27b27ac87512f07bd001827cf346d1b2.ppt

- Количество слайдов: 45

Long-term financing --Debt financing Mc. Graw-Hill/Irwin Copyright © 2010 by the Mc. Graw-Hill Companies, Inc. All rights reserved. 15 -0

Outline I. Different financing patterns II. The role of financial market and financial institutions III. Different types of debt IV. Yields on corporate debt and rating 15 -1

The Long-Term Financial Deficit Uses of Cash Flow (100%) Sources of Cash Flow (100%) Capital spending 80% Internal cash flow (retained earnings plus depreciation) 80% Net working capital plus other uses 20% Internal cash flow Financial deficit Long-term debt and equity 20% External cash flow 15 -2

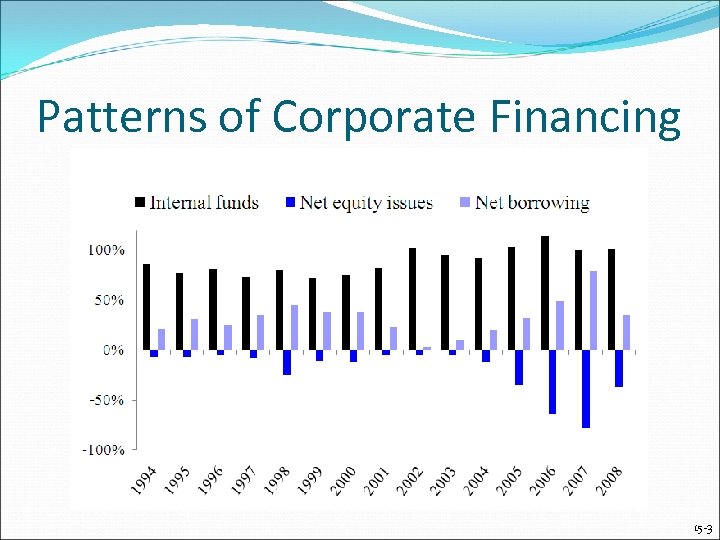

Patterns of Corporate Financing 15 -3

Patterns of Financing Internally generated cash flow dominates as a source of financing, typically between 70 and 90%. Net new issues of equity are reduced by new sales of debt. This is consistent with the pecking order hypothesis. 15 -4

II. Financial markets Money Primary OTC Markets Secondary Markets 15 -5

Financial markets Primary market: stocks or bonds are issued by the company Secondary market: stocks or bonds are traded among investors Ownership is transferred from one to another. No effect on the company’s cash, assets or operations. OTC: over the counter markets. Financial assets are traded by networks dealers or among banks. Basically private transaction, not necessarily to disclose information to the public 15 -6

Financial institutions act as financial intermediaries Gather savings of individuals and reinvest them in loans or in financial markets. Eg. banks; savings and loan companies; insurance companies; mutual funds. The institutions charge sufficient interest to cover their costs and to compensate depositors and other investors. 15 -7

Company Obligations Funds Intermediaries Banks Insurance Cos. Brokerage Firms 15 -8

Intermediaries Obligations Funds Investors Depositors Policyholders Investors 15 -9

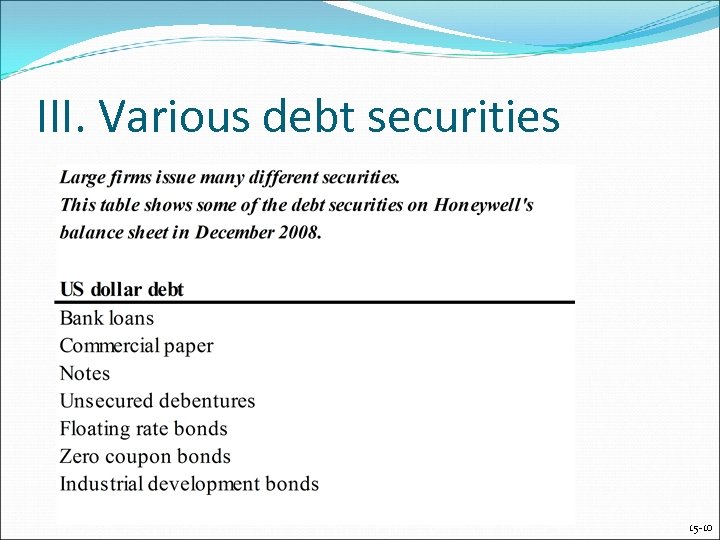

III. Various debt securities 15 -10

Mixtures of debt securities Questions may asked by financial managers: 1. 2. 3. 4. 5. Should the company borrow short term or long term? Should the debt be fixed or floating? Should you borrow dollars or some other currency? What promises should you make to the lender? Should you issue straight or convertible bonds? 15 -11

Bond Contract Summary of terms of 8. 25% sinking fund debenture 2022 issued by J. C. Penney 15 -12

The Bond Indenture Contract between the company and the bondholders that includes: The basic terms of the bonds The total amount of bonds issued A description of property used as security, if applicable Sinking fund provisions Call provisions Details of protective covenants 15 -13

The Bond Indenture Registered vs. Bearer Forms Registered: know the owner of the bonds Security Collateral – secured by financial securities Mortgage – secured by real property, normally land or buildings Debentures – unsecured Notes – unsecured debt with original maturity less than 10 years Seniority 15 -14

The Bond Indenture Repayment arrangement Bond may be paid in part or entirely before maturity. Sinking Fund - Fund established to retire debt before maturity. Call Prevision: Allows the company to repurchase or “call” part or all of the bond issue at stated prices over a specific period. Protective covenant: Negative: prohibit the company to do e. g, limits to div Positive: agrees the company to do, eg, maintaining the NWC above a level. 15 -15

What promises to the lender? Lenders want to make sure that their debt is as safe as possible. Senior debt vs. Junior/ subordinated debt: Pecking order: senior debt> junior debt > preferred stockholders> common stockholders Junior debt is repaid in bankruptcy only after senior debt is repaid. 15 -16

What promises to the lender? Secured vs. unsecured debt: Almost all debt issues by industrial and financial companies are general unsecured. (Notes/ Debentures) Utility company bonds are more often secured: Trustee or lender may take possession of the relevant asset. Mortgage bonds: secured by building or firm’s property. C 0 llateral trust bonds: by the firm’s own securities. Equipment trust certificate: by the equipement (trucks, aircraft, ships) 15 -17

Sinking funds Sinking fund - a fund established to retired debt before maturity. Valuable option for the corporation if the bonds are callable: If the bond price is low, buy the bonds in the market, using sinking funds. If the bond price is high, the firm can call the bonds by lottery and pay redeem them at the face value. If the firm cannot pay cash into sinking fund, lenders can demand their money back (like interest payment): Larger sinking funds<-> long-dated, lower-quality bonds. 15 -18

Call option Callable bond: a bond that may be repurchased by a the firm before maturity at a specified call price. The company should call bonds if its market price is higher than the call price. When interest rate fall, the company can reduce its funding costs by calling the bonds and replace it at a lower rate In practice, the investor won’t purchase if the market price is higher than the call price: => Call the bond when, and only when the market price reaches the call price 15 -19

Straight vs convertible Companies often issue securities that give the owner an option to convert them into other securities. Warrant: the owner can purchase a set number of the company’s shares at a set price before a set date. Warrant and bonds are sold together as package Convertible bond Gives its owner the option to exchange the bond for a predetermined number of shares. 15 -20

Required Yields The coupon rate depends on the risk characteristics of the bond when issued. Which bonds will have the higher coupon, all else equal? Secured debt versus a debenture Subordinated debenture versus senior debt A bond with a sinking fund versus one without A callable bond versus a non-callable bond 15 -21

short term vs. long term Short-term (notes): finance of temporary increase in inventories. Long-term(debenture): investment for an operation that last for long time. E. g. Oil refinery which might operate more or less continuously for 15 or 20 years. Occasionally, either borrower or lender has the option to terminate the loan early and to demand that it be repaid immediately. 15 -22

Fixed vs Floating rate The interest payment, or coupon on the long-term bonds is commonly fixed at the issue date. E. g. $1000 bond at 8. 25% means the firm continues to pay $82. 5 per year (41. 25 semiannual) regardless of the real interest rate variation. Most bank loans and some bonds offer a variable/ floating rate: interest varies with a benchmark level. Eg. Interest rate may be set at 1% above the U. S. Treasury bill or LIBOR (London Interbank Offered Rate): the rate at which international banks lend to one another. 15 -23

Libor Each day, the ICE ( previously BBA )surveys a panel of banks (18 major global banks for the USD Libor), asking the question, "At what rate could you borrow funds…in a reasonable market size just prior to 11 am? " The highest 4 and lowest 4 responses are thrown out, and the average of the remaining middle 10 is reported at 11: 30 am. Separate LIBOR rates reported for different maturities (overnight to 12 months) and currencies: USD, EUR, GBP, JPY, CHF Libor rates serve as benchmarks, or reference rates from which commercial loans are set. 24 15 -24

Dollars vs other currency Domestic bonds - local firms issue in a local market, purchased by foreigners at the local currancy. Foreign bonds - foreign firms issue in a local market and intended for local investors. (Yankee bond, Samurai bond. . ) Eurobond market – when multinational companies issue bonds in the international markets for capital. Can be of any currency and free of domestic regulation. Global Bonds - very large bond issues that are marketed both internationally (that is, in the eurobond market) and in individual domestic markets, simultaneously. 15 -25

Foreign bond A foreign bond is a bond issued in a host country's financial market, in the host country's currency, by a foreign borrower The three largest foreign bond markets are Japan, Switzerland, and the U. S. , representing issuance of about $40 billion in bonds annually 15 -26

Eurobond Issued outside country of currency Not subject to domestic registration or disclosure requirements In most cases take form of private placements Placed through syndicates in many countries who sell principally to nonresidents Bonds are structured so as to be free of withholding tax 15 -27

Private placement of Eurobond The private placement exemption from registration and disclosure is extended to Eurobonds as long as the U. S. investors meet the following requirements: They are large and sophisticated There are only a few investors They have access to information and analysis similar to that which would ordinarily be contained in a registered offering prospectus They are capable of sustaining the risk of losses, and They intend to purchase the bonds for their own investment portfolios, and not for resale. 15 -28

15 -29

Other Bond Types Income bonds: coupon payments depend on company income. There are many other types of provisions that can be added to a bond, and many bonds have several provisions – it is important to recognize how these provisions affect required returns. 15 -30

IV. Valuing Risky Bonds The risk of default changes the price of a bond and the YTM. Example We have a 5% 1 year bond. The bond is priced at par of $1000. But, there is a 20% chance the company will go into bankruptcy and only pay $500. What is the bond’s value? 15 -31

Valuing Risky Bonds Example We have a 5% 1 year bond. The bond is priced at par of $1000. But, there is a 20% chance the company will go into bankruptcy and only pay $500. What is the bond’s value? A: Bond Value Prob 1, 050 . 80 = 840. 00 500 . 20 = 100. 00 . 940. 00 = expected CF 15 -32

Valuing Risky Bonds Example – Continued Conversely - If on top of default risk, investors require an additional 3 percent market risk premium, the price and YTM is as follows: 15 -33

Key to Bond Ratings The highest quality bonds are rated triple-A. Investment grade bonds have to be equivalent of Baa or higher. Bonds that don’t make this cut are called “high-yield” or “junk” bonds. 15 -34

2008 2006 2004 2002 2000 1998 14 1996 1994 1992 1990 1988 1986 1984 1982 1980 Yield Spread, % (Promised) Yield Spreads 16 Aaa 12 Baa High Yield 10 8 6 4 2 0 15 -35

Credit default swap (CDS) --Debt financing Mc. Graw-Hill/Irwin Copyright © 2010 by the Mc. Graw-Hill Companies, Inc. All rights reserved. 15 -36

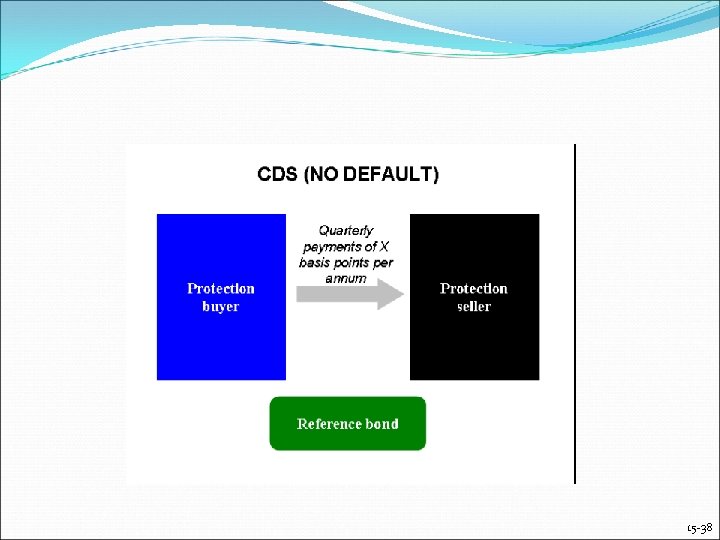

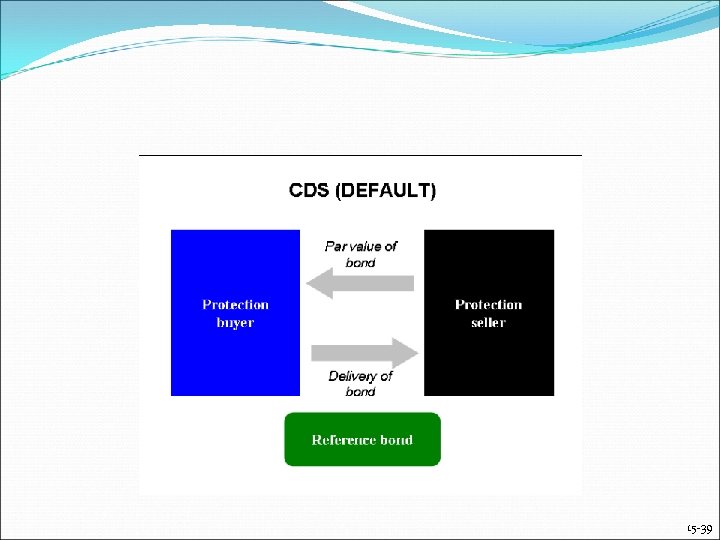

Spread on corporate bonds It is equal to the annual premium that would be needed to insure the bond against default. Credit default swap (CDS): an insurance of your corporate bonds You commit to pay a regular insurance premium (spread) In return, in case of default, the seller of CDS pays par value of the bond to the buyer, and the buyer transfers ownership of the bond to the seller. The seller pays you the difference between the face value of the debt and its market value. 15 -37

15 -38

15 -39

Credit Default Swap Data Credit default swaps insure the holders of corporate bonds against default. This figure shows the cost of default swaps on the 10 -year senior debt of four companies. Source: Datastream 700 600 Boeing GE Disney 400 Dow Chemical 300 200 100 0 01 -05 03 -05 05 -05 07 -05 09 -05 11 -05 01 -06 03 -06 05 -06 07 -06 09 -06 11 -06 01 -07 03 -07 05 -07 07 -07 09 -07 11 -07 01 -08 03 -08 05 -08 07 -08 09 -08 11 -08 01 -09 03 -09 05 -09 07 -09 Basis points Spread 500 15 -40

15 -41

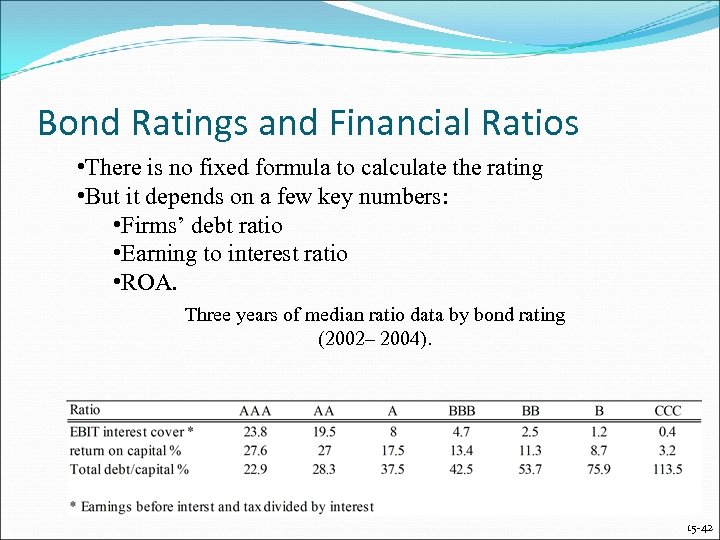

Bond Ratings and Financial Ratios • There is no fixed formula to calculate the rating • But it depends on a few key numbers: • Firms’ debt ratio • Earning to interest ratio • ROA. Three years of median ratio data by bond rating (2002– 2004). 15 -42

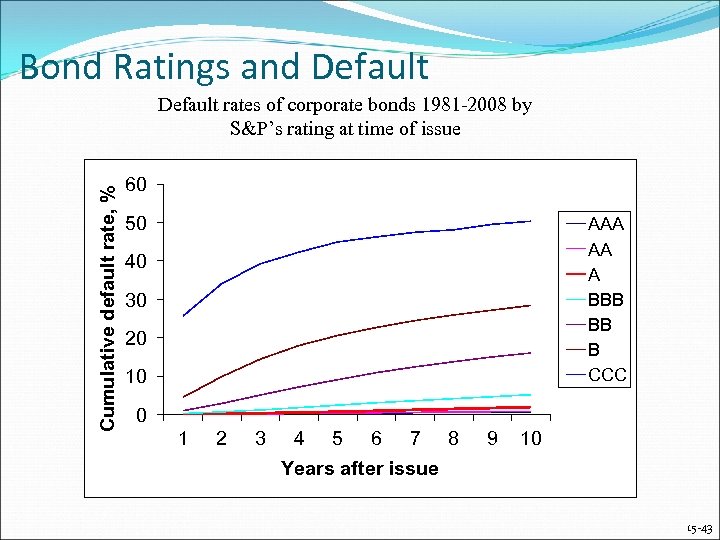

Bond Ratings and Default Cumulative default rate, % Default rates of corporate bonds 1981 -2008 by S&P’s rating at time of issue 60 50 AAA AA A BBB BB B CCC 40 30 20 10 0 1 2 3 4 5 6 7 8 9 10 Years after issue 15 -43

Credit Analysis Predicting Default - William Beaver, Maureen Mc. Nichols, and Jung-Wu Rhie, studied defaulting and non-defaulting firms and concluded the chance of failing during the next year relative to the chance of not failing was best estimated by the following equation: 15 -44

27b27ac87512f07bd001827cf346d1b2.ppt