08f7671a67554b20b7d2ffc6a07057fe.ppt

- Количество слайдов: 46

Long-Term Care Insurance Paying for Long-Term Care Understanding the Options 2008 01/29/08 1

Long-Term Care Insurance Paying for Long-Term Care Understanding the Options 2008 01/29/08 1

Disclaimer Note: The information provided by the Long-Term Care Insurance Education and Outreach Program is intended for the sole purpose of educating consumers in regard to the choices available for financing their future long-term care needs. Particular emphasis is placed on understanding long-term care insurance. Nothing herein is intended nor should it be construed as an endorsement by the State of New York of any specific insurance product or insurer. 01/29/08 2

Disclaimer Note: The information provided by the Long-Term Care Insurance Education and Outreach Program is intended for the sole purpose of educating consumers in regard to the choices available for financing their future long-term care needs. Particular emphasis is placed on understanding long-term care insurance. Nothing herein is intended nor should it be construed as an endorsement by the State of New York of any specific insurance product or insurer. 01/29/08 2

What is Long-Term Care ? n Medical and non-medical support services needed by individuals who are unable to care for themselves because of prolonged illness or disability. Care can range from personal care to skilled care n Care can take place in a variety of settings n 01/29/08 3

What is Long-Term Care ? n Medical and non-medical support services needed by individuals who are unable to care for themselves because of prolonged illness or disability. Care can range from personal care to skilled care n Care can take place in a variety of settings n 01/29/08 3

Risk of Needing Long-Term Care § Reach age 65 and there is a greater than a 40% chance of entering a nursing home in your lifetime. § Ten percent of those who reach age 65 may have a stay of 5 years or longer. § For women who reach age 65 the risk is greater. One of two women may expect a nursing home experience. For men the risk is one in three. § The average stay in a nursing home is 2. 5 years, (in NY, 30% who enter will stay longer than 3 years). 01/29/08 4

Risk of Needing Long-Term Care § Reach age 65 and there is a greater than a 40% chance of entering a nursing home in your lifetime. § Ten percent of those who reach age 65 may have a stay of 5 years or longer. § For women who reach age 65 the risk is greater. One of two women may expect a nursing home experience. For men the risk is one in three. § The average stay in a nursing home is 2. 5 years, (in NY, 30% who enter will stay longer than 3 years). 01/29/08 4

Assessing Your Risk of Needing Long-Term Care n Risk depends on a number of factors n Age, marital/partnership status, gender, lifestyle, health & family history 01/29/08 5

Assessing Your Risk of Needing Long-Term Care n Risk depends on a number of factors n Age, marital/partnership status, gender, lifestyle, health & family history 01/29/08 5

What is the Cost of Long-Term Care in New York State? n n The annual cost (2005) of skilled nursing home care in NY averaged $99, 645 ($273/day) Home care can be very expensive as well. 01/29/08 6

What is the Cost of Long-Term Care in New York State? n n The annual cost (2005) of skilled nursing home care in NY averaged $99, 645 ($273/day) Home care can be very expensive as well. 01/29/08 6

State Medicaid Spending for Long -Term Care Over 25% of Medicaid expenditures in New York State are for Long-Term Care, totaling over $10. 2 billion in 2006. 01/29/08 7

State Medicaid Spending for Long -Term Care Over 25% of Medicaid expenditures in New York State are for Long-Term Care, totaling over $10. 2 billion in 2006. 01/29/08 7

Payment Options Medicare n Self Pay n Medicaid ………Or a combination of methods n 01/29/08 8

Payment Options Medicare n Self Pay n Medicaid ………Or a combination of methods n 01/29/08 8

Original Medicare: Home Health Care Coverage Overview n Must require skilled care on a part-time or intermittent basis n n n Physician must certify the need and must set up a home health care plan Can be combined with personal care Beneficiary must be confined to the home (restrictions have relaxed) n Receive care from a Certified Home Health Agency (CHHA) 01/29/08 9

Original Medicare: Home Health Care Coverage Overview n Must require skilled care on a part-time or intermittent basis n n n Physician must certify the need and must set up a home health care plan Can be combined with personal care Beneficiary must be confined to the home (restrictions have relaxed) n Receive care from a Certified Home Health Agency (CHHA) 01/29/08 9

Original Medicare: Skilled Nursing Coverage Overview n Limited with strict eligibility guidelines n n n 01/29/08 Must follow a three day hospital stay Must require skilled care Typically for rehabilitation and must meet strict criteria for continued coverage Days 1 -20 Pays 100% of the cost Days 21 -100 You owe a daily coinsurance $128/day (2008) No coverage after 100 days 10

Original Medicare: Skilled Nursing Coverage Overview n Limited with strict eligibility guidelines n n n 01/29/08 Must follow a three day hospital stay Must require skilled care Typically for rehabilitation and must meet strict criteria for continued coverage Days 1 -20 Pays 100% of the cost Days 21 -100 You owe a daily coinsurance $128/day (2008) No coverage after 100 days 10

Self Pay Options n Self Pay Income n Savings/Investments n Home Equity/Reverse Mortgage n Life Insurance n Other Housing n Trusts n Long-Term Care Insurance n 01/29/08 11

Self Pay Options n Self Pay Income n Savings/Investments n Home Equity/Reverse Mortgage n Life Insurance n Other Housing n Trusts n Long-Term Care Insurance n 01/29/08 11

Medicaid n Most frequent payer of long-term skilled nursing home care A needs-based payer of last resort for medically necessary expenses n Medicaid income and resource spend down rules apply n Ensures that everyone receives the care they need n 01/29/08 12

Medicaid n Most frequent payer of long-term skilled nursing home care A needs-based payer of last resort for medically necessary expenses n Medicaid income and resource spend down rules apply n Ensures that everyone receives the care they need n 01/29/08 12

“Planning ahead with long-term care insurance secures your choices and peace of mind. ” 01/29/08 13

“Planning ahead with long-term care insurance secures your choices and peace of mind. ” 01/29/08 13

Long-Term Care Insurance n n Insurance policy that pays for long-term care expenses Reasons to purchase n Protect resources n Expand care options n Maintain independence and financial control 01/29/08 14

Long-Term Care Insurance n n Insurance policy that pays for long-term care expenses Reasons to purchase n Protect resources n Expand care options n Maintain independence and financial control 01/29/08 14

What is Long-Term Care Insurance? n Long-Term Care Insurance covers longterm care services provided- in a nursing home, n at home, n in an assisted living facility, or n in other community-based settings. n 01/29/08 15

What is Long-Term Care Insurance? n Long-Term Care Insurance covers longterm care services provided- in a nursing home, n at home, n in an assisted living facility, or n in other community-based settings. n 01/29/08 15

What Types of Long-Term Care Insurance are Available? n There are two general types of Long. Term Care Insurance in New York State: insurance sold under the New York State Partnership for Long-Term Care n traditional, non-Partnership insurance. n 01/29/08 16

What Types of Long-Term Care Insurance are Available? n There are two general types of Long. Term Care Insurance in New York State: insurance sold under the New York State Partnership for Long-Term Care n traditional, non-Partnership insurance. n 01/29/08 16

Long-Term Care Insurance General Guidelines n According to “Shopper’s Guide to Long-Term Care Insurance” published by the National Association of Insurance Commissioners in 2006: n n 01/29/08 Assets: If you are considering long-term care insurance and “your assets are less than $30, 000, you may wish to consider other options for financing your long-term care. ” Income: “If you will be paying premiums with money received only from your own income, a rule of thumb is that you may not be able to afford this policy if the premiums will be more than 7% of your income. ” 17

Long-Term Care Insurance General Guidelines n According to “Shopper’s Guide to Long-Term Care Insurance” published by the National Association of Insurance Commissioners in 2006: n n 01/29/08 Assets: If you are considering long-term care insurance and “your assets are less than $30, 000, you may wish to consider other options for financing your long-term care. ” Income: “If you will be paying premiums with money received only from your own income, a rule of thumb is that you may not be able to afford this policy if the premiums will be more than 7% of your income. ” 17

Long-Term Care Insurance: Insurability n Long-Term Care Insurance is medically underwritten -May be ineligible due to health status Underwriting standards may vary from company to company 01/29/08 18

Long-Term Care Insurance: Insurability n Long-Term Care Insurance is medically underwritten -May be ineligible due to health status Underwriting standards may vary from company to company 01/29/08 18

Factors to Consider When Purchasing Long-Term Care Insurance n n n n Daily Benefit Amount Elimination Period Benefit Trigger Length of Benefit Inflation Protection Premium Waiver Non-Forfeiture Tax Qualified 01/29/08 19

Factors to Consider When Purchasing Long-Term Care Insurance n n n n Daily Benefit Amount Elimination Period Benefit Trigger Length of Benefit Inflation Protection Premium Waiver Non-Forfeiture Tax Qualified 01/29/08 19

Daily Benefit Amount for Nursing Home n Benefit amount per day for skilled nursing care The average daily nursing home rate in NY was $273 in 2005 n Figure how much nursing home cost you can afford, then choose a policy that covers the rest n 01/29/08 20

Daily Benefit Amount for Nursing Home n Benefit amount per day for skilled nursing care The average daily nursing home rate in NY was $273 in 2005 n Figure how much nursing home cost you can afford, then choose a policy that covers the rest n 01/29/08 20

Daily Benefit Amount for Home Care n Usually between 50% and 100% of the Nursing Home Daily Benefit to cover home care At least 50% n Includes care at home, adult day care, assisted residential settings n Provides for custodial care that more and more meets the needs of older adults n 01/29/08 21

Daily Benefit Amount for Home Care n Usually between 50% and 100% of the Nursing Home Daily Benefit to cover home care At least 50% n Includes care at home, adult day care, assisted residential settings n Provides for custodial care that more and more meets the needs of older adults n 01/29/08 21

Elimination Period n n Amount of time an individual must pay out of pocket before policy begins to pay daily benefit Most policies offer a single elimination period for the life of the policy 01/29/08 22

Elimination Period n n Amount of time an individual must pay out of pocket before policy begins to pay daily benefit Most policies offer a single elimination period for the life of the policy 01/29/08 22

Benefit Trigger n Policies require a “trigger” before the elimination period begins. n Usually trigger is tied to requiring help with: n performing a certain number of ADLs n Severe cognitive impairment or 01/29/08 23

Benefit Trigger n Policies require a “trigger” before the elimination period begins. n Usually trigger is tied to requiring help with: n performing a certain number of ADLs n Severe cognitive impairment or 01/29/08 23

Length of Benefit n Number of years of coverage n n beginning at the end of the elimination period New York State Insurance law regulates policy coverage period. n For example: Long-Term Care Insurance must cover at least 24 months of nursing home coverage. n 01/29/08 The Partnership 1. 5/3/50 is an exception to this regulation 24

Length of Benefit n Number of years of coverage n n beginning at the end of the elimination period New York State Insurance law regulates policy coverage period. n For example: Long-Term Care Insurance must cover at least 24 months of nursing home coverage. n 01/29/08 The Partnership 1. 5/3/50 is an exception to this regulation 24

Inflation Protection n n In NY, insurers must offer inflation protection Two common options n n An automatic increase in benefit per year with no increase in premium. Premium is set initially to reflect inflation protection coverage on the policy that is chosen; or An increased benefit amount is offered periodically to the policy holder without requiring proof of insurability. The cost of the premium will increase if this increase in benefit amount is chosen. * Inflation Protection, specific to the Partnership, will be addressed during the Partnership segment 01/29/08 25

Inflation Protection n n In NY, insurers must offer inflation protection Two common options n n An automatic increase in benefit per year with no increase in premium. Premium is set initially to reflect inflation protection coverage on the policy that is chosen; or An increased benefit amount is offered periodically to the policy holder without requiring proof of insurability. The cost of the premium will increase if this increase in benefit amount is chosen. * Inflation Protection, specific to the Partnership, will be addressed during the Partnership segment 01/29/08 25

Premium Waiver n Permits the insured to stop making premium payments when receiving certain benefits 01/29/08 26

Premium Waiver n Permits the insured to stop making premium payments when receiving certain benefits 01/29/08 26

Non-Forfeiture n A benefit designed to ensure that if an insurance policy is lapsed after a specific number of years, some of the benefits from the policy will be retained. n 01/29/08 A policy is considered lapsed when the insured ceases to make premium payments. 27

Non-Forfeiture n A benefit designed to ensure that if an insurance policy is lapsed after a specific number of years, some of the benefits from the policy will be retained. n 01/29/08 A policy is considered lapsed when the insured ceases to make premium payments. 27

Tax Deductibility of Premiums Policies must be labeled as qualified for the federal tax deduction. n Policies identified as meeting federal requirements also meet requirements for the state and city tax deduction. n n 01/29/08 A listing of insurers that have policies that qualify for federal, state, and city income tax deduction is available from the Insurance Department website or upon request. 28

Tax Deductibility of Premiums Policies must be labeled as qualified for the federal tax deduction. n Policies identified as meeting federal requirements also meet requirements for the state and city tax deduction. n n 01/29/08 A listing of insurers that have policies that qualify for federal, state, and city income tax deduction is available from the Insurance Department website or upon request. 28

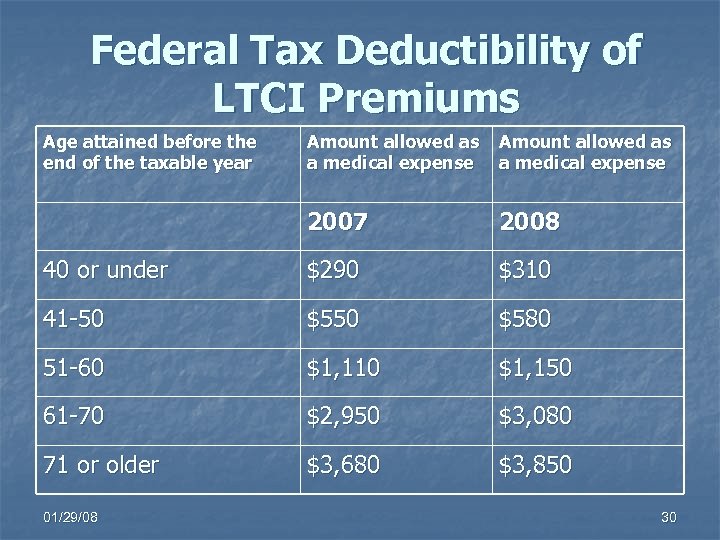

Tax Qualified Summary n Federal Income Tax Itemized deduction as a medical expense n Total medical expenses must exceed 7. 5% of adjusted gross income to claim a deduction n Maximum allowable deduction according to age n 01/29/08 29

Tax Qualified Summary n Federal Income Tax Itemized deduction as a medical expense n Total medical expenses must exceed 7. 5% of adjusted gross income to claim a deduction n Maximum allowable deduction according to age n 01/29/08 29

Federal Tax Deductibility of LTCI Premiums Age attained before the end of the taxable year Amount allowed as a medical expense 2007 2008 40 or under $290 $310 41 -50 $580 51 -60 $1, 110 $1, 150 61 -70 $2, 950 $3, 080 71 or older $3, 680 $3, 850 01/29/08 30

Federal Tax Deductibility of LTCI Premiums Age attained before the end of the taxable year Amount allowed as a medical expense 2007 2008 40 or under $290 $310 41 -50 $580 51 -60 $1, 110 $1, 150 61 -70 $2, 950 $3, 080 71 or older $3, 680 $3, 850 01/29/08 30

n NY State Income Tax Above the line tax credit: 20% (IT-249 Claim for Long-Term Care Insurance Credit) n 01/29/08 31

n NY State Income Tax Above the line tax credit: 20% (IT-249 Claim for Long-Term Care Insurance Credit) n 01/29/08 31

How Much Does Long-Term Care Insurance Cost? n The Long-Term Care Insurance premium depends on: n n n 01/29/08 The younger you are, the lower the premium. The options you select It is designed to stay level as the insured grows older. New York State provides an income tax credit for qualified long-term care insurance policies to help more people afford long-term care insurance coverage. There also may be Federal tax advantages. 32

How Much Does Long-Term Care Insurance Cost? n The Long-Term Care Insurance premium depends on: n n n 01/29/08 The younger you are, the lower the premium. The options you select It is designed to stay level as the insured grows older. New York State provides an income tax credit for qualified long-term care insurance policies to help more people afford long-term care insurance coverage. There also may be Federal tax advantages. 32

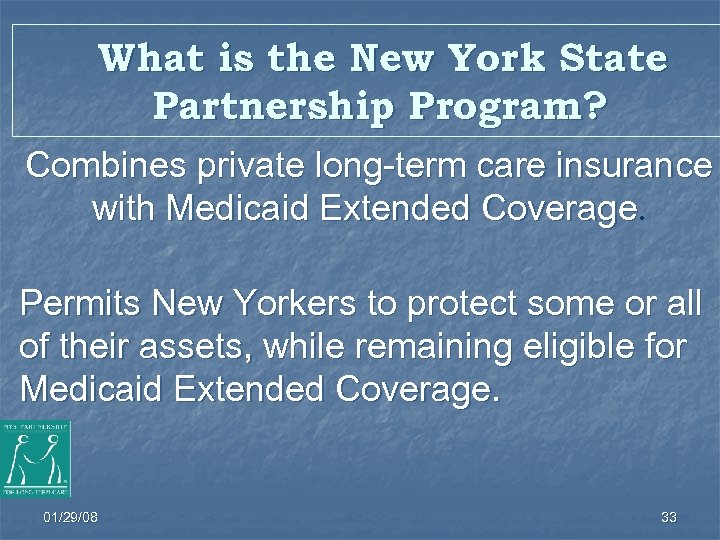

What is the New York State Partnership Program? Combines private long-term care insurance with Medicaid Extended Coverage Permits New Yorkers to protect some or all of their assets, while remaining eligible for Medicaid Extended Coverage. 01/29/08 33

What is the New York State Partnership Program? Combines private long-term care insurance with Medicaid Extended Coverage Permits New Yorkers to protect some or all of their assets, while remaining eligible for Medicaid Extended Coverage. 01/29/08 33

ONLY 2 STATES CAN OFFER TOTAL ASSET PROTECTION New York Indiana 01/29/08 34

ONLY 2 STATES CAN OFFER TOTAL ASSET PROTECTION New York Indiana 01/29/08 34

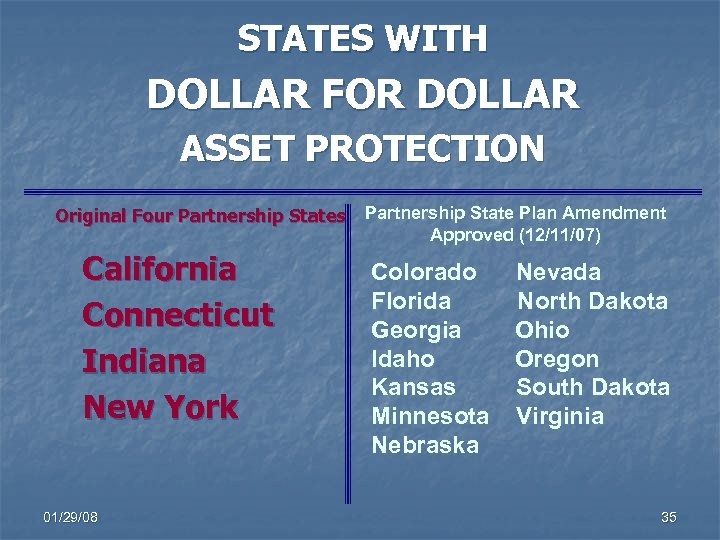

STATES WITH DOLLAR FOR DOLLAR ASSET PROTECTION Original Four Partnership States California Connecticut Indiana New York 01/29/08 Partnership State Plan Amendment Approved (12/11/07) Colorado Florida Georgia Idaho Kansas Minnesota Nebraska Nevada North Dakota Ohio Oregon South Dakota Virginia 35

STATES WITH DOLLAR FOR DOLLAR ASSET PROTECTION Original Four Partnership States California Connecticut Indiana New York 01/29/08 Partnership State Plan Amendment Approved (12/11/07) Colorado Florida Georgia Idaho Kansas Minnesota Nebraska Nevada North Dakota Ohio Oregon South Dakota Virginia 35

Why Buy a Partnership Policy? NYS Partnership offers: Total or Dollar for Dollar Asset Protection § New York State Endorsement § Lifetime Coverage § Consumer Safeguards § 01/29/08 36

Why Buy a Partnership Policy? NYS Partnership offers: Total or Dollar for Dollar Asset Protection § New York State Endorsement § Lifetime Coverage § Consumer Safeguards § 01/29/08 36

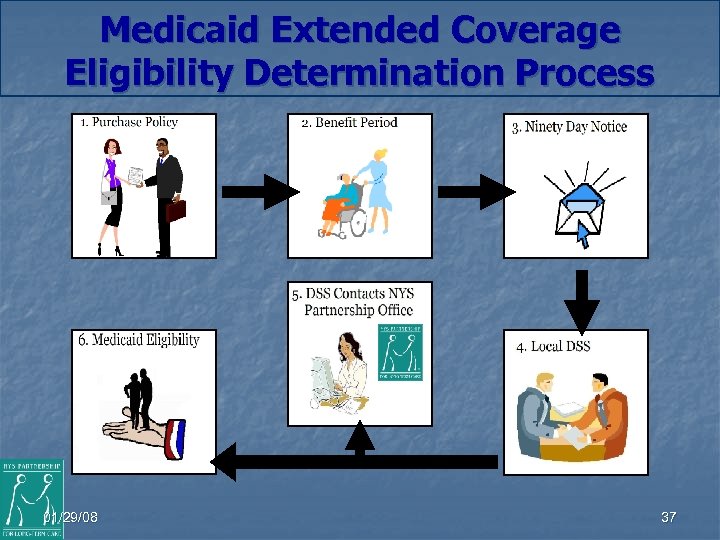

Medicaid Extended Coverage Eligibility Determination Process 01/29/08 37

Medicaid Extended Coverage Eligibility Determination Process 01/29/08 37

Key Difference When Applying for Medicaid Extended Coverage n n Total Asset Protection plans protect ALL assets. Under Dollar for Dollar Asset protection plans, the assets protected are equal to the amount of benefits paid by the insurer. 01/29/08 38

Key Difference When Applying for Medicaid Extended Coverage n n Total Asset Protection plans protect ALL assets. Under Dollar for Dollar Asset protection plans, the assets protected are equal to the amount of benefits paid by the insurer. 01/29/08 38

Total Asset Protection Plans n Assets are fully protected when you apply for Medicaid Extended Coverage n BUT n You will be required to contribute your income to the cost of your care following Medicaid guidelines 01/29/08 39

Total Asset Protection Plans n Assets are fully protected when you apply for Medicaid Extended Coverage n BUT n You will be required to contribute your income to the cost of your care following Medicaid guidelines 01/29/08 39

Dollar For Dollar Asset Protection Plans n n Assets in excess of asset protection and income will be subject to Medicaid rules in determining eligibility for Medicaid Extended Coverage. Asset protection in $ for $ plans is determined by the total amount of benefits paid from the policy 01/29/08 40

Dollar For Dollar Asset Protection Plans n n Assets in excess of asset protection and income will be subject to Medicaid rules in determining eligibility for Medicaid Extended Coverage. Asset protection in $ for $ plans is determined by the total amount of benefits paid from the policy 01/29/08 40

The NYS Partnership n n Insurance benefit portable to any state Must return to New York State to apply for Medicaid Extended Coverage 01/29/08 41

The NYS Partnership n n Insurance benefit portable to any state Must return to New York State to apply for Medicaid Extended Coverage 01/29/08 41

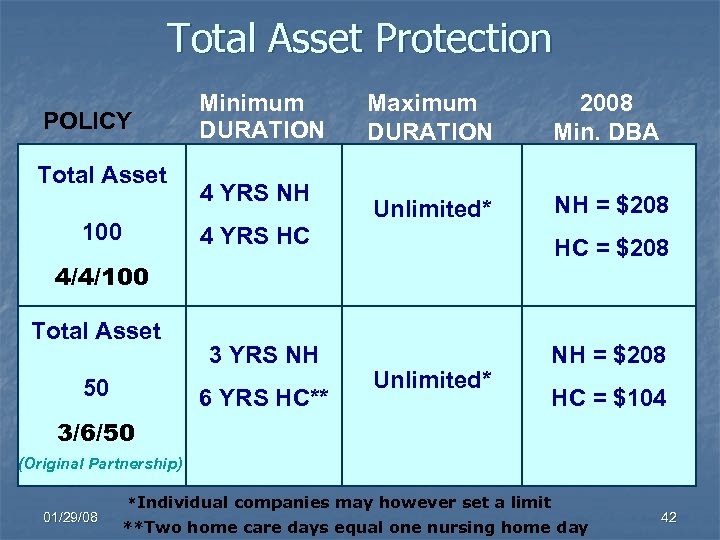

Total Asset Protection POLICY Total Asset 100 Minimum DURATION 4 YRS NH Maximum DURATION 2008 Min. DBA Unlimited* NH = $208 4 YRS HC HC = $208 4/4/100 Total Asset 50 3 YRS NH 6 YRS HC** Unlimited* NH = $208 HC = $104 3/6/50 (Original Partnership) 01/29/08 *Individual companies may however set a limit **Two home care days equal one nursing home day 42

Total Asset Protection POLICY Total Asset 100 Minimum DURATION 4 YRS NH Maximum DURATION 2008 Min. DBA Unlimited* NH = $208 4 YRS HC HC = $208 4/4/100 Total Asset 50 3 YRS NH 6 YRS HC** Unlimited* NH = $208 HC = $104 3/6/50 (Original Partnership) 01/29/08 *Individual companies may however set a limit **Two home care days equal one nursing home day 42

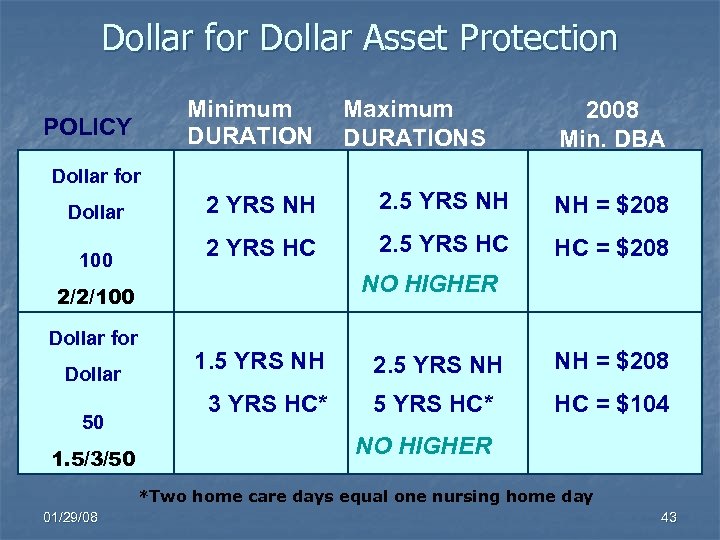

Dollar for Dollar Asset Protection Minimum DURATION POLICY Maximum DURATIONS 2008 Min. DBA Dollar for Dollar 2 YRS NH 2. 5 YRS NH NH = $208 100 2 YRS HC 2. 5 YRS HC HC = $208 NO HIGHER 2/2/100 Dollar for Dollar 50 1. 5/3/50 1. 5 YRS NH 3 YRS HC* 2. 5 YRS NH NH = $208 5 YRS HC* HC = $104 NO HIGHER *Two home care days equal one nursing home day 01/29/08 43

Dollar for Dollar Asset Protection Minimum DURATION POLICY Maximum DURATIONS 2008 Min. DBA Dollar for Dollar 2 YRS NH 2. 5 YRS NH NH = $208 100 2 YRS HC 2. 5 YRS HC HC = $208 NO HIGHER 2/2/100 Dollar for Dollar 50 1. 5/3/50 1. 5 YRS NH 3 YRS HC* 2. 5 YRS NH NH = $208 5 YRS HC* HC = $104 NO HIGHER *Two home care days equal one nursing home day 01/29/08 43

The Partnership A Win-Win Situation 01/29/08 44

The Partnership A Win-Win Situation 01/29/08 44

NYS Public Employees Long-Term Care Options NYPERL. net To speak to a representative, please call Customer Service at 1 -866 -474 -5824. 01/29/08 45

NYS Public Employees Long-Term Care Options NYPERL. net To speak to a representative, please call Customer Service at 1 -866 -474 -5824. 01/29/08 45

For More Information: n n www. planaheadny. com 1 -866 -950 -PLAN www. longtermcare. gov Own Your Future New York State Department of Health n Partnership for Long-Term Care n n New York State Department of Insurance n n www. nyspltc. org www. ins. state. ny. us Contact your local Long Term Care Resource Center 01/29/08 46

For More Information: n n www. planaheadny. com 1 -866 -950 -PLAN www. longtermcare. gov Own Your Future New York State Department of Health n Partnership for Long-Term Care n n New York State Department of Insurance n n www. nyspltc. org www. ins. state. ny. us Contact your local Long Term Care Resource Center 01/29/08 46