Literature review Empirical research devoted to the Market timing theory By Grebtsova Elena Eremeeva Katya Zhilina Katya Rabotinskiy Ilya Stepushkin Gennadiy Filin Yevgeniy

Literature review Empirical research devoted to the Market timing theory By Grebtsova Elena Eremeeva Katya Zhilina Katya Rabotinskiy Ilya Stepushkin Gennadiy Filin Yevgeniy

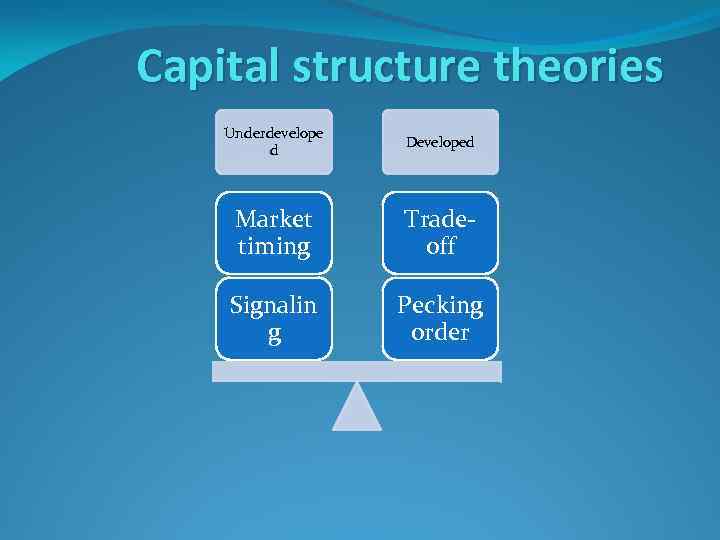

Capital structure theories Underdevelope d Developed Market timing Tradeoff Signalin g Pecking order

Capital structure theories Underdevelope d Developed Market timing Tradeoff Signalin g Pecking order

Market timing Basic idea: decisions to issue equity depend on market performance Reasoning: Equity issues and business cycle Market timing Stock returns and equity issues Extent of asymmetric information and equity issues

Market timing Basic idea: decisions to issue equity depend on market performance Reasoning: Equity issues and business cycle Market timing Stock returns and equity issues Extent of asymmetric information and equity issues

Market timing Line of research: Explanation Market timing vs Pecking order or Trade-off Market timing effect: long-lasting or not?

Market timing Line of research: Explanation Market timing vs Pecking order or Trade-off Market timing effect: long-lasting or not?

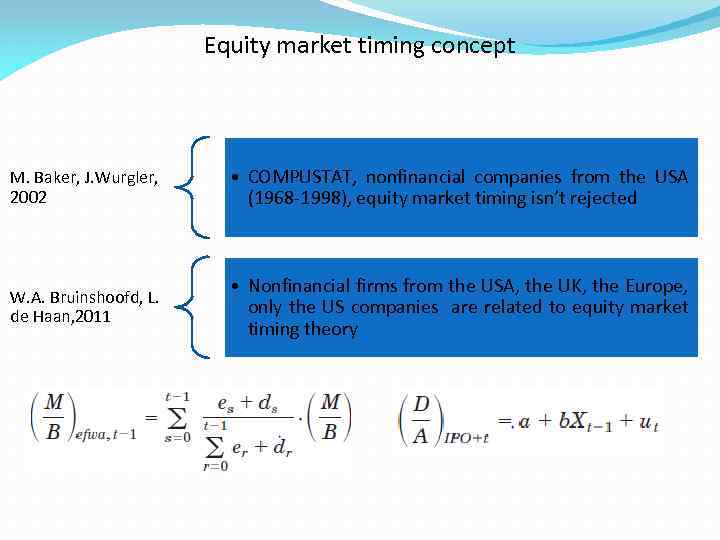

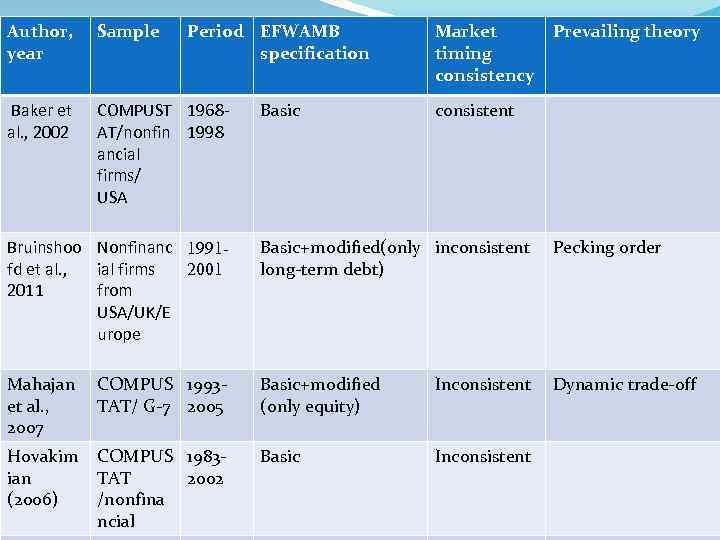

Equity market timing concept M. Baker, J. Wurgler, 2002 • COMPUSTAT, nonfinancial companies from the USA (1968 -1998), equity market timing isn’t rejected W. A. Bruinshoofd, L. de Haan, 2011 • Nonfinancial firms from the USA, the UK, the Europe, only the US companies are related to equity market timing theory

Equity market timing concept M. Baker, J. Wurgler, 2002 • COMPUSTAT, nonfinancial companies from the USA (1968 -1998), equity market timing isn’t rejected W. A. Bruinshoofd, L. de Haan, 2011 • Nonfinancial firms from the USA, the UK, the Europe, only the US companies are related to equity market timing theory

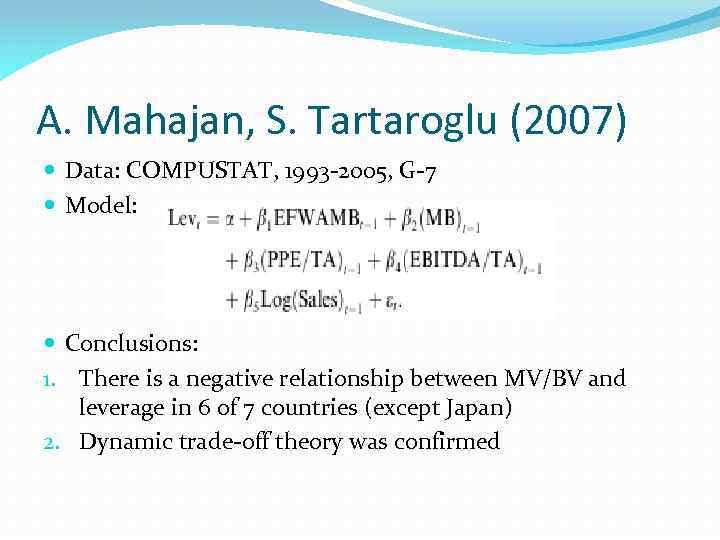

A. Mahajan, S. Tartaroglu (2007) Data: COMPUSTAT, 1993 -2005, G-7 Model: Conclusions: 1. There is a negative relationship between MV/BV and leverage in 6 of 7 countries (except Japan) 2. Dynamic trade-off theory was confirmed

A. Mahajan, S. Tartaroglu (2007) Data: COMPUSTAT, 1993 -2005, G-7 Model: Conclusions: 1. There is a negative relationship between MV/BV and leverage in 6 of 7 countries (except Japan) 2. Dynamic trade-off theory was confirmed

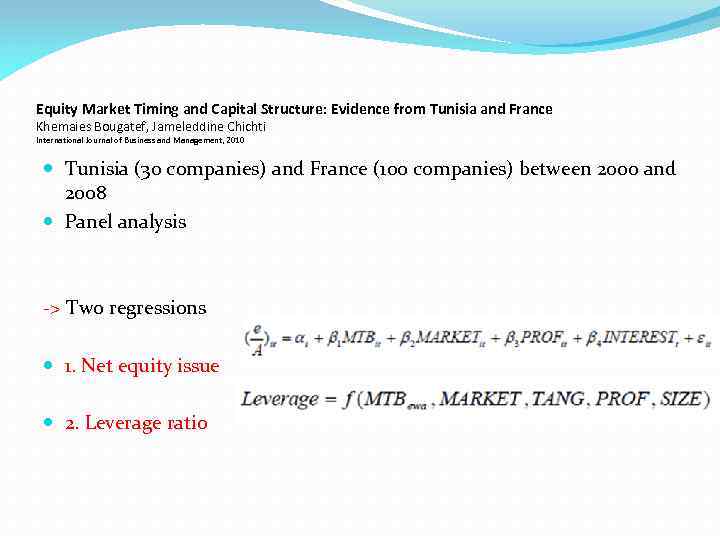

Equity Market Timing and Capital Structure: Evidence from Tunisia and France Khemaies Bougatef, Jameleddine Chichti International Journal of Business and Management, 2010 Tunisia (30 companies) and France (100 companies) between 2000 and 2008 Panel analysis -> Two regressions 1. Net equity issue 2. Leverage ratio

Equity Market Timing and Capital Structure: Evidence from Tunisia and France Khemaies Bougatef, Jameleddine Chichti International Journal of Business and Management, 2010 Tunisia (30 companies) and France (100 companies) between 2000 and 2008 Panel analysis -> Two regressions 1. Net equity issue 2. Leverage ratio

Author, year Sample Period EFWAMB specification Baker et al. , 2002 COMPUST 1968 AT/nonfin 1998 ancial firms/ USA Basic Market timing consistency Prevailing theory consistent Bruinshoo Nonfinanc 1991 fd et al. , ial firms 2001 2011 from USA/UK/E urope Basic+modified(only inconsistent long-term debt) Pecking order Mahajan et al. , 2007 COMPUS 1993 TAT/ G-7 2005 Basic+modified (only equity) Inconsistent Dynamic trade-off Hovakim ian (2006) COMPUS 1983 TAT 2002 /nonfina ncial Basic Inconsistent

Author, year Sample Period EFWAMB specification Baker et al. , 2002 COMPUST 1968 AT/nonfin 1998 ancial firms/ USA Basic Market timing consistency Prevailing theory consistent Bruinshoo Nonfinanc 1991 fd et al. , ial firms 2001 2011 from USA/UK/E urope Basic+modified(only inconsistent long-term debt) Pecking order Mahajan et al. , 2007 COMPUS 1993 TAT/ G-7 2005 Basic+modified (only equity) Inconsistent Dynamic trade-off Hovakim ian (2006) COMPUS 1983 TAT 2002 /nonfina ncial Basic Inconsistent