f4eebae3ed10be162ceb7053db861b38.ppt

- Количество слайдов: 22

LGPS 2014 Cory Blose & Beth Sargent – Employer Liaison & Communication Officers

Mythbusters The Myths • The new scheme is not as good • There is no tax-free cash lump sum • Members will have to work forever • Benefits built up before 1 st April 2014 are affected by the changes

Objectives LGPS 2014: • What is it? • What’s Different? • How does it work? • What will it cost me? • Are there any protections?

What is it? • New look LGPS following public service pensions review • Developed to ensure the LGPS is sustainable and affordable in the long term • Fairer for members and tax payers • Launches 1 st April 2014

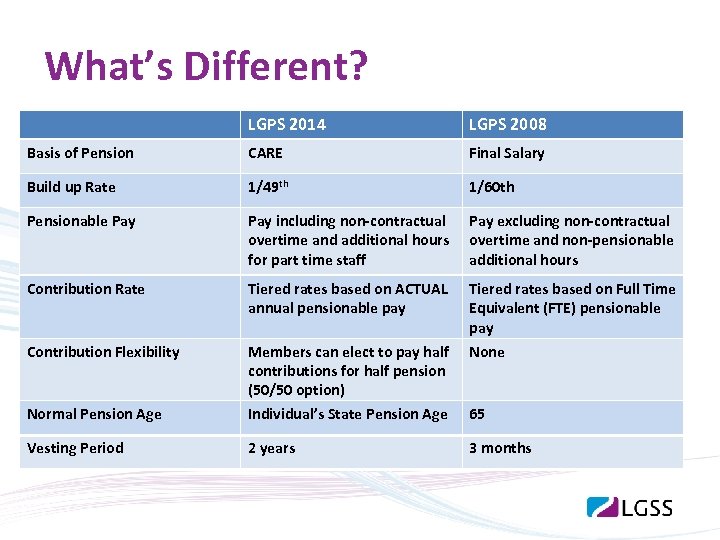

What’s Different? LGPS 2014 LGPS 2008 Basis of Pension CARE Final Salary Build up Rate 1/49 th 1/60 th Pensionable Pay including non-contractual overtime and additional hours for part time staff Pay excluding non-contractual overtime and non-pensionable additional hours Contribution Rate Tiered rates based on ACTUAL annual pensionable pay Contribution Flexibility Normal Pension Age Members can elect to pay half contributions for half pension (50/50 option) Individual’s State Pension Age Tiered rates based on Full Time Equivalent (FTE) pensionable pay None Vesting Period 2 years 65 3 months

What’s Staying the Same? • Secure, guaranteed benefits based on pay • Ability to convert Pension into Lump Sum (£ 1 of pension buys £ 12 of lump sum) • Tiered Ill Health Benefits • Death in Service Survivors Benefits • Protection against inflation

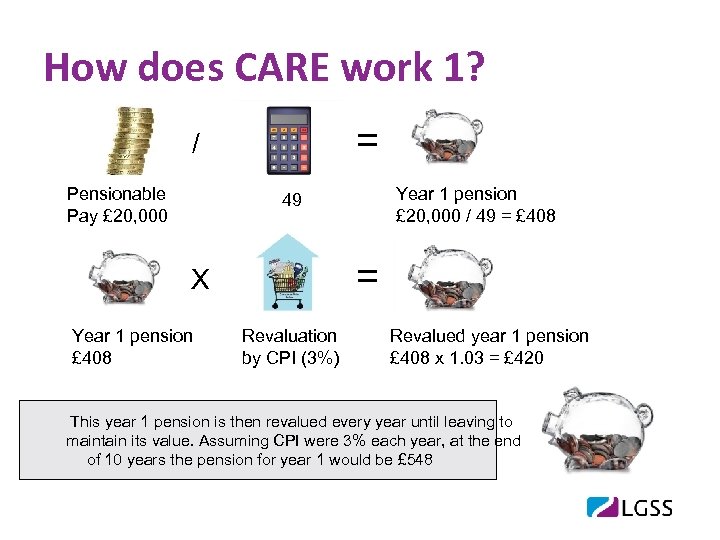

How does CARE work 1? = / Pensionable Pay £ 20, 000 Year 1 pension £ 20, 000 / 49 = £ 408 49 = X Year 1 pension £ 408 Revaluation by CPI (3%) Revalued year 1 pension £ 408 x 1. 03 = £ 420 This year 1 pension is then revalued every year until leaving to maintain its value. Assuming CPI were 3% each year, at the end of 10 years the pension for year 1 would be £ 548

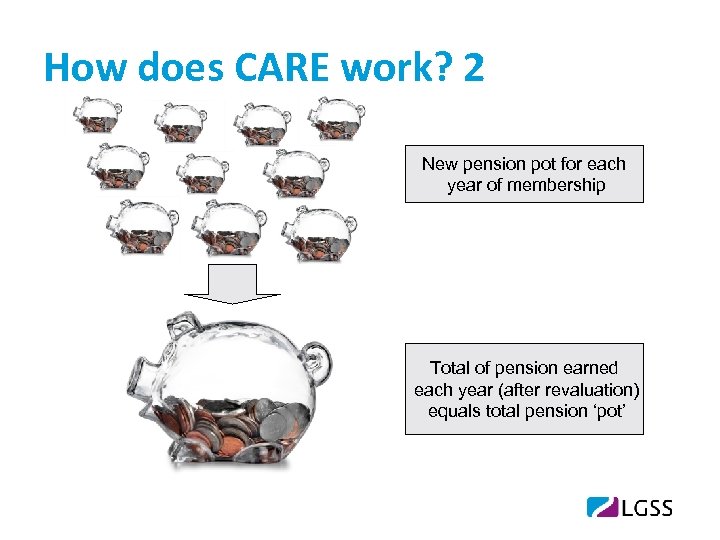

How does CARE work? 2 New pension pot for each year of membership Total of pension earned each year (after revaluation) equals total pension ‘pot’

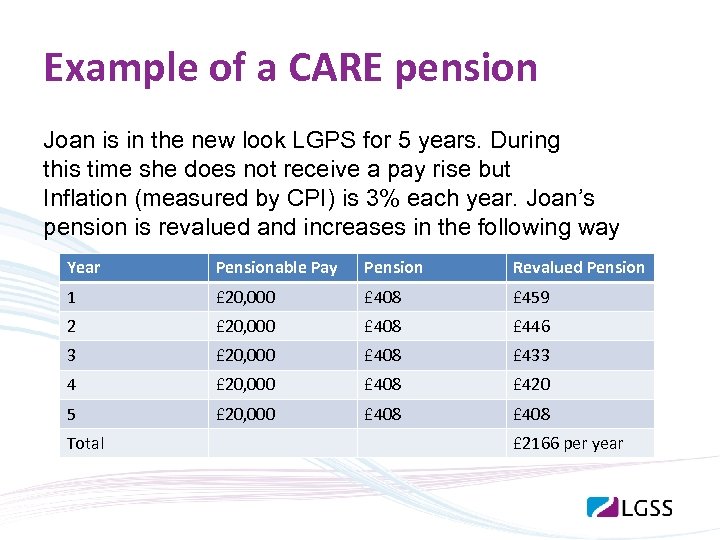

Example of a CARE pension Joan is in the new look LGPS for 5 years. During this time she does not receive a pay rise but Inflation (measured by CPI) is 3% each year. Joan’s pension is revalued and increases in the following way Year Pensionable Pay Pension Revalued Pension 1 £ 20, 000 £ 408 £ 459 2 £ 20, 000 £ 408 £ 446 3 £ 20, 000 £ 408 £ 433 4 £ 20, 000 £ 408 £ 420 5 £ 20, 000 £ 408 Total £ 2166 per year

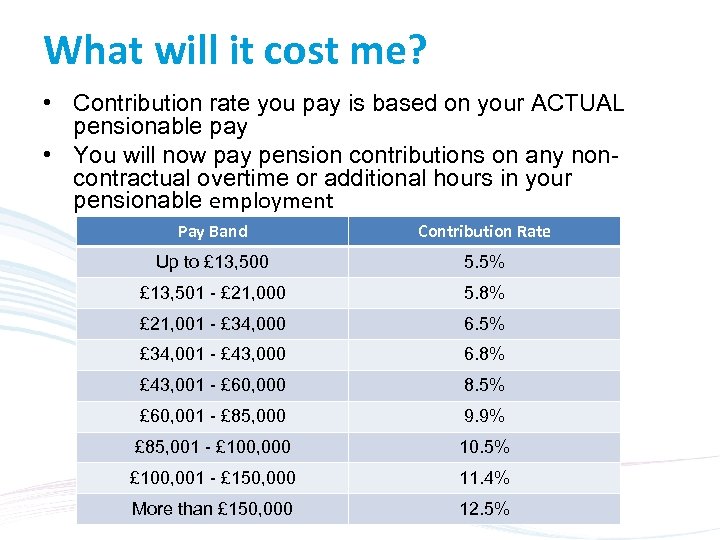

What will it cost me? • Contribution rate you pay is based on your ACTUAL pensionable pay • You will now pay pension contributions on any noncontractual overtime or additional hours in your pensionable employment Pay Band Contribution Rate Up to £ 13, 500 5. 5% £ 13, 501 - £ 21, 000 5. 8% £ 21, 001 - £ 34, 000 6. 5% £ 34, 001 - £ 43, 000 6. 8% £ 43, 001 - £ 60, 000 8. 5% £ 60, 001 - £ 85, 000 9. 9% £ 85, 001 - £ 100, 000 10. 5% £ 100, 001 - £ 150, 000 11. 4% More than £ 150, 000 12. 5%

50/50 Section • 50% contribution for 50% pension • Pension builds up at a rate of 1/98 th instead of 1/49 th • Other benefits paid in full e. g Death in Service • Short term solution

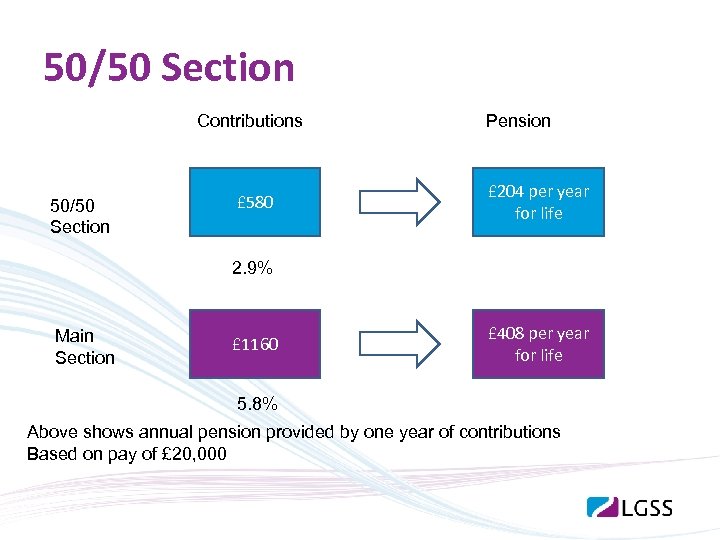

50/50 Section Contributions 50/50 Section £ 580 Pension £ 204 per year for life 2. 9% Main Section £ 1160 £ 408 per year for life 5. 8% Above shows annual pension provided by one year of contributions Based on pay of £ 20, 000

Can I still increase my Pension? • In LGPS 2014, you will have two tax efficient ways of making additional savings to increase your pension. These are: Ø Additional Voluntary Contributions (AVCs) – where you can invest money, deducted directly from your pay, through an AVC provider to provide additional retirement benefits Ø Additional Pension Contributions (APCs) – where you pay additional contributions to buy up to a maximum of £ 6, 500 additional pension

Can I still increase my Pension? • If you have a break in membership due to unpaid leave of absence, you can elect to pay an APC to buy the lost pension for that period • If you make an election to pay an APC within 30 days of returning to work, your employer shall pay 2/3 rds of the cost of the APC • If you wish to buy the lost pension for that period, but make this election after 30 days, you will have to pay the full cost of the APC

When can I take my benefits? • Normal Pension Age (NPA) = Individual State Pension Age (minimum age 65) • Increased flexibility – voluntarily draw benefits from age 55 • However, reduction if taken before NPA • Reduction based on how many years before NPA you draw your benefits • Increases apply if you take benefits after NPA • The extent of the reductions and increases has yet to be finalised with the Government Actuary's Department Protections for those who were members of the LGPS before 1 st April 2014 mean that different reductions or increases may apply to different parts of your benefits

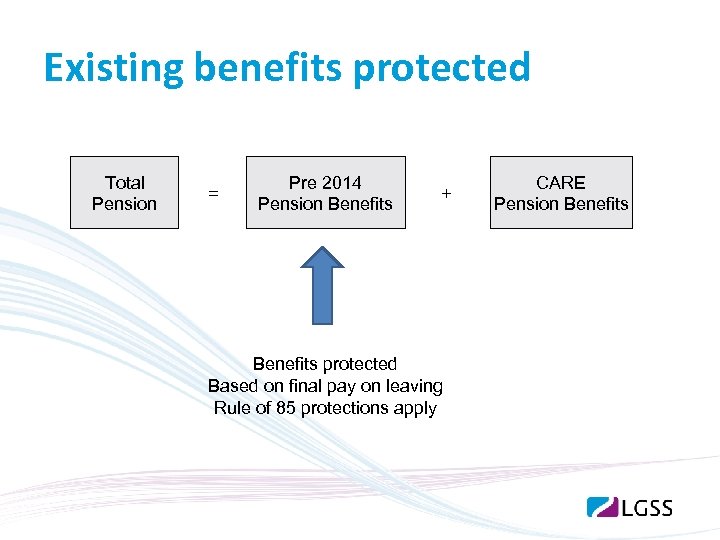

Are there any protections? • 1 st April 2014 – Everyone joins CARE scheme • Benefits built up to 31 st March 2014 protected for all members • Additional protection for those within 10 years of retirement as at 1 st April 2012

Existing benefits protected Total Pension = Pre 2014 Pension Benefits + Benefits protected Based on final pay on leaving Rule of 85 protections apply CARE Pension Benefits

Protection for members within 10 years of retirement as at April 2012 • Protection applies if you were: Ø an active member of the LGPS on 31 March 2012 and, Ø within 10 years of your then Normal Pension Age (i. e. 65) on 1 April 2012, Ø and you haven’t had a disqualifying break in membership of a public service pension scheme since 1 st April 2012 of more than 5 years • You will receive a pension at least equal to that which you would have received had the Scheme not changed on 1 April 2014 Please note: These are the provisions that are expected to be included in the Transitional Provisions Regulations, however these have yet to be formally agreed in Parliament

Myths busted The Myths • The new scheme is not as good • There is no tax-free cash lump sum • Members will have to work forever • Benefits built up before 1 st April 2014 are affected by the changes

Where Can I Find Out More? • The LGPS 2014 for Members page on our website – http: //pensions. cambridgeshire. gov. uk is up to date with the latest developments, relevant documents and links through to LGPS 2014 websites: – http: //lgps 2014. org/ (main LGPS 2014 site for members)

Disclaimer • This presentation is an overview of the LGPS 2014 and cannot cover every personal circumstance • Some legislation has not yet been agreed by Parliament so this information is what we understand to be true at this time and some of the details may be subject to change until the legislation has been agreed

Thank You. Any questions?

f4eebae3ed10be162ceb7053db861b38.ppt