25beb6c5f618bb232f85ef1bcd0d2fa4.ppt

- Количество слайдов: 24

Leveraging the Investment Decision Process: Dynamically Managing Beta and Alpha Dr. Arun S. Muralidhar Chairman Mcube Investment Technologies, LLC 22 July 2005

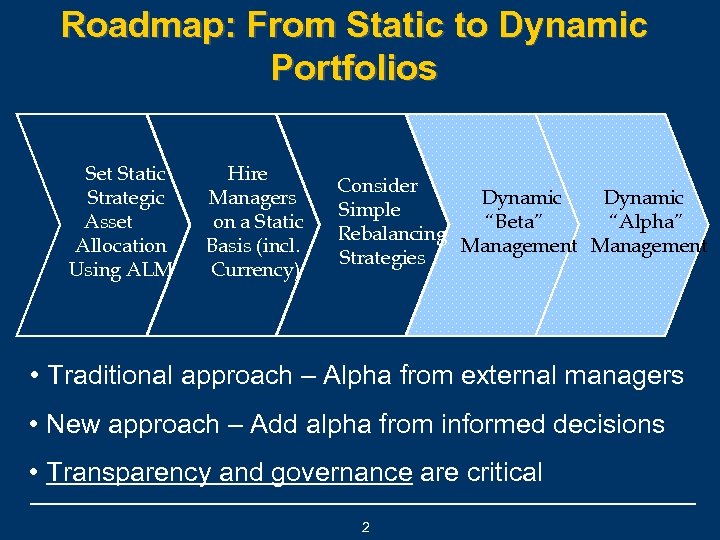

Roadmap: From Static to Dynamic Portfolios Set Static Strategic Asset Allocation Using ALM Hire Managers on a Static Basis (incl. Currency) Consider Dynamic Simple “Beta” “Alpha” Rebalancing Management Strategies • Traditional approach – Alpha from external managers • New approach – Add alpha from informed decisions • Transparency and governance are critical 2

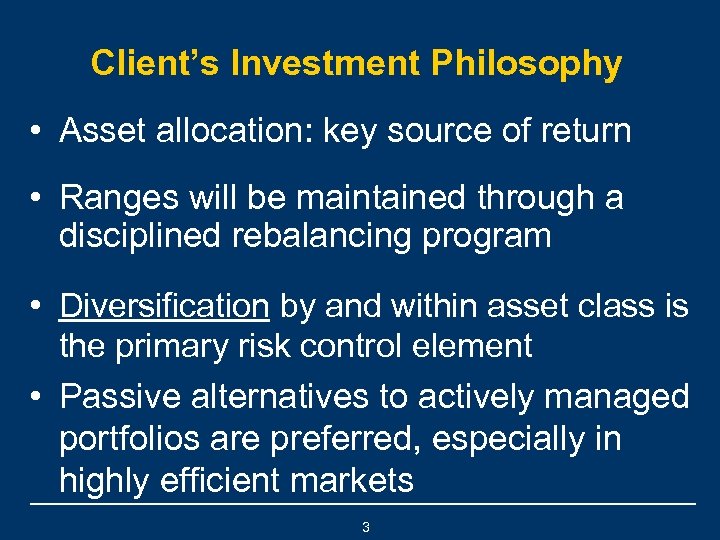

Client’s Investment Philosophy • Asset allocation: key source of return • Ranges will be maintained through a disciplined rebalancing program • Diversification by and within asset class is the primary risk control element • Passive alternatives to actively managed portfolios are preferred, especially in highly efficient markets 3

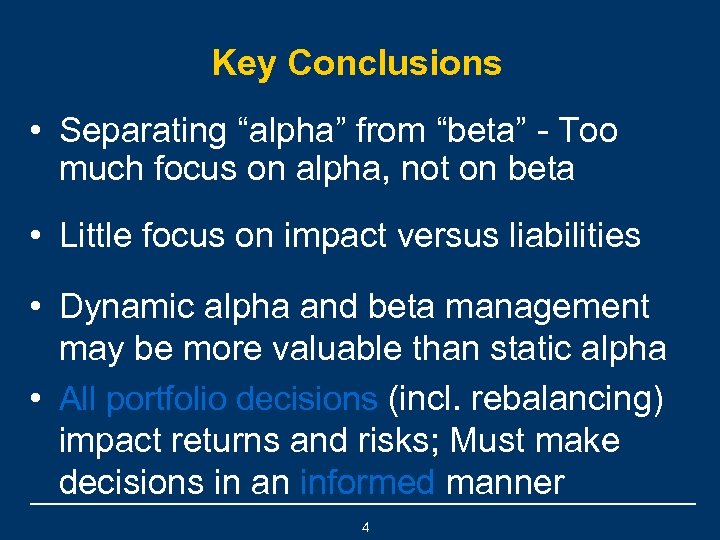

Key Conclusions • Separating “alpha” from “beta” - Too much focus on alpha, not on beta • Little focus on impact versus liabilities • Dynamic alpha and beta management may be more valuable than static alpha • All portfolio decisions (incl. rebalancing) impact returns and risks; Must make decisions in an informed manner 4

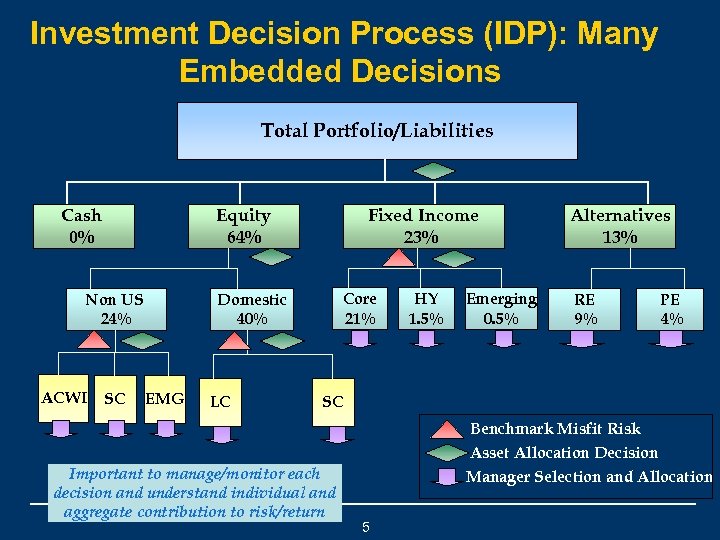

Investment Decision Process (IDP): Many Embedded Decisions Total Portfolio/Liabilities Cash 0% Equity 64% Non US 24% ACWI SC Fixed Income 23% Core 21% Domestic 40% EMG LC HY 1. 5% Emerging 0. 5% Alternatives 13% RE 9% PE 4% SC Benchmark Misfit Risk Asset Allocation Decision Important to manage/monitor each decision and understand individual and aggregate contribution to risk/return Manager Selection and Allocation 5

The “Old” Static Framework for Beta • Passive: Calendar or range-based rebalancing • Dutch model: benchmark includes drift until range is met or calendar period is completed • When range hit, go either to range or target or in-between (what happens within range? ? ? ) • +/- 3% range for most assets; 4% for RE • Client policy gives discretion = Tracking Error 6

The “Old” Static Framework for Alpha • Single asset class focus: Optimize information ratio on active managers for a risk budget • M 3 measure shows why this is incorrect (for single and multi-manager portfolios) • Modigliani 2: Could hire a negative IR manager! • Dynamic management of alpha: Cash flows make pension funds active – already make decisions on who to give money to and when! 7

Understanding Diversification or “Low Correlations” • Also means asset class performance will go through cycles – this aspect is often ignored • Intelligent staff cannot sit by as markets evolve • Managers can have low correlation with others • Manager cyclicality – why fund a manager who is starting to underperform? • Role of cash flows in implementing DYNAMISM 8

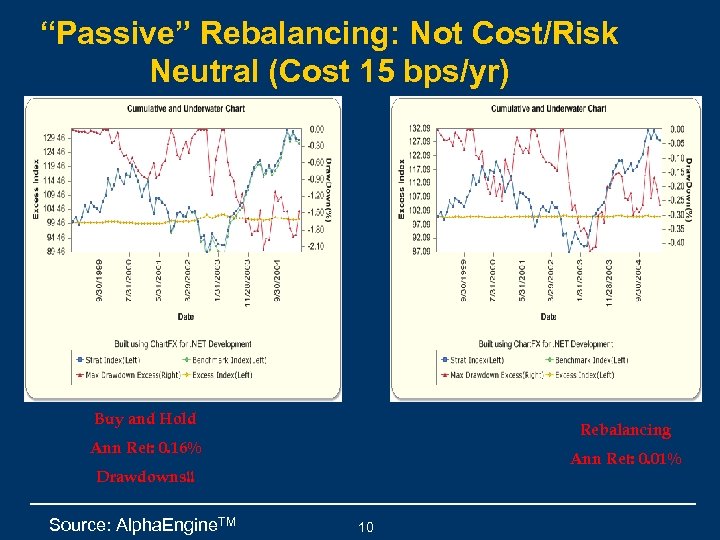

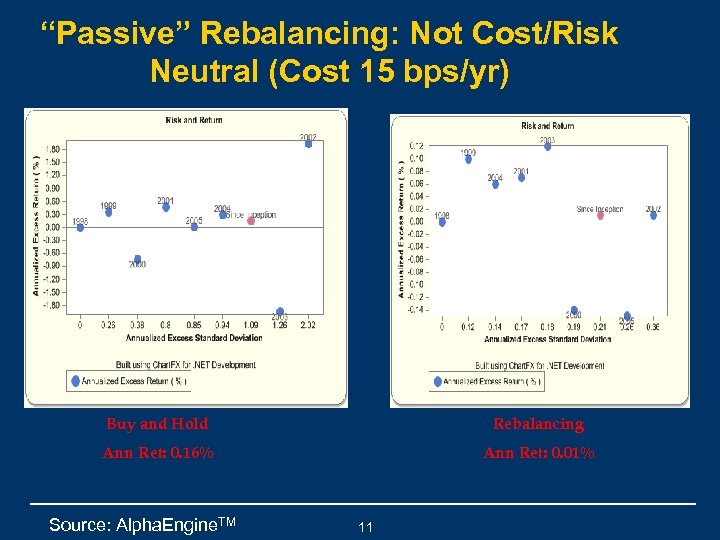

Passive Rebalancing: Can Be “Risky”* • Buy and Hold: Let Portfolio Drift ─ 0. 16% annualized return; 1. 09% tracking error ─ Worst drawdown = -2. 15% (multi-year period) • +/-3% range for most assets; 4% for RE** ─ Impact: 0. 01% annualized return for 0. 21% risk • Worst drawdown: much lower at – 0. 43% *Rebalancing was evaluated from 01/99 – 04/05. Only tested at the highest portfolio benchmark level. Transactions costs (one way) = 15 bps for equity; 10 bps for fixed income; 0. 5% for alternatives **Range-based rebalancing = if any asset drifts to the range limit, all assets are rebalanced to benchmark 9

“Passive” Rebalancing: Not Cost/Risk Neutral (Cost 15 bps/yr) Buy and Hold Rebalancing Ann Ret: 0. 16% Ann Ret: 0. 01% Drawdowns!! Source: Alpha. Engine. TM 10

“Passive” Rebalancing: Not Cost/Risk Neutral (Cost 15 bps/yr) Buy and Hold Rebalancing Ann Ret: 0. 16% Ann Ret: 0. 01% Source: Alpha. Engine. TM 11

Informed Decisions within Ranges – Dynamic Beta Management • • • Portfolio rebalancing is an “active” decision Use cash flows to structure fund appropriately Investment decision process creates opportunity • Large cap vs. Small cap (+/-2%) • Core vs. HY vs. EMG (+/-2%) • EAFE vs. EMG vs. Small (+/-2%) Can staff use discretion to create value? Key: Have a robust, transparent, consistent process 12

Improving the Quality of Decisions • Test variety of rules to use for specific decisions • Consistent evaluation and performance metrics • Many resources can be tapped • Internal staff – have ideas that are unused • Research: many articles on when asset classes do well • Leverage external managers/relationships – Verizon • Transparency and process key for good governance “Prudence is Process” 13

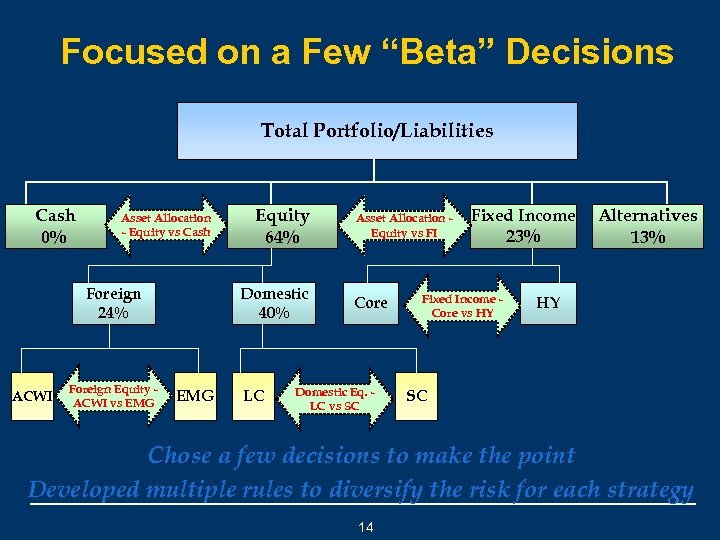

Focused on a Few “Beta” Decisions Total Portfolio/Liabilities Cash 0% Asset Allocation - Equity vs Cash Foreign 24% ACWI Foreign Equity ACWI vs EMG Equity 64% Domestic 40% EMG LC Asset Allocation Equity vs FI Core Domestic Eq. LC vs SC Fixed Income Core vs HY 23% Alternatives 13% HY SC Chose a few decisions to make the point Developed multiple rules to diversify the risk for each strategy 14

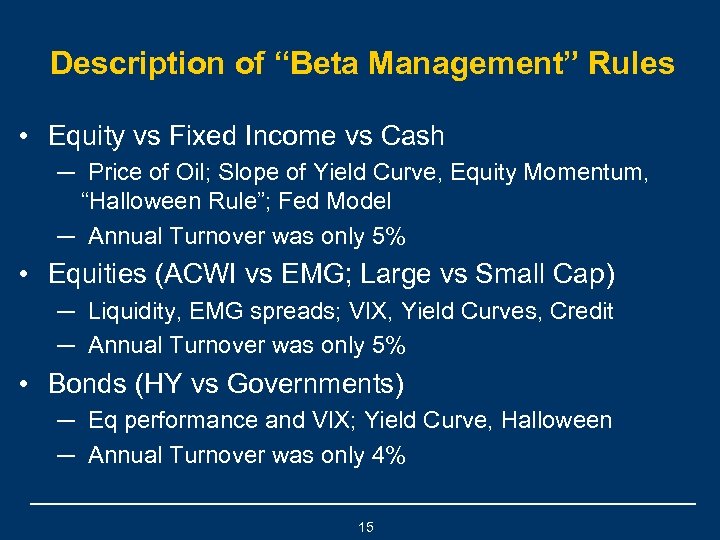

Description of “Beta Management” Rules • Equity vs Fixed Income vs Cash ─ Price of Oil; Slope of Yield Curve, Equity Momentum, “Halloween Rule”; Fed Model ─ Annual Turnover was only 5% • Equities (ACWI vs EMG; Large vs Small Cap) ─ Liquidity, EMG spreads; VIX, Yield Curves, Credit ─ Annual Turnover was only 5% • Bonds (HY vs Governments) ─ Eq performance and VIX; Yield Curve, Halloween ─ Annual Turnover was only 4% 15

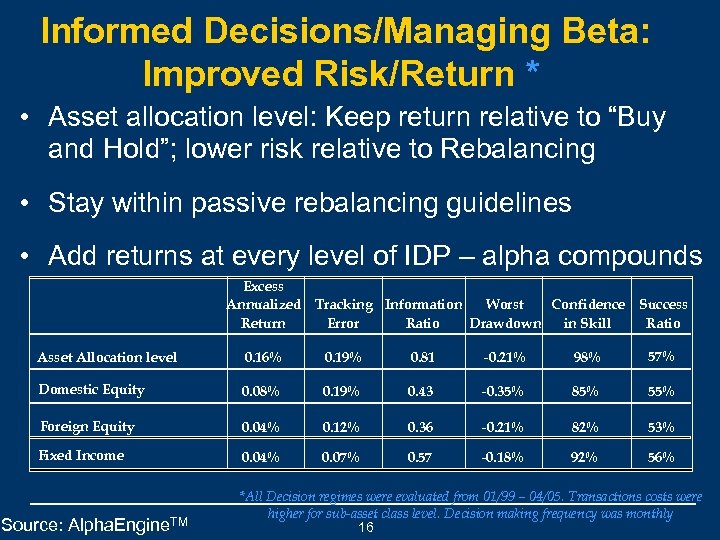

Informed Decisions/Managing Beta: Improved Risk/Return * • Asset allocation level: Keep return relative to “Buy and Hold”; lower risk relative to Rebalancing • Stay within passive rebalancing guidelines • Add returns at every level of IDP – alpha compounds Excess Annualized Tracking Information Worst Confidence Return Error Ratio Drawdown in Skill Success Ratio Asset Allocation level 0. 16% 0. 19% 0. 81 -0. 21% 98% 57% Domestic Equity 0. 08% 0. 19% 0. 43 -0. 35% 85% 55% Foreign Equity 0. 04% 0. 12% 0. 36 -0. 21% 82% 53% Fixed Income 0. 04% 0. 07% 0. 57 -0. 18% 92% 56% Source: Alpha. Engine. TM *All Decision regimes were evaluated from 01/99 – 04/05. Transactions costs were higher for sub-asset class level. Decision making frequency was monthly 16

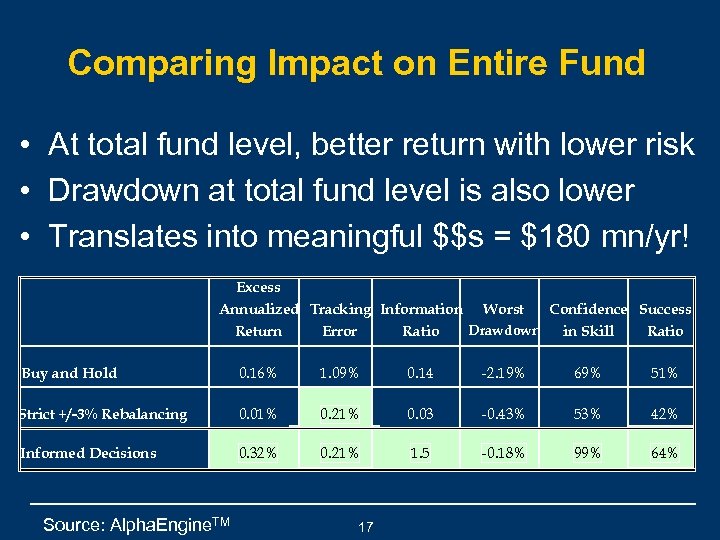

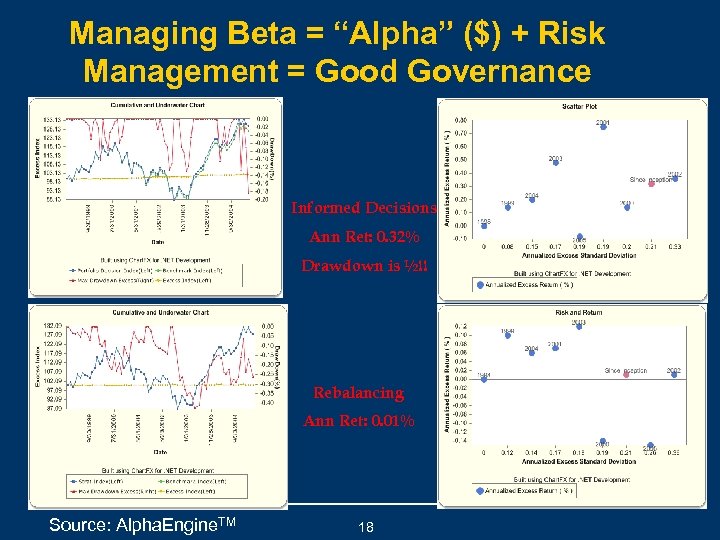

Comparing Impact on Entire Fund • At total fund level, better return with lower risk • Drawdown at total fund level is also lower • Translates into meaningful $$s = $180 mn/yr! Excess Annualized Tracking Information Worst Confidence Success Drawdown Return Error Ratio in Skill Ratio Buy and Hold 0. 16% 1. 09% 0. 14 -2. 19% 69% 51% Strict +/-3% Rebalancing 0. 01% 0. 21% 0. 03 -0. 43% 53% 42% Informed Decisions 0. 32% 0. 21% 1. 5 -0. 18% 99% 64% Source: Alpha. Engine. TM 17

Managing Beta = “Alpha” ($) + Risk Management = Good Governance Informed Decisions Ann Ret: 0. 32% Drawdown is ½!! Rebalancing Ann Ret: 0. 01% Source: Alpha. Engine. TM 18

Ideas for “Alpha” Management • UK vs Euro ex-UK managers: favor mgr in market with a higher interest rate ─ Added 0. 37% annualized over a static mix • Govt. bonds: favor the manager with greatest momentum over last 3 months ─ Added 0. 27% ann. over a static mix of 4 mgrs • Convertible Arbitrage vs Fixed Income Arb ─ Allocate to mgrs depending on VIX and OAS ─ Added return over static with 12% turnover! 19

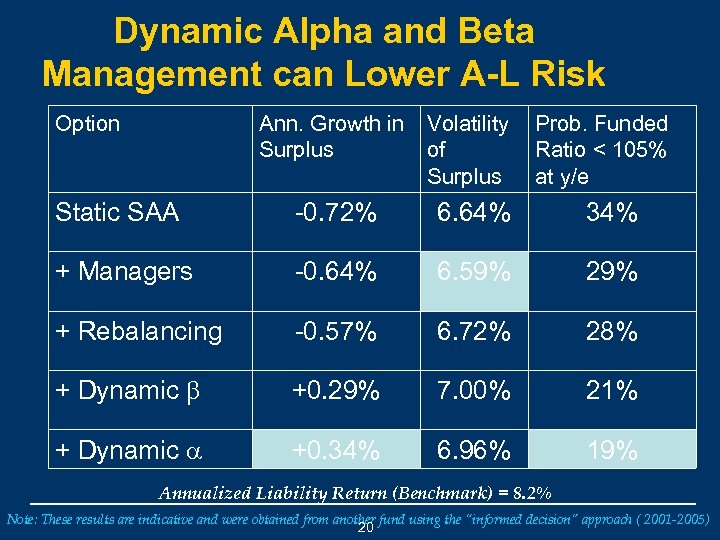

Dynamic Alpha and Beta Management can Lower A-L Risk Option Ann. Growth in Surplus Volatility of Surplus Prob. Funded Ratio < 105% at y/e Static SAA -0. 72% 6. 64% 34% + Managers -0. 64% 6. 59% 29% + Rebalancing -0. 57% 6. 72% 28% + Dynamic b +0. 29% 7. 00% 21% + Dynamic a +0. 34% 6. 96% 19% Annualized Liability Return (Benchmark) = 8. 2% Note: These results are indicative and were obtained from another fund using the “informed decision” approach ( 2001 -2005) 20

Summary • Many clients focus only on SAA, Rebalancing and Static Allocations to External Managers • Using dynamism in portfolio can lead to additional returns and lower Surplus-at-Risk • Dynamism: both managing beta and alpha • Cheaper source of excess return at total fund level (than any other “alpha” option) • Easy to adopt by leveraging external relationships 21

Appendix

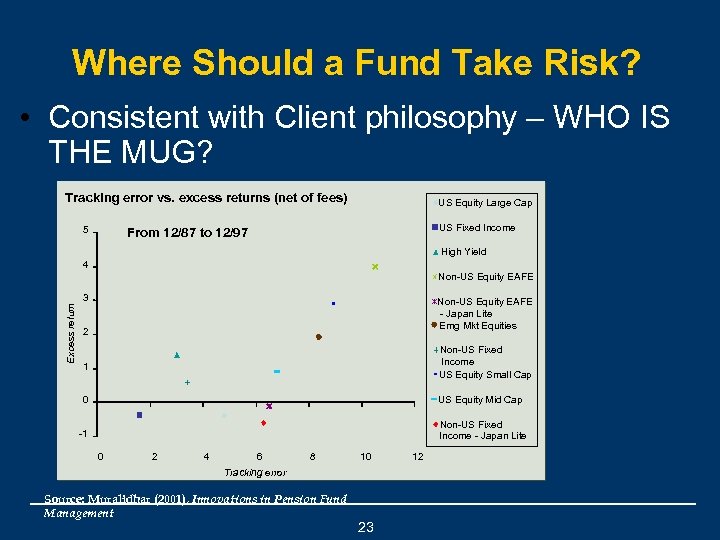

Where Should a Fund Take Risk? • Consistent with Client philosophy – WHO IS THE MUG? Tracking error vs. excess returns (net of fees) 5 US Equity Large Cap US Fixed Income From 12/87 to 12/97 High Yield 4 Excess return Non-US Equity EAFE 3 Non-US Equity EAFE - Japan Lite Emg Mkt Equities 2 1 Non-US Fixed Income US Equity Small Cap 0 US Equity Mid Cap -1 Non-US Fixed Income - Japan Lite 0 2 4 6 8 10 Tracking error Source: Muralidhar (2001), Innovations in Pension Fund Management 23 12

Contact Information Name: Dr. Arun S. Muralidhar Title: Chairman Company: Mcube Investment Technologies, LLC Phone: 1 -646 -591 -6991 E-mail: asmuralidhar@mcubeit. com Website address: www. mcubeit. com

25beb6c5f618bb232f85ef1bcd0d2fa4.ppt