4011f3efb37ad3cec37ed86c846f8209.ppt

- Количество слайдов: 35

Logistics Performance Index: what do indicators tell us? Virginia Tanase Sr. Transport Specialist Transport, Water and Information and Communication Technology Department The World Bank 6 th IRU Euro-Asian Road Transport Conference Tbilisi, Georgia 16 -17 June 2011

Logistics Performance Index: what do indicators tell us? Virginia Tanase Sr. Transport Specialist Transport, Water and Information and Communication Technology Department The World Bank 6 th IRU Euro-Asian Road Transport Conference Tbilisi, Georgia 16 -17 June 2011

This presentation 1. LPI 2010 2. LPI Data for selected countries 3. Transport considerations 4. Key topics ahead 5. Want to learn more?

This presentation 1. LPI 2010 2. LPI Data for selected countries 3. Transport considerations 4. Key topics ahead 5. Want to learn more?

1. LPI 2010

1. LPI 2010

LPI 2010 www. worldbank. org/lpi § Broad indication of where problems are § Awareness raising to stimulate public-private dialogue on priorities for reform § Trigger fresh impetus for reforms § Monitor progress over time The most comprehensive data on country performance 4 4

LPI 2010 www. worldbank. org/lpi § Broad indication of where problems are § Awareness raising to stimulate public-private dialogue on priorities for reform § Trigger fresh impetus for reforms § Monitor progress over time The most comprehensive data on country performance 4 4

What makes logistics efficient? The six dimensions of country performance measured by the LPI § § § 5 Efficiency of the clearance process Quality of trade and transport infrastructure Ease of arranging competitively priced shipments Logistics competence and quality of logistics services Ability to track and trace consignments Timeliness of shipment delivery

What makes logistics efficient? The six dimensions of country performance measured by the LPI § § § 5 Efficiency of the clearance process Quality of trade and transport infrastructure Ease of arranging competitively priced shipments Logistics competence and quality of logistics services Ability to track and trace consignments Timeliness of shipment delivery

Where is LPI originating from? Country 1 Country 2 Country 3 Country 4 Country 5 Country A Country 6 Country 7 Country 8 6

Where is LPI originating from? Country 1 Country 2 Country 3 Country 4 Country 5 Country A Country 6 Country 7 Country 8 6

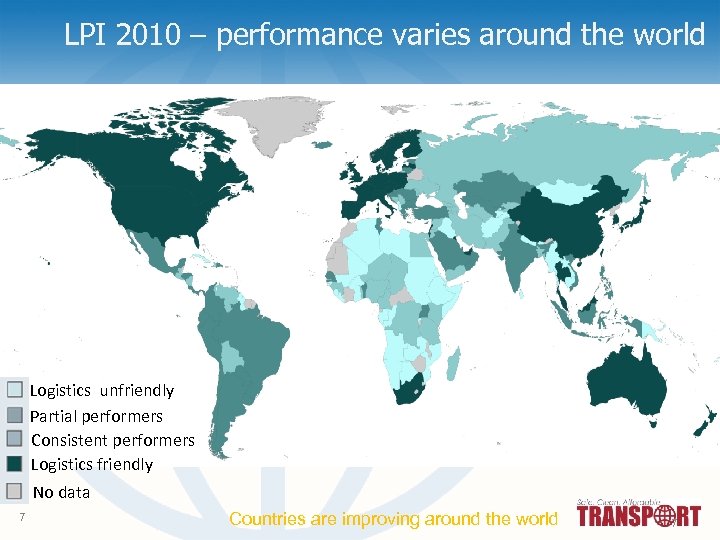

LPI 2010 – performance varies around the world Logistics unfriendly Partial performers Consistent performers Logistics friendly No data 7 Countries are improving around the world 7

LPI 2010 – performance varies around the world Logistics unfriendly Partial performers Consistent performers Logistics friendly No data 7 Countries are improving around the world 7

LPI 2010 ranks TOP 10 COUNTRIES UPPER MIDDLE INCOME LOW INCOME Country South Africa Malaysia Poland Lebanon Latvia Turkey Brazil Lithuania Argentina Chile LPI Rank 28 29 30 33 37 39 41 45 48 49 Country China Thailand Philippines India Tunisia Honduras Ecuador Indonesia Paraguay Syrian Arab Republic LPI Rank 27 35 44 47 61 70 71 75 76 Country Vietnam Senegal Uganda Uzbekistan Benin Bangladesh Congo, Dem. Rep. Madagascar Kyrgyz Republic Tanzania LPI Rank 53 58 66 68 69 79 85 88 91 95 80 8

LPI 2010 ranks TOP 10 COUNTRIES UPPER MIDDLE INCOME LOW INCOME Country South Africa Malaysia Poland Lebanon Latvia Turkey Brazil Lithuania Argentina Chile LPI Rank 28 29 30 33 37 39 41 45 48 49 Country China Thailand Philippines India Tunisia Honduras Ecuador Indonesia Paraguay Syrian Arab Republic LPI Rank 27 35 44 47 61 70 71 75 76 Country Vietnam Senegal Uganda Uzbekistan Benin Bangladesh Congo, Dem. Rep. Madagascar Kyrgyz Republic Tanzania LPI Rank 53 58 66 68 69 79 85 88 91 95 80 8

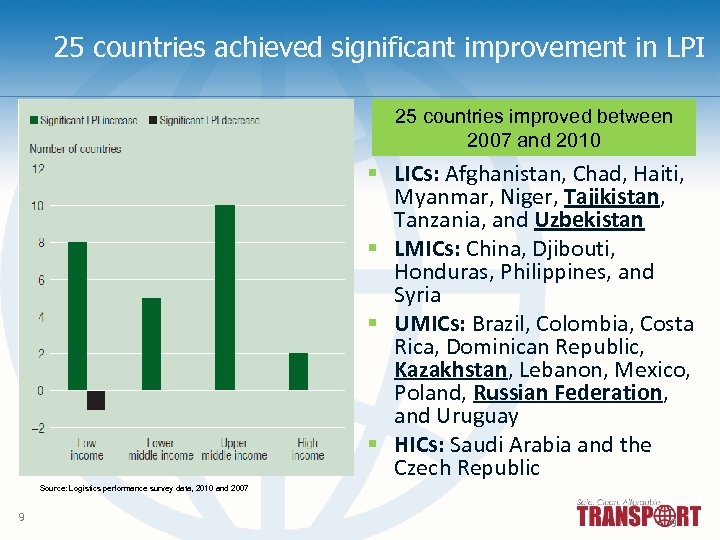

25 countries achieved significant improvement in LPI 25 countries improved between 2007 and 2010 § LICs: Afghanistan, Chad, Haiti, Myanmar, Niger, Tajikistan, Tanzania, and Uzbekistan § LMICs: China, Djibouti, Honduras, Philippines, and Syria § UMICs: Brazil, Colombia, Costa Rica, Dominican Republic, Kazakhstan, Lebanon, Mexico, Poland, Russian Federation, and Uruguay § HICs: Saudi Arabia and the Czech Republic Source: Logistics performance survey data, 2010 and 2007 9 9

25 countries achieved significant improvement in LPI 25 countries improved between 2007 and 2010 § LICs: Afghanistan, Chad, Haiti, Myanmar, Niger, Tajikistan, Tanzania, and Uzbekistan § LMICs: China, Djibouti, Honduras, Philippines, and Syria § UMICs: Brazil, Colombia, Costa Rica, Dominican Republic, Kazakhstan, Lebanon, Mexico, Poland, Russian Federation, and Uruguay § HICs: Saudi Arabia and the Czech Republic Source: Logistics performance survey data, 2010 and 2007 9 9

LPI: Key messages § Trade logistics is an important element of national competitiveness § A country’s performance is only as good as its weakest link § The LPI dataset can be used to identify key bottlenecks in your own country and therefore • Helps frame your needs and priorities in the trade facilitation and logistics area reform 10 10

LPI: Key messages § Trade logistics is an important element of national competitiveness § A country’s performance is only as good as its weakest link § The LPI dataset can be used to identify key bottlenecks in your own country and therefore • Helps frame your needs and priorities in the trade facilitation and logistics area reform 10 10

2. LPI Data – selected countries 11

2. LPI Data – selected countries 11

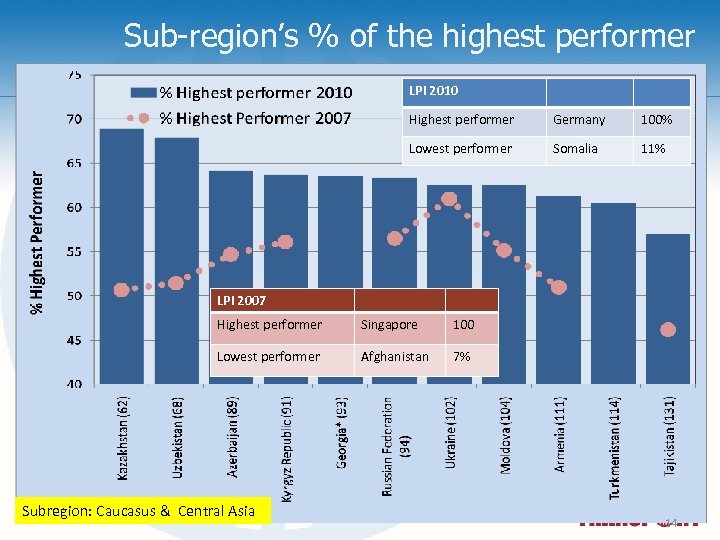

Sub-region’s % of the highest performer LPI 2010 Highest performer Germany 100% Lowest performer Somalia 11% LPI 2007 Highest performer 100 Lowest performer Subregion: 14 Singapore Afghanistan 7% Caucasus & Central Asia 14

Sub-region’s % of the highest performer LPI 2010 Highest performer Germany 100% Lowest performer Somalia 11% LPI 2007 Highest performer 100 Lowest performer Subregion: 14 Singapore Afghanistan 7% Caucasus & Central Asia 14

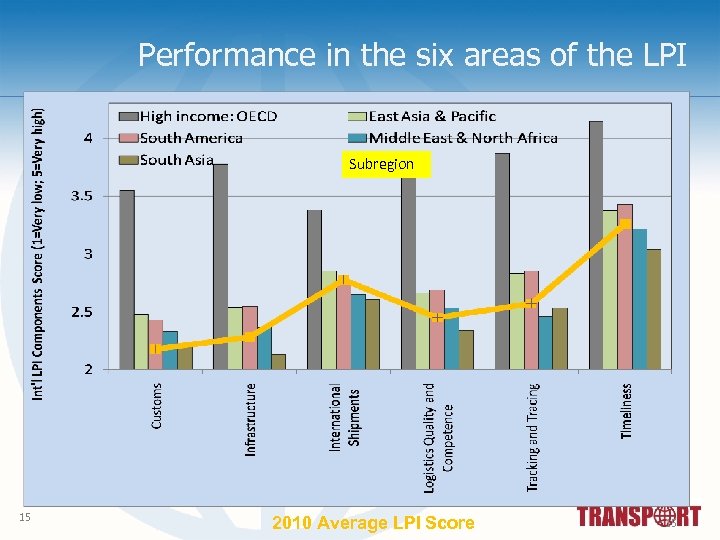

Performance in the six areas of the LPI Subregion 15 2010 Average LPI Score 15

Performance in the six areas of the LPI Subregion 15 2010 Average LPI Score 15

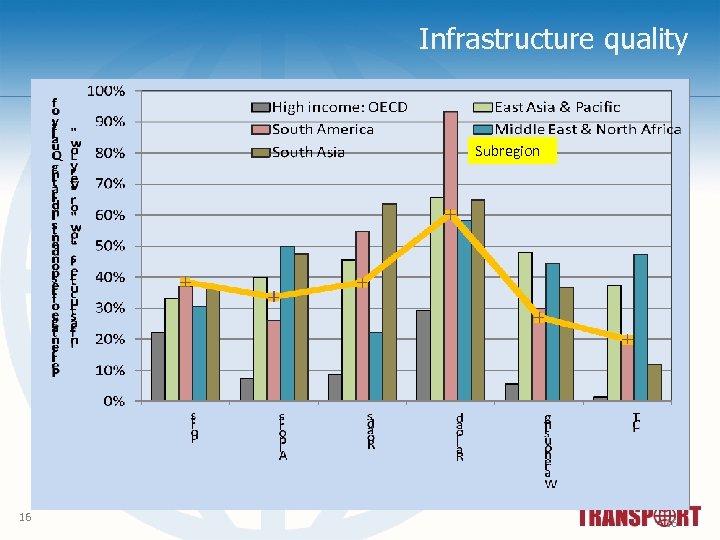

Infrastructure quality Subregion 16 16

Infrastructure quality Subregion 16 16

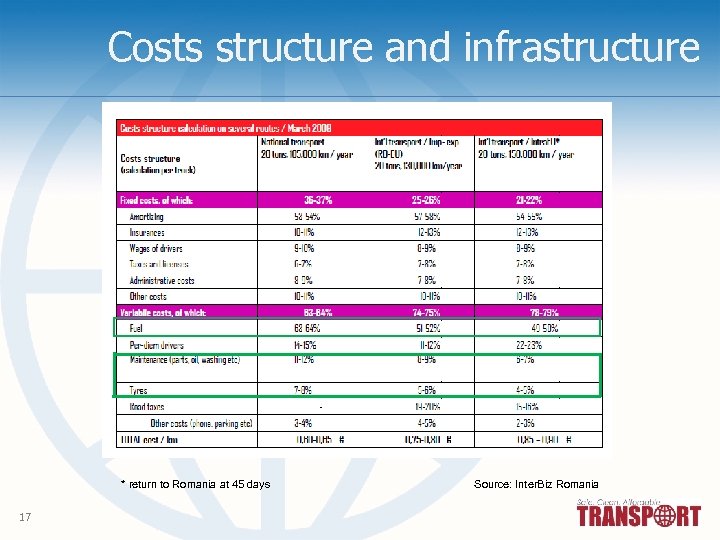

Costs structure and infrastructure * return to Romania at 45 days 17 Source: Inter. Biz Romania

Costs structure and infrastructure * return to Romania at 45 days 17 Source: Inter. Biz Romania

Quality of services I Subregion 18 TRANSPORT SERVICES 18

Quality of services I Subregion 18 TRANSPORT SERVICES 18

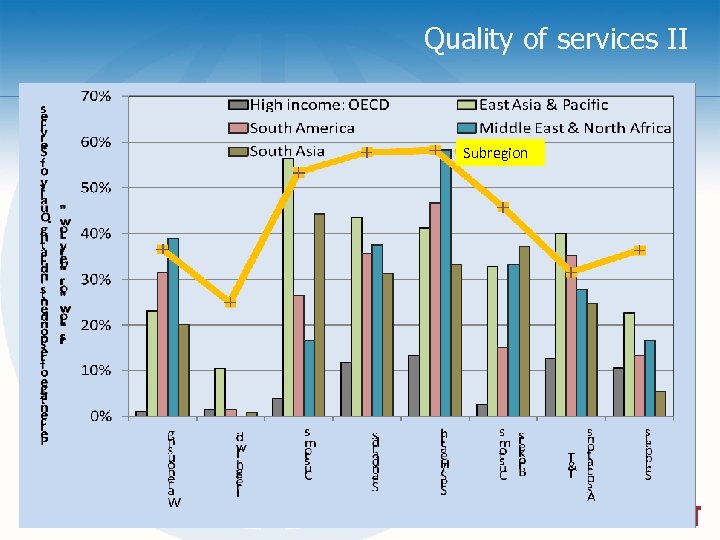

Quality of services II Subregion 19 19

Quality of services II Subregion 19 19

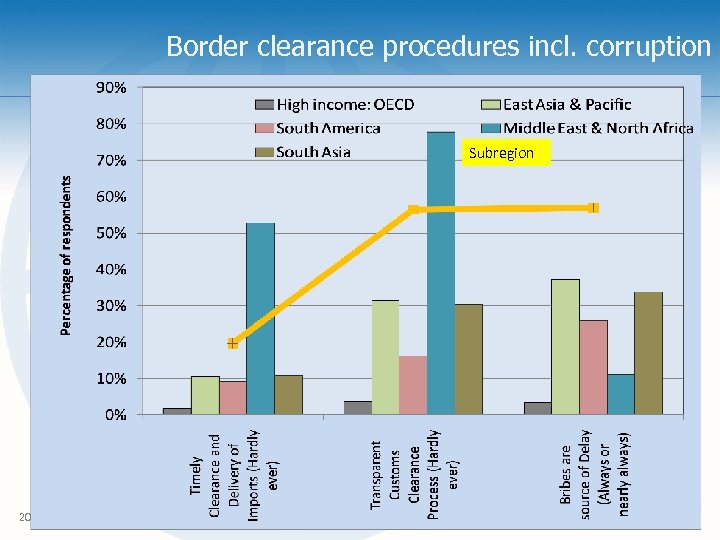

Border clearance procedures incl. corruption Subregion 20 20

Border clearance procedures incl. corruption Subregion 20 20

3. Transport considerations

3. Transport considerations

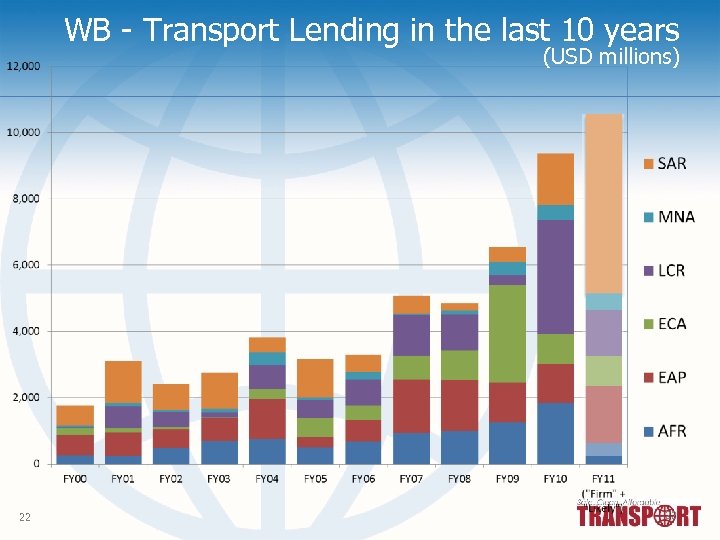

WB - Transport Lending in the last 10 years (USD millions) 22 22

WB - Transport Lending in the last 10 years (USD millions) 22 22

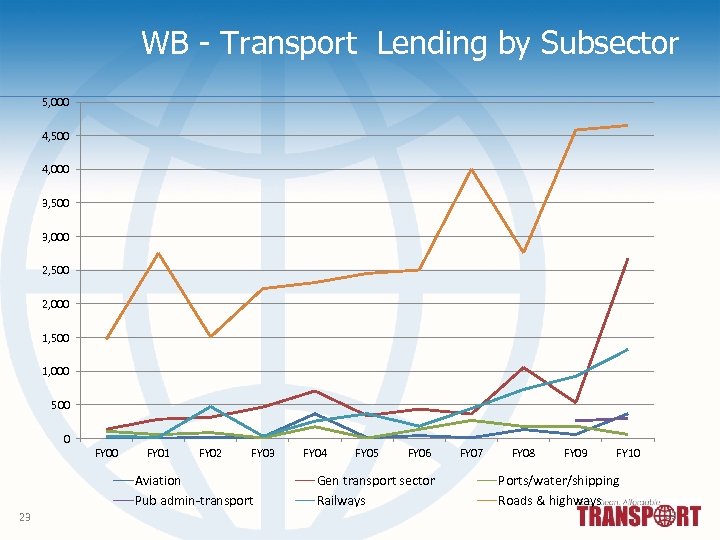

WB - Transport Lending by Subsector 5, 000 4, 500 4, 000 3, 500 3, 000 2, 500 2, 000 1, 500 1, 000 500 0 FY 01 FY 02 FY 03 Aviation Pub admin-transport 23 FY 04 FY 05 FY 06 Gen transport sector Railways FY 07 FY 08 FY 09 FY 10 Ports/water/shipping Roads & highways 23

WB - Transport Lending by Subsector 5, 000 4, 500 4, 000 3, 500 3, 000 2, 500 2, 000 1, 500 1, 000 500 0 FY 01 FY 02 FY 03 Aviation Pub admin-transport 23 FY 04 FY 05 FY 06 Gen transport sector Railways FY 07 FY 08 FY 09 FY 10 Ports/water/shipping Roads & highways 23

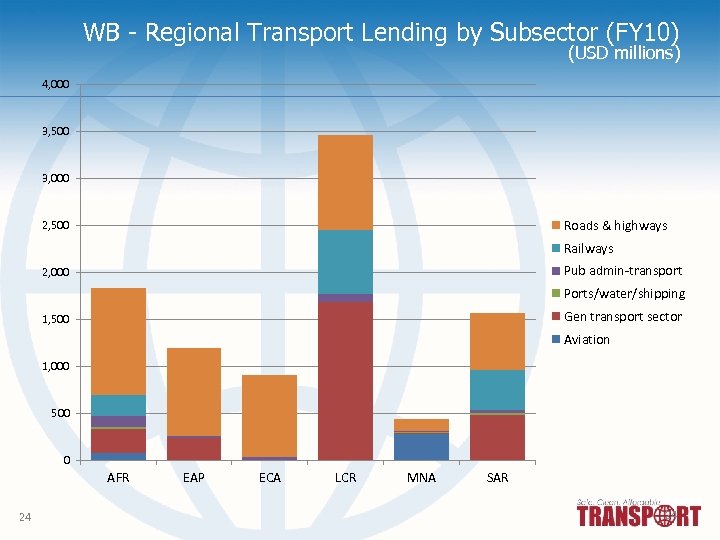

WB - Regional Transport Lending by Subsector (FY 10) (USD millions) 4, 000 3, 500 3, 000 Roads & highways 2, 500 Railways Pub admin-transport 2, 000 Ports/water/shipping Gen transport sector 1, 500 Aviation 1, 000 500 0 AFR 24 EAP ECA LCR MNA SAR 24

WB - Regional Transport Lending by Subsector (FY 10) (USD millions) 4, 000 3, 500 3, 000 Roads & highways 2, 500 Railways Pub admin-transport 2, 000 Ports/water/shipping Gen transport sector 1, 500 Aviation 1, 000 500 0 AFR 24 EAP ECA LCR MNA SAR 24

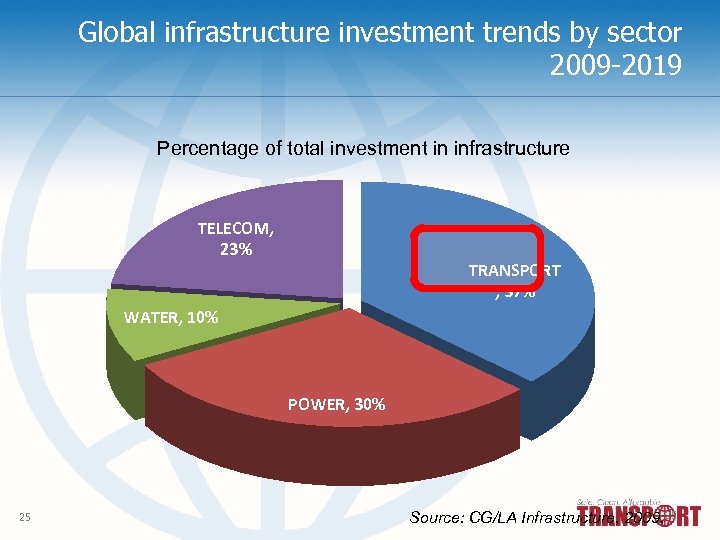

Global infrastructure investment trends by sector 2009 -2019 Percentage of total investment in infrastructure TELECOM, 23% TRANSPORT , 37% WATER, 10% POWER, 30% 25 Source: CG/LA Infrastructure, 2009. 25

Global infrastructure investment trends by sector 2009 -2019 Percentage of total investment in infrastructure TELECOM, 23% TRANSPORT , 37% WATER, 10% POWER, 30% 25 Source: CG/LA Infrastructure, 2009. 25

Who invests in Infrastructure? 26 26

Who invests in Infrastructure? 26 26

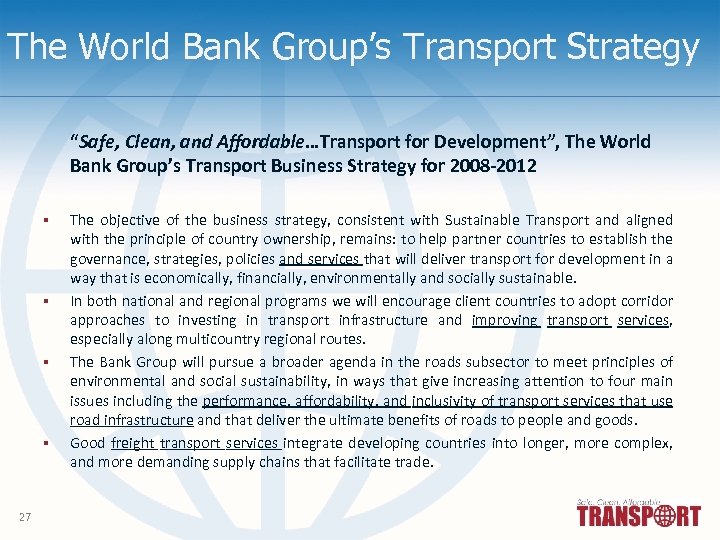

The World Bank Group’s Transport Strategy “Safe, Clean, and Affordable…Transport for Development”, The World Bank Group’s Transport Business Strategy for 2008 -2012 § § 27 The objective of the business strategy, consistent with Sustainable Transport and aligned with the principle of country ownership, remains: to help partner countries to establish the governance, strategies, policies and services that will deliver transport for development in a way that is economically, financially, environmentally and socially sustainable. In both national and regional programs we will encourage client countries to adopt corridor approaches to investing in transport infrastructure and improving transport services, especially along multicountry regional routes. The Bank Group will pursue a broader agenda in the roads subsector to meet principles of environmental and social sustainability, in ways that give increasing attention to four main issues including the performance, affordability, and inclusivity of transport services that use road infrastructure and that deliver the ultimate benefits of roads to people and goods. Good freight transport services integrate developing countries into longer, more complex, and more demanding supply chains that facilitate trade.

The World Bank Group’s Transport Strategy “Safe, Clean, and Affordable…Transport for Development”, The World Bank Group’s Transport Business Strategy for 2008 -2012 § § 27 The objective of the business strategy, consistent with Sustainable Transport and aligned with the principle of country ownership, remains: to help partner countries to establish the governance, strategies, policies and services that will deliver transport for development in a way that is economically, financially, environmentally and socially sustainable. In both national and regional programs we will encourage client countries to adopt corridor approaches to investing in transport infrastructure and improving transport services, especially along multicountry regional routes. The Bank Group will pursue a broader agenda in the roads subsector to meet principles of environmental and social sustainability, in ways that give increasing attention to four main issues including the performance, affordability, and inclusivity of transport services that use road infrastructure and that deliver the ultimate benefits of roads to people and goods. Good freight transport services integrate developing countries into longer, more complex, and more demanding supply chains that facilitate trade.

4. Key topics ahead

4. Key topics ahead

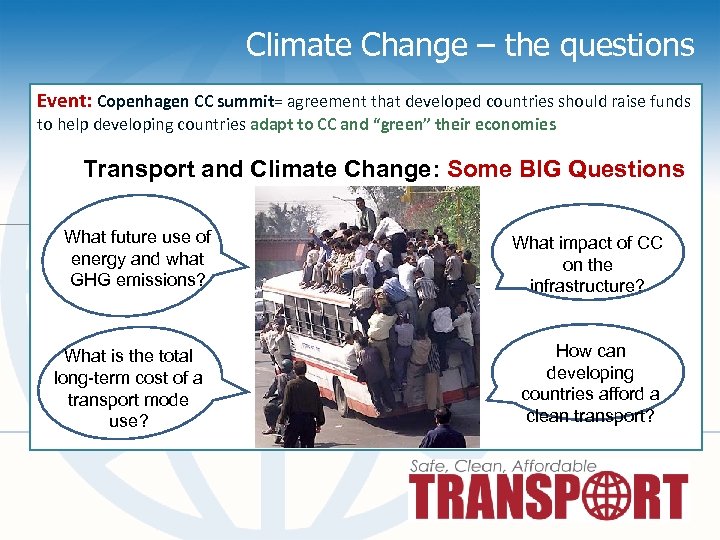

Climate Change – the questions Event: Copenhagen CC summit= agreement that developed countries should raise funds to help developing countries adapt to CC and “green” their economies Transport and Climate Change: Some BIG Questions What future use of energy and what GHG emissions? What is the total long-term cost of a transport mode use? What impact of CC on the infrastructure? How can developing countries afford a clean transport?

Climate Change – the questions Event: Copenhagen CC summit= agreement that developed countries should raise funds to help developing countries adapt to CC and “green” their economies Transport and Climate Change: Some BIG Questions What future use of energy and what GHG emissions? What is the total long-term cost of a transport mode use? What impact of CC on the infrastructure? How can developing countries afford a clean transport?

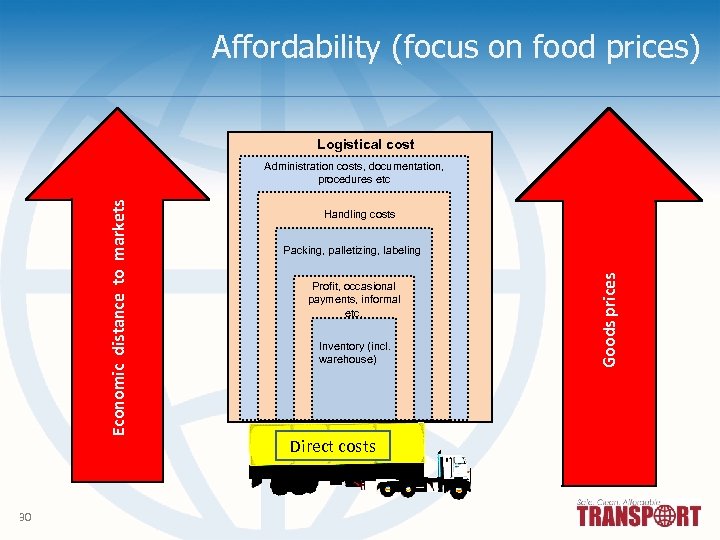

Affordability (focus on food prices) Logistical cost 30 Handling costs Packing, palletizing, labeling Profit, occasional payments, informal etc. Inventory (incl. warehouse) Direct costs Goods prices Economic distance to markets Administration costs, documentation, procedures etc

Affordability (focus on food prices) Logistical cost 30 Handling costs Packing, palletizing, labeling Profit, occasional payments, informal etc. Inventory (incl. warehouse) Direct costs Goods prices Economic distance to markets Administration costs, documentation, procedures etc

A changing Trade and Transport Facilitation approach New agenda Cross-cutting issues: • Making transit work • Collaborative border management Trade Related infrastructure • Roads • Ports • Railways Both the old and new agendas 31 needed Quality and efficiency of service providers • Customs brokers • Road transport operators • Freight forwarders Customs reform and modernization • Fiscal focus • IT orientation Old agenda 31

A changing Trade and Transport Facilitation approach New agenda Cross-cutting issues: • Making transit work • Collaborative border management Trade Related infrastructure • Roads • Ports • Railways Both the old and new agendas 31 needed Quality and efficiency of service providers • Customs brokers • Road transport operators • Freight forwarders Customs reform and modernization • Fiscal focus • IT orientation Old agenda 31

Key policy issues § Expanding the traditional reform agenda beyond customs reform and infrastructure development § Improving the quality of logistics services and increase border agency coordination § Embarking on comprehensive reform—processes, services, and infrastructure—with broad public and private support § Transit corridors: regional coordination and cooperation is vital for landlocked developing countries § Infrastructure: high on the agenda § Tailoring reform to each country’s circumstances 32 32

Key policy issues § Expanding the traditional reform agenda beyond customs reform and infrastructure development § Improving the quality of logistics services and increase border agency coordination § Embarking on comprehensive reform—processes, services, and infrastructure—with broad public and private support § Transit corridors: regional coordination and cooperation is vital for landlocked developing countries § Infrastructure: high on the agenda § Tailoring reform to each country’s circumstances 32 32

5. Want to learn more?

5. Want to learn more?

Logistics Performance Index (LPI) contacts Web site with data www. worldbank. org/lpi § Availability of Trade Department for regional presentations, and discussions. § For further questions, please contact main authors: § § Jean Francois Arvis; jarvis 1@worldbank. org § Monica Alina Mustra; mmustra@worldbank. org 34

Logistics Performance Index (LPI) contacts Web site with data www. worldbank. org/lpi § Availability of Trade Department for regional presentations, and discussions. § For further questions, please contact main authors: § § Jean Francois Arvis; jarvis 1@worldbank. org § Monica Alina Mustra; mmustra@worldbank. org 34

International Trade Department: contacts The World Bank Group International Trade Department www. worldbank. org/tradefacilitation www. worldbank. org/tradelogistics www. worldbank. org/lpi www. worldbank. org/tradestrategy Washington Office 1818 H Street NW Washington DC 20433 Contact: tradefacilitation@worldbank. org 35 35

International Trade Department: contacts The World Bank Group International Trade Department www. worldbank. org/tradefacilitation www. worldbank. org/tradelogistics www. worldbank. org/lpi www. worldbank. org/tradestrategy Washington Office 1818 H Street NW Washington DC 20433 Contact: tradefacilitation@worldbank. org 35 35

Transport Anchor: main contacts Web site with resources www. worldbank. org/transport § Availability for support and technical assistance § For further questions, you may wish to contact § § Marc Juhel-Sector Manager, mjuhel@worldbank. org § Virginia Tanase vtanase@worldbank. org 36

Transport Anchor: main contacts Web site with resources www. worldbank. org/transport § Availability for support and technical assistance § For further questions, you may wish to contact § § Marc Juhel-Sector Manager, mjuhel@worldbank. org § Virginia Tanase vtanase@worldbank. org 36

Thank you ! Virginia Tanase E-mail: vtanase@worldbank. org www. worldbank. org/transport

Thank you ! Virginia Tanase E-mail: vtanase@worldbank. org www. worldbank. org/transport