0eae4a8abca30deef18913c62cd5eb79.ppt

- Количество слайдов: 26

Living Wi$ely Session One Three Rules

Living Wi$ely Session One Three Rules

Your Money Story The first money you received § § § Gift or reward Occasion What to do with it

Your Money Story The first money you received § § § Gift or reward Occasion What to do with it

Some Questions How would you define the difference between “Wants” and “Needs”

Some Questions How would you define the difference between “Wants” and “Needs”

Meet Steve and Jessica Write down their financial mistakes you identify as the story is read

Meet Steve and Jessica Write down their financial mistakes you identify as the story is read

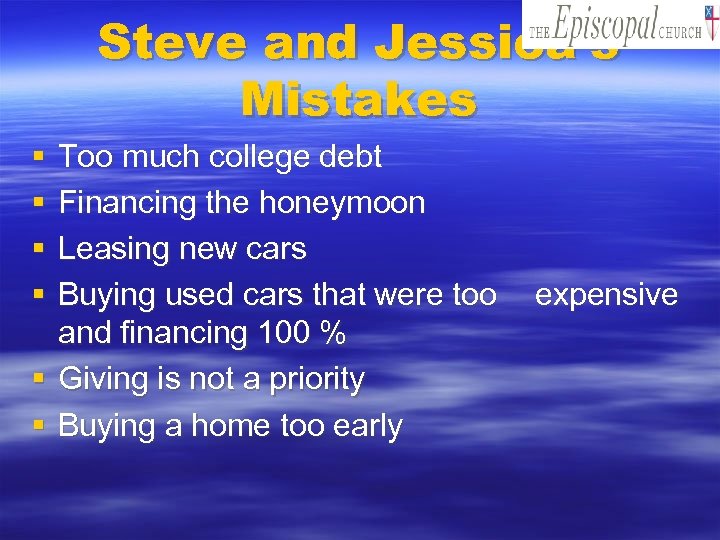

Steve and Jessica’s Mistakes § § Too much college debt Financing the honeymoon Leasing new cars Buying used cars that were too and financing 100 % § Giving is not a priority § Buying a home too early expensive

Steve and Jessica’s Mistakes § § Too much college debt Financing the honeymoon Leasing new cars Buying used cars that were too and financing 100 % § Giving is not a priority § Buying a home too early expensive

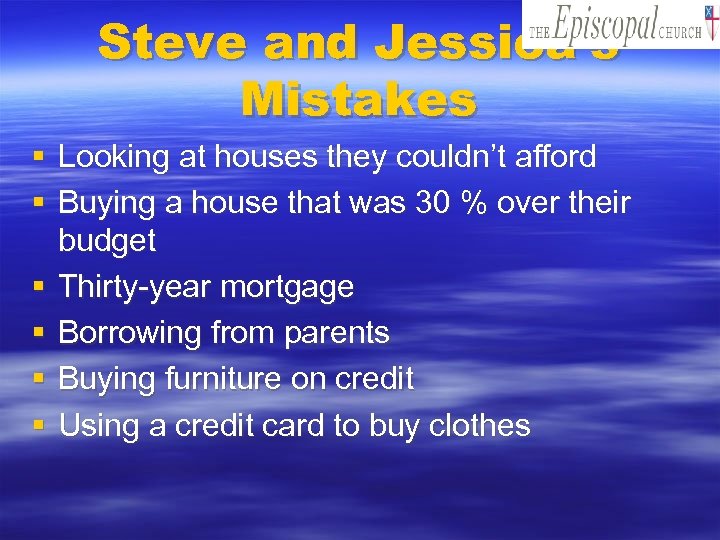

Steve and Jessica’s Mistakes § Looking at houses they couldn’t afford § Buying a house that was 30 % over their budget § Thirty-year mortgage § Borrowing from parents § Buying furniture on credit § Using a credit card to buy clothes

Steve and Jessica’s Mistakes § Looking at houses they couldn’t afford § Buying a house that was 30 % over their budget § Thirty-year mortgage § Borrowing from parents § Buying furniture on credit § Using a credit card to buy clothes

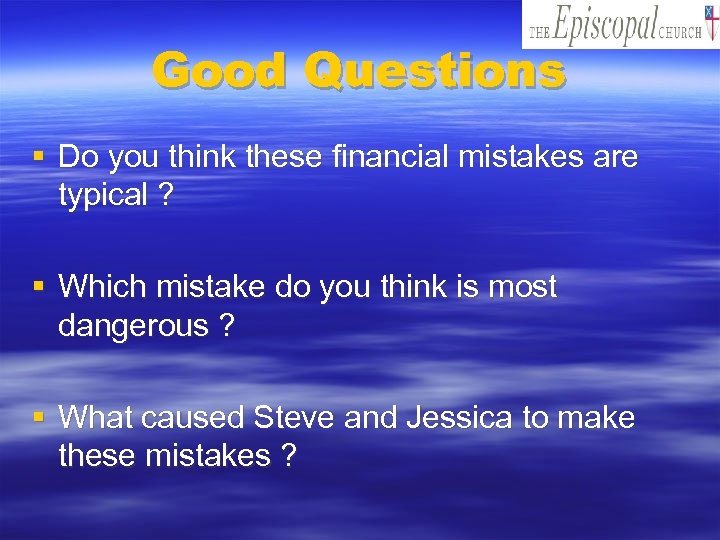

Good Questions § Do you think these financial mistakes are typical ? § Which mistake do you think is most dangerous ? § What caused Steve and Jessica to make these mistakes ?

Good Questions § Do you think these financial mistakes are typical ? § Which mistake do you think is most dangerous ? § What caused Steve and Jessica to make these mistakes ?

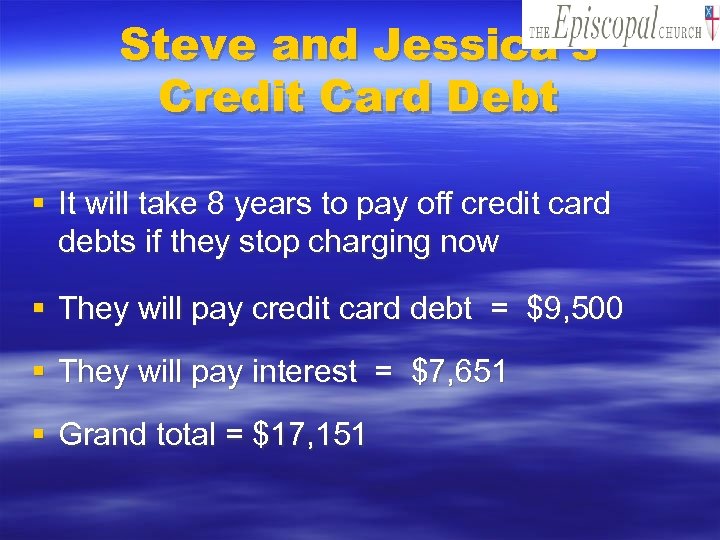

Steve and Jessica’s Credit Card Debt § It will take 8 years to pay off credit card debts if they stop charging now § They will pay credit card debt = $9, 500 § They will pay interest = $7, 651 § Grand total = $17, 151

Steve and Jessica’s Credit Card Debt § It will take 8 years to pay off credit card debts if they stop charging now § They will pay credit card debt = $9, 500 § They will pay interest = $7, 651 § Grand total = $17, 151

Good Questions § Do you think these financial mistakes are typical ? § Which mistake do you think is most dangerous ? § What caused Steve and Jessica to make these mistakes ?

Good Questions § Do you think these financial mistakes are typical ? § Which mistake do you think is most dangerous ? § What caused Steve and Jessica to make these mistakes ?

Babies R Us § Purchased furniture and clothes = $2, 500 § When paid off = $3, 470 They will still be paying for baby furniture when their child enters kindergarten

Babies R Us § Purchased furniture and clothes = $2, 500 § When paid off = $3, 470 They will still be paying for baby furniture when their child enters kindergarten

Personal Financial Habits Assessment

Personal Financial Habits Assessment

Personal Financial Habits § Most difficult good habit to maintain § Most difficult bad habit to break

Personal Financial Habits § Most difficult good habit to maintain § Most difficult bad habit to break

Three Simple Rules 1. Spend Less Than You Earn 2. Save Now Buy Later 1. Know Debt

Three Simple Rules 1. Spend Less Than You Earn 2. Save Now Buy Later 1. Know Debt

Rule One Spend Less Than You Earn

Rule One Spend Less Than You Earn

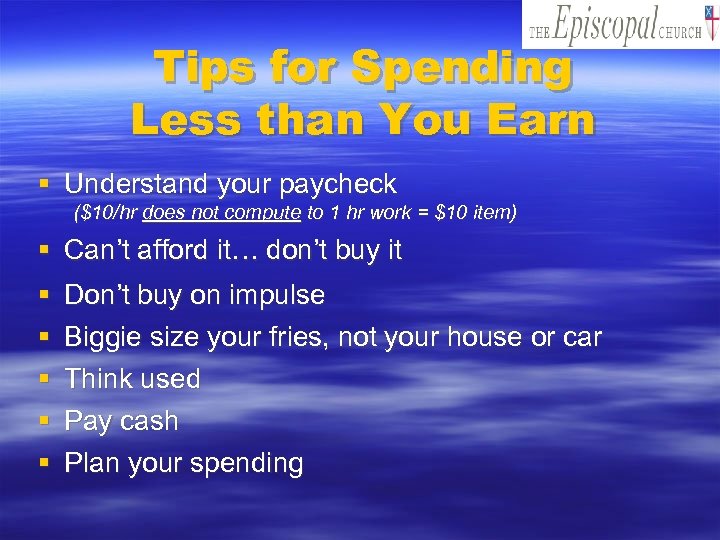

Tips for Spending Less than You Earn § Understand your paycheck ($10/hr does not compute to 1 hr work = $10 item) § Can’t afford it… don’t buy it § § § Don’t buy on impulse Biggie size your fries, not your house or car Think used Pay cash Plan your spending

Tips for Spending Less than You Earn § Understand your paycheck ($10/hr does not compute to 1 hr work = $10 item) § Can’t afford it… don’t buy it § § § Don’t buy on impulse Biggie size your fries, not your house or car Think used Pay cash Plan your spending

Rule One Spend Less Than You Earn

Rule One Spend Less Than You Earn

Rule Two Save Now Buy Later

Rule Two Save Now Buy Later

Types of Savings § Emergency Account Use for unplanned expenses – Add to this account every payday – Should equal 5 % of your annual income – Fund this account first

Types of Savings § Emergency Account Use for unplanned expenses – Add to this account every payday – Should equal 5 % of your annual income – Fund this account first

Types of Savings § Short Term Account Allows you to pay cash for big ticket items that you plan to buy in the next five years. Amount depends on big ticket items in your five-year plan

Types of Savings § Short Term Account Allows you to pay cash for big ticket items that you plan to buy in the next five years. Amount depends on big ticket items in your five-year plan

Types of Savings § Long Term Account Allows you to plan for items you will pay for in the future… children’s education, wedding, or retirement Recommendation: Save 10 % of every paycheck and divide among savings accounts as appropriate.

Types of Savings § Long Term Account Allows you to plan for items you will pay for in the future… children’s education, wedding, or retirement Recommendation: Save 10 % of every paycheck and divide among savings accounts as appropriate.

Rule Three Know Debt

Rule Three Know Debt

Consequences of Debt § Reduces standard of living § Reduces ability to save § Reduces ability to give § Causes frustration and stress § Causes discord in families

Consequences of Debt § Reduces standard of living § Reduces ability to save § Reduces ability to give § Causes frustration and stress § Causes discord in families

Getting Out of Debt § Have a plan § Apply the 4 “Ds”

Getting Out of Debt § Have a plan § Apply the 4 “Ds”

The Four “Ds” § Desire § Decision § Discipline § Delight

The Four “Ds” § Desire § Decision § Discipline § Delight

Remember the Three Rules 1. Spend Less Than You Earn 2. Save Now Buy Later 1. Know Debt

Remember the Three Rules 1. Spend Less Than You Earn 2. Save Now Buy Later 1. Know Debt

Homework § Read Three Simple Rules – Part 2 A Financial Physical – Addendum § Write down a few of your financial goals

Homework § Read Three Simple Rules – Part 2 A Financial Physical – Addendum § Write down a few of your financial goals