cc4fd8f4458c10b2adb312266359d596.ppt

- Количество слайдов: 88

Long-term financial management in public administration – different models of funding projects Irinel Nechita Public Auditor Romania 1

Ø Part I. Notions on financial management – definitions, key terms and core processes Ø Part II. Financial processes Ø Part III. Models of funding projects - practical examples and exercises 2

Ø Part I. Notions on financial management – definitions, key terms and core processes Ø Part II. Financial processes Ø Part III. Models of funding projects - practical examples and exercises 3

Definition • Financial management (FM) In the context of structural instruments, this term is understood to be the set of responsibilities of the management (which is responsible for carrying out the tasks of government budget handling units) to establish and implement a set of rules aiming at an efficient, effective and economic use of available funds (comprising income, expenditure and assets). It refers to planning, budgeting, accounting, payments, reporting and some form of ex ante financial control.

Key terms • Economy: minimizing the cost of resources used to achieve given planned outputs or outcomes of an activity (including having regard to the appropriate quality of such outputs or outcomes). • Effectiveness: the extent to which objectives of an activity are achieved i. e. the relationship between the planned impact and the actual impact of an activity. • Efficiency: maximizing the outputs or outcomes of an activity relative to the given inputs.

Key terms • Financial Systems: the procedures for preparing, recording and reporting reliable information concerning financial transactions. • Planning: defining the objectives, setting policies and determining the nature, scope, extent and timing of the procedures and tests needed to achieve the objectives.

Legal Framework for FM Financial Management under structural instruments is governed by: - EU rules - National rules

Legal Framework for FM EU rules on Financial Management: General provisions - Treaty on European Union - Accession Treaty - Financial Regulation 1605/2002 and its Implementation Regulation 2342/2002 - Protection of Financial Interests of the European Communities 2988/2005

Legal Framework for FM EU rules on Financial Management: Specific provisions - General Regulation 1083/2006 - Title VI Management, Monitoring and Controls - Title VII Financial Management - Regulation 1828/2006 for implementing General Regulation - Fund specific Regulation

Legal Framework for FM National rules on Financial Management (some): - Law 500/2002 on the public finance, as subsequently modified - Law 571/2003 of Fiscal Code, as subsequently modified - GO 119/ 1999 on internal control and preventive financial control - GO 79/2003 on the control and recovery of community funds, including related co-financing funds - Order 1850/2004 on financial/accounting registers and standard documents

Bodies involved in FM EU Level • European Commission • European Parliament

Bodies involved in FM National level • Certifying Authority • Body responsible for payments • Managing Authority • Intermediate Body • Beneficiary

Core processes 1. Financial planning - Starting from Financial tables (allocations) -> updated during implementation - Financial analysis and use of indicators - Breakdown of budget figures for respective periods into planned payments/ expected payments/cash flows - Preparation of mandatory forecasts and reports, in order to able to inform decision-making - Anticipation of synchronized payment cycles and operations related to co-financing mechanisms

Core processes 2. Budgeting - Based on financial planning figures; - Commitment from community budget, respectively national budget - Budget de-commitment, pending on implementation

Core processes 3. Statement of expenditures and application for payments - Regular certification of expenditures/application for payment - Partial closure of an operational programme - Final closure of an operational programme

Core processes 4. The payment function - Financial flows between the European Commission and Romania (payments and reimbursements; for pre -financing, interim and final payment); - Financial flows for payments (reimbursements) between bodies responsible for payment and beneficiary; - Financial flows to and from contractors

Core processes 5. Treasury - Providing enough cash to pay contractors/ beneficiaries - Monitoring payment and income systems - Monitoring bank facilities - Foreign exchange transactions - Cash flow monitoring

Core processes 6. Accounting and reporting - Capture, record , summarize and report on financial transactions and events in automated form and according to accounting standards. Particular attention need to be paid to accrual accounting - Create link to national budgetary accounting - Create link to MIS - Mandatory and ad hoc reporting - Financial archiving

Core processes 7. Internal Control function - Ex-ante controls

Core processes 8. Financial corrections By Member States - Consisting of recovering all or part of the Community contribution, when required, for individual detected or systemic irregularities in operations/OPs;

Core processes 8. Financial corrections By Commission, if after examination -> Serious deficiency in management and control system -> Irregular payment contained in a certified statement of expenditure

Ø Part I. Notions on financial management – definitions, key terms and core processes Ø Part II. Financial processes Ø Part III. Models of funding projects - practical examples and exercises 22

Content • • • Budgeting Statement of expenditure Payments Treasury Accounting

BUDGETING

EU Budget Commitments • Annually for each Fund and objective in the OPs • First budget commitment – before the OP approval by the Commission • Following commitments – by 30 April each year • Transfer from national contingency reserve to other OP upon request by the MS – by 30 September of the year n

EU Budget Decommitment n Automatic decommitment – Any part of a budget commitment in an OP not used for payment of the pre-financing or interim payments or not applied by 31 st December of the second/third year following the year of budget commitment under programme (n+2, n+3) – Rule changed for 2007 allocation (R 593/2010): divided in 6 parts – added to each of the following years of the programming period 2008 -2013 ; 2011 = first year to apply rule N+3

National Budget • Annual commitment, distinctively for each OP • Reflected in the budget of the line ministry of MA • Amounts non used by the end of the year carried forward

STATEMENT OF EXPENDITURES

Statement of expenditures n Statement of Expenditures on OP level n Information per each priority axis: - Total amount of eligible expenditures and - Corresponding public contribution n Expenditure paid by beneficiaries – justified with invoices or accounting documents of equivalent value (documents kept by the beneficiary)

Eligibility of Expenditure • Paid between the date of submission of the operational programmes to the Commission or from the 1 st January 2007 whichever is the earliest, and 31 December 2015 • Operations co-financed must not have been completed before the starting date for eligibility • Rules of eligibility shall be laid down at national level subject to exceptions in specific regulations

PAYMENTS

Payment rules n Forms of Payments from EC: – Pre-financing – Interim payments – Payment of the final balance

Payment rules n Amounts set out in operational programmes, certified statements of expenditure, applications for payment and expenditure mentioned in the annual and final report of implementation shall be denominated in Euro. n National currency shall be converted into Euro using the monthly accounting exchange rate of the Commission in the month during which the expenditure was registered in the accounts of the certifying authority of the operational programme concerned.

Payment rules n Any interest generated by the pre-financing shall be posted to the operational programme concerned, being regarded as a resource for the Member State in the form of a national public contribution, and shall be declared to the Commission at the time of the final closure of the operational programme.

Payment Rules n Interruption of payments – By the delegated authorising officer for a maximum period of six months – MS informed immediately and takes the necessary measure for correction n Suspension of payments – by the Commission: all or part of interim payments at the level of priorities or programmes – MS gets the opportunity to presents its observation and takes the necessary measure for correction

ACCOUNTING

Accounting Main accounting activities: n n n Recording business transactions and thereby providing a database of financial information. Maintenance of financial systems. Determination of financial procedures. Preparing statutory financial statements. Interpreting and analysing financial information for internal planning, control and decision making.

Accounting aspects to be dealt with: • • Organizational structure Accounting Framework System of accounting Records Description of accounting activities Accounting controls and records Archiving system Reporting Accounting information system

Ø Part I. Notions on financial management – definitions, key terms and core processes Ø Part II. Financial processes Ø Part III. Models of funding projects - practical examples and exercises 39

General aspects of structural funds in Romania 40

Regions of development in Romania North-West North-East Center West South-East South-West Bucharest. Ilfov 41

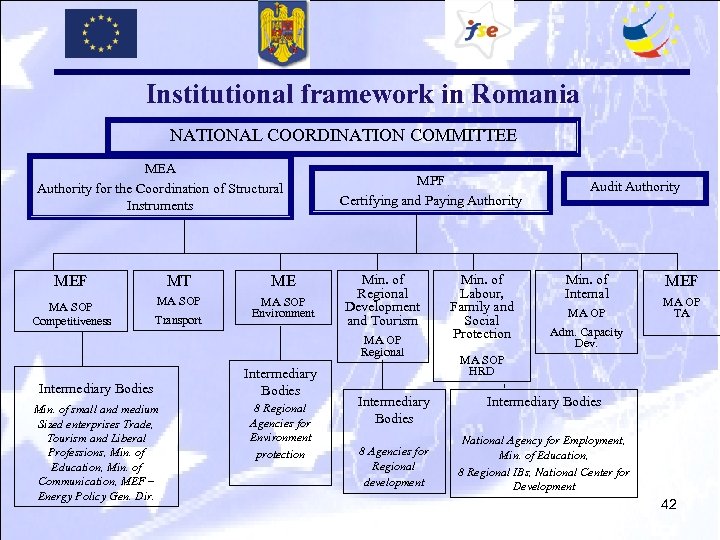

Institutional framework in Romania NATIONAL COORDINATION COMMITTEE MEA Authority for the Coordination of Structural Instruments MEF MT ME MA SOP Competitiveness MA SOP Environment Transport MPF Certifying and Paying Authority Min. of Regional Development and Tourism MA OP Regional Intermediary Bodies Min. of small and medium Sized enterprises Trade, Tourism and Liberal Professions, Min. of Education, Min. of Communication, MEF – Energy Policy Gen. Dir. Intermediary Bodies 8 Regional Agencies for Environment protection Intermediary Bodies 8 Agencies for Regional development Min. of Labour, Family and Social Protection Audit Authority Min. of Internal MA OP MEF MA OP TA Adm. Capacity Dev. MA SOP HRD Intermediary Bodies National Agency for Employment, Min. of Education, 8 Regional IBs, National Center for Development 42

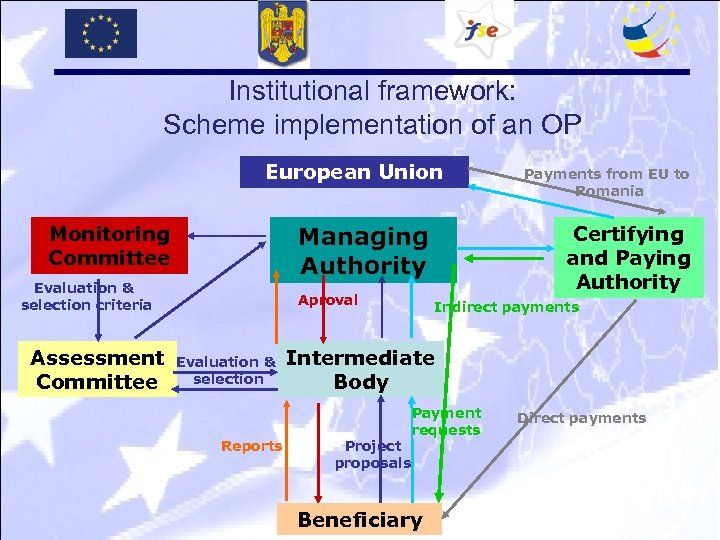

Institutional framework: Scheme implementation of an OP European Union Managing Authority Monitoring Committee Evaluation & selection criteria Assessment Committee Aproval Evaluation & selection Reports Payments from EU to Romania Certifying and Paying Authority Indirect payments Intermediate Body Project proposals Payment requests Beneficiary Direct payments

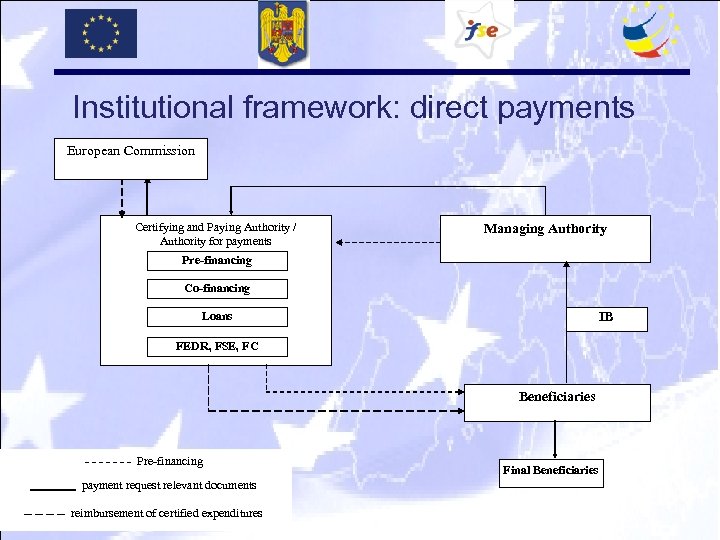

Institutional framework: direct payments European Commission Certifying and Paying Authority / Authority for payments Managing Authority Pre-financing Co-financing IB Loans FEDR, FSE, FC Beneficiaries - - - - Pre-financing payment request relevant documents -- -- reimbursement of certified expenditures Final Beneficiaries

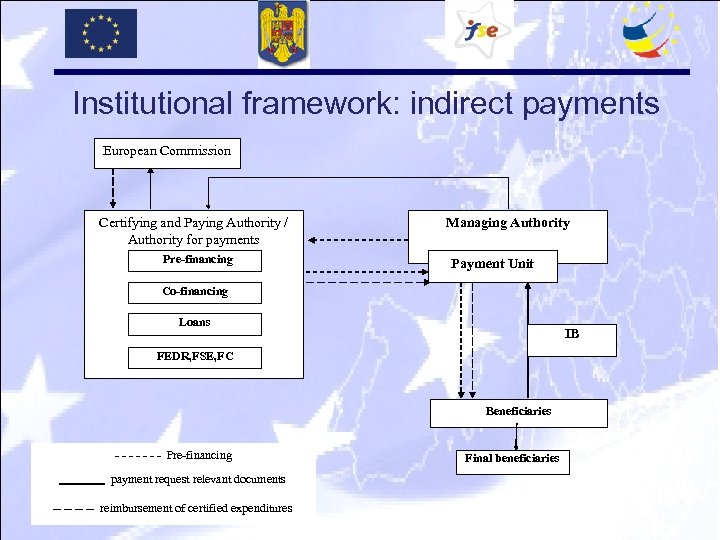

Institutional framework: indirect payments European Commission Certifying and Paying Authority / Authority for payments Pre-financing Managing Authority Payment Unit Co-financing Loans IB FEDR, FSE, FC Beneficiaries - - - - Pre-financing payment request relevant documents -- -- reimbursement of certified expenditures Final beneficiaries

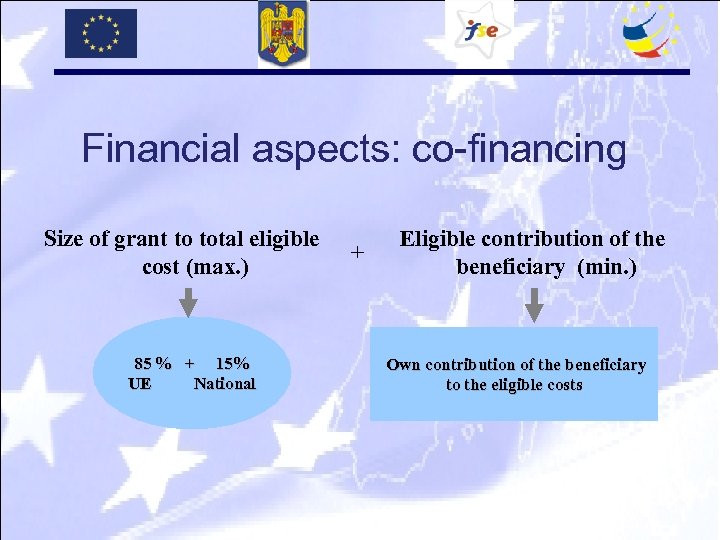

Financial aspects: co-financing Size of grant to total eligible cost (max. ) 85 % + 15% UE National + Eligible contribution of the beneficiary (min. ) Own contribution of the beneficiary to the eligible costs

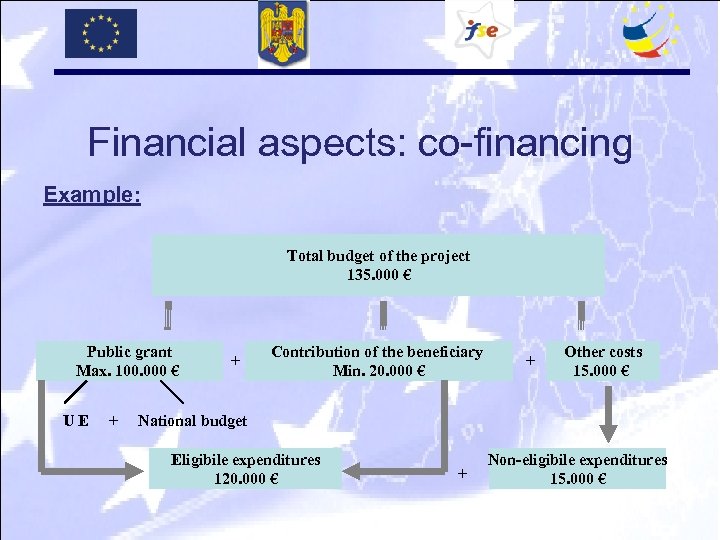

Financial aspects: co-financing Example: Total budget of the project 135. 000 € Public grant Max. 100. 000 € UE + + Contribution of the beneficiary Min. 20. 000 € + Other costs 15. 000 € National budget Eligibile expenditures 120. 000 € + Non-eligibile expenditures 15. 000 €

Specific aspects of Regional Operational Programme from Romania 48

Specific aspects of Regional Operational Programme from Romania • Unlike other Operational Programmes, that pursue national objectives to reduce disparities between Romania and other Member States, ROP aims to reduce disparities among the eight development regions of Romania. • The strategic objective of achieving socio-economic and territorial cohesion in the whole country is put into practice through an allocation of funds differentiated by region, depending on the degree of development and in close coordination with the activities in the other OPs. 49

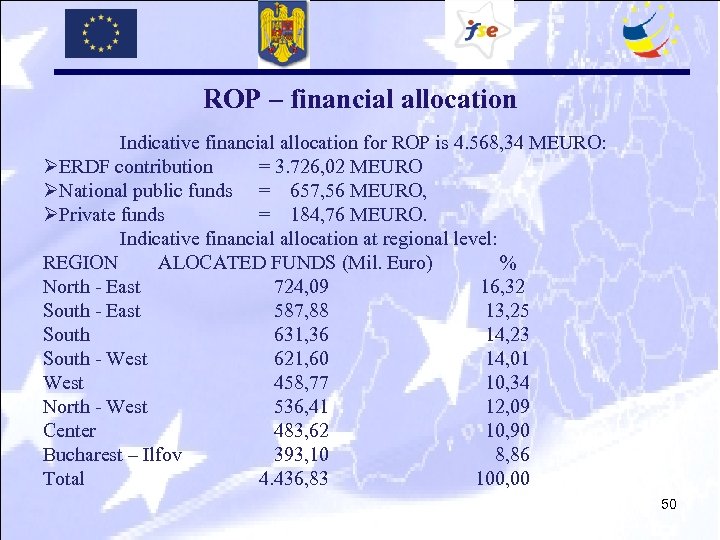

ROP – financial allocation Indicative financial allocation for ROP is 4. 568, 34 MEURO: ØERDF contribution = 3. 726, 02 MEURO ØNational public funds = 657, 56 MEURO, ØPrivate funds = 184, 76 MEURO. Indicative financial allocation at regional level: REGION ALOCATED FUNDS (Mil. Euro) % North - East 724, 09 16, 32 South - East 587, 88 13, 25 South 631, 36 14, 23 South - West 621, 60 14, 01 West 458, 77 10, 34 North - West 536, 41 12, 09 Center 483, 62 10, 90 Bucharest – Ilfov 393, 10 8, 86 Total 4. 436, 83 100, 00 50

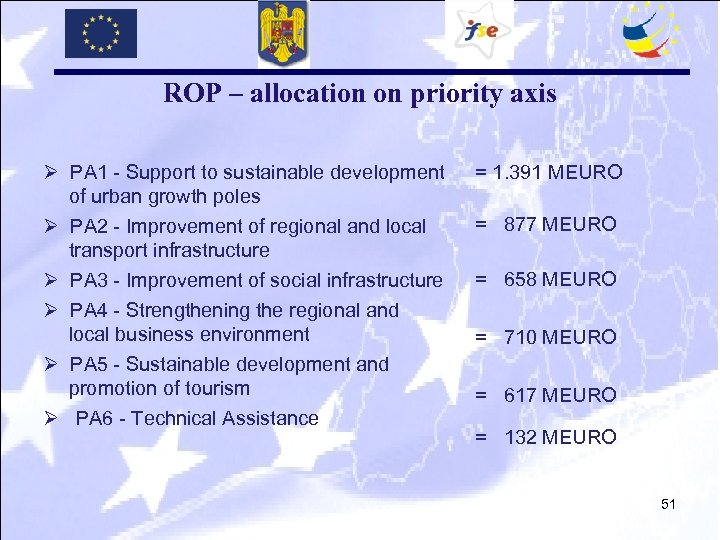

ROP – allocation on priority axis Ø PA 1 - Support to sustainable development of urban growth poles Ø PA 2 - Improvement of regional and local transport infrastructure Ø PA 3 - Improvement of social infrastructure Ø PA 4 - Strengthening the regional and local business environment Ø PA 5 - Sustainable development and promotion of tourism Ø PA 6 - Technical Assistance = 1. 391 MEURO = 877 MEURO = 658 MEURO = 710 MEURO = 617 MEURO = 132 MEURO 51

ROP – AREAS OF INTERVENTION What projects does ROP finance? The ROP funds projects aiming among other to: • Improve the quality of life and the “appearance” of towns and strengthen their role in the region • Improve the access to and within a region, by developing its infrastructure such as county roads and ring-roads; • Modernize social services: schools, clinics, emergency situations units etc; • Increase business investments, by providing support to microenterprises, to the improvement of utility networks and business infrastructure; • Modernization and rehabilitation of existing tourism facilities. 52

ROP –Who can apply for the ROP funds? The potential applicants for the ROP funds could be: • Public administration authorities (Town Halls, Local Councils, County Councils); • Public institutions, such as social welfare and health institutions, academic institutions, emergency intervention services etc; • NGOs; • Private companies, especially SME’s and microenterprises. 53

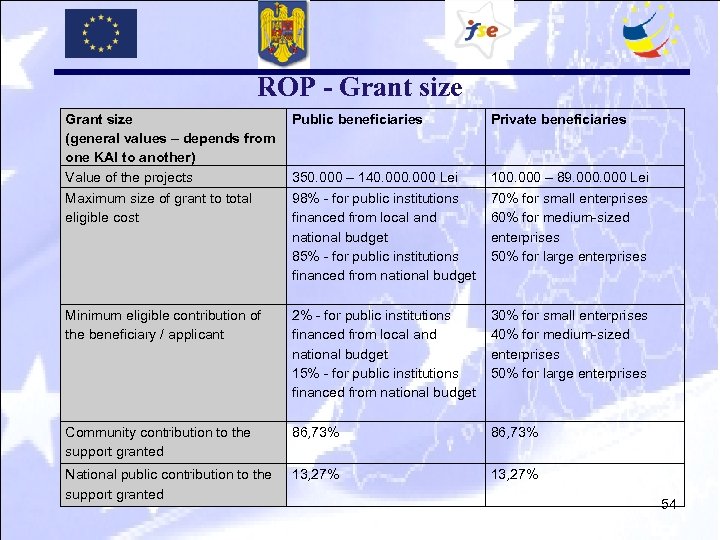

ROP - Grant size (general values – depends from one KAI to another) Value of the projects Public beneficiaries Private beneficiaries 350. 000 – 140. 000 Lei 100. 000 – 89. 000 Lei Maximum size of grant to total eligible cost 98% - for public institutions financed from local and national budget 85% - for public institutions financed from national budget 70% for small enterprises 60% for medium-sized enterprises 50% for large enterprises Minimum eligible contribution of the beneficiary / applicant 2% - for public institutions financed from local and national budget 15% - for public institutions financed from national budget 30% for small enterprises 40% for medium-sized enterprises 50% for large enterprises Community contribution to the support granted 86, 73% National public contribution to the support granted 13, 27% 54

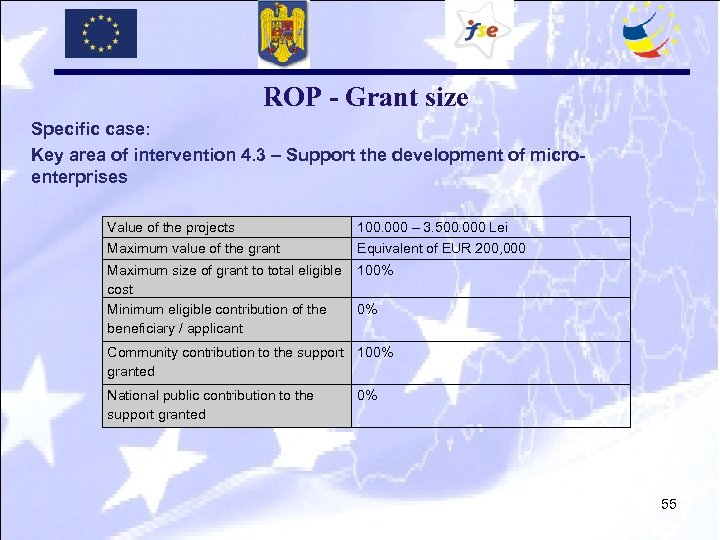

ROP - Grant size Specific case: Key area of intervention 4. 3 – Support the development of microenterprises Value of the projects 100. 000 – 3. 500. 000 Lei Maximum value of the grant Equivalent of EUR 200, 000 Maximum size of grant to total eligible cost Minimum eligible contribution of the beneficiary / applicant 100% 0% Community contribution to the support 100% granted National public contribution to the support granted 0% 55

ROP - Calls for project applications Type of calls for project applications • Open call with fixed deadline • Open call with rolling submission • Call based on list of eligible projects (for hospitals - Key Area of Intervention 3. 1. Rehabilitation, modernization and equipping of the health services’ infrastructure) 56

ROP - Dimensioning and conditions for pre-financing A. Pre-financing may be granted in the maximum rate of 20% of eligible project under the following conditions: Ø The project does not include execution of public works; Ø A contract for the supply of goods / service between beneficiary and an operator; Ø Application for pre-financing; Ø Financial identification account dedicated exclusively to pre-financing. 57

ROP - Dimensioning and conditions for pre-financing B. For investment projects (execution of public works), pre-financing may be granted in instalments as follows: I. The first instalment of pre-financing, representing 10% of the eligible costs: Ø A contract for the supply of goods / service between beneficiary and an operator; Ø Application for pre-financing; Ø Financial identification 58

ROP - Dimensioning and conditions for pre-financing II. The second instalment of pre-financing, representing 10% of the eligible costs, based on following documents: Ø Contract of execution of public works; Ø Application for pre-financing; C. For investment projects (execution of public works), prefinancing may be granted by aggregating the two parts = 20% Ø Ø A contract for the supply of goods / service Contract of execution of public works Application for pre-financing Financial identification 59

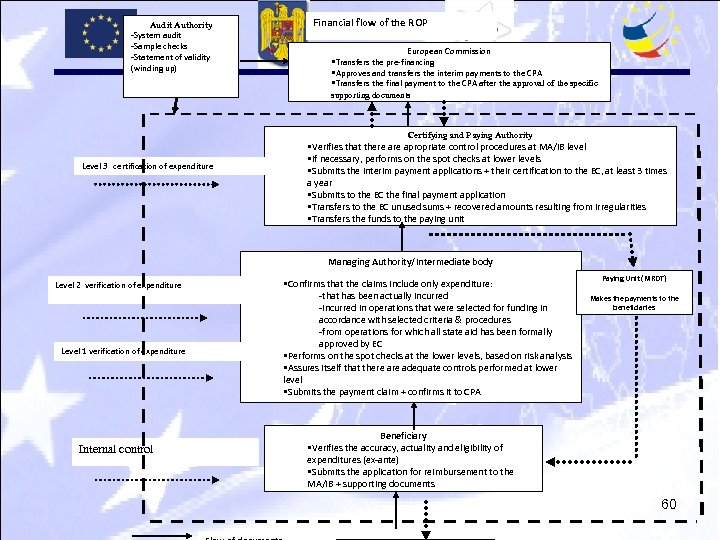

Audit Authority -System audit -Sample checks -Statement of validity (winding up) Financial flow of the ROP European Commission §Transfers the pre-financing §Approves and transfers the interim payments to the CPA §Transfers the final payment to the CPA after the approval of the specific supporting documents Certifying and Paying Authority Level 3 certification of expenditure §Verifies that there apropriate control procedures at MA/IB level §If necessary, performs on the spot checks at lower levels §Submits the interim payment applications + their certification to the EC, at least 3 times a year §Submits to the EC the final payment application §Transfers to the EC unused sums + recovered amounts resulting from irregularities §Transfers the funds to the paying unit Managing Authority/Intermediate body Level 2 verification of expenditure Level 1 verification of expenditure Internal control §Confirms that the claims include only expenditure: -that has been actually incurred -incurred in operations that were selected for funding in accordance with selected criteria & procedures -from operations for which all state aid has been formally approved by EC §Performs on the spot checks at the lower levels, based on risk analysis §Assures itself that there adequate controls performed at lower level §Submits the payment claim + confirms it to CPA Paying Unit (MRDT) Makes the payments to the beneficiaries Beneficiary §Verifies the accuracy, actuality and eligibility of expenditures (ex-ante) §Submits the application for reimbursement to the MA/IB + supporting documents 60

• Group Exercise 1: ROP vs. SOP HRD Starting from the main differences, decide which took the appropriate decisions … 61

ROP vs. SOP HRD Main differences POR SOP HRD • Institutions responsible: Ø Managing Authority within the Ministry of Regional Development and Tourism public institution/public servants Ø 8 Intermediate Bodies – NGOs/contractual employees Ø Managing Authority within the Ministry of Labour and Social Protection - public institution/public servants Ø 8 Intermediate Bodies – public institution/public servants Ø + 2 IBs - National Agency for Employment and Min. of Education for 2 KAI – public institutions/public servants 62

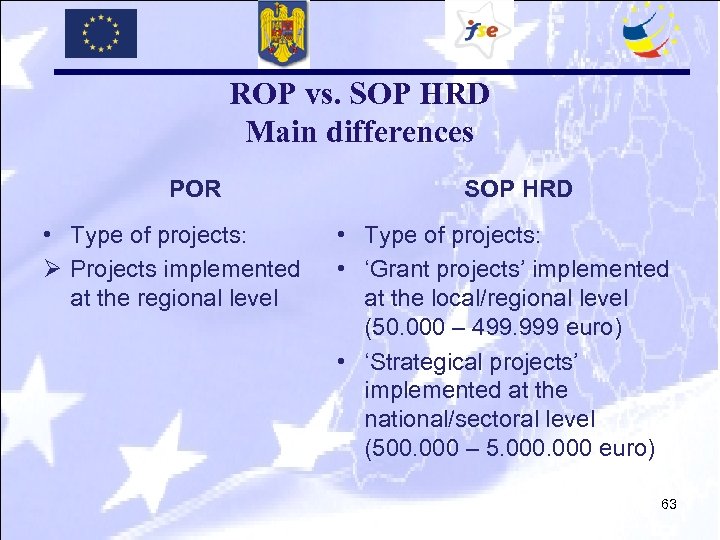

ROP vs. SOP HRD Main differences POR • Type of projects: Ø Projects implemented at the regional level SOP HRD • Type of projects: • ‘Grant projects’ implemented at the local/regional level (50. 000 – 499. 999 euro) • ‘Strategical projects’ implemented at the national/sectoral level (500. 000 – 5. 000 euro) 63

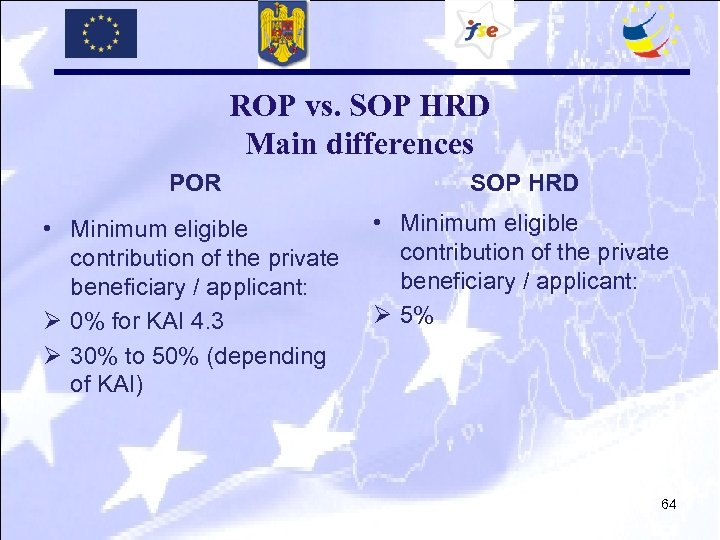

ROP vs. SOP HRD Main differences POR SOP HRD • Minimum eligible contribution of the private beneficiary / applicant: Ø 0% for KAI 4. 3 Ø 30% to 50% (depending of KAI) • Minimum eligible contribution of the private beneficiary / applicant: Ø 5% 64

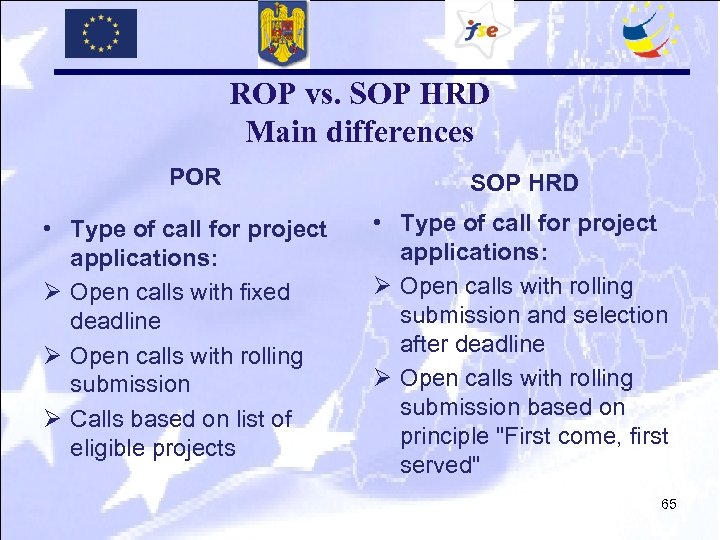

ROP vs. SOP HRD Main differences POR • Type of call for project applications: Ø Open calls with fixed deadline Ø Open calls with rolling submission Ø Calls based on list of eligible projects SOP HRD • Type of call for project applications: Ø Open calls with rolling submission and selection after deadline Ø Open calls with rolling submission based on principle "First come, first served" 65

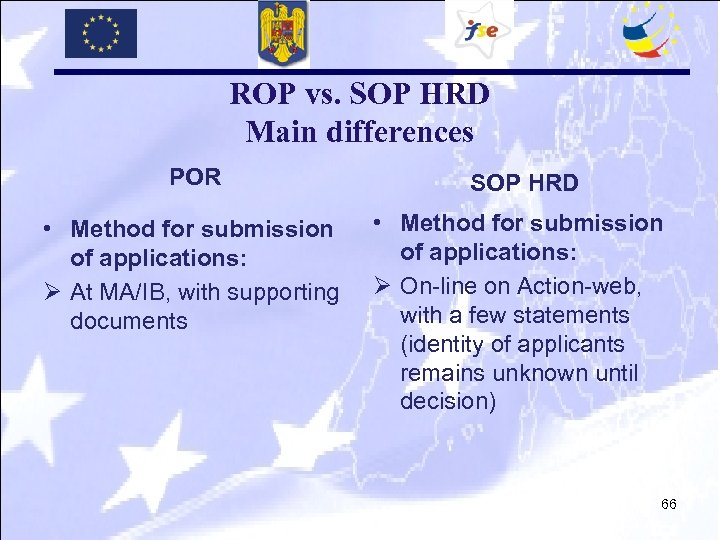

ROP vs. SOP HRD Main differences POR SOP HRD • Method for submission of applications: Ø At MA/IB, with supporting documents • Method for submission of applications: Ø On-line on Action-web, with a few statements (identity of applicants remains unknown until decision) 66

ROP vs. SOP HRD Main differences POR • Responsibility for contracting : Ø MA/IB SOP HRD • Responsibility for contracting : Ø Externalized action to a law firm 67

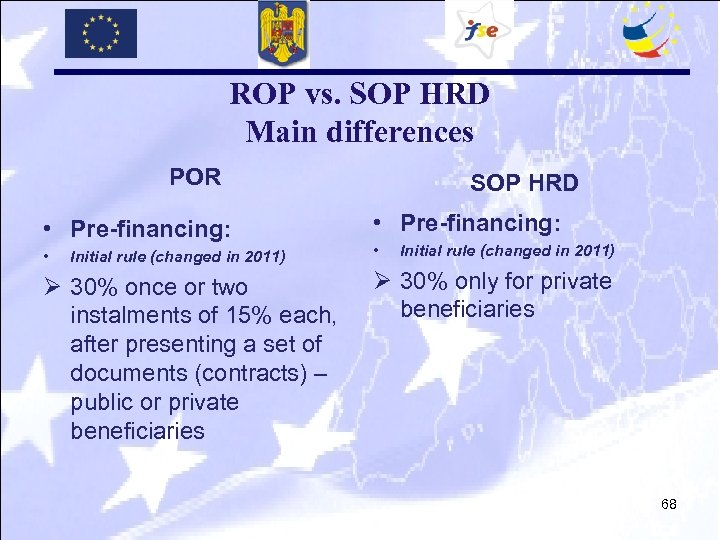

ROP vs. SOP HRD Main differences POR • Pre-financing: • Initial rule (changed in 2011) Ø 30% once or two instalments of 15% each, after presenting a set of documents (contracts) – public or private beneficiaries SOP HRD • Pre-financing: • Initial rule (changed in 2011) Ø 30% only for private beneficiaries 68

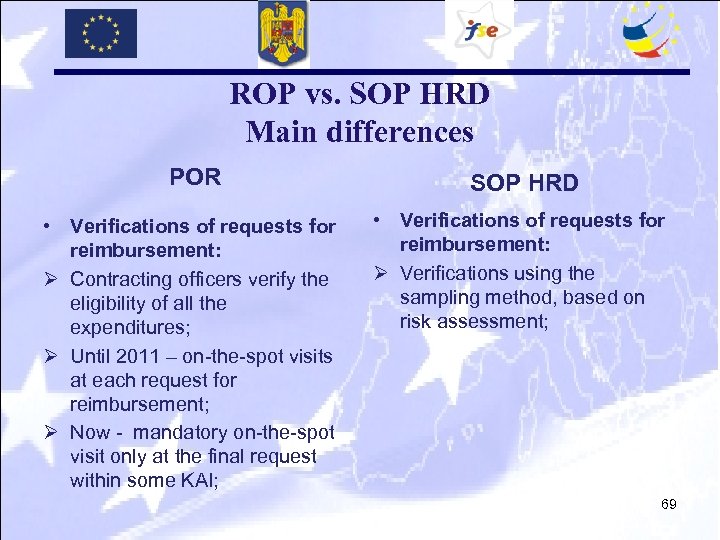

ROP vs. SOP HRD Main differences POR SOP HRD • Verifications of requests for reimbursement: Ø Contracting officers verify the eligibility of all the expenditures; Ø Until 2011 – on-the-spot visits at each request for reimbursement; Ø Now - mandatory on-the-spot visit only at the final request within some KAI; • Verifications of requests for reimbursement: Ø Verifications using the sampling method, based on risk assessment; 69

ROP vs. SOP HRD Main differences POR SOP HRD • Internal Audit function: Ø Responsibilities in auditing the projects (audit of the operations); • Internal Audit function: Ø Not responsible for auditing the projects (system audit, compliance audit and regularity audit) 70

• And the winner is: ROP ? ? ? SOP HRD? ? ? 71

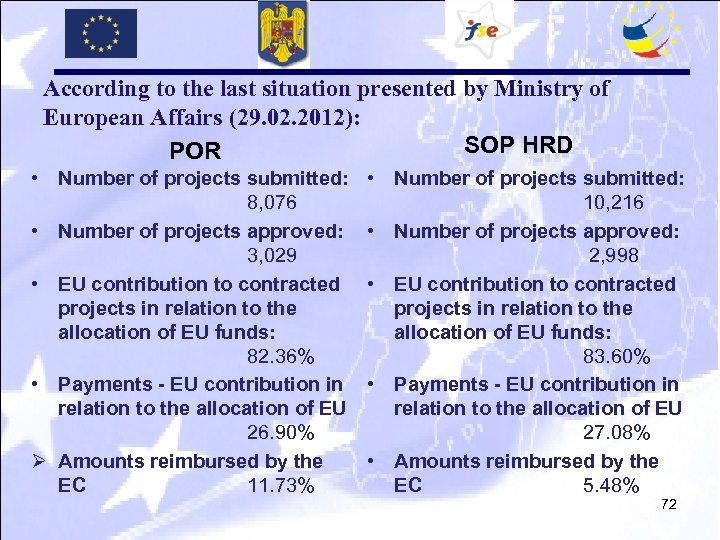

According to the last situation presented by Ministry of European Affairs (29. 02. 2012): SOP HRD POR • Number of projects submitted: 8, 076 • Number of projects approved: 3, 029 • EU contribution to contracted projects in relation to the allocation of EU funds: 82. 36% • Payments - EU contribution in relation to the allocation of EU 26. 90% Ø Amounts reimbursed by the EC 11. 73% • Number of projects submitted: 10, 216 • Number of projects approved: 2, 998 • EU contribution to contracted projects in relation to the allocation of EU funds: 83. 60% • Payments - EU contribution in relation to the allocation of EU 27. 08% • Amounts reimbursed by the EC 5. 48% 72

Interrupted/suspended payments: POR SOP HRD • Payments interrupted from • Payments suspended starting July to December 2011: with 20. 02. 2012: Ø Irregularities identified in public Ø Major deficiencies in the procurement procedures during management and control system an audit mission from EC identifies by the Audit Authority from Romania (deficiencies in Ø Romania decided to withdraw all project selection procedures and payment certificates submitted to first level of verifications) EC 73

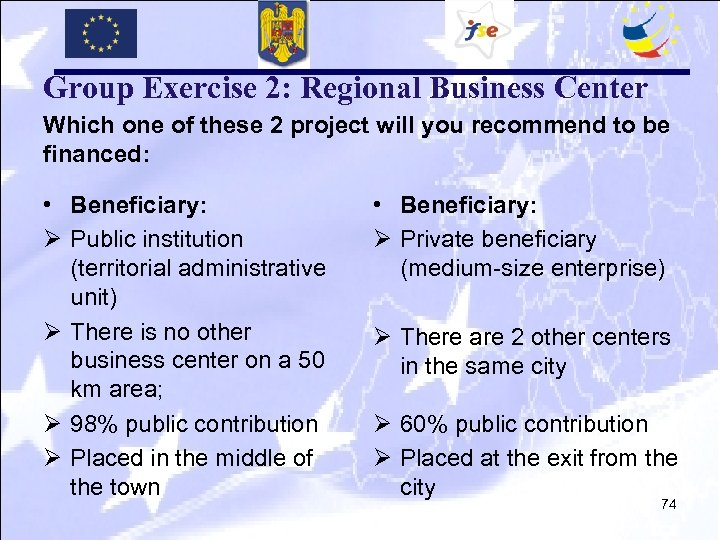

Group Exercise 2: Regional Business Center Which one of these 2 project will you recommend to be financed: • Beneficiary: Ø Public institution (territorial administrative unit) Ø There is no other business center on a 50 km area; Ø 98% public contribution Ø Placed in the middle of the town • Beneficiary: Ø Private beneficiary (medium-size enterprise) Ø There are 2 other centers in the same city Ø 60% public contribution Ø Placed at the exit from the city 74

• Difficulties in implementing European Funds projects – experience and solutions 75

Application process Problem: Ø Lack of knowledge about future call for proposals and its rules Solution: Ø Implementation of Annual Action Plans presenting all criteria, call for proposal schedules and financial allocations

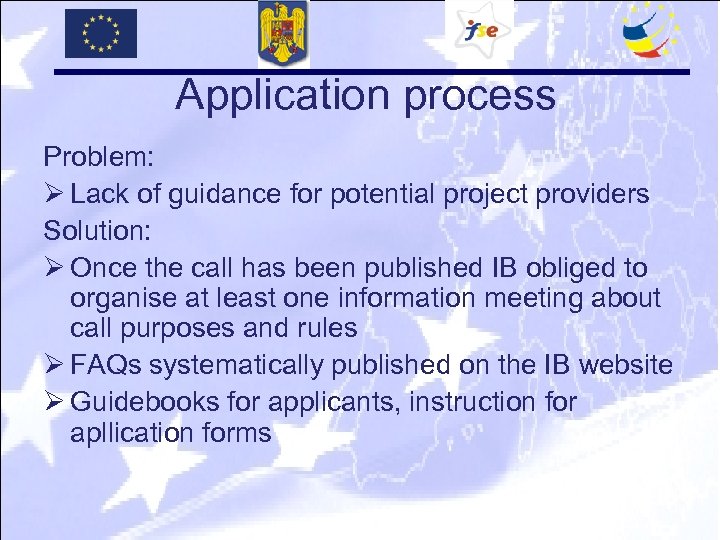

Application process Problem: Ø Lack of guidance for potential project providers Solution: Ø Once the call has been published IB obliged to organise at least one information meeting about call purposes and rules Ø FAQs systematically published on the IB website Ø Guidebooks for applicants, instruction for apllication forms

Application process Problem: Ø Many documents required with the application form Solution: Ø Decrease of mandatory attachements to the application form Ø Documents to be presented once the project has been selected

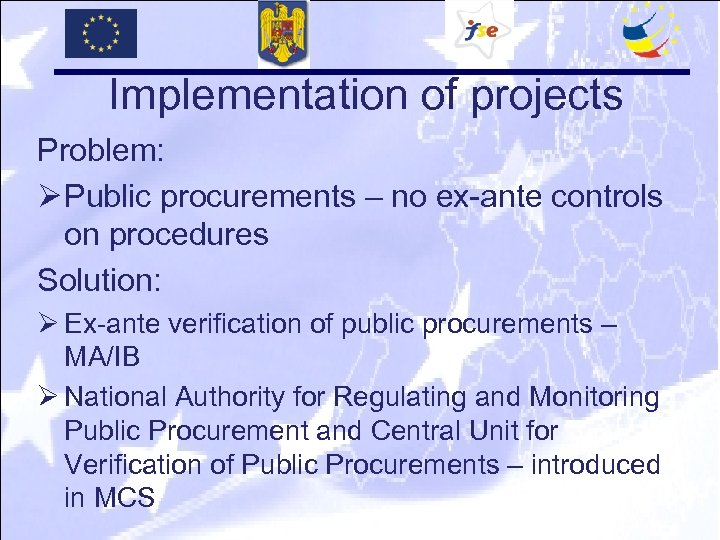

Implementation of projects Problem: Ø Public procurements – no ex-ante controls on procedures Solution: Ø Ex-ante verification of public procurements – MA/IB Ø National Authority for Regulating and Monitoring Public Procurement and Central Unit for Verification of Public Procurements – introduced in MCS

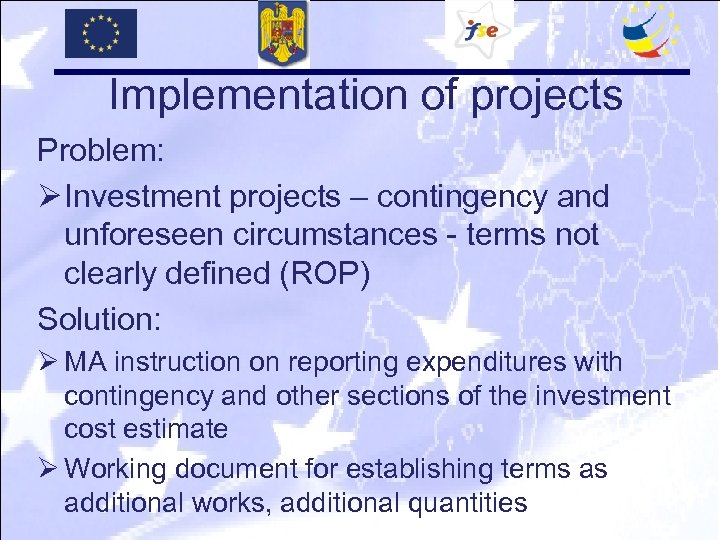

Implementation of projects Problem: Ø Investment projects – contingency and unforeseen circumstances - terms not clearly defined (ROP) Solution: Ø MA instruction on reporting expenditures with contingency and other sections of the investment cost estimate Ø Working document for establishing terms as additional works, additional quantities

Implementation of projects Problem: Ø Public servants – lack of knowledge and lack of interest (underpaid) Solution: Ø Consultancy from private entities with experience in the field; Ø Increase salaries for public servants who work within projects financed with European funds Ø Training programs (projects from TA OP or other OPs)

Financing of projects Problem: Ø Lack of internal resources at the beneficiary level Solution: Ø Introduction of advance payments for beneficiaries Ø Prefinancing for public beneficiaries also

Financing of projects Problem: Ø Liquidity problems in the projects Solution: Ø Cooperation with the banks Ø Opportunity to guarantee the bank loans with the works / goods that will be executed / purchase through the project

Financing of projects Problem: Ø Differences between the costs of projects Solution: Ø Introduction of cost standards (for example - standard cost per km of road) – working document

Financing of projects Problem: Ø Differences between estimated costs of the project and values of the contract signed within the project Solution: Ø Reports requested from beneficiaries regarding estimated costs and signed contracts Ø Additional acts to the financing contract with new values Ø Redistribution of funds

Reporting Problem: Errors in reports sent to MA / IBs (numeric, substantial, blank fields) Solution: IT supporting application

• Conclusions … 87

Thank you for your attention !!! Irinel Nechita Public Auditor Romania irinelnechita@yahoo. com +40 745 587 942 88

cc4fd8f4458c10b2adb312266359d596.ppt