1b740fcb2dbb61b0c19887ccb16a330f.ppt

- Количество слайдов: 75

Life, Money, and You Ms. Grinde

Life, Money, and You Ms. Grinde

Unit 2: Budgeting Review Jeopardy! • Today we will review the material we’ve learned in Unit 2: Budgeting by playing a game of jeopardy! You are ALLOWED to use your notes, but the more you know off hand, the better! This review will be great to assess your knowledge of the learning objectives in Unit 2. • First let’s cover the rules & then divide into teams!

Unit 2: Budgeting Review Jeopardy! • Today we will review the material we’ve learned in Unit 2: Budgeting by playing a game of jeopardy! You are ALLOWED to use your notes, but the more you know off hand, the better! This review will be great to assess your knowledge of the learning objectives in Unit 2. • First let’s cover the rules & then divide into teams!

Rules: • The Jeopardy board consists of 30 questions, divided into six categories. There will be TWO teams. The game starts when the first team chooses a category and question with a corresponding point value. • The higher the point value, the more difficult the question. • The ‘questions’ are actually posed as statements and you must answer the ‘questions’ in the form of a question. • When questions are asked either team can buzz in to answer. Your team will have 15 seconds to answer before your turn is loss and the opposing team can try to answer. • The team that answers correctly gains control of the board and picks next question.

Rules: • The Jeopardy board consists of 30 questions, divided into six categories. There will be TWO teams. The game starts when the first team chooses a category and question with a corresponding point value. • The higher the point value, the more difficult the question. • The ‘questions’ are actually posed as statements and you must answer the ‘questions’ in the form of a question. • When questions are asked either team can buzz in to answer. Your team will have 15 seconds to answer before your turn is loss and the opposing team can try to answer. • The team that answers correctly gains control of the board and picks next question.

Rules: • The board contains ‘double jeopardy’ questions. At this time only the team who landed on the ‘D. J. ’ can answer. You will wager (maximum: your total score) what you’d like to bet on the question BEFORE seeing it. You will have 30 seconds to answer. • The final jeopardy round will be a single question posed to each team. You will see the category, and then be asked to wager (maximum: total score). You will be asked the question and have 30 seconds to WRITE down the answer (remember: In the form of a question). • The team with the highest score at the end of the final jeopardy round WINS!

Rules: • The board contains ‘double jeopardy’ questions. At this time only the team who landed on the ‘D. J. ’ can answer. You will wager (maximum: your total score) what you’d like to bet on the question BEFORE seeing it. You will have 30 seconds to answer. • The final jeopardy round will be a single question posed to each team. You will see the category, and then be asked to wager (maximum: total score). You will be asked the question and have 30 seconds to WRITE down the answer (remember: In the form of a question). • The team with the highest score at the end of the final jeopardy round WINS!

Now Let’s Play!

Now Let’s Play!

THIS IS

THIS IS

With Your Host. . .

With Your Host. . .

Understanding Your Paycheck Receiving $ From Government Spending Plans Taxes 100 100 200 300 Living Expenses Random Fun 100 100 200 200 300 300 300 400 400 400 500 500 500

Understanding Your Paycheck Receiving $ From Government Spending Plans Taxes 100 100 200 300 Living Expenses Random Fun 100 100 200 200 300 300 300 400 400 400 500 500 500

The percentage of one’s paycheck that is deducted. A 100

The percentage of one’s paycheck that is deducted. A 100

What is 31%? A 100

What is 31%? A 100

The largest deduction with held from one’s paycheck. A 200

The largest deduction with held from one’s paycheck. A 200

What is federal withholding tax? A 200

What is federal withholding tax? A 200

These are three ways in which an employer can pay their employees. A 300

These are three ways in which an employer can pay their employees. A 300

What are payroll card, paycheck, and direct deposit? A 300

What are payroll card, paycheck, and direct deposit? A 300

An employee’s earnings before deductions. A 400

An employee’s earnings before deductions. A 400

What is gross income? A 400

What is gross income? A 400

The paycheck amount and this income amount are the same. A 500

The paycheck amount and this income amount are the same. A 500

What is net income? A 500

What is net income? A 500

All government assistance programs are intended for use for this amount of time. B 100

All government assistance programs are intended for use for this amount of time. B 100

What is a temporary (or short amount of time)? B 100

What is a temporary (or short amount of time)? B 100

An action that you can do with your fingers or a temporary government assistance program to buy food. B 200

An action that you can do with your fingers or a temporary government assistance program to buy food. B 200

What is S. N. A. P (Supplemental Nutrition Assistance Program)? B 200

What is S. N. A. P (Supplemental Nutrition Assistance Program)? B 200

A tax that is quite controversial and provides a small income and services to the elderly, disabled, and orphaned minors. B 300

A tax that is quite controversial and provides a small income and services to the elderly, disabled, and orphaned minors. B 300

What is social security? B 300

What is social security? B 300

A worker who has been let go or laid off receives this stipend from the government. B 400

A worker who has been let go or laid off receives this stipend from the government. B 400

What is unemployment insurance? B 400

What is unemployment insurance? B 400

This government program provides medical care to the elderly and people with disabilities. B 500

This government program provides medical care to the elderly and people with disabilities. B 500

What is medicare? B 500

What is medicare? B 500

A plan for managing your money during a given period of time. C 100

A plan for managing your money during a given period of time. C 100

What is a spending plan/budget? C 100

What is a spending plan/budget? C 100

For those living on this ‘federal and state determined ‘least amount earnings’, budgeting is even more critical. C 200

For those living on this ‘federal and state determined ‘least amount earnings’, budgeting is even more critical. C 200

What is minimum wage? C 200

What is minimum wage? C 200

In order to Budget, you must first determine what is the money you have coming in and out. C 300

In order to Budget, you must first determine what is the money you have coming in and out. C 300

What is cash flow? C 300

What is cash flow? C 300

DAILY Place A Wager DOUBLE C 400

DAILY Place A Wager DOUBLE C 400

Name 5 of the 7 government assistance programs. C 400

Name 5 of the 7 government assistance programs. C 400

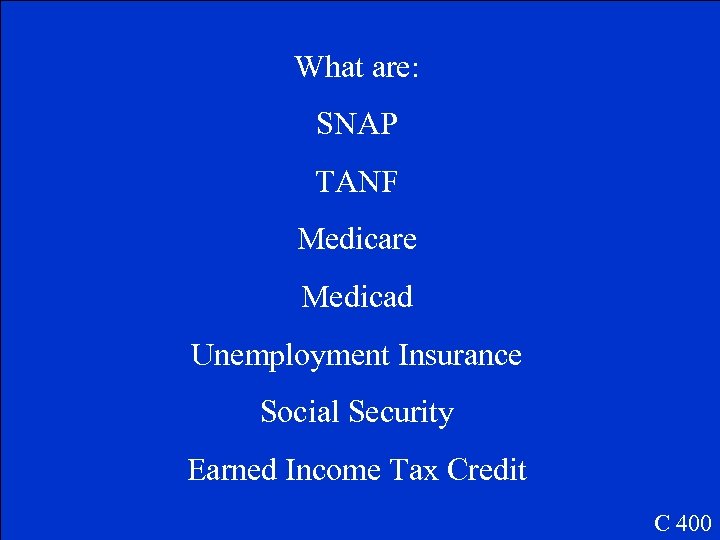

What are: SNAP TANF Medicare Medicad Unemployment Insurance Social Security Earned Income Tax Credit C 400

What are: SNAP TANF Medicare Medicad Unemployment Insurance Social Security Earned Income Tax Credit C 400

When budgeting a meal, a family can buy this instead of brand name foods to save money. C 500

When budgeting a meal, a family can buy this instead of brand name foods to save money. C 500

What is generic/or store brand? C 500

What is generic/or store brand? C 500

This term can label every person who receives a paycheck. D 100

This term can label every person who receives a paycheck. D 100

What is a taxpayer? D 100

What is a taxpayer? D 100

Taxes issued on a house or land. D 200

Taxes issued on a house or land. D 200

What are property taxes? D 200

What are property taxes? D 200

Responsible for collecting federal taxes, issues regulations, and enforcing tax laws written by the United States Congress. D 300

Responsible for collecting federal taxes, issues regulations, and enforcing tax laws written by the United States Congress. D 300

What is the IRS or Internal Revenue Service? D 300

What is the IRS or Internal Revenue Service? D 300

Taxes are enforced at these three levels. D 400

Taxes are enforced at these three levels. D 400

What are local, state, and federal? D 400

What are local, state, and federal? D 400

The tax on money you make. D 500

The tax on money you make. D 500

What is income tax? D 500

What is income tax? D 500

A type of expense that changes month to month. E 100

A type of expense that changes month to month. E 100

What is a variable expense? E 100

What is a variable expense? E 100

An expense that is the same month to month. E 200

An expense that is the same month to month. E 200

What is a fixed expense? E 200

What is a fixed expense? E 200

An expense that comes about every once in a while, like a 6 month car insurance payment. E 300

An expense that comes about every once in a while, like a 6 month car insurance payment. E 300

What is a periodic expense? E 300

What is a periodic expense? E 300

The most important expense is also the person you should pay first when you receive a paycheck. E 400

The most important expense is also the person you should pay first when you receive a paycheck. E 400

What is PYF (yourself!)? E 400

What is PYF (yourself!)? E 400

As you get older you will have _______ expenses, compared to now. E 500

As you get older you will have _______ expenses, compared to now. E 500

What is more/more expensive? E 500

What is more/more expensive? E 500

Some possibilities of this are state plan, local plan, or a 401(k). F 100

Some possibilities of this are state plan, local plan, or a 401(k). F 100

What is a retirement plan? F 100

What is a retirement plan? F 100

This person relies on the taxpayer for financial support. F 200

This person relies on the taxpayer for financial support. F 200

What is a dependent? F 200

What is a dependent? F 200

This program temporarily fund families with income to help them achieve self sufficiency. F 300

This program temporarily fund families with income to help them achieve self sufficiency. F 300

What is TANF? F 300

What is TANF? F 300

The form issued to verify eligibility of people to avoid hiring undocumented workers. F 400

The form issued to verify eligibility of people to avoid hiring undocumented workers. F 400

What is the I-9 form? F 400

What is the I-9 form? F 400

The grade everyone is going to receive on the Unit 2 Exam. F 500

The grade everyone is going to receive on the Unit 2 Exam. F 500

What is an A? F 500

What is an A? F 500

The Final Jeopardy Category is: Smart Spending Please record your wager. Click on screen to begin

The Final Jeopardy Category is: Smart Spending Please record your wager. Click on screen to begin

Final Jeopardy Question: What was the most important thing you learned about your spending habits after tracking your expenses this unit? Why was it important? How will you use this information in the future? Click on screen to continue

Final Jeopardy Question: What was the most important thing you learned about your spending habits after tracking your expenses this unit? Why was it important? How will you use this information in the future? Click on screen to continue

Answers will vary: What was the important thing? Why was it important? How will you use it in the future? Click on screen to continue

Answers will vary: What was the important thing? Why was it important? How will you use it in the future? Click on screen to continue

Thank You for Playing Jeopardy! Game Designed By C. Harr-MAIT

Thank You for Playing Jeopardy! Game Designed By C. Harr-MAIT

Reflection: • Take out a piece of paper and reflect on the Unit 2 review game. Write down three things that we’ve learned over the Unit that you think are most important and explain why. Also, write down one thing you think you still need to learn more about/review before our exam tomorrow.

Reflection: • Take out a piece of paper and reflect on the Unit 2 review game. Write down three things that we’ve learned over the Unit that you think are most important and explain why. Also, write down one thing you think you still need to learn more about/review before our exam tomorrow.