7c445626f14a4d2ac3ec6e1d5f59aa17.ppt

- Количество слайдов: 35

Limits to Arbitrage and the Asset Growth Anomaly Eric F. Y. C. Lam and K. C. John Wei Hong Kong University of Science and Technology

Literature Review • Capital investment anomaly or asset growth anomaly – Fairfield, Whisenant, and Yohn (AR, 2003) • Changes in long-term net operating assets – Hirshleifer, Hou, Teoh, and Zhang (JAE, 2004) • Levels of net operating assets scaled by lagged total assets – Titman, Wei, and Xie (JFQA, 2004) • Abnormal levels of capital expenditures – Richardson, Sloan, and Tuna (WP, 2006) • Levels of net operating assets scaled by total assets – Cooper, Gulen, and Schill (JF, 2008) • Total asset growth • Composite measure, most powerful cross-sectional predictability

Literature Review (cont’d) • Investors misprice unfavorable signal on firm value? – Titman, Wei, and Xie (JFQA, 2004) • Investment discretion • Hostile takeovers period in mid-to-late 1980 s • Earnings announcements – Chan, Karceski, Lakonishok, and Sougiannis (WP, 2008) • Underperformance of high asset growth firms • Past profitability • Corporate governance

Why not arbitrage?

Hypothesis Development Arbitrage is risky? • De Long, Shleifer, Summers, and Waldmann (JPE, 1990) • Noise trades • Shleifer and Vishny (JF, 1997) • Capital constraints and margin calls • Liu and Longstaff (RFS, 2004) • Optimized arbitrage is still risky

Hypothesis Development (cont’d) Arbitrage is not always obvious? • Information can be sparse, imprecise, or ignored • Zhang (JF, 2006) • Information with higher uncertain flow slower

Hypothesis Development (cont’d) Arbitrage is costly to exploit? • Trading costs, short-sale constraints, and liquidity • Mashruwala, Rajgopal, and Shevlin (JAE, 2006)

Hypothesis Development (cont’d) ØLimits to arbitrage may slow down arbitrage activities hence correct pricing of fundamental information • Main hypothesis: If the asset growth anomaly is due to mispricing of fundamental information, it should be more pronounced when limits to arbitrage are more severe

Preview of Major Findings 1. When arbitrage is more difficult, the asset growth anomaly is stronger

Preview of Major Findings 2. When arbitrage risk is low or when firms are followed by S&P, the anomaly is insignificant

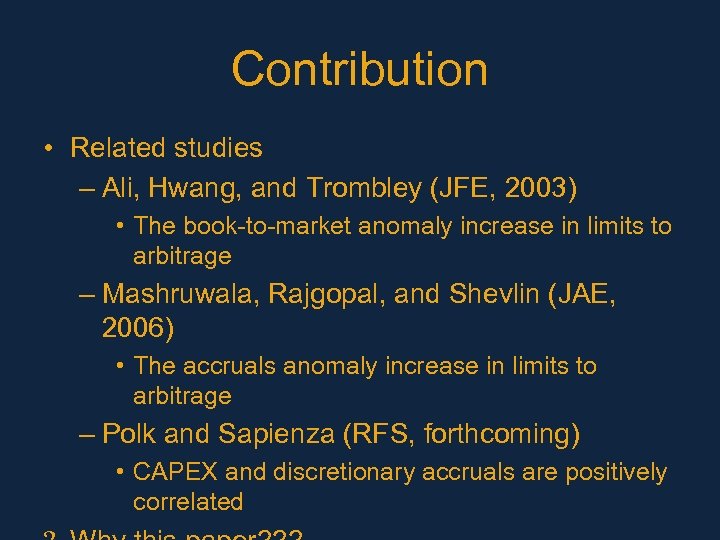

Contribution • Related studies – Ali, Hwang, and Trombley (JFE, 2003) • The book-to-market anomaly increase in limits to arbitrage – Mashruwala, Rajgopal, and Shevlin (JAE, 2006) • The accruals anomaly increase in limits to arbitrage – Polk and Sapienza (RFS, forthcoming) • CAPEX and discretionary accruals are positively correlated

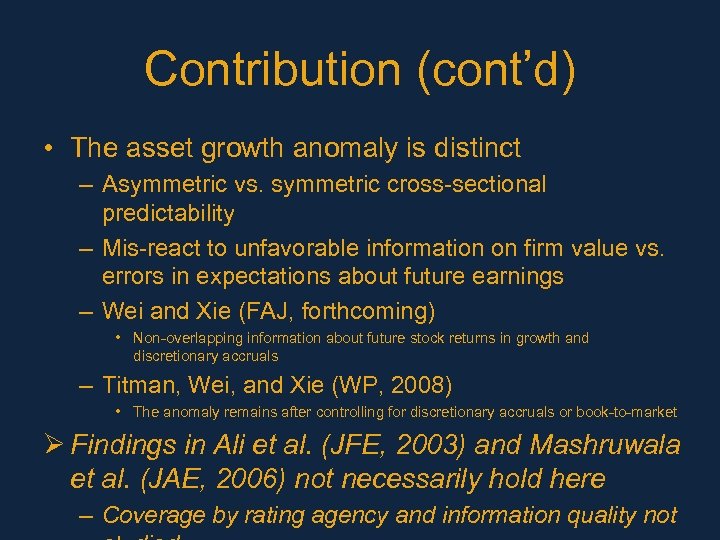

Contribution (cont’d) • The asset growth anomaly is distinct – Asymmetric vs. symmetric cross-sectional predictability – Mis-react to unfavorable information on firm value vs. errors in expectations about future earnings – Wei and Xie (FAJ, forthcoming) • Non-overlapping information about future stock returns in growth and discretionary accruals – Titman, Wei, and Xie (WP, 2008) • The anomaly remains after controlling for discretionary accruals or book-to-market Ø Findings in Ali et al. (JFE, 2003) and Mashruwala et al. (JAE, 2006) not necessarily hold here – Coverage by rating agency and information quality not

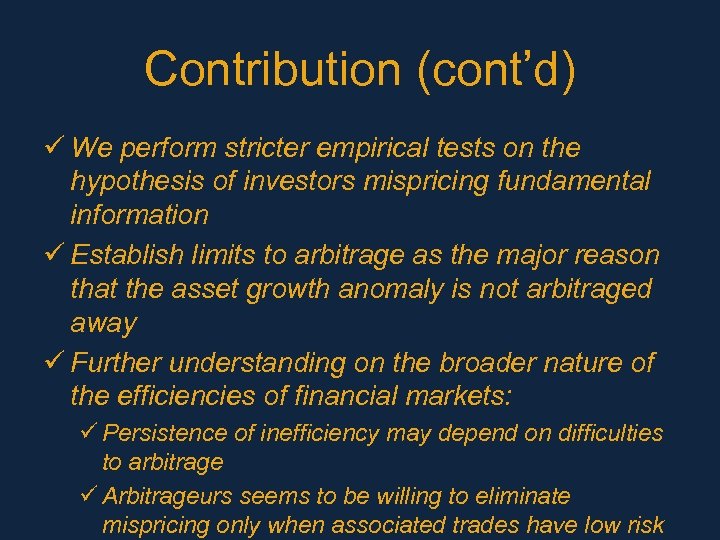

Contribution (cont’d) ü We perform stricter empirical tests on the hypothesis of investors mispricing fundamental information ü Establish limits to arbitrage as the major reason that the asset growth anomaly is not arbitraged away ü Further understanding on the broader nature of the efficiencies of financial markets: ü Persistence of inefficiency may depend on difficulties to arbitrage ü Arbitrageurs seems to be willing to eliminate mispricing only when associated trades have low risk

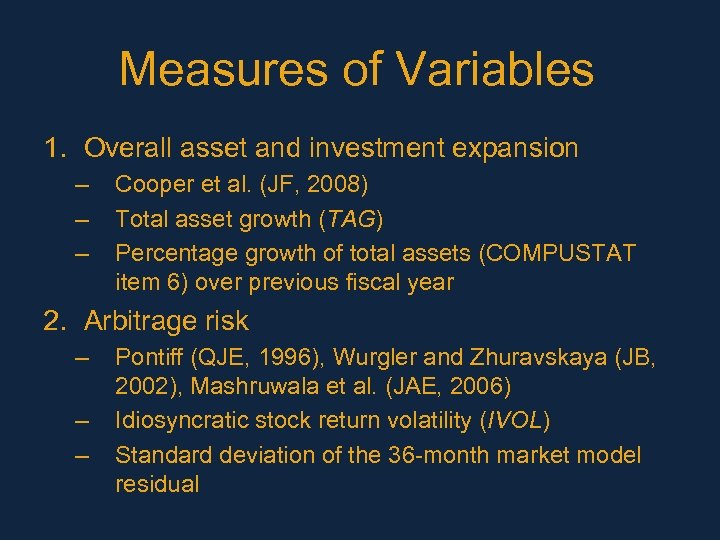

Measures of Variables 1. Overall asset and investment expansion – – – Cooper et al. (JF, 2008) Total asset growth (TAG) Percentage growth of total assets (COMPUSTAT item 6) over previous fiscal year 2. Arbitrage risk – – – Pontiff (QJE, 1996), Wurgler and Zhuravskaya (JB, 2002), Mashruwala et al. (JAE, 2006) Idiosyncratic stock return volatility (IVOL) Standard deviation of the 36 -month market model residual

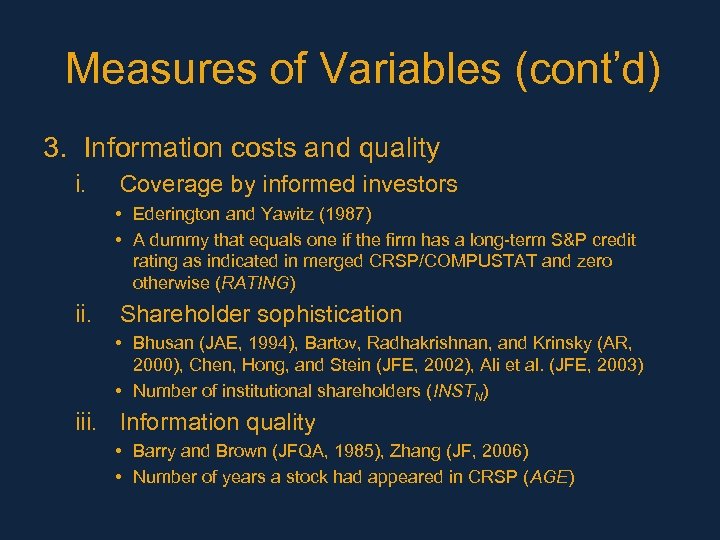

Measures of Variables (cont’d) 3. Information costs and quality i. Coverage by informed investors • Ederington and Yawitz (1987) • A dummy that equals one if the firm has a long-term S&P credit rating as indicated in merged CRSP/COMPUSTAT and zero otherwise (RATING) ii. Shareholder sophistication • Bhusan (JAE, 1994), Bartov, Radhakrishnan, and Krinsky (AR, 2000), Chen, Hong, and Stein (JFE, 2002), Ali et al. (JFE, 2003) • Number of institutional shareholders (INSTN) iii. Information quality • Barry and Brown (JFQA, 1985), Zhang (JF, 2006) • Number of years a stock had appeared in CRSP (AGE)

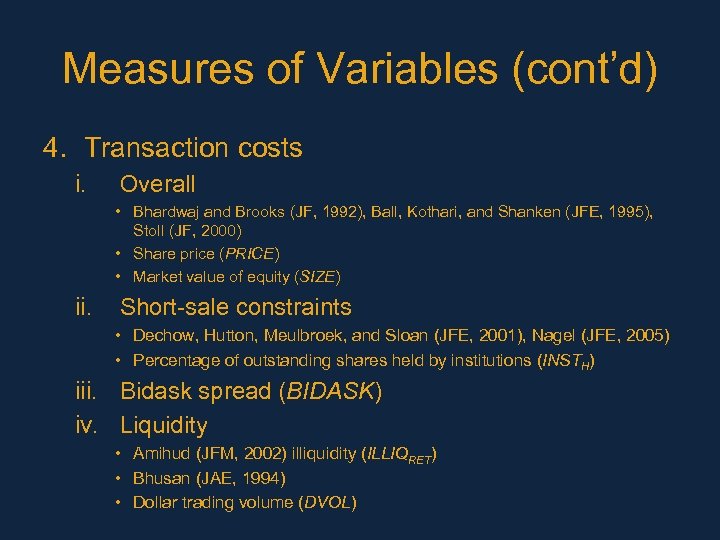

Measures of Variables (cont’d) 4. Transaction costs i. Overall • Bhardwaj and Brooks (JF, 1992), Ball, Kothari, and Shanken (JFE, 1995), Stoll (JF, 2000) • Share price (PRICE) • Market value of equity (SIZE) ii. Short-sale constraints • Dechow, Hutton, Meulbroek, and Sloan (JFE, 2001), Nagel (JFE, 2005) • Percentage of outstanding shares held by institutions (INSTH) iii. Bidask spread (BIDASK) iv. Liquidity • Amihud (JFM, 2002) illiquidity (ILLIQRET) • Bhusan (JAE, 1994) • Dollar trading volume (DVOL)

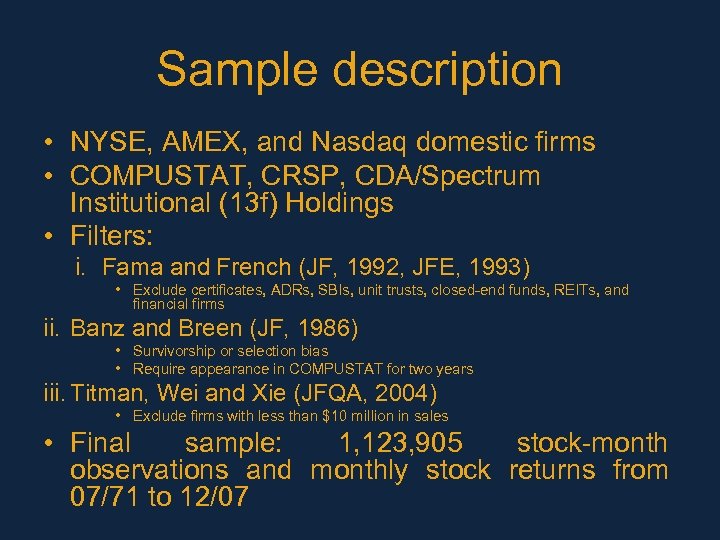

Sample description • NYSE, AMEX, and Nasdaq domestic firms • COMPUSTAT, CRSP, CDA/Spectrum Institutional (13 f) Holdings • Filters: i. Fama and French (JF, 1992, JFE, 1993) • Exclude certificates, ADRs, SBIs, unit trusts, closed-end funds, REITs, and financial firms ii. Banz and Breen (JF, 1986) • Survivorship or selection bias • Require appearance in COMPUSTAT for two years iii. Titman, Wei and Xie (JFQA, 2004) • Exclude firms with less than $10 million in sales • Final sample: 1, 123, 905 stock-month observations and monthly stock returns from 07/71 to 12/07

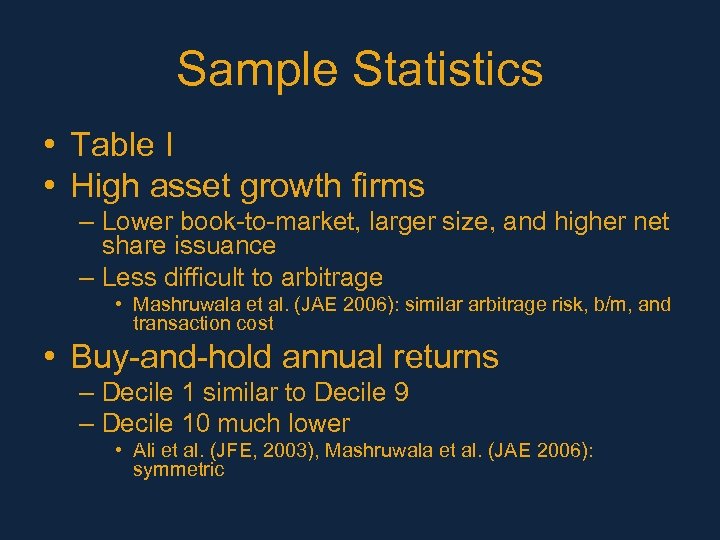

Sample Statistics • Table I • High asset growth firms – Lower book-to-market, larger size, and higher net share issuance – Less difficult to arbitrage • Mashruwala et al. (JAE 2006): similar arbitrage risk, b/m, and transaction cost • Buy-and-hold annual returns – Decile 1 similar to Decile 9 – Decile 10 much lower • Ali et al. (JFE, 2003), Mashruwala et al. (JAE 2006): symmetric

Sample Statistics (cont’d) • Low-high growth return spread – Positive but declining over first three years • Ali et al. (JFE, 2003): positive and increasing – Insignificant over the fourth and fifth years • TAG is not correlated with the limits to arbitrage proxies • Information cost proxies positively correlated but not high • Transaction cost proxies positively correlated but not high

Methodology • • 10 by 3 independent sorts Equally weighted portfolios at the end of June Delisting returns to mitigate survivorship bias Portfolio returns (D 1, D 10, D 1 – D 10) i. Raw return (Raw) ii. Characteristics-adjusted return (Adj) – Excess stock returns over matching Fama and French (JF, 1992) 25 size-and-book-to-market benchmark portfolios iii. Risk-adjusted return (α) – – Fama and French (JFE, 1993), Carhart (JF, 1997) Intercept of four-factor regression • Data from Professor Kenneth French

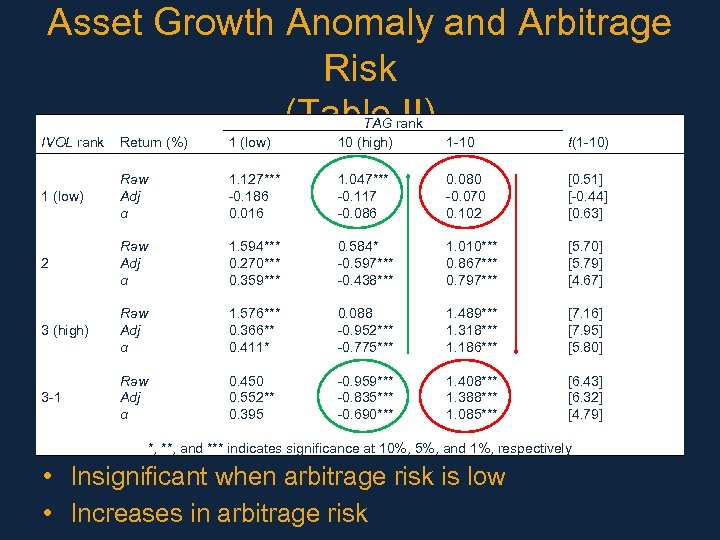

Asset Growth Anomaly and Arbitrage Risk (Table II) IVOL rank Return (%) 1 (low) TAG rank 10 (high) 1 (low) Raw Adj α 1. 127*** -0. 186 0. 016 1. 047*** -0. 117 -0. 086 0. 080 -0. 070 0. 102 [0. 51] [-0. 44] [0. 63] 2 Raw Adj α 1. 594*** 0. 270*** 0. 359*** 0. 584* -0. 597*** -0. 438*** 1. 010*** 0. 867*** 0. 797*** [5. 70] [5. 79] [4. 67] 3 (high) Raw Adj α 1. 576*** 0. 366** 0. 411* 0. 088 -0. 952*** -0. 775*** 1. 489*** 1. 318*** 1. 186*** [7. 16] [7. 95] [5. 80] 3 -1 Raw Adj α 0. 450 0. 552** 0. 395 -0. 959*** -0. 835*** -0. 690*** 1. 408*** 1. 388*** 1. 085*** [6. 43] [6. 32] [4. 79] 1 -10 t(1 -10) *, **, and *** indicates significance at 10%, 5%, and 1%, respectively • Insignificant when arbitrage risk is low • Increases in arbitrage risk

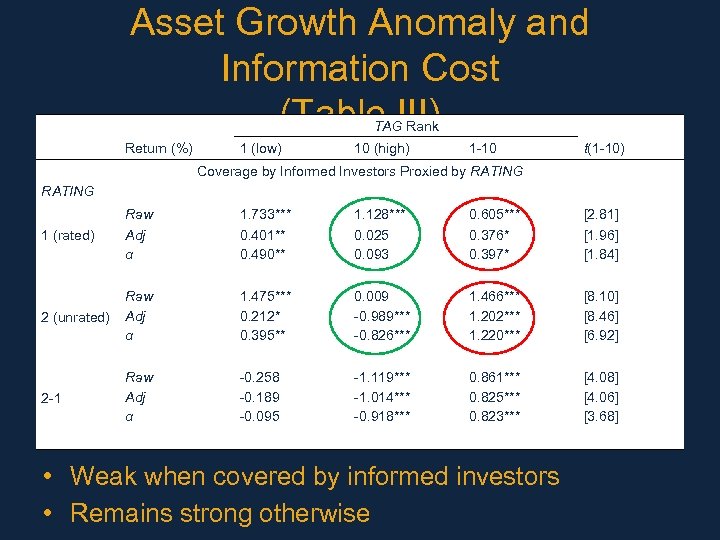

Asset Growth Anomaly and Information Cost (Table III) TAG Rank Return (%) 1 (low) 10 (high) 1 -10 t(1 -10) Coverage by Informed Investors Proxied by RATING Raw 1. 733*** 1. 128*** 0. 605*** [2. 81] Adj α 0. 401** 0. 490** 0. 025 0. 093 0. 376* 0. 397* [1. 96] [1. 84] 2 (unrated) Raw Adj α 1. 475*** 0. 212* 0. 395** 0. 009 -0. 989*** -0. 826*** 1. 466*** 1. 202*** 1. 220*** [8. 10] [8. 46] [6. 92] 2 -1 Raw Adj α -0. 258 -0. 189 -0. 095 -1. 119*** -1. 014*** -0. 918*** 0. 861*** 0. 825*** 0. 823*** [4. 08] [4. 06] [3. 68] 1 (rated) • Weak when covered by informed investors • Remains strong otherwise

Rated versus unrated firms • 609 rated firms vs. 2, 038 unrated firms at formation • Unrated firms are around 13 years old – Not IPO • Unrated firms are about 10 times smaller in assets and size – But about 34% of the market capitalization in our sample • No economic difference in book-to-market

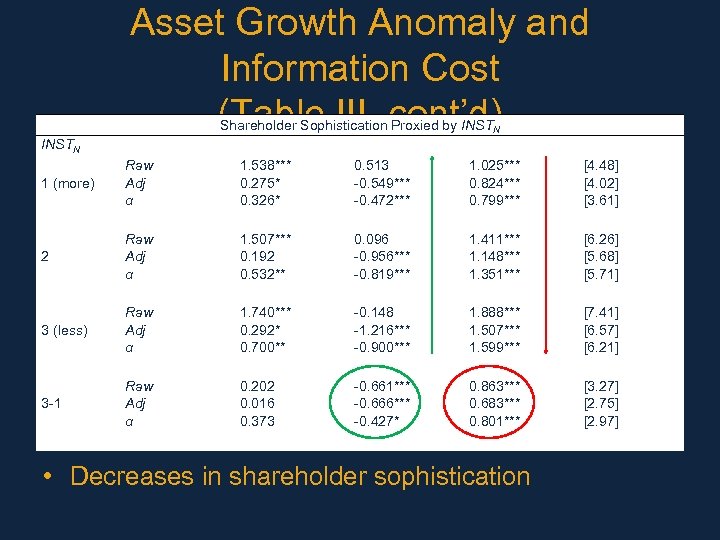

Asset Growth Anomaly and Information Cost (Table III, cont’d) Shareholder Sophistication Proxied by INSTN 1 (more) Raw Adj α 1. 538*** 0. 275* 0. 326* 0. 513 -0. 549*** -0. 472*** 1. 025*** 0. 824*** 0. 799*** [4. 48] [4. 02] [3. 61] 2 Raw Adj α 1. 507*** 0. 192 0. 532** 0. 096 -0. 956*** -0. 819*** 1. 411*** 1. 148*** 1. 351*** [6. 26] [5. 68] [5. 71] 3 (less) Raw Adj α 1. 740*** 0. 292* 0. 700** -0. 148 -1. 216*** -0. 900*** 1. 888*** 1. 507*** 1. 599*** [7. 41] [6. 57] [6. 21] 3 -1 Raw Adj α 0. 202 0. 016 0. 373 -0. 661*** -0. 666*** -0. 427* 0. 863*** 0. 683*** 0. 801*** [3. 27] [2. 75] [2. 97] • Decreases in shareholder sophistication

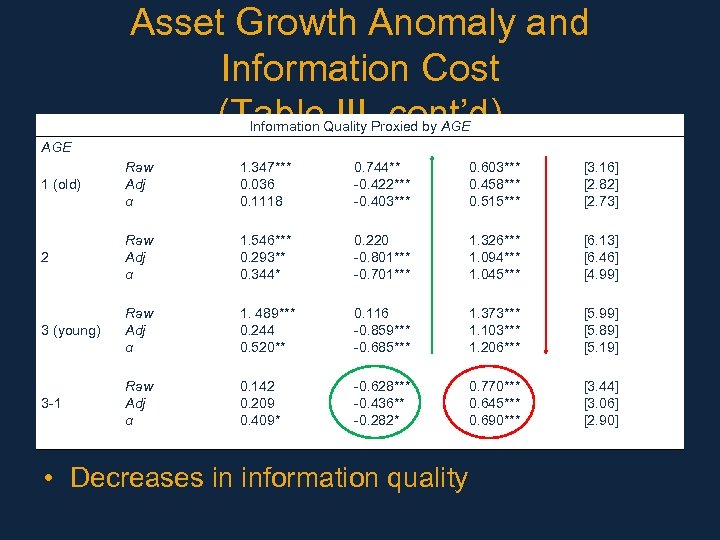

Asset Growth Anomaly and Information Cost (Table III, cont’d) Information Quality Proxied by AGE 1 (old) Raw Adj α 1. 347*** 0. 036 0. 1118 0. 744** -0. 422*** -0. 403*** 0. 603*** 0. 458*** 0. 515*** [3. 16] [2. 82] [2. 73] 2 Raw Adj α 1. 546*** 0. 293** 0. 344* 0. 220 -0. 801*** -0. 701*** 1. 326*** 1. 094*** 1. 045*** [6. 13] [6. 46] [4. 99] 3 (young) Raw Adj α 1. 489*** 0. 244 0. 520** 0. 116 -0. 859*** -0. 685*** 1. 373*** 1. 103*** 1. 206*** [5. 99] [5. 89] [5. 19] 3 -1 Raw Adj α 0. 142 0. 209 0. 409* -0. 628*** -0. 436** -0. 282* 0. 770*** 0. 645*** 0. 690*** [3. 44] [3. 06] [2. 90] • Decreases in information quality

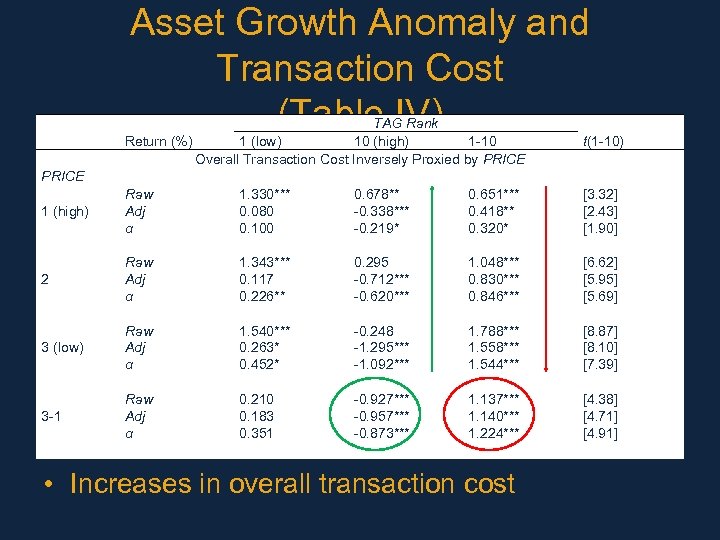

Asset Growth Anomaly and Transaction Cost (Table IV) TAG Rank Return (%) 1 (low) 10 (high) 1 -10 Overall Transaction Cost Inversely Proxied by PRICE t(1 -10) 1 (high) Raw Adj α 1. 330*** 0. 080 0. 100 0. 678** -0. 338*** -0. 219* 0. 651*** 0. 418** 0. 320* [3. 32] [2. 43] [1. 90] 2 Raw Adj α 1. 343*** 0. 117 0. 226** 0. 295 -0. 712*** -0. 620*** 1. 048*** 0. 830*** 0. 846*** [6. 62] [5. 95] [5. 69] 3 (low) Raw Adj α 1. 540*** 0. 263* 0. 452* -0. 248 -1. 295*** -1. 092*** 1. 788*** 1. 558*** 1. 544*** [8. 87] [8. 10] [7. 39] 3 -1 Raw Adj α 0. 210 0. 183 0. 351 -0. 927*** -0. 957*** -0. 873*** 1. 137*** 1. 140*** 1. 224*** [4. 38] [4. 71] [4. 91] PRICE • Increases in overall transaction cost

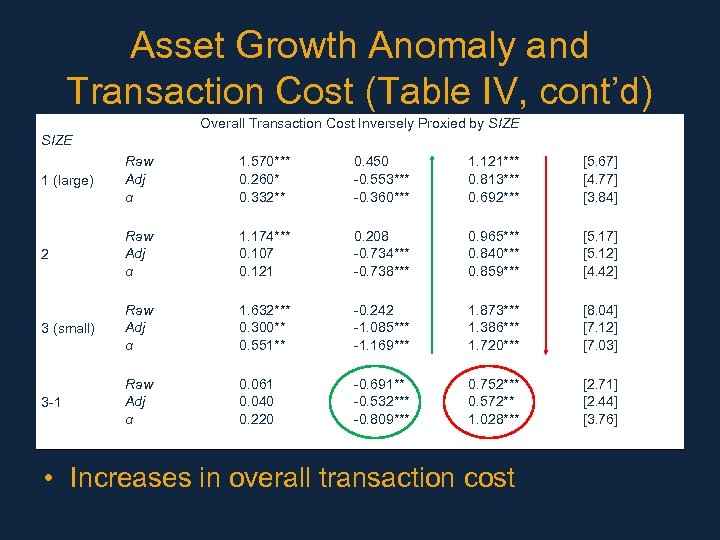

Asset Growth Anomaly and Transaction Cost (Table IV, cont’d) Overall Transaction Cost Inversely Proxied by SIZE 1 (large) Raw Adj α 1. 570*** 0. 260* 0. 332** 0. 450 -0. 553*** -0. 360*** 1. 121*** 0. 813*** 0. 692*** [5. 67] [4. 77] [3. 84] 2 Raw Adj α 1. 174*** 0. 107 0. 121 0. 208 -0. 734*** -0. 738*** 0. 965*** 0. 840*** 0. 859*** [5. 17] [5. 12] [4. 42] 3 (small) Raw Adj α 1. 632*** 0. 300** 0. 551** -0. 242 -1. 085*** -1. 169*** 1. 873*** 1. 386*** 1. 720*** [8. 04] [7. 12] [7. 03] 3 -1 Raw Adj α 0. 061 0. 040 0. 220 -0. 691** -0. 532*** -0. 809*** 0. 752*** 0. 572** 1. 028*** [2. 71] [2. 44] [3. 76] • Increases in overall transaction cost

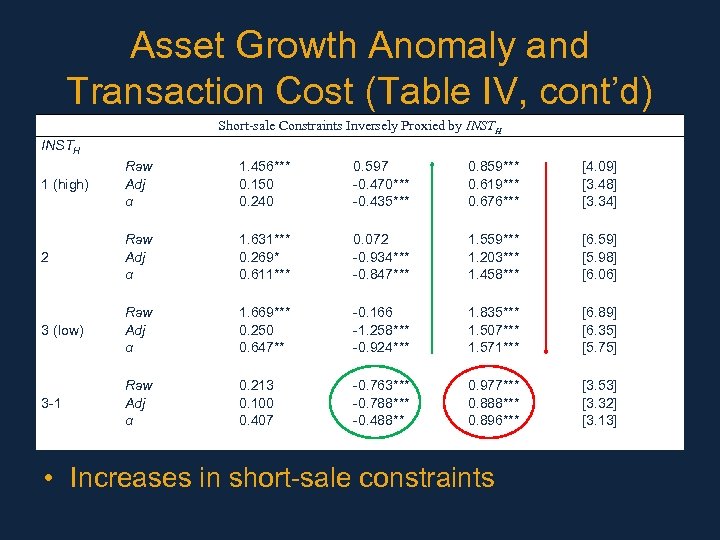

Asset Growth Anomaly and Transaction Cost (Table IV, cont’d) Short-sale Constraints Inversely Proxied by INSTH 1 (high) Raw Adj α 1. 456*** 0. 150 0. 240 0. 597 -0. 470*** -0. 435*** 0. 859*** 0. 619*** 0. 676*** [4. 09] [3. 48] [3. 34] 2 Raw Adj α 1. 631*** 0. 269* 0. 611*** 0. 072 -0. 934*** -0. 847*** 1. 559*** 1. 203*** 1. 458*** [6. 59] [5. 98] [6. 06] 3 (low) Raw Adj α 1. 669*** 0. 250 0. 647** -0. 166 -1. 258*** -0. 924*** 1. 835*** 1. 507*** 1. 571*** [6. 89] [6. 35] [5. 75] 3 -1 Raw Adj α 0. 213 0. 100 0. 407 -0. 763*** -0. 788*** -0. 488** 0. 977*** 0. 888*** 0. 896*** [3. 53] [3. 32] [3. 13] • Increases in short-sale constraints

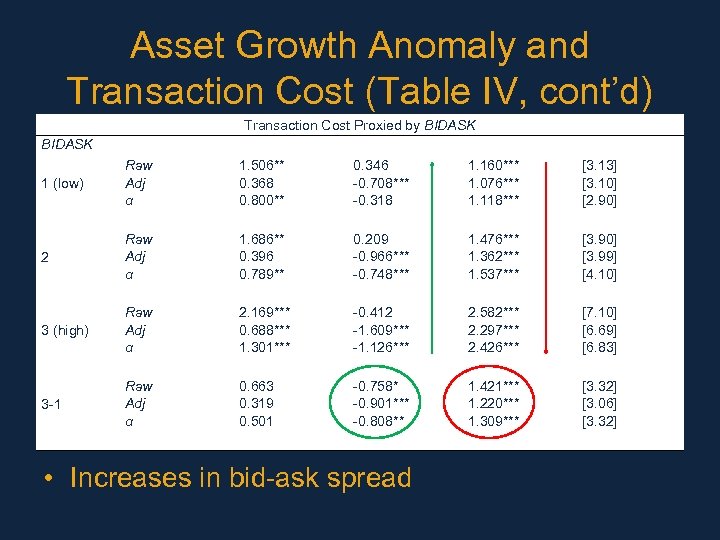

Asset Growth Anomaly and Transaction Cost (Table IV, cont’d) Transaction Cost Proxied by BIDASK 1 (low) Raw Adj α 1. 506** 0. 368 0. 800** 0. 346 -0. 708*** -0. 318 1. 160*** 1. 076*** 1. 118*** [3. 13] [3. 10] [2. 90] 2 Raw Adj α 1. 686** 0. 396 0. 789** 0. 209 -0. 966*** -0. 748*** 1. 476*** 1. 362*** 1. 537*** [3. 90] [3. 99] [4. 10] 3 (high) Raw Adj α 2. 169*** 0. 688*** 1. 301*** -0. 412 -1. 609*** -1. 126*** 2. 582*** 2. 297*** 2. 426*** [7. 10] [6. 69] [6. 83] 3 -1 Raw Adj α 0. 663 0. 319 0. 501 -0. 758* -0. 901*** -0. 808** 1. 421*** 1. 220*** 1. 309*** [3. 32] [3. 06] [3. 32] • Increases in bid-ask spread

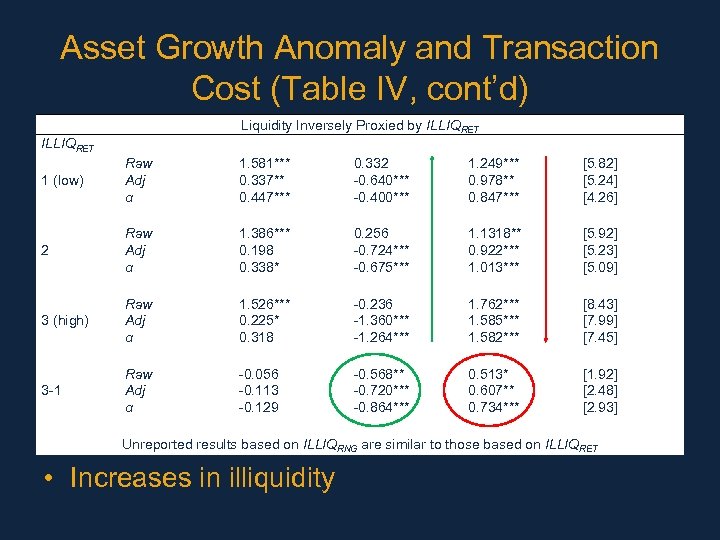

Asset Growth Anomaly and Transaction Cost (Table IV, cont’d) Liquidity Inversely Proxied by ILLIQRET 1 (low) Raw Adj α 1. 581*** 0. 337** 0. 447*** 0. 332 -0. 640*** -0. 400*** 1. 249*** 0. 978** 0. 847*** [5. 82] [5. 24] [4. 26] 2 Raw Adj α 1. 386*** 0. 198 0. 338* 0. 256 -0. 724*** -0. 675*** 1. 1318** 0. 922*** 1. 013*** [5. 92] [5. 23] [5. 09] 3 (high) Raw Adj α 1. 526*** 0. 225* 0. 318 -0. 236 -1. 360*** -1. 264*** 1. 762*** 1. 585*** 1. 582*** [8. 43] [7. 99] [7. 45] 3 -1 Raw Adj α -0. 056 -0. 113 -0. 129 -0. 568** -0. 720*** -0. 864*** 0. 513* 0. 607** 0. 734*** [1. 92] [2. 48] [2. 93] Unreported results based on ILLIQRNG are similar to those based on ILLIQRET • Increases in illiquidity

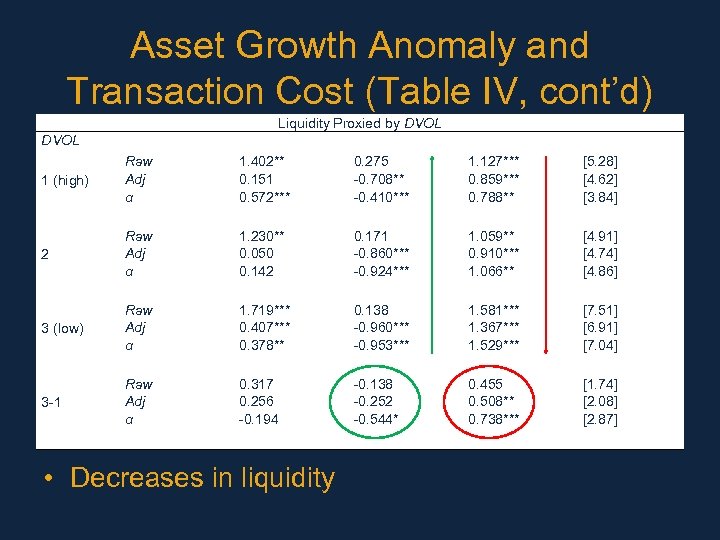

Asset Growth Anomaly and Transaction Cost (Table IV, cont’d) Liquidity Proxied by DVOL 1 (high) Raw Adj α 1. 402** 0. 151 0. 572*** 0. 275 -0. 708** -0. 410*** 1. 127*** 0. 859*** 0. 788** [5. 28] [4. 62] [3. 84] 2 Raw Adj α 1. 230** 0. 050 0. 142 0. 171 -0. 860*** -0. 924*** 1. 059** 0. 910*** 1. 066** [4. 91] [4. 74] [4. 86] 3 (low) Raw Adj α 1. 719*** 0. 407*** 0. 378** 0. 138 -0. 960*** -0. 953*** 1. 581*** 1. 367*** 1. 529*** [7. 51] [6. 91] [7. 04] 3 -1 Raw Adj α 0. 317 0. 256 -0. 194 -0. 138 -0. 252 -0. 544* 0. 455 0. 508** 0. 738*** [1. 74] [2. 08] [2. 87] • Decreases in liquidity

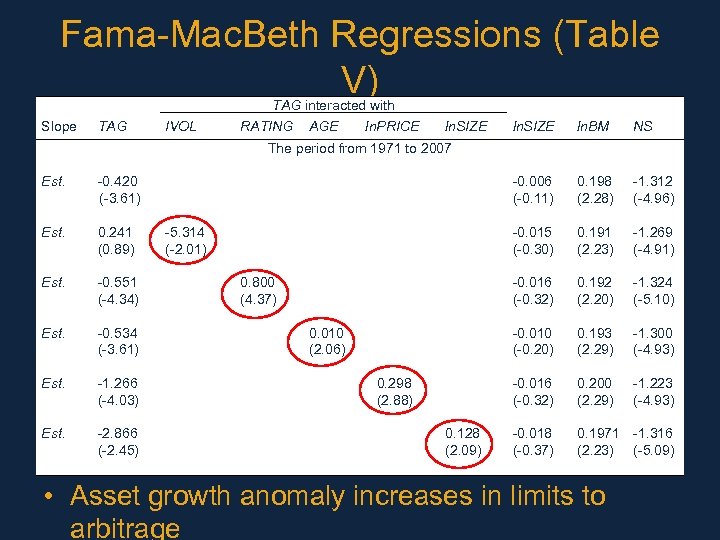

Fama-Mac. Beth Regressions (Table V) TAG interacted with Slope TAG IVOL RATING AGE ln. PRICE ln. SIZE ln. BM NS -0. 006 (-0. 11) 0. 198 (2. 28) -1. 312 (-4. 96) -0. 015 (-0. 30) 0. 191 (2. 23) -1. 269 (-4. 91) -0. 016 (-0. 32) 0. 192 (2. 20) -1. 324 (-5. 10) -0. 010 (-0. 20) 0. 193 (2. 29) -1. 300 (-4. 93) -0. 016 (-0. 32) 0. 200 (2. 29) -1. 223 (-4. 93) -0. 018 (-0. 37) 0. 1971 -1. 316 (2. 23) (-5. 09) The period from 1971 to 2007 Est. -0. 420 (-3. 61) Est. 0. 241 (0. 89) Est. -0. 551 (-4. 34) Est. -0. 534 (-3. 61) Est. -1. 266 (-4. 03) Est. -2. 866 (-2. 45) -5. 314 (-2. 01) 0. 800 (4. 37) 0. 010 (2. 06) 0. 298 (2. 88) 0. 128 (2. 09) • Asset growth anomaly increases in limits to arbitrage

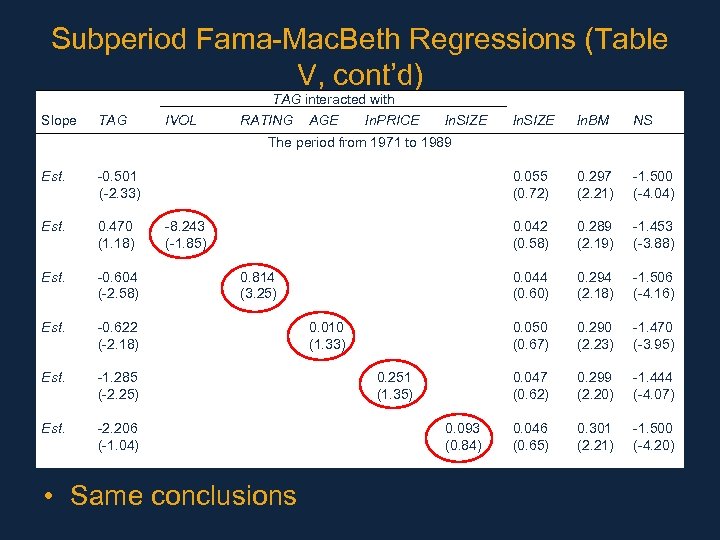

Subperiod Fama-Mac. Beth Regressions (Table V, cont’d) TAG interacted with Slope TAG IVOL RATING AGE ln. PRICE ln. SIZE ln. BM NS 0. 055 (0. 72) 0. 297 (2. 21) -1. 500 (-4. 04) 0. 042 (0. 58) 0. 289 (2. 19) -1. 453 (-3. 88) 0. 044 (0. 60) 0. 294 (2. 18) -1. 506 (-4. 16) 0. 050 (0. 67) 0. 290 (2. 23) -1. 470 (-3. 95) 0. 047 (0. 62) 0. 299 (2. 20) -1. 444 (-4. 07) 0. 046 (0. 65) 0. 301 (2. 21) -1. 500 (-4. 20) The period from 1971 to 1989 Est. -0. 501 (-2. 33) Est. 0. 470 (1. 18) Est. -0. 604 (-2. 58) Est. -0. 622 (-2. 18) Est. -1. 285 (-2. 25) Est. -2. 206 (-1. 04) -8. 243 (-1. 85) 0. 814 (3. 25) • Same conclusions 0. 010 (1. 33) 0. 251 (1. 35) 0. 093 (0. 84)

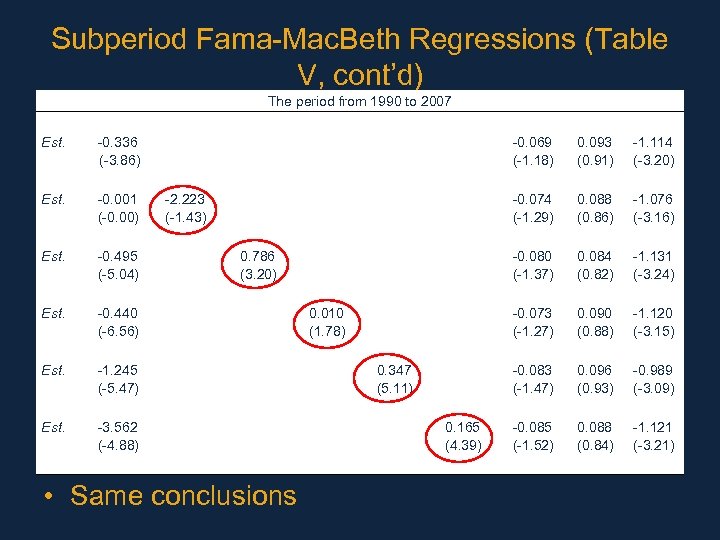

Subperiod Fama-Mac. Beth Regressions (Table V, cont’d) The period from 1990 to 2007 Est. -0. 336 (-3. 86) Est. -0. 001 (-0. 00) Est. -0. 495 (-5. 04) Est. -0. 440 (-6. 56) Est. -1. 245 (-5. 47) Est. -3. 562 (-4. 88) -0. 069 (-1. 18) • Same conclusions 0. 165 (4. 39) 0. 084 (0. 82) -1. 131 (-3. 24) 0. 090 (0. 88) -1. 120 (-3. 15) -0. 083 (-1. 47) 0. 347 (5. 11) -1. 076 (-3. 16) -0. 073 (-1. 27) 0. 010 (1. 78) 0. 088 (0. 86) -0. 080 (-1. 37) 0. 786 (3. 20) -1. 114 (-3. 20) -0. 074 (-1. 29) -2. 223 (-1. 43) 0. 093 (0. 91) 0. 096 (0. 93) -0. 989 (-3. 09) -0. 085 (-1. 52) 0. 088 (0. 84) -1. 121 (-3. 21)

Conclusion • We investigate and find evidence that limits to arbitrage plays a significant role in the asset growth anomaly • It seems that limits to arbitrage slow down the flow of information about fundamental changes into stock prices and delay mispricing from being corrected • Also help reconcile recent mixed findings – Cooper et al. (JF, 2008) • Among all size firms, but weaker among large firms – Fama and French (JF, 2008) • Insignificant for big firms – Both consistent with limits to arbitrage • Thanks!

7c445626f14a4d2ac3ec6e1d5f59aa17.ppt