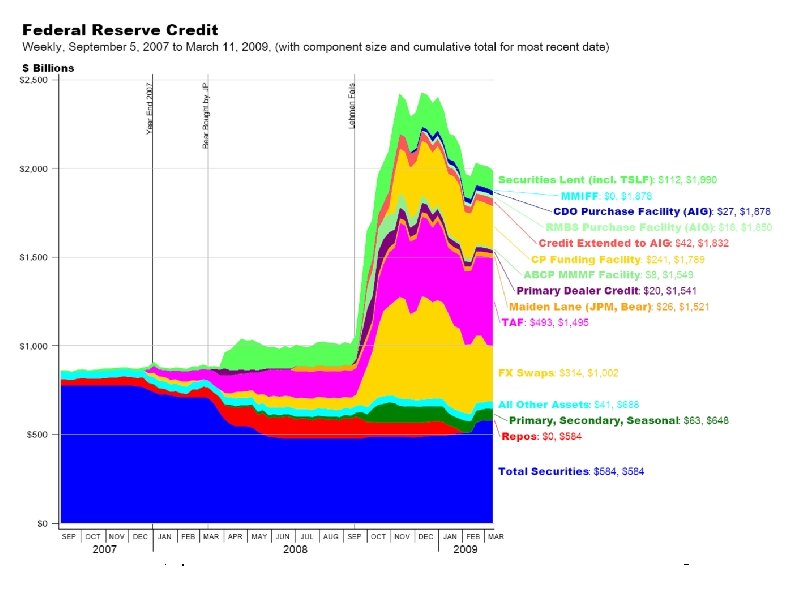

Risk Conference, April 2009 Page 11

Risk Conference, April 2009 Page 11

A Thought: We’ve gone from disintermediation right past reintermediation to nonintermediation Risk Conference, April 2009 Page 12

A Thought: We’ve gone from disintermediation right past reintermediation to nonintermediation Risk Conference, April 2009 Page 12

Presentation Outline • Risk and Reinforcement: When Moods Add to Models • Learnings Gained the Hard Way Risk Conference, April 2009 Page 13

Presentation Outline • Risk and Reinforcement: When Moods Add to Models • Learnings Gained the Hard Way Risk Conference, April 2009 Page 13

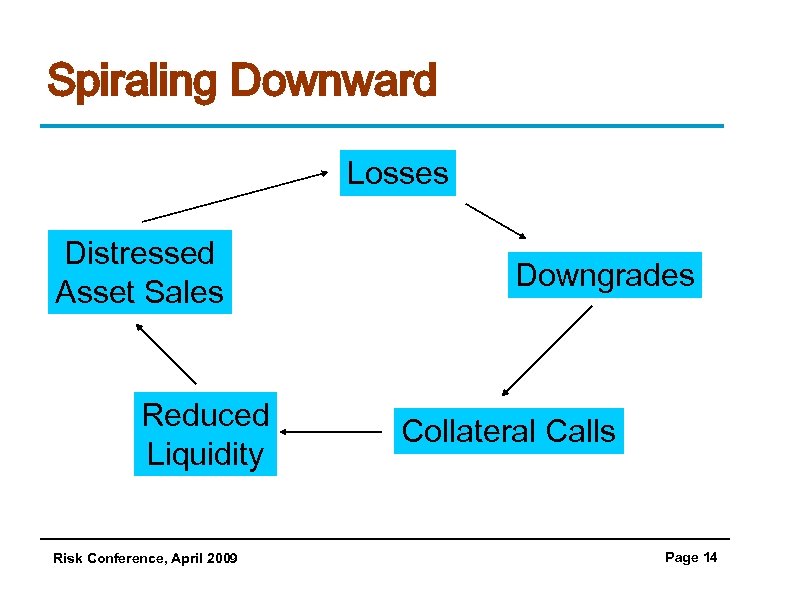

Spiraling Downward Losses Distressed Asset Sales Reduced Liquidity Risk Conference, April 2009 Downgrades Collateral Calls Page 14

Spiraling Downward Losses Distressed Asset Sales Reduced Liquidity Risk Conference, April 2009 Downgrades Collateral Calls Page 14

Liquidity Issues to Think About • Mismatches matter – Think about liquidity transfer pricing • Look beyond the boundaries of the balance sheet – Commitments, SPVs, sponsored funds • Value collateral conservatively – Don’t assume availability, even with FHLB – Know when you might be asked for more • When will investors return to buy assets in the seconday market? – Structures go back to basics Risk Conference, April 2009 Page 15

Liquidity Issues to Think About • Mismatches matter – Think about liquidity transfer pricing • Look beyond the boundaries of the balance sheet – Commitments, SPVs, sponsored funds • Value collateral conservatively – Don’t assume availability, even with FHLB – Know when you might be asked for more • When will investors return to buy assets in the seconday market? – Structures go back to basics Risk Conference, April 2009 Page 15

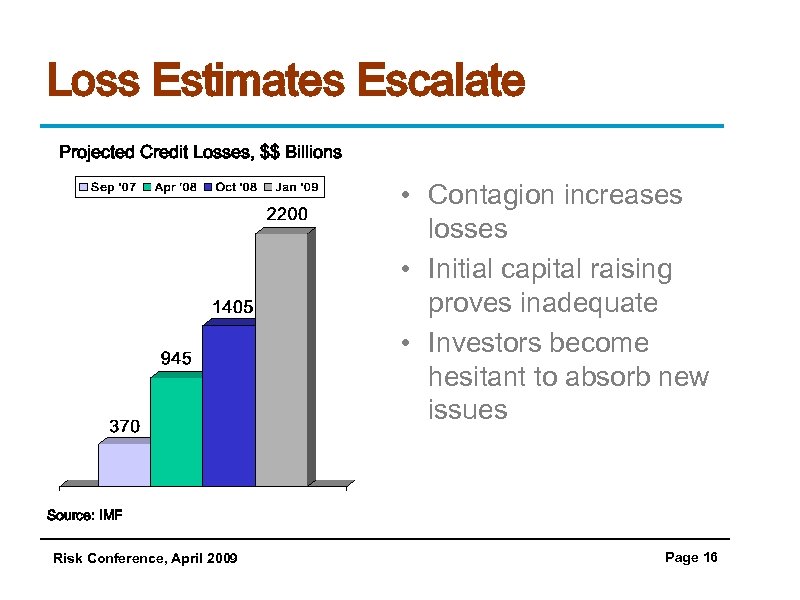

Loss Estimates Escalate Projected Credit Losses, $$ Billions • Contagion increases losses • Initial capital raising proves inadequate • Investors become hesitant to absorb new issues Source: IMF Risk Conference, April 2009 Page 16

Loss Estimates Escalate Projected Credit Losses, $$ Billions • Contagion increases losses • Initial capital raising proves inadequate • Investors become hesitant to absorb new issues Source: IMF Risk Conference, April 2009 Page 16

Lessons Learned: 2 • Declines in asset prices can be a cross product of loss and liquidity – Note: A pool with a 50% PD and 50% LGD still has an intrinsic value of 75 cents on the dollar • Credit and liquidity risk are closely related, for both markets and institutions • Know where you stand in the capital hierarchy Ø Follow-up: linking events in stress testing for liquidity and market risk Risk Conference, April 2009 Page 17

Lessons Learned: 2 • Declines in asset prices can be a cross product of loss and liquidity – Note: A pool with a 50% PD and 50% LGD still has an intrinsic value of 75 cents on the dollar • Credit and liquidity risk are closely related, for both markets and institutions • Know where you stand in the capital hierarchy Ø Follow-up: linking events in stress testing for liquidity and market risk Risk Conference, April 2009 Page 17

Presentation Outline • Risk and Reinforcement: When Moods Add to Models • Learnings Gained the Hard Way • Where We Stand in the Journey Back to Normalcy Risk Conference, April 2009 Page 18

Presentation Outline • Risk and Reinforcement: When Moods Add to Models • Learnings Gained the Hard Way • Where We Stand in the Journey Back to Normalcy Risk Conference, April 2009 Page 18

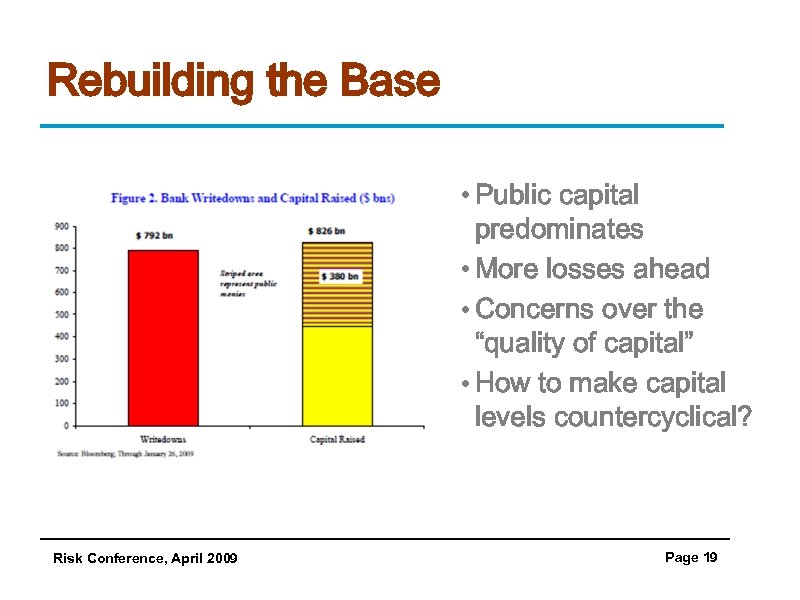

Rebuilding the Base • Public capital predominates • More losses ahead • Concerns over the “quality of capital” • How to make capital levels countercyclical? Risk Conference, April 2009 Page 19

Rebuilding the Base • Public capital predominates • More losses ahead • Concerns over the “quality of capital” • How to make capital levels countercyclical? Risk Conference, April 2009 Page 19

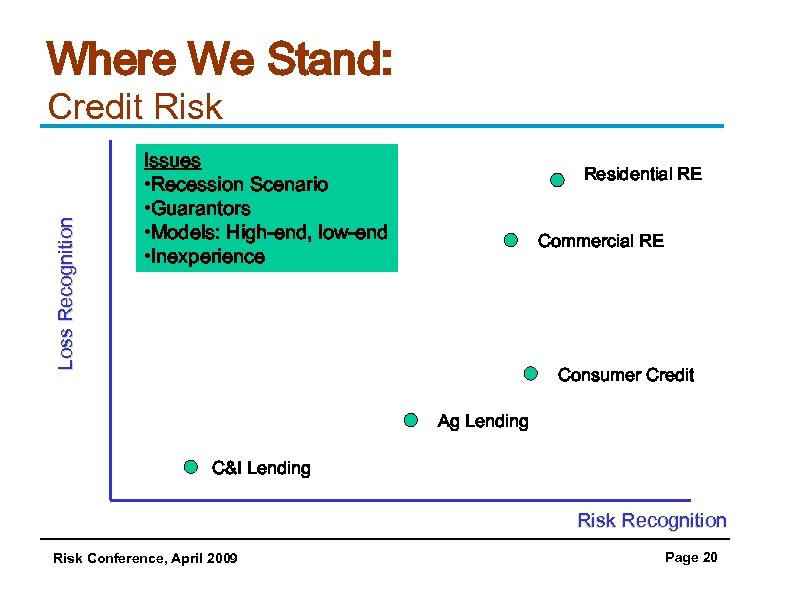

Where We Stand: Loss Recognition Credit Risk Issues • Recession Scenario • Guarantors • Models: High-end, low-end • Inexperience Residential RE Commercial RE Consumer Credit Ag Lending C&I Lending Risk Recognition Risk Conference, April 2009 Page 20

Where We Stand: Loss Recognition Credit Risk Issues • Recession Scenario • Guarantors • Models: High-end, low-end • Inexperience Residential RE Commercial RE Consumer Credit Ag Lending C&I Lending Risk Recognition Risk Conference, April 2009 Page 20

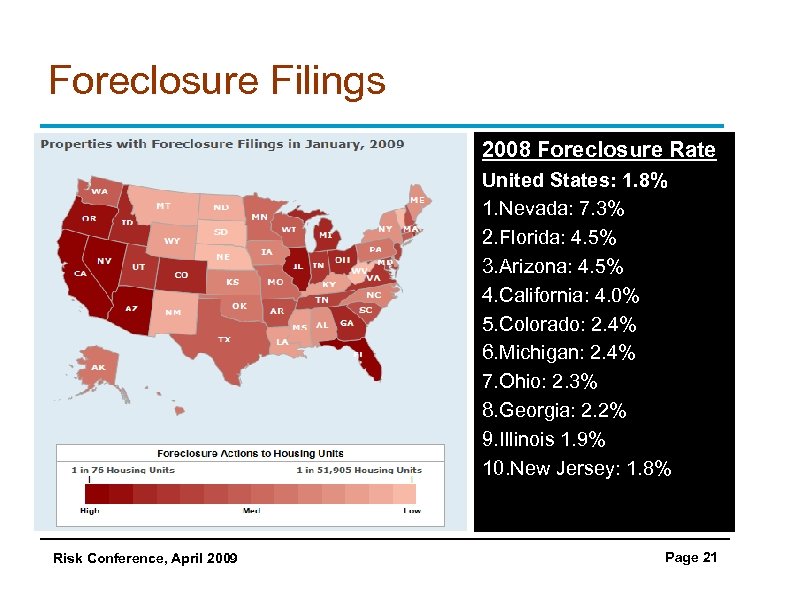

Foreclosure Filings 2008 Foreclosure Rate United States: 1. 8% 1. Nevada: 7. 3% 2. Florida: 4. 5% 3. Arizona: 4. 5% 4. California: 4. 0% 5. Colorado: 2. 4% 6. Michigan: 2. 4% 7. Ohio: 2. 3% 8. Georgia: 2. 2% 9. Illinois 1. 9% 10. New Jersey: 1. 8% Risk Conference, April 2009 Page 21

Foreclosure Filings 2008 Foreclosure Rate United States: 1. 8% 1. Nevada: 7. 3% 2. Florida: 4. 5% 3. Arizona: 4. 5% 4. California: 4. 0% 5. Colorado: 2. 4% 6. Michigan: 2. 4% 7. Ohio: 2. 3% 8. Georgia: 2. 2% 9. Illinois 1. 9% 10. New Jersey: 1. 8% Risk Conference, April 2009 Page 21

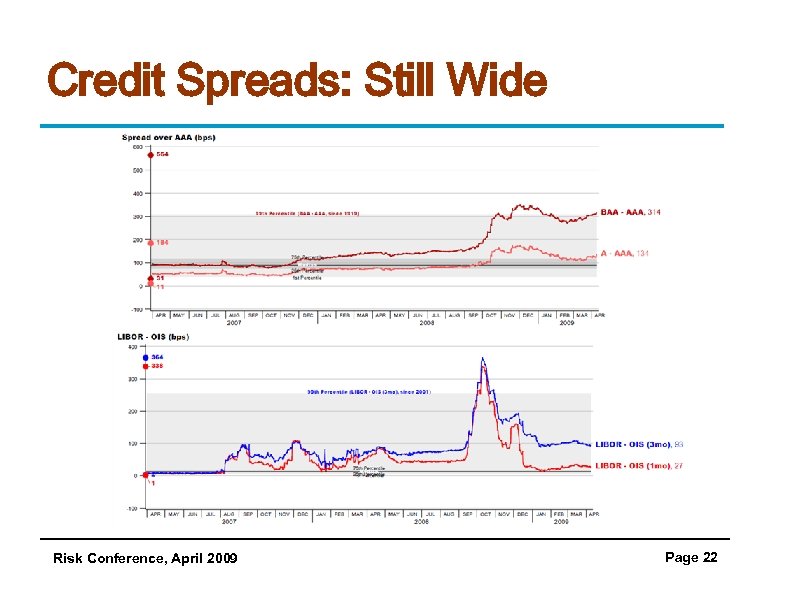

Credit Spreads: Still Wide Risk Conference, April 2009 Page 22

Credit Spreads: Still Wide Risk Conference, April 2009 Page 22

Policy Steps • • • $800 billion in fiscal stimulus TALF, PPIFF for banks Foreclosure mitigation Bigger line for the FDIC Review of Mark to Market Accounting • Regulatory Restructuring Risk Conference, April 2009 Page 23

Policy Steps • • • $800 billion in fiscal stimulus TALF, PPIFF for banks Foreclosure mitigation Bigger line for the FDIC Review of Mark to Market Accounting • Regulatory Restructuring Risk Conference, April 2009 Page 23

Conclusions • The American financial landscape has changed historically in just the past six months; maybe more ahead? • The Treasury and the Fed have been exceptionally active • We’ll be learning from and debating recent events for years to come Risk Conference, April 2009 Page 25

Conclusions • The American financial landscape has changed historically in just the past six months; maybe more ahead? • The Treasury and the Fed have been exceptionally active • We’ll be learning from and debating recent events for years to come Risk Conference, April 2009 Page 25

Losses, Leverage, and Liquidity The Road Ahead for Risk Management Carl Tannenbaum Vice President, Risk Specialist Division Federal Reserve Bank of Chicago

Losses, Leverage, and Liquidity The Road Ahead for Risk Management Carl Tannenbaum Vice President, Risk Specialist Division Federal Reserve Bank of Chicago