b8c9a2c922ba1893c2850b7fb7e79170.ppt

- Количество слайдов: 15

Licensing Biotechnology In-Chull Kim

R&D Expenditure in Korea World Rank √ √ √ #7 in R&D Expenditure #4 in Ratio to GDP #5 for IP Applications R&D Expenditure and as % of GDP (2008) IP Applications (2010) Rank 1 USA 44, 855 11. 7% Japan 32, 156 7. 9% Germany 17, 171 2. 2% China 12, 337 56. 2% 5 Republic of Korea 9, 686 20. 5% 6 France 7, 193 -0. 6% 7 England 4, 857 -3. 7% 8 Netherland 4, 097 -6. 2% 9 Switzerland 3, 611 -1. 6% 10 US Ja A Ge pan rm an y Ch i Fr na Re an pu c bl Eng e ic la n of Ko d re Ca a na da Ita lia Sp ai Sw n ed e Ru n Ne ss th er ia la nd Sw is Ta s iw Au an st Fi ria nl an d Is ra Be el lg De ium nm ar k % Change to Previous Year 4 Source : OECD, Main Science and Technology Indicators 2010 -1 # of IP Applications 3 KOREA Country 2 (M USD) Sweden 3, 152 -11. 6%

Korea’s Industrial Development Successful Growth in Various Industry Competitiveness of Korean Companies Success in … § Technical Competitiveness by Aggressive Investment § Qualified Human Resources 1 st 1 st § Agile Response to Market § Cost Competitiveness § Risk Taking & Speedy Decision Making

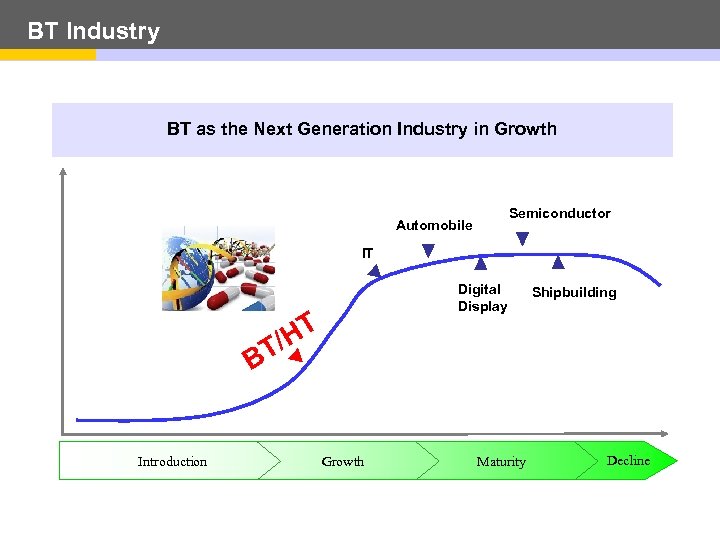

BT Industry BT as the Next Generation Industry in Growth Semiconductor Automobile IT Digital Display T /H T Shipbuilding B Introduction Growth Maturity Decline

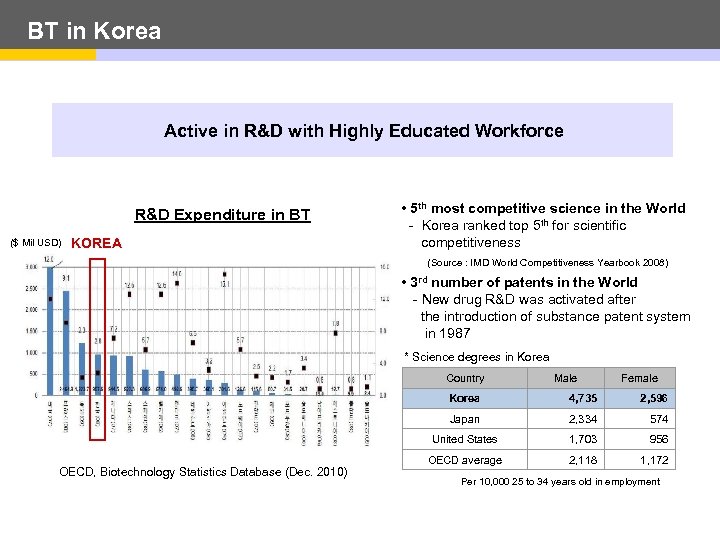

BT in Korea Active in R&D with Highly Educated Workforce R&D Expenditure in BT ($ Mil USD) KOREA • 5 th most competitive science in the World - Korea ranked top 5 th for scientific competitiveness (Source : IMD World Competitiveness Yearbook 2008) • 3 rd number of patents in the World - New drug R&D was activated after the introduction of substance patent system in 1987 * Science degrees in Korea Country Male Female Korea 2, 596 Japan 2, 334 574 United States OECD, Biotechnology Statistics Database (Dec. 2010) 4, 735 1, 703 956 OECD average 2, 118 1, 172 Per 10, 000 25 to 34 years old in employment

BT in Korea Excellent Industry Base & Governmental Support § Strong Pharmaceutical Industry & Positive Outlook for Growth § One of the More Developed Asian Pharma Markets § High Quality Medical Clinical Investigators & Regulatory Authority § “Collaboration friendly” Governmental Support § Easy to Expand in Emerging Markets

BT Collaboration • Strong in Early Development Stage • Promoting Full Development through License Agreement with Partners Year Relative Effort Select Targets Discovery Preclinical Phase I Warner Chilcott Erectile Dysfunction 2009 SK Chemicals CSL Hemophilia Dong Wha Teijin Osteoporosis 2007 LG Life Sciences Gilead Science Hepatitis C 2006 Dongbu Hannong Danube Pharma Glaucoma Il-Yang TAP Gastritis 2004 Phase II & III Global Marketing Dong-A 2005 Korean Company Technology 2008 Partner 2010 Core competence of Korean Company Bukwang Pharmasset Hepatitis B 2002 LG Life Sciences Gene. Soft Antibiotics 2000 SK J&J Depression 2000 Yuhan SKB Gastritis

LG Life Sciences § The Most R&D-driven Pharmaceutical Company in Korea with US FDA & EMEA Approved Drugs § Leveraging LG Group’s Competitive Advantages 98 B LG Group • Revenue in 2010: $312 M (Global: $140 M, Domestic: $172 M) • R&D Expenditure: $60 M Established in 1947 Revenue in 2010: $ 129 B Investment: $ 17 B • Spun-off from LG Chem in 2002 • 30 yr R&D Experience and Expertise 71 B 16 B 52 M 3. 2 B • Number of Employees: 1, 200 • Number of R&D Employees: 340 1970 1980 1990 2009

Strategic Alliances in LGLS Successful Partnership Experiences with Multinational Companies 2010 Nobel - DPP IV inhibitor 2009 DCPC – DPP IV inhibitor 2007 Gilead – Caspase Inhibitor Takeda - Obesity Pasteur institute - Cardiovascular disease 2004 Anadys Pharma - HBV treatment 1990 s Smith. Kline Beecham - Quinolone antibiotics Warner-Lambert - anti-coagulant Agouron - Anti-HIV Smith. Kline Beecham - Anti-virus program Bio. Partners - Bio Products Warner-Lambert - Oral thrombin inhibitor Glaxo - Cepha antibiotics

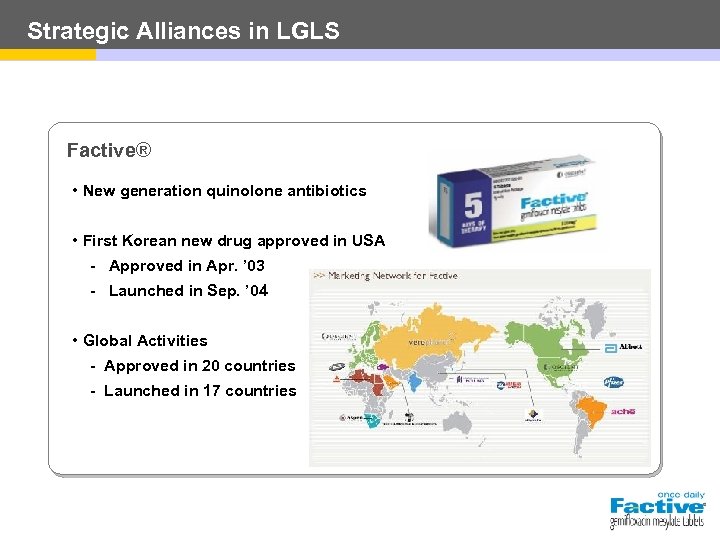

Strategic Alliances in LGLS Factive® • New generation quinolone antibiotics • First Korean new drug approved in USA - Approved in Apr. ’ 03 - Launched in Sep. ’ 04 • Global Activities - Approved in 20 countries - Launched in 17 countries

Strategic Alliances in LGLS l Caspase Inhibitor l Anti-Obesity Program - Signing Fee : $ 20 M - Signing Fee : $ 2 M - Total Milestone : $ 200 M - Total Milestone : $ 100 M

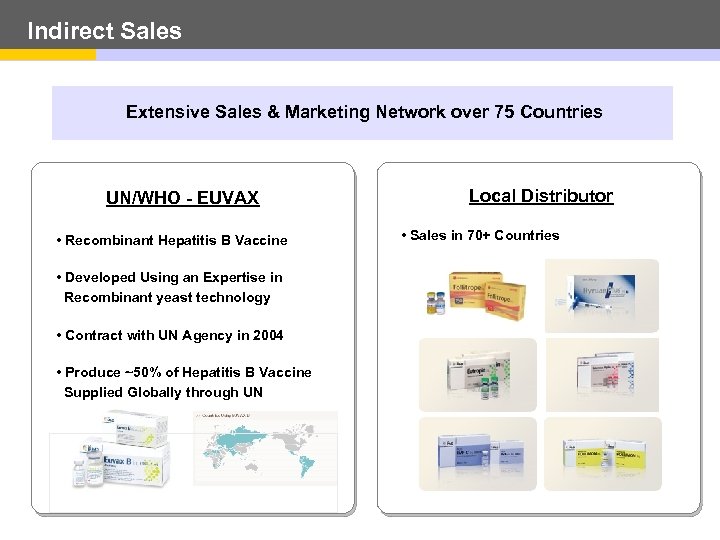

Indirect Sales Extensive Sales & Marketing Network over 75 Countries UN/WHO - EUVAX • Recombinant Hepatitis B Vaccine • Developed Using an Expertise in Recombinant yeast technology • Contract with UN Agency in 2004 • Produce ~50% of Hepatitis B Vaccine Supplied Globally through UN Local Distributor • Sales in 70+ Countries

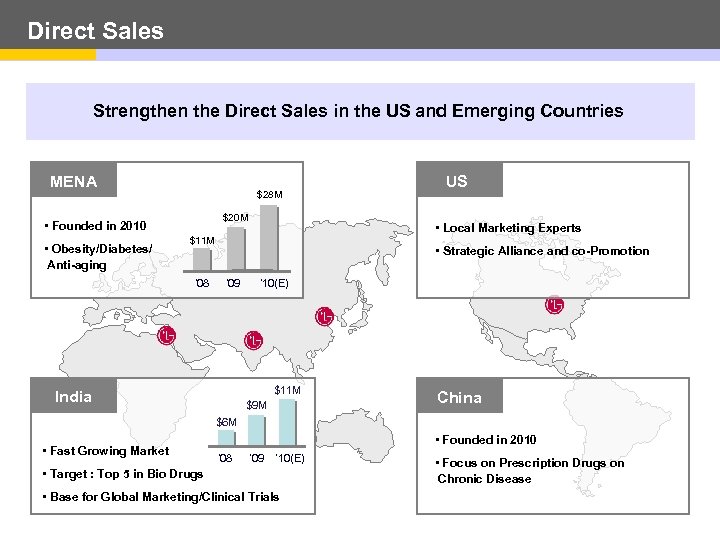

Direct Sales Strengthen the Direct Sales in the US and Emerging Countries MENA $28 M $20 M • Founded in 2010 • Obesity/Diabetes/ Anti-aging • Local Marketing Experts $11 M ’ 08 US • Strategic Alliance and co-Promotion ’ 09 ’ 10(E) $11 M India $9 M China $6 M • Fast Growing Market • Founded in 2010 ’ 08 ’ 09 ’ 10(E) • Target : Top 5 in Bio Drugs • Base for Global Marketing/Clinical Trials • Focus on Prescription Drugs on Chronic Disease

Alliances Driving Growth Korean Companies Partner (LG Life Sciences) Successful alliances Generate value and growth & Deliver better therapeutics to the patients

Thank You

b8c9a2c922ba1893c2850b7fb7e79170.ppt