3262163ea7adbb61d0b1fad151aab30b.ppt

- Количество слайдов: 55

LOSE LESS AND SELL MORE: Using the ECR Europe Approach to Manage Shrinkage Adrian Beck Reader in Criminology University of Leicester, UK

LOSE LESS AND SELL MORE: Using the ECR Europe Approach to Manage Shrinkage Adrian Beck Reader in Criminology University of Leicester, UK

Structure • Defining Shrinkage • The Scale of the Problem • Key Principles of Effective Shrinkage Management • A Case Study in Success

Structure • Defining Shrinkage • The Scale of the Problem • Key Principles of Effective Shrinkage Management • A Case Study in Success

Defining Shrinkage

Defining Shrinkage

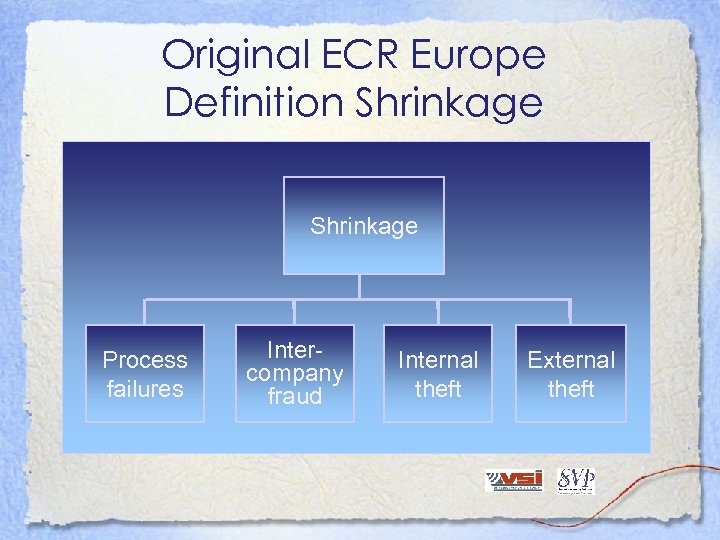

Original ECR Europe Definition Shrinkage Process failures Intercompany fraud Internal theft External theft

Original ECR Europe Definition Shrinkage Process failures Intercompany fraud Internal theft External theft

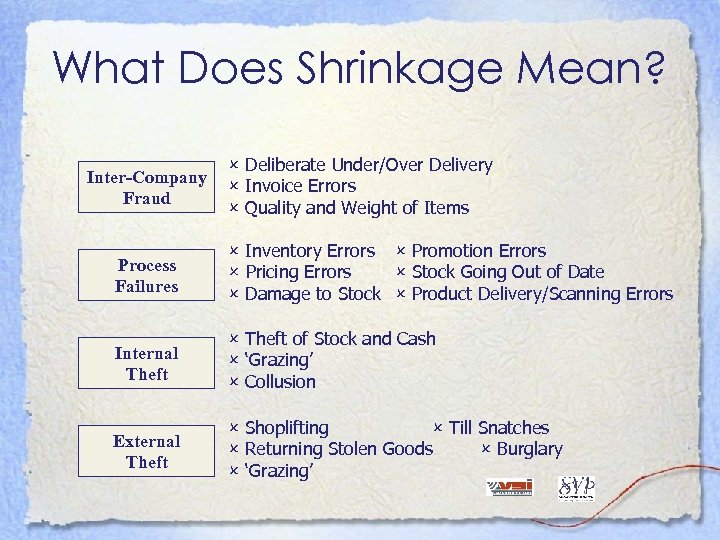

What Does Shrinkage Mean? Inter-Company Fraud Deliberate Under/Over Delivery Invoice Errors Quality and Weight of Items Process Failures Inventory Errors Promotion Errors Pricing Errors Stock Going Out of Date Damage to Stock Product Delivery/Scanning Errors Internal Theft of Stock and Cash ‘Grazing’ Collusion External Theft Shoplifting Till Snatches Returning Stolen Goods Burglary ‘Grazing’

What Does Shrinkage Mean? Inter-Company Fraud Deliberate Under/Over Delivery Invoice Errors Quality and Weight of Items Process Failures Inventory Errors Promotion Errors Pricing Errors Stock Going Out of Date Damage to Stock Product Delivery/Scanning Errors Internal Theft of Stock and Cash ‘Grazing’ Collusion External Theft Shoplifting Till Snatches Returning Stolen Goods Burglary ‘Grazing’

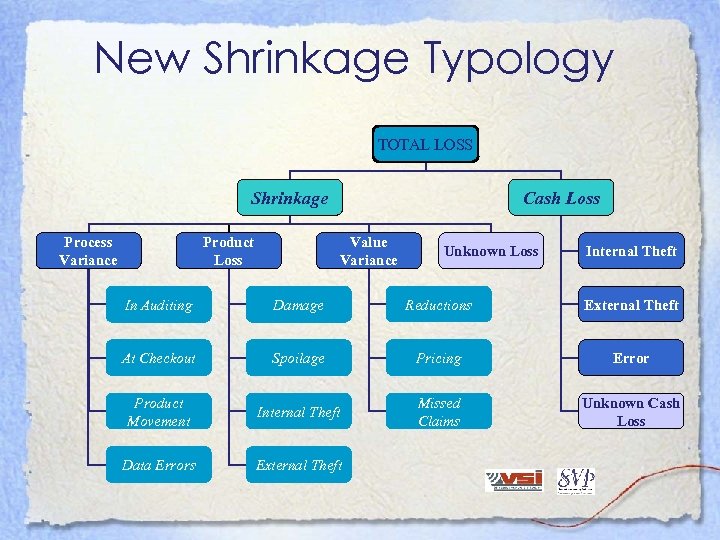

New Shrinkage Typology TOTAL LOSS Shrinkage Process Variance Product Loss Cash Loss Value Variance Unknown Loss Internal Theft In Auditing Damage Reductions External Theft At Checkout Spoilage Pricing Error Product Movement Internal Theft Missed Claims Unknown Cash Loss Data Errors External Theft

New Shrinkage Typology TOTAL LOSS Shrinkage Process Variance Product Loss Cash Loss Value Variance Unknown Loss Internal Theft In Auditing Damage Reductions External Theft At Checkout Spoilage Pricing Error Product Movement Internal Theft Missed Claims Unknown Cash Loss Data Errors External Theft

Scale of the Problem

Scale of the Problem

International Comparisons Year 2002 2004 2003 2006 2002 2003 2006 2003 Source National S’market Res. Group (US) ECR Europe Retail Council of Canada Food Marketing Institute (US) NRSS (US) ECR Australia Otago University (New Zealand) European Theft Barometer Eurohandelinstituts (Germany) Size 2. 32 1. 84 1. 75 1. 69 1. 52 1. 50 1. 24 1. 23

International Comparisons Year 2002 2004 2003 2006 2002 2003 2006 2003 Source National S’market Res. Group (US) ECR Europe Retail Council of Canada Food Marketing Institute (US) NRSS (US) ECR Australia Otago University (New Zealand) European Theft Barometer Eurohandelinstituts (Germany) Size 2. 32 1. 84 1. 75 1. 69 1. 52 1. 50 1. 24 1. 23

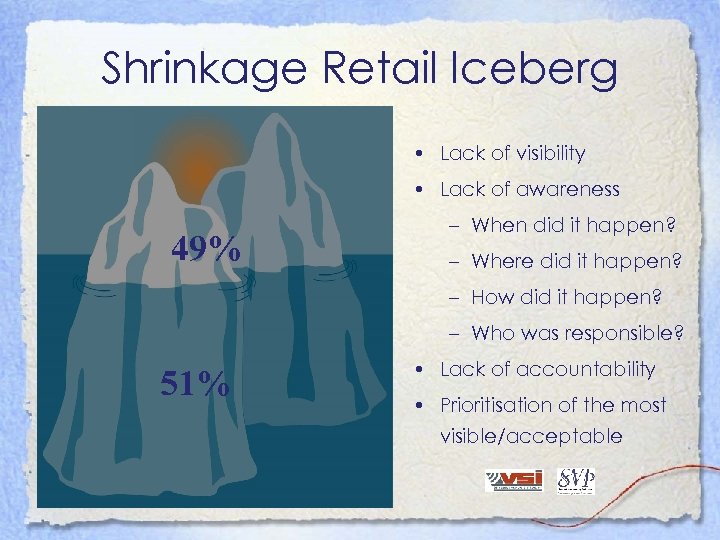

Shrinkage Retail Iceberg • Lack of visibility • Lack of awareness 49% – When did it happen? – Where did it happen? – How did it happen? – Who was responsible? 51% • Lack of accountability • Prioritisation of the most visible/acceptable

Shrinkage Retail Iceberg • Lack of visibility • Lack of awareness 49% – When did it happen? – Where did it happen? – How did it happen? – Who was responsible? 51% • Lack of accountability • Prioritisation of the most visible/acceptable

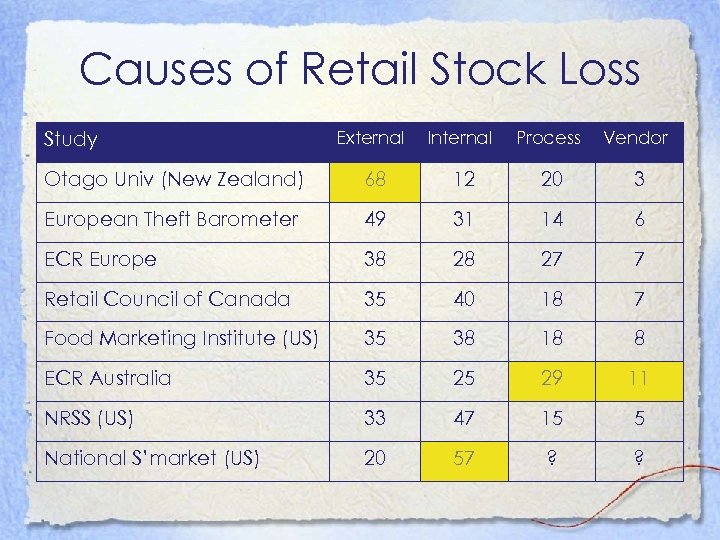

Causes of Retail Stock Loss External Internal Process Vendor Otago Univ (New Zealand) 68 12 20 3 European Theft Barometer 49 31 14 6 ECR Europe 38 28 27 7 Retail Council of Canada 35 40 18 7 Food Marketing Institute (US) 35 38 18 8 ECR Australia 35 25 29 11 NRSS (US) 33 47 15 5 National S’market (US) 20 57 ? ? Study

Causes of Retail Stock Loss External Internal Process Vendor Otago Univ (New Zealand) 68 12 20 3 European Theft Barometer 49 31 14 6 ECR Europe 38 28 27 7 Retail Council of Canada 35 40 18 7 Food Marketing Institute (US) 35 38 18 8 ECR Australia 35 25 29 11 NRSS (US) 33 47 15 5 National S’market (US) 20 57 ? ? Study

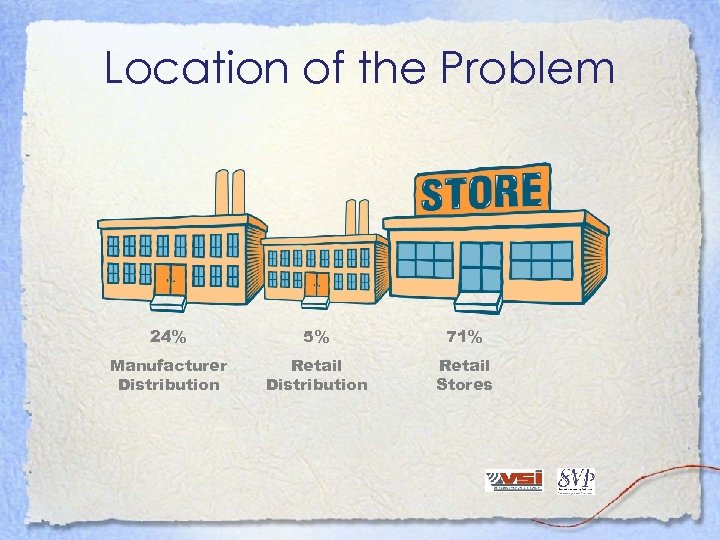

Location of the Problem 24% 5% 71% Manufacturer Distribution Retail Stores

Location of the Problem 24% 5% 71% Manufacturer Distribution Retail Stores

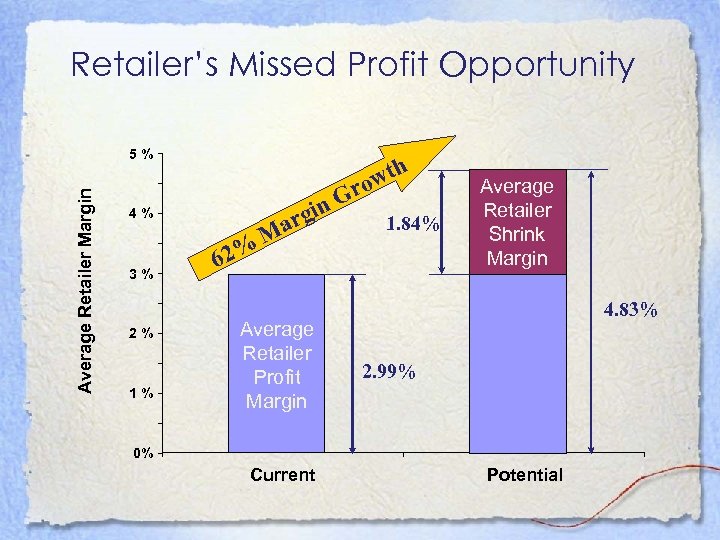

Retailer’s Missed Profit Opportunity Average Retailer Margin 5% 4% 3% 2% 1% 62% arg M in G wth ro Average Retailer Profit Margin 1. 84% Average Retailer Shrink Margin 4. 83% 2. 99% 0% Current Potential

Retailer’s Missed Profit Opportunity Average Retailer Margin 5% 4% 3% 2% 1% 62% arg M in G wth ro Average Retailer Profit Margin 1. 84% Average Retailer Shrink Margin 4. 83% 2. 99% 0% Current Potential

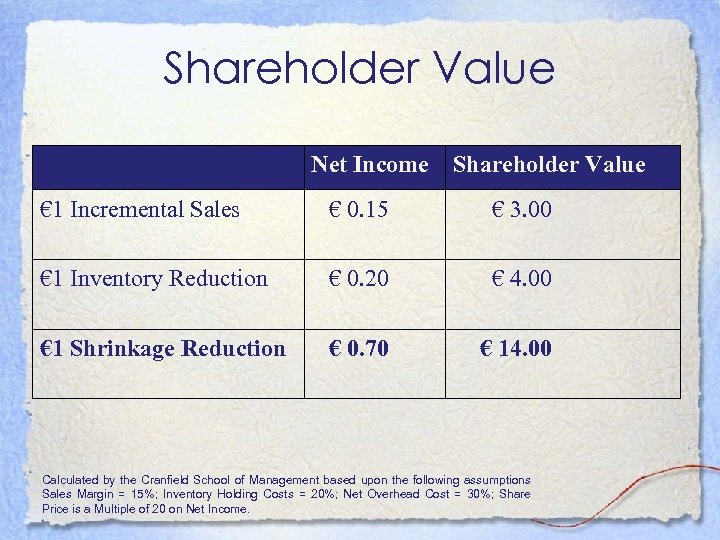

Shareholder Value Net Income Shareholder Value € 1 Incremental Sales € 0. 15 € 3. 00 € 1 Inventory Reduction € 0. 20 € 4. 00 € 1 Shrinkage Reduction € 0. 70 € 14. 00 Calculated by the Cranfield School of Management based upon the following assumptions Sales Margin = 15%; Inventory Holding Costs = 20%; Net Overhead Cost = 30%; Share Price is a Multiple of 20 on Net Income.

Shareholder Value Net Income Shareholder Value € 1 Incremental Sales € 0. 15 € 3. 00 € 1 Inventory Reduction € 0. 20 € 4. 00 € 1 Shrinkage Reduction € 0. 70 € 14. 00 Calculated by the Cranfield School of Management based upon the following assumptions Sales Margin = 15%; Inventory Holding Costs = 20%; Net Overhead Cost = 30%; Share Price is a Multiple of 20 on Net Income.

Principles of Effective Shrinkage Management

Principles of Effective Shrinkage Management

Guiding Principles • Engage senior management • Convince them of the opportunity • Show the impact on the consumer • Persuade them that a multi functional approach is required • Secure resource

Guiding Principles • Engage senior management • Convince them of the opportunity • Show the impact on the consumer • Persuade them that a multi functional approach is required • Secure resource

Guiding Principles • Measure the problem • Data accessibility, timeliness and granularity • Mining the data warehouse • Monitor and generate transparency

Guiding Principles • Measure the problem • Data accessibility, timeliness and granularity • Mining the data warehouse • Monitor and generate transparency

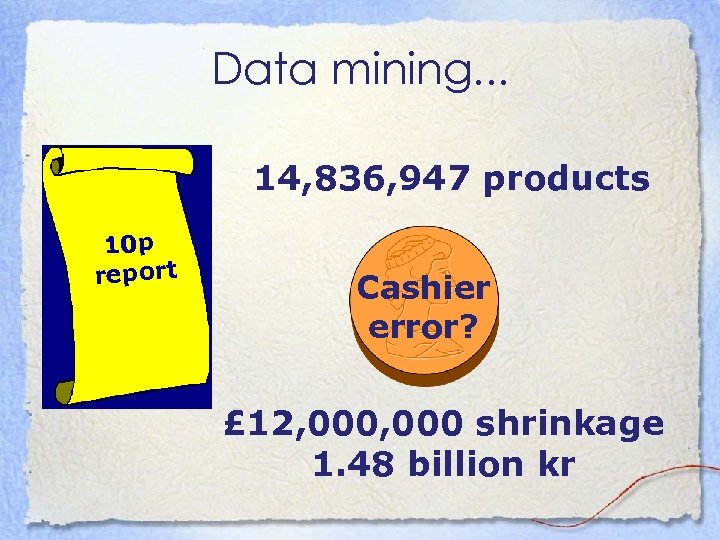

Data mining. . . 14, 836, 947 products 10 p report Cashier error? £ 12, 000 shrinkage 1. 48 billion kr

Data mining. . . 14, 836, 947 products 10 p report Cashier error? £ 12, 000 shrinkage 1. 48 billion kr

Guiding Principles • Promote inter and intra company collaboration • Who needed to be involved? – Manufacturer • • • Design team Production Supply Chain Marketing Sales – Retailer • • Buyer/Merchandising Loss Prevention Supply Chain Store Operations – Environmental agency

Guiding Principles • Promote inter and intra company collaboration • Who needed to be involved? – Manufacturer • • • Design team Production Supply Chain Marketing Sales – Retailer • • Buyer/Merchandising Loss Prevention Supply Chain Store Operations – Environmental agency

End to End Solutions Before After

End to End Solutions Before After

Guiding Principles • Adopt a systemic and systematic approach – The ECR Europe Road Map

Guiding Principles • Adopt a systemic and systematic approach – The ECR Europe Road Map

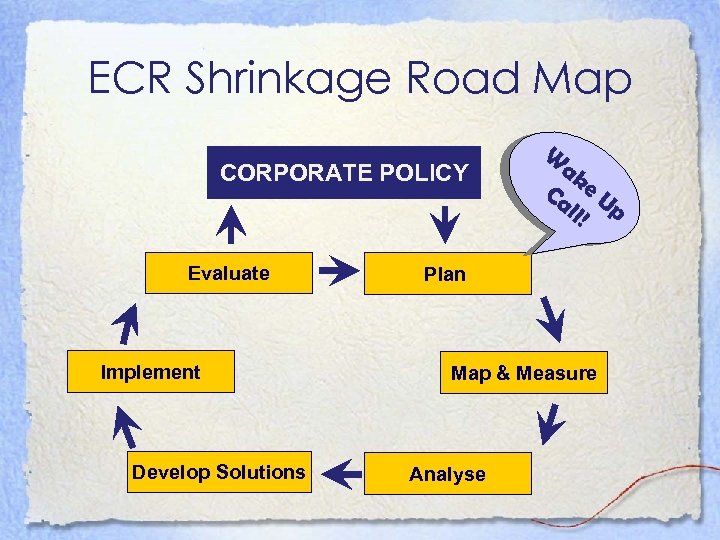

ECR Shrinkage Road Map CORPORATE POLICY Evaluate Implement Develop Solutions W ak Ca e U ll! p Plan Map & Measure Analyse

ECR Shrinkage Road Map CORPORATE POLICY Evaluate Implement Develop Solutions W ak Ca e U ll! p Plan Map & Measure Analyse

Crisis-Driven Shrinkage Management CORPORATE POLICY Evaluate Implement Develop Solutions W ak Ca e U ll! p Plan Map & Measure Analyse

Crisis-Driven Shrinkage Management CORPORATE POLICY Evaluate Implement Develop Solutions W ak Ca e U ll! p Plan Map & Measure Analyse

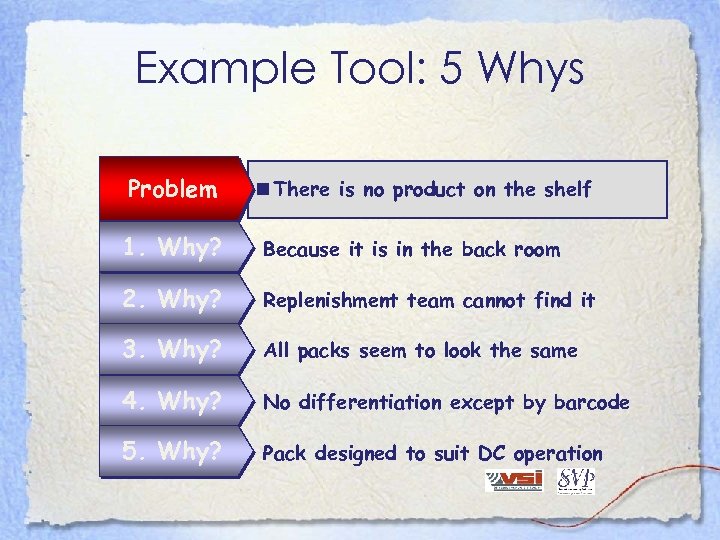

Example Tool: 5 Whys Problem n There is no product on the shelf 1. Why? Because it is in the back room 2. Why? Replenishment team cannot find it 3. Why? All packs seem to look the same 4. Why? No differentiation except by barcode 5. Why? Pack designed to suit DC operation

Example Tool: 5 Whys Problem n There is no product on the shelf 1. Why? Because it is in the back room 2. Why? Replenishment team cannot find it 3. Why? All packs seem to look the same 4. Why? No differentiation except by barcode 5. Why? Pack designed to suit DC operation

ECR Road Map Principles • Collaborate and engage all stakeholders • Focus effort on the processes: Products/Information/Money • Identify greatest oppportunities then target root causes • Remove the opportunity for loss or error • Encourage evaluation & learning

ECR Road Map Principles • Collaborate and engage all stakeholders • Focus effort on the processes: Products/Information/Money • Identify greatest oppportunities then target root causes • Remove the opportunity for loss or error • Encourage evaluation & learning

ECR Road Map Benefits • Ensures the right resources and people engaged • Better and more sustainable results • Less daunting • More cost efficient • Higher probability of success • Quicker to implement • Lessons can be reapplied to other problems

ECR Road Map Benefits • Ensures the right resources and people engaged • Better and more sustainable results • Less daunting • More cost efficient • Higher probability of success • Quicker to implement • Lessons can be reapplied to other problems

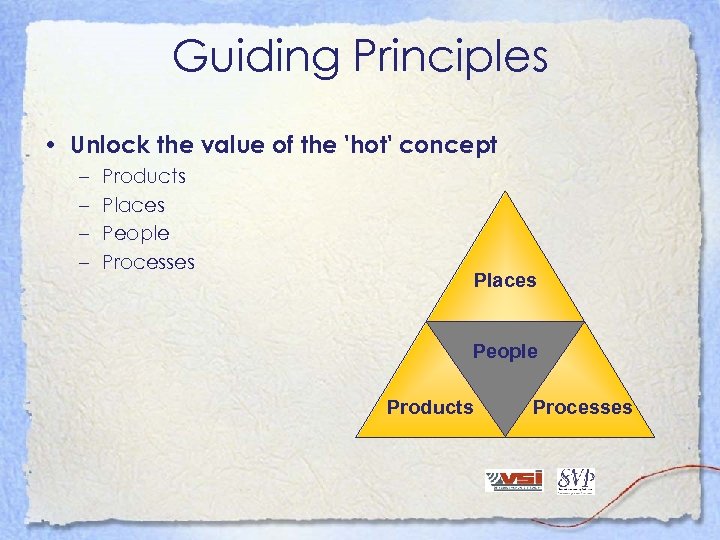

Guiding Principles • Unlock the value of the 'hot' concept – – Products Places People Processes Places People Products Processes

Guiding Principles • Unlock the value of the 'hot' concept – – Products Places People Processes Places People Products Processes

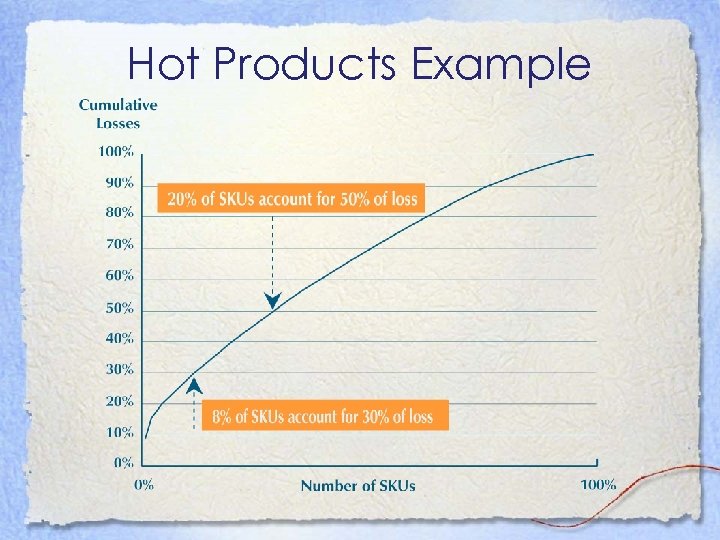

Hot Products Example

Hot Products Example

Benefits of the ‘Hot’ Concept • Avoids spreading valuable resources too thinly • Focus on the vital few amongst the trivial many • Rapid impact • Greatest return • Possible diffusion of benefits

Benefits of the ‘Hot’ Concept • Avoids spreading valuable resources too thinly • Focus on the vital few amongst the trivial many • Rapid impact • Greatest return • Possible diffusion of benefits

Guiding Principles • Focus on process failures first – Removes opportunity • Receipt process • Returns – Masks malicious activity – Delivers • Quick wins • Cost effective wins • Sustainable solutions

Guiding Principles • Focus on process failures first – Removes opportunity • Receipt process • Returns – Masks malicious activity – Delivers • Quick wins • Cost effective wins • Sustainable solutions

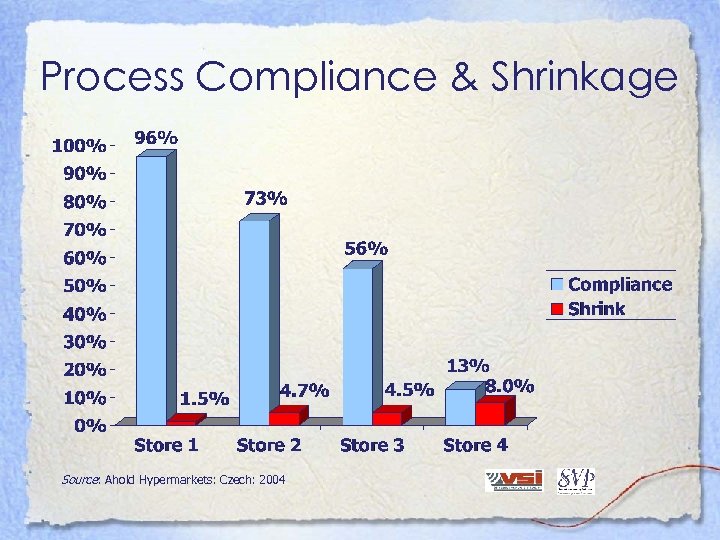

Process Compliance & Shrinkage Source: Ahold Hypermarkets: Czech: 2004

Process Compliance & Shrinkage Source: Ahold Hypermarkets: Czech: 2004

Guiding Principles • Encourage innovation and experimentation – Keep ahead of the game – Initiate……. • Pilot Studies on new ideas • Road Map projects with suppliers • Benchmarking against industry surveys – Experiment…. . • New solutions • New store layouts – ECR survey showed that retailers who innovated and experimented most had 20% lower shrinkage

Guiding Principles • Encourage innovation and experimentation – Keep ahead of the game – Initiate……. • Pilot Studies on new ideas • Road Map projects with suppliers • Benchmarking against industry surveys – Experiment…. . • New solutions • New store layouts – ECR survey showed that retailers who innovated and experimented most had 20% lower shrinkage

Guiding Principles • Document learning and disseminate success

Guiding Principles • Document learning and disseminate success

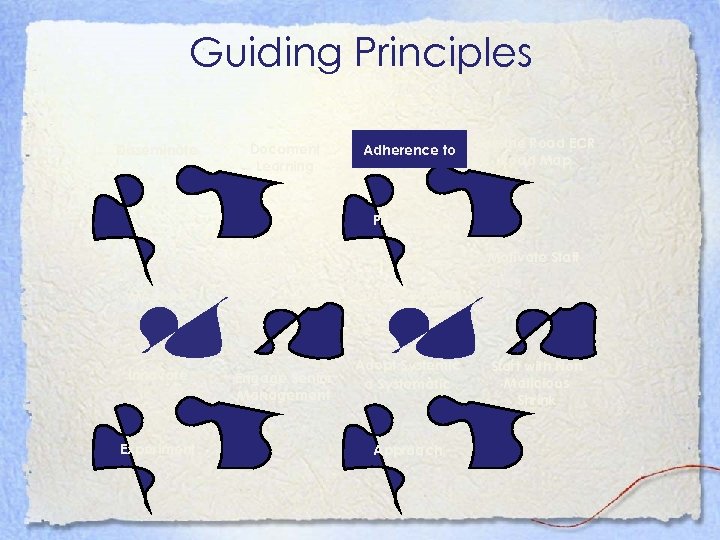

Guiding Principles Disseminate Document Learning Adherence to Use the Road ECR Road Map Procedures Motivate Staff Collaborate Measure Innovate Experiment Focus on Hot Concept Engage Senior Management Adopt Systemic a Systematic Approach Start with Non Malicious Shrink

Guiding Principles Disseminate Document Learning Adherence to Use the Road ECR Road Map Procedures Motivate Staff Collaborate Measure Innovate Experiment Focus on Hot Concept Engage Senior Management Adopt Systemic a Systematic Approach Start with Non Malicious Shrink

The ECR Road Map in Action: Tesco and P&G Case Study

The ECR Road Map in Action: Tesco and P&G Case Study

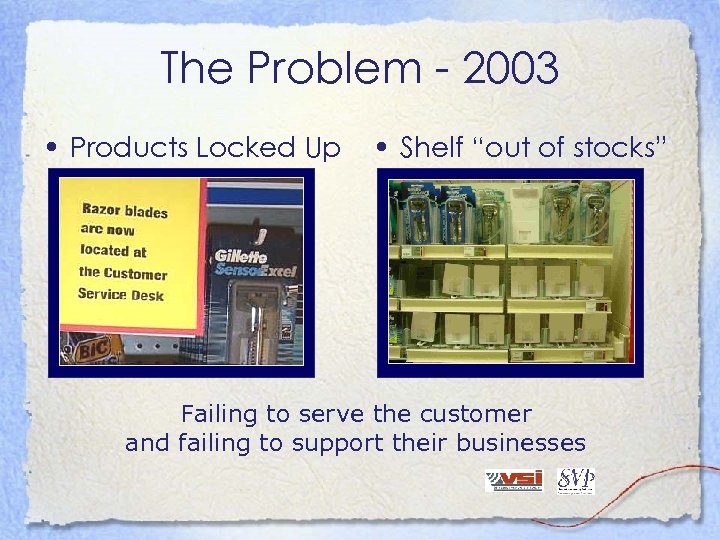

The Problem - 2003 • Products Locked Up • Shelf “out of stocks” Failing to serve the customer and failing to support their businesses

The Problem - 2003 • Products Locked Up • Shelf “out of stocks” Failing to serve the customer and failing to support their businesses

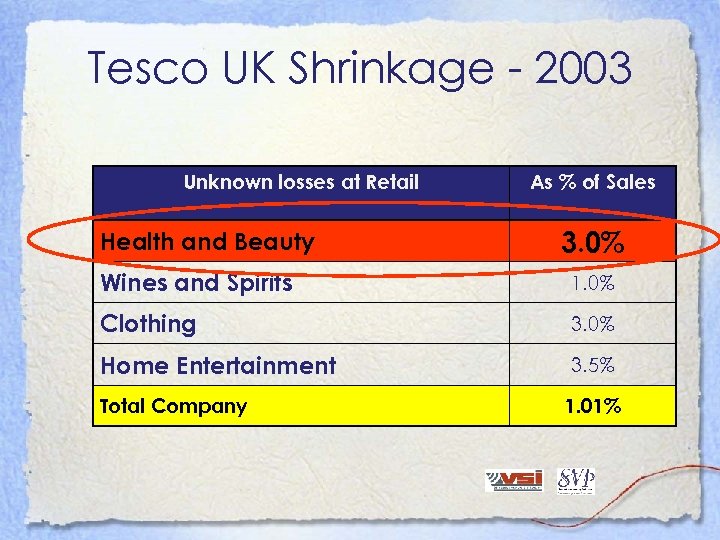

Tesco UK Shrinkage - 2003 Unknown losses at Retail As % of Sales Health and Beauty 3. 0% Wines and Spirits 1. 0% Clothing 3. 0% Home Entertainment 3. 5% Total Company 1. 01%

Tesco UK Shrinkage - 2003 Unknown losses at Retail As % of Sales Health and Beauty 3. 0% Wines and Spirits 1. 0% Clothing 3. 0% Home Entertainment 3. 5% Total Company 1. 01%

Tesco - Call to Action • “Got the call” from the very top • “Licence” to work across functions to reduce shrinkage • Permission granted to take drastic action if needed

Tesco - Call to Action • “Got the call” from the very top • “Licence” to work across functions to reduce shrinkage • Permission granted to take drastic action if needed

Plan • Hot Products • Hot Stores • Look for Internal Process Failures

Plan • Hot Products • Hot Stores • Look for Internal Process Failures

Hot Products. . . Health & Beauty

Hot Products. . . Health & Beauty

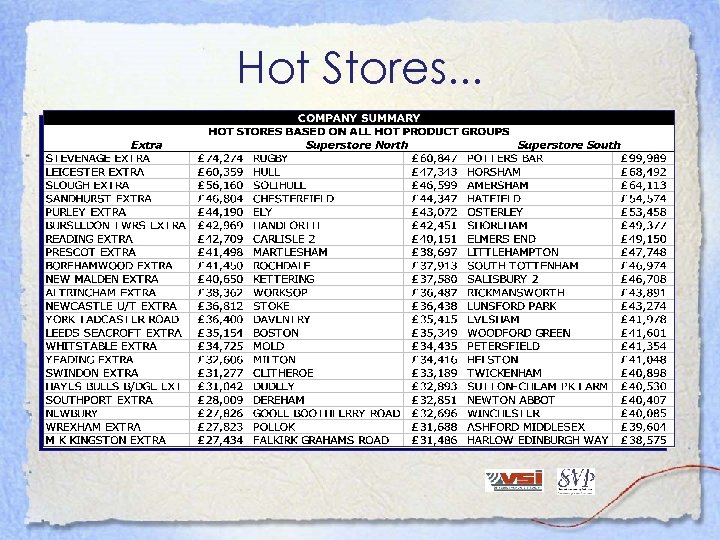

Hot Stores. . .

Hot Stores. . .

Tesco UK Shrinkage - 2003 Unknown losses at Retail Health and Beauty As % of Sales 3. 0% Wines and Spirits 1. 0% Clothing 3. 0% Home Entertainment 3. 5% Total Company 1. 01%

Tesco UK Shrinkage - 2003 Unknown losses at Retail Health and Beauty As % of Sales 3. 0% Wines and Spirits 1. 0% Clothing 3. 0% Home Entertainment 3. 5% Total Company 1. 01%

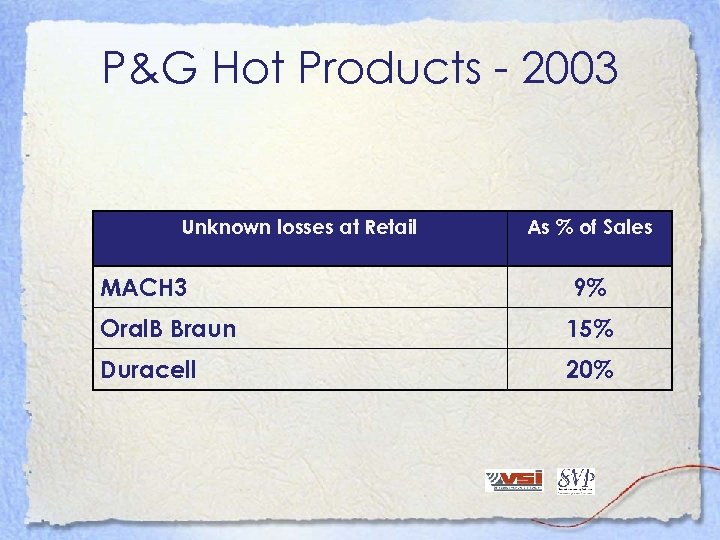

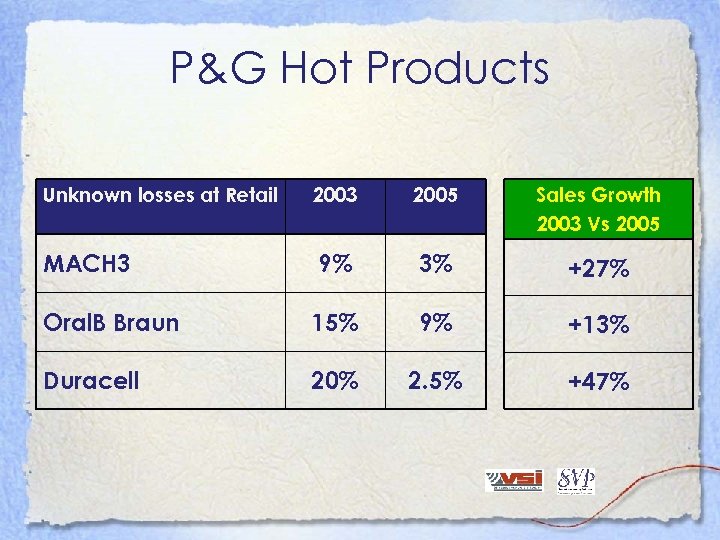

P&G Hot Products - 2003 Unknown losses at Retail As % of Sales MACH 3 9% Oral. B Braun 15% Duracell 20%

P&G Hot Products - 2003 Unknown losses at Retail As % of Sales MACH 3 9% Oral. B Braun 15% Duracell 20%

Map & Measure Picking Shelf

Map & Measure Picking Shelf

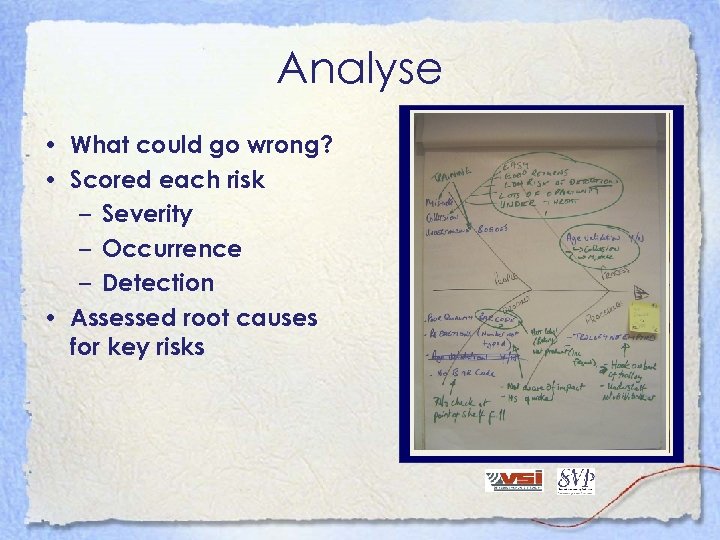

Analyse • What could go wrong? • Scored each risk – Severity – Occurrence – Detection • Assessed root causes for key risks

Analyse • What could go wrong? • Scored each risk – Severity – Occurrence – Detection • Assessed root causes for key risks

Solutions Developed • Secure Supply Chain for top 500 hot products

Solutions Developed • Secure Supply Chain for top 500 hot products

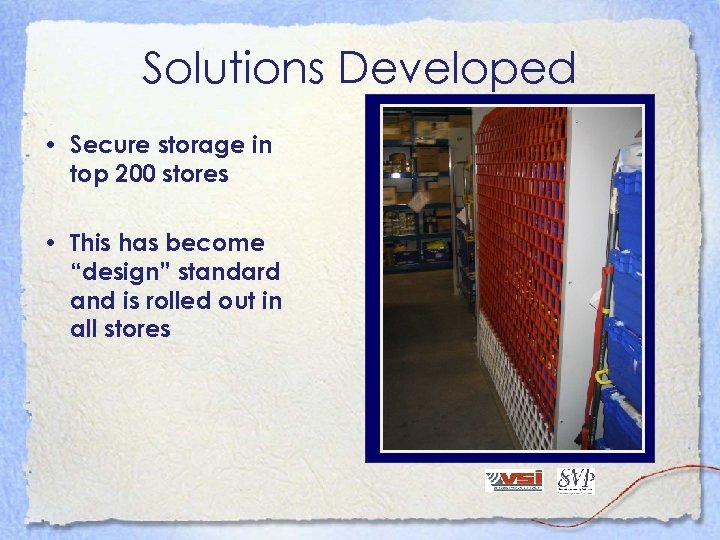

Solutions Developed • Secure storage in top 200 stores • This has become “design” standard and is rolled out in all stores

Solutions Developed • Secure storage in top 200 stores • This has become “design” standard and is rolled out in all stores

Solutions Developed • Modified Packaging to enable product protection in all stores

Solutions Developed • Modified Packaging to enable product protection in all stores

Solutions Developed • Introduced regular counting of hot products to measure results

Solutions Developed • Introduced regular counting of hot products to measure results

P&G Hot Products Unknown losses at Retail 2003 2005 Sales Growth 2003 Vs 2005 MACH 3 9% 3% +27% Oral. B Braun 15% 9% +13% Duracell 20% 2. 5% +47%

P&G Hot Products Unknown losses at Retail 2003 2005 Sales Growth 2003 Vs 2005 MACH 3 9% 3% +27% Oral. B Braun 15% 9% +13% Duracell 20% 2. 5% +47%

Tesco UK Shrinkage Unknown losses at Retail 2003 Health and Beauty 3. 0% Wines and Spirits 1. 0% Clothing 3. 0% Home Entertainment 3. 5% Total Company 1. 01% 2005

Tesco UK Shrinkage Unknown losses at Retail 2003 Health and Beauty 3. 0% Wines and Spirits 1. 0% Clothing 3. 0% Home Entertainment 3. 5% Total Company 1. 01% 2005

Tesco UK Shrinkage 2003 2005 Health and Beauty 3. 0% 1. 75% Wines and Spirits 1. 0% 0. 95% Clothing 3. 0% 1. 75% Home Entertainment 3. 5% 1. 5% Total Company 1. 01% 0. 69% Unknown losses at Retail

Tesco UK Shrinkage 2003 2005 Health and Beauty 3. 0% 1. 75% Wines and Spirits 1. 0% 0. 95% Clothing 3. 0% 1. 75% Home Entertainment 3. 5% 1. 5% Total Company 1. 01% 0. 69% Unknown losses at Retail

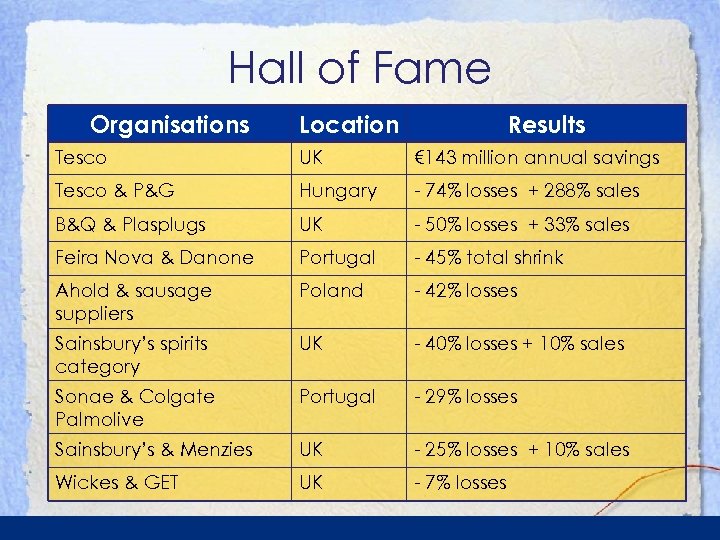

Hall of Fame Organisations Location Results Tesco UK € 143 million annual savings Tesco & P&G Hungary - 74% losses + 288% sales B&Q & Plasplugs UK - 50% losses + 33% sales Feira Nova & Danone Portugal - 45% total shrink Ahold & sausage suppliers Poland - 42% losses Sainsbury’s spirits category UK - 40% losses + 10% sales Sonae & Colgate Palmolive Portugal - 29% losses Sainsbury’s & Menzies UK - 25% losses + 10% sales Wickes & GET UK - 7% losses

Hall of Fame Organisations Location Results Tesco UK € 143 million annual savings Tesco & P&G Hungary - 74% losses + 288% sales B&Q & Plasplugs UK - 50% losses + 33% sales Feira Nova & Danone Portugal - 45% total shrink Ahold & sausage suppliers Poland - 42% losses Sainsbury’s spirits category UK - 40% losses + 10% sales Sonae & Colgate Palmolive Portugal - 29% losses Sainsbury’s & Menzies UK - 25% losses + 10% sales Wickes & GET UK - 7% losses

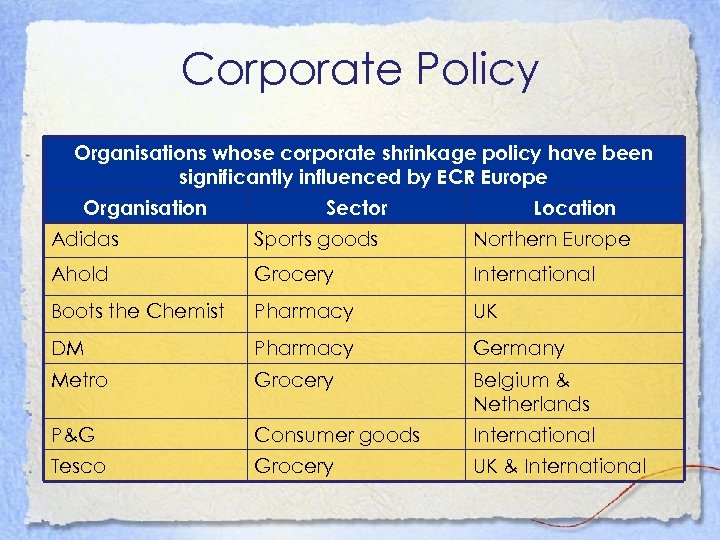

Corporate Policy Organisations whose corporate shrinkage policy have been significantly influenced by ECR Europe Organisation Sector Location Adidas Sports goods Northern Europe Ahold Grocery International Boots the Chemist Pharmacy UK DM Pharmacy Germany Metro Grocery Belgium & Netherlands P&G Consumer goods International Tesco Grocery UK & International

Corporate Policy Organisations whose corporate shrinkage policy have been significantly influenced by ECR Europe Organisation Sector Location Adidas Sports goods Northern Europe Ahold Grocery International Boots the Chemist Pharmacy UK DM Pharmacy Germany Metro Grocery Belgium & Netherlands P&G Consumer goods International Tesco Grocery UK & International

Concluding Thoughts • Shrinkage offers an enormous opportunity • Need to measure the problem accurately • Need to adopt a systematic and systemic approach • Collaboration is key • Solutions need to be ‘fit for purpose’ • Shrinkage is the last free money on the table

Concluding Thoughts • Shrinkage offers an enormous opportunity • Need to measure the problem accurately • Need to adopt a systematic and systemic approach • Collaboration is key • Solutions need to be ‘fit for purpose’ • Shrinkage is the last free money on the table

Thank you for listening!

Thank you for listening!