7cc4de43c60e9b613ed1e39c9d0b0137.ppt

- Количество слайдов: 31

LIMITED LIABILITY PARTNERSHIP Overview & Tax Issues on Conversion to LLP CA AKSHAY K GUPTA- Kanpur

LIMITED LIABILITY COMPANY • LEGAL ENTITY • PERPETUAL SUCCESSION • LIMITED LIABILITY • SEPERATION OF OWNERSHIP & MANAGEMENT • CORPORATE DEMOCRACY

UNLIMITED LIABILITY PARTNERSHIP Partnership is an agreement between two and more persons to work for each other to carry on a business or profession for profits or gains. • An agreement or arrangement between two or more persons: No legal entity separate from partners-unlimited joint and several liability • To work for each other: agent for each other. Acts of one may effect others. • Carry on a business or profession: essentially for business or profession • Share profits or gains: sharing of profits or gains may not be of losses

THE LIMITED LIABILITY PARTNERSHIP ACT 2008 An overview

APPLICABILITY & STRUCTURE SEC 1: Whole of India from 7 th January 2009 (Rules Notified w. e. f 1 st April 2009) SEC 3: -LLP a body corporate incorporated under the Act -LLP shall have perpetual succession -Change in partners –no effect in existence, rights or liabilities of LLP SEC 66: Partner may lend or transact business with LLP as another person SEC 4: Partnership Act do not apply SEC 67: Companies Act not to apply-Except as specified by central government

PARTNERS AND THEIR RELATIONS SEC 6: - Minimum two partners Below two for six months - Individual obligation SEC 22: Who are Partners - Subscribers to incorporation documents are partners -New partner with LLP agreement SEC 23: Relationship of partners -Mutual rights and duties of partners interse and with LLP as per agreement -Agreement and changes to file with registrar-Form 3 -If no agreement First schedule apply continued……

……. continued SEC 24: Cessation of Partner Interest -As per agreement -Notice not less than 30 days -Death of a partner -Dissolution of LLP SEC 24(5): Former Partner entitle to: Capital contribution Share in accumulated profits less losses SEC 25: Changes in partners to be registered

EXTENT AND LIMITATION OF LIABILITY SEC 26: Partner agent of LLP, not of other partners SEC 27: -LLP liable for all the acts of partnersincluding wrongful act or omission-done in ordinary course or with authority -LLP not bound by partners unauthorized Act and person known he has no authority or person does not know him as a partner -LLP sole obligation-not of partners -LLP liability out of LLP property Continued…. .

……continued SEC 28: -Partners not personally liable for LLP obligation -Partners may be liable for own wrongful act or omission. Not other partners SEC 30: Unlimited liability in case of fraud

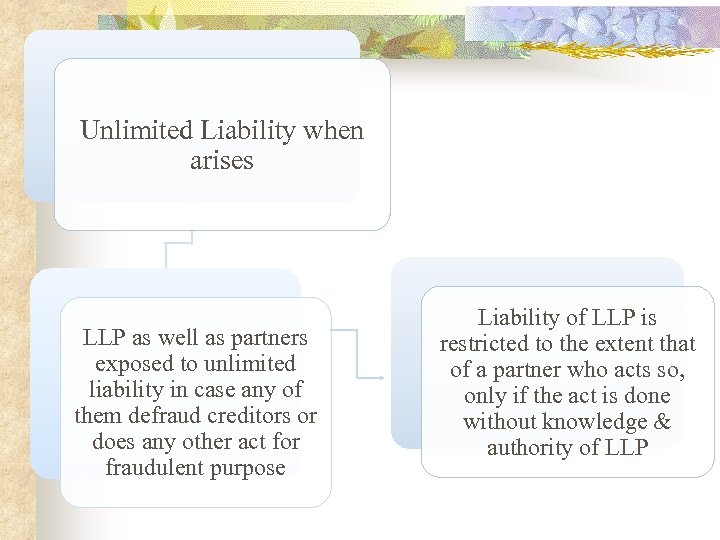

Unlimited Liability when arises LLP as well as partners exposed to unlimited liability in case any of them defraud creditors or does any other act for fraudulent purpose Liability of LLP is restricted to the extent that of a partner who acts so, only if the act is done without knowledge & authority of LLP

CONTRIBUTIONS SEC 32: -Contribution of a partner may be of Tangible or Intangible property -Cash or in kind or services SEC 33: Obligation to contribute as per LLP agreement -Creditor acting in reliance of LLP agreement may enforce original obligation against such partner

ASSIGNMENT AND TRANSFER OF PARTNERSHIP RIGHTS SEC 42: Rights to profits and losses and distributions of LLP are transferable-wholly or in part -Transfer itself is not disassociation of partner or dissolution of LLP -Transferee does not by itself entitle him the right to manage or information

DESIGNATED PARTNERS SEC 7: Minimum 2 individual designated partners One shall be resident in India Designated Partner Identification No – Form 7 Particulars and consent to be filed – Form 4 SEC 7(2): Designated partners— As specified in incorporation document As specified in LLP agreement with prior consent Sec 8: Designated partners liability— To comply provisions of the Act Liable for all penalties.

OTHER PROVISIONS SEC 34: Maintenance of accounts compulsory File annual statement of accounts and Solvency –Form 8. Accounts shall be audited if contribution exceed 25 lakh or turnover exceed 40 lakhs. SEC 35: Annual Return within 60 days of financial year – Form 11 SEC 43 -54: Inspection of LLP. SEC 63 -65: Winding up voluntary or tribunal SEC 55 -58: Conversion – Firm to LLP Private company to LLP Public company to LLP

Beneficial Features of LLP n n n n Partners Shielded with Joint Liability Flexibility in Mutual Relations Acceptance of Deposit Rules Not Apply No Restrictions of Loans to Partners or Related Parties Withdrawal of Capital & Profits No Restrictions Managerial Remuneration Rigors/Compliances of Co. Act not Apply

CONVERSION FROM FIRM TO LLP (SECOND SCHEDULE) n With the consent and shall comprise of all the partners. n Application with the registrar. Form 17 n All movable, immovable property, interests, rights, privileges, liabilities, obligations shall transfer. n Partners liable for Act prior to conversion although the LLP may indemnify to the partners.

CONVERSION FROM PRIVATE COMPANY TO LLP(THIRD SCHEDULE) n Partners of LLP comprises of all the shareholders and no one else. n Statement by all the shareholders. n All movable, immovable property, interests, rights, privileges, liabilities, obligations & whole of the undertaking will be transferred to LLP. n Company shall be deemed to dissolved & removed from the register of ROC.

CONVERSION FROM UNLISTED PUBLIC CO. TO LLP(FOURTH SCHEDULE) n Partners of LLP comprises of all the shareholders and no one else. n Statement by all the shareholders. n All movable, immovable property, interests, rights, privileges, liabilities, obligations & whole of the undertaking will be transferred to LLP. n Company shall be deemed to dissolved & removed from the register of ROC.

RESULT OF CONVERSION Ø All Properties, assets, interest, rights, privileges, liabilities, and obligations relating to the company and the whole of the undertaking of the firm/company shall be transferred to and shall vest in the LLP. Ø No further assurance, act or deed is required. Ø The firm/company shall stand dissolved and shall be removed from the records under Partnership Act/records of the Registrar of Companies.

CONVERSION NOT TO EFFECT : Ø Pending proceedings Ø Any conviction, ruling, judgement or order Ø All deeds, contracts (including contracts of employment ), schemes, bonds, agreements, applications, instruments and arrangements subsisting immediately before the date of registration Ø Any appointment, authority, or power of the firm/company

CONVERSION NOT TO APPLY TO: Ø Any approval, permit or licence issued under any written law to the firm/company

TAXATION Ø Most countries treat LLPs as pass through entities Ø Share of income and capital gains taxed in the hands of partners Ø In UK, tax relief for interest and trading losses against partner’s income other than from LLP, limited to capital contribution Ø However, both US and UK require the LLP to file an annual return showing details of the whole partnership

Taxation in India n n As a Partnership Firm Sec 2(23)(i): Firm includes LLP Sec 2(23)(ii)(b): Partner shall mean Partner under LLP Sec 2(23)(iii): Partnership shall mean Partnership in LLP

Tax benefits to LLP v Company n n n No Dividend Distribution Tax No Minimum Alternate Tax But Alternate Minimum Tax 115 JC No Deemed Dividend u/s 2(22) No Application Explanation to Section 73 Interest on Capital allowable Salary to Partners

Tax neutral conversions of companies into LLP n n n [47(xiiib) (w. e. f 1. 4. 2011)] Conversion in accordance with LLP Act All assets and liabilities of company to LLP All shareholders to become partners in LLP with capital contribution and profit sharing ratio in the proportion of shareholding Aggregate of profit sharing ratio of the shareholders of company in LLP ≥ 50% for a period of 5 years

. . . Tax Neutral Company to LLP n n n Shareholders not to receive any consideration or benefit, directly/indirectly, in any form except by way of share in profit and capital contribution in LLP Sales, turnover or gross receipts in business of company in any of 3 years < INR 6 million No direct / indirect payment to any partner out of accumulated profits of company for a period of 3 years post conversion date

Other Provisions on Conversion Only to conversion u/s 47(xiiib) § Carry forward losses and depreciation § WDV of company to be the Cost of LLP § Depreciation as if no transfer § Amortization of VRS to be allowed

No Tax Provision For n n n n TDS & Tax Credit MAT Credit will lapse 115 JA(7) 43 B payments by LLP Benefits u/s 80 IA- 80 IB etc Date of Acquisition of assets converted Cost step up if benefit forfeited Conversion of firm into LLP

Tax on Conversion of Firm/other companies to LLP n n n No Specific Provision in IT Act Finance Bill 2009 Memorandum- no tax implications if same rights of partners CIT vs. Texspin Engineering 263 ITR 345 Effect of Definition of Convert in LLP Act Taxability of partners/shareholders Whether Extinguishment of rights in shares

Other Issues n n n Transfer of Stocks and other assets Interse transfer of shares after conversion Stamp Duty 50 C Vat and Excise on Conversion Cenvat & Vat credit

THANK YOU

7cc4de43c60e9b613ed1e39c9d0b0137.ppt