Презентация1j.k.pptx

- Количество слайдов: 11

Liquidity ratio Done by: Abdrakhman Aida Bolatova Bakhyt

Liquidity ratio The liquidity of the balance shows the extent to which the company is able to pay off short -term debt by current assets. As a base, you can use the general liquidity ratio. In our case we will compare three companies.

Liquidity - the ability of the company: - respond quickly to unexpected financial problems and opportunities - increase assets while increasing the volume of sales, - return a short-term debts by the usual transformation of assets into cash.

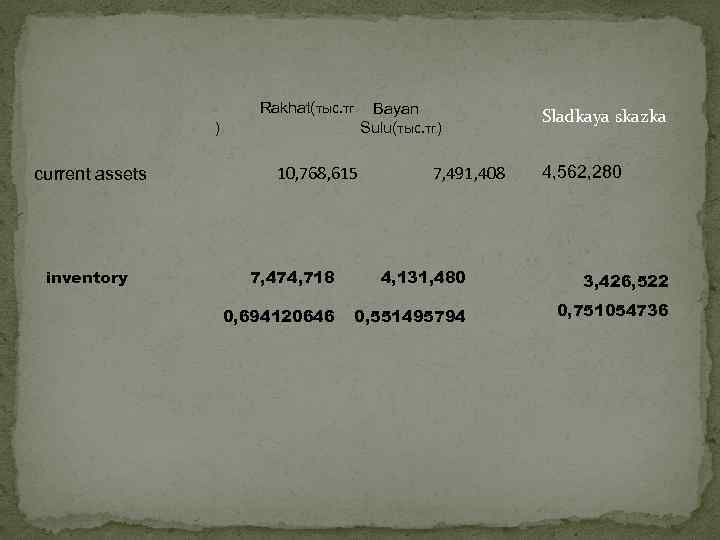

Rakhat(тыс. тг ) current assets inventory 10, 768, 615 Bayan Sulu(тыс. тг) 7, 491, 408 Sladkaya skazka 4, 562, 280 7, 474, 718 4, 131, 480 3, 426, 522 0, 694120646 0, 551495794 0, 751054736

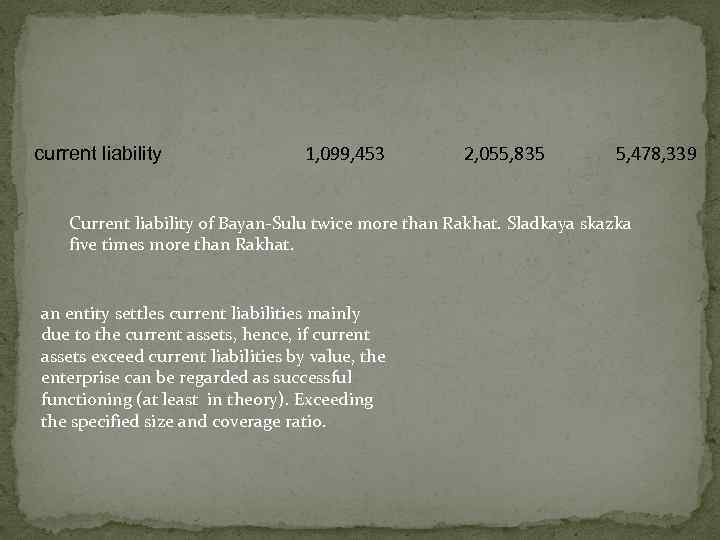

current liability 1, 099, 453 2, 055, 835 5, 478, 339 Current liability of Bayan-Sulu twice more than Rakhat. Sladkaya skazka five times more than Rakhat. an entity settles current liabilities mainly due to the current assets, hence, if current assets exceed current liabilities by value, the enterprise can be regarded as successful functioning (at least in theory). Exceeding the specified size and coverage ratio.

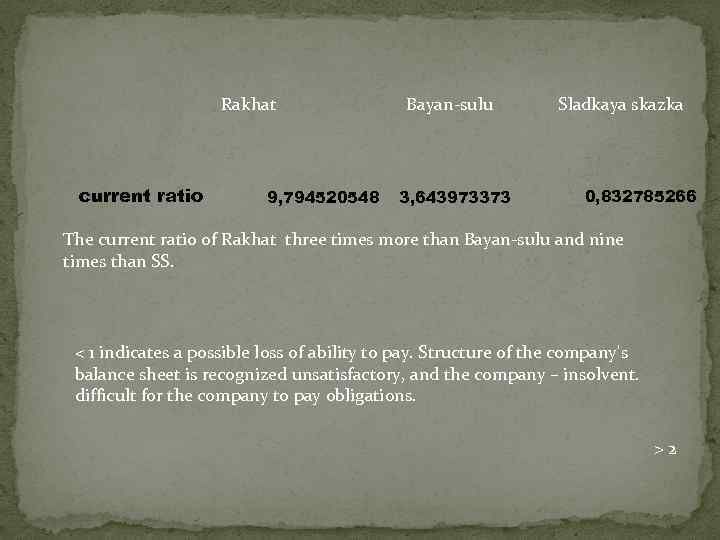

Rakhat Bayan-sulu current ratio 9, 794520548 3, 643973373 Sladkaya skazka 0, 832785266 The current ratio of Rakhat three times more than Bayan-sulu and nine times than SS. < 1 indicates a possible loss of ability to pay. Structure of the company's balance sheet is recognized unsatisfactory, and the company – insolvent. difficult for the company to pay obligations. > 2

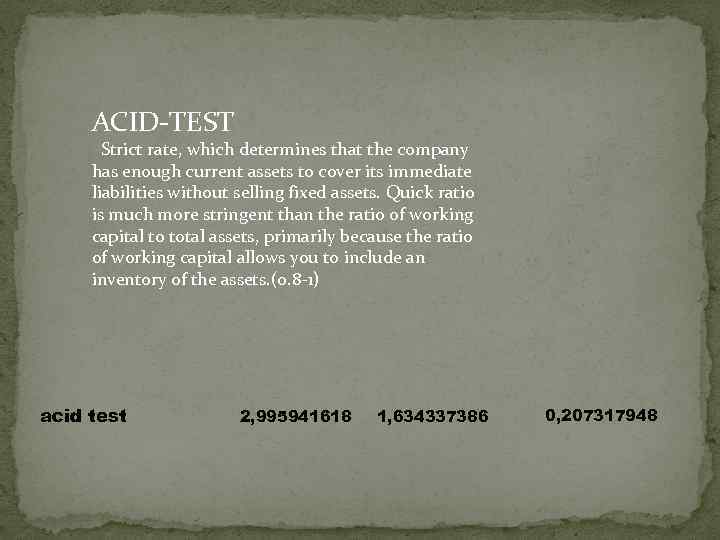

ACID-TEST Strict rate, which determines that the company has enough current assets to cover its immediate liabilities without selling fixed assets. Quick ratio is much more stringent than the ratio of working capital to total assets, primarily because the ratio of working capital allows you to include an inventory of the assets. (0. 8 -1) acid test 2, 995941618 1, 634337386 0, 207317948

If the " Sladkaya skazka " intends not only to survive but also to be activein the direction of its development, changing the principles of performance management enterprise, it will need to revise the overall governance structure the enterprise. If the company intends to make a profit , you need to sell products , and for This is necessary to seek a buyer , identify their needs , create the goods , and promote them in the market , negotiate prices. An indicator of market stability of the company is its ability to successfully progress in the transformation of the external and internal medium. For this necessary to have a flexible structure and financial resources in the event of needs to be able to borrow the funds to be creditworthy.

- on receivables - is recommended to use a system of discounts for early payment delivered products , which leads to faster turnover of accounts receivable ; -in respect of cash - we recommend the use of models for the analysis , prediction and optimization of the balance of funds - Reduction of excessive stocks. -Obtaining long-term financing - Formulate certain goal for company and achieve(Rakhat) expansion of assortments and something else

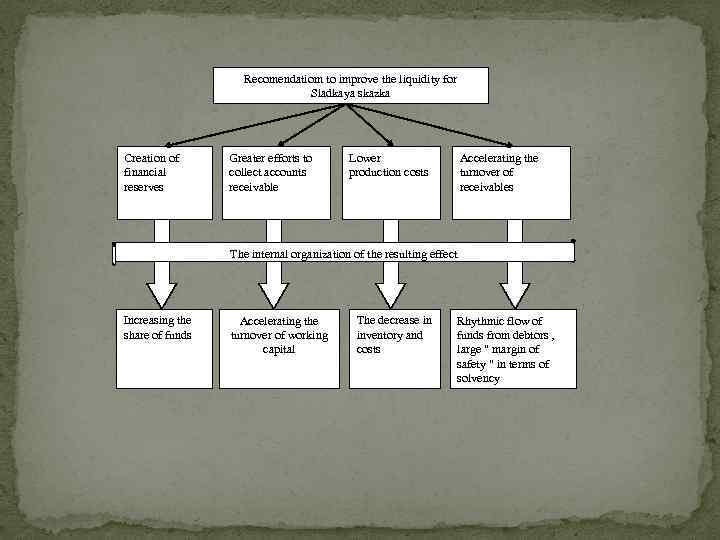

Recomendatiom to improve the liquidity for Sladkaya skazka Creation of financial reserves Greater efforts to collect accounts receivable Lower production costs Accelerating the turnover of receivables The internal organization of the resulting effect Increasing the share of funds Accelerating the turnover of working capital The decrease in inventory and costs Rhythmic flow of funds from debtors , large " margin of safety " in terms of solvency

Презентация1j.k.pptx