5ca258e4f2cefc806c7f78c5d754e96c.ppt

- Количество слайдов: 26

LO 1 Supply of Money Interest Rate • the annual rate at which payment is made for the use of money (or borrowed funds) • a percentage of the borrowed amount • the price of money © 2012 Mc. Graw-Hill Ryerson Limited 9 - 1

LO 1 Supply of Money Interest Rate • the annual rate at which payment is made for the use of money (or borrowed funds) • a percentage of the borrowed amount • the price of money © 2012 Mc. Graw-Hill Ryerson Limited 9 - 1

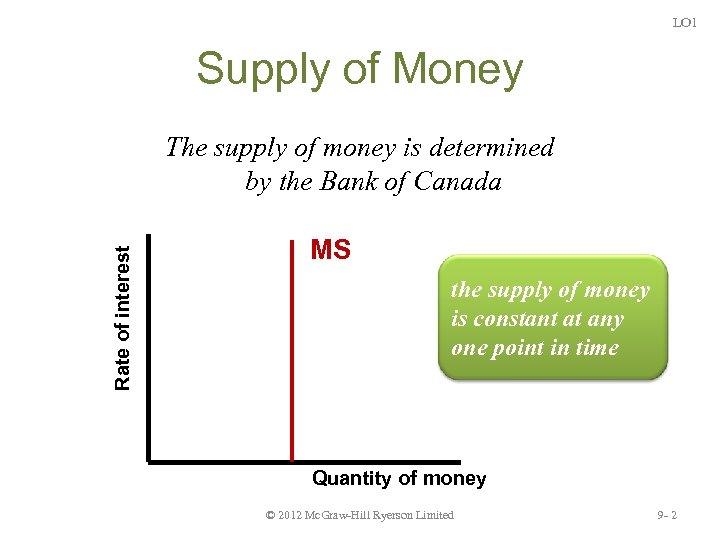

LO 1 Supply of Money Rate of interest The supply of money is determined by the Bank of Canada MS the supply of money is constant at any one point in time Quantity of money © 2012 Mc. Graw-Hill Ryerson Limited 9 - 2

LO 1 Supply of Money Rate of interest The supply of money is determined by the Bank of Canada MS the supply of money is constant at any one point in time Quantity of money © 2012 Mc. Graw-Hill Ryerson Limited 9 - 2

LO 1 The Bank of Canada • Canada’s central bank • Government owned institution • Directors and governor are appointed by the federal cabinet • Current governor Mark Carney © 2012 Mc. Graw-Hill Ryerson Limited 9 - 3

LO 1 The Bank of Canada • Canada’s central bank • Government owned institution • Directors and governor are appointed by the federal cabinet • Current governor Mark Carney © 2012 Mc. Graw-Hill Ryerson Limited 9 - 3

LO 1 Functions of the Bank of Canada • The issuer of currency • The government’s bank and manager of foreign currency reserves • The bankers’ bank and lender of last resort • The auditor and inspector of commercial banks • The regulator of the money supply © 2012 Mc. Graw-Hill Ryerson Limited 9 - 4

LO 1 Functions of the Bank of Canada • The issuer of currency • The government’s bank and manager of foreign currency reserves • The bankers’ bank and lender of last resort • The auditor and inspector of commercial banks • The regulator of the money supply © 2012 Mc. Graw-Hill Ryerson Limited 9 - 4

LO 1 Demand for Money Made up of 2 types of demand: 1. Transactions demand for money – The desire to hold money as a medium of exchange, that is, to effect transactions – The major determinants are the level of real income and the level of prices 2. Asset demand for money – The desire to use money as a store of wealth, that is, to hold money as an asset – The major determinant is the rate of interest © 2012 Mc. Graw-Hill Ryerson Limited 9 - 5

LO 1 Demand for Money Made up of 2 types of demand: 1. Transactions demand for money – The desire to hold money as a medium of exchange, that is, to effect transactions – The major determinants are the level of real income and the level of prices 2. Asset demand for money – The desire to use money as a store of wealth, that is, to hold money as an asset – The major determinant is the rate of interest © 2012 Mc. Graw-Hill Ryerson Limited 9 - 5

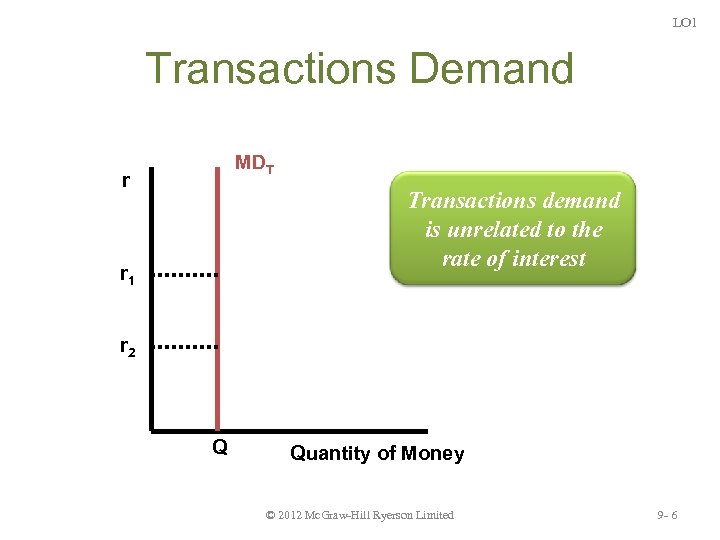

LO 1 Transactions Demand MDT r Transactions demand is unrelated to the rate of interest r 1 r 2 Q Quantity of Money © 2012 Mc. Graw-Hill Ryerson Limited 9 - 6

LO 1 Transactions Demand MDT r Transactions demand is unrelated to the rate of interest r 1 r 2 Q Quantity of Money © 2012 Mc. Graw-Hill Ryerson Limited 9 - 6

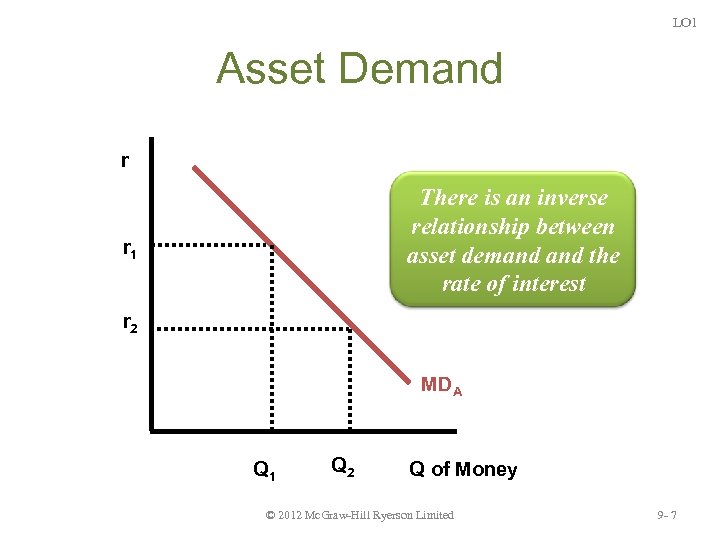

LO 1 Asset Demand r There is an inverse relationship between asset demand the rate of interest r 1 r 2 MDA Q 1 Q 2 Q of Money © 2012 Mc. Graw-Hill Ryerson Limited 9 - 7

LO 1 Asset Demand r There is an inverse relationship between asset demand the rate of interest r 1 r 2 MDA Q 1 Q 2 Q of Money © 2012 Mc. Graw-Hill Ryerson Limited 9 - 7

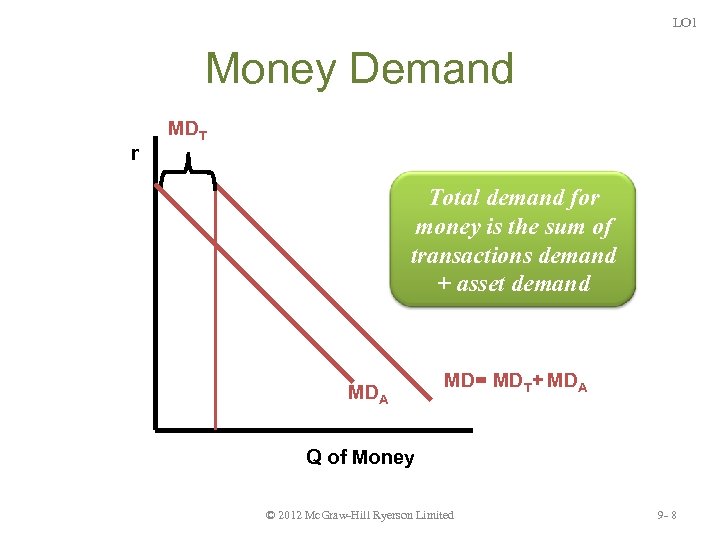

LO 1 Money Demand r MDT Total demand for money is the sum of transactions demand + asset demand MDA MD= MDT+ MDA Q of Money © 2012 Mc. Graw-Hill Ryerson Limited 9 - 8

LO 1 Money Demand r MDT Total demand for money is the sum of transactions demand + asset demand MDA MD= MDT+ MDA Q of Money © 2012 Mc. Graw-Hill Ryerson Limited 9 - 8

LO 1 Demand for Money Determined by: 1. The level of transactions (real GDP) 2. The average value of transactions (the price level) 3. The rate of interest © 2012 Mc. Graw-Hill Ryerson Limited 9 - 9

LO 1 Demand for Money Determined by: 1. The level of transactions (real GDP) 2. The average value of transactions (the price level) 3. The rate of interest © 2012 Mc. Graw-Hill Ryerson Limited 9 - 9

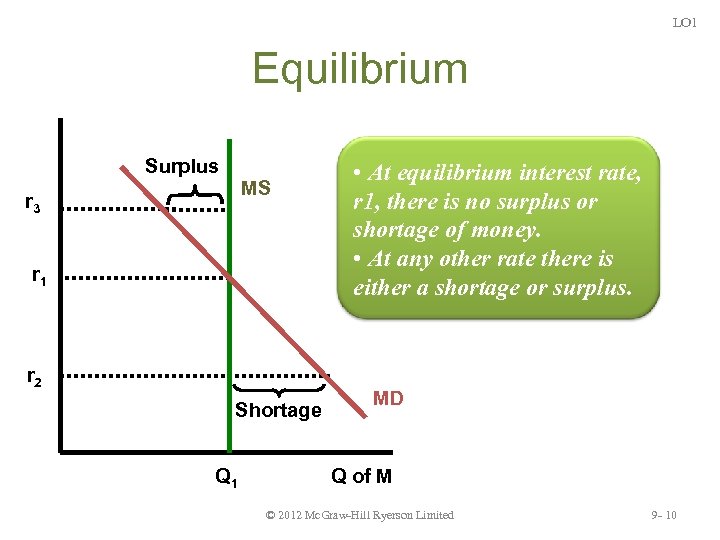

LO 1 Equilibrium Surplus MS r 3 r 1 r 2 Shortage Q 1 • At equilibrium interest rate, r 1, there is no surplus or shortage of money. • At any other rate there is either a shortage or surplus. MD Q of M © 2012 Mc. Graw-Hill Ryerson Limited 9 - 10

LO 1 Equilibrium Surplus MS r 3 r 1 r 2 Shortage Q 1 • At equilibrium interest rate, r 1, there is no surplus or shortage of money. • At any other rate there is either a shortage or surplus. MD Q of M © 2012 Mc. Graw-Hill Ryerson Limited 9 - 10

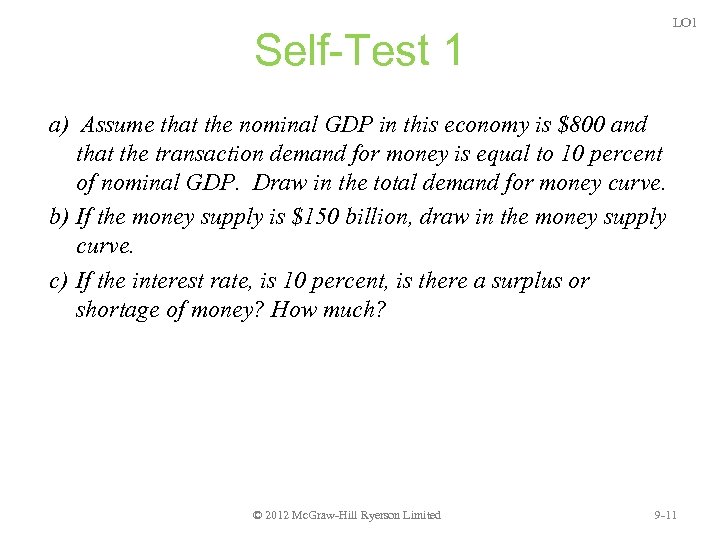

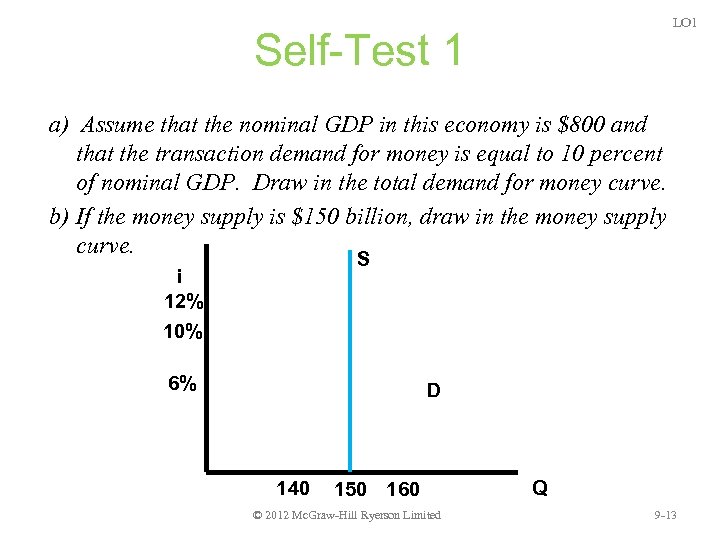

LO 1 Self-Test 1 a) Assume that the nominal GDP in this economy is $800 and that the transaction demand for money is equal to 10 percent of nominal GDP. Draw in the total demand for money curve. b) If the money supply is $150 billion, draw in the money supply curve. c) If the interest rate, is 10 percent, is there a surplus or shortage of money? How much? © 2012 Mc. Graw-Hill Ryerson Limited 9 -11

LO 1 Self-Test 1 a) Assume that the nominal GDP in this economy is $800 and that the transaction demand for money is equal to 10 percent of nominal GDP. Draw in the total demand for money curve. b) If the money supply is $150 billion, draw in the money supply curve. c) If the interest rate, is 10 percent, is there a surplus or shortage of money? How much? © 2012 Mc. Graw-Hill Ryerson Limited 9 -11

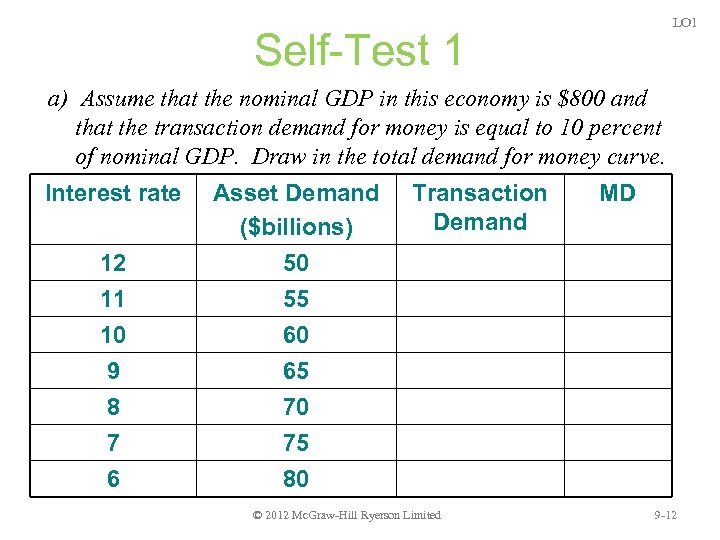

LO 1 Self-Test 1 a) Assume that the nominal GDP in this economy is $800 and that the transaction demand for money is equal to 10 percent of nominal GDP. Draw in the total demand for money curve. Interest rate 12 11 Asset Demand ($billions) 50 55 10 9 8 7 6 Transaction Demand 60 65 70 75 80 © 2012 Mc. Graw-Hill Ryerson Limited MD 9 -12

LO 1 Self-Test 1 a) Assume that the nominal GDP in this economy is $800 and that the transaction demand for money is equal to 10 percent of nominal GDP. Draw in the total demand for money curve. Interest rate 12 11 Asset Demand ($billions) 50 55 10 9 8 7 6 Transaction Demand 60 65 70 75 80 © 2012 Mc. Graw-Hill Ryerson Limited MD 9 -12

LO 1 Self-Test 1 a) Assume that the nominal GDP in this economy is $800 and that the transaction demand for money is equal to 10 percent of nominal GDP. Draw in the total demand for money curve. b) If the money supply is $150 billion, draw in the money supply curve. S i 12% 10% 6% D 140 150 160 © 2012 Mc. Graw-Hill Ryerson Limited Q 9 -13

LO 1 Self-Test 1 a) Assume that the nominal GDP in this economy is $800 and that the transaction demand for money is equal to 10 percent of nominal GDP. Draw in the total demand for money curve. b) If the money supply is $150 billion, draw in the money supply curve. S i 12% 10% 6% D 140 150 160 © 2012 Mc. Graw-Hill Ryerson Limited Q 9 -13

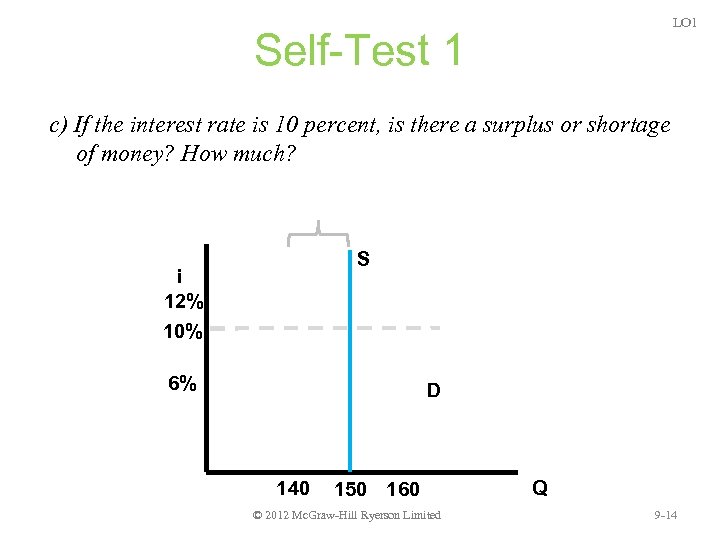

LO 1 Self-Test 1 c) If the interest rate is 10 percent, is there a surplus or shortage of money? How much? S i 12% 10% 6% D 140 150 160 © 2012 Mc. Graw-Hill Ryerson Limited Q 9 -14

LO 1 Self-Test 1 c) If the interest rate is 10 percent, is there a surplus or shortage of money? How much? S i 12% 10% 6% D 140 150 160 © 2012 Mc. Graw-Hill Ryerson Limited Q 9 -14

LO 1 How the Money Market Adjusts – Money markets adjust to a surplus or shortage through bond yields – People can hold wealth as either money or bonds – Surplus of money: people buy bonds – Shortage of money: people sell bonds © 2012 Mc. Graw-Hill Ryerson Limited 9 - 15

LO 1 How the Money Market Adjusts – Money markets adjust to a surplus or shortage through bond yields – People can hold wealth as either money or bonds – Surplus of money: people buy bonds – Shortage of money: people sell bonds © 2012 Mc. Graw-Hill Ryerson Limited 9 - 15

LO 1 Bond Yields Bonds – Loans for a set period of time – Issued by corporations, banks, and various levels of government – Have a set face value – Pay a fixed rate of interest (the coupon rate) – Can be bought and sold in the market © 2012 Mc. Graw-Hill Ryerson Limited 9 - 16

LO 1 Bond Yields Bonds – Loans for a set period of time – Issued by corporations, banks, and various levels of government – Have a set face value – Pay a fixed rate of interest (the coupon rate) – Can be bought and sold in the market © 2012 Mc. Graw-Hill Ryerson Limited 9 - 16

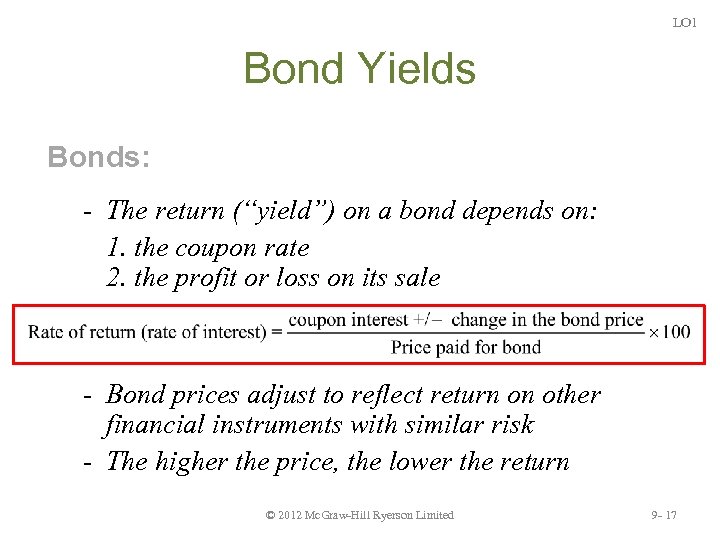

LO 1 Bond Yields Bonds: - The return (“yield”) on a bond depends on: 1. the coupon rate 2. the profit or loss on its sale - Bond prices adjust to reflect return on other financial instruments with similar risk - The higher the price, the lower the return © 2012 Mc. Graw-Hill Ryerson Limited 9 - 17

LO 1 Bond Yields Bonds: - The return (“yield”) on a bond depends on: 1. the coupon rate 2. the profit or loss on its sale - Bond prices adjust to reflect return on other financial instruments with similar risk - The higher the price, the lower the return © 2012 Mc. Graw-Hill Ryerson Limited 9 - 17

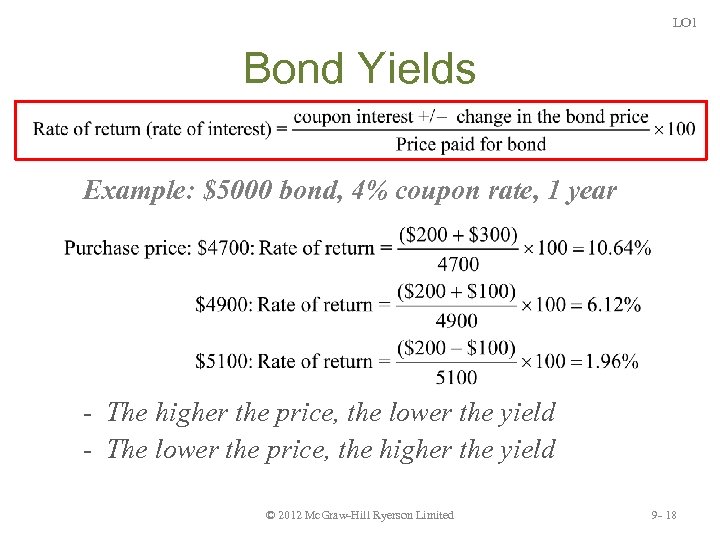

LO 1 Bond Yields Example: $5000 bond, 4% coupon rate, 1 year - The higher the price, the lower the yield - The lower the price, the higher the yield © 2012 Mc. Graw-Hill Ryerson Limited 9 - 18

LO 1 Bond Yields Example: $5000 bond, 4% coupon rate, 1 year - The higher the price, the lower the yield - The lower the price, the higher the yield © 2012 Mc. Graw-Hill Ryerson Limited 9 - 18

LO 1 How the Money Market Adjusts Surplus of money – People choose to buy bonds to reduce their liquidity and earn income – Bond prices rise, leading to a fall in bond yields and interest rates – Rates fall until there is no more surplus © 2012 Mc. Graw-Hill Ryerson Limited 9 - 19

LO 1 How the Money Market Adjusts Surplus of money – People choose to buy bonds to reduce their liquidity and earn income – Bond prices rise, leading to a fall in bond yields and interest rates – Rates fall until there is no more surplus © 2012 Mc. Graw-Hill Ryerson Limited 9 - 19

LO 1 How the Money Market Adjusts Shortage of money – People sell bonds in order to increase their liquidity – Bond prices fall, leading to an increase in bond yields and interest rates – Rates increase until there is no more shortage © 2012 Mc. Graw-Hill Ryerson Limited 9 - 20

LO 1 How the Money Market Adjusts Shortage of money – People sell bonds in order to increase their liquidity – Bond prices fall, leading to an increase in bond yields and interest rates – Rates increase until there is no more shortage © 2012 Mc. Graw-Hill Ryerson Limited 9 - 20

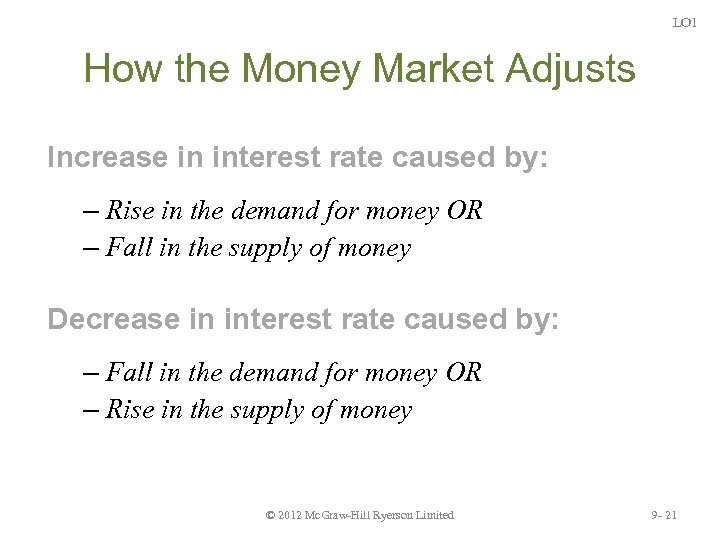

LO 1 How the Money Market Adjusts Increase in interest rate caused by: – Rise in the demand for money OR – Fall in the supply of money Decrease in interest rate caused by: – Fall in the demand for money OR – Rise in the supply of money © 2012 Mc. Graw-Hill Ryerson Limited 9 - 21

LO 1 How the Money Market Adjusts Increase in interest rate caused by: – Rise in the demand for money OR – Fall in the supply of money Decrease in interest rate caused by: – Fall in the demand for money OR – Rise in the supply of money © 2012 Mc. Graw-Hill Ryerson Limited 9 - 21

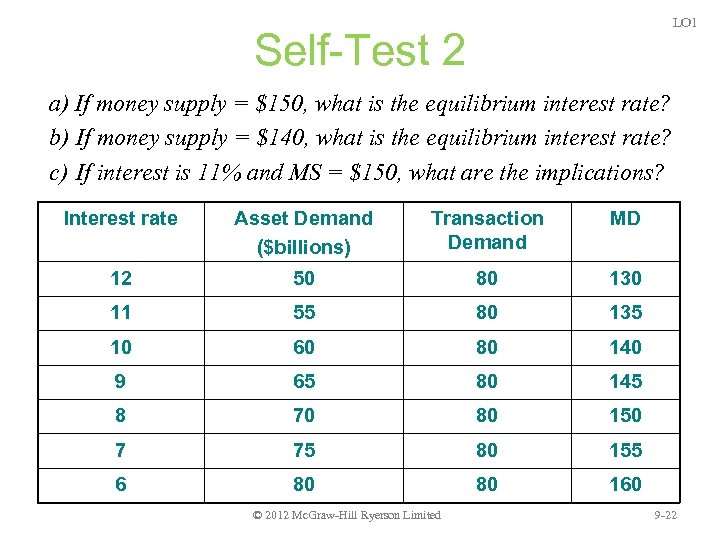

LO 1 Self-Test 2 a) If money supply = $150, what is the equilibrium interest rate? b) If money supply = $140, what is the equilibrium interest rate? c) If interest is 11% and MS = $150, what are the implications? Interest rate Asset Demand ($billions) Transaction Demand MD 12 50 80 130 11 55 80 135 10 60 80 140 9 65 80 145 8 70 80 150 7 75 80 155 6 80 80 160 © 2012 Mc. Graw-Hill Ryerson Limited 9 -22

LO 1 Self-Test 2 a) If money supply = $150, what is the equilibrium interest rate? b) If money supply = $140, what is the equilibrium interest rate? c) If interest is 11% and MS = $150, what are the implications? Interest rate Asset Demand ($billions) Transaction Demand MD 12 50 80 130 11 55 80 135 10 60 80 140 9 65 80 145 8 70 80 150 7 75 80 155 6 80 80 160 © 2012 Mc. Graw-Hill Ryerson Limited 9 -22

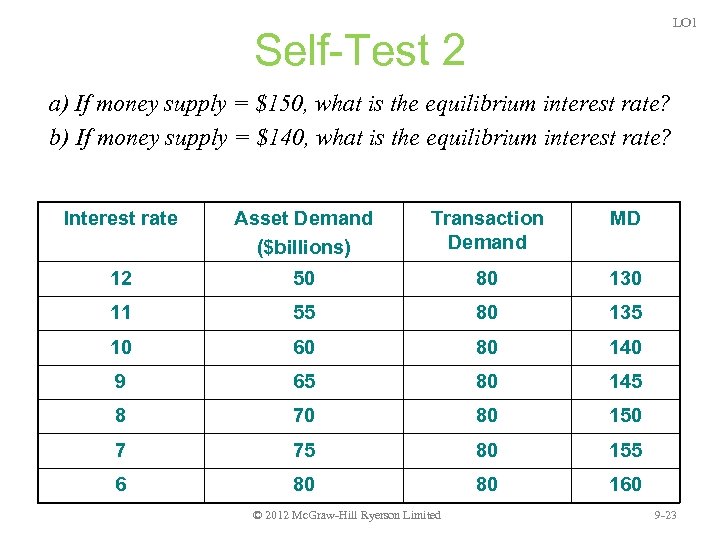

LO 1 Self-Test 2 a) If money supply = $150, what is the equilibrium interest rate? b) If money supply = $140, what is the equilibrium interest rate? Interest rate Asset Demand ($billions) Transaction Demand MD 12 50 80 130 11 55 80 135 10 60 80 140 9 65 80 145 8 70 80 150 7 75 80 155 6 80 80 160 © 2012 Mc. Graw-Hill Ryerson Limited 9 -23

LO 1 Self-Test 2 a) If money supply = $150, what is the equilibrium interest rate? b) If money supply = $140, what is the equilibrium interest rate? Interest rate Asset Demand ($billions) Transaction Demand MD 12 50 80 130 11 55 80 135 10 60 80 140 9 65 80 145 8 70 80 150 7 75 80 155 6 80 80 160 © 2012 Mc. Graw-Hill Ryerson Limited 9 -23

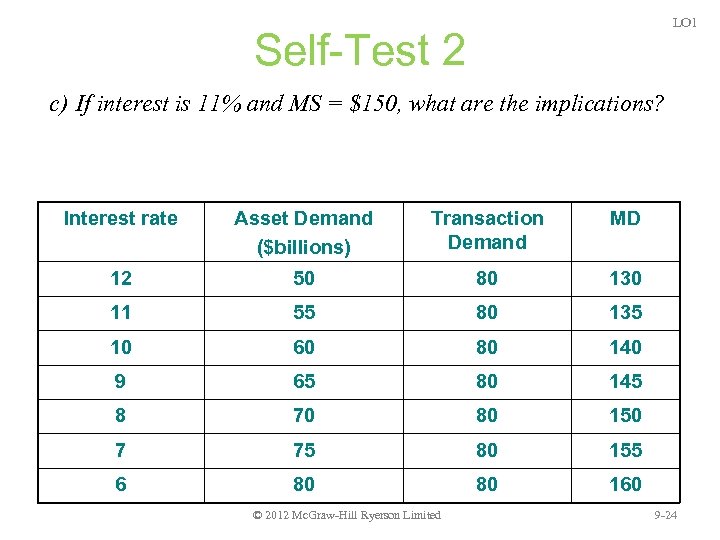

LO 1 Self-Test 2 c) If interest is 11% and MS = $150, what are the implications? Interest rate Asset Demand ($billions) Transaction Demand MD 12 50 80 130 11 55 80 135 10 60 80 140 9 65 80 145 8 70 80 150 7 75 80 155 6 80 80 160 © 2012 Mc. Graw-Hill Ryerson Limited 9 -24

LO 1 Self-Test 2 c) If interest is 11% and MS = $150, what are the implications? Interest rate Asset Demand ($billions) Transaction Demand MD 12 50 80 130 11 55 80 135 10 60 80 140 9 65 80 145 8 70 80 150 7 75 80 155 6 80 80 160 © 2012 Mc. Graw-Hill Ryerson Limited 9 -24

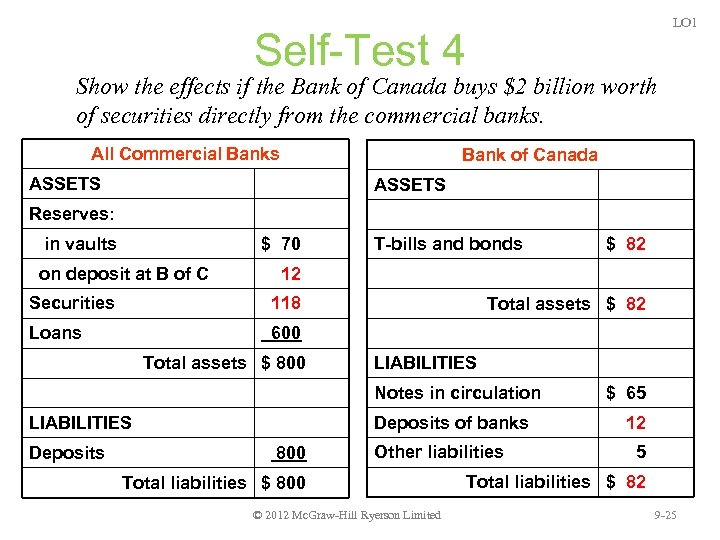

LO 1 Self-Test 4 Show the effects if the Bank of Canada buys $2 billion worth of securities directly from the commercial banks. All Commercial Banks Bank of Canada ASSETS Reserves: in vaults $ 70 on deposit at B of C T-bills and bonds $ 82 12 Securities 118 Loans 600 Total assets $ 82 LIABILITIES Notes in circulation Deposits of banks LIABILITIES Deposits 800 Other liabilities Total liabilities $ 800 © 2012 Mc. Graw-Hill Ryerson Limited $ 65 12 5 Total liabilities $ 82 9 -25

LO 1 Self-Test 4 Show the effects if the Bank of Canada buys $2 billion worth of securities directly from the commercial banks. All Commercial Banks Bank of Canada ASSETS Reserves: in vaults $ 70 on deposit at B of C T-bills and bonds $ 82 12 Securities 118 Loans 600 Total assets $ 82 LIABILITIES Notes in circulation Deposits of banks LIABILITIES Deposits 800 Other liabilities Total liabilities $ 800 © 2012 Mc. Graw-Hill Ryerson Limited $ 65 12 5 Total liabilities $ 82 9 -25

Self-Test 10 LO 1 a) If M is $100, P is $2, and Q is 500, what is the velocity of money? b) Given the same parameters as in a), if the velocity of money stays constant and assuming the economy is at full employment, what will be the level of P if M increases to $120? © 2012 Mc. Graw-Hill Ryerson Limited 9 -26

Self-Test 10 LO 1 a) If M is $100, P is $2, and Q is 500, what is the velocity of money? b) Given the same parameters as in a), if the velocity of money stays constant and assuming the economy is at full employment, what will be the level of P if M increases to $120? © 2012 Mc. Graw-Hill Ryerson Limited 9 -26