5802a4a92158fd10e80dea55ce475a4b.ppt

- Количество слайдов: 22

LGPS 2011 Employer Training

Objectives • Understand what changes are being made • Know what you have to do to implement them

Areas to be covered • New contribution rates • What counts as pensionable pay • Eligibility to join the scheme • Casual employees • Buying additional benefits

Areas to be covered • Employer awards • Unpaid leave • Multiple employments • Ill-health retirements • Minimum retirement age

Contribution Rates • Everyone’s rate changed from 01. 04. 08 • Rate to be applied dependent on pensionable pay • For part-timers, use full–time equivalent pay to determine rate • For term-timers, use full-time, term-time pay to determine rate

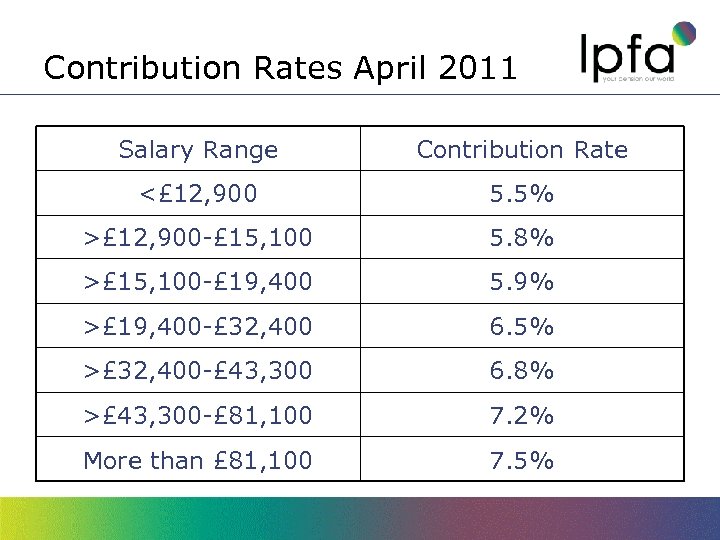

Contribution Rates April 2011 Salary Range Contribution Rate <£ 12, 900 5. 5% >£ 12, 900 -£ 15, 100 5. 8% >£ 15, 100 -£ 19, 400 5. 9% >£ 19, 400 -£ 32, 400 6. 5% >£ 32, 400 -£ 43, 300 6. 8% >£ 43, 300 -£ 81, 100 7. 2% More than £ 81, 100 7. 5%

Contribution Rates • Final decision on band belongs to employer • Example: Member has basic pay of £ 17, 500 and no pensionable extras – rate is 5. 9% Member has basic pay of £ 17, 500 and £ 3, 000 bonus – rate is 6. 5% Member has basic pay of £ 17, 500 and variable bonus – rate is employer’s decision

Contribution Rates • Member works 18 hours per week out of 36, parttime pay is £ 12, 000 pa, rate to use is 6. 5% (fulltime pay is £ 24, 000), membership is recorded as 50% • Member works full time week (36 hours) but only 48 weeks per year. Pay received is £ 17, 000, rate to use is 5. 9%, membership recorded as 92. 31% • Member works 18 hours per week out of 36 and 48 weeks per year. Pay received is £ 8, 500, rate to use is 5. 9% (full-time, term-time pay is £ 17, 000), membership recorded as 46. 15%

Contribution Rates • Bands increased each year in line with Orders made under Pensions (Increase) Act 1971 • Employer’s decision on if and when to review members’ rates • Options include: each time pay changes (i. e. promotion during the year), each 1 st April (or when cost of living increase applied), never

Contributions: Protected rate • Protected 5% rate abolished • Phased contribution rates until member matches normal rate • Contributions from 01. 04. 2011 in accordance with normal rate

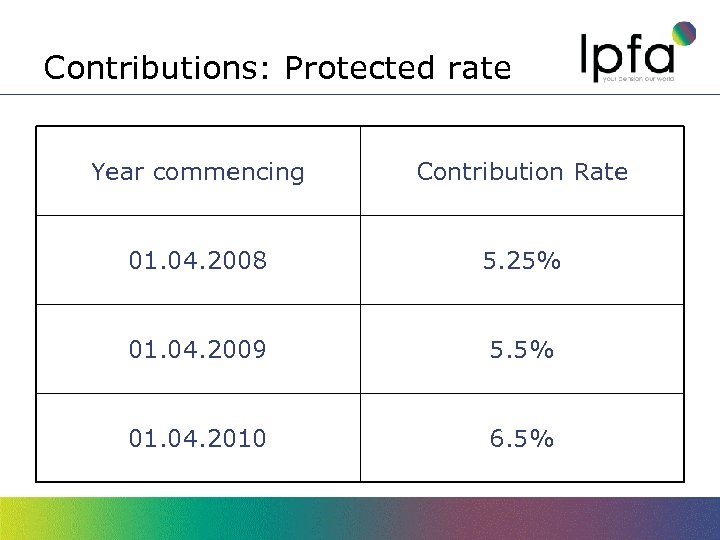

Contributions: Protected rate Year commencing Contribution Rate 01. 04. 2008 5. 25% 01. 04. 2009 5. 5% 01. 04. 2010 6. 5%

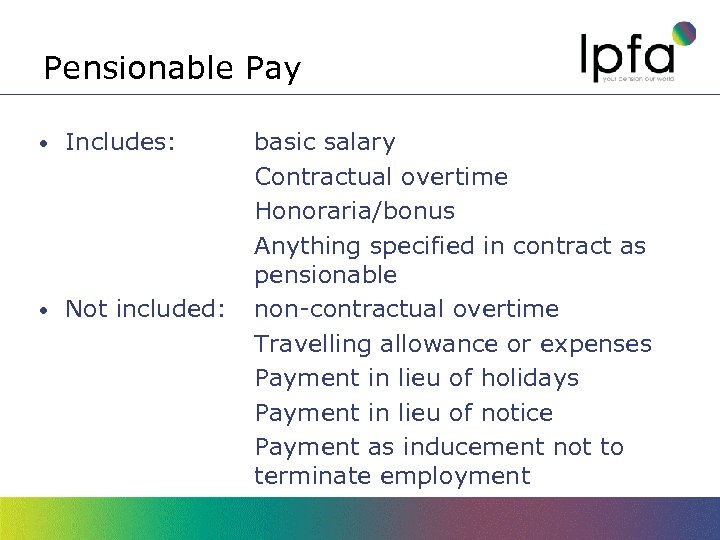

Pensionable Pay • Includes: • Not included: basic salary Contractual overtime Honoraria/bonus Anything specified in contract as pensionable non-contractual overtime Travelling allowance or expenses Payment in lieu of holidays Payment in lieu of notice Payment as inducement not to terminate employment

Eligibility • Last day in scheme must be no later than 2 days before 75 th birthday • Must have contract of at least 3 months • Effectively excludes some casual employees • Contributions can be backdated if contract extended beyond 3 months

Casual Employees • Mutuality of obligation: if you have work to offer it must be offered to that employee, who must accept • New casuals must have 3 month mutual obligation contract to be eligible • Current casuals must have mutuality of obligation to remain in scheme

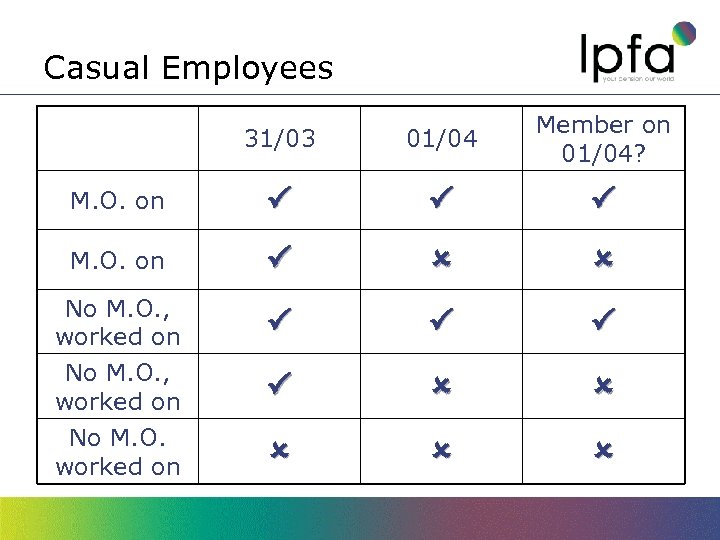

Casual Employees 31/03 01/04 Member on 01/04? M. O. on No M. O. , worked on No M. O. worked on

Additional Benefits • All AVCs and current added years contracts to continue as normal • Added years abolished • Replaced by additional pension • Can buy up to £ 5, 000 p. a. in multiples of £ 250 • Paid for by additional pension contributions • To be deducted in same way as added years contributions

Employer awards • Ability to award up to 10 years extra membership remains • New ability to award additional pension • Can award up to £ 5, 000 pa in multiples of £ 250 • Paid by lump sum, or additional employer contributions

Unpaid leave • Regulations have been clarified • Contributions for first 30 days of unpaid leave must be paid

Multiple Employments • Must be treated separately for contribution rates • Do not have to be member in all employments

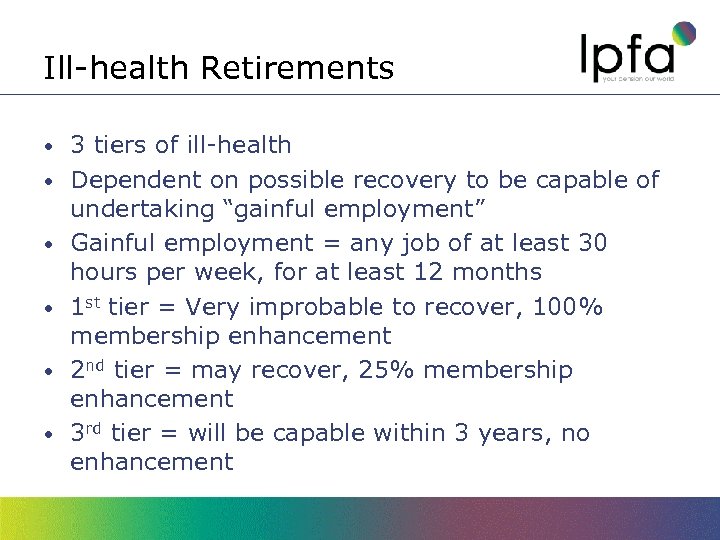

Ill-health Retirements • • • 3 tiers of ill-health Dependent on possible recovery to be capable of undertaking “gainful employment” Gainful employment = any job of at least 30 hours per week, for at least 12 months 1 st tier = Very improbable to recover, 100% membership enhancement 2 nd tier = may recover, 25% membership enhancement 3 rd tier = will be capable within 3 years, no enhancement

Ill-health Examples Mr Smith, retires aged 44 with no real likelihood of recovery. Enhancement 21 years (100% potential membership between LDS and 65 th birthday) • Mrs Jones, retires aged 35 with reduced likelihood of recovery. Enhancement 71/2 years (25% potential membership between LDS and 65 th birthday) • Mr Alas, retires aged 50 (over 45 on 31. 03. 08) with 20 years membership and reduced likelihood of recovery. Enhancement 62/3 years because of protections •

Earliest Retirement Date • Increased from age 50 to 55 • Ill-health benefits still payable from any age

5802a4a92158fd10e80dea55ce475a4b.ppt